Understanding the Yen Carry Trade Impact on World Markets

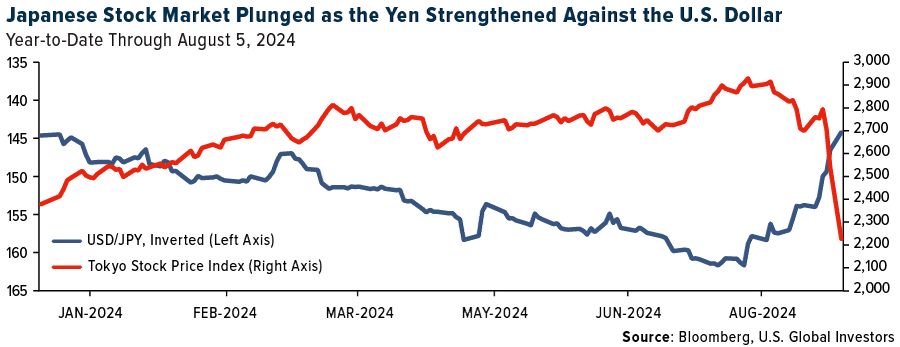

On Monday, global equities and digital assets underwent a dramatic selloff as the unwinding of the Japanese yen carry trade rattled markets. The S&P Global Broad Market Index (BMI), which measures the performance of more than 14,000 stocks around the world, retreated 3.3%, its worst trading day in over two years. The Tokyo Stock Price Index, or TOPIX, fell 20% in its biggest three-day wipeout ever.

Meanwhile, the Bloomberg Galaxy Crypto Index tumbled as much 1as 17.5%.

As an investor who’s weathered numerous market storms over the decades, I believe it’s important to understand the underlying causes of these movements and the lessons they hold for us.

Carry trades, for those less familiar, involve borrowing in a low-interest-rate currency—like the Japanese yen or Swiss franc—and investing the proceeds in higher-yielding assets elsewhere. This strategy has been immensely profitable, given the Bank of Japan’s (BOJ) longstanding zero-rate policy.

However, the recent rate hike by the BOJ has thrown a wrench into these trades, leading to a rapid appreciation of the yen against the U.S. dollar. As many of you are aware, a strong local currency puts pressure on that country’s stock market because exported goods become less competitive.

The Yen’s Rise Echoes Past Financial Crises

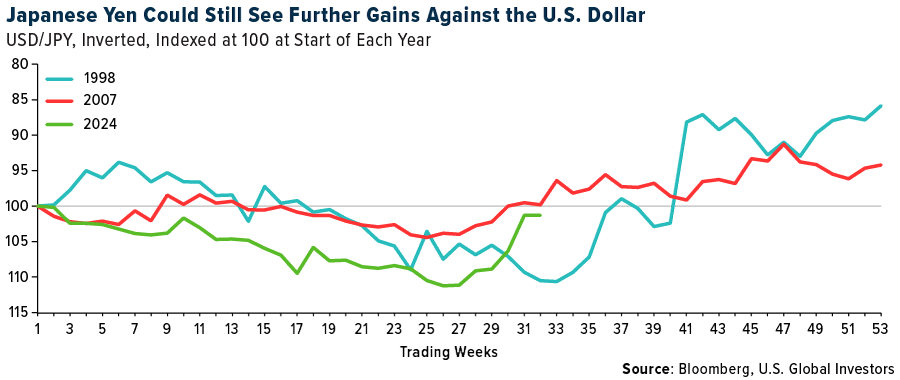

The yen’s appreciation mirrored past episodes, such as the 1998 Long-Term Capital Management (LTCM) hedge fund collapse and the 2007 subprime mortgage crisis, where the yen appreciated 20% from its low. As of early August, the yen had already appreciated over 10% against the U.S. dollar.

Following the selloff, the BOJ walked back its hawkish stance, with Deputy Governor Shinichi Uchida pledging to refrain from further rate hikes amid market instability. This should provide some relief in the near term, but the broader implications of the yen’s rebound and the carry trade unwind will likely continue to influence markets.

Given these developments, I urge caution. History suggests that the unwinding is not yet complete. In a report dated August 9, JPMorgan says it believes the unwind is about halfway done. What’s more, financial markets are pricing in multiple rate cuts by the Federal Reserve this year, which could further exacerbate the carry trade unwind. In such a scenario, it’s prudent to remain cautious about “buying the dip.”

Bitcoin Volatility Challenges Digital Gold Narrative

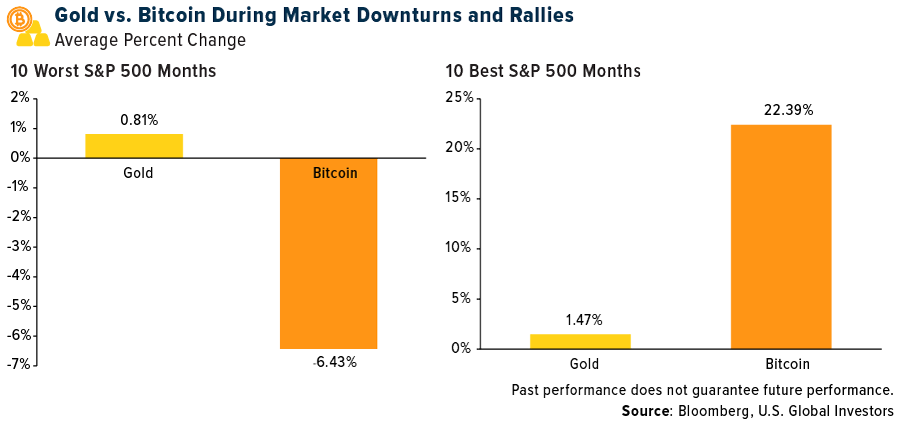

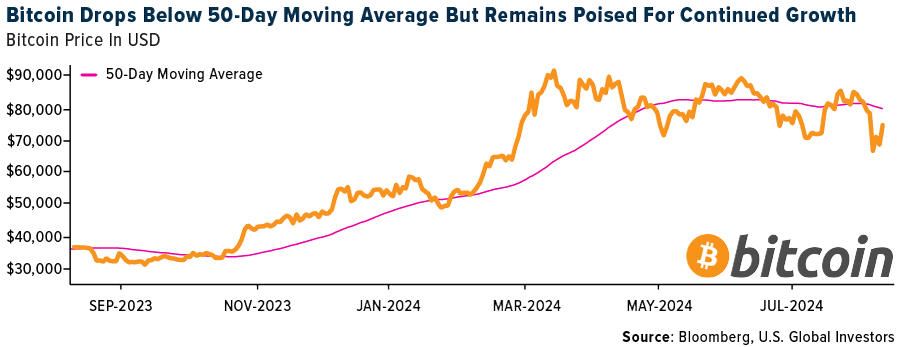

As equities plummeted, Bitcoin’s behavior sparked significant interest. The world’s largest digital asset dropped as much as 17% on Monday—briefly falling below $50,000 for the first time since February—before recovering some of its losses, ending the day down 8%.

This contrasted with gold, which fell just over 1% on the day.

The selloff in Bitcoin highlights a crucial point: While it’s often touted as “digital gold,” there are some who believe the cryptocurrency has yet to prove itself as a stable store of value in times of market stress. “Despite both gold and Bitcoin being limited supply, zero-coupon instruments, [Bitcoin] does not exhibit gold’s ‘store of value’ properties,” Citi analyst David Glass said in a note this week.

Our own analysis adds some color to Citi’s conclusion and shows that Bitcoin has historically behaved more like a risk-on asset than a safe haven. Over the past decade, during the 10 worst months for the S&P 500, Bitcoin fell by an average of 6.4%, while gold remained slightly positive with an average return of 0.8%. During the best 10 best months, on the other hand, Bitcoin surged an eye-popping 22.4% on average, significantly outpacing gold’s 1.5%.

This suggests that Bitcoin may offer higher potential returns than gold during market rallies, but it comes with greater risk during downturns. This is why I always recommend a 10% weighting in gold and gold mining stocks for more conservative investors, while Bitcoin and other digital assets may be more attractive to investors with a longer time horizon or higher risk tolerance.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.60%. The S&P 500 Stock Index fell 0.04%, while the Nasdaq Composite fell 0.18%. The Russell 2000 small capitalization index lost 1.35% this week.

- The Hang Seng Composite gained 0.85% this week; while Taiwan was down 0.78% and the KOSPI fell 3.28%.

- The 10-year Treasury bond yield rose 14 basis points to 3.939%.

Airlines and Shipping

Strengths

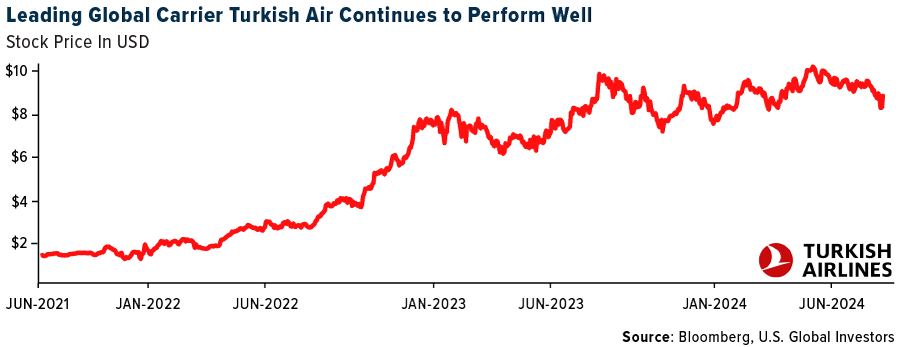

- The best performing airline stock for the week was Embraer, up 13.2%. Turkish Air surprised positively and reported US$943 million in net income in the second quarter, which was up 49% year-over-year and 43% above company-compiled consensus. The strong beat was a combination of better-than-expected operational performance. Positively, the airline faced much softer yield pressure than its European peers, with passenger RASK down 3% year-over-year, and cargo revenues ramped up faster than the first quarter, reports JPMorgan.

- According to Morgan Stanley, capesize bulkers’ supply remains tight, while iron ore shipments from Brazil strengthened further, likely supporting fundamentals.

- Embraer reported second quarter 2024 revenue 4% above consensus, reports Goldman, with adjusted EBITDA margin 180 basis points ahead driving an adjusted EBITDA beat of 22%. The company delivered 46 jets in the quarter, including 19 commercial aircraft and 27 executive jets.

Weaknesses

- The worst performing airline stock for the week was Tripadvisor, down 16.2%. Airline stocks fell 6.9% in July compared to the S&P 500’s 1.1% return. Year-to-date through July, the group is now down 0.7%, underperforming the S&P 500’s 15.8% return. On 2024E/2025E EBITDAR, 67%/44% of airline stocks trade below the midpoint of historical ranges, according to Bank of America.

- Clarkson Research says that charter fees for car carriers fell for the third consecutive month year-over-year in July 2024. Their view that shipping prices for car carriers are entering an adjustment phase is unchanged.

- Delta Air Lines was the most affected airline by last month’s CrowdStrike outage, quantifying the impact at $500 million. As a result, Bank of America is lowering its third quarter and 2024 earnings per share (EPS) estimates by $0.60. The group expects lost revenues to contribute two-thirds of the $500 million loss figure, and costs to contribute the remaining one-third.

Opportunities

- IndiGo announced a string of new initiatives as part of its 18th anniversary update in New Delhi. The update hinged on three aspects: 1) expansion of international business; 2) launch of premium business class product offering – IndiGo Stretch; and 3) launch of new premium loyalty program – IndiGo BlueChip. JP Morgan believes these initiatives should help IndiGo maintain its dominant market share and profit leadership.

- The ISI Shipper Survey is indicating Trans-Atlantic volumes have been notably strong and LATAM and Asia to U.S. routes are all showing strength over the summer.

- Chinese airlines began to perform better over the past three months, encouraged by the country’s better-than-feared summer travel activity, pricing trends, though easing year-over-year, still came in better-than-feared with international ticket prices holding up above 2019 levels.

Threats

- Bank of America believes investor concerns over change of ownership of AENA’s airports in Catalonia are unsubstantiated, as there is no reference to such a scenario in the recent agreement signed by the largest parties in the Catalan parliament. Any meaningful revision to AENA’s governance would likely require an act of Spanish parliament.

- Even though LNG carriers are not transiting the Suez Canal, which is certainly aiding average voyage lengths, the fleet has grown 5.4% already this year outstripping demand growth and is expected to add another 6-7% before the end of the year. While there is a surge of new LNG production capacity, the fleet could grow by 13-15% gross each year, meaning there would need to be a healthy level of removal among the older assets to balance the market, reports Stifel.

- JPMorgan feels Latin American airlines have the highest risk. Regarding leverage, Brazilian airlines are the most levered companies (Azul at 4.5x net debt to EBITDA and GOL at 4.3x), followed by SIMPAR (4.1x net debt to EBITDA). When it comes to foreign exchange, the companies with the highest exposure to hard currency (in terms of LTM revenues) are Copa (nearly 100%), ASUR (50%) and LATAM (50%).

Luxury Goods and International Markets

Strengths

- According to our in-house earnings watchlists, since the beginning of this quarter, 54 companies in the luxury sector have released their latest quarterly earnings reports. Most of these companies posted earnings per share (EPS) that beat expectations, with only 16 out of the 54 (about 30%) reporting earnings misses.

- In the United States, initial jobless claims were reported at 233,000, which is lower than the expected 240,000 and down from the previous week’s figure of 249,000. Continuing claims also declined, falling from 1,877,000 to 1,875,000.

- Royal Caribbean was the top-performing S&P Global Luxury stock, rising 12.1% over the past five days. In intraday trading on Tueday, shares gained 10% after JPMoragan added the company to its Focus List.

Weaknesses

- According to a recent UBS study, tourist spending in Europe in July slowed by 14.1% compared to 2019, with only American and Southeast Asian tourists showing improvements. While Chinese spending in Europe was up 0.6% year-over-year in July, it is still down 70.4% compared to pre-pandemic levels in 2019.

- China exports in July grew 7% from the same period last year, falling short of an expected 9.7% increase. The figures for July also fell below China’s 8.6% export growth in June, which was the fastest in 15 months. Meanwhile, China’s imports in July surged 7.2% year-over-year, significantly higher than the expected 3.2%.

- Amorepacific Corporation was the worst-performing S&P Global Luxury stock, losing 15.2% in the past five days. On Wednesday, shares dropped 25% after the company reported weak second quarter earnings due to poor cosmetic sales in China.

Opportunities

- According to FactSet, European second quarter earnings are showing positive growth for the first time since 2022. Earnings per share (EPS) are up 3.6% year-over-year based on 70% of companies reporting. Financials are key divers, while consumer discretionary and energy stocks are underperforming. Nevertheless, analysts suggest the second quarter now is expected to show 5% EPS growth, up from (3%) in the first quarter.

- Last weekend, China announced a 20-point plan to develop the consumer services industry. Targeted sectors included hospitality, domestic services, elderly care, childcare, entertainment, tourism, sports, education, and training. The government also pledged to foster new segments such as digital, green and health services, create new consumption scenarios, and relax market access.

- Luxury consumption in China is currently low, but Generation Z (those born between 1997 and 2012) has a few products they love to buy. According to Antonello Germano, a Chinese consumer insight manager at Daxue Consulting, there are five luxury goods that are particularly popular among China’s Gen Z: two bags from Gucci, two bags from Saint Laurent, and sneakers from Maison Margiela Replica. The sneakers’ retail price is from $670 to $750, and the Saint Laurent bags range from $980 to $5,100. Kering is a parent company of Gucci and Sait Laurent.

Threats

- American consumers have been heavily relying on credit cards and other forms of financing to support their spending as wage growth has slowed, pandemic savings have evaporated, and inflation remains elevated. With interest rates still at a two-decade high, economists are concerned that some consumers may not be able to sustain their spending for much longer. A recent Philadelphia Fed report showed that the share of credit card balances past due reached a record high at the start of the year, based on data going back to 2012.

- Bloomberg reported that wealthier customers are visiting IHOP and Applebee’s more often, while visits from lower-income customers have declined in recent quarters as they opt to eat at home to save money. Customers’ budgets are stretched after years of elevated prices, which will further pressure spending on discretionary goods and services.

- It seems we had many publications this week reporting on the weakening of consumer spending in the United States, which is the main contributor to gross domestic product (GDP) growth. Morgan Stanley also notes a slowdown in consumer spending and believes it will continue, leading to the underperformance of consumer-related and cyclical stocks.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 9.61%, largely on the National Weather Service forecasting most states to see hotter than seasonal temperatures over the next eight to 14 days. Prices had dropped 15% in the past month, Bloomberg reports.

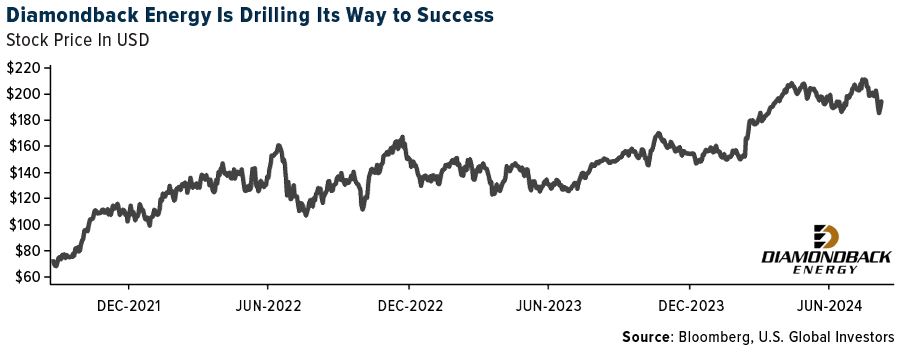

- Diamondback Energy Inc. raised its 2024 oil production target, joining other U.S. shale drillers lifting full-year forecasts. Diamondback, one of the largest independent explorers in the oil-rich Permian Basin of West Texas and New Mexico, expects to pump as much as 276,000 barrels a day this year, up from an earlier top-end forecast of 275,000, according to a statement released Monday.

- Siemens Energy AG increased its cash flow outlook after demand for grid technologies and gas services swelled, propping up turnaround plans for the beleaguered wind-turbine division. The industrial company now expects pre-tax cash flow of as much as €1.5 billion ($1.6 billion) during fiscal 2024, up from as high as €1 billion, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was palm oil, dropping 4.34%, perhaps on Indonesia discussing increasing its biodiesel mandate. Copper plunged to the lowest in nearly five months and mining equities tumbled as industrial metals were swept up in the turmoil across global equity and currency markets, writes Bloomberg.

- Oil extended losses to a new seven-month low as a selloff in wider financial markets continued to heap pressure on prices, reports Bloomberg. Brent futures slipped toward $75 a barrel — erasing this year’s gains — and hit the lowest level since January.

- Mont Belvieu ethane prices ended last week at 11.4c/gallon versus 20c in early June. This is the lowest level in decades except for 2019-20. Natural gas production has been strong and inventories through the end of July are tracking well-above the prior five-year average, according to Bank of America.

Opportunities

- Woodside Energy Group Ltd., Australia’s largest energy producer, will buy a clean ammonia project in Texas for $2.35 billion. Woodside will buy OCI Clean Ammonia Holding BV from Dutch chemicals company OCI NV in an all-cash transaction, it said in a statement on Monday.

- BHP Group Ltd., the world’s No. 1 miner, is planning to sell Brazilian copper and gold assets it acquired with the takeover of Oz Minerals Ltd., according to people familiar with the matter and Bloomberg.

- Morgan Stanley is expecting the manganese market to continue tightening until the first quarter of 2025 and non-traditional sources of supply will need to be found. The group expected South Africa, Ghana, and domestic China to fill the gap. Ghana has now maxed out, if prior maximum production is a guide.

Threats

- Uranium explorers are calling on Australian state governments to lift bans on mining the fuel, which is set for a long-term jump in demand as decarbonization spurs a nuclear energy revival. Australia boasts nearly a third of known uranium ore deposits worldwide, but only two of the nation’s eight states and territories — South Australia and Northern Territory — allow the mining of it, reports Bloomberg.

- Copper was roughed up to begin the week on Monday as commodities were exposed to the wider tumult, and prices remain under pressure. Part of the reason lies in bulging stockpiles, reports Bloomberg, which suggest the global market is too amply supplied for the material to stage a serious comeback. Overall inventories in LME-tracked warehouses have expanded by 50% year-to-date and stand at the highest level in three years.

- According to BMO, for copper, Zambia’s new Minerals Regulation Commission Bill would give the nation’s minister of finance the right to maintain a free-carry shareholding in a mining license on behalf of the government if minerals are discovered. The Zambian government came under fire for this yesterday, with two mining bodies in the country stating that it would deter investment and boost the perception of investment risk in the country.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Sui, rising 22.48%.

- One of the strengths highlighted this week by Bloomberg is Bitcoin’s recent movement back above its weekly moving averages after falling below the 50-day, marking its biggest gain in 16 months. This significant upward momentum is a strong indicator of renewed investor confidence, suggesting the potential for continued growth in the market.

- Ripple’s continued efforts to integrate its XRP token into the banking sector highlight its practical use case and potential for widespread adoption. Discussions of a spot XRP ETF have also emerged, which could significantly boost the token’s price and attract institutional investors, reports Benzinga.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Lido DAO, falling 30.15%.

- Ethereum plunged by a staggering 61% to begin the week, marking one of its most significant declines in recent history. According to FX Empire, the drawdown comes from a deep sell-off from Ethereum ETFs and major crypto trading firms. This shows the vulnerability of the asset in a turbulent market environment.

- Japan’s finance regulator, Hideki Ito, emphasized the need for “cautious consideration” before approving crypto-linked ETFs, citing concerns about their long-term contribution to wealth creation for Japanese people, despite the global trend of easing regulations on such financial products.

Opportunities

- Fasttoken is gaining traction due to its energy-efficient Proof-of-Stake (PoS) mechanism and user-friendly tools for decentralized applications (dApps). The project aims to provide quick, low-cost transactions and robust support for developers, positioning it as a potentially strong player in the blockchain ecosystem, according to insidebitcoins.com.

- The Federal Reserve issued an enforcement action against Customers Bancorp Inc. for deficiencies in risk management and anti-money laundering compliance, causing its shares to drop by 22%, and requiring the company to improve its digital-asset strategy and customer due-diligence program.

- Crypto startup Concrete’s move to New York’s Meatpacking District from the San Francisco Bay Area highlights a growing digital-asset renaissance in the city, driven by a more favorable crypto sentiment, increased regulation setbacks, and a shift in Silicon Valley’s focus to artificial intelligence.

Threats

- According to a report from crypto researcher Kaiko, the amount of Bitcoin held in reserve by mining companies has dropped to a three-year low, reaching approximately 1,510,300 tokens as of August 3. This decline, which represents a 2.4% decrease from the peak in December 2020, reflects the significant impact of the April software code adjustment that slashed miner revenue, pushing many companies to sell their Bitcoin holdings to cover operating costs.

- Following a $247 million drop in value between August 4 and 8, Jump Trading’s recent large transfers of Ether to exchange hot wallets have sparked scrutiny among crypto investors amid a broader market selloff and regulatory uncertainties.

- Robinhood Markets Inc. is engaging with the U.S. SEC after receiving a Wells notice regarding its cryptocurrency business, signaling a potential enforcement action, according to CEO Vlad Tenev, who noted the firm has submitted a detailed response.

Defense and Cybersecurity

Strengths

- General Dynamics Electric Boat secured a $1.3 billion contract modification from the U.S. Department of Defense to acquire materials for Virginia Class Block VI submarines. The company’s president also announced his retirement and the firm’s revenue still increased by 18% in the second quarter.

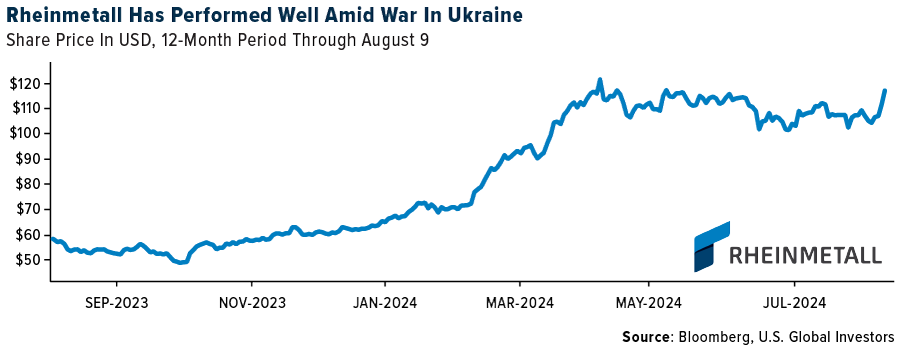

- Rheinmetall reported a 49% sales increase to €2.23 billion in the second quarter, surpassing estimates due to strong demand for ammunition and weaponry amid the Ukraine conflict, though it maintained its full-year guidance.

- The best performing stock in the XAR ETF this week was Axon Enterprise Inc., rising 24.85%, after it reported a 35% year-over-year increase in second quarter 2024 revenue to $504 million. The company raised its full-year revenue outlook, and saw significant growth in its cloud services and recurring revenue.

Weaknesses

- A Hezbollah drone attack in Israel’s Western Galilee killed one person, wounded two others, and caused damage near Nahariya, following an Israeli military strike on a Hezbollah structure in southern Lebanon.

- Yahya Sinwar, recently named the political leader of Hamas, has been a key figure in cease-fire negotiations and strategic planning, viewed by Israeli officials as a symbol of Palestinian armed struggle and the main target for assassination following Hamas’ October 7 attack on Israel.

- The worst performing stock in the XAR ETF this week was Triumph Group Inc., falling 13.2%, after it reported a 7% increase in first quarter fiscal 2025 net sales to $281 million. However, the company also reported a net loss from continuing operations of $18.8 million, while maintaining its full-year guidance.

Opportunities

- The U.S. has sent 12 Raptor F22 fighters to the Middle East. Additionally, Lufthansa has suspended flights to Amman, Beirut, Tehran, and Tel Aviv until August 13.

- Bell Textron Inc. announced that the U.S. Army has approved the Milestone B decision for the Future Long Range Assault Aircraft, marking the beginning of the weapon system’s Program of Record and advancing it to the Engineering and Manufacturing Development phase. This approval follows years of collaboration to meet requirements and reduce risks, positioning Bell to deliver a highly advanced and transformational aircraft for the Army.

- Germany’s Rheinmetall is acquiring a majority stake in South African engineering firm Resonant Holdings to expand its ammunition production capabilities amid rising global demand, driven by NATO’s efforts to replenish depleted ammo stocks. The new joint venture, in which Rheinmetall will own 51%, aims for annual sales of over €100 million and will enhance Rheinmetall’s expertise in building chemical and explosives plants.

Threats

- European natural gas prices surged after reports of Ukrainian troops seizing the Sudzha transit point, causing benchmark futures to rise as much as 5.3%, amidst ongoing border fighting and despite assurances from Gazprom and Ukraine’s transmission system operator that gas flows remain normal.

- Several U.S. personnel were injured in a suspected rocket attack by Iranian-backed militias at al-Asad air base in Iraq amid escalating tensions in the Middle East following the killings of senior Hezbollah and Hamas leaders.

- Russian Security Council Secretary Sergei Shoigu visited Iran for talks with President Masoud Pezeshkian and other top officials to discuss potential Iranian retaliation against Israel. This comes following the death of a Hamas leader, as well as regional and international issues, amid growing tensions and closer Moscow-Tehran ties since Russia’s 2022 invasion of Ukraine.

Gold Market

This week gold futures closed the week at $2,469.70, down $0.10 per ounce, or 0.00%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 2.55%. The S&P/TSX Venture Index came in off 3.33%. The U.S. Trade-Weighted Dollar fell 0.07%.

Strengths

- The best performing precious metal for the week was palladium, up 1.30%, perhaps on ETF purchases of the metal this week which shows the year-to-date rise in palladium ounces held in the ETFs climbed 27%, Bloomberg reports. It is still worth noting that AUM in physically backed ETFs have been trending higher in recent weeks, suggesting more involvement from investors trading in a pocket of the gold market that had been very quiet. Bank of America previously noted that a resumption of ETF buying may be necessary for a sustained increase in prices

- With $200 million of its term loan paid in the second quarter of this year, Kinross confirmed its plans to use its high free cash flow to continue to strengthen its balance sheet. CIBC modelled the remaining $800 million term loan to be fully paid down in the second quarter of 2025, which would reduce debt from $2.2 billion to $1.2 billion.

- Morgan Stanley says precious metals have been much more resilient in the recent pullback in pricing, while industrial metals, energy and agricultural commodities are all moving lower for now. The group thinks gold can continue to find support from both physical demand and financial inflows, with the first U.S. rate cut likely a key catalyst.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.91%, perhaps from some platinum ETF selling reported this week. Endeavour Mining said its former CEO paid the firm $1.35 million in a settlement, months after the gold miner fired him for alleged serious misconduct, according to Bloomberg.

- The rough diamond parcels from South African operations, originally earmarked for sale in August/September as part of Tender 1 for fiscal year 2025, will now be sold under Tender 2 that is expected to close mid-October, Bloomberg reports.

- With second quarter production of 3.88 million ounces of silver equivalent pre-released (100% basis), Gatos Silver reported GAAP second quarter EPS of $0.13, lower than consensus of $0.16, due to a combination of variances in depreciation, taxes, and other expenses, CIBC reports.

Opportunities

- Gold will trade higher three months out from now as the Federal Reserve cuts interest rates, China’s economy continues to drag along, and central banks (big, medium, and small) go on stacking up bars in their vaults. According to Bloomberg, retail investors may even join in too.

- For Oceana Gold, with the Haile underground reaching 2,000 tons per day run rate reached at end of July, RBC views a significant free cash flow inflection now in sight. Coupled with higher grades from the Ledbetter Phase 2 pit and stronger output from Macraes, RBC anticipates robust free cash flow generation in the second half.

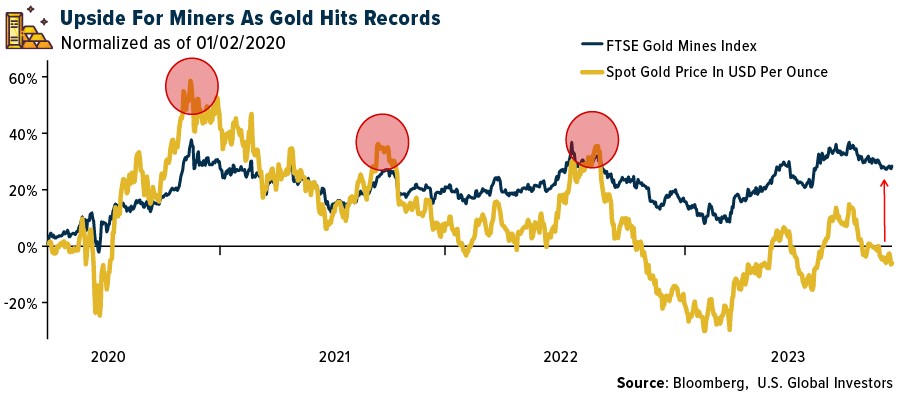

- NBF says that in the following three months from the Sahm Rule being triggered, gold has, on average, risen nearly 3% while the S&P 500 has, on average, declined 8.4%. Over the last three market corrections, both gold and gold equities have outperformed the S&P 500 over the following three months from the start of a market correction. If gold is poised to move, the gold stocks may finally be back in play. For more than a year, gold stocks have failed to perform relative to the higher gold prices due to a lack of margin expansion. Over the past two quarters the number of gold miners reporting positive free cash flow and expanding margins has increased and is likely to expand further. Goldman Sachs reiterated its price target of $2,700 for gold in 2025.

Threats

- RBC feels Oceana Gold’s full-year guidance may be tough to achieve following operating challenges in the second quarter, particularly on costs with 30% AISC improvement ($600 per ounce) required in the second half to reach upper end of cost guidance.

- According to CIBC, with second quarter gold-equivalent ounces (GEOs) of 20,068 pre-released, Osisko Gold Royalties reported earnings of $0.18 per share, ahead of consensus of $0.12 per share, because of variances in G&A and finance expenses. However, investor attention will likely be focused on the reduction of annual guidance from 82k-92k GEOs to 77k-83k GEOs to account for the continued suspension of production at the Eagle mine, as well as for the recently disclosed two-month delay in Capstone’s ramp-up to 20,000 tons per day at Mantos Blancos.

- West African Resources says that a new mining code has been adopted for Burkina Faso and a new local content law has been adopted. Key changes under the new mining code include increasing the State’s free-carried equity interest in mining projects to 15% from 10%, according to Bloomberg.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Embraer SA

Delta Air Lines

Copa Holdings

Kering

Deutsche Lufthansa

General Dynamics Corp.

BHP Group

Kinross

Endeavour Mining

Gatos Silver

Oceana Gold

Osisko Gold Royalties

West African Resources

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The FTSE Gold Mines Index measures the performance of companies engaged in the mining of gold.

The S&P Global BMI (Broad Market Index), comprised of the S&P Developed BMI and S&P Emerging BMI, is a comprehensive, rules-based index measuring global stock market performance.

The TOPIX, also known as the Tokyo Stock Price Index, is a capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange.

The Bloomberg Galaxy Crypto Index (BGCI) is a capped market capitalization-weighted index designed to measure the performance of the largest digital assets traded in USD.