Trump and Haley’s Election Battle Forecasts Defense Industry Trends

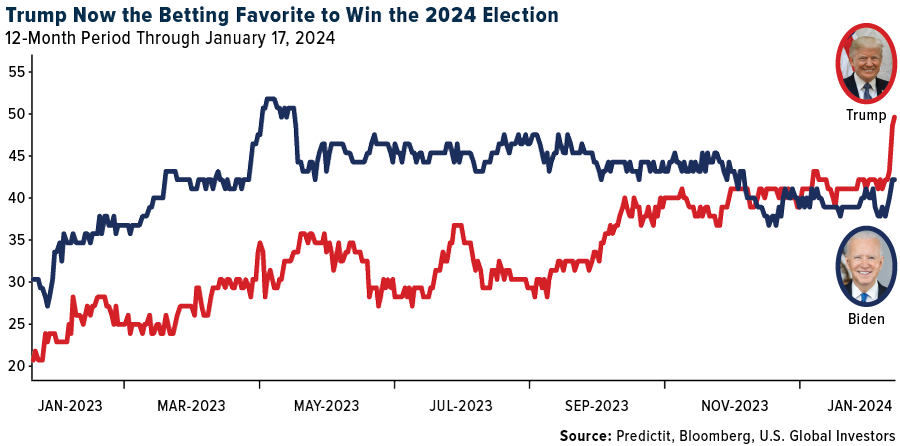

The race for the White House intensified last week as Donald Trump won the Iowa caucus with 51% of the vote, handily beating rivals Ron DeSantis and Nikki Haley. This was followed by second-place winner DeSantis suspending his campaign, leaving only Trump and Haley, the ex-president’s former ambassador to the United Nations. Results from the online prediction market PredictIt now show that Trump has become the betting favorite to win November’s general election.

Whether you support him or not, it’s important for investors to consider the potential market ramifications of a possible second Trump term. One such sector that has come into focus is defense, especially in light of escalating tensions in the Middle East.

Trump vs. Haley’s Military Strategies

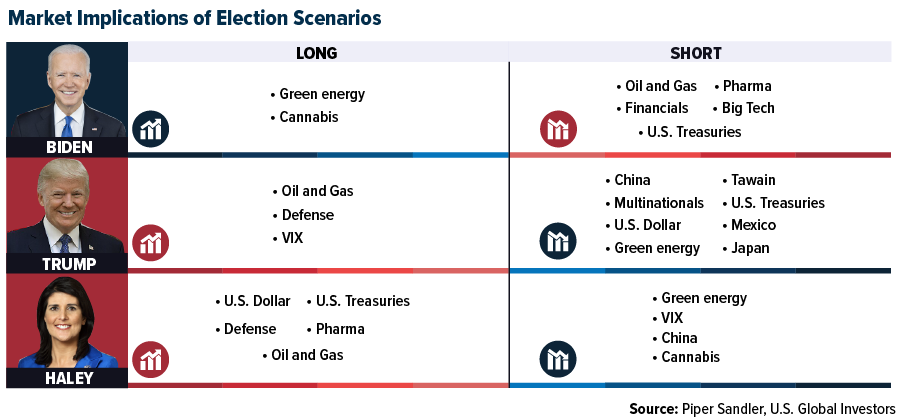

In a note to investors last week, Piper Sandler’s head of U.S. policy research, Andy Laperriere, highlighted defense as a sector to watch should Trump or Haley win in November. In fact, Laperriere gives Haley higher marks than Trump when it comes to boosting defense spending, writing that the former South Carolina governor would be “more focused on winning substantive legislative victories in Congress than Trump.”

But then, a second Trump presidency might mean the U.S. pulls out of the North Atlantic Treaty Organization (NATO)—one of Trump’s longstanding priorities—in which case the U.S. would likely need to increase military outlays. The U.S. currently spends about 3.5% of its gross domestic product (GDP) on national defense, which is significantly higher than what most countries spend, but it trails the military buildup of the 1980s, when outlays were closer to 7% and 8% of GDP.

A $1 Trillion Annual Defense Budget?

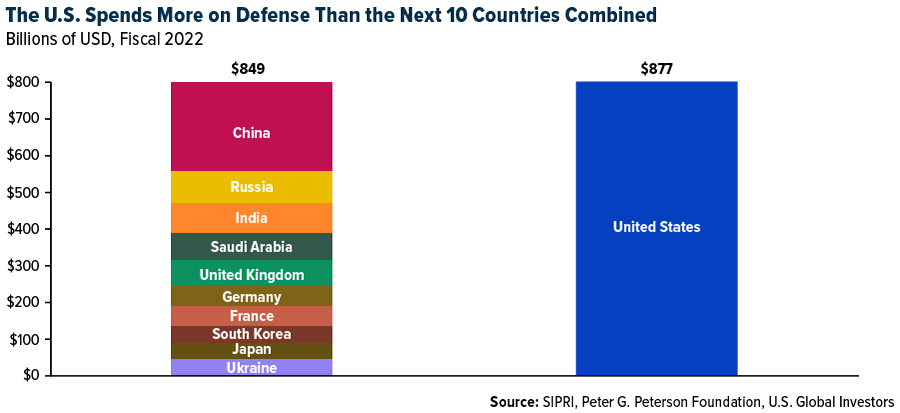

None of this is to suggest that the military has languished under President Joe Biden. The U.S. already outspends the next 10 countries combined, and at the end of last year, the president signed the U.S. defense policy bill, authorizing a record $886 billion in annual military spending.

But with the world’s geopolitical thermostat climbing, it’s easy to see this budget going even higher—even topping $1 trillion. According to U.S. Under Secretary of Defense Mike McCord, that eye-watering dollar amount is “inevitable” within just a few years.

I believe this would carry clearly positive implications for defense stocks, but don’t take it from me. In December, Fitch Ratings raised its outlook of the defense industry, writing that contractors “will be supported by higher backlogs and elevated spending on national security.”

That same month, the Financial Times reviewed the orderbooks of 15 global defense contractors, finding that their combined backlogs in just the first half of 2023 totaled a massive $764 billion. Governments’ “sustained spending” on defense “has spurred investors’ interest in the sector,” the article reads.

The “Big Five” and Federal Contracts

When evaluating a defense service company and its growth potential, it’s essential to spend time looking at its contract portfolio. Many of these firms have only one buyer—the federal government—which creates a unique market dynamic where competition is often less about price and more about technological and strategic superiority.

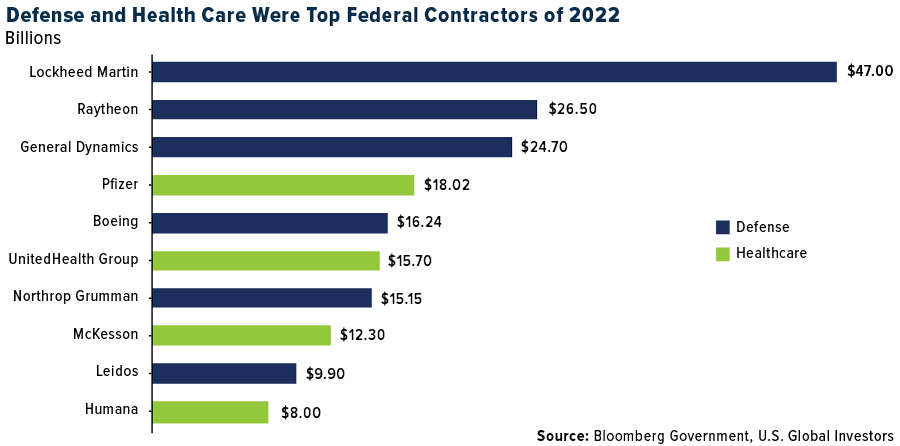

Over the years, the “Big Five” defense contractors—Lockheed Martin, RTX, General Dynamics, Boeing and Northrop Grumman—have received about a third of the Defense Department’s annual budget, according to the Congressional Research Service (CRS). 2022 saw a record $705 billion in military contracts, with $47 billion going to Lockheed Martin alone, more than any other company. In fiscal 2024’s military budget, a whopping 58 out of 78 major weapons systems—or roughly three quarters—involve at least one of the Big Five companies as a primary contractor. (In the chart below, please note that Raytheon Technologies rebranded as RTX in June 2023.)

With defense spending constituting a significant portion of the U.S. GDP and an escalating global geopolitical landscape, the 2024 election could indeed be a defining moment for defense stocks. Investors and market observers alike are keenly watching the unfolding political developments, understanding that the election’s outcome could propel the defense sector to new financial heights.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2023): The Boeing Co., General Dynamics Corp.