Trump Prevailed by Running on the Need for Safety and Protection

Maslow’s hierarchy of needs was a groundbreaking concept when it appeared in 1943. American psychologist Abraham Maslow argued that certain basic needs—food, water, shelter, etc.—must be met before a person can move on to higher levels of self-worth and fulfillment.

Safety is another important, fundamental human need, one that I believe played a major role in this week’s election outcome. People want to feel safe, physically as well as financially. They want to feel protected in their homes and communities, and when they don’t, they take their outrage to the ballot box.

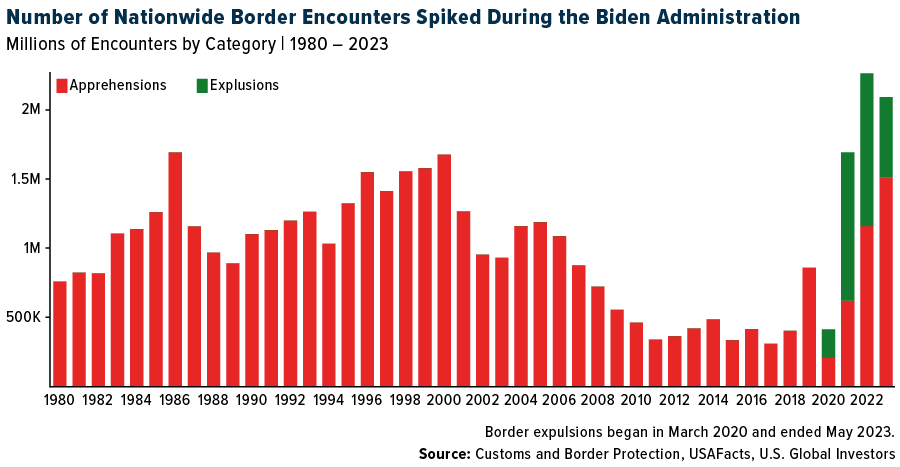

I wrote about this a little over a year ago. I believed then that the record numbers of illegal immigrants pouring across the Southern Border would end up hurting President Joe Biden’s then-reelection bid.

It appears that’s precisely what happened, based on the theory of wisdom of crowds. When Kamala Harris became the Democratic presidential nominee in August, she failed to convince voters that the problem would be fixed. Meanwhile, President-Elect Donald Trump aggressively ran on the issue of illegal immigration and border security, and he turned out the victor.

In hindsight, the writing was on the wall all along. A Gallup poll conducted back in February found that immigration was Americans’ number one concern. Over a quarter of people (28%) cited immigration as the most important problem facing the country, topping other issues like the government (20%), the economy (12%) and even inflation (11%).

Perceptions of Safety Are Shaping Spending and Policy

I’m aware of the many studies that show that immigrants commit crimes at lower rates than U.S. citizens. But as we all know, politics is perception, and the prevailing perception is that American towns and cities have become less safe due to an influx of unvetted, undocumented migrants.

This perception has grown strong enough to affect people’s spending behavior. On my early morning jogs through my neighborhood, I’ve noticed more and more families putting up fences, indicating a heightened sense of insecurity.

Voters are likewise telling elected officials they’re done playing nice with those who commit crime. This week, California voters approved a measure that would impose harsher penalties for theft and drug trafficking, reversing “woke” criminal justice policies that have the perception of coddling criminals.

“America First” Policies to Support Domestic Corporations

Moving on, I’d like to highlight some areas that I think could see a tailwind under a second Trump presidency.

As was the case during his first term, Trump is expected to prioritize business-friendly policies that especially favor companies that generate most of the revenue from domestic, rather than international, sales. Think small- to mid-cap stocks, many of which could be in a good position to benefit from lower income taxes and relaxed regulations.

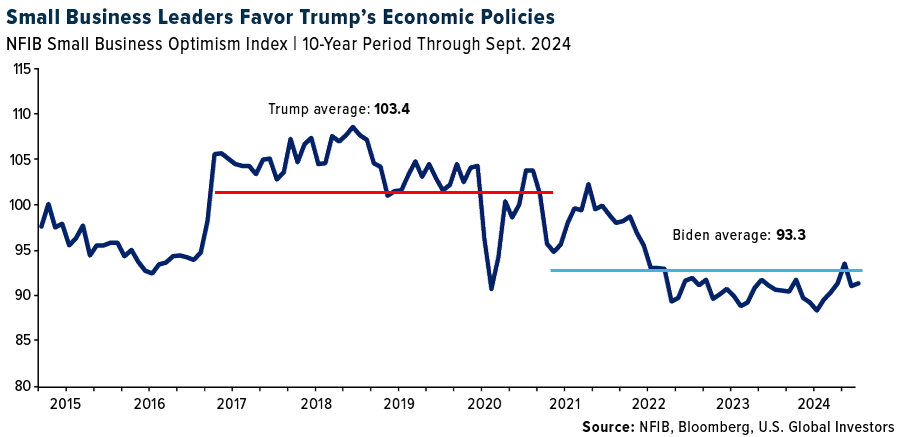

Take a look at Trump’s favorability among small business leaders during his first term. The National Federation of Independent Business (NFIB) Optimism Index remained at historically elevated levels, scoring an average monthly reading of 103.4—even when you factor in the pandemic months.

The average reading under Biden has been about 10 points lower, indicating that entrepreneurs have lacked confidence in the country’s business climate. The NFIB reported last month that uncertainty was at its highest reading ever, due in large part to the upcoming election.

But what about tariffs? Throughout his campaign, Trump touted the economic benefits of tariffs, claiming they will help ease deficit spending, not to mention protect domestic industries from lower-cost competition abroad. Economists warn that tariffs will lead to another spike in inflation, since U.S. companies are responsible for paying these import taxes. But if you recall, Trump had tariffs on billions of dollars’ worth of goods during his first term, and headline inflation remained anemic.

Bitcoin Stands to Benefit

Soon after it was clear that Trump won reelection, Bitcoin hit a new all-time high price on hopes that the president-elect will make good on his promise to transform the U.S. into the world’s “Bitcoin superpower.”

Senator Cynthia Lummis of Wyoming, perhaps the Senate’s most vocal Bitcoin advocate, declared on X that the U.S. would be “GOING TO BUILD A STRATEGIC BITCOIN RESERVE.” According to Lummis’s plan, the U.S. will incrementally buy up to 1 million BTC, roughly 5% of total supply.

At today’s prices, that’s approximately $76 billion. For comparison’s sake, the value of the country’s gold reserve was over $540 billion at the end of last year.

It’s believed that if the U.S. ends up establishing a Bitcoin reserve, it might encourage other nations to follow suit in a fit of FOMO (fear of missing out).

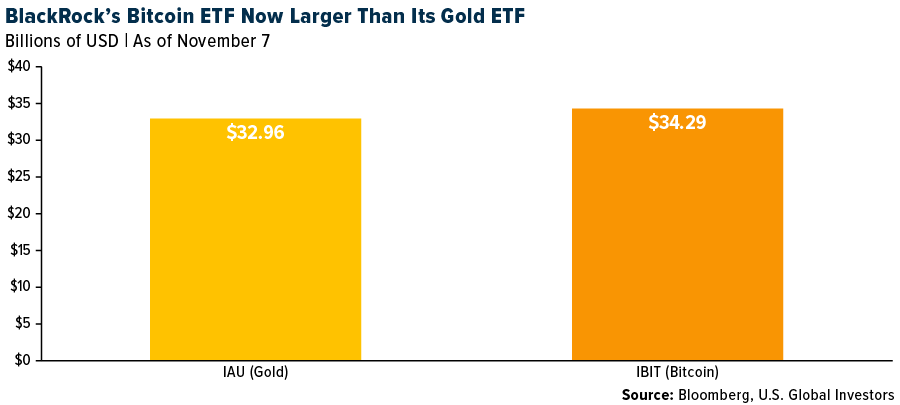

On the investing side, BlackRock’s Bitcoin ETF (IBIT) is now larger than its gold ETF (IAU). Launched in early 2024, IBIT had over $34 billion in assets as of Thursday, compared to IAU’s approximately $33 billion. IBIT launched earlier this year, while IAU launched nearly 20 years ago, in 2005.

Gold’s Fear Trade & Love Trade

Gold dropped more than 3% the day after the election as the U.S. dollar surged as much as 1.6%, its biggest one-day jump in about two years. During Trump’s first term, the yellow metal gained 55.4%, underperforming the S&P 500, which rose 83.8% over the same period.

Remember, gold can be divided into the Fear Trade and the Love Trade. Whereas the former is more associated with auspicious gold-buying in India and China, the latter has to do with buying physical gold in an effort to hedge against inflation, interest rates, bad fiscal policies, general uncertainty and the like?

Will the Trump 2.0 era ignite the Fear Trade or the Love Trade? Time will tell, but to prepare, I always recommend a 10% weighting in gold, with 5% in physical bullion and the other 5% in gold stocks and ETFs. Remember to rebalance every year.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 4.61%. The S&P 500 Stock Index rose 4.66%, while the Nasdaq Composite climbed 5.74%. The Russell 2000 small capitalization index gained 8.57% this week.

- The Hang Seng Composite lost 6.78% this week; while Taiwan was up 3.40% and the KOSPI rose 0.74%.

- The 10-year Treasury bond yield fell 8 basis points to 4.303%.

Airlines and Shipping

Strengths

- United Airlines’ stock surged by 37% in October, outpacing industry rivals and driven by strong earnings, subdued fuel costs, and strategic investments, according to Bloomberg. Market analysts remain optimistic about further growth despite potential risks from fuel price swings and aircraft shortages.

- Ethiopian Airlines has become the first African carrier to operate the Airbus A350-1000, reports the Global Times. This expands the carrier’s global reach with this advanced, fuel-efficient aircraft featuring 395 seats while simultaneously reinforcing its leadership in the African aviation sector.

- The best performing airline stock this week was Air Transport Services Group, rising 26.49%, after announcing that Stonepeak is acquiring Air Transport Services Group (ATSG) for $3.1 billion. This offers a 29% premium per share, with the deal set to close in early 2025, after which ATSG will go private.

Weaknesses

- Severe storms and unprecedented flooding in Spain have disrupted daily life, reports Yahoo! News. Over 200 deaths have been reported along with significant damage to infrastructure, including airports like Barcelona-El Prat and Valencia. The storms have also caused widespread flight cancellations, delays and access issues for travelers.

- Ryanair’s profit fell 18%, the company reported, due to lower ticket prices and Boeing delivery delays, prompting the airline to reduce its passenger growth forecast.

- The worst performing airline stock this week was Air France KLM, falling 12.73%, after third-quarter earnings missed forecasts due to rising labor and maintenance costs, leading the airline to increase its full-year unit cost projections.

Opportunities

- The Cayman Islands have become the first Caribbean destination to launch an omnichannel marketing campaign on United Airlines’ Kinective Media platform, reports TravelDailyNews. The campaign should enhance its tourism strategy to reach millions of travelers through various media channels and solidify its position as a premier travel destination.

- Nashville International Airport (BNA) announced that starting May 1, 2025, Air Canada will expand its service by introducing a new seasonal route to Vancouver. This will increase flights to Montreal to twice daily, while maintaining year-round flights to Toronto and enhancing connectivity between Nashville and Canada for travelers.

- London Luton Airport has made significant investments in sustainable vehicle technology, transitioning its operational fleet to low-carbon options to support its goal of achieving Net Zero emissions by 2040.

Threats

- Negotiations between Lufthansa and the Italian government over the purchase of Ita Airways have stalled due to disagreements on the pricing, with the Italian Finance Ministry rejecting Lufthansa’s proposed price reduction after the airline’s value declined.

- American Airlines has extended its suspension of flights to Israel until September 2025, joining other carriers in delaying their return due to security concerns. This makes El Al the only airline currently offering direct flights between the U.S. and Israel.

- A 47-year-old Senior First Officer for British Airways tragically collapsed and died at a luxury hotel before a scheduled flight from the Caribbean to London, leaving onlookers and his crew devastated, resulting in the flight’s cancellation and prompting the airline to express condolences and support for affected staff.

Luxury Goods and International Markets

Strengths

- In the United States, financial stocks led the market following Trump’s victory this week, surging more than 6%, while industrial stocks were the second-best performers, rising nearly 4%. The real estate sector, however, recorded the largest losses.

- China reported a stronger-than-expected trade balance this week. Year-over-year exports rose by 12.7%, well above the anticipated 5% increase, while imports fell by 2.3%, exceeding expectations. The trade balance came in at $95.72 billion, significantly higher than the expected $75 billion.

- Tesla was the top-performing stock in the S&P Global Luxury sector, gaining 26.2% in the past five days. This surge followed the recent presidential election, where Donald Trump secured victory. Tesla’s stock increased by nearly 15% on Wednesday while its capitalization has reached $1 trillion for the first time since April 2022.

Weaknesses

- Richmont sales missed expectations. Sales growth in the United States, Europe and Japan were offset by an 18% drop in the Asia Pacific Region, which included China, where sales fell 27%. Chairman Johann Rupert said Chinese demand for luxury goods “will take longer to recover.”

- European markets reacted negatively to Trump’s victory in the United States, with carmakers particularly impacted by expectations of higher tariffs and a potential new phase of trade tensions between the U.S. and the Eurozone. On November 6, shares of Mercedes fell 8.2%, BMW dropped 6.6% and Volkswagen declined 4%.

- Wynn Resorts, which operates hotels and casinos, was the worst-performing stock in the S&P Global Luxury Index, falling 11.3%. Shares declined after company reported weaker-than-expexted quarterly results. Gaming revenue in the third quarter from the Las Vegas strip declined 7.2% year-over-year.

Opportunities

- China has been reporting stronger economic data, suggesting that government measures to support growth may be gaining traction with potential for further improvement. Recently, the country reported better-than-expected manufacturing activity, and this week, exports also exceeded expectations. The luxury sector will benefit from the improving growth and consumer sentiment in the mainland.

- Financial companies and those driving innovation and growth are likely to continue performing well in the United States, supported by reduced regulations and Trump’s efforts to stimulate economic growth. Leading up to the elections, Trump has consistently criticized excessive government regulation, emphasizing its negative impact on businesses and overall economic progress.

- On Friday, China announed a $1.4 trillion program to allow local governments to refinance debt. China’s top lawmakers have approved a proposal to increase the debt ceiling for local governments by $840 billion, described as China’s most powerful debt reduction measure in recent years. The finance chief promised more measures next year.

Threats

- According to HSBC research, the average luxury item now costs 60% more than it did in 2019. For instance, a simple cotton T-shirt featuring the Christian Dior logo is priced at $1,000. Wealthy consumers remain largely unaffected by these steep price tags, allowing companies to raise prices consistently. However, with demand for luxury items—particularly in China—starting to decline, it is uncertain if these price hikes can continue.

- Some experts suggest that Trump’s victory may drive higher inflation and postpone interest rate cuts. Elevated Fed rates would likely keep mortgage rates high, discouraging real estate buyers from pursuing new deals. Following Trump’s win, real estate stocks have underperformed.

- In Germany, Europe’s largest economy, the political situation deteriorated after Chancellor Olaf Scholz dismissed Finance Minister Christian Lindner of the pro-business Free Democrats. In response, the three remaining ministers from the party resigned, causing the collapse of the governing coalition. Scholz is expected to lead the country with a minority government, but the opposition is calling for a no-confidence vote.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was palm oil, rising 4.79%. Palm oil prices have surged to a two-year high due to supply concerns and increased soybean oil prices, driven by aging trees in key production areas that are limiting output. This tight supply outlook supports a robust palm oil market, with prices likely to remain elevated in the medium-term, Bloomberg cites.

- The surge in AI-driven data centers and computer-chip factories is fueling unprecedented demand for natural gas, presenting a major growth opportunity for pipeline companies like Energy Transfer, Williams and Kinder Morgan. This increased demand is expected to drive the largest power demand boost in a generation, strengthening the role of gas in the energy mix alongside renewables.

- Ingredion hit an all-time high this week. The company, which operates in the food and beverage industry, reported adjusted earnings per share (EPS) of $3.05, beating out the consensus estimate of $2.60 by 17%. Management also raised guidance on forecasts, including an upward revision $10.35 to $10.65 from $9.70 to $10.20. The earnings estimates referenced were published by Bloomberg.

Weaknesses

- The worst performing commodity for the week was palladium, dropping 10.44%. Bloomberg reports that hedge fund managers have increased their bearish bets on palladium, with net short positions rising by 988 to 2,696. This trend highlights weak investor sentiment in the palladium market, which could pressure prices and indicate limited demand expectations. Clean energy stocks also dropped starkly after the U.S. presidential election ended with Donald Trump coming out on top.

- Crude oil inventories have risen to their highest levels since August due to slumping exports and unexpected builds in fuel stocks, signaling an oversupply in the market. Meanwhile, weakening diesel demand in India—attributed to slower economic growth and shifting consumption patterns—along with signs of reduced buying in China and Europe, highlights a global softening in crude oil demand, according to Bloomberg.

- Declining coal and iron ore prices have significantly dented the profits of major Japanese trading firms backed by Warren Buffett, reports Bloomberg, with most firms missing analyst earnings estimates due to these drops. This weakness highlights their heavy reliance on commodity markets, exposing them to financial risks when commodity prices fall despite efforts to diversify their business portfolios.

Opportunities

- According to BMO, the International Tin Association’s latest survey—which covers companies representing 42% of global refined tin usage—forecasts a 3% increase in tin demand this year after a 5% decline last year, with consumer stockpiles expected to drop to 3.4 weeks of supply. The survey also notes that solar ribbon now accounts for about 20% of solder production (though efforts to reduce tin usage are starting), and tin use in chemicals and tinplate is projected to rise by 4.9% and 12%, respectively.

- BMO also reports that nuclear energy is gaining renewed support in the U.S., with a Bisconti Research poll indicating 77% public approval, and despite expressing some concerns, former President Trump has pledged to expand nuclear capacity. However, since the U.S. isn’t expected to be a significant growth market for nuclear energy, this is unlikely to substantially impact supply-demand forecasts until the end of the decade, with China remaining the primary driver of future demand growth.

- Rio Tinto Group is launching a two-year trial at its Oyu Tolgoi copper mine in Mongolia, reports Bloomberg, using battery-swapping technology from China’s State Power Investment Corp. to power eight electric haul trucks capable of carrying 91 tons each. Aiming to decarbonize its global fleet of approximately 700 haul trucks, this initiative complements similar electrification trials in Western Australia’s Pilbara region and a positive advancement in clean energy resources.

Threats

- According to Bloomberg, CMOC Group Ltd., the world’s largest cobalt miner, is warning that the metal’s significance in electric vehicle batteries is rapidly diminishing due to the growing adoption of cobalt-free lithium iron phosphate batteries; in China, the share of EV batteries containing cobalt is expected to drop from 44% in 2022 to 31% in 2024. Despite aggressively increasing production and surpassing Glencore as the top supplier, CMOC faces shrinking profits as cobalt prices fall amid oversupply, Bloomberg continues, acknowledging that cobalt may eventually play only a minimal role in the EV industry.

- Based on an article from the Australian Financial Review, brokers believe that Mineral Resources’ decision to give Managing Director Chris Ellison up to 18 months to depart will negatively impact the company’s undervalued share price due to potential ongoing volatility and uncertainty. They warn that this prolonged exit could result in the company trading at a discount, making it vulnerable to mergers and acquisitions or a potential take-private scenario.

- U.S. shale drillers risk oversupplying the market in 2025, with companies like ConocoPhillips and Matador Resources increasing production guidance despite potential market pressures. Diamondback Energy cautions that this growth trend could repeat past mistakes, jeopardizing oil prices and industry profitability if an oil glut materializes.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Cronos, rising 53.51%.

- Bitcoin jumped to a record high as global markets responded to Donald Trump’s victory over Kamala Harris in the U.S. presidential election. Bitcoin jumped 9% as early results showed Trump barreling toward a win.

- Blackrock’s spot Bitcoin ETF has surpassed the size of its gold fund amid record demand for ETFs that invest in the original cryptocurrency. The iShares Bitcoin Trust ETF surpassed the $33 billion iShares Gold Trust in total assets, reaching $34.3 billion after a record inflow of $1.1 billion on Thursday, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Kaia, down 11.25%.

- U.S. exchange-traded funds investing in Bitcoin recorded their highest daily net outflow to date as markets braced for Election Day. The group of 12 funds managed by the likes of BlackRock and Fidelity shed $579.5 million on Monday, November 4, according to Bloomberg.

- QNB, one of Turkey’s largest banks, abruptly ended its crypto asset service operations as of November 7, reports Bloomberg. According to a post on its website, the firm will no longer be accepting any new customers.

Opportunities

- The government of Indonesia is allowing businesses to invest in crypto in a new Commodity Futures Trading Regulatory Agency. Under previous rules, only individuals are allowed to invest in digital currencies and the regulation reiterates that crypto is only allowed as an investment asset and cannot be used as payment in transactions, writes Bloomberg.

- They crypto industry poured millions of dollars into the presidential and congressional races, but its most salient election victory is likely to be the departure of U.S. SEC chair Gary Gensler, explains Bloomberg. President Donald Trump’s decisive victory all but ensures a pullback on crypto-related enforcement once he take office.

- UBS developed a piloted blockchain-based, multi-currency payment solution with UBS Digital Cash. The solution aims to increase efficiency, transparency, and to enable programmability, writes Bloomberg.

Threats

- An exploiter managed to steal a significant number of tokens from crypto casino Metawin’s Ethereum and Solana hot wallets by exploiting the protocol’s frictionless withdrawal system, Bloomberg reports. Blockchain sleuth ZachXBT pegged the amount stolen to over $4 million with 115 theft addresses tied to the exploit.

- The CEO of WondeFi, a publicly listed crypto holding company that owns one of Canada’s largest crypto exchanges, has been safely released after he was kidnapped, according to Bloomberg.

- Coinbase Global executives and directors recently adopted trading plans to sell more than $900 million of shares of the crypto-trading platform, writes Bloomberg. Three Coinbase executives and two directors will sell as many as five million shares.

Defense and Cybersecurity

Strengths

- Rheinmetall reported a 39.5% year-on-year increase in third-quarter sales to €2.45 billion. Sales were driven by strong demand for ammunition and weapons in Europe and globally. The company maintained its full-year guidance with expectations of reaching €10 billion in sales and a boosted operating margin of around 15%.

- Howmet Aerospace Inc. achieved record EBITDA, strong revenue growth, and strategic advancements in the third quarter of 2024. This was further highlighted by a 54% year-over-year earnings per share (EPS) increase and notable debt reduction, despite supply chain and market challenges.

- The best performing stock in the XAR ETF this week was AXON Enterprise Inc., rising 41.64%, after raising its full-year forecast, predicting adjusted EBITDA of $510 million and revenue of $2.07 billion, exceeding analyst estimates. While third-quarter results showed a 32% revenue increase year-over-year to $544.3 million, driven by strong performance in its Taser and Software & Sensors segments.

Weaknesses

- Ukrainian President Volodymyr Zelenskiy announced that Russia has significantly escalated its war against Ukraine since July and emphasized the urgent need for sufficient weapons, not just diplomatic support, to achieve a just peace.

- The FAA plans to intensify its oversight of Boeing’s production processes following a recent strike, emphasizing the use of Boeing’s Safety Management System as workers return to their roles, according to a recent conversation between FAA Administrator Mike Whitaker and Boeing’s CEO.

- The worst performing stock in the XAR ETF this week was Spirit Aerosystems, falling 5.32%, after it was warned of significant financial strain due to cash burn and reduced deliveries to Boeing. This has raised doubts about its future viability ahead of Boeing’s planned acquisition in 2025.

Opportunities

- Investors may be prematurely boosting defense stocks based on expectations that president-elect Donald Trump’s policies will push NATO allies to increase defense spending. This comes despite his stance on avoiding foreign wars and potential budget cuts could limit gains.

- Next Hydrogen Solutions (NXHSF) and Pratt & Whitney Canada are collaborating on a project to demonstrate hydrogen combustion technology for the aviation industry. Canada’s Initiative for Sustainable Aviation Technology is supporting the development of high efficiency electrolyzers and hydrogen fuel testing on Pratt & Whitney’s advanced PW127XT regional turboprop engine.

- NASA recently began testing the engine of the X-59, an experimental supersonic aircraft designed to create quieter sonic booms. This marks a key milestone in its Quest mission toward achieving quieter commercial supersonic flight over land, with the first flight expected in early 2025 and data collection flights to follow across U.S. cities.

Threats

- Ukrainian President Volodymyr Zelenskiy congratulated Donald Trump on his re-election and expressed hope for a “just peace” in Ukraine under Trump’s leadership. His comments come despite concerns that Trump’s approach may pressure Ukraine into a conflict freeze while Russian forces advance.

- Israeli airstrikes across Lebanon have intensified, hitting sites near Baalbek and Beirut and killing dozens of people as the conflict with Hezbollah escalates, displacing over 1 million Lebanese and affecting humanitarian efforts in both Lebanon and Gaza.

- Ukraine engaged North Korean troops stationed in Russia’s Kursk region, marking the first confrontation as concerns grow over Moscow and Pyongyang’s military ties, which NATO calls a significant escalation.

Gold Market

This week gold futures closed at $2,694.30, down $54.90 per ounce, or 2.00%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 2.68%. The S&P/TSX Venture Index came in off 2.26%. The U.S. Trade-Weighted Dollar rose 0.64%.

Strengths

- Triple Flag reported earnings this week, which topped earnings per share (EPS) overestimates given by analysts covering the company. Triple Flag also beat revenue estimates of $67.18M with actual $73.7M in revenue reported.

- Pandora A/S, the world’s largest jewelry maker, is raising prices and cutting costs due to a significant surge in silver prices, which have risen by roughly a third this year. This sharp increase highlights the strength of silver in the market, as its growing value impacts on major industry players and underscores its robust demand, reports Bloomberg.

- National Bank of Canada released an analysis on Kinross Gold Corp. which reported strong third quarter 2024 results, exceeding expectations in adjusted EPS and production, with focused cost control driving robust free cash flow and positioning the company to fully repay its term loan by year-end. These operational efficiencies and financial strengths not only enhance Kinross’s gold operations but also indicate potential positive impacts on its silver activities, highlighting significant growth opportunities within North America.

Weaknesses

- SSR Mining reported a big miss on earnings due to higher-than-expected care and maintenance costs at its idled Copler mine due to the heap leach failure.

- The Treasury yield curve surged with Donald Trump’s decisive election victory which pulled up the dollar and conversely, gold slid back on higher inflation expectations. The surge in interest rates and reduced political uncertainty weakened gold’s appeal with the shifting market sentiments, according to Bloomberg.

- Hecla Mining reduced its full-year silver production guidance, missing analyst estimates, after reporting lower-than-expected third-quarter silver output due to unplanned mill maintenance, Bloomberg reports. This operational setback highlights weaknesses in silver production capabilities, potentially impacting the silver market negatively.

Opportunities

- Fitch Ratings indicates that gold miners have strong credit outlooks supported by balanced capital deployment, healthy balance sheets, and stable-to-improving mining profiles. This presents an opportunity for investors, as gold miners are poised to benefit from heightened gold prices and receding inflationary pressures, leading to stronger margins, increased free cash flow, and potential deleveraging—making them attractive prospects in the precious metals market.

- Exchange-traded funds have been reducing their holdings in gold and silver while increasing investments in platinum and palladium, indicating a shift in investor focus within the precious metals market. This trend highlights an opportunity to spread out investment flows across all precious metals, allowing investors to diversify portfolios and potentially capitalize on the varying performance of gold, silver, platinum and palladium.

- Bloomberg reports that G Mining Ventures is investing $936 million to develop the Oko West Gold Mine in Guyana, aiming to begin production in 2028 with an annual output of 353,000 ounces of gold. This significant project represents an opportunity in the gold sector, highlighting potential growth in gold production and investment prospects in emerging markets.

Threats

- B2Gold reported a significant 26% year-over-year decline in third-quarter gold production and anticipates full-year output at the low end of its forecasted range, highlighting operational challenges. This production shortfall, especially considering the company’s operations in jurisdictions with potential geopolitical and operational risks, poses a threat to B2Gold’s future production stability and financial performance while giving warnings to investors and operators alike of the risks taken in less appealing jurisdictions.

- FXStreet shares some technical insight into silver as exhibiting a negative bias and technical indicators point to further declines, with the price potentially breaking below key support levels like the 100-day moving average as well as the psychological $30 mark. This downward trajectory poses a threat to silver investors, signaling a bearish outlook for the precious metal in the near term.

- Australia Broadcasting Corp. has reported that Regis Resources’ McPhillamys Gold Project in New South Wales has been halted due to a federal Aboriginal protection order over the site, leading the company to launch a legal challenge. This situation highlights the threat of jurisdictional risk, as regulatory and legal obstacles imposed by government decisions can render mining projects unviable and cause significant delays.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

United Airlines

Ryanair

Lufthansa

American Airlines

Tesla

Richmont

Mercedes

BMW

Volkswagen

Wynn Resorts

Christian Dior

ConocoPhilips

Triple Flag

Kinross Gold Corp.

Regis Resources

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.