Why Junior Gold Stocks Could Be Gearing Up for a Glittering Performance

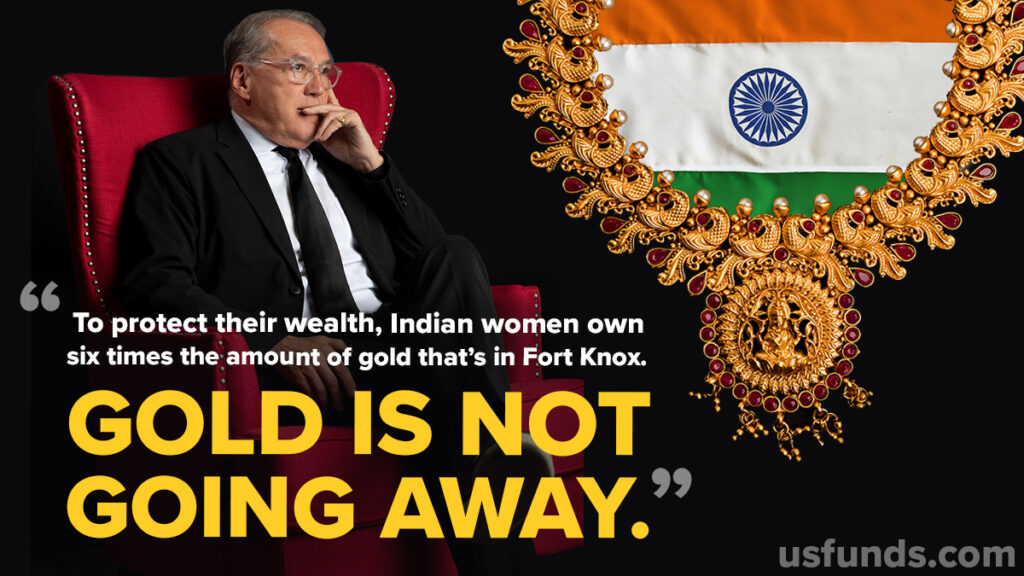

Many of the speakers and attendees were bullish on the physical metal, pointing to gold’s resilience in the face of a very strong U.S. dollar and multiyear-high yields.

Early in the week I was in beautiful Colorado Springs attending the 35th annual Denver Gold Forum, where sentiment for all things gold was cautiously optimistic.

First, however, I want to share with you some discussions and concerns I overheard at the conference about the ongoing migrant crisis, not just at the U.S.-Mexico border but also in Italy and Europe. The mainstream media has finally started reporting on the situation, with the story appearing on page one of today’s Wall Street Journal.

Some people pointed out that they believe the crisis is not accidental, but orchestrated with the purpose of overextending local law enforcement and infrastructure and destabilizing the U.S. and Europe. If you watch videos of migrants arriving on the shores of Italy’s Lampedusa Island, for instance, you’ll notice that they made the trip in nice, high-end boats that cost upwards of $100,000. There’s serious funding behind this activity, and many conferencegoers said they believed it could be Russian president Vladimir Putin.

I can’t say if this is true or not, but the issue was top of mind among many of the people I spoke with.

In the past 24 hours 20 more boats have arrived.

— Wall Street Silver (@WallStreetSilv) September 20, 2023

Total over over 18,000! More boats are underway towards Lampedusa, Italy.

The local population of the island is 6,000 and is now outnumbered by 3 to 1. Areas of the island are now blocked off and controlled by various ethnic… pic.twitter.com/DH7p0jCyUl

Many of the speakers and attendees were bullish on the physical metal, pointing to gold’s resilience in the face of a very strong U.S. dollar and multiyear-high yields. When the Federal Reserve begins to lower rates and the value of the greenback cools relative to other currencies, I believe it will really be dollar-denominated gold’s time to shine, as it is right now in many countries such as Argentina, Japan, China, South Africa and more.

Investment in gold and gold mining stocks is another thing altogether. Total known holdings in physical gold ETFs currently stand at just under 89 million ounces, down from around 106 million ounces in April 2023, according to Bloomberg data.

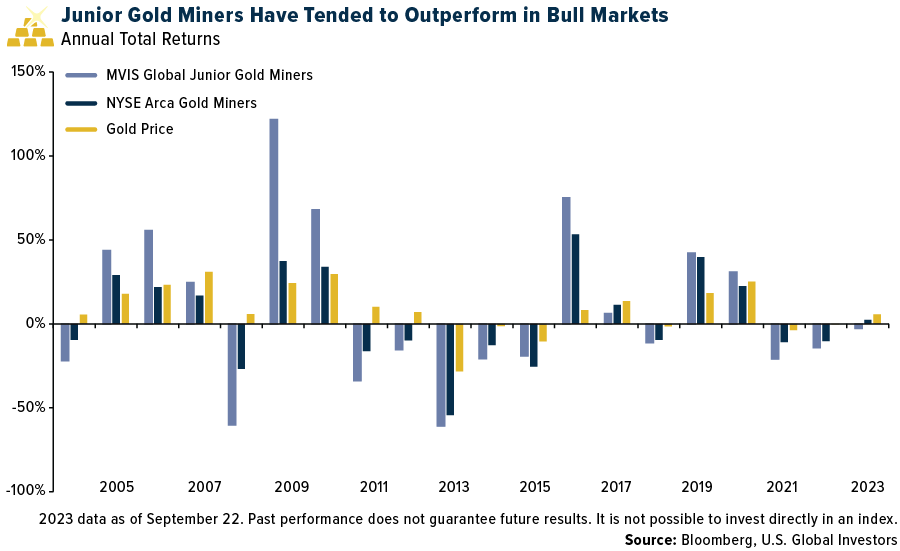

Investor appetite for junior gold miners—those that produce less than 1 million ounces a year, if at all—has also been muted, despite small-cap explorers and producers having greater operating leverage and earnings upside to rising gold prices. In the chart below, you can see that the MVIS Junior Gold Miners Index outperformed the seniors—sometimes greatly—when gold prices were ripping, though juniors also had lower lows when the yellow metal was under pressure.

Should shares of junior miners end 2023 in negative territory, it would mark the third straight year of lackluster returns and the longest losing streak since the gold bear market that persisted from 2011 through 2015. It’s important to note the high-risk, high-reward nature of the junior gold space. For the 20-year period, the juniors have averaged about 9% per year compared to around 4.1% for the seniors.

Many speakers at the conference were focused specifically on Canadian juniors, but challenges persist in other markets as well. The Johannesburg Stock Exchange (JSE), historically rooted in mining, is increasingly losing junior mining and exploration companies. Of the 39 mining companies listed on the JSE, only six were genuine precious metal exploration or development firms, starkly contrasting with over 2,000 listings on Canadian stock exchanges.

With the Fed potentially near the end of its rate-hiking cycle and the dollar poised to correct, now could be an opportune time to start considering an allocation to junior gold explorers and producers in anticipation of higher gold prices.

But how do you go about doing it?

Anticipate Before You Participate: The Lifecycle of a Mine

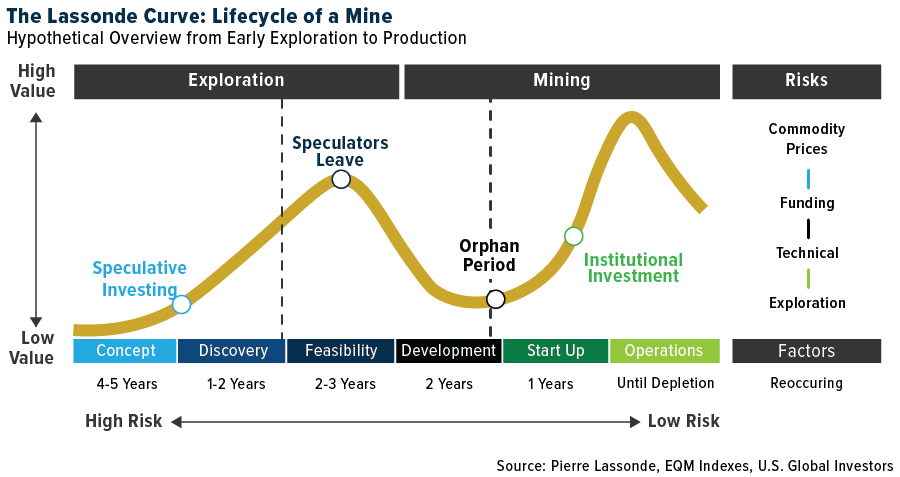

Investing in junior mining companies requires a deep understanding of the mine’s lifecycle. For that, we’ll turn to the Lassonde Curve. Named for my longtime friend and mentor, Pierre Lassonde, cofounder of Franco-Nevada, this metric illustrates seven distinct stages from early exploration to depletion, each offering unique risks and opportunities.

Initially, in the “Concept” stage, geologists use geochemical and sampling techniques to locate potential gold deposits and analyze drill cores for mineral content, which, if found in sufficient amounts, might hint at a viable mineral deposit. The second stage, “Discovery,” rewards early speculators, showing the potential for mining based on a significant presence of gold. This stage gives way to the “Feasibility” phase, where studies evaluate the deposit’s profitability prospects. Speculative investment peaks here due to lingering uncertainties.

The subsequent “Development” phase is a pivotal point where many mineral deposits can falter, with companies required to secure funding, develop a production blueprint and assemble an operational team. Successfully navigating this stage leads to the “Startup” stage, where the company starts processing ore, resulting in revenue generation. The concluding “Operations” stage, when gold is actively being dug out of the ground, has historically attracted even more institutional investors.

Are Microcaps Poised for a Comeback Post Rate Cuts?

I believe the allure of small-cap gold mining stocks extends to microcap stocks in general.

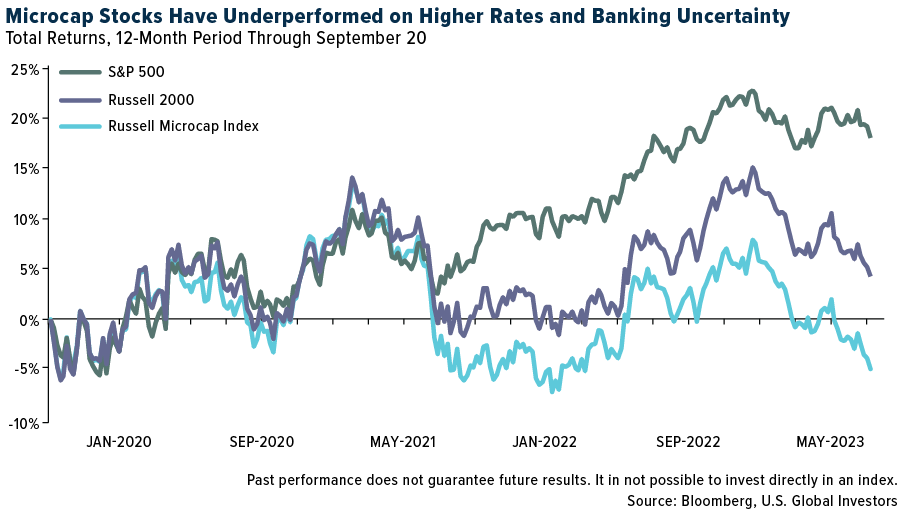

Microcap stocks in general, which constitute less than 2% of the U.S. stock market’s total investable market cap, can be an attractive part of a portfolio due to their low correlation with larger market caps and potential as a liquid and cost-effective substitute for private equity. However, they come with challenges like increased volatility, limited liquidity and scant options for investors seeking exposure.

The Russell Microcap Index, with over 1,500 holdings and an average market cap of $660 million as of August, serves as a common microcap reference. Stocks in this group have underperformed this year primarily because of rising borrowing costs and uncertainty in the banked sector. Large companies raise most of their funds from capital markets by issuing bonds, after all, while smaller companies largely rely on lending from banks.

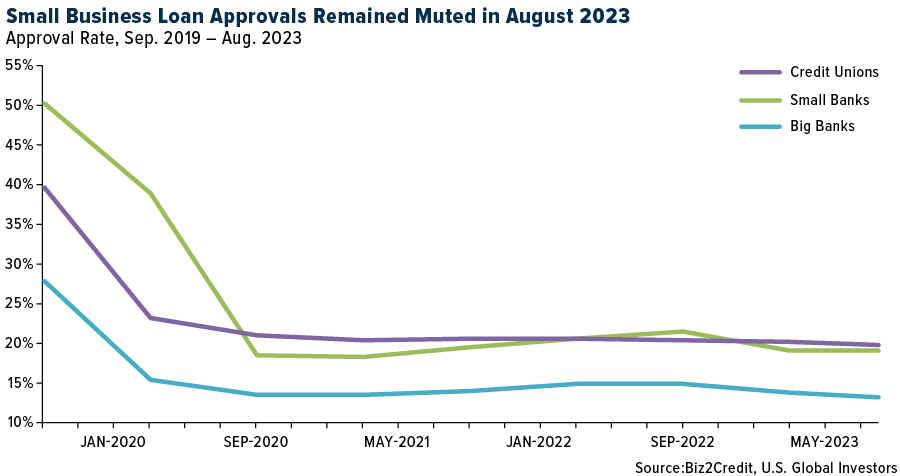

Indeed, small U.S. businesses are finding it increasingly difficult to access the necessary capital to operate and expand right now, according to a recent survey by Goldman Sachs. Of those who applied for a business loan in the past year, 70% of businesses reported difficulties in obtaining capital, up from 61% in April 2023.

In August, the Biz2Credit Small Business Lending Index revealed that big banks ($10 billion+ in assets) experienced a decline in small business loan approval percentages, dropping to 13.2% from 13.3% in July—a near two percent decrease from 15.1% in August 2022. This continued a trend of declining approvals by big banks since June 2022.

In contrast, small banks, which often process government-backed Small Business Administration (SBA) loans, saw a slight rise in approval percentages from 18.9% in July to 19.1% in August, though this is significantly lower than pre-pandemic figures.

Meanwhile, credit unions’ approval rates hit an all-time low in August at 19.8%, slightly down from July’s 19.9%.

But as is the case for gold stocks, we may see a reversal of fortunes for microcaps once the Fed starts trimming rates and borrowing costs come down. Now could be an attractive buying opportunity.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.89%. The S&P 500 Stock Index fell 2.96%, while the Nasdaq Composite fell 3.62%. The Russell 2000 small capitalization index lost 3.71% this week.

- The Hang Seng Composite lost 0.99% this week; while Taiwan was down 3.41% and the KOSPI fell 3.58%.

- The 10-year Treasury bond yield rose 10 basis points to 4.43%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Azul, up 6.9%. According to UBS, China’s total air passenger volume increased by 5% from the 2019 level in August. Domestic passenger volume exceeded the pre-Covid level by 11%, slightly weaker than in July (and 12% higher than 2019 level). International passenger traffic continued picking up gradually to 52% of August 2019 levels. UBS attributes the slowdown in passenger volume recovery to the typhoon impact and the end of summer travel season.

- According to Bank of America, world container trade remains resilient with U.S. container imports tracking 5-10% above 2019 levels in the past four weeks, with a return to normal world trade patterns and with destocking largely over. Container vessel idling remains low at below 1% of the world’s fleet and Panama Canal disruptions are small for container (loaders waiting 3-4 hours). However, congestion has built a little to 5.7% of the world fleet given recent Asian typhoons.

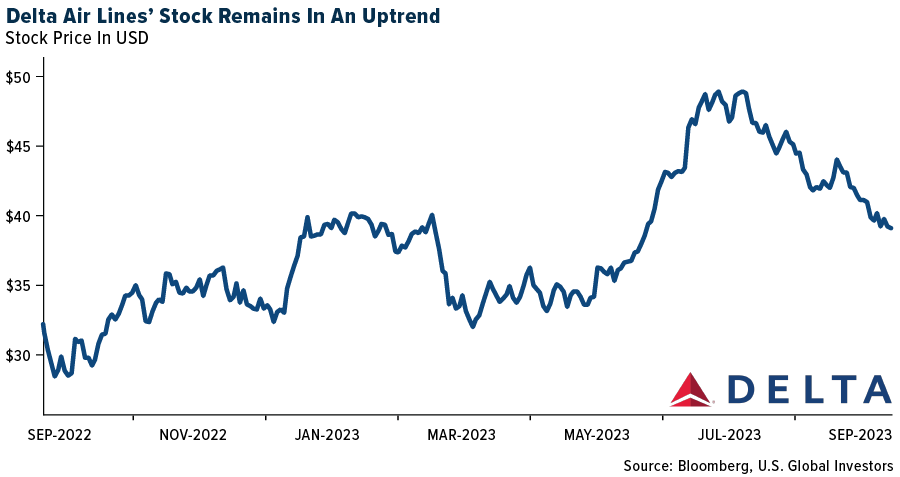

- According to Raymond James, Delta Air Lines notes that bookings remain strong into January-March. Business demand recovery appears to be in line with expectations, with no meaningful change versus 2019.

Weaknesses

- The worst performing airline stock for the week was Frontier, down -15.2%. A total of 73 A320neo family aircraft are currently in the Lufthansa fleet (64 use the GTF engine). Lufthansa expects around 20 aircraft will not be available, on average, in 2024 due to shop visits. This could lead to some impact on capacity for 2024.

- According to Bank of America, the worst of air cargo demand headwinds appear to have passed – but demand remains sluggish, down year-over-year through August/September, and the bank’s checks suggest a modest peak season ahead. The recovery in air cargo supply has somewhat stalled for now, although the group sees further belly capacity recovery ahead, led by ramping Chinese flights and new aircraft deliveries. Air cargo rates have held around 20-30% above 2019 levels in recent months and could sequentially rally into the fourth quarter peak. However, Bank of America sees another downward leg to freight rates on supply pressure into 2024.

- Qantas is facing fresh headwinds, including the negative publicity associated with alleged ticket shares for cancelled flights, steep airfares, and the ease to which flight credits could be redeemed. Qantas’ former CEO, Mr. Alan Joyce, has also departed two months earlier than planned as the airline seeks to reset and remediate deemed deficiencies. The Australian government launched an inquiry over denial of Qatar Airways’ bid to fly extra services to and from Australia. It has been suggested by industry participants that competition may have reduced the cost of flights, despite prevailing supply-side constraints.

Opportunities

- Norwegian Air Shuttle said Friday that the Norwegian Competition Authority will continue its review of the airline’s proposed acquisition of Wideroe to determine whether the deal is likely to significantly impede effective competition. The low-cost carrier outlined a 1.13 billion Norwegian-kroner ($105.3 million) all-cash deal in July for regional airline Wideroe, as it seeks to expand the reach of its low-cost offering, gain market share in the business segment, and boost its green aviation investment capacity while yielding cost synergies.

- According to ISI, if there is a single leading indicator that has been most predictive in the short term, it is time charter activity. In the first two weeks of September there have been 19 reported dry bulk time charters (1 Capesize, 14 Kamsar/Panamax, and 4 Supra/Handy) and the month is on pace for around 40 charters. This is about twice the rate seen in each of the past three months. Most of the contracts are between 6-12 months, meaning charters are concerned with the price and availability of dry bulk capacity in the near term. The last two times there were more than 40 charters reported in a single month were in March 2021 and March 2022. From the start of March 2021 through the next two months, dry bulk rates were up 84% on a very strong rally and in 2022 the rise was 16%.

- The near full easing of group tour restrictions and international flight capacity reinstatement could support recovery of China outbound tourism. Based on preliminary expectations, Chinese travelers prefer domestic travel and short-haul destinations (i.e., South Korea, Japan) relative to key long-haul destinations (U.S./Europe).

Threats

- The European Parliament has adopted new requirements for aviation fuel, which means that from 2025, aircraft in the EU will have to use a growing proportion of sustainable fuels. From 2025, all EU aircraft must use at least 2% sustainable aviation fuels in their fuel tanks, rising to 6% in 2030 and 70% in 2050. These are the rules which have been negotiated and finally adopted by the European Parliament.

- The Evercore ISI Shipping Company Survey has shed 16.5 points over the past seven weeks as slower dry bulk activity combined with late summer tanker softness drove the index lower. OPEC cuts and the extension of existing cuts remain headwinds to tankers, but overall, the wet market and tanker markets remain solid.

- According to JPMorgan, Raytheon announced a new plan for servicing the 3,000 GFT engines powering the A320neo globally. There will be 3,000 shop visits “SVs” between 2023 and 2026. Most incremental visits will happen in 2023 and early 2024; leading to more A320 aircraft grounded for maintenance than originally expected. In addition, the expected wing-to-wing turnaround times for the incremental visits will also be longer than expected at 250-300 days.

Luxury Goods and International Markets

Strengths

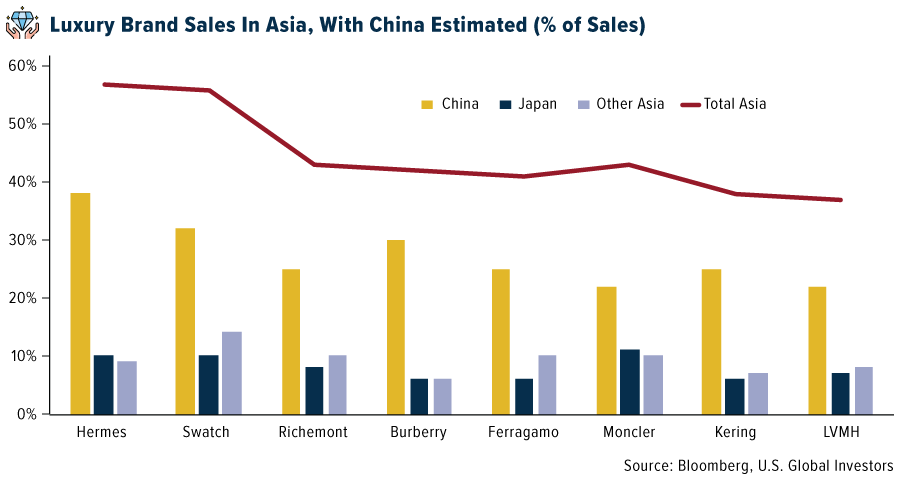

- Asian broker CLSA has begun coverage of the luxury sector, with recommendations to buy LVMH and Richemont. According to the broker, the market share of personal luxury goods reached EUR353 billion in 2022, growing at 5.5% over the past two decades. In comparison, the World Bank has noted global GDP only growing at 3.3% over the same period, significantly less than the growth seen luxury goods.

- Nicholas Hieronimus from L’Oreal believes that the beauty industry will continue to grow, as the middle class continues to expand with consumers wanting premium products with higher price tags. He also highlighted that more men are using beauty and self-care products, predicting that the beauty market will grow from the current low of EUR 270 billion to EUR 400 billion by 2030.

- MGM China Holdings, a hotel and real estate operator, was the best-performing S&P Global Luxury stock, gaining 4.2% in the past five days. Shares gained on expectations that the upcoming eight-day Fall Festival in China will bring extra revenue as people will travel during that time. The Mid-Fall Festival will start next Friday, September 29.

Weaknesses

- Oddo BHF analyst Jean Danjou cut the recommendation on Hermes International and Moncler to neutral from outperform. Shares of Hermes have been holding up well recently while most luxury names have been correcting since the most recent peak in mid-July. On the day when Oddo changed its recommendation (Thursday), however, company shares dropped 6.5%. This was the biggest slump since July.

- Bloomberg reported that private sector activity in the Eurozone continued to shrink in September. The preliminary Manufacturing PMI was reported at 43.4 vs. the expected 44.0. The key drivers of the regional downturn were Germany, with a manufacturing PMI of 39.8, and France, with a manufacturing PMI of 43.6. PMI index readings below the 50-mark represent a contraction in manufacturing activity.

Opportunities

- JPMorgan reduced growth expectations for Louis Vuitton and Richemont for the second half of this year, cutting sales forecast by 2-3%. The broker backed its revisions on slowing Western consumers and uncertainty around China. However, JPMorgan said that the recent price correction in LVMH looks overdone, recommending both luxury giants to be overweight.

- CLSA predicts that the global luxury goods sector will grow 6.5% from 2022 to 2025, slightly surpassing the 5.5% seen over the past two decades. This will be driven by Chinese demand recovery on the back of reopening and outbound travel resumption. In 2019, Chinese consumers comprised one-third of global personal luxury sales at $92 billion, and this should continue to rise, reaching EUR100 billion by 2025.

- Next Friday China will begin its Mid-Autum Festival celebrations. The festival is an important eight-day holiday in Chinese culture where people travel and families reunite. CLSA sees more robust tourism this year, and greater interest in long-distance trips despite more Covid-19 infections being reported. Hong Kong, Macau remains the most popular overseas destination. Thailand has recently gained more popularity due to a new visa policy.

Threats

- This week, Bloomberg Intelligence warned about the luxury sector being highly exposed to China, where growth is slowing down, and the post-pandemic recovery has not been as smooth as expected. The companies that have the largest sales in China may be the most exposed to the country’s slowdown. Hermes generates 38% of its sales there, followed by Swatch at 32%, and Richemont at 25%.

- The World Travel & Tourism Council predicts that international travel in China may take another year to fully recover to the pre-pandemic level. According to Bloomberg, China was the world’s fastest-growing source of tourism before Covid-19, with about 70% of luxury spending taking place outside of the mainland in 2019.

- The Federal Reserve Bank in the United States left rates unchanged, but the overall expectation is that the rates will be hiked again later this year and will stay at the elevated level for longer. The Fed’s baseline policy rate is between 5.25% and 5.%. That’s the highest in 22 years. After the Fed’s decision and Fed Chairman Jerome Powell’s update, yields spiked higher, pushing equites lower.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was uranium, rising 5.XX% as proxied by the Sprott Physical Uranium Trust. Demand for cleaner forms of energy has seen policy shifts in Japan and Germany on revising plans to retire nuclear facilities. The World Nuclear Association sees fuel demand for reactors growing by 28% by 2030, and nearly twofold by 2030.

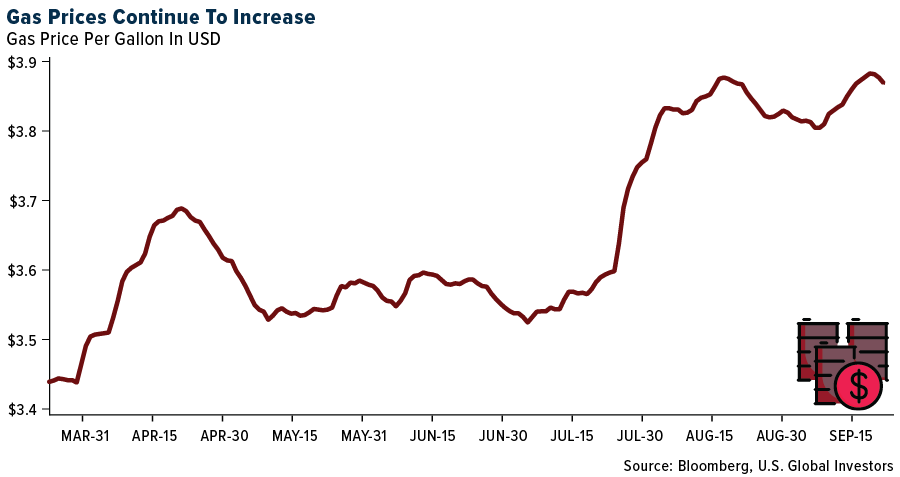

- U.S. gasoline prices have climbed to a record September high, while U.S. East Coast distillate supply is set to further tighten and drive regional prices higher ahead of planned maintenance at two key refineries.

- Russia has temporarily banned exports of diesel in a bid to stabilize domestic supplies, adding pressure on already tight global fuel markets. “Temporary restrictions will help saturate the fuel market, that in turn will reduce prices for consumers” in Russia, the government’s press office said on its website.

Weaknesses

- The worst performing commodity for the week was coffee, dropping 5.XX% on light rain forecast for the top coffee producer Brazil, lessening the fear of crop damage. According to BMO, at the World Chemical Forum from a high level, most presenters noted that a) the trough is here, but it is likely a “lower-for-longer” backdrop. b) The next one to two years remain challenging for most commodities as oversupply conditions (demand erosion in case of chlor-alkali) will create a loose S/D environment — thereby pressuring producers’ margins. c) Op rates for many commodities stand at multi-decade lows requiring both demand uplift and supply curtailment.

- CMA noted a “lower-for-longer” outlook as their base case for polyethylene. There is a global capacity surplus of 11% seen over 2022-23 (the highest ever) and they expect the world takes two to three years to absorb the same. For polypropylene, the global capacity adds outweighing demand growth will continue into next year, with 2022-24 having 14.4 million tons per annum (Mtpa), or 18% of global surplus capacity. Op rates are expected to dip lower next year, to 76% versus 78% in 2023. China will drive the capacity expansions and with 60% of capacity state owned/controlled, CMA says it is less likely that capacity adds will be delayed or capacity shut down.

- According to RBC, the U.S. Court of International Trade (CIT) ruled the U.S. International Trade Commission’s (ITC) findings leading to countervailing duties on Russian and Moroccan potash imports was based on insufficient evidence. The Court has ruled the ITC must conduct new analysis of the situation and make a new determination, with a timeline of about seven months. Prior to this ruling, imports from Moroccan producer OCP were subject to a 19.97% duty and imports from Russia subject to duties ranging from 9.19-47.05%.

Opportunities

- The world’s oil refiners are proving powerless to make enough diesel, opening a new inflationary front and depriving economies of a fuel that powers industry and

transport alike. While oil futures are rocketing —they were just

below $95 a barrel in London — the rally pales in comparison with the surge in diesel. U.S. prices jumped above $140 to the highest ever for this time of year. - Goldman Sachs now sees a modest 634,000-ton global aluminum deficit for full-year 2023. They also expect a modestly tighter balance in 2024, reflecting a stabilization in Western demand, resilient China green demand and margin restrained supply dynamics. In that base case, they continue to expect higher prices to prevail though reduced deficits.

- According to Bank of America, the constructive backdrop for iron comes with significant caveats, though. Indeed, profit margins at China’s steel mills remain negative, which usually dampens raw material purchases. In their view, an improvement in margins is essential, and that needs steel prices to rebound. While they remain cautious iron ore for 2024, the combination of government stimulus and official calls to cut steel production could make that happen near-term.

Threats

- According to J.P Morgan, the last significant U.S. autoworker strike was in late-2019 when 48,000 United Auto Workers (UAW) union members across 50 General Motors (GM) plants walked out. In terms of metals prices, North America steel prices were the hardest hit over the six-week GM strike in 2019, with steel prices falling more than 15%. Aluminum and copper prices both declined 5%.

- According to RBC, while 5% of global liquid natural gas (LNG) supply being at risk is cause for concern, they are yet to see an impact on exports as strike action continues at Gorgon and Wheatstone, with operator Chevron highlighting contingencies to keep volumes flowing. In their view, current market dynamics are healthy enough to absorb any short-term pressures, should they materialize.

- According to J.P Morgan, after reaching their target of $90 for oil in September, further price gains may be limited as they believe most bullish cues—both macro and micro—for the market have been exhausted for now. Their end-year target remains $86/bbl., while acknowledging that the path to this target can take different shapes.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was IMX, rising 33.54%.

- Tether Holdings resumed lending out its own stablecoins to customers, less than a year after it said it would wind down the practice. The company calls them secured loans and discloses little about the borrowers or the collateral accepted, writes Bloomberg.

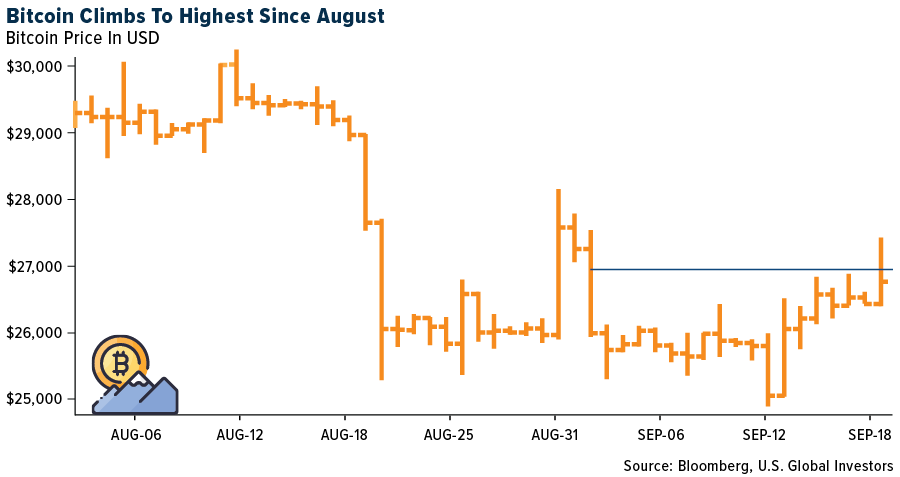

- Bitcoin extended its rally from last week, rising above $27,000 for the first time since August. Other digital assets followed suit, with smaller tokens such as Solana, Litecoin, and Bitcoin Cash rallying, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was IOTA, down 9.01%.

- A report by dappGambl found that 95% of non-fungible tokens (NFTs) are effectively worthless. Out of 73,257 NFT collections, 69,795 of them have a market cap of zero ether, based on data provided by NFT scan and coin market caps, writes Bloomberg.

- FTX Trading sued to claw back transfers valued at $153 million received by former employees of an FTX affiliate just before the cryptocurrency trading platform collapsed into bankruptcy. Four former employees of Salameda Ltd. used their personal connections to prioritize withdrawals of their funds and digital assets from FTX when it became clear last November that the company was in trouble, writes Bloomberg.

Opportunities

- Volatility in Bitcoin remains suppressed, consistent with the calm in the U.S stock and bond markets. The low volatility regime will likely continue after Wednesday’s Federal Reserve decision, according to some crypto traders, as reported by Bloomberg.

- PayPal announced on Wednesday that Venmo users will be able to buy PayPal’s new stablecoin, increasing the number of cryptocurrencies customers can purchase on the app to five. The ability to purchase PYUSD is now open to select users and it will be rolled out to more customers in the coming weeks, writes Bloomberg.

- Carly Nuzback, the former chief legal officer of UK crypto custodian Copper Technologies, has started a new company which will help crypto firms deal with tougher new rules on marketing their services in the UK, writes Bloomberg.

Threats

- The managers of bankrupt crypto exchange FTX sued the parents of co-founder and CEO Sam Bankman-Fried to “recover millions of dollars in fraudulently transferred and misappropriated funds.” Allan and Barbara Fried allegedly exploited their access and influence within FTX to enrich themselves by millions of dollars at the expense of the debtors and creditors, the court filing said, as reported by Bloomberg.

- A former Wall Street trader who became the head of a major crypto company has been caught up in allegations about drug use and his relationship with a 19-year-old intern at a Bitcoin conference last year. This comes as part of a lawsuit filed by a former colleague, writes Bloomberg.

- Crypto exchange Bybit is exiting the UK market ahead of new crypto marketing rules set to be enforced by the country’s financial regulator, writes Bloomberg.

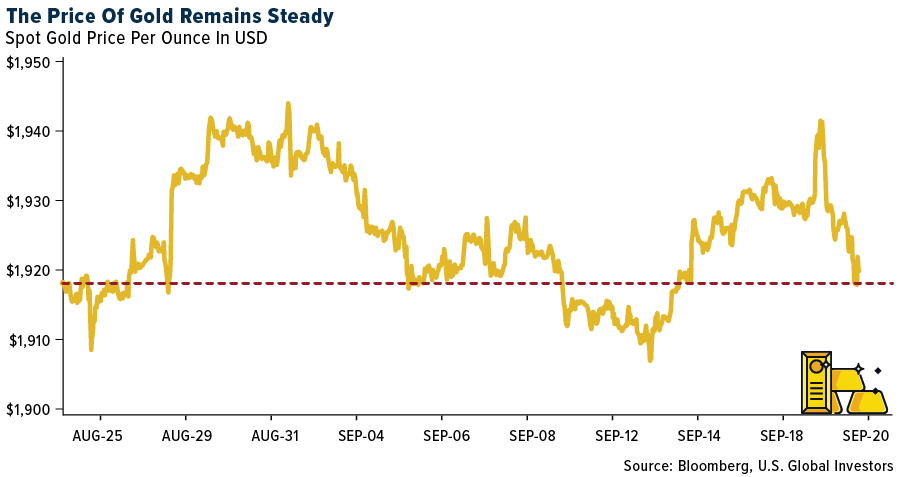

Gold Market

This week gold futures closed the week at $1,945.00, down $1.20 per ounce, or 0.06%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 2.47%. The S&P/TSX Venture Index came in off 3.50%. The U.S. Trade-Weighted Dollar rose 0.27%.

Strengths

- The best performing precious metal for the week was silver, up 1.86%. AngloGold Ashanti agreed to sell its entire 50% indirect interest in the Gramalote Project to B2Gold for a total consideration of up to $60 million. B2 owns the other 50% already. Under the terms of the deal, B2Gold will pay $20 million upon deal closing. There are also additional milestone payments of $10 million each.

- According to Scotia, Centerra Gold announced its strategic plan for each asset in its portfolio along with its capital allocation strategy. Focus at Mount Milligan is to advance work on productivity and cost efficiencies together with mine plan optimization. At Öksüt, the company provided an updated the LOM plan, with a 6 year-mine life and elevated production expected through mid-2024. Production is estimated at 190,000-210,000 ounces at an all-in sustain cost (AISC) of $800-$900/ounce in 2024.

- Gold gained for the first three trading days of the week as investors waited for an interest rate decision by Federal Reserve. Upon leaving rates unchanged but still with a hawkish tone of rates staying higher for longer, gold sunk 1.40% on Thursday but bounced back on Friday to get finish with a slight loss for the week in the futures market but there was a slight weekly gain in spot prices.

Weaknesses

- The worst performing precious metal for the week was gold, down 0.05%. According to BMO, Hecla announced that the fire at Lucky Friday’s shaft #2 has been extinguished with normal ventilation re-established. The company expects the mine to remain suspended for the remainder of 2023 as it conducts underground development to bypass the damaged portion of the shaft and re-establish secondary egress for the mine. 2024 guidance is unchanged, and the company expects insurance compensation for both property damage and lost production.

- At the Gold Forum Americas, Newmont said it expects to leverage its previous experience at Boddington and Penasquito where it delivered over $700 million in synergies at each asset to deliver synergies from the Newmont portfolio. Penasquito remains on strike and Newmont noted that it will not offer back pay, change the bonuses, or pay a bonus in 2023, considering how long the asset has been shut down as a result of the strike. Workers have not been paid since the strike commenced 104 days ago.

- According to CIBC, Sierra Metals announced that is has put its Cusi silver mine in Mexico into care and maintenance and initiated a sale process for the asset. Earlier this year, new management had classified the asset as non-core. They value the asset at $22 million, but expect that certain liabilities held on the balance sheet at the corporate level can imply a transaction price of $10 million to $15 million.

Opportunities

- Calibre announced an initial open pit Mineral Resource Estimate for its 100% owned Cerro Volcan Gold Deposit located five kilometers from the Libertad processing facility. The company has also identified two target areas, Calvario and Salvadorita, where high-grade surface samples.

- According to Scotia, many mining executives highlighted an apparent valuation disconnect as development companies are trading at a fraction of Net Asset Value (NAV). Within their coverage universe for example, gold development companies are trading an average spot price-to-NAV (P/NAV) of 0.34x, or an adjusted average of 0.28x when excluding the highest-valued firm.

- Silver Lake Resources has purchased an 11% stake in RED5, securing 383 million shares at $0.26/share through a block trade for a cost of A$100 million. SLR finished FY23 with A$332 million in cash and bullion with no debt.

Threats

- According to National Bank Financial, Mali’s existing gold operations will not be affected by the nation’s new mining code, a senior lawmaker said. The updated rules – which entitle the state to a bigger stake in producing assets – are not intended to apply, while existing contracts remain in force, to these established operations, according to Assane Sidibe. “Valid mining titles benefit from stability clauses that will be respected,” Sidibe, president of the mining commission within Mali’s National Transition Council, the nation’s legislative body, said by email. The new code “applies in its entirety to new projects or to projects that are being renewed,” he said.

- According to Scotia, for i-80 Gold, they ascribe a neutral bias to announcement of additional $20 million funding. It provides upfront financing for i-80 to advance its key projects, the facility utilizes an $1,500/ounce gold price for the prepaid ounces, representing a discount of 21% to spot price or 12% to their $1,700 LT price, thus, reducing leverage to rising gold prices.

- According to an RBC report titled “You Could Hear a Pin Drop,” the gold mining industry’s largest conference was hosted by the Denver Gold Group in Colorado Springs. Overall, the conference was reasonably well attended, with approximately 900 registered participants, up 4% year-over-year. Buy-side attendance was noticeably quieter, representing 240 participants in total—flat on a yoy basis but down more than 20% from pre-COVID levels.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/31/2023):

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.