U.S. Consumers Defy the Odds Ahead of the Holiday Shopping Season

The economy may be on shaky ground, but you wouldn’t know it by looking at U.S. consumer spending habits alone.

Retail sales rose a healthy 1.3% in October from September, according to Census Bureau data. Some economists put the increase into context by pointing out that Amazon held a Prime Early Access sales event in October, while California distributed over $5 billion in inflation relief checks. Higher prices for everything, including new vehicles and fuel, also contributed to the retail sales jump.

Despite stubbornly high inflation and recessionary fears, spending by consumers may not slow down as we approach the busy holiday shopping season.

In its annual forecast of holiday spending, the National Retail Federation (NRF) says it believes sales will increase between 6% and 8% from last year, potentially making this season the third best year in the past 20 years following 2020 and 2021, when American consumers were stuck at home and flush with pandemic stimulus money. Holiday sales could top $960.4 billion as “consumers remain resilient and continue to engage in commerce,” NRF President and CEO Matthew Shay says.

The big exception appears to be Target. This week, the Minneapolis-based retailer warned shareholders of lackluster spending this holiday season due to higher prices. Although sales were slightly higher in the third quarter compared to the same quarter last year, due mostly to higher consumer prices, operating income decreased nearly 50% on a rise in expenses.

Luxury Market Set to Grow 21% this Year, 3% – 8% Next Year

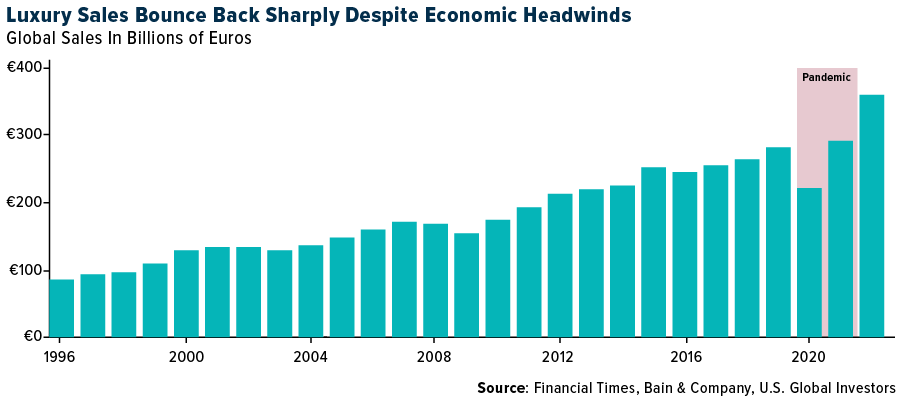

Target aside, I believe the holiday forecast is incredibly constructive for retailers. That includes luxury retailers, many of which reported strong results for the third quarter. Industry leader LVMH reported a 19% jump in sales from the same quarter last year, while Kering (parent company of Gucci) and Hermes reported increases of 14% and 24%, respectively.

This week, Bain & Company announced that the global luxury market is on track to grow 21% this year, reaching $1.4 trillion. The firm projects that personal luxury sales will increase a further 3% to 8% next year, even as the global economy is expected to contract.

Unlike what happened during the 2008-2009 financial crisis, when consumers cut back on luxury items, today’s luxury market appears poised to expand with a larger global consumer base and greater concentration among high-earning buyers, Bain says.

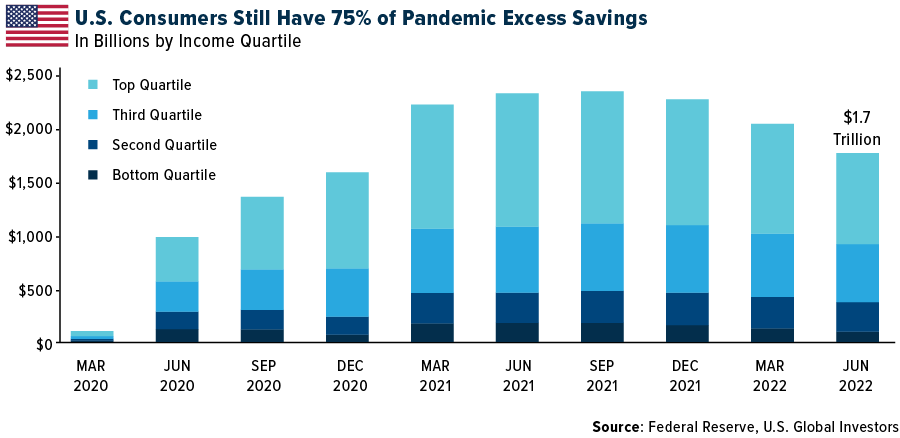

$1.7 Trillion Remain of Pandemic Savings

There could be two things in particular supporting strong retail sales: excess savings and credit card debt.

In a report issued last month, the Federal Reserve stated that U.S. households are still holding onto a sizeable chunk of their pandemic savings. At the peak, Americans were saving as much as 33% of their disposable income.

The rate has since fallen to just over 3%, but Americans still have access to a massive $1.7 trillion. That represents about 75% of the total cash that households collected and saved during the pandemic. Reserves are steadily being depleted, but there’s still plenty left in the tank to support consumption in the near- to medium-term.

Average APRs Hit a New All-Time High

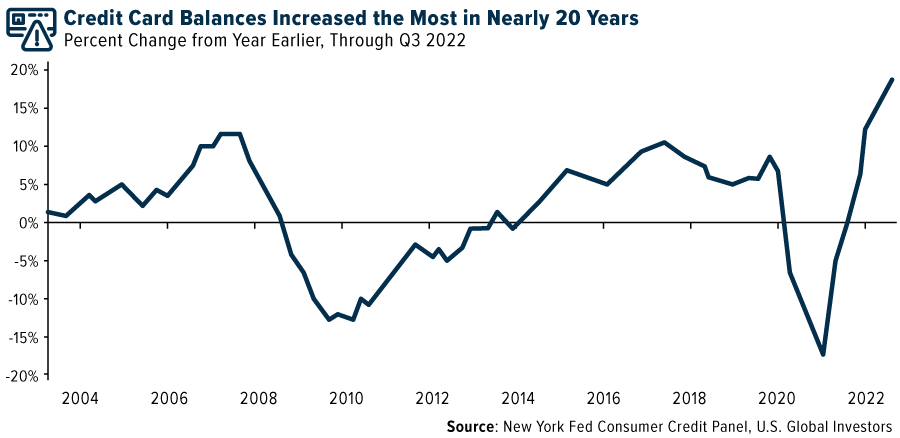

And how are Americans choosing to make transactions? Credit cards, apparently.

In the third quarter, credit card balances surged 15% year-over-year, the largest annual jump since the New York Fed began keeping track of this data. More than 190 million Americans have at least one credit card, while half of all American adults have at least two. Some 13% have five or more, the New York Fed says.

With interest rates on the rise, this could be a problem to keep an eye on. The average annual percentage rate (APR) for retail cards just hit a fresh new high of 26.72%, with some exceeding an unbelievable 30%, according to CreditCards.com. Retail credit cards differ from general purpose cards in that they’re issued by or on behalf of a store. Among the highest APRs belonged to cards issued by Kroger, Macy’s, Exxon Mobil, Speedway and Wayfair.

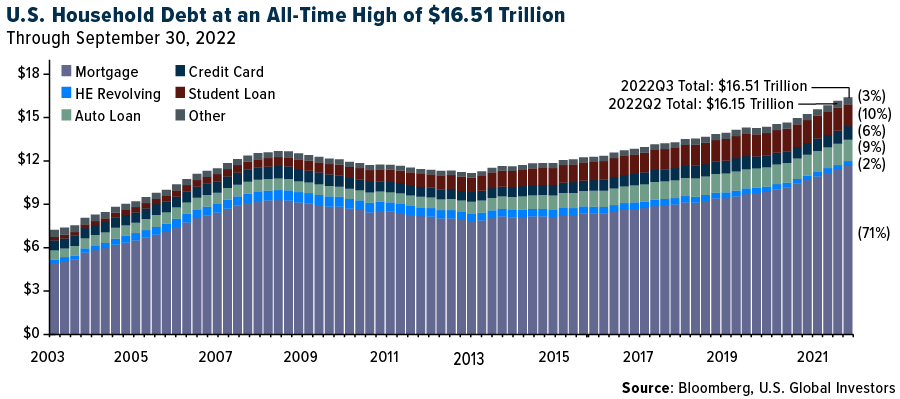

Total Household Debt at $16.51 Trillion

While I’m on this topic, total U.S. household debt grew to a new record high of $16.51 trillion in the third quarter, according to a separate report by the New York Fed. This amounts to an increase of $351 billion from the previous quarter, a sign of strong consumer demand and rising prices.

Mortgages remained the number one category, representing close to three quarters of total debt.

However, the bank points out that the number of new home mortgages slowed to a pre-pandemic low during the quarter as 30-year mortgage rates have climbed above 6%, the highest since 2002.

Do you know what the Three T’s of Luxury are? Find out in our video by clicking here!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.01%. The S&P 500 Stock Index fell 0.69%, while the Nasdaq Composite fell 1.57%. The Russell 2000 small capitalization index lost 1.75% this week.

- The Hang Seng Composite gained 4.14% this week; while Taiwan was up 3.55% and the KOSPI fell 1.56%.

- The 10-year Treasury bond yield rose 1 basis point to 3.825%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Copa, up 7.3%. Azul posted better-than-expected results, with EBIT at R$404 million, 4% above consensus. The company reported a record-high top line, boosted by a supportive demand environment and better-than-expected yields. On the cost front, fuel costs were 9% ahead of consensus although CASK ex-fuel offset it, leading to the EBIT beat.

- Hapag Lloyd’s third quarter results are quite strong, 7% above company consensus and driven by higher freight rates than expected, offset partly by higher costs. The guidance is also unchanged for fiscal year 2022, though the company does say that capacity growth will likely exceed demand in the coming quarters.

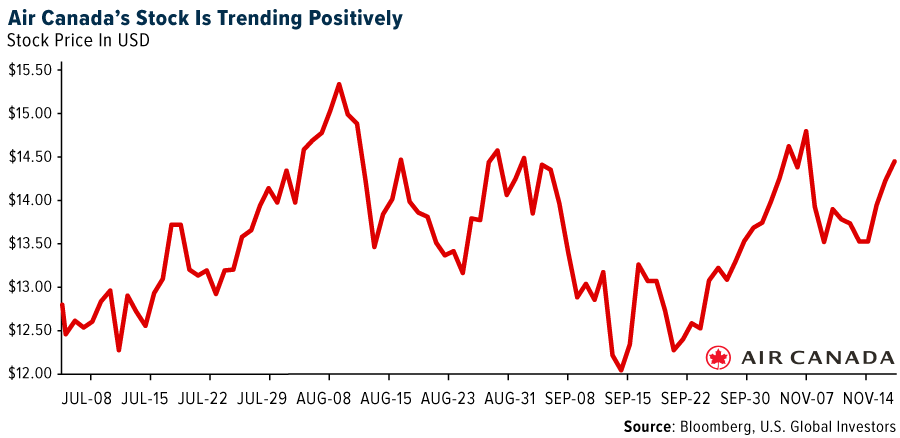

- Air Canada’s announcement of up to $300 million of convertible note repurchases (56% of outstanding) is positive for the company, which will aid in reaching its 2024 leverage guidance of 1x. Once completed, the repurchase should provide some interest savings and demonstrate that Air Canada will continue to buy back debt at its next largest maturity date in 2025, further de-risking its balance sheet.

Weaknesses

- The worst performing airline stock for the week was Air China, down 9.5%. Embraer reported its third quarter results. Adjusted EBITDA was at $93 million – excluding $40 million on expenses – a downward miss of 18% versus consensus, impacted mostly by a low top line, as expected. Embraer also increased its free cash flow guidance to $150 million in 2022.

- Global demand for air cargo fell by 10.6% year-on-year in September 2022, according to the latest data from the IATA. However, against a backdrop of rising inflation and low consumer spending, the sector is “bearing up well,” the airline trade association noted. Global demand, measured in cargo ton-kilometers (CTKs), fell 10.6% compared to September 2021 but continued to track at near pre-pandemic levels, the IATA noted.

- More than three-quarters of commercial U.S. airports have fewer flights now than three years ago, according to an analysis of OAG data by the Regional Airline Association (RAA). On a percentage basis, small airports have been hit harder than large airports. The RAA analysis, which compared October 2022 operations to operations in October 2019, found a decline in U.S. domestic air operations of 18.4%, according to Cirium schedule data. RAA found that 324 U.S. commercial airports lost flight frequency between 2019 and 2022. Those airports comprise 76% of commercial airports.

Opportunities

- Flight activity within the Asia Pacific region has been clearly gaining momentum since early-October, boosted by easing of cross-border travel restrictions across North Asia. The outlook is looking even brighter with China announcing that it will be further easing quarantine measures, scrapping the “circuit breaker” mechanism for inbound flights. China has been progressively opening its borders in a bid to rebuild international connectivity. It is worth noting, however, this is not a broad-based re-opening seen in other parts of the world, with China undertaking a more calibrated approach.

- According to RBC, Cargojet announced that it has renewed and extended its agreement with UPS; the current agreement was due to expire in 2025 and the new agreement is extended to December 31, 2030. RBC views the contract renewal as a key positive as it further secures the company’s positioning in the domestic overnight air cargo market as well as validates Cargojet’s strong service offering reflecting customer willingness to lock in with the company long-term.

- The IATA continues to see strong forward international air travel bookings, with the uncertain global economic outlook not yet eating into leisure travel spend. Asian airline travel should reach about two-thirds of pre-pandemic levels by the end of 2022, with momentum going into 2023 based on bookings which was highlighted by the Association of Asia Pacific Airlines (AAPA).

Threats

- There is no quick fix to air traffic control capacity constraints. There are 1,000-1,500 fewer controllers in U.S. currently versus 10 years ago and more flights. Training lead-time to become a controller is two years for simple markets and three to four years for high-traffic markets like New York. ATC constraints drive higher pilot reserve ratios.

- Of the approximately 104,000 oceangoing ships with capacity of greater than 100 tons, normally about 3-4% of the fleet is removed annually. However, this year scrapping through the first 10-and-a-half months is only 30% of normal levels. This comes despite higher-than-average scrap value and a higher-than-average fleet age. Historically, there is a very indirect correlation to cash flows and asset scrapping.

- Bank of America Flight Signals decelerated to -3.0 from -1.9 last quarter. In the pandemic, this indicator had been less meaningful than it was originally intended. However, with the recovery in full swing and capacity changes normalizing, the bank believes it can be a better indicator of future airline unit revenues. Today, the indicator shows unit revenues will begin to normalize back to 2019, with first quarter 2023 expected to decelerate versus the fourth quarter of this year, driven by more capacity, weaker economic data, and lower fuel prices than earlier this year.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was Hungary, gaining 1.8%. The best performing country in Asia this week was Hong Kong, gaining 4.1%.

- The Russian ruble was the best performing currency in emerging Europe this week, gaining 0.4%. The Malaysian ringgit was the best performing currency in Asia this week, gaining 1.6%.

- The Taiwan Stock Exchange outperformed for the second week in a row, supported by strong gains in semiconductor producers. Warren Buffett disclosed buying about 60 million American depository receipts in the world’s leading chipmaker, Taiwan Semiconductor Manufacturing Corporation (TSMC), during the three months ended September 30.

Weaknesses

- The worst performing country in emerging Europe for the week was the Czech Republic, losing 1.2%. The worst performing country in Asia this week was South Korea, losing 1.6%.

- The Romanian leu was the worst performing currency in emerging Europe this week, losing 1.1%. The South Korean won was the worst relative performing currency in Asia this week, losing 1.9%.

- Tencent, the Chinese internet giant, reported a further decline in revenue in the third quarter. Total revenue in the quarter was down 2%, reaching 140.1 billion yuan, down from 142.37 billion yuan a year ago. This marks the second quarterly decline since the company’s listing and worse than expected.

Opportunities

- Despite China reporting a higher number of Covid cases, the government wants to pursue a more targeted Covid prevention approach, focusing on specific areas with Covid outbreaks rather than imposing city-wide restrictions. The National Health Commission (NHC) said it would speed up vaccinations and cancel mass testing where there is no risk of illness spreading.

- China announced 16 measures to support a property market recovery. Key measures include commercial banks extending maturing loans to developers and policy banks providing funding to ensure completion of the pre-sold homes. In addition, lenders were encouraged to negotiate with homebuyers on extending mortgage payments.

- Goldman Sachs’s analyst turned bullish on equity markets in China and South Korea, predicting they will outperform in 2023. The broker is predicting both the MSCI China benchmark and the country’s CSI 300 Index to gain 16% in the next 12 months, the most in the region. They also raised South Korea to overweight from neutral status.

Threats

- Following Russia’s attack on Ukraine, the country’s Finance Minister Serhiy Marchenko said the damage to Ukraine’s infrastructure from missile attacks may exceed $100 billion. Russia has launched 148 missiles and 26 drones against Ukraine since November 11, mostly attacking infrastructure and power plants. On Tuesday, two people died in Poland after a missile landed on Polish territory, close to the border with Ukraine. The leaders of NATO said that it was an accident, nevertheless markets corrected after news emerged about the missile hitting a NATO member.

- Eurozone inflation climbed to 10.6% in October from 9.9% in September on a year-over-year basis. In Poland, final October CPI was reported at 17.9% versus 17.2% in October. Central banks may continue to hike rates to bring the prices lower.

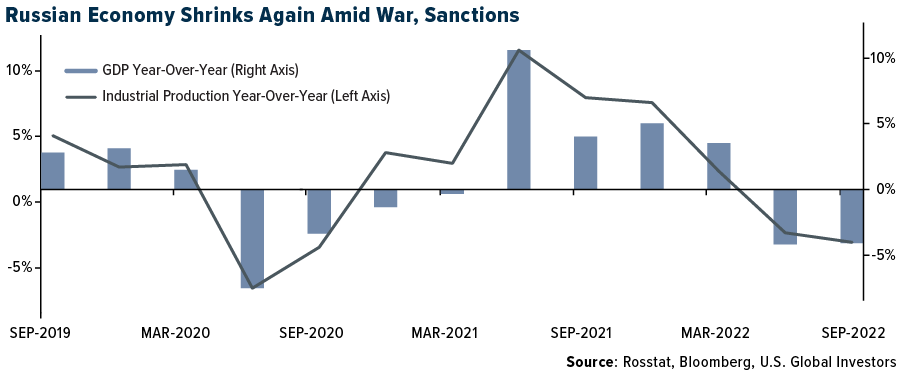

- Russia’s economy shrank for the second quarter, and Bloomberg predicts the worst is yet to come with more downturn likely early next year. GDP fell an annual 4% in the third quarter, in line with the central bank’s estimates but holding up stronger than every forecast in a Bloomberg survey of analysts. This follows a drop of 4% in the prior three months. More economic slowdown will likely follow due to sanctions imposed by the West.

Energy and Natural Resources

Strengths

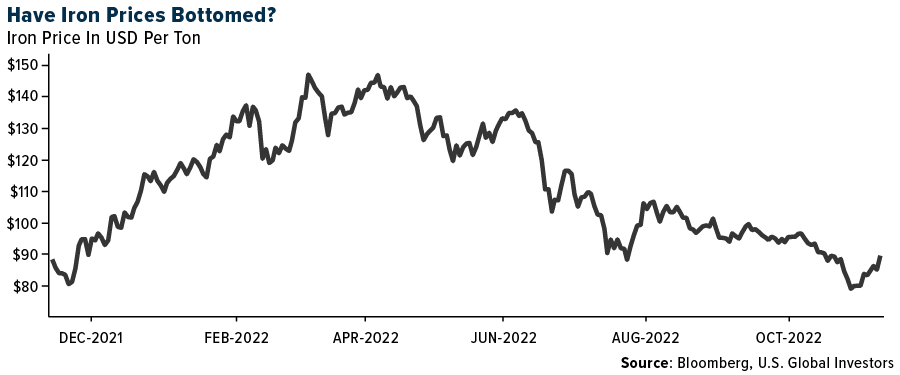

- The best performing commodity for the week was natural gas, rising 7.96% on coming colder weather. DCE iron ore futures rose 6.96%, after China introduced its plan to rescue the crisis hit real estate sector, which may help revive steel consumption. Iron ore is down 15% over the past month, but prices have now improved for the past three weeks. Steel margins remain in negative margin territory and production cuts are increasing with CRU’s surveyed blast furnace utilization decreasing to 86%.

- Oil inventories in developed nations have sunk to the lowest since 2004, leaving global markets vulnerable as sanctions on Russian exports take effect, according to the International Energy Agency. Supplies of diesel fuel, used in trucks, are “exceptionally tight” and prices may need to climb further in order to rein in demand, the Paris-based agency said in its monthly report. “Oil markets remain finely balanced going into the winter months,” said the IEA, which advises most major economies. “The approaching EU embargoes on Russian crude and oil products, and a ban on maritime services, will add further pressure on global

oil balances.” - Lithium supply remains tight at each key component of the electric vehicle (EV) battery supply chain. According to SMM’s lithium carbonate inventory data, which covers more than 30 lithium refiners and more than 70 cathode makers in China, LCE inventory levels declined further in October, down 25% to 181,000 tons.

Weaknesses

- The worst performing commodity for the week was crude oil, falling 10.96%. OPEC+ cuts in crude oil production appear to be overtaken by recession fears being signaled by crude oil futures. Energy prices across the complex, even gasoline futures, are sliding lower. Falling energy futures prices are signaling inflation will be lower and that the Federal Reserve is closer to a pause.

- Shipments of Russian seaborne oil surged to an average 6.5 million barrels per day in the first 11 days of November, reaching the highest monthly average on record. The exports appear to be ramping up before the December 5 deadline when the EU embargo on Russian seaborne crude oil imports kicks in and the EU and the U.K. will prohibit their companies from providing shipping, insurance and trade finance for tankers carrying Russian crude unless the cargo is purchased at or below a yet-to-be-agreed price cap. The biggest increase was recorded in shipments of oil products, which rose to 3.0 million barrels per day so far in November, surpassing the levels last seen in February 2022, before the start of the war.

- Aluminum retreated after the London Metal Exchange decided against banning Russian metal supplies, easing fears of supply shortages. The world’s biggest metals exchange announced the decision after the market closed on Friday, dealing a blow to those — including some big western producers and traders — who had lobbied for action.

Opportunities

- With JPMorgan highlighting that a 1 million barrels per day change in supply is worth ~$15 per barrel on the oil price, the group remains bullish on oil. JPMorgan global oil equities have forecast $80 per barrel Brent and see a scope for prices to overshoot $150 per barrel during 2023. Looking to gas, while EU gas storage is close to full today (99bcm), key panels concluded the stars need to align to keep it above 45bcm by the end of March to mitigate acute tightness and potential supply shortfalls into winter 2023/24. However, the spread in oil futures has fallen to just a seven-cent premium, indicating ample supplies. Should it go negative, this would signal oversupply.

- Bank of America continues to see upward momentum for U.S. refiners – with no break to the thesis behind the Regional Golden Age of refining (RGA) outlook for the sector. This is punctuated again by its mid-quarter earnings mark-up that sees estimates for the U.S. refiners raised again by 22% for the fourth quarter, underpinned by persistently high diesel cracks particularly in the Atlantic Basin. On average, the estimates stand 34% above the Street, and the bank sees upside risks as we head deeper into winter, underpinning its view that the seasonal trade for the sector has evolved from a single season of strength in summer gasoline to a bi-annual peak with the emergence of Winter Diesel.

- Macquarie remains constructive on the lithium market outlook despite near-term headwinds from economic slowdowns and Covid-lockdowns in China. The group believes the theme of supply security could result in lithium trading and processing reshuffles, leading to an even tighter market. Spot lithium prices have remained buoyant; Macquarie now expects spodumene prices to peak at $6,500 per ton.

Threats

- UBS sees further downside in copper, iron ore and PGM prices; aluminum downside should be limited by high energy costs and production cuts. Key commodities year-to-date: iron ore -26%, met coal -13%, copper -15%, aluminum -18%, gold -3% while thermal coal and lithium prices are up more than 2x.

- The Times on Saturday reported that the new U.K. Prime Minister Rishi Sunak is reportedly preparing to increase the windfall taxes on oil and gas companies to 35% from 25%, versus a previously reported planned increase to 30%. The government is planning to raise an estimated £45bn over the next five years from the tax. British finance minister Jeremy Hunt is also considering extending the scope of windfall taxes on power generation firms.

- A major U.S. liquefied natural gas (LNG) exporter will likely extend an outage that began in June, curbing much-needed supply to customers in Europe and Asia right before winter. Freeport LNG told buyers it will likely cancel shipments scheduled for November and December as work continues on repairs and regulatory approvals before a restart, according to people with knowledge of the matter.

Luxury Goods

Strengths

- Luxury spending is growing faster than ever, supported by strong post-pandemic buying, and shifting demographics, as younger, more diverse consumers buy into tiny-handbag and post-streetwear trends, according to a study released Tuesday. Global sales of personal luxury goods, including leather accessories, apparel, footwear, jewelry, and watches, are expected to grow by 22% this year, to €353 billion (US$366 billion) from €290 billion in 2021, according to the Bain consultancy study commissioned by Italy’s Altagamma association of high-end producers.

- Americans continue to buy abroad, taking advantage of a strong U.S. dollar. Real estate broker Charles McDowell has sold six luxury homes in central London over the last six months and five of the buyers were American, Bloomberg reported this week.

- Wynn Macau, casino, and hotel chain in Macau, was the best performing S&P Global Luxury stock for the week, gaining 13.95%. Shares gained with growing optimism around China relaxing its Covid policy and reopening borders.

Weaknesses

- Retail sales in China fell by 0.5% in October from a year ago, which is below Bloomberg economists’ expectations for sales to expand by 0.70%. Year to date, sales weakened as well.

- The high-end housing market across almost all of Australia’s capital cities are seeing values drop more significantly than their more affordable segments, according to a report from property firm CoreLogic. Declines were the greatest in Brisbane, the capital and most populous city of Queensland. Prices for high-end homes—which are defined as the top 25% of the market—dropped 6.5% in the three months to the end of October. In comparison, prices fell 2.1% and 5.4% for lower-end and mid-market homes, respectively.

- Faraday Future Intelligence was the worst performing S&P Global Luxury stock for the week, losing 42.06%. Shares fell after the company signed a deal to get an equity line of credit of up to $350 million, (money needed to develop its new FF 91 EV car, which is described as a large-tech luxury car with 1,050 horsepower and range certificate of 381 miles).

Opportunities

- Analysts at Bain & Company and Altagamma expect customers to continue buying luxury goods despite warnings of a global recession. Both firms predict the €353 billion luxury goods sector to expand by at least 3% to 8% in 2023. Global luxury growth is expected to accelerate after 2023, with Bain forecasting a sales increase of 60% from 2022 to 2030, driven mostly by people in India, South Korea and Mexico becoming wealthier.

- Bain & Company also believes that the luxury market is better prepared to overcome global recession thanks to a larger base of wealthy shoppers and more consumer spending. Consumers were able to accumulate savings during lockdowns and are willing to spend that money now, especially with a “you only live once” attitude and the perception that luxury products can be treated as an asset class that will grow in value over time.

- New Chief Executive Officer at Burberry Group Jonathan Akeroyd and Creative Director Daniel Lee plan to increase company sales from just under GBP 3 billion last year to GBP 4 billion in three to five years, and GBP 5 billion thereafter. In addition, the company plans to focus on Burberry’s heritage and made-in-Britain status. Akeroyd wants to broadly double sales of leather goods, shoes and women’s clothing and increase outerwear sales by 50% in the next three to five years. Their plan is to create a British luxury powerhouse, competing against Louis Vuitton, the French luxury giant.

Threats

- According to Yaok, a Chinese luxury research firm, China’s luxury goods market will grow by 15-18% in 2022. Not a small number, but it is much lower than the 37% prediction made in 2021, and 45% prediction made in 2020. President Xi’s support for common prosperity and ongoing Covid lockdowns could continue putting pressure on luxury buying in China.

- Swiss watch exports slowed, growing at 6.8% year-over-year in October, down from 19.1% in September. Morgan Stanley’s research team believes that it is relatively neutral to Richemont and slightly negative for Swatch. Swatch will continue to be penalized by its high exposure to China (42% in 2021; estimated to be the highest amongst all luxury companies that the broker covers in the luxury space).

- The U.S. housing market may see weaker sales data when Bloomberg announces the number next week on November 23. New home sales are expected to be reported at 575,000 in October versus 603,000 in September. Spiking mortgage rates are not attracting new buyers.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Trust Wallet Token, rising 93.04%.

- The World Cup has an official crypto exchange sponsor – Crypto.com – and it’s just one of several decentralized tie-ins for the World Cup, which kicks off in Qatar in the coming week. In September, FIFA launched its own NFT platform on the Algorand blockchain platform, and it’s coming to the World Cup too, writes Bloomberg.

- There can be little doubt that crypto investors expect more firms to blow up in the treacherous wreckage of the wipeout at FTX. Their puzzling response, however, has been to drive up Bitcoin this week. The token is up 3% over the period, topping global stocks while a gauge of the leading 100 virtual coins added about 1%, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Casper, down 20.04%.

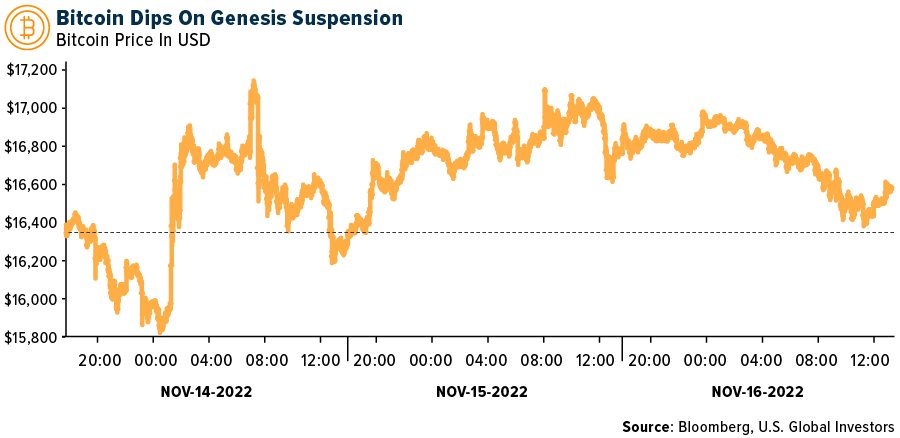

- Bitcoin dropped after the crypto brokerage Genesis and its partner in a lending business, Gemini Trust Co, were the latest industry firms to detail the fallout from the spreading contagion after the collapse of the FTX exchange. The token dropped as much as 3.1%, erasing a small gain from earlier in the session Wednesday, writes Bloomberg.

- Coinbase CEO Brian Armstrong sold more than 30,000 Class A Coinbase shares for $1.6 million on November 11, according to a filing with the SEC. Coinbase shares were trading over $340 when the company first went public in April 2021. They closed today at $55.53 as crypto prices have shed their value over the past year, writes Bloomberg.

Opportunities

- Ark Investment Management snapped up more than 315,000 shares, worth roughly $2.8 million, of the beleaguered crypto fund on Monday for the ARK Next Generation Internet ETF (ARKW). Bloomberg data shows the firm’s first purchase of the Grayscale product since July 2021, according to website Ark Invest Daily trades, which tracks the firm’s portfolio moves.

- Man Group is close to starting a dedicated cryptocurrency hedge fund, delving deeper into a market that’s reading from the collapse of exchange operator FTX. The world’s largest publicly traded hedge fund firm has been developing the strategy, led by money manager Andre Rzym, for months, writes Bloomberg.

- A CFTC commissioner has urged crypto industry whistleblowers to come forward in the aftermath of FTX Group’s implosion, saying tipsters have previously received millions of dollars for their help. CFTC said on Thursday that informants would get anonymity, adding that such tips play a crucial role in enforcement given the opaqueness of some of the crypto world, writes Bloomberg.

Threats

- Temasek International invested $200 million to $300 million in FTX before its implosion and is preparing to write down the entire bet. Michael Novogratz, the billionaire founder of Galaxy Digital Holdings, said the crypto crisis could get worse as the industry braces for more contagion from the fall of Sam Bankman-Fried’s FTX empire, writes Bloomberg.

- Crypto brokerage Genesis is suspending redemption at its lending business after facing what it describes as “abnormal withdrawal request” in the aftermath of the collapse of FTX. Genesis’ lenders include Gemini Trust Co., the cryptocurrency platform run by the Winklevoss brothers. Gemini said it has paused withdrawals on its lending program, writes Bloomberg.

- Advisers overseeing the bankruptcy of FTX Group are struggling to locate the company’s cash and crypto, citing poor internal controls and record keeping. The complete failure of corporate controls at the company is “unprecedented” according to new CEO John J. Ray III, who has a more than 40-year career in restructuring, including overseeing the liquidation of Enron, writes Bloomberg.

Gold Market

This week gold futures closed at $1764.90, down $18.60 per ounce, or 1.04%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.41%. The S&P/TSX Venture Index came in off 3.99%. The U.S. Trade-Weighted Dollar rose 0.64%.

| Date | Event | Survey | Actual– | Prior |

|---|---|---|---|---|

| Nov-14 | China Retail Sales YoY | 0.7% | -0.5% | 2.5% |

| Nov-15 | Germany ZEW Survey Expectations | -51.0 | -36.7 | -59.2 |

| Nov-15 | Germany ZEW Survey Current Situation | -69.3 | -64.5 | -72.2 |

| Nov-15 | PPI Final Demand YoY | 8.3% | 8.0% | 8.4% |

| Nov-17 | Eurozone CPI Core YoY | 5.0% | 5.0% | 5.0% |

| Nov-17 | Housing Starts | 1410k | 14425k | 1488k |

| Nov-17 | Initial Jobless Claims | 228k | 222k | 226k |

| Nov-23 | Durable Goods Orders | 0.5% | — | 0.4% |

| Nov-23 | Initial Jobless Claims | 225k | — | 222k |

| Nov-23 | New Home Sales | 575k | — | 603k |

Strengths

- The best performing precious metal for the week was gold, but still down 1.04%. Torex Gold announced adjusted earnings per share (EPS) of $0.40, beating consensus of $0.33 on pre-reported gold sales of 119,800 ounces. Total cash costs were $760 per ounce and AISC (all-in sustaining costs) were $1,059 per ounce, both significantly better than consensus. With 357,000 ounces produced year-to-date, Torex is on track to achieve the upper end of its 2022 guidance of 430-470,000 ounces of gold with AISC of $980-$1,030 per ounce.

- Endeavor Mining expects to be at the top end of its production guidance range of 1,315k-1,400k ounces, driven by the strong performance year-to-date from Ity, Hounde, Mana and a stronger fourth quarter expected at Sabodala Massawa. With the increased production and lower sustaining capex spend expected for the year, AISC could fall to $929 per ounce versus $960 per ounce previously.

- i-80 Gold Corp. soared as much as 17% after drilling results from an exploration program in Nevada yielded “bonanza grade” mineral results. Separately, Peter Schiff’s Euro Pacific Asset Management said it took a 1.4% stake in the

miner in the third quarter. “We believe that the grades of mineralization at Ruby Hill are truly world-class, and the Hilltop Zone ranks among the highest-grade new discoveries being drilled anywhere on the planet,” CEO Ewan Downie said in a release.

Weaknesses

- The worst performing precious metal for the week was platinum, down 5.09%. Gold and other precious metals declined this week as the dollar climbed after comments from Federal Reserve officials dimmed the prospect of a pause in rate hikes, reports Bloomberg. Moves by the U.S. central bank to combat inflation through monetary tightening have helped drive the precious metal about 14% lower from its March peak by boosting the dollar and Treasury yields.

- First Majestic Silver’s adjusted EPS of ($0.09) missed consensus of ($0.01). Revenue was roughly in line with forecasts (production was pre-reported), but costs of $120.7 million were 15% higher than consensus. In comparison to the prior quarter, AISC improved mostly due to higher-than-expected production at Santa Elena and San Dimas.

- Argonaut Gold executed a $17.25 million flow through share offering at the start of the week, with shares finishing the week off 16%.

Opportunities

- Gold is getting strong demand from central bank buying this year as they try to diversify away from dollar-denominated assets. The third quarter saw record buying with a surge to 400 tonnes. The largest central bank buyer remains undisclosed, although it is likely China, (which stopped reporting its buying activities several years ago). Bloomberg Intelligence believes central bank buying could reach 750 tonnes in 2022.

- Federal Reserve Bank of Minneapolis President Neel Kashkari tweeted that the whole notion of cryptocurrency is “nonsense” after the implosion of FTX revealed the industry’s shortcomings. He further elaborated: No inflation hedge. No scarcity. No taxing authority. Just a tool of speculation and greater fools. His comments could be positive for gold going forward as crypto gets decimated with rising interest rates, while the yellow metal remains competitive.

- Franco-Nevada’s deal pipeline is robust today, particularly for new royalty/streams in the $100-$300 million range and on pre-development projects. As debt turns more expensive and equity markets increasingly challenged, more mine developers may choose streaming as part of a project financing package. Despite market weakness, Franco-Nevada continues to see sanction of development and/or construction.

Threats

- Producers saw inflation pressures in third-quarter costs like those seen in the second quarter at 10%-12%. Importantly, management indicated on third quarter calls that they are seeing signs of easing in the cost structure, related to relief in energy prices, consumables, and reduced constraints to supply chains. Companies were hesitant to provide 2023 cost guidance, but general commentary is for operating costs to be like 2022 levels.

- Gold declined as the dollar rallied after a Federal Reserve official cautioned that the U.S. central bank isn’t close to pausing interest-rate hikes as inflation remains hot. Aggressive monetary policy tightening to cool inflation has weighed on bullion throughout the year by pushing up U.S. bond yields and the dollar. Investors have been searching for evidence that the Fed will pivot to smaller rate hikes, a possibility Chair Jerome Powell mooted at its last meeting. A lower-than-expected rise in the consumer price index last week stoked bets on a slowdown, resulting in gold notching its biggest weekly gain since the start of the global pandemic.

- The volume of rough imports to India decreased by 55% year-over-year (down 45% month-over-month), while the value of imports decreased by 40% month-over-month (down 32% year-over-year), implying that rough prices increased by 8% month-over-month, but this could be due to mix. The value of polished stone exports from India – a proxy for demand – was down 11% month-over-month and down 26% year-over-year.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/22):

Torex Gold

Endeavor Mining

i-80 Gold Corp.

Yamana Gold

Maverix Metals

Franco-Nevada

Burberry Group

LVHM Moet Hennessy Louis Vuitton

Tencent

Taiwan Semiconductor Manufacturing Corporation

Azul SA

Hapag-Lloyd AG

Embraer SA

Cargojet Inc.

Air Canada

Hermes International

Kering SA

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The CSI 300 is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.