Weaponized Migration and Its Implications for Investors

Savvy investors are aware that geopolitical tensions and uncertainty can significantly influence the financial markets.

Savvy investors are aware that geopolitical tensions and uncertainty can significantly influence the financial markets. That includes human migration—or, to be more specific, weaponized migration.

Many of you, no doubt, watched Elon Musk’s livestream of the historic U.S.-Mexico border crisis last month on X, the platform formerly known as Twitter. You may also be aware of the situation that’s unfolding in the Mediterranean, with thousands of refugees from Northern Africa overwhelming Italy, prompting much-needed immigration reform.

Both cases have raised questions about who’s behind this global immigration surge.

The tactic of using migrants as pawns is not new. Since at least the 1950s, bad actors have employed this strategy against liberal democracies like the U.S. and Europe, which historically have tended to accept large numbers of refugees, according to Kelly Greenhill, author of the 2016 book Weapons of Mass Migration: Forced Displacement, Coercion and Foreign Policy.

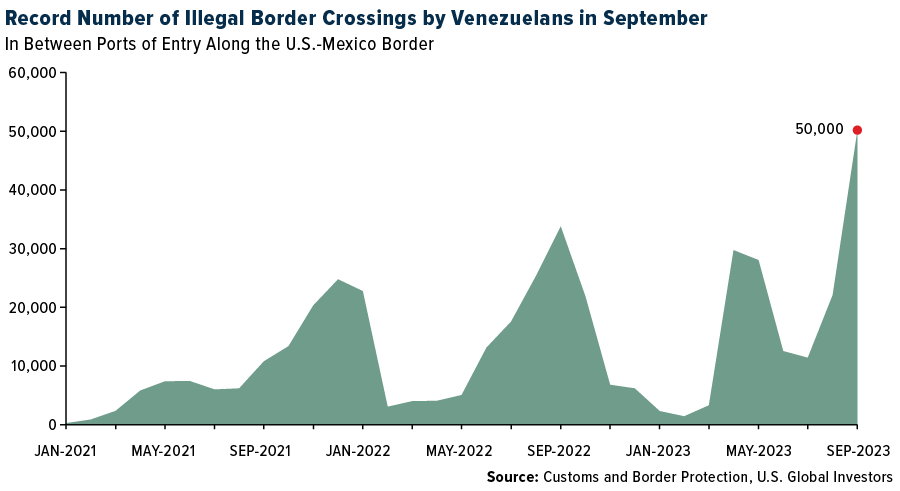

Back to the U.S.-Mexico border. In August, the U.S. Customs and Border Protection (CBP) reported a 36% increase in migrant encounters compared to July, totaling over 180,000 apprehensions. And last month, a staggering 50,000 migrants from crisis-stricken Venezuela illegally crossed the border, marking an all-time monthly record.

The driving force? Beyond immediate socio-economic and political crises, deeper geopolitical manipulations may be at play.

The Mexican government, for instance, has initiated a program to bus immigrants from the southern part of Mexico toward the U.S. Mexican President Andres Manuel Lopez Obrador recently stated that around 10,000 people were reaching the border every day.

Europe’s Rising Tide of Migrants

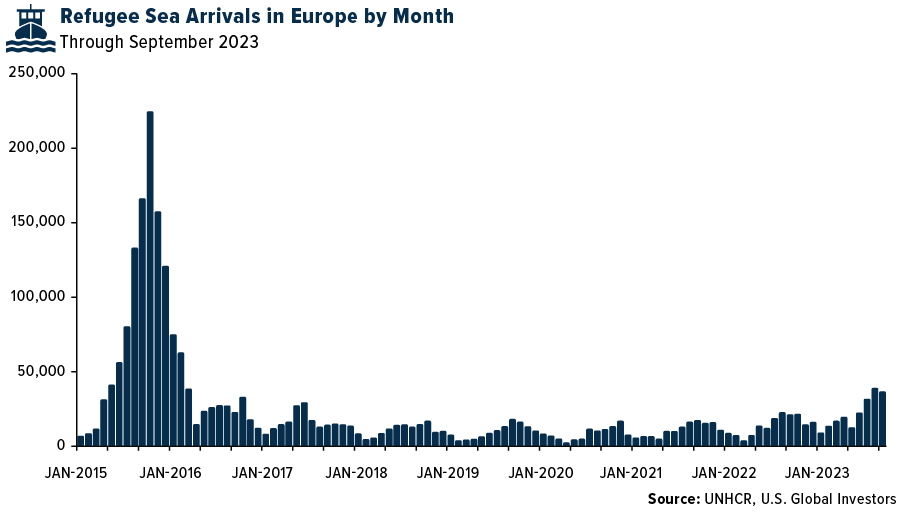

Across the Atlantic, Europe—and Southern Europe in particular—faces parallel challenges. Between January and July 2023, the continent saw a significant increase in arrivals of refugees and migrants, totaling over 120,000 individuals, primarily through the Mediterranean and Northwest African maritime routes. This marked a 77% rise compared to the same period the previous year.

The Italian island of Lampedusa has seen an overwhelming surge in migrant boats. On September 15 alone, some 7,000 people landed on the island, doubling its population, and prompting local authorities to declare a state of emergency. This brought the total number of arrivals in Italy to nearly 126,000 in 2023, making it a significant political issue.

As for the boats that migrants used to make the journey from North Africa to Italy, many appear to be expensive, high-end speedboats and other such vessels, clueing some observers in to the possibility that this sort of activity is being engineered to destabilize Western governments.

The Strategic Manipulation of Migrant Flows

Some immigration experts suspect that Russia could be behind the current crisis. According to the Heritage Foundation’s Daniel Kochis, Moscow has employed and continues to employ the weaponization of migrants to manipulate the situation in places like Syria, North Africa and the Sahel, effectively pushing refugees toward European shores.

Russia isn’t the only country to have used this strategy. According to Judge Aaron Petty, an Appellate Immigration Judge at the Board of Immigration Appeals, Belarusian leader Alexander Lukashenko orchestrated a crisis in 2021 by enticing thousands of migrants and asylum seekers—primarily from Iraq, Syria and Afghanistan—to Belarus and then pushing them toward the European Union (EU) border, exploiting EU legislation and UN treaties for asylum seekers.

Judge Petty believes the weaponization of migrants will increase, particularly by states like China and Russia. Such “gray zone” activities, including the manipulation of population flows, are aimed at shaping the strategic environment, destabilizing rivals and achieving objectives through means just short of direct warfare.

Manufacturing an influx of migrants, or even just threatening to do so, has proven effective in the past in leveling the playing field with more powerful adversaries. It has created a bargaining chip and forces the engagement of targeted countries.

Unless policymakers address the underlying dynamics that enable weaponized migration, the use of this tactic is likely to persist and expand, Judge Petty says.

The EU’s Collective Response to Asylum Challenges

That’s precisely what European policymakers are seeking to do. On Wednesday, EU diplomats reached a consensus on immigration policy reforms, following the resolution of a dispute between Italy and Germany over non-governmental organizations (NGOs) operating in the Mediterranean.

The aim of these reforms is to enable EU states to respond in a unified manner to significant increases in asylum-seekers. A pivotal element of the agreement proposes the redistribution of migrants from countries with high influxes, like Italy and Greece, to other EU nations. Countries that opt out of hosting asylum-seekers would be obligated to financially compensate those that do.

For investors, this is a sign that Europe is keenly aware of the risks and is looking to mitigate them. A stable Europe means a more predictable investment environment, especially in industries like tourism, real estate and manufacturing.

Government Policy Is a Precursor to Change

The bigger question remains: will the U.S. follow suit? The ongoing challenges at the U.S.-Mexico border, combined with weaponized migration’s growing prominence as a tool, mean that U.S. policy decisions in the coming months will be crucial.

For investors, this means staying informed, agile and ready to adapt. Government policy is a precursor to change, after all, and it’s important to be prepared for sudden policy shifts. It’s also wise to diversify investments across sectors and regions, hedging against potential disruptions such as weaponized migration.

As always, I recommend a 10% weighting in gold, with 5% in physical bullion and jewelry, the other 5% in high-quality gold mining mutual funds and ETFs.

What do you know about Diwali? With the celebration coming up in a month, learn more about India’s Festival of Lights by clicking here!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 0.30%. The S&P 500 Stock Index rose 0.50%, while the Nasdaq Composite climbed 1.60%. The Russell 2000 small capitalization index lost 2.22% this week.

- The Hang Seng Composite lost 1.84% this week; while Taiwan was up 1.32% and the KOSPI fell 2.64%.

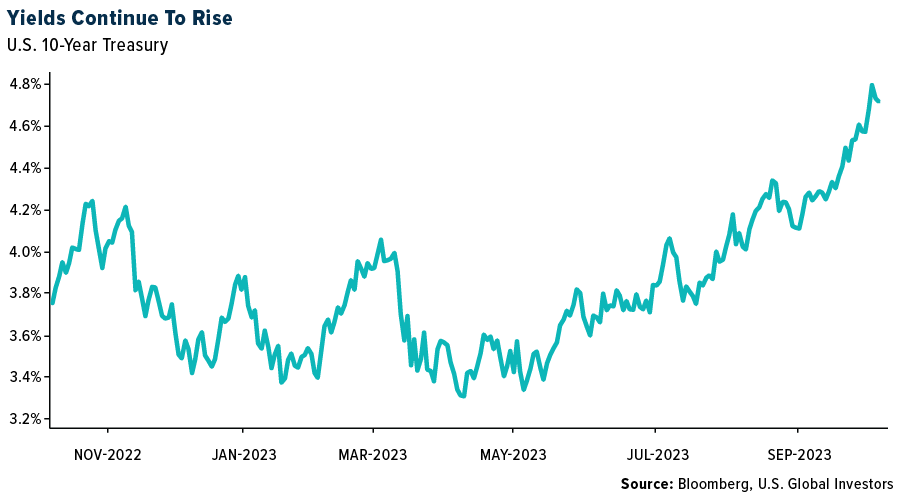

- The 10-year Treasury bond yield rose 22 basis points to 4.794%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was International Consolidated Airline, up 5.6%. According to Raymond James, following 50% cuts at U.S. legacy airlines during the early 2000s, pilot wages have fully recovered to 1994 levels on an inflation-adjusted basis since 2019. This excludes generous profit sharing after 2012.

- According to Stifel, airfreight rates ticked up healthily through September on major Asia-outbound lanes, giving credence to the possibility of a peak season in 2023. While transatlantic rates were flat, with Frankfurt to North American pricing down 1.7% since August, Hong Kong to North America and Shanghai to North America increased 8% and 11%, respectively, in September versus the previous month. Meanwhile, Hong Kong to Europe and Shanghai to Europe monthly rates rose 7% and a healthy 34%, respectively.

- According to Morgan Stanley, United Airlines’ pilots approved a new labor contract. 82% of United’s pilots voted in favor of the new four-year pilot agreement that is valued at $10 billion over the life of the contract. This announcement comes two months after the Air Line Pilots Association (ALPA), which represents over 16,000 pilots at United Airlines, announced that it reached an agreement in principle (AIP) with the airline’s management on a new labor agreement after more than four years of negotiations.

Weaknesses

- The worst performing airline stock for the week was Hawaiian Holdings, down 16.2%. According to UBS, major Mexican airports received a notification from the Mexican Federal Civil Aviation Agency (AFAC) informing them that it has decided to amend, with immediate effect, the terms of the tariff base regulation of the airports’ concession agreements. The tariff base regulation set out the maximum tariffs at each airport and are determined at five-year intervals in the Master Development Programs (MDP), based on several variables such as traffic forecasts, operating costs and expenses, pre-tax profits and investment commitments related to tariff-regulated services. The last MDP negotiations occurred in late 2020/early 2021, and the upcoming negotiations were expected between 2023-2025.

- According to Stifel, container movements in July and August were down about 1% year-over-year and the full year is likely to be down slightly after 2022 being 3.8% below the record 2021 levels. Ideally, the modest sequential improvements seen in recent months are a sign of gradual recovery, but probably very gradual. Global GDP is expected to be up 2.6% in 2024 down from 2.7% this year against inflation expectations of 4.3% in 2024. While not terrible, implicitly this translates into container growth of perhaps 3%. Comparatively, gross fleet growth based on vessels scheduled for delivery should be 10.5%.

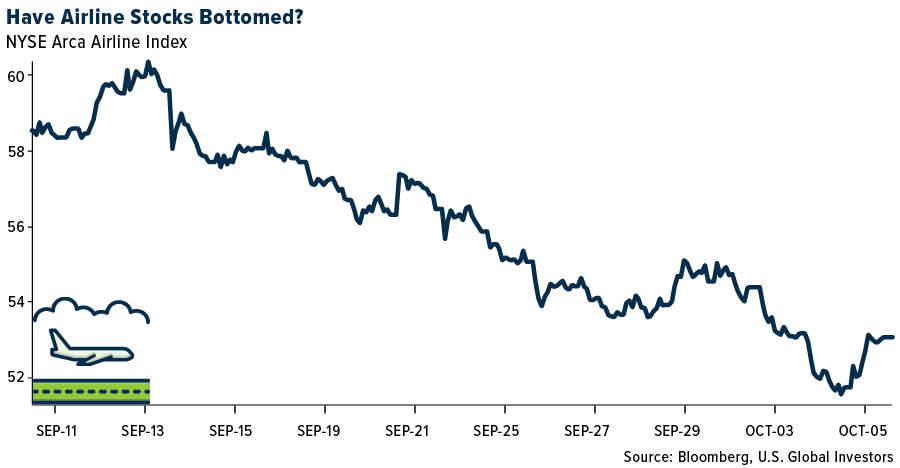

- September has historically been one of the strongest months for airline stock performance versus the market, outperforming 67% of the time since 2000 and every year from 2008 to 2021, except for 2014. However, this September airlines underperformed for the second year in a row, down 14% versus the S&P down 5%. Several airlines provided lower third-quarter revenue guidance during the month as pricing has softened following the peak travel season. This, coupled with sustained higher fuel, drove 2023 EBITDAR estimates down about 9%.

Opportunities

- Raymond James recently attended the RAA Leaders Conference. While still facing considerable NT challenges, comments seemed somewhat improved from last year. This was underscored by Oliver Wyman’s forecast for the mainline pilot shortage by 2033 moderating from 17,300 in 2022 to 13,300 currently. Oliver Wyman expects 75%/15%/10% of the demand to be met by the regional/military/business aviation hires.

- According to ISI, the on-the-water VLCC fleet currently totals 906 vessels, yet the delivery schedule for 2024 calls for just one new ship to be added to the fleet, with the present 2025 schedule. However, history does show that in prior periods of limited new capacity adds, tanker spot rates typically move and given the record-low outlook for incremental capacity in the coming years, spot rates should at worst have an elevated floor and at best a launch pad to persistent strength.

- Raymond James sees upside to U.S. airline shares under its base-case scenario. This reflects demand holding sufficiently to respond to moderating capacity plans, resulting in a partial pass through of higher fuel prices particularly for airlines catering to a less price-sensitive pax base. U.S. airline shares are indicating peak earnings in 2023 in the group’s opinion.

Threats

- According to Morgan Stanley, typically airlines can “pass through” an increase in fuel with higher fares, but with fuel prices rising nearly 20% in six weeks, it becomes nearly impossible to do so. While jet fuel is now in the $3.15-$3.25 range, the forward curve is pointing to $2.87 year-end 2023 and $2.68 at the end of the first quarter of 2024.

- According to Stifel, low rates are exacerbated by cost and interest inflation, meaning break evens are likely much higher. Shipping charter rates are still generally above pre-Covid levels as idle capacity is low. However, as more ships (particularly modern and middle-aged ships) come off legacy contracts, idle capacity is likely to rise, and shipping rates are likely to fall further.

- According to JPMorgan, the ongoing problems regarding Pratt & Whitney GTF engines should materially impact Mexican airlines over the coming year – or potentially years – as per publicly available fleet plan Volaris (OW-rated) and VivaAerobus are the two airlines operating the Airbus NEO family. As a spillover effect, they also expect airports to be impacted given a more limited domestic capacity. Based on their assumptions, Volaris could have 30% downside to 2024 expected capacity, likely mostly concentrated in the domestic market. Assuming a lower capacity by local carriers, the Mexican domestic market could imply up to 25% less passenger traffic, according to the group’s calculation.

Luxury Goods and International Markets

Strengths

- According to property consultant Knight Frank LLP, Dubai is the world’s busiest market for luxury homes. The number of sales for homes worth $10 million or more reached a record 277 in the first nine months of the year, with $4.91 billion in transactions. The luxury market in Dubai is benefiting from the inflow of wealthy investors such as Russians seeking to shield their assets, crypto millionaires, and rich Indians seeking second homes, Bloomberg commented.

- BMW of North America reported impressive third-quarter sales for 2023, showcasing substantial growth for both BMW and MINI brands in the U.S., underscoring its commitment to electric vehicles. In the third quarter, BMW’s U.S. sales reached 83,949 vehicles, marking a 7.6% increase compared to the same period in 2022. The success extended through the year, with BMW brand sales totaling 254,363 vehicles for the first three quarters, a notable 10.3% increase over the previous year, driven in part by strong demand for BMW’s electric vehicle offerings. CEO Sebastian Mackensen expressed satisfaction with the results and highlighted the company’s diverse product range, ensuring it can meet the varied needs of customers.

- Luk Fook, a retail jeweler in Hong Kong, was the best performing S&P Global Luxury stock, gaining 5.9% in the past five days. Hong Kong should continue to experience a rise in travelers from mainland China, boding well for the company’s sales. In addition, the Mid-Fall Festival is a busy season for retailers as many friends and family members travel during the eight-day holiday, which ends this weekend.

Weaknesses

- Germany, Europe’s largest economy, reported weaker economic data this week. The Manufacturing PMI for the month of September declined to 39.6 from a preliminary reading of 39.8, remaining well below the 50 mark that separates growth from contraction. German trade balance improved in August, but exports were down much more than expected. Furthermore, the July drop in exports was revised downward.

- Electric vehicle (EV) car makers are burning cash as they push for innovation/production competing for new customers lining up to purchase battery-powered vehicles. According to a New York Times report, Chinese EV maker Nio lost about $35,000 per car last quarter. Rivian, a U.S. EV maker backed by Amazon, lost $32,594 per car in the second quarter. Rivian had more than $9 billion in capital at the end of the second quarter, but it is still trying to build more capital. On Thursday, the company announced a private offering of $1.5 billion of senior notes due 2030.

- Rivian Automotive was the worst performing S&P Global Luxury stock, losing 22.6% in the past five days. Shares declined after the company announced debt issuance. On Friday, Battle Road Research analyst Ben Rose downgraded Rivian shares to a “sell” from a “hold.” The company expects third-quarter revenue of about $1.31 billion, about $70 million less than what was anticipated by Wall Street. In addition, the company’s cash balance also declined to $9.1 billion, down about $1.1 billion compared with the second quarter.

Opportunities

- China Renaissance believes that the luxury goods momentum in the Asian nation remains strong and predicts strong sales next year. Louis Vuitton, Chanel, and Cartier have reported sales growth of 15-25% year-over-year in August, similar to the growth in the prior month. 2024 sales growth should be double digits, supported by an increasing number of inbound Chinese travelers.

- General Motors is returning to Europe. This Thursday, the company announced taking orders for its battery-powered Cadillac Lyriq vehicle in Switzerland, with deliveries taking place in the first half of 2024. Over the next two years, the company is planning to bring its electric model to Sweden, France, and three other European countries. This model will cost roughly the same as premium German electric SUVs with a price tag of around $90,000.

- Royal Caribbean International has announced that the second Icon-class ship, debuting in summer 2025, will be named “Star of the Seas.” The decision comes in response to the tremendous consumer demand generated by the concept of an ultimate adventure combining the best of various vacation types, as demonstrated by the success of the first ship, Icon of the Seas, which led to the cruise line’s highest volume booking week ever in October 2022.

Threats

- JPMorgan updated Kering forecasts ahead of the trading update scheduled for the 24th of October, cutting earnings estimates by 4% and the price target to 575 Euros from 600 Euros. The broker expects this quarter to be particularly soft for Kering, with sales declining at all key brands/segments. A few weeks ago, brokers started to revise down luxury companies’ earnings, citing high yields, economic slowdown, and depletion of pandemic savings, leading to weaker consumer spending.

- Singapore may subject luxury assets, such as cars, watches, and handbags to anti-money laundering controls. The government proposed broader anti-money laundering regulations after an illegal activity scandal erupted in the summer. Back in August, 10 people were arrested, and luxury goods were sized due to illegal activities run by individuals holding Chinese passports.

- Brokers, universal banks, and trust banks are grappling with a challenging environment as markets declined in the third quarter, and interest rates increased, according to Evercore ISI analyst Glenn Schorr. Schorr also noted that while there was some improvement in capital markets activity during the quarter, it was not particularly significant, and trading results were mixed.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 13.55%. Traders awaited the first cold weather of the season as a smaller-than-expected build of natural gas raised concerns about tight supplies. According to RBC, uranium extended gains for the 12th consecutive week, with active interest across the spot and term markets, although spot prices eased on Monday/Tuesday with some profit taking and a broader materials sector slow-down. RBC’s industry conversations point to market-related term contracts with floors and ceilings at around $60-100 per pound.

- According to Bank of America, despite power supply problems, the Kamoa-Kakula mining complex in the Democratic Republic of Congo turned out 103,947 t of copper-in-concentrate in the third quarter, a quarterly all-time high. The two concentrators operated at steady-state capacity of 9.2 Mt/y, following ahead-of-schedule completion of a debottlenecking program in the first quarter, said co-owner Ivanhoe Mines.

- Canadian miner Barrick Gold plans to increase production capacity at its Lumwana copper mine in Zambia to an estimated 240,000 t/y by processing 50 Mt/y of ore. Mine life will be 36 years. The almost $2 billion (€1.9 bn) of investment will elevate the once-unprofitable operation into the front rank of copper producers, the Toronto-headquartered company said.

Weaknesses

- The worst performing commodity for the week was crude oil, dropping 8.69%, over worries of a potential recession, perhaps induced by higher oil prices slowing the economy. In the same vein, U.S. Oil Weekly reported that implied gasoline demand had slipped to a 25-year low, citing higher pump prices, but electric vehicles are likely playing a role there too.

- Copper was also hit by the Fed’s “rates higher for longer” message that the markets continue to digest, with less than stellar economic news. Chinese traders have been absent from world markets with the Golden Week holiday, while the industry will be watching for any buying appetite from China, which has largely underpinned the price this year.

- Lithium prices are plunging around the world, but the slump is particularly glaring in China, where the key battery metal is trading at a big discount versus the U.S.

After a buying frenzy sent global prices soaring though last year, they have since plunged as electric vehicle demand disappoints and supplies are expected to remain ample. Yet despite the broad rout, futures in the crucial Chinese market

are about a third cheaper.

Opportunities

- News out on Friday that ExxonMobil was said to be in talks to acquire Pioneer Natural Resources Co. sent the share price up by more than 10%. This would be ExxonMobil’s biggest merger since they acquired Mobil in 1999. The transaction would unite two of the biggest acreage holders in the Permian Basin of West Texas and New Mexico. In 2021, an International Energy Agency report stated that no new conventional long-lead-time projects were required but concluded that new shale drilling would be required “to avoid a sudden near-term drop in supply.”

- Kommersant reports the Russian government is considering partially lifting a ban on product exports in the coming days and excluding pipeline exports of diesel; and that a decision could come as diesel fuel storage capacity in the Transneft system was almost completely exhausted, which could lead to a decrease in refining throughput in the country. Kommersant notes deliveries from Transneft North and South product pipelines provide three-quarters of diesel fuel exports from Russia; and the North pipeline, with capacity of 25Mtpa, allows exports from the Nizhny Novgorod, the Yaroslavl refinery and the Kirishi refinery through the Baltic ports of Primorsk and Vysotsk.

- Freeport LNG is seeking permission from the U.S. Federal Energy Regulatory Commission (FERC) to move the process ahead to return its export plant in Texas to full commercial operation and supply more LNG to global markets ahead of the winter heating season, Reuters reported. Freeport reportedly asked the FERC to authorize the second phase of its restart process, which includes the “nitrogen cooldown of the Loop 2 LNG rundown piping system and the introduction of hydrocarbons to Loop 2.” In the first phase of its restart efforts, Freeport returned the three liquefaction trains, two LNG storage tanks (Tanks 1 and 2) and a single LNG berth (Dock 1) to service.

Threats

- Ripples from Peru’s notoriously slow mine permitting is reaching all the way to the global market for zinc, a metal used in automaking and construction.

Cia. de Minas Buenaventura SAA will halt operations at its Tajo Norte pit northeast of Lima for as long as three years due to approval delays in modifying permits, the Peruvian mining company said in a Tuesday statement. - Carmakers and steelmakers are sealing deals for green steel and using them to tout their environmental credentials. The trouble is the steel is still being forged

using fossil-fuels and it is not clear how soon that can change. German steelmakers Thyssenkrupp AG and Salzgitter AG are finding buyers prepared to pay a premium for green steel, including Mercedes-Benz Group AG, Volkswagen AG, BMW AG, and Ford Motor Co. But without large-scale supplies of green hydrogen, much of that steel will initially be made with natural gas. - Met coal prices continue to show strength at +25% in one month to $340 per ton. Australia reported August/September shipments at 10-year lows, driven in part by maintenance across the sector (BHP in particular) and weakness post fiscal year 2023 (FY23). Met coal prices may drift lower into the fourth quarter on seasonal supply uplift and weakness post FY23.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Trust Wallet, rising 17.91%.

- Banks will have to disclose cryptocurrency holdings under new plans floated Thursday, as international regulators partly blamed banking collapses on the sudden popularity of crypto, writes Bloomberg.

- Coinbase Global received a full license to operate as a digital payment token service provider in Singapore. Coinbase will take a “cautious” approach to growth and seek to have sustained a viable business both globally and in individual markets, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Frax Share, down 10.68%.

- Blockchain data company Chainalysis implemented another round of layoffs, the latest job cuts to hit the crypto sector. The company had about 900 staff after layoffs earlier in 2023, according to Bloomberg, that it said affected less than 5% of workers.

- Sam Bankman-Fried “lied to the world” as he built his cryptocurrency empire at FTX, telling only his friends and girlfriend the truth about what was happening, prosecutors said on the first day of a historic fraud trial. Nathan Rehn, an assistant U.S. attorney, painted a picture of the 31-year-old as a calculated criminal who used investor deposits at FTX as a personal bank account before the company collapsed a year ago, writes Bloomberg.

Opportunities

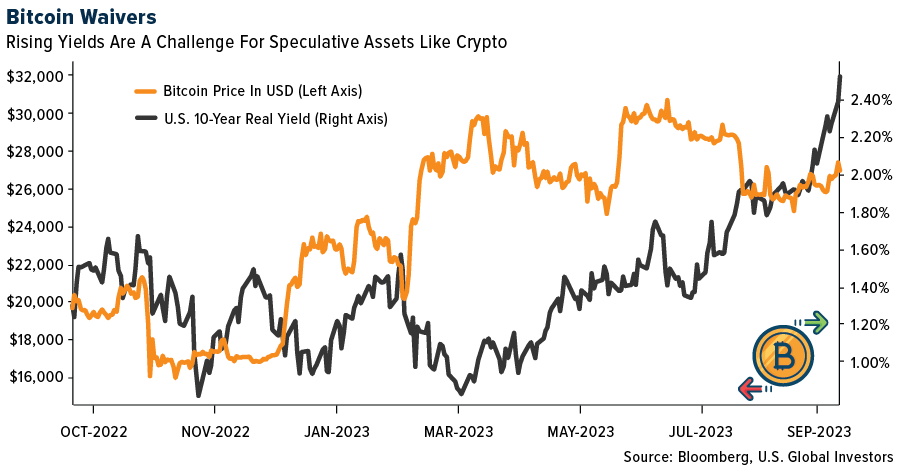

- Bitcoin retreated from a six-week peak after a jump in bond yields dented demand for riskier investments. Bitcoin shed as much as 2% on Tuesday before paring some of the drop to trade at about $27,400 in New York, writes Bloomberg.

- Binance’s spot market share fell for a seventh consecutive month as a dearth in volatility and lingering regulatory woes weighed on the largest cryptocurrency exchange, reports Bloomberg.

- Tim Grant, the former head of crypto investor Galaxy Digital Holdings’ European business, is to spearhead a new investment and operating firm backing companies in areas including digital assets, fintech, and institutional capital markets, writes Bloomberg.

Threats

- All 15,000 ether (ETH) sitting in a wallet associated with last year’s $600 million attack on FTX’s wallets have now moved through privacy tools and bridges. About $26 million worth of ETH sat in a single wallet until earlier this weekend, when a first tranche of 2,500 ETH ($4 million) began moving, ultimately ending up at the Thorchain bridge, the Railgun privacy wallet, or intermediary addresses, writes Bloomberg.

- The criminal trial of former Celsius Network CEO Alex Mashinsky has been scheduled for September 17, 2024. Mashinsky was charged in July with securities fraud, commodities fraud, wire fraud, and conspiracy to manipulate the value of the Celsius token, writes Bloomberg.

- The DOU targeted several Chinese businesses and their employees Tuesday in the latest round of charges tied to productions and trafficking of fentanyl. Alongside the criminal case, the U.S. OFAC also sanctioned the list of Chinese nationals, identifying 16 associated crypto wallets, writes Bloomberg.

Gold Market

This week gold futures closed the week at $1,843.30, down $22.80 per ounce, or 1.22%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.55%. The S&P/TSX Venture Index came in off 4.53%. The U.S. Trade-Weighted Dollar fell 0.10%.

Strengths

- The best performing precious metal for the week was gold, but still off 1.22%. Workers at Mexico’s biggest gold mine agreed to accept Newmont Corp.’s offer, which has kept the Penasquito mine idle for four months. Workers are basically getting an 8% pay raise, according to Bloomberg.

- West African Resources and Orezone Gold say that they intend to enter a memorandum of understanding (MOU) to investigate synergies on their respective mining projects. Orezone’s Bomboré and WAF’s Sanbrado operating centers are located 14 kilometers from each other and currently host some 11 million ounces in gold resources.

- Star Royalties Ltd. entered into a non-binding agreement with Sabre Gold Mines Corp. to restructure the Company’s existing gold streaming agreement on the Copperstone Gold Mine. The proposed restructuring will revise the Copperstone gold stream from 6.6% of gold produced with production-based step-downs to a flat 4% of gold produced for the duration of Copperstone’s life-of-mine (“LOM”) and additional consideration of C$4.55 million being paid by Sabre Gold to Star Royalties in a combination of cash and shares. Under the terms of the streaming agreement, Star Royalties will continue to provide a cash payment to Sabre Gold equal to 25% of the spot gold price for each ounce of gold delivered.

Weaknesses

- The worst performing precious metal for the week was palladium, down 7.60%. According to Bank of America, Eldorado Gold reported weak third-quarter production results. While production was up 10% quarter-over-quarter (QoQ), it still missed their expectations by 6%. Additionally, a weaker-than-expected third quarter heightens the need for a very strong fourth quarter: Eldorado will need to increase production another 12% QoQ to simply hit the low end of its 2023 production guidance range. This heightens the risk for a guidance miss, in their view.

- Pan American Silver suspended operations at its La Colorada mine in Mexico due to security concerns. On the morning of October 5, the operation experienced an armed robbery of two trailers of metal concentrates. No injuries occurred as a result of the incident, and the company is working with state and federal authorities on resolving the security issue.

- Anglo American Plc’s De Beers sold a provisional $200 million of rough stones in its eighth sale of 2023, compared with $370 million at the prior sale and $508 million a year earlier.

Opportunities

- According to Stifel, multiple technical indicators are showing a bottom is in or very near for gold and the junior gold equities. The relative strength index (RSI) for gold is currently at 21; this level has only been seen seven times over the past decade. Gold returned 10% on average over the next 78 days each time this indicator hit this level. This implies a gold price of $2,000 per ounce near the end of the year. The ratio of the VanEck Vectors Junior Gold Miners ETF (GDXJ)-to-gold is also near a low only seen 3 other times since 2013 with following rallies averaging a 95% return over the next 78 days.

- Gold Fields, along with its subsidiary companies, for purposes of funding general corporate and working capital requirements of the group, entered into a sustainability-linked syndicated revolving credit facility agreement of as much as A$500 million, with a A$100 million accordion option. The facility agreement was concluded with a syndicate of 10 banks, with the Commonwealth Bank of Australia as mandated lead arranger and bookrunner, as well as sustainability coordinator.

- For Fortuna Mines silver production at Yaramoko, the beat was due to higher gold grade (7.72 g/t versus consensus of 5.40 g/t), leading to an upward revision in the mine’s production guidance to 110,000-120,000 ounces (from 92,000 to 102,000 ounces) in 2023.

Threats

- According to Bank of America, platinum and palladium prices are down 15% and 30% year-to-date, respectively. While both have faced headwinds, their paths have also diverged. The palladium price has fallen pretty much in a straight line since it peaked after Russia’s invasion of Ukraine. The sharp drop is also because the metal is heavily exposed to demand from internal combustion engine vehicles (ICEVs), which are losing market share. Meanwhile, platinum has stayed within the same range for the past few years as supply uncertainties around South Africa’s power situation have been offset by weaker auto-catalyst demand. At the same time, both metals face one big overhang: inventories. All this means that they see no immediate catalyst to change the fundamental outlook of the two metals.

- De Beers CEO states: “De Beers reduced its rough diamond availability… as the industry’s midstream rebalances certain areas of stock accumulation. De Beers will continue to support its Sight holders to help re-establish equilibrium between wholesale supply and demand by providing full flexibility for rough diamond allocations in Sights 9 and 10 of 2023, suspending De Beers Group online rough diamond auctions for the remainder of 2023.”

- According to Canaccord, Orezone gold production of 30,700 ounces was 7% below their estimate of 32,900. The lower production was a result of a grade 6% below their estimate and recovery 2% lower, partially offset by plant throughput 2% above. Management continues to expect to meet the lower end of 2023 gold production guidance of 140,000-155,000 ounces.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/31/2023):

United Airlines

Kering

Louis Vuitton

Nio

BMW

West African Resources Ltd.

Star Royalties Ltd.

Eldorado Gold Corp.

Pan American Silver Corp.

Gold Fields Ltd.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territ

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.