Why the Smart Money Is Heading to Texas

A seismic shift is taking place in corporate America as even more companies announce plans to relocate from blue states to more business-friendly jurisdictions like Texas.

This week, Elon Musk announced he would be moving the headquarters of two of his companies, X and SpaceX, from California to Texas. The “final straw,” according to Musk, was a new California law that blocks schools from notifying families if students change their gender identity.

But the underlying reasons for this ongoing migration go far deeper than one bad law.

The Great Corporate Migration

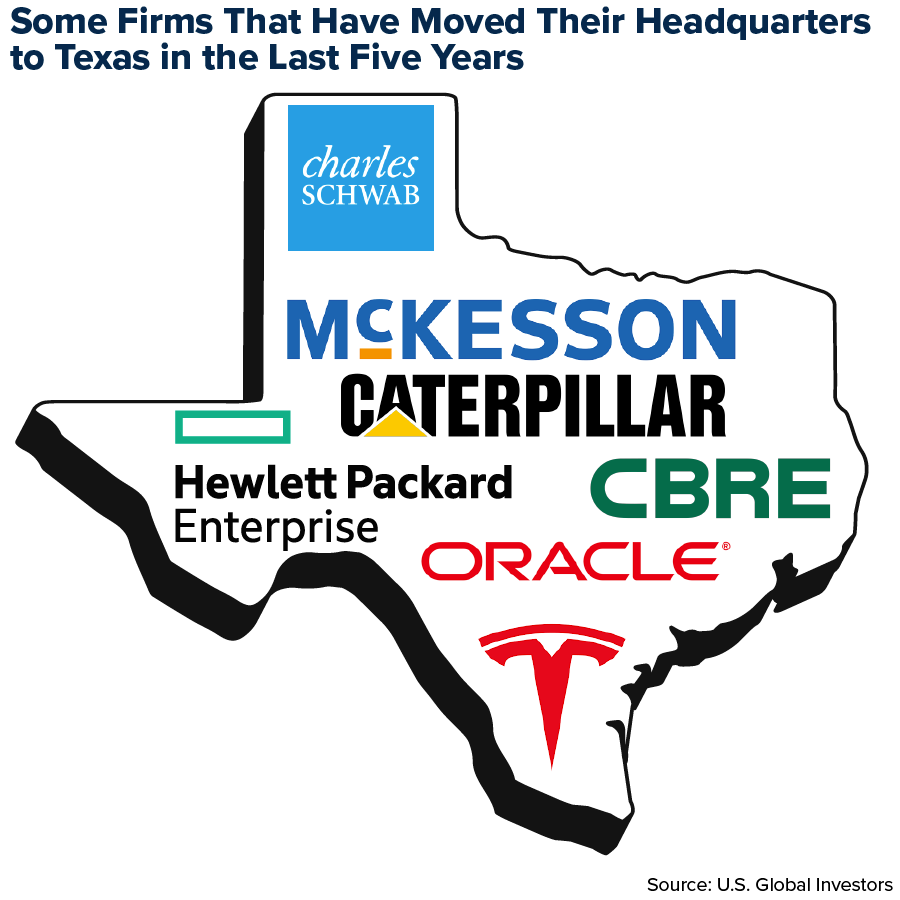

Simply put, high living costs and operating costs in select metro areas are prompting companies to seek greener pastures elsewhere. A staggering 465 headquarters have moved since 2018, with Texas welcoming the most at 209 relocations, according to commercial real estate firm CBRE (which itself moved from Los Angeles to Dallas in 2020).

By contrast, 79 companies left California’s Bay Area over the same period, 50 departed from Los Angeles and 21 moved away from New York City.

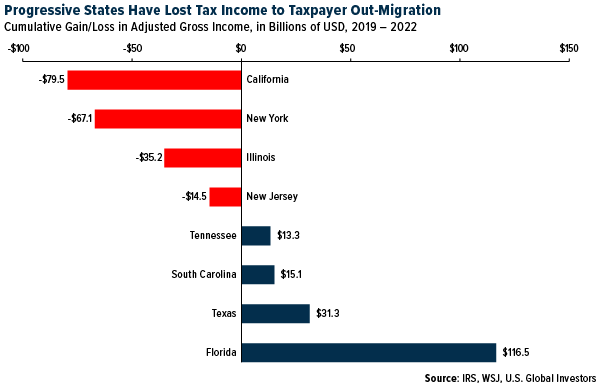

California’s losses are Texas’s gains. Between 2019 and 2022, the Golden State lost nearly $80 billion in tax revenue as residents fled high living costs and burdensome regulations, while Texas gained $31 billion (and Florida a whopping $116 billion). In 2022 alone, California lost about three times as much income to other states as it did in 2019.

This trend has had tangible impacts. San Francisco’s office vacancy rate nearly doubled from 17% in March 2021 to 32% today. That’s well ahead of the vacancy rates in similarly impacted cities such as L.A. (27%), Seattle (22%) and New York (18%).

Energy Costs and Mandates Burden California Businesses

If a business continued to lose customers quarter after quarter, it might consider reducing prices or improving services.

Not so with progressive states, which are doubling down on policies that only drive costs higher. Increased climate mandates and taxes are set to raise California energy costs—already among the highest in the U.S.—while a new $20-an-hour minimum wage for fast-food workers has led to a jump in restaurant prices.

In stark contrast, Texas has a relatively low cost of living and low energy costs. It has no personal or corporate income tax. Nearly every year since 2001, it’s topped Chief Executive’s survey of the best states for business in 2024. California, meanwhile, has remained at the bottom behind New York, Illinois and New Jersey.

Today, Texas is home to 55 Fortune 500 companies, the highest number in any state. Major firms like Oracle, Hewlett Packard Enterprise (HPE) and Charles Schwab have relocated their headquarters to the Lone Star State since the pandemic began, a move that CBRE says can help save a company 15% to 20% in employee wages.

Tech Leaders Lining Up Behind Trump

Elon Musk’s move out of California is more than a business decision; it’s also political. The Tesla chief has increasingly aligned himself with the conservative movement, and this week, he endorsed former President Donald Trump and pledged to donate around $45 million a month to a pro-Trump super PAC.

This shift reflects a broader recent trend of prominent Silicon Valley figures throwing their weight behind Trump, especially since he tapped former venture capitalist and first-term senator J.D. Vance as his running mate.

Marc Andreessen and Ben Horowitz, founders of the legendary venture capital firm Andreessen Horowitz, have also announced their support of Trump. They reportedly told staff this week that they intend to contribute money to pro-Trump political organizations, believing that the ex-president would do more than Joe Biden to help startups.

Writing in a July 5 blog post, Andreessen and Horowitz said they plan to support candidates who support “Little Tech” —their term for tech startups. Startups are the “vanguard of American technology supremacy,” and yet there’s a strong “anti-startup bias… across the American government” right now.

The way to foster continued economic growth in the U.S., Andreessen and Horowitz insist, is to “encourage new startups—to drive innovation, competition and growth—and to prevent big companies from weaponizing the government to crush them.”

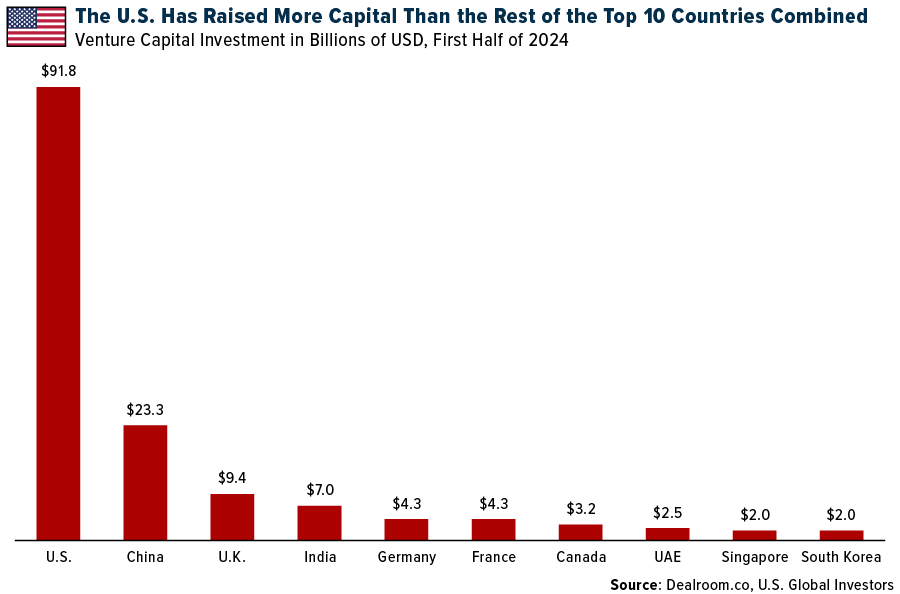

The U.S. remains the world’s largest hub for VC investment. According to startup data provider Dealroom.co, the U.S. raised close to $92 billion in the first half of this year, significantly more than the next nine countries combined. The U.S. is home to six of the world’s top 10 tech hubs by the amount of VC raised, with the Bay Area topping the list at almost $34 billion raised so far in 2024.

Vance to Bridge Trump and Silicon Valley?

Let’s talk about J.D. Vance for a moment. The 39-year-old Ohio senator, who authored the bestselling memoir Hillbilly Elegy in 2016, has seen a rapid ascent in U.S. politics. A graduate of Yale Law School and a former venture capitalist, Vance has used his background to bridge the gap between the Trump campaign and wealthy Silicon Valley donors. Despite his VC background, the lawmaker is an outspoken critic of Big Tech and has called for the breakup of Google, which he named “one of the most dangerous companies in the world.”

Trump, Vance’s would-be boss, has increasingly supported cutting-edge tech that he once criticized, including Bitcoin, artificial intelligence and non-fungible tokens (NFTs). Slated to speak next week at the Bitcoin Conference in Nashville, Trump is the first major presidential candidate to accept crypto donations. His campaign said it collected $3 million in crypto last quarter.

Trump hasn’t named who will lead his administration’s policymaking on AI if he rewins the presidency, but I believe Vance could play a major role in this growing industry. Allies of Trump have reportedly drafted an AI executive order aimed at boosting military technology and reducing AI regulations. The plan, titled “Make America First in AI,” signals a dramatic potential shift in AI policy under a future Trump administration.

Index Summary

- The major market indices were mixed this week. The Dow Jones Industrial Average gained 0.72%. The S&P 500 Stock Index fell 2.04%, while the Nasdaq Composite fell 3.65%. The Russell 2000 small capitalization index gained 1.64% this week.

- The Hang Seng Composite gained 3.44% this week; while Taiwan was down 4.38% and the KOSPI fell 2.15%.

- The 10-year Treasury bond yield rose 6 basis points to 4.24%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was United Airlines, up 7.2%. According to Raymond James, Aer Lingus pilots called off industrial action as IALPA backs a pay raise deal. The industrial action began when pilots demanded a 24% pay increase and IALPA agreed to recommend the Labor Court-brokered deal to increase pay by 17.75%.

- The container shipping spot rally since the first quarter has been supported by synchronized supply-and-demand disruptions, reports Morgan Stanley, including excess capacity delivered during 2022-2023 being digested by the Red Sea disruption. This also includes an earlier start to the demand peak season as well as restocking amid global supply chain disruptions, hiking freight costs, and potentially higher tariffs amid geopolitical tensions.

- According to Raymond James, United Airlines’ second quarter adjusted EPS of $4.14 was at the higher end of the $3.75-4.25 mid-April guide, and above its $3.95 estimate. This was primarily driven by better-than-expected CASM-Ex fuel.

Weaknesses

- The worst performing airline stock for the week was Frontier, down 15.1%. Airlines and airports are among the businesses impacted by the Microsoft outages, linked to cybersecurity firm Crowdstrike. U.S. airlines have been substantially impacted, with United, Delta and American all grounding scheduled flights, and U.S. low-cost carrier operations (and the Allegiant website) impacted by outages. issues with online check-ins or booking retrieval.

- The Shanghai Shipping Exchange released the latest weekly SCFI (Shanghai (export) Containerized Freight Index), with the comprehensive index down 2% week-over-week. Among the routes, the long-haul routes to the West Coast/East Coast recorded -6%/-1% declines week-over-week, reports Morgan Stanley.

- According to Raymond James, Spirit reduced second quarter 2024 revenue guidance by 3-4%. The miss was driven by non-ticket revenue weakness, which Spirit attributed to changes in the competitive marketplace.

Opportunities

- Goldman estimates domestic air passenger traffic could reach +15% of the 2019 level, and international (carried by Chinese airlines) could remain at 90%, outperforming China’s total international at 80%.

- According to CIBC, the delta between air freight rates and ocean rates has narrowed, making the former more competitive. The average worldwide cost of shipping a 40-foot container reached $4,988 late last week, according to Freightos, up more than 5x from a year ago. Peak season demand combined with the Red Sea capacity constraints have pushed Asia-North America spot rates 60% higher than their February peak, while prices to Northern Europe are 80% higher than peaks seen in January.

- According to JPMorgan, Indian airlines should remain in a sweet spot from a demand-supply point of view for the next four to six quarters. Industry consolidation as well as supply tightness should keep industry load factors elevated at 87-88% until fiscal year 2025. This should drive a healthy yield environment, and even crude prices are starting to ease.

Threats

- With meaningful debt maturities approaching in 2025 and 2026 ($1.1B and $500M, respectively), this was not the quarter Spirit needed, as creditor negotiations remain ongoing and the larger issuance becomes current in September, writes Bank of America. Spirit now expects to receive $30 million in credits related to GTF engine availability issues in the second quarter, down from the prior expectation of $35 million.

- According to Morgan Stanley, since its peak in 2021, the container shipping industry has added 19% capacity as of mid-2024. By the group’s estimates, another 10% capacity will be added by the end of 2025. By contrast, Morgan Stanley notes that global trade is growing by 3-4% p.a. That said, the peak season in 2024 could see the spot peak for the next two to three years.

- Changes are occurring at Allegiant. President Gregory Anderson has been named CEO and President. In anticipation of capital requirements related to fleet investments, the company is suspending its quarterly cash dividend effective immediately.

Luxury Goods and International Markets

Strengths

- Richmont’s first-quarter sales met analysts’ expectations. The jewelry brand’s sales offset declines from China and its luxury watchmakers. Growth accelerated across all regions except for Asia Pacific. The strongest sales were reported in Japan and the United States.

- Goldman Sachs reported an earnings beat. Both fixed income and equity traders outpaced analysts’ estimates. Earnings in the second quarter were almost three times what Goldman posted a year ago. The asset and wealth management business was up 27% from a year ago.

- Lucid Group, EV maker was the top-performing S&P Global Luxury stock, rising 45.6% over the past five days. On Monday, the company reported production of 2,110 cars during the first quarter, above analyst expectations of 1,954. Later in the week, the CEO Peter Rawlison announced that production of the Gravity SUV would begin this year. Shares were up more than 20% in a single day of trading, on Friday.

Weaknesses

- China’s gross domestic product (GDP) grew 4.7% in the second quarter compared with the same period a year ago, missing forecasts despite Chinese government efforts to boost consumer confidence. Bloomberg economists were forecasting GDP at 5.1% in the second quarter, still below the growth of 5.3% reported in the first quarter of the year. Goldman Sachs, Barclays and JPMorgan lowered their full-year growth estimates in response to the weak second-quarter growth.

- Swiss watch exports declined 7% year-over-year, the Federation of the Swiss Watch Industry said in a statement this week. The sharpest declines were noted in China and Hong Kong.

- Melco Resorts & Entertainment, a hotel & casino operator was the worst-performing S&P Global Luxury stock, losing 6.5% in the past five days. Bank of America lowered the company’s price target to $8.5 from $10.4.

Opportunities

- Luxury stocks have been declining recently, largely due to weaker-than-expected economic growth in China. This downturn led to a sell-off, especially affecting luxury companies because a significant part of their revenue comes from the Chinese market. LVMH’s shares had previously dropped into oversold territory, which often suggests a potential rebound in the share price soon.

- Blackstone reported lower quarterly earnings as the value of investments rose less than a year ago; however, the company is well-positioned to benefit from falling rates. “The worst is over for the real estate market, except for offices,” President Jon Gray said in an interview. Years ago, Blackstone made a strategic move, shifting its real estate portfolio from traditional office buildings to warehouses, rental houses, and data centers.

- Summer travel will boost luxury spending. According to NerdWallet’s annual summer travel survey released earlier in the year, nearly half of Americans (45%) plan to take a trip that requires a flight or hotel stay this summer, and they’ll spend $3,594, on average, on these expenses. That’s over 118 million Americans spending a total of more than $424 billion on airfare and hotel stays in summer 2024.

Threats

- Donald Trump’s chance of winning the presidential election after the attempted assassination in Pennsylvania increased. Part of his agenda is to bring production back to the United States, by putting higher tariffs on imported goods. Companies that rely on imported goods may face increased costs due to higher tariffs.

- Hugo Boss reported a second-quarter miss and cut guidance for the full year. Burberry reported a quarterly sales decrease of 21% in China. Swiss watchmaker Swatch also said its first-half sales fell due to weaker demand in China and warned that it expects the Chinese market to remain challenging until the year-end.

- LVMH will report its quarterly results next week. So far, Hugo Boss and Burberry reported weaker sales in the latest financial quarter, mostly due to weaker demand in China. This company is a luxury giant, but it too may feel the side effects of the economic slowdown in the world’s second-largest economy. Tesla will also release its full results.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising 3.19%, on little positive news. Lumber prices have fallen from April price levels of $610’s to the mid $450’s on what may have been bargain buying this week. Prices are moving up for chemicals too. According to CMA, 55% of U.S. ethylene supply was impacted to some extent along with well over half of the HDPE and LLDPE supply.

- Taseko reported second quarter production that was a bit better than expectations, reports BMO. Given the previously disclosed events impacting the quarter, BMO anticipates second-quarter costs to be elevated on a per-pound basis. Insurance proceeds to be received in the third quarter should help to boost Taseko’s cash balance.

- According to Morgan Stanley, for refiners, following heavy first quarter turnarounds, most refiners ran well operationally in the second quarter. On a quarter-over-quarter basis, Morgan Stanley expects headwinds to overall capture, driven by weaker secondary products (ex: naphtha, propylene) and less favorable crude differentials.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 10.76%, as ample stockpiles and a cooling forecast for weather let prices slide further. According to Goldman, the group’s China survey suggests that finished goods inventory picked up with 30% of manufacturing producers seeing excess stock, versus 20% in June. Their high-frequency trackers suggest current demand is 10-25% lower year-over-year for cement and long steel, 7-12% lower for metals, and stable for flat steel.

- Atalaya released an operations update for the second quarter reports Stifel, detailing copper production from the Rio Tinto mine that was broadly in line with estimates, but below management expectations. As a result, the company lowered full-year production guidance, but continues to anticipate stronger second half 2024 output on improved ore grades as mining returns to the bottom of the Cerro Colorado pit.

- Boliden mine has hit the lowest year-to-date low, declining as much as 9.1% after the miner reported a miss in revenue for the second quarter. The headwinds that copper has faced such as weakening demand have been a weakness for Aitik, a mine owned by Boliden, which is also touted as Sweden’s largest copper mine.

Opportunities

- Serbia’s constitutional court overturned a 2022 government decree which halted Rio Tinto’s production of a $2.4 billion lithium project in the country. The current president incumbent, Aleksander Vucic, has expressed regret for the halted project, stating it has been a missed opportunity for Serbia’s economy. After this announcement, the EU and Serbia inked a deal for Serbia’s expected production of lithium supply. This comes as an opportunity for both Serbia, which is expected to add 20,000 new jobs and $6.5 billion from the production, as well as Rio Tinto who had capital that sat dormant as Serbia mandated the halt of its mine.

- Cleveland Cliffs (CLF) proposed acquiring Stelco for CAD$60/share in cash and 0.454 shares of CLF stock. Given CLF’s most recent close price of $16.17 per share, this implies a total consideration of CAD$70/share and an 87% premium to STLC’s last close.

- Business Wire is reporting that Bloom Energy (BE) announced a strategic partnership with Core Weave. BE will deploy its proprietary fuel cells to generate on-site power for Core Weave at a data center owned by Chirisa Technology Parks in Illinois. The data center will allow for high-density deployments with advanced cooling systems. Bloom’s fuel cells are to be commissioned in the third quarter 2025.

Threats

- China’s ruling party met for the twice-a-decade meeting, known as The Third Plenum. Many traders expected China to announce direct stimulus or government aid to help prop up the country’s sliding property sector. However, China did not announce any stimulus which pushed copper and iron ore prices lower. China continues to be a net exporter of copper, seeing a slight rise in the country’s copper production which could further compound the price weakness.

- Donald Trump stated at the GOP convention that he will repeal the electric vehicle mandate, which is a fuel efficiency standard to further dismantle the green policies of the Biden administration towards electrification. This would be negative for copper, nickel and lithium demand and would strand those existing investments.

- Natural gas traders are giving up on the idea that a sweltering summer will boost demand for power-plant fuel and curb a massive U.S. supply glut. The spread between October and January gas futures — essentially a bet on how tight stockpiles will be heading into the northern hemisphere’s winter, has collapsed in recent weeks according to Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was dogwifhat, rising 57.40%.

- German authorities secured $2.89 billion from the sale of almost 50,000 bitcoins confiscated in January, money it intends to hold in safe custody until criminal proceedings surrounding the seizure are concluded. The state of Saxony completed the emergency sale through Frankfurt securities trading house Bankhaus, writes Bloomberg.

- Bitcoin jumped the most in three weeks after Donald Trump’s defiant response to an assassination attempt spurred speculation that the pro-crypto former president’s chances of winning reelection have improved, Bloomberg reports. Bitcoin rose as much as 4.9% to $63,000 on Monday.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Celestia, down 2.26%.

- Following a lawsuit and countersuit regarding KeyFi and its founder Jason Stone’s relationship to bankrupt crypto lender Celsius, the two parties have agreed to settle according to an agreement filed in court last week, writes Bloomberg.

- The Spain National Fan token has dropped 20% in the past 24 hours after Spain won the UEFA 2024 soccer championship. The token fell to $.024 in the past 24 hours and had a market cap of $565,000, writes Bloomberg.

Opportunities

- Financial services and banking giant State Street is exploring ways to get involved in settling payments on blockchain, according to people familiar with the matter. The company is exploring creating its own stablecoin and is considering creating its own deposit token as well, Bloomberg explains.

- Crypto trading firm Wintermute Trading is in talks with investors including Tencent Holdings, reports Bloomberg, to raise money at a valuation of roughly $2 billion. As part of the transaction, early investors and employees could sell some shares.

- Hong Kong plans to introduce a licensing regime for stablecoin issuers whose tokens reference the price of fiat currencies. Under the proposed regime, issuers of stablecoins that track fiat currencies in the city will need to obtain a license from the Hong Kong Monetary Authority, writes Bloomberg.

Threats

- Valdimir Putin warned on Wednesday that unregulated cryptocurrency mining risks overloading Russia’s electrical grid and causing widespread power outages, reports Bloomberg. Russia’s energy ministry estimates that crypto mining consumes, on average, 16 billion kilowatt hours per year, almost 1.5% of Russia’s total electricity consumption.

- An Indian crypto exchange said it halted withdrawals from the platform after discovering that one of its multi-signature wallets had been breached. WazirX didn’t give an estimate of the amount of crypto that was stolen but a blockchain security firm said $234.9 million worth of assets had been moved from the exchange to a new address, writes Bloomberg.

- An investor in Logan Paul’s failed CryptoZoo game is requesting a federal judge to deny the YouTuber default judgment against two business partners Paul says defrauded him. CryptoZoo would allow participants to purchase NFTs and play games, according to Bloomberg.

Defense and Cybersecurity

Strengths

- The Pentagon has awarded a $251 million contract to Sikorsky, part of Lockheed Martin, to supply the UH-60M Black Hawk aircraft for foreign military sales to Croatia and Jordan, with an estimated completion date of June 30, 2027, including eight aircraft for Croatia to enhance their fleet for various military operations.

- Raytheon, a division of RTX Corp., secured a $1.2 billion contract to provide Germany with Patriot air and missile defense systems, enhancing Germany’s air defenses and NATO’s defense posture, amid ongoing discussions for increased air defense systems in Ukraine. RTX’s stock saw a modest rise as a result.

- The best performing defense stock this week was Mercury Systems, rising 7.09% after it received a contract from the U.S. Navy to enhance sensor processing technologies. The company plans to develop a next-generation RF System-in-Package using advanced commercial semiconductor chips in a more compact design.

Weaknesses

- The Royal Thai Air Force has recommended the Swedish Gripen E/F fighter jet over the American F-16 Block 70 to replace its aging fleet, with final approval still pending. This decision comes as the global fighter jet market shifts towards more affordable fourth-generation jets like the F-16s and Gripens, which are easier for smaller air forces to operate compared to advanced fifth-generation models.

- Britain’s attempt to build low-cost warships led to Babcock suffering nearly £190 million in losses on the Type 31 frigates program, primarily due to soaring labor costs and inflation, despite sustaining significant employment and operational advancements.

- The worst performing stock this week was Virgin Galactic, falling 20.93% after the company’s stock price continued a series of declines and reached historical lows.

Opportunities

- European defense spending may see a significant rise amid heightened threats from Russia and U.S. military priorities shifting towards China. This potentially benefits companies like Leonardo, Airbus, BAE Systems, MTU and Rolls-Royce, with billions in added revenue.

- Pratt & Whitney has completed the preliminary design review for the F135 Engine Core Upgrade, enhancing the F-35’s performance and durability to support advanced Block 4 software, next-generation weapons and sensors.

Threats

- Four Indian soldiers were killed in a gunfight with suspected militants in Jammu and Kashmir amid a surge in regional violence linked to Pakistan, just months before court-mandated local elections, following the Indian government’s 2019 revocation of the region’s special constitutional status and the deployment of thousands of troops.

- At least 90 people died and over 300 were injured in an airstrike targeting top Hamas commanders Mohammed Deif and Rafa Salama in Gaza, though it remains unclear if either was killed, according to Israeli Prime Minister Benjamin Netanyahu.

- ASML’s surging sales to China, making up nearly half of its revenue in the second quarter, show the limited impact of U.S. export restrictions so far. The Biden administration is considering tougher curbs to prevent China from accessing advanced semiconductor technology, potentially escalating diplomatic tensions between the U.S. and the Dutch government.

Gold Market

This week gold futures closed the week at $2,449.20, down $19.80 per ounce, or 0.80%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 1.87%. The S&P/TSX Venture Index came in off 2.29%. The U.S. Trade-Weighted Dollar rose 0.27%.

Strengths

- The best performing precious metal for the week was gold, but still down 0.80%. Total known ETF holdings of gold bottomed out at 80 million troy ounces on May 13, 2024. Since then, investors have had a change in outlook regarding the precious metal, with ETF holdings of gold rising to 82 million troy ounces, a 2% increase. A 2% lift might seem trivial, but holdings have dropped 27% from their high set back in September 2020.

- RBC views Alamos Gold’s elimination of over 50% of the inherited Argonaut hedge book favorably, increasing leverage to expected higher gold prices over the next several years as production from Island/Magino ramps up. They continue to see the acquisition of Magino positively, given the expected tangible capex and operating synergies at the new Island Gold complex, and see potential for further upside from resource growth and optimization during Magino’s ramp-up.

- According to BMO, Franco-Nevada has acquired a gold stream on SolGold plc’s Cascabel copper-gold project in Ecuador for $525 million. This stream provides Franco-Nevada with an attractive use of cash, further growth optionality and increased future exposure to gold and precious metals. They estimate the internal rate of return (IRR) of this stream (including staged payments) at 6% and with further upside.

Weaknesses

- The worst-performing precious metal for the week was palladium, down 7.08%. According to Bank of America, Barrick’s second-quarter gold production of 948,000 ounces was 1% to 4% below Bloomberg consensus at 983,000 ounces and Visible Alpha (VA) consensus at 971,000 ounces. Gold production was up a modest 1% quarter-over-quarter. Production in the first half and guidance for the second half are 2-2.4 million ounces.

- According to BMO, Petra Diamonds reported its fourth-quarter operating update with a miss on diamond production relative to their estimates. Annual production also came in slightly below the revised annual guidance. However, diamond sales, and therefore revenue, was in line as all the Tender results were already pre-released.

- According to BMO, Aris Mining reported Q2/24 gold production of 49,000 ounces, which missed expectations. This was due to the Segovia Operations processing relatively low-grade zones in the production schedule. The company reiterated 2024 production guidance (220-240 thousand ounces), noting that it will meet the lower end, and provided construction updates on the Segovia and Marmato expansions.

Opportunities

- According to Scotia, Calibre Mining announced a 100,000-meter expansion to its existing 60,000-meter drill program at the Valentine gold mine in Newfoundland and Labrador. The expanded diamond drill program will include high-definition property wide LiDAR geophysical surveying, till sampling and enhanced prospecting to assist with resource expansion and discovery drilling.

- Franco-Nevada announced its subsidiary has acquired a gold stream from SolGold plc with reference to production from the Cascabel project located in Ecuador. FNB has partnered with Osisko Gold Royalties’ subsidiary to provide a syndicated financing package on a 70%/30% basis. FNB will provide a total of $525 million and Osisko a total of $225 million of funding for a total of $750 million.

- Gold is starting to find momentum, touching a new all-time high of $2,470 per ounce. So far, physical factors have driven the rally, but Morgan Stanley has argued financial flows will drive the next leg higher. This is starting to come through.

Threats

- According to Bank of America, while rising silver demand from solar PV manufacturers has contributed to the recent rally, operators are now looking to reduce silver loadings. This has been well flagged and is worth following, because solar panel manufacturers have been able to reduce silver loadings in the past.

- According to Morgan Stanley, Evolution Mining’s fiscal fourth quarter was pre-flagged for weaker production in which production of 212,000 ounces was in-line with consensus. Underperformance was driven by Red Lake and Mungari, offset by Cowal.

- Scotia ascribes a slight negative bias to First Majestic’s announcement. While second-quarter production results were in line, full-year cost guidance was weaker than previously guided. Following these updates, at spot metal prices, they forecast First Majestic could generate free cash flow (FCF) of $34 million ($0.12 per share) in 2024.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Airbus SE

Alamos Gold Inc.

Argonaut Gold Inc.

Franco Nevada Corp.

Barrick Gold Corp.

Aris Mining Corp.

Calibre Mining Corp.

Cie Financiere Richemont SA

LVMH Moet Hennessy Louis Vuitton

Blackstone Inc.

Hugo Boss AG

Burberry Group PLC

The Goldman Sachs Group Inc.

United Airlines

Delta Air Lines

American Airlines

Allegiant Air

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.