Why Gold Stocks Could Be a Contrarian Investor’s Dream Right Now

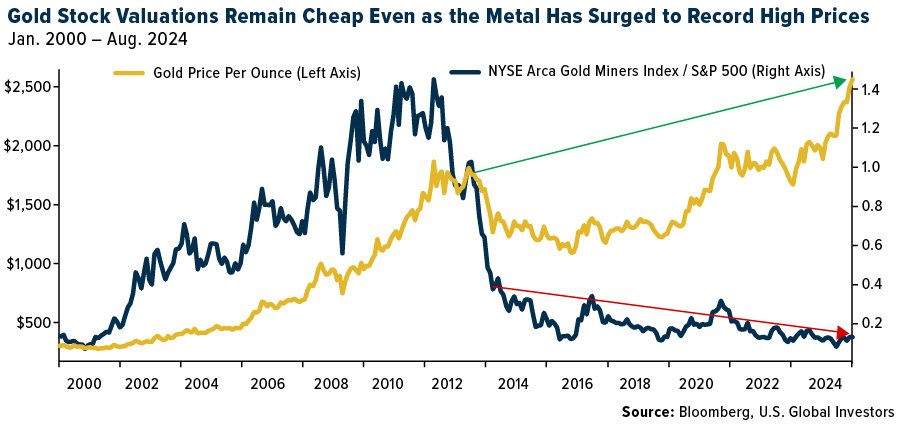

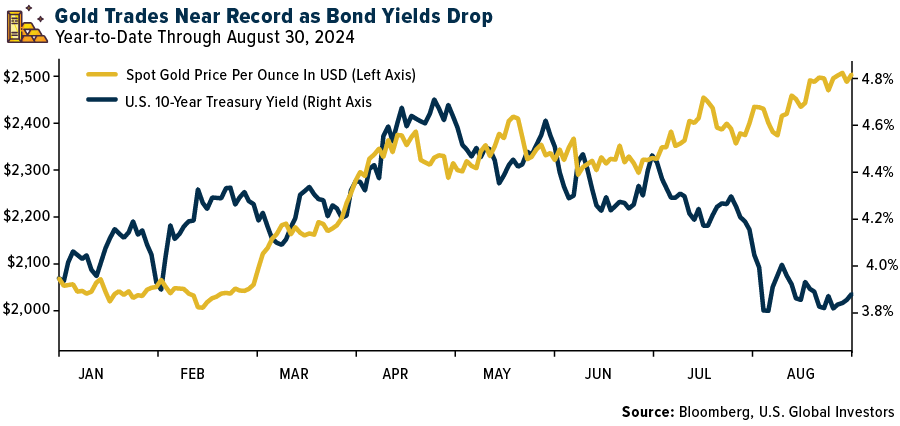

As I write this, gold continues to trade above $2,500 an ounce after surging past the psychologically important level for the first time ever in mid-August. For seasoned gold mining investors, this should be a moment of validation. After all, the yellow metal has long been seen as the ultimate hedge against economic uncertainty.

And yet, despite the bull run, gold stocks—those companies that mine, process and sell the metal—are trading at historically low valuations relative to the market.

This apparent disconnect offers contrarian investors an extraordinary opportunity.

Rising Yields and the Gold Selloff Explained

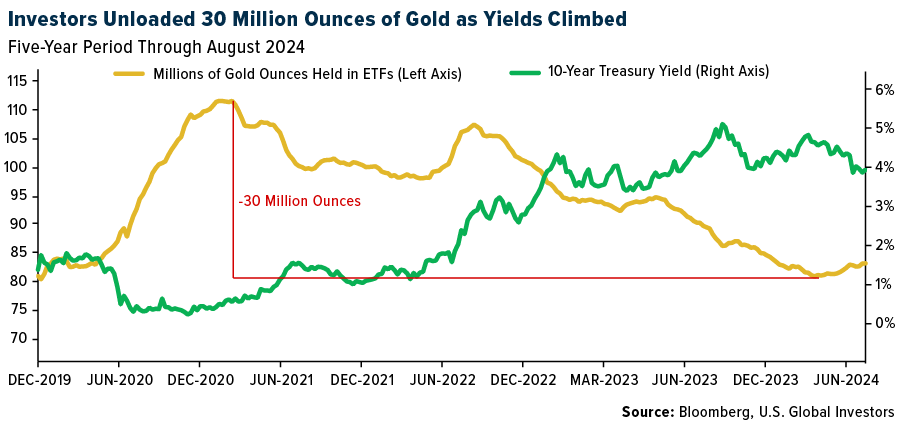

But first, why is this happening? The primary culprit for this disparity, I believe, lies in the impact of interest rates and central banks’ gold-buying spree. The real, inflation-adjusted 10-year Treasury yield rose from a low of around -1.2% in August 2021 to nearly 2.5% in October 2023, and for many investors, particularly those in Western countries, rising yields are a signal to sell non-interest-bearing gold.

That’s exactly what happened. From the end of 2020 to May 2024, exchange-traded funds (ETFs) backed by physical gold shed approximately 30 million ounces, over a quarter of their total holdings, as yield-seeking investors pared back their positions.

What some investors may have overlooked, I’m afraid, is the long-term potential of the very assets they were letting go of. Gold stocks, unlike the physical metal, offer not just a hedge but also a means of participating in the upside of gold prices. Put another way, when gold prices have gone up, gold stocks have historically tended to rise even more.

Right now, I believe these stocks are offering an unprecedented combination of low valuations and high potential returns.

A Contrarian Take on Gold Stocks

As contrarians, we understand that the best time to invest is often when sentiment is at its lowest. And sentiment around gold equities is pretty low right now.

But history tells us that this could be the perfect time to buy. As you may be able to tell in the chart above, we’re seeing a reversal of the gold ETF selloff. Since mid-May, investors have added about 2.3 million ounces of gold, according to Bloomberg data; holdings now stand at their highest level since February of this year.

This could be just the beginning. If real interest fall substantially, the tide could turn in favor of gold and gold equities.

$3,000 Gold by Mid-2025?

Historically, gold’s biggest gains have occurred when the Federal Reserve cuts interest rates amid economic uncertainty. Although there’s no obvious crisis on the horizon, markets are pricing in a 25-basis point cut at each of the next two Fed meetings in September and November, with a larger cut expected in December.

If the Fed follows through, we could see gold prices not only maintain their current levels but soar to new heights. UBS is calling for $2,700 gold by mid-2025; Citigroup, Goldman Sachs and Bank of America all see the metal hitting $3,000.

Stock Market Trends After the First Fed Rate Cut

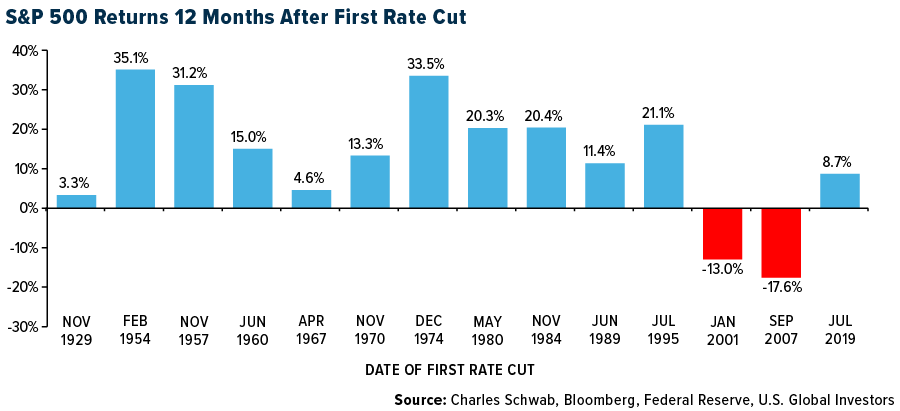

That’s not to say you should dump all your equities in favor of gold, especially as the Fed is on the verge of easing. Charles Schwab recently showed what stocks did in the past when rates fell, and investors may want to take note.

The stock market traded up 12 out of 14 times—or 86% of the time—a year after the Fed made its initial cut in a new easing cycle. Schwab points out that the two back-to-back negative periods were predicated on extraordinary circumstances: the dotcom bubble in 2001 and the housing crisis in 2007. Past performance is no guarantee of future results, but it’s worth considering.

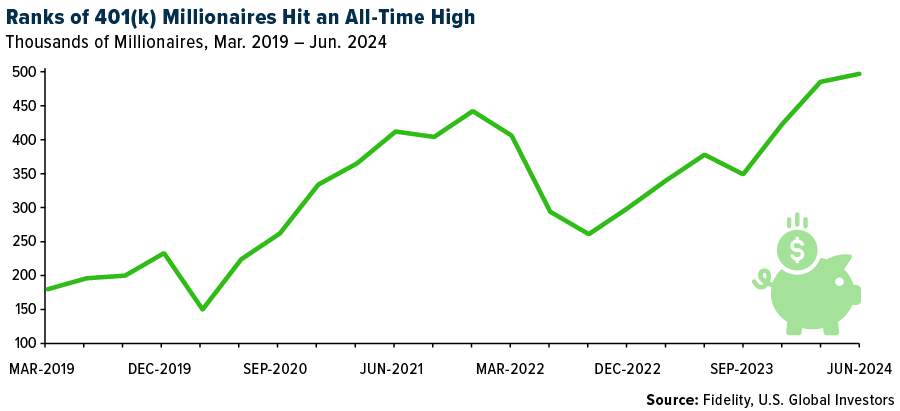

This is excellent news for general investors, including the record number of “401(k) millionaires”—investors who have $1 million or more in their retirement accounts. According to Fidelity, there are now almost half a million such millionaires… and growing!

Similarly, our ABC Investment Plan allows investors to fund their retirement more affordably. The ABC Investment Plan is an automatic investment plan that uses the advantages of dollar-cost averaging—an investment technique that lets you invest a fixed amount in a specific investment at regular intervals—together with financial discipline to help you work towards your financial goals.

ENROLL BY CLICKING HERE

As always, I encourage you to do your own research, consider your risk tolerance and consult with your financial advisor. But from where I stand, the opportunity in gold equities is one that should not be overlooked.

Index Summary

- The major market indices finished mostly down this week. The Dow Jones Industrial Average gained 0.94%. The S&P 500 Stock Index fell 0.14%, while the Nasdaq Composite fell 0.92%. The Russell 2000 small capitalization index lost 0.41% this week.

- The Hang Seng Composite gained 8.01% this week; while Taiwan was up 0.50% and the KOSPI fell 1.01%.

- The 10-year Treasury bond yield rose 12 basis points to 3.92%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Trip.com, up 11.8%. Southwest Airlines announced the return of its limited-time tier acceleration promotion this week in a press release, making it easier for Rapid Rewards members to earn tier status through 2025.

- More broadly over the past year, the impact of longer trade routes has had a positive impact on freight rates due to the increase in ton-miles. Reduced capacity in the Panama Canal, rerouting of ships due to attacks in the Red Sea, as well as the war in Ukraine and in the Middle East, have all extended routes and boosted rates. These factors appear to be the primary drivers of the strength in the ISI survey as opposed to final demand for the products.

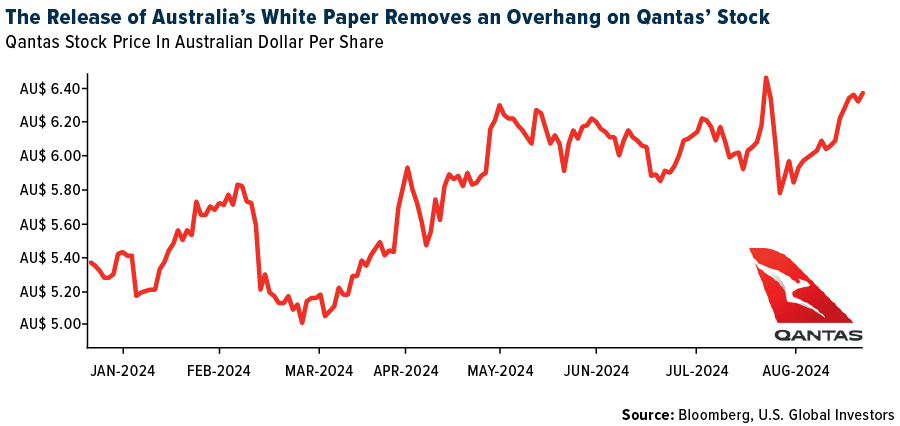

- The Australia Government’s Aviation White Paper details 56 initiatives to guide long-term policy. Overall, UBS’s first read is that the proposed changes are less significant than some investors had feared. The group expects minimal impacts to Qantas’ earnings in the next five years.

Weaknesses

- The worst performing airline stock for the week was Spirit, down 7.9%. Azul is focused on renegotiating the Lessor Equity Structure prior to raising debt against its cargo business, with bankruptcy filing/renegotiating lease rates not in the plan. Moreover, these negotiations are independent of a potential merger with GOL, according to Raymond James.

- Stifel feels most of the cargo traffic has rerouted away from the Gulf of Aden with sailings down 74%. However, not all ship types have reacted equally, with virtually all LNG ships having moved away, 89% of container ships, and 64% of dry bulk ships. Tanker traffic, however, is only down 42% as the potential for outsized profits is simply too great for some to ignore.

- Mexican domestic traffic dropped 3.6% year-over-year for the first half of 2024 due to capacity constraints caused by P&W engine inspections, reports UBS, which is impacting mainly Volaris, and should be completed only by 2026. Meanwhile, international traffic has been marginally decelerating and U.S. airlines reported Latin America yields have been dropping by double-digits, possibly indicating post pandemic pent-up demand normalization.

Opportunities

- TSA expects the busiest Labor Day travel period on record, according to Morgan Stanley. Passenger volumes are projected to be up 8.5% versus last year as TSA anticipates that it will screen over 17 million people over the long weekend. Travel continues to be robust this year as the top 10 busiest travel days on record have occurred since May.

- ZIM expects normal seasonality trends this year with a positive peak season and buildup in the U.S. inventory levels. However, the company is uncertain about the sustainability of the recent pick-up in demand, which is either linked to an early peak season or a more sustained demand uptick, according to Bank of America.

- For Ryanair, the €700 million buyback has been completed ahead of schedule, reports RBC, and the company announced a follow-on buyback of €800 million in fiscal year 2025 (estimated). Including dividend payments, this will take cash returns to >10% of the market cap in FY25E. There could be upside to the group’s assumption of €1 billion of buybacks in FY26E with capex stepping down to €1.1 billion.

Threats

- According to Bank of America, American Airlines’ schedules reflect this moderation, with November and December system capacity lowered by 330 basis points (bps) and 270bps, respectively. Cuts were focused on short-haul flying, with domestic capacity lowered by 420/370bps in November/December, while Latin American capacity was lowered by 270/150bps.

- The downside risks for shipping, according to JP Morgan, include share prices falling even if freight rates do not immediately fall when Middle East conditions ease and the Red Sea route looks to be restored. In addition, the bank notes slowing North American cargo movement and sharp yen appreciation.

- Ryanair told Bloomberg that it plans to grow its capacity by 8% this winter, though it is too early to forecast demand levels, they said. Ryanair may miss its annual target to carry 200 million passengers, depending on the extent of the delays in deliveries of Boeing’s 737 Max jets.

Luxury Goods and International Markets

Strengths

- Brunello Cucinelli, an Italian luxury-fashion firm, reported earnings before interest and taxes of 104.6 million euros ($117 million), compared with the 87.7 million euros it booked in the year-earlier period. The result is broadly in line with analysts’ views. The company maintained its guidnacne for a 10% sales growth in 2024 and 2025, despite slower demand for luxury goods in some of its rivals.

- Diageo, a multinational alcoholic beverage company headquartered in London, successfully priced €1.9 billion in fixed-rate euro-denominated bonds, indicating strong investor confidence and providing the company with substantial funds for general corporate purposes.

- Resorttrust, a leading company in Japan that offers luxury resort memberships, hotels, golf courses and more, was the best perfoerming S&P Global Luxury stock, gaining 6.2%. Shares gained in the local currency for nine consecutive days, marking their longest winning streak in 10 years.

Weaknesses

- Shares of PVH company dropped after its financial results were released. The company reported an earnings beat but guided the next quarter’s earnings per share below the street estimate. Revenue in international businesses decreased 4% compared to the prior year, primarily due to weakness in Asia Pacific, China and Australia.

- Burberry is set to exit the FTSE 100 Index due to a significant share price drop, ending its 15-year presence and reflecting challenges in its brand revamp and demand slowdown.

- Cettire, an online marketplace, was the worst-performing S&P Global Luxury stock, losing 28.3% in the past five days. The company lost almost 20% ot its market share on Thursday after the company reported diappointing financial results.

Opportunities

- Ferrari shares have risen 40% this year and are expected to see further price appreciation, according to Morgan Stanley. The company has minimal exposure to China, with less than 7% of its profits coming from the region. Additionally, Ferrari has a strong base of repeat buyers and collectors, with 75% of new cars sold to existing customers. As a result, the brokerage has raised its price target for Ferrari from $400 to $520.

- Mumbai has become the second-fastest-growing property market globally. The city recorded a 13% increase in prime residential prices year-over-year, while Manila was the fastest-growing market, with property prices surging by 26%. In Europe, Stockholm showed the strongest performance, according to the Prime Global Cities Index, which tracks residential prices across 44 cities worldwide.

- The Rolex Rainbow Daytona watch from the 1990s will go on sale in November at the Phillips auction house, with a price tag that could reach $3.5 million. The watch is believed to be the first-ever example of a rainbow watch produced by Rolex using multi-colored sapphire gems. Although demand for expensive watches has slowed down, rare and unique models from Swiss brands continue to attract interest. Last year, the same auction house, Phillips, sold a gold Rolex 6270 Cosmograph Daytona from 1988 for nearly 4 million Swiss francs.

Threats

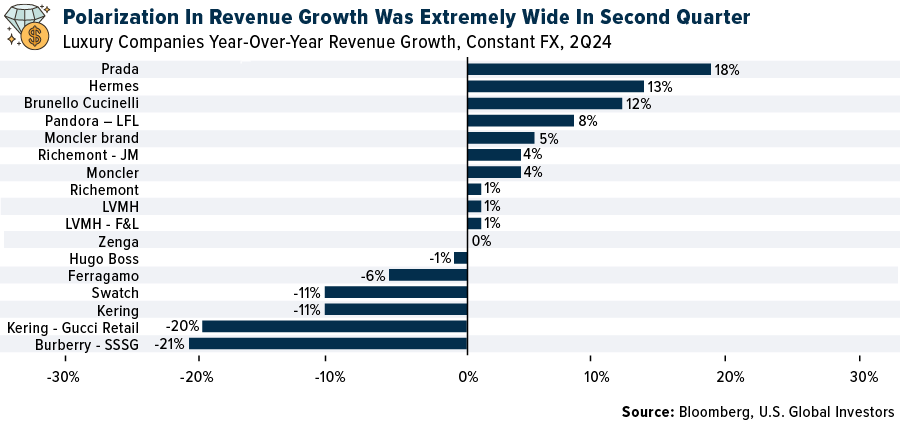

- In the second quarter, luxury revenue growth was flat, compared to a 2% increase in the first quarter of this year, according to BofA’s luxury research firm. The company highlighted weaker spending trends in China, noting that brands most exposed to the Chinese market experienced the largest revenue declines. There is a significant difference in revenue performance, with the top brands achieving much higher revenues than the bottom-performing ones, showing a spread of about 40%.

- Harmony Auto Holdings, which operates dealerships for 14 luxury car brands in China, including BMW, Ferrari and Lexus, has announced a company-wide salary reduction as an emergency measure to manage operational losses from the ongoing price war among domestic car makers. The salary of the chairman and vice chairmen will be cut by 50%, while the president, vice president and other senior managers will face a 35% reduction. Middle management salaries will be reduced by 25%, and other staff members will see a 15% decrease in their pay.

- Shares of Remy Cointreau and Pernod Ricard gained as China said it won’t impose temporary tariffs on brandy imports from the European Union, but still could put measures at a later date. Meanwhile, the EU has been pushing ahead with plans to impose tariffs on Chinese made EVs. The bloc is set to publish a final verdict on those levies by October 30, unless both parties reach an agreement.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was sugar, rising 5.38%, on the threat of massive fires in Brazil where conditions are dry, and crops could be wiped out. Oil advanced at the start of the week after Libya’s eastern government said it will halt exports, building on tensions in the Middle East after Israeli strikes on Hezbollah targets in southern Lebanon raised concerns of a broader conflict, Bloomberg reports. However, oil slumped by the end of the week with OPEC+ expected to raise production in the fourth quarter.

- About 100 miles east of Roswell, a dusty corner of New Mexico with more cattle than people is quietly buttressing the U.S.’s world oil dominance, writes Bloomberg. After pumping less crude in the years leading up to the pandemic than top counties in neighboring Texas, New Mexico’s Lea County has been rapidly gaining ground. Output there has expanded faster than in any other U.S. county, the article explains, last year becoming the first to ever produce more than 1 million barrels per day, according to energy research firm Enverus. EOG Resources, ConocoPhillips, Chevron, Coterra Energy and Occidental Petroleum are large producers in the Delaware Basin of New Mexico and West Texas.

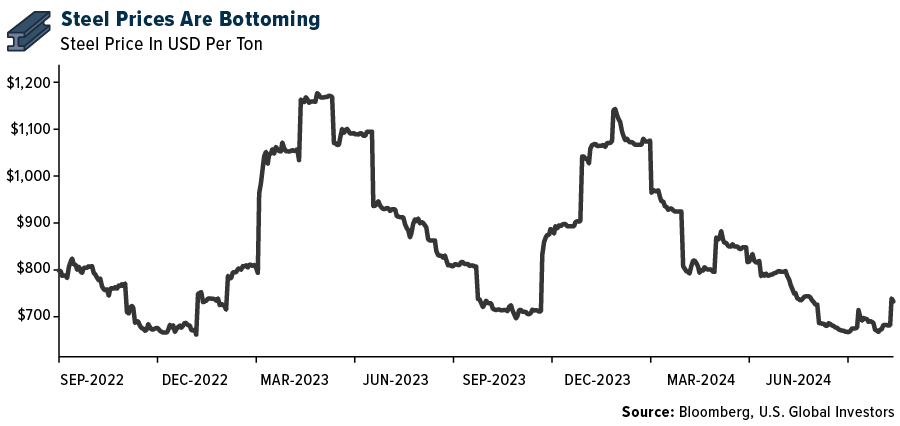

- U.S. raw steel mill utilization rates increased to 80.2% in the week, up from 79.0% the previous week, the American Iron and Steel Institute reported. Production during the week totaled 1.782 million tons, up 1.6% from the week before when production was 1.754 million tons. Production increased 2.3% from the corresponding week a year ago.

Weaknesses

- The worst performing commodity for the week was lead, dropping 4.67%, on weak demand. Refiners traded down and are now down nearly 10% since June 30 and >30% since peaking on April 5. East Coast 321 cracks at <$15 per barrel are down >$5 per barrel in the past two weeks and are beginning to approach five-year lows, according to JPMorgan.

- China does not paint a bright picture for refining margins. Cnooc Ltd., Sinopec and PetroChina Co. all reported that their refining margins tumbled – making that sector one of the industrial economy’s worst performers, Bloomberg reports.

- Fitch Ratings has downgraded the Long-Term Issuer Default Rating (IDR) for Albemarle Corporation and its issuing subsidiaries to ‘BBB-‘ from ‘BBB’ on expectations for sustained overcapacity and lower-for-longer pricing in the lithium industry.

Opportunities

- Chile’s copper-mining industry is emerging from an intense period of wage negotiations, signaling a diminished risk of further disruptions in a country that accounts for a quarter of world supply. Over the weekend, about 300 striking workers at a Lundin Mining Corp.-operated mine went back to work. A week earlier, the main union at the giant Escondida mine run by BHP Group ratified a labor pact following a three-day stoppage. Antofagasta Plc reached an early wage deal with the main union at its Centinela facility, completing the firm’s talks for the year, according to Bloomberg. Labor unrest may be in the rear-view mirror for now.

- Bank of America strategists have made a secular call on swapping out your 40% bond allocation from the traditional 60% stocks/40% bonds portfolio to 40% commodities. The “commodity secular bull market in the 2020s is just getting started as debt, deficits, demographics, reverse-globalization, AI & net zero policies are all inflationary,” wrote BofA strategists Jared Woodard and Michael Hartnett.

- If you want to understand the shifting sands in Australia’s resources sector, do a quick keyword search on the slide deck that accompanies BHP’s profit result. The word “copper” appears 78 times. The words “iron ore” just 14 times. Such a statistic may sound trivial, but it speaks to an extraordinary shift in the growth narrative of BHP chief executive Mike Henry – and an important moment for an Australian economy that has long ridden on the miracle of the Chinese boom, according to the Financial Review.

Threats

- A legislative change is threatening to unravel one of the world’s safest bets in renewable energy, a Chilean incentive program that lured companies backed by BlackRock Inc. and JPMorgan Chase & Co, reports Bloomberg. President Gabriel Boric’s administration is seeking to raise funds by altering a pricing mechanism for small electricity generators that has attracted billions of dollars of investment in mainly solar power.

- The government of Canada announced that it is implementing 25% tariffs on steel and aluminum imports from China, effective October 15, 2024, according to Morgan Stanley.

- As reported by Bloomberg, Wall Street is beginning to sour on the outlook for crude next year, with Goldman Sachs Group and Morgan Stanley lowering price forecasts as global supplies increase, including potentially from OPEC+. The two banks now foresee global benchmark Brent averaging less than $80 a barrel in 2025, with Goldman’s revised forecast cut to $77, while Morgan Stanley sees futures ranging from $75 to $78.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Akash Network, rising 5.33%.

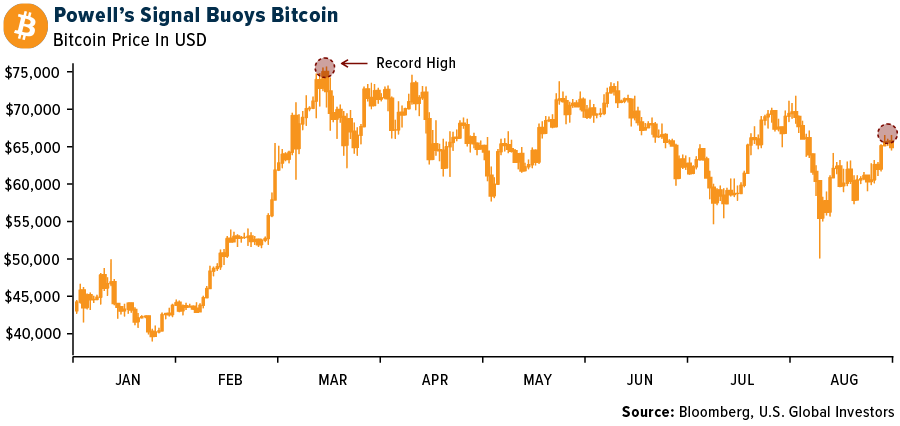

- Bitcoin touched $65,000 for the first time in about three weeks, writes Bloomberg, aided by revived demand for U.S. spot Bitcoin ETFs and signs that the Federal Reserve is set to loosen monetary policy. Bitcoin rose as much as 1.2% to start the week and has since fallen back slightly, closer to $60,000 on Friday.

- Digital asset manager ParaFi Capital, backed by KKR co-founder Henry Kravis, raised $120 million to invest in general-partner stakes in other crypto funds, reports Bitcoin.com. The aim is to build a portfolio of 30 to 50 stakes over the next three to five years as the crypto-fund landscape grows.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Notcoin, down 22.55%.

- The detention of Telegram founder Pavel Durov has shaken the crypto venture capital sector, writes Bloomberg, particularly those who invested in Toncoin, a token linked to the Telegram app. The token’s value has plummeted amid concerns over the app’s future due to Durov’s legal troubles.

- Binance Japan’s CEO, Takeshi Chino, indicated that launching a stablecoin in Japan by the end of the year is challenging, with a dollar-denominated stablecoin now likely delayed until the first half of 2025.

Opportunities

- Despite recent setbacks with exchanges withdrawing applications, there is a 70% chance the SEC will approve options on spot Bitcoin ETFs by May, following additional input from the OCC and CFTC.

- MakerDAO, one of the oldest decentralized finance platforms, is rebranding as Sky to attract more mainstream users. The platform has plans to launch new tokens and simplify the user experience as part of its broader growth strategy.

- Solayer Labs, the developer of the Solana restaking protocol, raised $12 million in a seed funding round led by Polychain Capital, bringing its valuation to $80 million. Solayer Labs aims to expand its team, integrate new protocols, and eventually launch a native token.

Threats

- The U.S. SEC has settled with crypto lending platform Abra after charging the startup with selling unregistered securities to consumers and operating as an unregistered investment company, reports Bloomberg. Plutus Lending LLC agreed to settle with the SEC without admitting or denying the agency’s allegations.

- Big law firms have earned over $750 million in legal fees from cryptocurrency-related bankruptcies since 2022, with the work nearing completion as most cases wrap up. This includes major cases like FTX, Genesis and Terraform Labs.

- OpenSea has received a Wells Notice from the SEC, signaling potential legal action over allegations that the NFTs on its platform are unregistered securities, making it the latest crypto company to face regulatory scrutiny.

Defense and Cybersecurity

Strengths

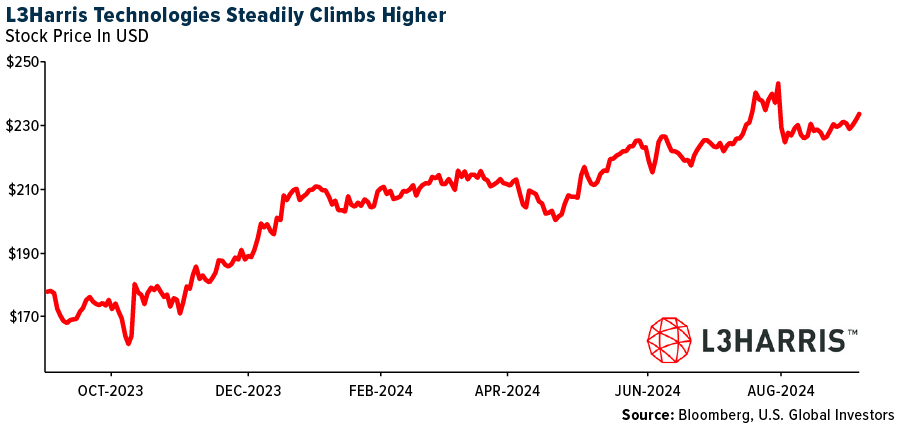

- L3Harris Technologies was awarded a $587.39 million Navy contract for the design, production and delivery of electronic warfare test articles and prototypes, supporting the Next Generation Jammer Low Band program, with completion expected by August 2029.

- BAE Systems has been awarded a $177.8 million Navy contract for the repair, maintenance and modernization of the USS Halsey, with potential extensions increasing the contract value to $225.6 million. The work is expected to be completed by April 2026 in San Diego, California.

- The best performing stock this week was Aerovironment Inc., rising 9.78%, after winning a record $990 million Army contract, leading to a stock upgrade and increased price target from analysts.

Weaknesses

- Russia launched over 100 missiles and nearly as many drones in a massive attack on Ukraine’s power infrastructure, causing widespread blackouts and leaving at least three dead. Ukraine’s President Zelenskiy called for increased Western military support amid ongoing Russian efforts to cripple civilian infrastructure before winter.

- This week, France arrested Pavel Durov, the creator of the Telegram app, issuing an arrest warrant right as his plane landed in Paris. Later, they brought forward a series of charges, likely based on his refusal to cooperate and provide access codes to the app for French government agencies. The United Arab Emirates reacted extremely negatively, freezing the purchase of Rafael fighter jets worth a total of $17 billion and demanding Pavel Durov’s immediate release. Several socially significant political figures also reacted sharply, calling this an attack on freedom of speech, political imprisonment, and the imposition of censorship.

- The worst-performing stock this week was Archer Aviation, dropping 10.99%. The decline followed news of increased competition in the same segment, which may negatively impact future expectations.

Opportunities

- Northrop Grumman’s ATHENA sensor, a next-gen missile warning system offering 360-degree situational awareness and advanced threat detection, has been selected by the U.S. Army for the first phase of the Improved Threat Detection System program. This will showcase its capabilities in enhancing aircraft protection and integrating with existing countermeasure systems.

- Zelensky announced that successful tests of a new ballistic missile developed in Ukraine have been conducted. Additionally, Ukraine now meets 98% of its military needs for small, inexpensive drones through domestic production.

- Lockheed Martin and General Dynamics are forming a joint venture to produce missile engines, addressing supply chain bottlenecks caused by Northrop Grumman and L3Harris’s production limitations, which could significantly benefit their businesses.

Threats

- Boeing announced that two astronauts stranded on the International Space Station (ISS) will remain in space for an additional six months due to issues with the Starliner spacecraft and will return to Earth via SpaceX’s Dragon instead.

- Zelensky stated that Ukraine will not extend the contract for the transit of gas from Russia to Europe through Ukraine, which could significantly impact the supply chain.

- Following a large-scale Israeli airstrike targeting Hezbollah in southern Lebanon, which prompted retaliatory missile fire, tensions in the Middle East temporarily deescalated. However, the threat of a broader regional conflict involving Iran remains high as ceasefire negotiations between Israel and Hamas continue amid ongoing low-level clashes.

Gold Market

This week gold futures closed the week at $2,535.00, down $x11.30 per ounce, or 0.44%. Gold stocks, as measured by the NYSE Arca old Miners Index, ended the week lower by 1.43%. The S&P/TSX Venture Index came in off 1.75%. The U.S. Trade-Weighted Dollar rose 0.95%.

Strengths

- The best performing precious metal for the week was palladium, up 1.67%, perhaps on Ford mentioning the scale back of its EV expansion program. According to Goldman, Zijin reported 1H24A recurring profit of Rmb15.7 billion, up 51% year-over-year, above the bank’s estimates due to operational improvement with higher realized ASP and lower-than-expected cost.

- Gold’s record-setting rally above $2,500 an ounce looks to have further to run as the Federal Reserve prepares to chop rates, traditional drivers such as lower yields return, and Western investors pile back in. “Everybody thought the Fed was going to be the last to cut, but now they’re getting in line,” said Jay Hatfield, chief executive officer of Infrastructure Capital Advisor.

- According to Scotia, Endeavour Mining announced that it has reached a settlement agreement with Lilium Mining with respect to the delayed payment and subsequent legal proceedings arising from the 2023 sale of Endeavour’s Boungou and Wahgnion mines in Burkina Faso. Pursuant to the settlement, Lilium will transfer the ownership of the Boungou and Wahgnion mines to the State of Burkina Faso, and Endeavour will receive upfront and deferred cash consideration totaling $60 million, plus a 3% royalty.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.64%, on little news. According to UBS, Zhaojin mining announced its H124 results, with net profit attributable to shareholders of Rmb553m (119% year-over-year) which missed expectations of Rmb700m.

- Gold Road reported its first half 2024 results with an underlying EBITDA of $94 million, 8% weaker year-over-year and lower than Bank of America’s expectations. The underlying net profit of $43 million was 15% lower than BofA’s expectations.

- According to UBS, at Hochschild Mining, the Mara Rosa mine achieved commercial production on May 13. However, mechanical availability issues and contractor delays have meant production is behind schedule. Although all issues are now resolved with production to increase in the second half of the year, production will be at the lower end of guidance and will be updated with third quarter results.

Opportunities

- Harmony Gold Mining beat its production target for fiscal 2024 on higher grades and said earnings jumped on surging gold prices. The South African miner of the precious metal expects to report earnings per share of at least 72 U.S. cents for the year ended June 30, which would be a 64% increase from fiscal 2023’s 44 cents. This is driven by a 6% increase in gold production to 1.56 million ounces, according to Dow Jones.

- Opportunities for Torex Gold, according to Scotia, include nearing completion of the transformational $950 million Media Luna Au-Cu project for startup early next year, as well as free cash flow inflection in 2025. A capital return program could also be initiated next year.

- Bloomberg reported that Bitcoin has underperformed in August, stimmed by ebbing liquidity and lingering worries over the potential for governments to sell off their Bitcoin. Kaiko, a leading crypto industry data group, estimated the U.S. administration holds about 203,220 Bitcoin, followed by China’s 190,000, the UK’s 61,200 and 46,350 for Ukraine. Governments seize tokens in criminal cases, while Ukraine is thought to have received donations to help fund its defense against Russia’s invasion. Meanwhile, Mt. Gox has roughly 46,170 tokens left to distribute, Kaiko said. The trading backdrop has also become more challenging in the U.S. Bitcoin ETF sector, according to JPMorgan strategists. That’s based, in part, on a metric known as the Hui-Heubel ratio, which purports to provide insights into liquidity by measuring the number of trades it takes to move prices. “It is striking that this metric has been deteriorating for all spot-Bitcoin ETFs since March, pointing to overall deterioration of spot Bitcoin ETF liquidity over the past six months,” the JPMorgan team including Nikolaos Panigirtzoglou said. Any Bitcoin liquidation under these conditions could force money to flee to gold bullion.

Threats

- Major Chinese copper and gold producer Zijin Mining Group said a slowing global economy, geopolitical tensions, and resource nationalism could restrict its overseas deal-making ambitions. The company flagged negative factors in the future potentially impacting “the company’s revenue, profits, merger and acquisitions of new overseas projects,” according to Bloomberg.

- According to UBS, there is 8% downside risk to forward consensus earnings, on average, for South African gold producers. If spot commodity prices prevail, they calculate downside risk for the SA diversifieds (-5%), PGM miners (-19%) on an average market cap-weighted basis.

- Predictive Discovery’s share price dropped the most in three years with a surge in volume as the government of Guinea announced the suspending of permit applications and the processing of existing permits as they conduct a mining title review. Predictive Discovery finished the week down 15%.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Southwest Airlines

Qantas Airways

American Airlines

Ryanair Holdings PLC

Pernod Ricard

Ferrari

Brunello Cucinelli

ConocoPhillips

EOG Resources

Occidental Petroleum

Lundin Gold

BHP Group

Endeavour Mining

Hochschild Mining

Harmony Gold Mining

Trip.com

Spirit Airlines

General Dynamics

The Boeing Co.

Prada SpA

Hermes International SCA

Brunello Cucinelli SpA

Moncler SpA

Cie Financiere Richemont SA

LVMH

Hugo Boss AG

Kering SA

Burberry Group PLC

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the “Footsie”, is the United Kingdom’s best-known stock market index of the 100 most highly capitalized blue chips listed on the London Stock Exchange.