Unraveling the Regional Banking Crisis Amid Skyrocketing Interest Rates

[tta_listen_btn]

According to the official rules of Monopoly, the bank can never run out of money.

Obviously that’s not always the case in the real world. We’ve already seen three regional banks fail in the U.S. so far this year, and we may see more as depositors continue to move cash from smaller institutions to those perceived to be safer.

To make depositors whole, these smaller banks must sell interest rate-sensitive securities at a loss, which cuts further into their bottom line. A March report by Moody’s showed that, compared to banks in the United Kingdom and European Union, U.S. banks are far more exposed to the potential impact of higher interest rates on the valuation of their available-for-sale and held-to-maturity securities. They also keep the lowest percentage of cash balances relative to their assets.

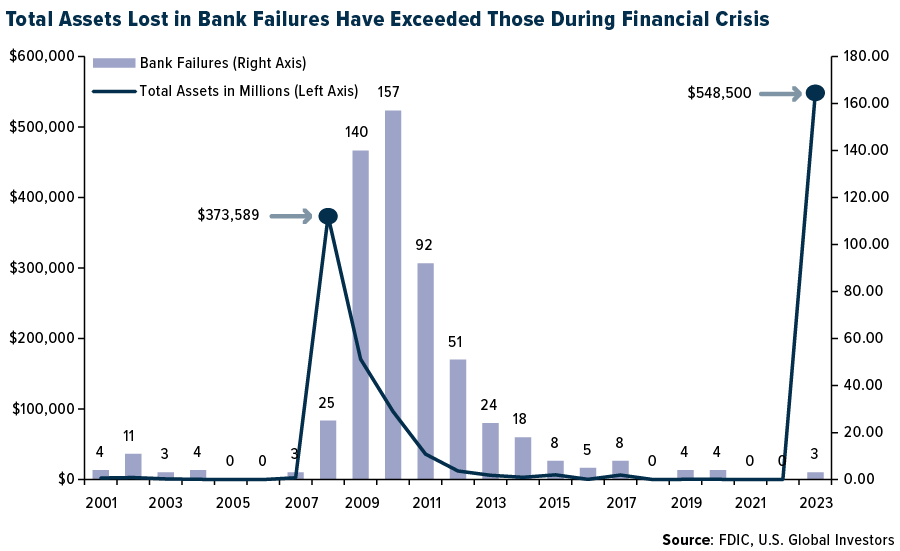

The consequence is that the regional banking crisis is already worse than the global financial crisis—by one metric, anyway. More than half a trillion dollars in assets have been wiped out this year from the failures of Silicon Valley Bank (SVB), Signature Bank and First Republic Bank. That significantly exceeds the amount that was disrupted in 2008, when 25 U.S. banks went under.

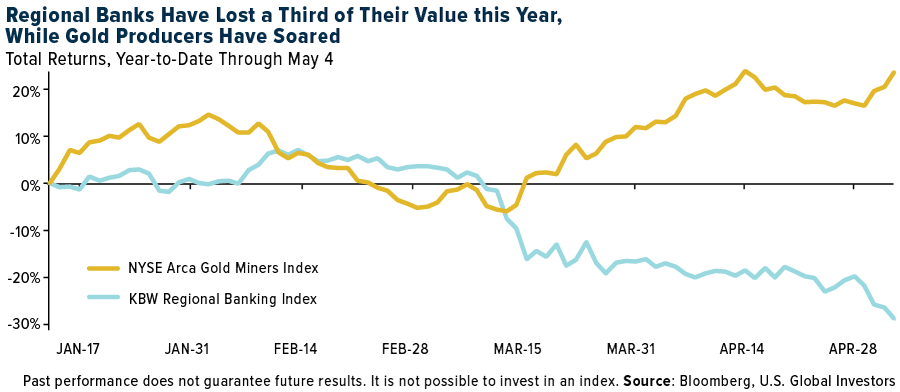

And we may be headed for more pain, as indicated by the whipsaw volatility of banking stocks. The KBW Regional Banking Index has lost nearly a third of its value year-to-date, with Los Angeles-based PacWest Bancorp leading the rout with a decline of 75%.

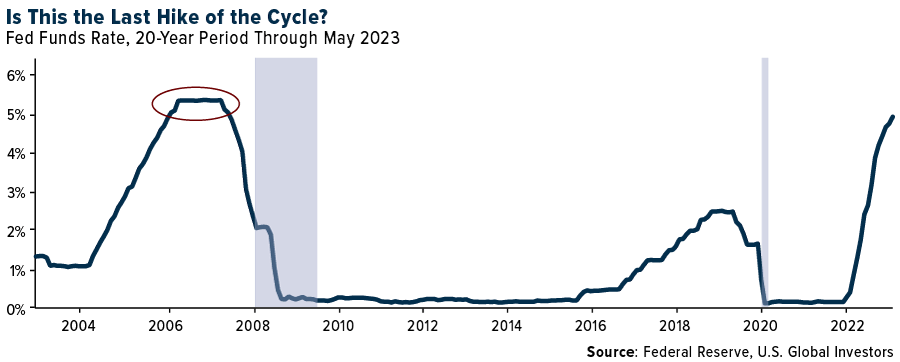

Speaking to Bloomberg this week, former Federal Reserve Bank of Dallas President Robert Kaplan said that the “banking situation may well be more serious than we currently understand.” He added that he supported a “hawkish pause” in interest rate hikes—which, alas, didn’t happen. In a unanimous vote, the Federal Open Market Committee (FOMC) agreed to raise the federal funds rate to a target range of 5.00% – 5.25%. That’s the highest range since 2007, shortly before the financial crisis.

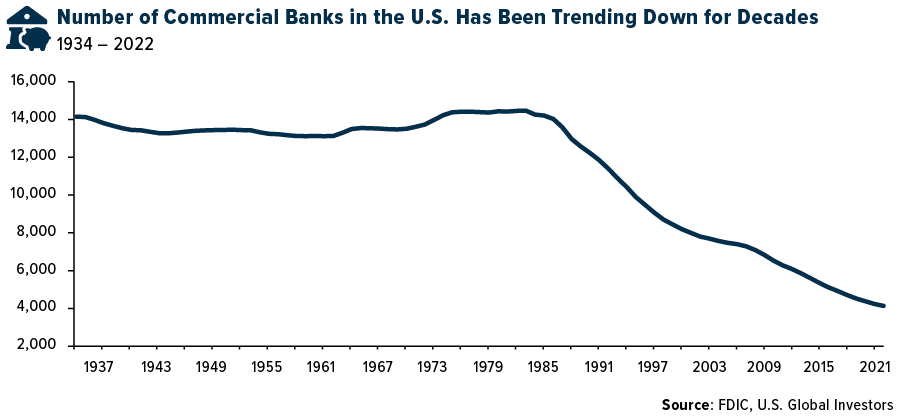

U.S. Has More Banks Than Any Other Nation

It’s worth remembering that the U.S. has more banks than any other nation on earth, even as the number has dropped precipitously over the past few decades. From a high of nearly 14,500 commercial banks in 1983, the U.S. is now home to more than 4,000 as the industry has consolidated.

The country’s diverse banking system is largely due to Americans’ historic distrust of large banks. You may recall a time when it was illegal for a bank to operate out of more than one building. In effect, every city and town in the U.S. had its own bank.

This may seem like overkill, but I believe it’s contributed to a rich and thriving financial network. There may not have been so many home mortgage loans, small business loans and other loans over the decades had there not been so many banks—smaller regional banks in particular.

What’s more, such banks “often outperform larger banks during periods of stress like the pandemic and during the 2008 financial crisis,” says Michelle Bowman, member of the Board of Governors of the Federal Reserve System. Preserving them should, therefore, be “a regulatory and legislative imperative,” she argues.

Gold and Gold Miners on a Tear

During periods of stress, it’s also important for investors to have exposure to gold and gold miners, I believe.

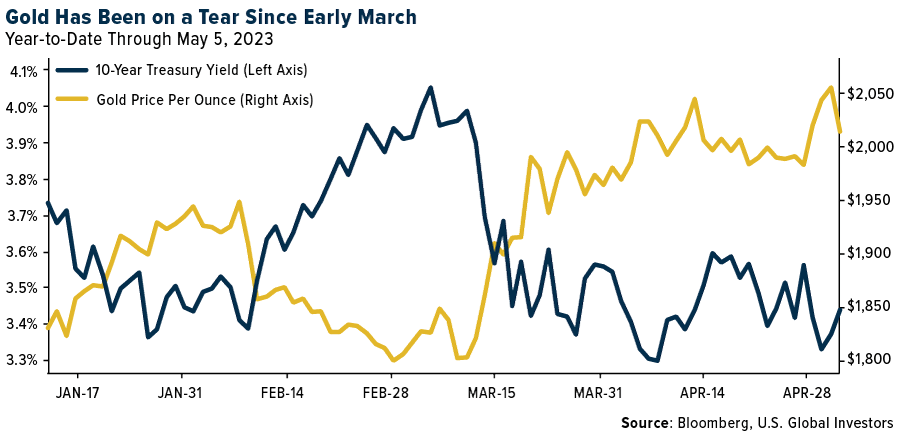

This time is no different. As I said earlier, regional banking stocks have lost around 30% of their value year-to-date. Gold mining stocks, meanwhile, have soared 25% as the underlying asset has increased 7% since the start of 2023.

Gold has a real shot at hitting a new all-time high as the additional rate hike is fully felt by the economy. Markets seem to be betting that this week’s tightening was the last hike of this cycle, and it may take a few weeks for us to see its impact on jobs growth. As I shared with you in early April, over the past 70 years, a Fed pause was followed by an economic recession 75% of the time, with an average lag of six months.

If this instance follows the same playbook, we may be looking at a full-blown recession by the end of the year. Getting exposure to gold and gold mining stocks, I believe, is a wise and rational strategy to manage this risk.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 1.24%. The S&P 500 Stock Index fell 0.79%, while the Nasdaq Composite was essentially flat at 0.07%. The Russell 2000 small capitalization index lost 0.51% this week.

- The Hang Seng Composite gained 0.78% this week; while Taiwan was up 0.30% and the KOSPI fell 0.02%.

- The 10-year Treasury bond yield was flat at 3.43%.

Airlines and Shipping

Strengths

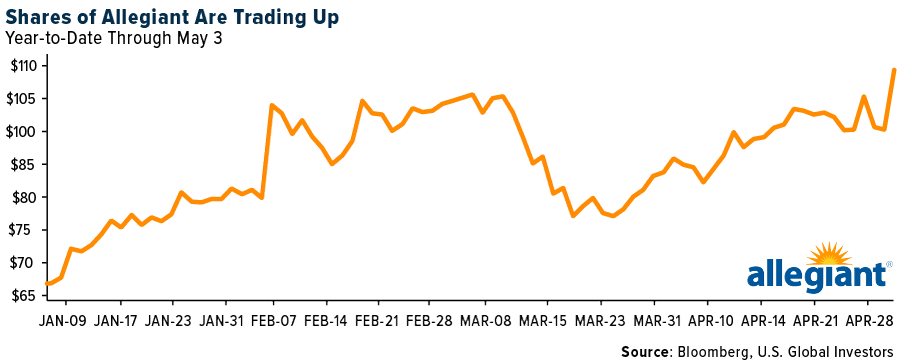

- Allegiant’s strong earnings beat showed adjusted earnings per share (EPS) in the first quarter at $3.04, well ahead of the consensus estimate of $2.33, largely due to stronger revenue and lower fuel costs. The 1Q23 system revenue per available seat mile (RASM) of 29% exceeded the mid-20% guide and consensus 24% estimates.

Weaknesses

- The worst-performing airline stock this week was xxxx, which fell by xx.x%. In April, airline stocks declined by 3.3% and underperformed the S&P 500 by 4.7%. Despite a strong start to the year, airline stocks are now up only 3% compared to the S&P 500’s 9% gain. Consensus 2023 EPS and EBITDAR estimates have moved on average 16.0% and 2.4% higher, respectively, in April, driven by lower fuel costs and stronger-than-expected demand trends into 2Q23. However, macroeconomic concerns caused multiple compression and underperformance relative to the market.

- Average ship speeds have slowed from about 14.5 knots to about 13.7 knots. Taking into account time at port and variations in ship size, the 5.5% reduction in speed is likely to have had about a 4.5% impact on the effective size of the fleet.

- Aggregate first-quarter maintenance spending for airlines reached 121% of Q1 2019, increasing 18% year-over-year. This acceleration outpaces y/y available seat miles (ASM) growth, which rose 15% y/y to 101% of 1Q 2019.

Opportunities

- On 2023E and 2024E EBITDAR, 73% and 82% of airline stocks, respectively, trade below the midpoint of historical ranges. The group trades at an average market cap and enterprise value that are 60% and 81% of 2019 levels, respectively, both flat from March.

- Credit Suisse reiterates its positive view on tankers, citing (1) the most visible demand catalysts with better resilience against global macro volatilities, (2) the most favorable demand-supply dynamics, and (3) undemanding valuations. Its top pick is COSCO Shipping Energy Transportation, a pure tanker company with exposure to smaller-sized crude and product tankers.

- Jet fuel prices have fallen 30% since the start of the year, driven by an 80% decrease in crack spreads during this period. Although lower fuel costs typically result in lower fares and accelerated growth, supply constraints in the industry will keep growth limited. With strong demand indicators, pricing should accelerate into the summer.

Threats

- The Mexican government is discussing a potential new state-owned airline, but it seems to be in the early stages of execution. The impact on airlines should be limited given existing airlines’ competitive cost structures.

- Misui OSK Lines’ (MOL) non-container 2023-2024 guidance of JPY150 billion profit came in below consensus. The car carrier boom appears to be losing momentum, with 4Q seeing disruptions from Australian port quarantines, and guidance suggesting profits are peaking rather than moving higher. MOL is also guiding to sharply weaker dry bulk profits due to expiring cape contracts, a weak macro environment, and softer paper/open hatch vessels.

- UBS identifies two potential factors that could increase airlines’ costs associated with intra-European flights emissions: i) the European Union (EU) Emissions Trading System (ETS) free allowances are likely to be gradually phased out by 2027; ii) potential significant increases in the cost of an ETS allowance versus the current levels of EUR 90/unit would increase the costs associated with purchased allowances. At the European level, UBS estimates that the phase-out of free allowances under the EU ETS will lead to an incremental cost for airlines of EUR 2 billion at today’s price of EUR 90/unit. This higher cost will likely result in higher ticket prices.

Luxury Goods and International Markets

Strengths

- Private sector employment in the U.S. grew at a stronger pace than anticipated in April. Data published by Automatic Data Processing (ADP) on Wednesday revealed a 296,000 increase in private-sector employment, following a 142,000 increase in March. This figure significantly exceeded the market expectation of 148,000.

- Volkswagen and BMW reported higher-than-expected earnings per share for the first quarter of 2023. Volkswagen surpassed expectations due to increased production and robust demand in the U.S. and Europe, which helped offset declining sales in China. BMW reported a higher earnings margin but maintained its outlook unchanged due to ongoing high costs and rising competition. BMW approved an additional €2 billion share buyback program, set to commence after the current buyback concludes in mid-2023.

- Lucid, a Chinese electric car producer, was the best-performing S&P Global Luxury stock for the week, gaining 12.8%. The company is preparing its second EV model, the Gravity SUV which is undergoing testing in the United States. Production of the new model should start next year.

Weaknesses

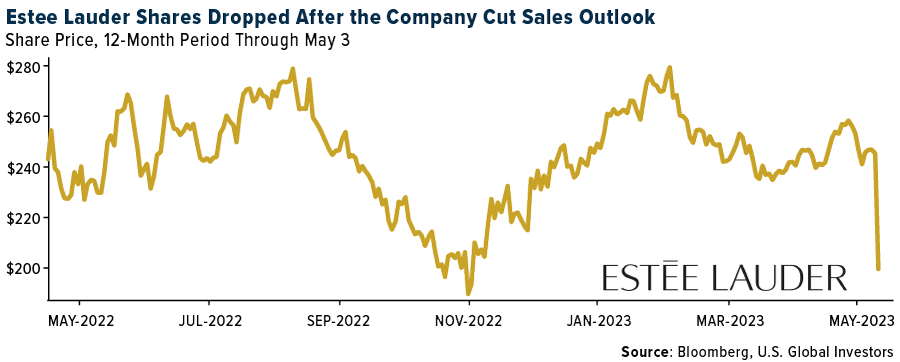

- Estee Lauder shares experienced their largest drop on record this week after the cosmetics company reduced its forecast for the third time in six months. A slower-than-expected recovery in the key market of China negatively impacted business. The retailer now predicts annual sales to decline by approximately 10-12% for the fiscal year ending in June, a worse outlook than its previous guidance of a 5-7% decrease.

- China’s market reopened mid-week during the Golden Week Holiday, reporting a weaker-than-expected Caixin Manufacturing PMI. The index, which measures manufacturing activity in smaller, privately-owned firms, fell to 49.5 in April (from 50.0 in March), following a decline in the China PMI that measures production activities among larger, state-owned conglomerates. Both the China and Caixin Manufacturing PMIs are now below the 50-mark, indicating contraction in the sector.

- Faraday Future Intelligence was the worst-performing S&P Global Luxury stock for the second week in a row, losing 21.8% in the past five days. Shares continue to decline despite the company recently announcing the production completion of its first car, the first long-awaited FF91.

Opportunities

- Morgan Stanley estimates that South Korea has the highest per-capita spending on luxury items, amounting to $325 a year, compared to $55 for Chinese shoppers. Overall, South Koreans represent about 6% of global spending on personal luxury goods, according to Edouard Aubin, an analyst at Morgan Stanley. Louis Vuitton held a fashion show in South Korea’s capital to raise brand awareness and promote its products. The company made over $1 billion in sales in the country last year, as stated in a local company filing.

- During the first half of China’s Golden Week holiday, domestic tourism surged. Bloomberg reported that over 159 million trips were made by car, rail, airplane and waterways, representing a 162% year-over-year increase. High-spending buyers of luxury goods and services still prefer to shop domestically rather than abroad. In April, up to 62% of luxury spending by consumers occurred within China, compared to 41% pre-pandemic, as noted by FactSet.

- Chinese airlines will be permitted to increase their flights to the United States from the current eight to twelve per week, matching the number of U.S. flights to China. This modest concession comes amid tense relations between the two countries, which are competing for business and global dominance.

Threats

- Chinese financial data providers have recently stopped offering detailed information on the nation’s companies to overseas clients. This makes it more challenging for foreign firms to access data that China may consider sensitive. Investors operating in China may face increased difficulties, despite the Chinese government’s efforts to encourage foreign investment in the country.

- Despite the banking crisis in the United States, the Federal Reserve raised the cost of borrowing by another 25 basis points on Wednesday due to concerns that elevated inflation may persist longer than previously expected. The year-over-year rate of inflation is currently 5%, well above the Fed’s target of 2%. By hiking rates, the Fed aims to discourage spending and slow down economic activities, which should lead to lower inflation. However, this may also push the U.S. economy into a recession.

- Russia has accused Ukraine and the United States of launching a drone attack on the Kremlin. No one was injured in the attack, and damage was limited to two copper panels on the dome of the Kremlin’s Senate Palace, where Vladimir Putin’s office is located, according to spokesman Dmitry Peskov. This drone attack occurred less than a week before President Putin is scheduled to attend the annual Red Square military parade to celebrate the Soviet triumph in World War II.

Energy and Natural Resources

Strengths

- The top-performing commodity for the week was crude palm oil, gaining 7.XX% due to an unexpected drop in Malaysian stockpiles to an 11-month low. China became the largest buyer of U.S. crude oil in March, with purchases likely to increase further. This surge in demand could be attributed to the popularity of Singapore’s transshipment hub. In May 2020, China bought the most U.S. crude oil since the ban was lifted in late 2015.

- As of late April, about 125 tankers were observed carrying crude to China, indicating the world’s largest importer is drawing in significant amounts of crude by sea. China’s oil demand is expected to remain relatively strong, despite crude futures sliding around 17% since mid-April.

- Ferrite stocks in South Korea have been soaring, following Tesla’s announcement in March to drop the usage of rare earths in its future models, and growing speculation that ferrite is the most likely candidate to replace rare earths in Tesla’s electric vehicles.

Weaknesses

- Natural gas was the worst-performing commodity for the week, dropping 11.XX%. Weak oil demand data from the U.S. added to concerns that the global economy is heading toward recession. OPEC and its allies’ plan to regain control of the market by cutting production hasn’t yet worked, causing market volatility. Implied volatility in U.S. crude and Brent spiked to the highest since late March on Wednesday.

- European natural gas extended its decline, trading at a 21-month low amid record LNG imports and rising stockpiles, as prices are less than half their level at the start of the year. Iron ore is heading for a steep weekly decline due to persistently disappointing steel demand in China’s construction sector, the key steel market. Rio Tinto is “not too worried” about the softer China steel market, and traders await employment data that will provide a fresh gauge of the performance of the U.S. economy.

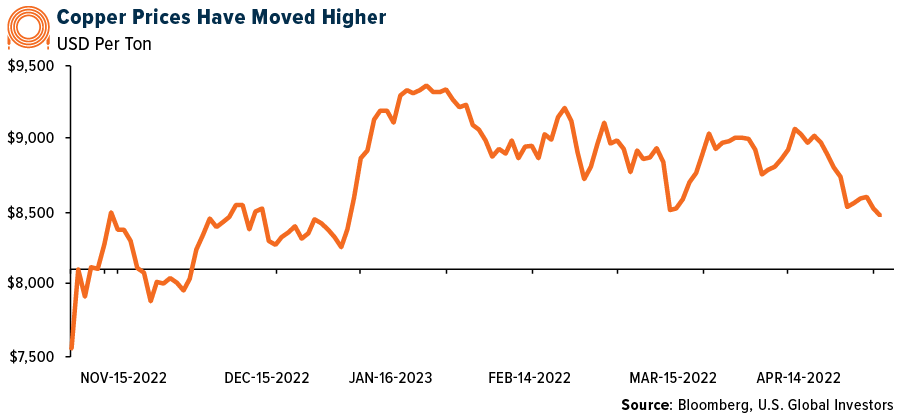

- Copper prices fell due to mixed Chinese data and ongoing banking troubles in the U.S., causing a risk appetite fall. The latest economic indicators from China pointed to a contraction in manufacturing while the housing market continues to rebound, suggesting that recovery remains patchy. Janet Yellen’s warning that the Treasury could run out of cash next month has also contributed to economic uncertainty.

Opportunities

- Fortescue Metals Group aims to acquire copper, lithium and rare earth assets in South America to expand its exposure to clean energy. The push into metals such as copper, used in wind and solar installations; lithium, a core ingredient in electric vehicle batteries; and rare earths, used in electric vehicles (EVs) and wind turbines, would increase the company’s exposure to the energy transition.

- Albemarle Corp. plans to invest between $1.25 billion and $1.5 billion to double its lithium hydroxide output in Australia. The two additional processing trains at its Kemerton plant will process spodumene ore from the Greenbushes mine, one of the world’s top lithium sources.

- The energy transition requires an enormous surge in metals demand to enable the world to largely dump hydrocarbons and rein in temperature increases. The consumption of metals such as lithium and copper is set to surge in the coming years, but mine supply will not be able to keep up with the growth. One short-term solution is to increase secondary production, or recycling, as the current trajectory of primary supply or copper mining investment is not enough to meet the growing demand in time.

Threats

- Exxon Mobil Corp. was found to have breached its environmental permit in Guyana for failing to provide adequate oil-spill insurance, with the High Court ordering the company to offer an unlimited guarantee for clean-up costs. This ruling highlights Exxon’s non-compliance with environmental regulations. Guyana is home to the biggest oil discovery in a decade while Goldman Sachs Group is forecasting Exxon Mobil to produce 30% more oil than the company is forecasting.

- There is a gap between the expected demand for refined copper and mine supply growth, putting the energy transition and carbon zero initiatives at risk. Analysts estimate a shortage of six million tons of copper by next decade, but the number of new mines is limited. The Oyu Tolgoi mine in Mongolia, which is currently the world’s largest underground copper mine, highlights the environmental and technical complexities, as well as the potential resource nationalism risks in mining copper.

- China and Venezuela are re-establishing economic and political ties, including the restructuring of Venezuela’s line of credit and possible renewal of collaborations in telecommunications and oil. China’s support of Venezuela may increase its influence in Latin America and affect U.S. sanctions and its own economic interests. China has effectively worked itself into the world’s mineral supply chain.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Pepe, rising 1,382%.

- Sales of NFTs seem to be climbing from the lowest levels since 2021 after NFT marketplace Blend launched its lending program. The peer-to-peer perpetual platform aims to improve NFT liquidity and allows owners to borrow against their digital assets within seconds, according to Bloomberg.

- Conor Ryder, a research analyst at Kaiko, notes that Bitcoin perpetual futures are increasingly driving the largest digital token’s price. He highlights that the Bitcoin perpetuals-to-spot-volume ratio is at its highest in nearly two years, as reported by Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was BRISE, down 17.78%.

- Dubai authorities reprimanded the co-founder of failed crypto hedge fund Three Arrows Capital for operating and promoting their new digital-asset exchange, OPNX, without the required local license. The action signals Dubai regulators taking a stricter approach toward crypto, as reported by Bloomberg.

- The South Korean prosecutor leading the investigation into crypto entrepreneur Do Kwon believes extraditing him to his native country would be the best way to bring justice to victims of the TerraUSD cryptocurrency crash, which wiped out around $40 billion from digital currency markets, according to Bloomberg.

Opportunities

- Ark Invest added more Coinbase shares to its stockpile. The U.S. investment management firm added 129,604 Coinbase shares to the Ark Innovation ETF, 23,456 to the Ark Generation Internet ETF and 15,809 shares to its Fintech Innovation ETF, as reported by Bloomberg.

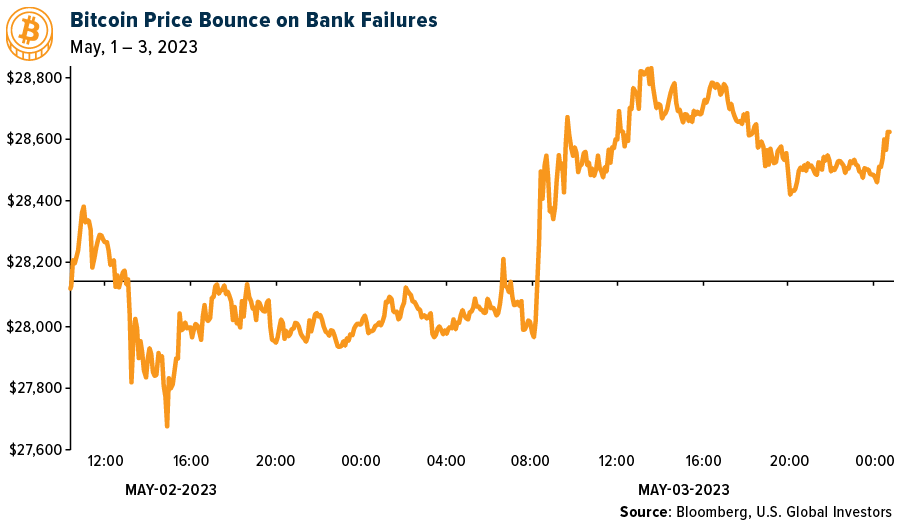

- Bitcoin climbed as renewed fears of instability in the U.S. financial system bolstered the price of cryptocurrencies. Bitcoin rose as much as 4.4% to $28,892. The gains came as U.S. regional banks led a selloff in American equities following the collapse and sale of First Republic Bank, according to Bloomberg.

- Coinbase Global is launching an international derivatives exchange for institutional crypto traders outside the U.S., aiming to diversify its business amid souring relations with American regulators. The new platform will list Bitcoin and Ether perpetual futures starting this week after receiving a license from the Bermuda Monetary Authority, as reported by Bloomberg.

Threats

- Coinbase Inc. chairman and CEO Brian Armstrong, Marc Andreessen and other officers allegedly avoided over $1 billion in losses by using inside information to sell stock within days of the cryptocurrency platform’s listing two years ago. The company’s board deployed a so-called direct listing instead of an IPO and rapidly sold off $2.9 billion in stock before Coinbase management revealed “material, negative information that destroyed market optimism from the company’s first quarterly earnings,” according to Bloomberg.

- Former Celsius Network CEO Alex Mashinsky moved to dismiss a New York state lawsuit, having been accused of duping crypto investors by repeatedly making false and misleading statements about the lender’s safety, as reported by Bloomberg. Mashinsky was sued for fraud by the New York attorney general in January, who alleged that his actions led to hundreds of thousands of investors losing billions of dollars’ worth of crypto when Celsius collapsed.

- New York Attorney General Letitia James proposed a state law to tighten rules over cryptocurrency companies in her latest move against an industry she claims is suffering from “rampant fraud and dysfunction.” Under her proposal, New York would require independent public audits of crypto exchanges and bar people from owning both brokerages and tokens to prevent conflicts of interest, as reported by Bloomberg.

Gold Market

Gold futures closed the week at $2,025.90, up $26.80 per ounce, or 1.34%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 5.59%. The S&P/TSX Venture Index came in up only 0.33%. The U.S. Trade-Weighted Dollar fell 0.37%.

Strengths

- The best-performing precious metal for the week was silver, up 2.77% as hedge funds increased their bullish position size to its highest level in 15 weeks, according to Bloomberg. Agnico Eagle Mines reported an adjusted first-quarter earnings per share (EPS) beat versus consensus, driven by stronger operating performance and lower costs. Notably, the company reported better-than-expected results at Macassa, Fosterville and Kittila. While unit costs were below expectations due to strong operational performance and early signs of deflationary pressure, management reaffirmed guidance across the board.

- Gold mining stocks rose along with the price of the commodity as investors considered safe havens amid First Republic Bank’s failure and the Federal Reserve’s upcoming meeting, where the central bank delivered another interest rate hike.

- Barrick Gold Corp. reported first-quarter adjusted EPS of $0.14, above FactSet’s consensus of $0.13, and adjusted EBITDA of $1,183 million, 6% ahead of the consensus of $1,113 million, due to lower operating costs and favorable non-GAAP adjustments.

Weaknesses

- The worst-performing precious metal for the week was platinum, down 1.98%, on little news. Silver Lake Resources’ gold production was 63,000 ounces, 9% below consensus. All-in-sustaining costs (AISC) of A$2,014/ounce was 5% above consensus. Mt Monger performed well, with issues at Deflector and Sugar Zone. The company now expects 2023 group sales to be at the bottom end of the 260,000-725,000 ounce guidance range.

- Franco Nevada reported first-quarter adjusted EPS of $0.79, missing the $0.84 consensus. The EPS miss was driven primarily by lower revenue (fewer ounces). First-quarter production was 145,000 ounces, falling short of the 166,000-ounce consensus using the same commodity price assumptions as the company.

- The decline in palladium and rhodium during the first quarter surprised many in the market, given the ongoing growth in global auto production and downside risk to primary supply. Market commentary has focused on softer Asian spot market demand, growing electric vehicle (EV) penetration, financial/speculative flows, and the liquidation of a large quantity of rhodium metal from a Chinese glass facility.

Opportunities

- According to Google Trends data, the phrase “how to buy gold” has reached record levels in the U.S. (even higher than when gold prices reached all-time highs in 2020). Gold prices are up 9.4% year-to-date and are hovering around $1,995 per ounce at the time of this writing. Investors are still concerned about persistent inflation, elevated interest rates for longer periods and a potential recession—scenarios that have historically been positive for gold.

- Agnico Eagle Mines’ focus for the remainder of 2023 is on delivering: (1) 2023 guidance; (2) updated exploration results on the Odyssey underground (expected in June 2023); (3) studies to fill the unused mill at Canadian Malartic, which are expected in early 2024; and (4) an underground resource estimate and technical study on the Detour underground potential (early 2024), including working on the optimization of the mill.

- Osisko Gold Royalties announced a 50/50 joint venture agreement with Gold Fields for the joint ownership and development of Osisko’s Windfall gold project, located in the Abitibi greenstone belt of Québec. Gold Fields will make an initial cash payment to Osisko of CAD $300 million on signing, plus a deferred cash payment of CAD $300 million on the issuance of permits for the Windfall project, among others, for a 50% interest in the project. In total, Gold Fields’ contingent and deferred payments will be CAD $709 million (USD $525 million), after which Gold Fields and Osisko will share all costs on a 50/50 basis going forward. Gold Fields estimates its investment will ultimately total CAD $1.26 billion.

Threats

- Newmont is currently conducting technical due diligence on Newcrest assets to determine whether to move forward with a binding agreement. If Newmont is successful, it would need government approval from four countries (Australia, Papua New Guinea, Canada and the U.S.) and approvals from both Newmont and Newcrest shareholders.

- Eldorado Gold is undergoing a large mine build, with $850 million in capital expenditures, relative to its size (market capitalization of $1.9 billion). This results in expected negative free cash flow over the next three years. Given that the mine build is large and occurring in an inflationary environment with a tight labor market, particularly for experienced workers, there is above-average risk in the shares.

- The World Gold Council (WGC) reported that central bank gold purchases fell 40% last quarter, marking the second straight quarterly decline. This may suggest that the frenzied pace of central bank gold buying could be coming to an end. Bloomberg reports that central bank purchases accounted for nearly a third of global gold demand in 2022. However, foreign governments are not as keen as they used to be on holding U.S. dollars as a central bank reserve asset.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2023):

Bombardier Inc.

Allegiant Travel Co.

COSCO Shipping Holdings Co. Ltd.

Mitsui OSK Lines Ltd.

Tesla Inc.

Volkswagen AG

Bayerische Motoren Werke AG

Lucid Group Inc.

LVMH Moet Hennessy Louis Vuitton

Agnico Eagle Mines Ltd.

Silver Lake Resources Ltd.

Franco-Nevada Corp.

Osisko Gold Royalties Ltd.

Gold Fields Ltd.

Newcrest Mining Ltd.

Eldorado Gold Corp.

Air Canada

Embraer SA

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The KBW Regional Banking Index is a modified-capitalization-weighted index, created by Keefe, Bruyette & Woods, designed to effectively represent the performance of the broad and diverse U.S. regional banking industry

A bond’s credit quality is determined by private independent rating agencies such as Standard & Poor’s, Moody’s and Fitch. Credit quality designations range from high (AAA to AA) to medium (A to BBB) to low (BB, B, CCC, CC to C).