Will Trump Be a One-Term President Because of Mexican Tariffs?

Tariffs are paid by U.S.-based importing companies, which pass the extra expenses on to the end consumer. As such, tariffs are inflationary, and historically, that's been good for gold.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

“Tariff Man” strikes again. In a surprise tweet Thursday afternoon, President Donald Trump announced that, beginning June 10, the U.S. would impose a 5 percent tariff on all goods coming into the U.S. from Mexico “until such time as illegal migrants coming through Mexico, and into our Country, STOP.” The tariff is scheduled to rise incrementally to a hefty 25 percent through October.

As I’ve explained elsewhere, including in an interview this week with Kitco’s Daniela Cambone, tariffs are essentially taxes that are paid by U.S.-based importing companies, which then pass the extra expenses along to the end consumer. As such, tariffs are inflationary. Historically, faster inflation has boosted investor demand for gold, and indeed, the price of the yellow metal crossed above $1,310 an ounce on Friday for the first time since April 11.

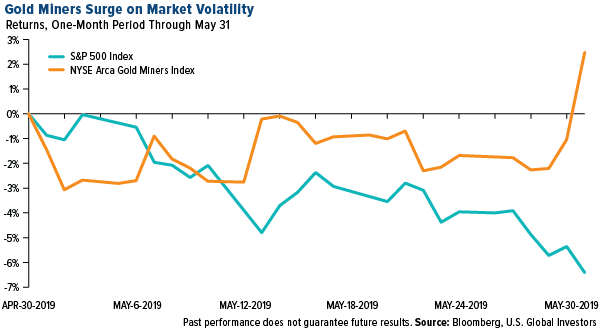

Gold miners also increased sharply on Friday. The NYSE Arca Gold Miners Index jumped nearly 4 percent in intraday trading, the group’s biggest one-day gain in two years. The S&P 500 Index, meanwhile, lost some $1.5 trillion in market cap in the month of May.

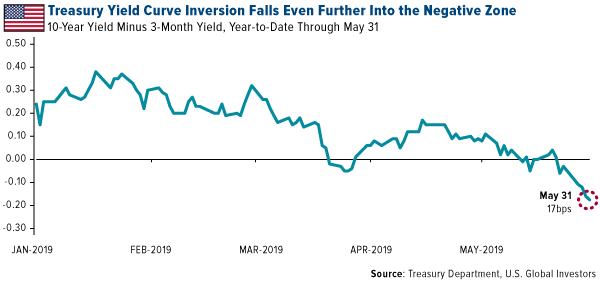

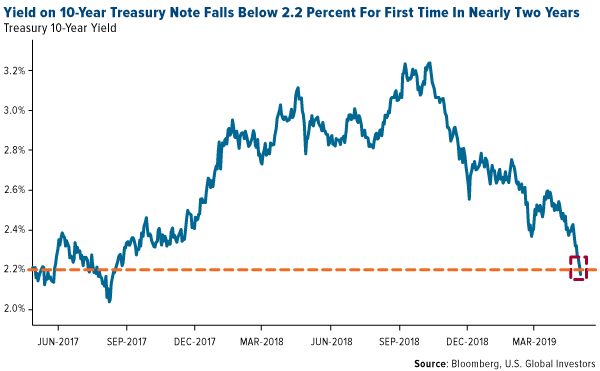

Investors also sought protection in U.S. Treasuries, whose yields fell to a fresh 2019 low. This pushed the already-inverted yield curve between the 10-year and three-month Treasuries deeper into negative territory. On Friday the yield curve sunk to 17 basis points (bps), its lowest level since well before the financial crisis. An inverted yield curve has preceded every U.S. recession over the last 60 years.

Many successful, ultra high-net-wealth individuals (UHNWIs) favor municipal bonds, not only because they’re tax-free at the federal and often state and local levels, but also because they’ve managed to perform well even during equity bear markets. According to the first-quarter asset allocation report for Tiger 21, a peer-to-peer network for UHNWIs, members had an average weighting of 9 percent in fixed income, which includes muni bonds.

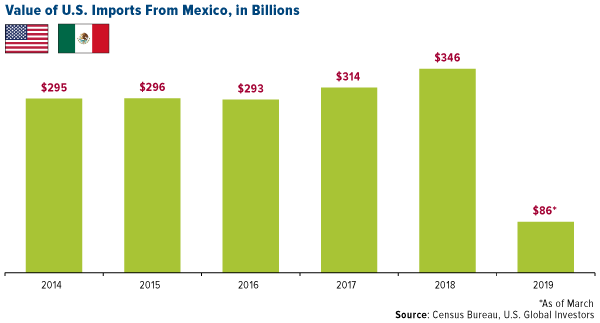

Tariffs Against Mexico Will Hit Middle-Class Americans

In 2018, the total value of imports from Mexico stood at $346 billion. A 5 percent tariff on this volume amounts to a $17 billion hit on the U.S. economy. At 25 percent, this cost surges to a whopping $87 billion.

To be sure, this will have a much more direct inflationary impact on middle-class Americans than tariffs on Chinese goods have had so far. That’s because Mexico—besides being the number one exporter of car parts and vehicles to the U.S.—is also America’s top supplier of agricultural goods, with exports totaling $26 billion in 2018 alone. Fresh fruits and vegetables (valued at a combined $11.7 billion), beer and wine ($3.6 billion), snack foods ($2.2 billion) and more are all set to rise in price at your local grocery store if the 5 percent tariff takes effect as planned.

Think I’m exaggerating? On an investor conference call this week, Costco Chief Financial Officer Richard Galanti said, “At the end of the day, prices will go up on things” due to tariffs on Chinese and now Mexican-made goods.

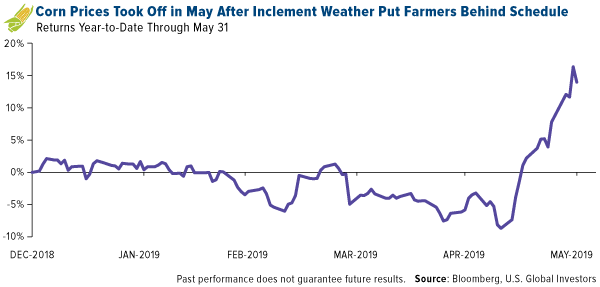

For some idea of what might happen with food prices, take a look at what corn has done in the past month alone. Granted, this price jump is due to inclement weather, which put U.S. famers behind in their planting schedule. But imagine all of your tomatoes, avocados, cucumbers, onions, strawberries and other produce from Mexico making similar moves. This would have a serious multiplying effect on the U.S. economy.

Vehicle prices are also likely to climb. In a press release dated May 31, Matt Blunt, president of the American Automotive Policy Council (AAPC), wrote that tariffs against Mexico will undermine the United States Mexico Canada Agreement (USMCA)—the not-yet-ratified replacement for NAFTA—and “would impose significant cost on the U.S. auto industry.”

Speaking specifically of General Motors (GM), Citi analyst Itay Michaeli said that the 5 percent tax could result in a significant “several-hundred-million-dollar” impact to the carmaker’s annual earnings. Shares of GM, Ford and Fiat Chrysler were all down significantly in Friday trading.

Could Trump Be Ambushing His Own 2020 Reelection Bid?

|

Taken as a whole, the Mexican tariffs could very well end up being the one policy that costs Trump many die-hard supporters who have stuck with him up until now.

On Thursday, the U.S. Chamber of Commerce—the staunchly Republican business lobbyist group—condemned the president’s plan, writing that “tariffs on goods from Mexico is exactly the wrong move. These tariffs will be paid by American families and businesses without doing a thing to solve the very real problems at the border.”

Senator Chuck Grassley of Iowa, who has also safely been in Trump’s corner on most policies, came close to suggesting the imposition of tariffs was an abuse of power. “Trade policy and border security are separate issues,” Grassley said. “This is a misuse of presidential tariff authority and counter to congressional intent.”

Further, Grassley commented that the tariffs could risk the ratification of the USMCA, one of the president’s greatest achievements in his two-and-a-half-year-old administration.

Further still, the tariffs could sabotage any chance of a trade resolution with China. In a note to investors, Raymond James public policy analyst Ed Mills wrote that he views the president’s actions as “further deteriorating the U.S.-China trade fight. Chinese officials have stated their concern about the reliability of President Trump as a trading partner. These tariffs were announced the same day as significant advancement of the USMCA. If China does not believe a deal will stick, why negotiate?”

While I’m on the subject of China, the number of Chinese tourists to the U.S. fell 5.7 percent in 2018 from the previous year, the first time that’s happened since 2003. Trade tensions between the two economic superpowers appear to be a huge contributing factor. Hopefully this isn’t the start of a trend, as Chinese tourists top the list of the world’s biggest spenders.

Is Gold the Solution?

|

All of this is ample reason to ensure that you have some gold in your portfolio. I always advocate the 10 percent Golden Rule. That means I think you should have half of that 10 percent in gold coins, bars and 24-karat jewelry. The other half should be in high-quality gold mining stocks and funds. Make sure you rebalance at least once a year.

One of the biggest proponents of gold is the Austrian school of economics, which emphasizes self-reliance and individualism. Because fiat currencies are solely based on the faith and credit of the economy, they have no intrinsic value and are prone to huge swings, according to Austrian economic thought.

Gold, on the other hand, is nobody’s liability. As destructive as socialist policies can be to business and capital, they can’t reduce the value of your gold. In fact, the inverse is true. Historically, the more debt that the government accrues, and the higher inflation gets, the more valuable the yellow metal has become.

Missed my special post on rare earth metals? Read it now by clicking here!

Gold Market

This week spot gold closed at $1,305.45, up $20.70 per ounce, or 1.61 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 4.75 percent. The S&P/TSX Venture Index came in off 1.01 percent. The U.S. Trade-Weighted Dollar rose just 0.15 percent.

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| May-27 | Hong Kong Exports YoY | 0.1% | -2.6% | -1.2% |

| May-28 | Conf. Board Consumer Confidence | 130.0 | 134.1 | 129.2 |

| May-30 | GDP Annualized QoQ | 3.0% | 3.1% | 3.2% |

| May-30 | Initial Jobless Claims | 214k | 215k | 212k |

| May-31 | Germany CPI YoY | 1.6% | 1.4% | 2.0% |

| Jun-2 | Caixin China PMI Mfg | 50.0 | — | 50.2 |

| Jun-3 | ISM Manufacturing | 53.0 | — | 52.8 |

| Jun-4 | Eurozone CPI Core YoY | 0.9% | — | 1.3% |

| Jun-4 | Durable Goods Orders | — | — | -2.1% |

| Jun-5 | ADP Employment Change | 183k | — | 275k |

| Jun-6 | ECB Main Refinancing Rate | 0.000% | — | 0.000% |

| Jun-6 | Initial Jobless Claims | 215k | — | 215k |

| Jun-7 | Change in Nonfarm Payrolls | 180k | — | 263k |

Strengths

- The best performing metal this week was gold, up 1.61 percent. Gold traders are neutral on the yellow metal this week; however, the weekly Bloomberg survey was conducted on Thursday before gold shot above $1,300 on Friday morning. Gold saw its first monthly gain in May, breaking a streak of three straight months of losses. In China, premiums on gold rose this week as investors bought the metal on safe haven demand due to rising trade tensions, reports Reuters India.

- The Philippines is joining a list of central banks adding to their gold reserves this year. The nation’s deputy governor said this week that sales could reach almost 1 million fine troy ounces a year from the current 20,000 to 30,000 ounces due to a new law that exempts the central bank from taxes on bullion purchases from small-scale miners. Bloomberg reports that Malaysia’s prime minister said a gold-based currency for the East Asian region would help avoid manipulative trading.

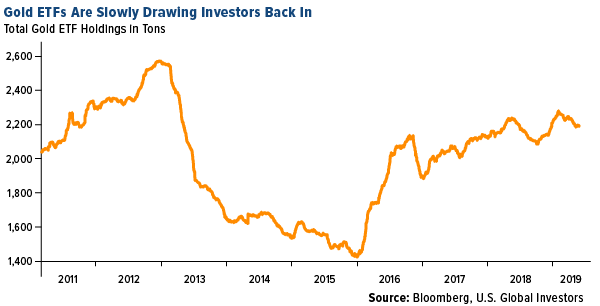

- Gold finally crossed back above the $1,300 per ounce level this morning after President Donald Trump announced tariffs on all imports from Mexico. The amped up trade tensions helped push the Index of South African gold producers up 5.7 percent to a two week high. Additionally, inflows to gold ETFs are gaining momentum so far in 2019 after declining for several years.

Weaknesses

- The worst performing metal this week was platinum, down 1.44 percent, as hedge funds flip to net bearish in their positioning. After increasing last week, Turkey’s gold reserves fell this week by $272 million, according to official data from its central bank. JPMorgan analyst John Bridges downgraded several gold companies, including Eldorado Gold, Kinross and New Gold, to neutral. Bridges said an “increasingly inverted U.S. yield curve suggests the dollar could just be firming into typical recessionary strength and seasonally this is the time when gold can begin its summer time-out.”

- Newcrest’s Cadia mine, which is Australia’s largest and most lucrative, is being forced to buy water on the open market and invest in pumping equipment due to a severe drought in the area.

- Panama rejected a bill that underpins First Quantum Minerals’ copper mine in the country, reports Bloomberg. The nation’s panel took issue with the project’s low 2 percent royalty rate. SolGold Plc, a copper miner in Ecuador, saw its shares fall the most in six years after news broke that the nation is close to holding a referendum on mining in some parts of the country.

Opportunities

- The bond market is flashing a recession signal and it could be good for gold. Win Thin, head of currency strategy at Brown Brothers Harriman, told Bloomberg that “if the U.S. goes into a recession, then the Federal Reserve cuts rates and the dollar’s yield advantage evaporates.” A weaker dollar is historically positive for gold, and the latest tariffs are another sign that the Fed could cut rates.

- Australian gold reserves are being depleted and there are only so many ways to restock inventory: acquisition, discovery or re-optimization of current projects. St. Barbara CEO Bob Vassie said this week that the consolidation between large gold producers in North American lately could open up a plethora of unwanted assets that could spur deal making among smaller producers. If the gold prices runs, those assets may be slower to be sold with expanding margins. That might elevate the shunned exploration and development companies desirability as there are cheap shovel ready projects waiting for capital to move forward.

- Eldorado Gold shares rose as much as 12 percent early this week after Greece held snap elections that saw its current prime minister defeated. Bloomberg writes that there is hope the new administration will be more business friendly and open the door for foreign investment.

Threats

- Morgan Stanley strategists led by Mike Wilson say that the Treasury yield curve is flashing recession angst and that the trade war is just a sideshow, reports Bloomberg. The strategists wrote “get ready for more potential growth disappointments even with a trade deal.” The gold and silver ratio is also sending a worrisome signal to other risk assets. The ratio is at the highest in 26 years and approaching the record peak hit in 1991 when the U.S. was in a recession. Bloomberg’s Sungwoo Park writes that “the gauge underscores the hostile environment for risk assets.”

- In a statement released on Tuesday, two top officers are leaving the Federal Reserve Bank of New York on June 1 – the same day and with only three days’ notice. It is concerning to see two high ranking personnel leave at the same time, taking with them 50 years of experience.

- Modern Monetary Theory (MMT), a theory that says governments have spare capacity to borrow and spend, has gained attention on Wall Street, and enemies in Washington, and is now gaining attention in academia. A college-level textbook about the theory has sold out of its initial print run of 600,000 copies, according to publisher Macmillan.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 3.01 percent. The S&P 500 Stock Index fell 2.62 while the Nasdaq Composite fell 2.41percent. The Russell 2000 small capitalization index lost 3.21 percent this week.

- The Hang Seng Composite lost 0.63 percent this week; while Taiwan was up 1.65 percent and the KOSPI fell 0.17 percent.

- The 10-year Treasury bond yield fell 19 basis points to 2.13 percent.

Domestic Equity Market

Strengths

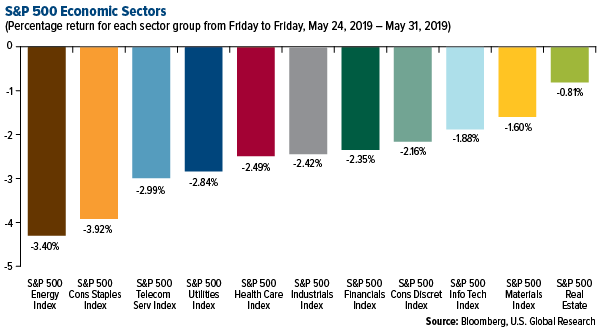

- Real estate was the best performing sector of the week, decreasing 0.81 percent versus an overall decrease of 2.47 percent for the S&P 500.

- Total System Services was the best performing stock for the week, increasing 24.00 percent.

- Earnings season has been better than expected. The S&P 500 earnings grew 1.5 percent in the first quarter, well above the 2.4 percent decline that was expected.

Weaknesses

- Energy was the worst performing sector for the week, decreasing by 4.30 percent versus an overall decrease of 2.47 percent for the S&P 500.

- Foot Locker was the worst performing stock for the week, falling 25.52 percent.

- The U.S.-China trade war could shrink global output by $600 billion. The disputes could also shave 0.5 percent off of China’s gross domestic product and 0.2 percent off both U.S. and world GDP as a whole in 2021, according to a Bloomberg Economics study.

Opportunities

- On the first trading day following Advanced Micro Devices’(AMD) appearance at the Computex trading show in Taipei, shares of the company jumped 11.5 percent, reports the Motley Fool. Shares were sent higher on the announcement of AMD’s third generation of AMD Ryzen desktop processors, including what is called the “highest performance 12 core desktop processor ever,” the article continues.

- During this year’s South by Southwest, NYU professor Scott Galloway (who predicted Amazon’s takeover of Whole Foods) made the prediction that Tesla will be acquired within a year, reports Business Insider. According to Galloway, the company’s tanking share price makes it a prime takeover target.

- Fiat Chrysler has proposed a deal that would create the world’s third-largest car manufacturer – a $37 billion merger with Renault. As Business Insider reports, such a deal would represent a major shift for the automobile industry and spark plans to boost electric-vehicle production.

Threats

- Investors who thought small-cap stocks might provide some shelter from the latest flare-up in the U.S.-China trade war are getting shell shocked, writes BN’s Richard Richtmyer. The Russell 2000 Index on Thursday closed below its 50-day, 100-day and 200-day moving averages for the first time since the market recovered from last year’s sell-off.

- Elizabeth Warren’s presidential campaign is running a billboard in San Francisco calling for the breakup of the tech giants. "Break up big tech," the sign reads, and then asks people to text the campaign to "join our fight." The increased political attention could lead to regulations that negatively impact the profits of these big tech companies.

- Huawei says blacklisting it could cost American workers big time. The Chinese telecommunications company says its blacklisting will directly harm 1,200 U.S. companies and put "tens of thousands" of U.S. jobs at risk.

The Economy and Bond Market

Strengths

- First-quarter economic growth in the U.S. came in slightly better than expected, up 3.1 percent, the Commerce Department reported Thursday. First-quarter gross domestic product beat the 3 percent Dow Jones estimate but was lower than the initial 3.2 percent projection from the Bureau of Economic Analysis, reports CNBC.

- The Department of Commerce reported personal incomes grew at a month-on-month clip of 0.5 percent in the month of April. This beat forecasts for an increase of 0.3 percent.

- After falling to more than a two-year low in April, the Chicago PMI business barometer rebounded in May, reports MarketWatch. The measure of business conditions in the Chicago region climbed to 54.2 from 52.6 in the prior month, according to MNI Indicators on Friday.

Weaknesses

- Pending homes sales fell 1.5 percent in April compared with March, according to the National Association of Realtors’ measurement. Compared to a year earlier, sales were 2 percent lower, making this the 16th straight month of annual declines.

- U.S. consumer sentiment increased by “less than initially reported in May as an escalation of the trade war with China weighed on the outlook for the overall economy,” writes Bloomberg. The University of Michigan’s sentiment index rose to 100 from 97.2 a month earlier.

- Consumer spending, which accounts for over two-thirds of U.S. economic activity, rose 0.3 percent as consumers spent less on services, the government reported Friday. This compares to 0.9 percent growth in spending during March. The weak number for April could suggest slower economic growth during the second quarter of the year.

Opportunities

- The yield on the benchmark 10-year Treasury note fell below 2.2 percent after President Trump said that he would impose a tariff on Mexican goods until the country stops immigrants from entering the U.S. illegally, reports Bloomberg. The move extended the rally in bonds that has gathered pace in recent weeks as rising geopolitical tensions drive a safe-haven bid from investors.

- Investors are “too aggressive” in their expectation that the Federal Reserve will cut rates sometime this year, according to BlackRock. Scott Thiel, BlackRock’s chief fixed income strategist, said it’s a case of money managers overreacting to geopolitical noise, such as U.S.-China trade tension. The implied probability of the Federal Reserve lowering borrowing costs in 2019 is more than 70 percent, data compiled by Bloomberg show.

- Citigroup’s municipal-market analysts say investors can still find value in the “City of Brotherly Love.” Philadelphia’s tax base has grown by nearly 20 percent over the past two years, it’s home to some of the nation’s top universities and hospitals, and the city is collecting more revenue than expected, allowing it to boost its rainy-day reserves. Nine of Philadelphia’s top 10 private employers are "eds and meds," which tend to be more resilient in a recession. “If you’re looking for a city, a strong local GO, Philly meets the requirement," said Vikram Rai, Citigroup’s lead municipal strategist.

Threats

- President Trump’s tariffs could cost U.S. households more than $800 a year, according to a new study. Specifically, $831 per year, reports economists at the Federal Reserve Bank of New York, Columbia and Princeton. This assessment comes after the president hiked the tariff rate on $200 billion worth of Chinese imports to 25 percent from 10 percent, writes Business Insider.

- In a new move that would further escalate its assault on global trading rules, the Trump administration is proposing tariffs on goods from countries found to have undervalued currencies, writes Bloomberg. The new proposal was laid out in a Federal Register notice released on Thursday, and would allow U.S.-based companies seek anti-subsidy tariffs on products from countries found by the U.S. Treasury Department to be engaging in competitive devaluation of their currencies, the article continues.

- New findings from the Federal Reserve show that three in 10 Americans do gig work of some kind, and those who rely on this type of work are in a “financially fragile state,” Bloomberg reports. Gig work can mean babysitting, house cleaning or ride sharing. The Fed study goes on to explain that nearly one-fifth of gig workers rely on it for their primary source of income, while over half of these individuals have a hard time affording an unexpected expense of $400. As the Bloomberg article explains, some economists see this trend as a sign that job quality could be eroding, even as the job market tightens.

Energy and Natural Resources Market

Strengths

- The best performing major commodity for the week was coffee, which gained 12.11 percent as heavy rains in Brazil threatened to increase the amount of low-quality beans that will be produced. Goldman Sachs upgraded Rio Tinto to a buy this week saying it is the only major iron ore producer with infrastructure capacity to boost volumes over the medium term. Rio shares rose as much as 3.3 percent in London on Tuesday after the news. Gazprom PJSC’s quarterly profits rose to the highest level since at least 2007 due to higher export prices and higher prices for customers. First quarter net income for the Russian natural gas giant jumped 44 percent from a year earlier to 535.91 billion rubles, reports Bloomberg.

- Drax Group Plc, Equinor ASA and National Grid Plc said in a statement this week that they will be teaming up to explore how to create the first large-scale carbon capture usage and storage network and hydrogen production facility in the U.K. The plan is to build on Drax’s existing carbon capture pilot project in Yorkshire, which is already trapping one ton of carbon gas per day.

- Canadian Natural Resources Ltd. is close to overtaking its rival Suncor Energy Inc. after its $2.8 billion purchase of Devon Energy Corp.’s Jackfish Athabasca drilling site, reports Bloomberg’s Robert Tuttle. This brings Canadian Natural’s oil sands production capacity to more than 700,000 barrels a day, just behind Suncor’s 900,000 barrels a day.

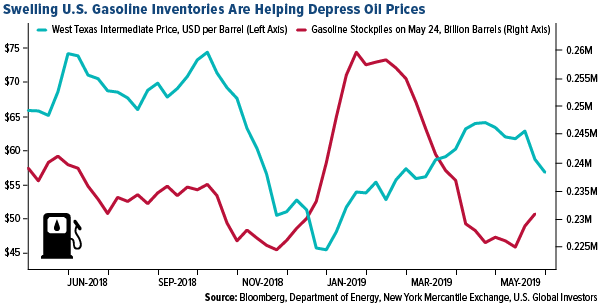

Weaknesses

- The worst performing major commodity for the week was crude oil, which fell 9.16 percent as fears of an economic slowdown permeated through the markets this week. Oil is heading for its biggest monthly slump this year as fear that the U.S.-China trade war, and now tariffs on Mexican imports, will hurt demand. Bloomberg reports that futures slipped to the lowest in more than two months in New York and London on Friday. Stockpiles in the U.S. have been rising in May and are helping to depress WTI prices.

- Bloomberg reports that Duke Energy Corp. is decommissioning a closed Florida nuclear power plant 47 years earlier than previously scheduled. The Crystal River plant closed in 2013 and the company announced this week that demolition will begin next year and be complete by 2027.

- Copper is heading for its worst monthly loss in at least three years as the continuing trade war with China feeds growth concerns for demand, writes Bloomberg. Although iron ore hit the $100 per ton mark, some think it might not stay above that level for long. Iron ore futures took a hit on Wednesday after a top Chinese exchange raised fees on futures trading, reports Bloomberg News. Citigroup, which has long been bullish on iron, revised its outlook down for the second half of the year to an average of $88 per ton.

Opportunities

- The world’s largest copper miner, Chilean state-owned Codelco, says that the global market faces a production shortfall 60 times as big as last year’s deficit in less than a decade, as current trade frictions are stopping companies from investing in new projects, reports Bloomberg. Codelco’s CEO says that copper supply will start to decline in 2022 and will result in a shortfall of 4 million metric tons by 2028.

- In a positive sign for cobalt miners in the Democratic Republic of Congo, Umicore SA has signed a long-term deal to buy cobalt from Glencore PLC’s mines in the nation. Bloomberg’s Felix Njini writes that ethical sourcing has become a central theme for cobalt producers and buyers, especially from Congo, and Umicore had said previously that it would only tap bona fide sources of the metal.

- As the auto industry is going through major changes into renewables and greater fuel efficiency, Japanese steelmaker Nippon Steel Corp. has opened a research department to identify ways to make car parts lighter, as the industry moves away from heavy steel. The company revealed an all-steel car body, built in-house, that has cut weight by 30 percent and puts it on par with aluminum, reports Bloomberg.

Threats

- China, which accounts for close to 80 percent of the world’s annual production of rare earth metals, is allegedly preparing to curb the export of these important materials to the U.S. as a bargaining chip in the ongoing trade war. According to the editor of the Chinese state-owned Global Times newspaper, China is “seriously” considering restricting exports. This would present a major problem for the U.S. as it is dependent on China for 80 percent of rare earths uses.

- President Donald Trump announced that the U.S. will impose a 5 percent tariff on all goods imported from Mexico and will increase by 5 percent each month, capping at 25 percent, until Mexico helps to limit illegal immigration. This could be a huge threat for oil if it is included in the list of tariffed items. Mexico accounts for about 10 percent of U.S. imports. Bloomberg reports that a 5 percent tariff would add about $3 a barrel to the cost of Maya crude.

- In even more geopolitical news, Papua New Guinea has elected James Marape as its new prime minster. Marape, who was previously the nation’s finance minister, is a critic of recent resource deals made with a Total-led group of companies. Bloomberg reports that Total and Exxon reached a deal with the government in April that moved forward their efforts to double gas exports from the nation.

Emerging Europe

Strengths

- Greece was the best performing country this week, gaining 13.4 percent. Banks gained the most among stocks trading on the Athens exchange on the back of election results of the European Parliament. Piraeus Bank has gained 67 percent while Alpha Bank has gained 37 percent in the past five days.

- The Turkish lira was the best performing currency this week, gaining 4.3 percent against the U.S. dollar. Turkey has taken steps to improve its relationship with the U.S. The probability of the U.S imposing new sanctions on Turkey for taking the delivery of S-400 missiles from Russia has declined.

- Industrials was the best performing sector among eastern European markets this week.

Weaknesses

- Czech Republic was the worst relative performing country this week, gaining 20 basis points. The nation reported first quarter annual GDP growth of 2.6 percent, which is much lower than neighboring Poland at 4.7 percent and Hungary at 5.3 percent. The Central Bank of Czech Republic has hiked its main rate five times in the past two years, while the central banks of Poland and Hungary have kept their rates unchanged.

- The Russian ruble was the worst performing currency this week, losing 1.4 percent against the U.S. dollar. The ruble declined with the price of Brent crude oil. Brent sharply dropped on worries of weaker demand due to global trade tensions.

- Utilities was the worst performing sector among eastern European markets this week.

Opportunities

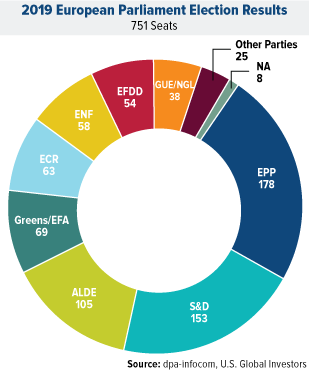

-

Results of European parliamentary elections show that Eurosceptic and anti-establishment groups and parties increased their weight in parliament, but gained less than expected. The Parliament will become more fragmented, as Conservatives and Socialists did not manage to hold on to the majority of seats, and the coalition will be made of three or four parties. For the first time in Europe’s history the turnout for these elections has risen, climbing to 51 percent from 43 percent.

- The Russian agriculture sector may benefit from heavy rainfalls in the U.S. Midwest, as buyers of American grains are looking for markets to replace lost supplies due to flooding. Buyers in Japan and Korea are seeking quotes for South American and Black Sea corn to replace the U.S. supplies, and they are making inquiries about feed wheat from Russia and South America.

- In Greece, the pro-business New Democracy party received significantly more votes than the current ruling Syriza party. Following the wide win of the opposition party, the Greek Prime Minister Tsipras announced snap elections that will take place on July 7. Stocks trading on the Athens exchange gained the most among European peers and the uptrend could continue.

Threats

- Based on JPMorgan’s report “How much can the CEE grow if the Euro area keeps slowing?”, the current growth rate in central emerging Europe of four to five percent is not sustainable. Poland, Hungary are Czech Republic are shielded from the slower growth in the EU area due to strong utilization of funds, the fiscal and monetary policy mix and the inflow of Ukrainian workers. JPMorgan expects CEE growth to decline in the absence of these three factors, with exception of Poland, where the inflow of immigrants from Ukraine and upcoming elections will continue to support economic expansion.

- According to the European Central Bank, risks to the euro area’s public and private finances have risen in the past six weeks. In its Financial Stability Review, the ECB said downside risks remain prominent. There was also a gloomy prognosis for the banking industry.

- The yield on German 10-year bonds is heading for a fourth weekly decline after President Donald Trump announced tariffs on Mexican goods. German yields fell below the previous low set three years ago when Brexit and European Central Bank policy were driving yields lower. Today, geopolitical tensions have been the driver in the latest bond rally in Europe. Some fear that Europe may be going the way of Japan, where there are permanently low bond yields and loose monetary policy.

China Region

Strengths

- Malaysia was the best performing country in the region this week, up 3.28 percent.

- The best performing sector in Hong Kong’s Hang Seng Composite Index for the week was materials, up 2.25 percent.

- The Japanese economy unexpectedly grew in the first quarter of 2019 supported by government spending, although there were some worrisome signs connected to the U.S.-China trade dispute. The economy expanded at an annualized 2.1 percent during the January to March period, following 1.6 percent revised growth in the previous quarter. Most economists had forecast that the first-quarter figure would be flat or slightly negative.

Weaknesses

- Hong Kong was the worst performing country in the region this week, down 1.66 percent.

- The worst performing sector in Hong Kong’s Hang Seng Composite Index for the week was telecommunications, down 3.68 percent.

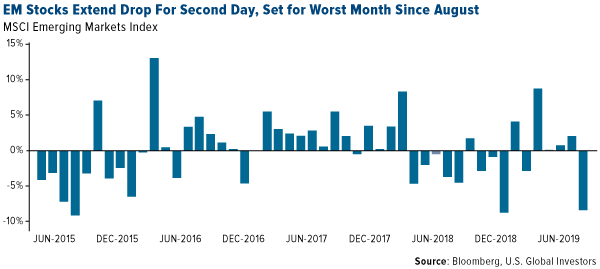

- Emerging market stocks are poised for their worst monthly drop since August 2015, when China’s shock devaluation of the yuan spurred a $2 trillion rout. The MSCI Emerging Markets Index has retreated almost 9 percent so far in May, helping to erase $1.1 trillion from equity values globally, as heightened trade tensions between the world’s two largest economies led investors to scurry away from riskier assets. The key risk for stocks remains the continued strength of the U.S. dollar, which is set for a fourth month of gains.

Opportunities

- Vietnam’s economy has the potential to grow 6 percent to 6.5 percent over the next decade, says DBS Bank. Economic growth has held above 6 percent for the past five years, driven in part by a manufacturing sector that churns out everything from Nike sportswear to Samsung smartphones. Vietnam stands out to benefit from the trade war as companies will likely move manufacturing facilities out of China to diversify supply chain. Vietnam also stands out to benefit, as its young and educated labor force, heavy investment in infrastructure and improving regulatory environment are all well suited to take in manufacturing capacity moving out of China.

- China’s real estate sector perked up in April, Bloomberg economics gauge is showing overall conditions moving above the historical average for the first time this year. The Bloomberg Economics China Real Estate Comprehensive Index came in at 3.66 in April, returning to positive territory after registering -0.27 in March and -14.95 in February. The sub-index reflecting market conditions were the major supporting component, with a 70.23 reading, up from 69.34 in March. This mainly reflected increases in housing prices, which have been accelerating since 2018. But tight financing and weak sentiment remain strong headwinds.

- Indonesia won a sovereign rating upgrade from S&P Global Ratings for its “strong economic growth prospects” and prudent fiscal policy, brightened by the re-election of President Joko Widodo. The nation’s currency, stocks and bonds rallied. The rating was increased to BBB from BBB- and put on a stable outlook, S&P said in a statement on Friday. The long-term rating may be raised again if Indonesia’s external settings improve materially from their current levels, or if its fiscal settings improve over the next two years, it said.

Threats

- Beijing took over a troubled regional bank, the first in 20 years, citing serious credit risk. The move raised market concern over the quality of its peers and drove interbank funding cost higher, since smaller lenders rely more on the channel due to a smaller depositor base. The PBoC promptly injected more liquidity to keep money rates in check. Financial risk remains high on Beijing’s watch list as a double-whammy of economic slowdown and trade war uncertainties pose higher risks to banks.

- China’s manufacturing purchasing managers’ index (PMI) for May slid into contraction at 49.4 and its employment sub-index tumbled to the lowest level in three years. The yuan has fallen 2.5 percent in May, and stocks had a tough month as turbulence from Trump’s tariff hike hit home. The outlook for services and construction looks relatively robust, with the non-manufacturing remaining at 54.3. Reports suggest China is “seriously” considering limiting exports of its rare earths to the U.S. About 80 percent of U.S. imports of rare earths come from China adding to the ongoing trade war.

- India’s economy expanded at the slowest pace in several quarters, underscoring the challenge facing Prime Minister Narendra Modi as he begins his second term in office. Gross domestic product rose 5.8 percent in the three months to March from a year ago. Growth has been slowing on the back of weak domestic consumption, waning global demand and rising trade tensions. In the fiscal year to March 2019, GDP growth slowed to 6.8 percent and compared with a 6.9 percent median estimate in a Bloomberg survey.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performing for the week ended May 31 was StarterCoin, up 489.72 percent.

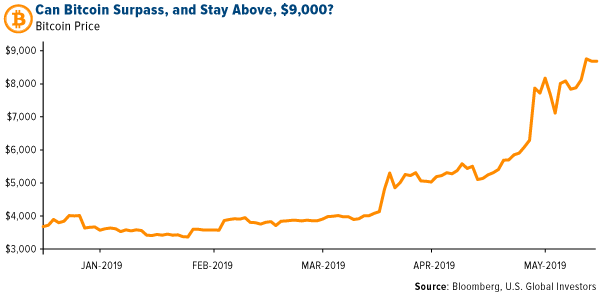

- The number one digital currency has soared 66 percent during the month of May, writes MarketWatch. Now, bitcoin could be on track to break above a “psychologically significant level” of $9,000, touching a 52-week peak at $8,938.27 on May 26. If the cryptocurrency stays at these levels, it could mean the longest monthly winning run since 2017, writes CoinDesk.

- In an interview with Bloomberg Markets: Asia, co-founder and managing partner at Kenetic Jehan Chu, says he sees bitcoin rising to $30,000 by year-end. “Cryptocurrency is not going away,” says Chu. “You don’t have to take my word for it. It’s Facebook, it’s Jamie Dimon, it’s Fidelity – all who are getting in the space, either by building infrastructure or providing services.”

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the best performing for the week ended May 31 was Beetle Coin, down 68.33 percent.

- Jesse Lund, who was IBM’s blockchain finance lead, is no longer with the firm, a spokesperson for the company confirmed via email to CoinDesk. Lund spearheaded IBM’s World Wire payment network and harbored an ambitious plan to bring cryptos into the enterprise world, reports Coindesk. Despite the unfortunate departure from the company, Lund says he is “still optimistic about payments innovation using blockchain.”

- According to research by Chainalysis, only 1.3 percent of economic transactions for bitcoin came from merchants in the first four months of 2019. The news, reported by Bloomberg today, is “ostensibly symptomatic of a speculative trend that suggests is preventing the cryptocurrency from being adopted by payments,” writes CoinTelegraph. Senior economist for Bloomberg Kim Grauer wrote in an email that this “suggests bitcoin’s top use case remains speculative, and that mainstream use of bitcoin for everyday purchases is not yet a reality.”

Opportunities

- Compared to other areas of the market, the price of bitcoin is looking pretty impressive so far this year. As MarketWatch reports, the digital currency is up around 140 percent in 2019, compared with a gain of 15.3 percent for the Nasdaq Composite, an advance of 12.8 percent for the S&P 500 and a return year-to-date of 9.8 percent for the Dow Jones.

- The University of Surrey in the U.K. is now “fingerprinting” digital government records of national video archives worldwide against tampering by using blockchain technology and artificial intelligence, reports CoinDesk. In a press release, the university describes the development of this “highly secure, decentralized computer vision and blockchain-based system,” which is known as ARCHANGEL. It is designed to preserve the integrity of digital archives for the long term.

- Executives at Salesforce revealed its own blockchain solution on the Hyperledger Sawtooth platform at the company’s tech conference this week. As reported by CoinDesk, the product called Salesforce Blockchain is a “low-code blockchain platform that extends the power of client relations management.”

Threats

- Can all other cryptocurrencies be absorbed into Bitcoin SV? According to Calvin Ayre, founder of Ayre Group and CoinGeek, the answer is yes, and in a recent interview with BNN Bloomberg he discusses why he believes Bitcoin SV is the “real” bitcoin. “The main difference from a functional perspective is that BSV massively scales on chain the rest do not, so it works and the others are dysfunctional,” Ayre explained.

- After hitting a new 12-month high of $9,097 this week, the price of bitcoin fell by $1,100 on Thursday, reports CoinDesk, creating a bearish candle on the daily chart and confirming a bearish divergence of a key indicator. Should the price find acceptance below the 30-day moving average, the case for bitcoin extending its four-month winning streak in June would weaken, the article continues.

- The appointed liquidators, Grant Thornton New Zealand, of failed crypto exchange Cryptopia released their first report on the firm’s financial situation on Friday. As reported by CoinDesk, the collapsed exchange owes creditors $2.7 million, while staff at the firm is owed $207,000 for outstanding salaries and holiday pay. According to the liquidators, the amount owed to unsecured creditors will likely rise.

Leaders and Laggards

| Index | Close | Weekly Change($) |

Weekly Change(%) |

|---|---|---|---|

| S&P/TSX Global Gold Index | 190.44 | +10.74 | +5.98% |

| Gold Futures | 1,310.20 | +21.00 | +1.63% |

| Natural Gas Futures | 2.46 | -0.14 | -5.35% |

| S&P/TSX VENTURE COMP IDX | 601.55 | -6.13 | -1.01% |

| 10-Yr Treasury Bond | 2.13 | -0.19 | -8.27% |

| Nasdaq | 7,453.15 | -183.86 | -2.41% |

| Oil Futures | 53.32 | -5.31 | -9.06% |

| Hang Seng Composite Index | 3,600.80 | -22.70 | -0.63% |

| S&P 500 | 2,752.06 | -74.00 | -2.62% |

| DJIA | 24,815.04 | -770.65 | -3.01% |

| Korean KOSPI Index | 2,041.74 | -3.57 | -0.17% |

| Russell 2000 | 1,465.49 | -48.62 | -3.21% |

| S&P Energy | 432.10 | -20.12 | -4.45% |

| S&P Basic Materials | 329.32 | -7.01 | -2.08% |

| XAU | 70.02 | +3.46 | +5.20% |

| Index | Close | Monthly Change($) |

Monthly Change(%) |

|---|---|---|---|

| Natural Gas Futures | 2.46 | -0.16 | -6.15% |

| S&P/TSX Global Gold Index | 190.44 | +10.62 | +5.91% |

| 10-Yr Treasury Bond | 2.13 | -0.37 | -14.87% |

| Oil Futures | 53.32 | -10.28 | -16.16% |

| Gold Futures | 1,310.20 | +20.00 | +1.55% |

| S&P 500 | 2,752.06 | -171.67 | -5.87% |

| S&P Energy | 432.10 | -46.64 | -9.74% |

| Hang Seng Composite Index | 3,600.80 | -374.64 | -9.42% |

| DJIA | 24,815.04 | -1,615.10 | -6.11% |

| Korean KOSPI Index | 2,041.74 | -161.85 | -7.34% |

| Nasdaq | 7,453.15 | -596.49 | -7.41% |

| S&P Basic Materials | 329.32 | -23.91 | -6.77% |

| Russell 2000 | 1,465.49 | -110.89 | -7.03% |

| S&P/TSX VENTURE COMP IDX | 601.55 | -8.36 | -1.37% |

| XAU | 70.02 | +0.43 | +0.62% |

| Index | Close | Quarterly Change($) |

Quarterly Change(%) |

|---|---|---|---|

| Natural Gas Futures | 2.46 | -0.35 | -12.55% |

| 10-Yr Treasury Bond | 2.13 | -0.59 | -21.61% |

| DJIA | 24,815.04 | -1,100.96 | -4.25% |

| Oil Futures | 53.32 | -3.90 | -6.82% |

| S&P 500 | 2,752.06 | -32.43 | -1.16% |

| Gold Futures | 1,310.20 | -18.70 | -1.41% |

| S&P Energy | 432.10 | -47.84 | -9.97% |

| Nasdaq | 7,453.15 | -79.38 | -1.05% |

| Korean KOSPI Index | 2,041.74 | -153.70 | -7.00% |

| S&P Basic Materials | 329.32 | -14.73 | -4.28% |

| Russell 2000 | 1,465.49 | -110.06 | -6.99% |

| Hang Seng Composite Index | 3,600.80 | -243.97 | -6.35% |

| S&P/TSX Global Gold Index | 190.44 | +0.03 | +0.02% |

| S&P/TSX VENTURE COMP IDX | 601.55 | -21.99 | -3.53% |

| XAU | 70.02 | -5.83 | -7.69% |

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2019):

Gazprom PJSC

Equinor ASA

Canadian Natural Resources Ltd

Suncor Energy Inc

Alpha Bank AE

Eldorado Gold Corp

Kinross Gold Corp

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks.

The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months.

The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange.

The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500.

The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500.

The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period.

The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500.

The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500.

The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500.

The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500.

The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500.

The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500.

The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The University of Michigan Confidence Index is a survey of consumer confidence conducted by the University of Michigan. The report, released on the tenth of each month, gives a snapshot of whether or not consumers are willing to spend money. The China Real Estate Comprehensive Index gives a snapshot of the situation in China’s property sector. It covers main aspects for the sector, covering funding, investment, construction, sales and inventory. A positive figure means the sector is performing above the historical average. A rising reading of the index means the improving performance in the sector. A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.