U.S. Global Investors Provides Update on Enhanced Stock Buyback and Dividend Programs, Responds to Proposal

SAN ANTONIO, TX – July 1, 2022 – U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm that focuses on specialized markets around the world, is pleased to share updates on its stock buyback and dividend programs.

Earlier this year, the Company announced that it increased the limit to its annual share buyback program, from $2.75 million to $5 million. As such, the Company bought back 13,255 shares in June 2022, at a net cost of approximately $59,000. This represents a significant increase over the same month last year when the Company repurchased 3,319 shares at an approximate net cost of $20,000. For the quarter ended June 30, 2022, the Company bought back a total of 45,696 shares at a net cost of $219,000, compared to 17,155 shares at a net cost of $125,000 during the same quarter in 2021. The Company strategically repurchases stock on down days using an algorithm.

Further, the Company raised its monthly dividend twice in 2021, once in February and once in October. The monthly dividend of $0.0075 is authorized through September 2022 and will be considered for continuation at that time by the Board. The record dates are July 11, August 8 and September 12, and the payment dates will be July 25, August 22 and September 26.

At the June 30, 2022, closing price of $4.42, the $0.0075 monthly dividend equals a 2.04% yield on an annualized basis. The continuation of future cash dividends will be determined by the Board, at its sole discretion, after review of the Company’s financial performance and other factors, and is dependent on earnings, operations, capital requirements, general financial condition of the Company and general business conditions.

Building Up Our Cash Position

The Company has also been building up its cash position in anticipation of a potential recession.

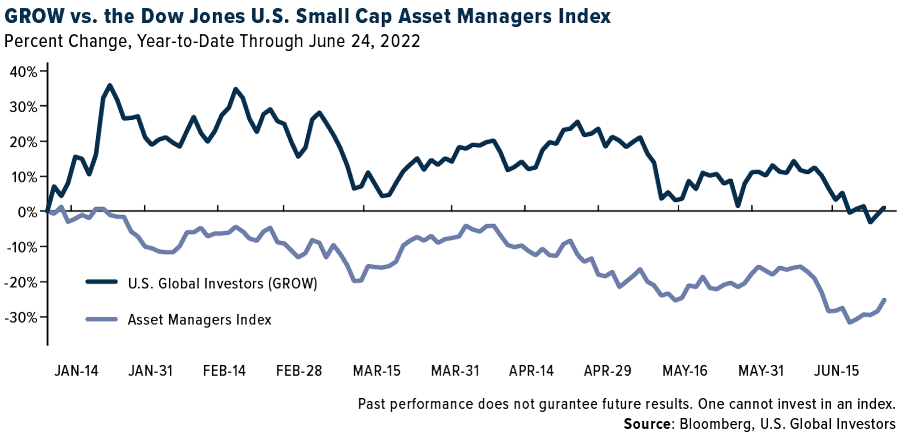

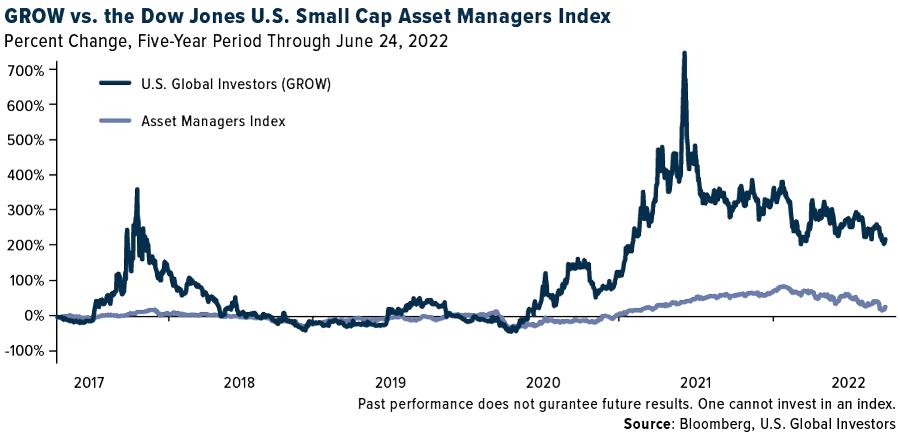

“In a recession, cash is king,” says Frank Holmes, the Company’s CEO and Chief Investment Officer. “We have raised the limit to our share buyback program and increased our dividend twice, and now we are building up our cash position, which we believe is wise and prudent to weather this bear market and what could be a challenging recession. The market has clearly recognized our strategy, as anyone can see in the charts provided. Shares of GROW have managed to outperform an index of asset managers for the shorter year-to-date period and longer five-year period.”

U.S. Global Investors Responds to Proposal

The Company acknowledges that it is in receipt of Echo Lake Capital and Deerhaven Capital’s proposal, issued on June 27, 2022, to acquire the Company’s outstanding common shares (the “Proposal”), which has been shared with the Board of Directors (the “Board”). While the Company would normally not view a proposal of this nature as warranting a reply, the fact that it was publicized requires that the Company provide a timely public response.

The Company does not believe the Proposal provides the Company’s shareholders with appropriate value for their securities and therefore is not interested in pursuing the Proposal based on the terms submitted.

To sign up for news and research on a variety of asset classes, from gold to airlines to Bitcoin, please click here.

Follow U.S. Global Investors on Twitter by clicking here.

Subscribe to U.S. Global Investors’ YouTube channel by clicking here.

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides money management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

# # # #

The Dow Jones U.S. Small Cap Asset Managers Index is a market cap-weighted index of publicly traded small-cap asset management firms in the U.S.