Top 10 Countries That Have Bought the Most Gold Over the Past Decade

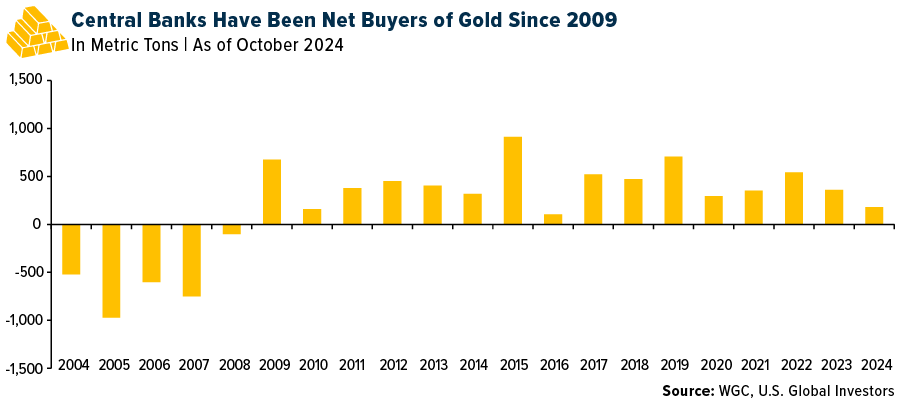

With over 36,000 metric tons in reserves—about one-fifth of all the gold ever mined—central banks know something we should too: Gold is the ultimate safety net. Since 2009, these institutions have been net buyers of the precious metal, and in the past decade alone, they’ve scooped up one out of every eight ounces produced globally.

If these guys are loading up on gold, shouldn’t that tell you something about where your own portfolio should be?

While fiat currencies can be printed at will (and we’ve seen plenty of that lately), gold remains a finite resource. That makes it the go-to asset when economic uncertainty rears its head. Countries all over the globe have realized this, and they’ve been buying gold in bulk.

Here’s a look at the top 10 nations that have been piling up the most gold in the last decade:

10. Hungary | 91.4 metric tons

The Hungarian National Bank has been holdings gold since it was created in 1924. Lately, it’s been serious about adding to its stockpile. With 110 metric tons in reserves, Hungary now boasts the highest per capita gold holdings in Central and Eastern Europe.

9. Qatar | 96.3 metric tons

Qatar views gold as a safe investment, especially during times of economic uncertainty. In recent years, Qatar’s gold purchases have soared, with holdings over 100 tons by the end of 2023. For a nation built on oil and gas wealth, it’s clear they see gold as a reliable backup plan.

8. Singapore | 101.5 metric tons

Singapore is no stranger to gold, even if it has to import every ounce. This year, it made a historic move, bringing its gold reserves to 236 metric tons, the highest level since the city-state gained independence in 1965. A savvy play for a global financial hub like Singapore!

7. Uzbekistan | 126.3 metric tons

Uzbekistan has been a quiet yet powerful player in the gold market. Its reserves have grown steadily, hitting 373 tons in 2024. Almost 80% of Uzbekistan’s total international assets are now in gold—a solid choice, we believe.

6. Kazakhstan | 132.6 metric tons

Kazakhstan, a top global gold producer, has steadily increased its reserves, which now stand at a combined $23 billion. The country plans to reduce gold’s share of its reserves slightly but remains a major player in the global market, accounting for 2% of global gold production.

5. India | 291.4 metric tons

India’s Reserve Bank has been making some big moves in the gold market. Its purchases in the first half of 2024 were the highest since 2013, surpassing the previous two years combined. For India, where gold holds deep cultural significance, the metal remains central to its economic strategy.

4. Poland | 295.0 metric tons

Poland’s National Bank has been one of the most aggressive gold buyers this year, tying with India for the largest purchase in the second quarter of 2024. With current holdings at 16%, Poland is on a mission to have the precious metal make up 20% of its reserves.

3. Türkiye | 475.6 metric tons

Over the past decade, Türkiye has grown its gold reserves from 116 metric tons to over 584 tons today. With nearly 20% of its reserves in gold, Türkiye is one of the top buyers, thanks to its long history of domestic gold ownership and investment.

2. China | 1,210.2 metric tons

China is always one to watch, and it’s been no slouch in the gold department. Having added over 1,200 metric tons in the past 10 years, the People’s Bank of China sits just behind the U.S. in total global rankings. However, it hit pause on new purchases in recent months as gold prices surged.

1. Russia | 1,230.6 metric tons

Taking the top spot, Russia has added more than 1,200 tons of gold to its reserves over the last decade. With sanctions from the West in mind, Russia has been preparing, even going as far as to peg its currency, the ruble, to gold—a strategy we haven’t seen since the days of the Bretton Woods system.

At U.S. Global Investors, we’ve always seen gold as a key part of a diversified portfolio, and we believe our gold-focused funds offer an excellent way to participate in this time-tested asset. After all, if it’s good enough for central banks, shouldn’t it be good enough for you?

If you’d like more information on ways to invest in the yellow metal, send us a note at info@usfunds.com!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.21%. The S&P 500 Stock Index rose 1.11%, while the Nasdaq Composite climbed 1.13%. The Russell 2000 small capitalization index gained 0.98% this week.

- The Hang Seng Composite lost 16.33% this week; while Taiwan was up 2.69% and the KOSPI rose 1.06%.

- The 10-year Treasury bond yield rose 12 basis points to 4.093%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Air Transport Services, up 9.4%. According to JPMorgan, Latam has raised $1.4 billion to prepay a portion of its Chapter 11 debt due in 2027. The new loan was issued at a 7.8% rate and matures in 2030. This is its first debt issuance since exiting its Chapter 11 process.

- According to the TAC, air freight rates on Asia-outbound are 80% above 2019 levels. In recent weeks, the sequential increase in spot rates on China-Europe may indicate the start to the peak season – the spot rate on the lane is now 11% above November 2023 levels.

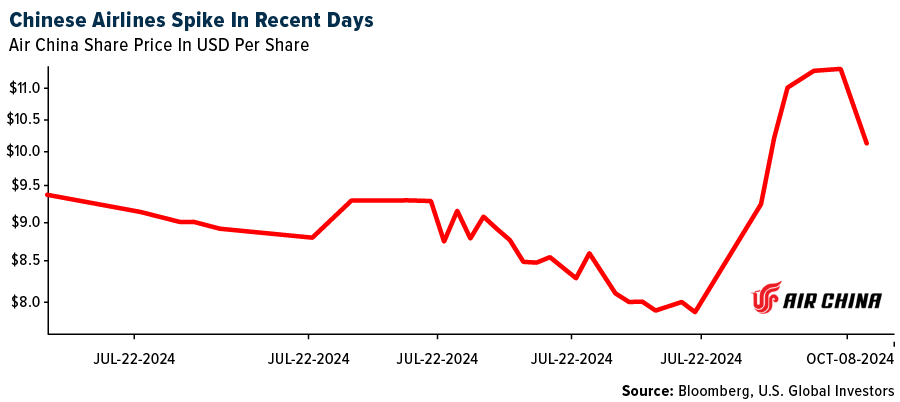

- Chinese airlines A/H shares rallied 25/60% over the past two weeks, then slowing down again, on the back of optimism for robust travel traffic during National Day Golden Week break, reports JPMorgan, along with expectations for third-quarter 2024 profitability.

Weaknesses

- The worst performing airline stock for the week was Tongcheng Travel Holdings, down 12.0%. According to CIBC, the Canadian Air Transport Security Authority saw 5.5 million passengers through Canada’s largest 17 airports. This is down 17% month-over-month but up 2% year-over-year.

- The three-day strike that closed ports on the U.S. East and Gulf coasts last week could result in a 10% to 20% reduction in capacity on the transatlantic and Asia-U.S. East Coast routes, according to the latest report from Sea-Intelligence. Depending on the route, the three-day shutdown has resulted in around 50 container ships sitting idle outside the ports awaiting reopening.

- Qantas has been ordered by the Federal Court to pay A$100 million in penalties for misleading consumers by offering and selling tickets for flights it had already decided to cancel, and by failing to promptly tell existing ticketholders of its decision, in a case brought by the ACCC. These penalties were imposed after Qantas admitted that it had contravened the Australian Consumer Law.

Opportunities

- According to TD, Spirit Airlines owns five A319 outright and has equity in a combined 51 A320/A321. The other 161 aircraft are leased. TD expects most of the aircraft to eventually leave the U.S. should they be repossessed, which could tighten the U.S. market.

- Following last week’s 5.0 point increase the Evercore ISI Shipping Cos. Survey rose for a second straight week, increasing from 77.8 to 78.3 as participants highlighted improvement in tanker activity. Reduced capacity in the Panama Canal, rerouting of ships due to attacks in the Red Sea, as well as the war in Ukraine and in the Middle East, have all extended routes and boosted rates. These factors appear to be the primary drivers of the strength in the survey as opposed to final demand for the products.

- Delta’s third-quarter earnings and revenues were in line with consensus. According to management, the industry backdrop is improving as it relates to capacity in both the fourth quarter and the beginning of 2025. In addition, bookings into the holiday season and even into January look good.

Threats

- According to Bank of America, Frontier Airlines lowered system capacity by 910 basis points (bps) in December, following a similar reduction. Cuts were domestic-focused, lowered by 13.0%, while Latin American capacity was raised by 12.4%. Frontier’s first quarter 2025 capacity is currently tracking higher by 15.4%.

- The parked freighters fleet was 19.4%, exceeding the last 10-year peak of 16.9% reached in mid-2023, reports Bank of America. Parked freighters are up 3.8ppts year-over-year, 13.0ppts versus 2019 levels, and 10.0ppts since the COVID peak in April 2020 of 9.1%. In the bank’s view, this indicates the risk of an oversupply of freighters in the market.

- Azul’s lessors and OEMs agreed to exchange their stake of 3 billion Brazilian real in the equity instrument for up to 100 million new preferred shares of Azul, in a one-time issuance. Azul noted this is subject to certain conditions and corporate approvals. Per Goldman’s estimates, post issuance, the lessors and OEMs would hold up to a 22% stake in the company.

Luxury Goods and International Markets

Strengths

- Tesla unveiled its highly anticipated Robotaxi, a two-seater sedan named Cybercab, which is expected to begin production in 2026 and be priced below $30,000. Elon Musk also introduced the Robovan, designed to accommodate up to 20 passengers, and provided updates on Tesla’s humanoid robot, Optimus. There was a lack of technical and regulatory details on the upcoming releases.

- Carnival reported record-breaking quarterly results and raised its annual profit forecast for the third time, driven by strong demand for cruise vacations, controlled spending, and increased onboard guest spending. Citigroup raised its price targets for Carnival and Norwegian Cruise Line, boosting the share prices of both companies.

- Cettire, an online apparel retailer, was the top-performing stock in the S&P Global Luxury sector, rising by 26.1%. On Friday, shares surged over 10%, despite minimal news coverage.

Weaknesses

- Deliveries of BMW cars have fallen by 30%, marking the steepest decline in over four years. Sales have dropped across all regions, with the exception of electric vehicles, which saw an increase. Similarly, Mercedes experienced a 13% sales decline in China; however, its electric vehicle sales plummeted, while hybrid car sales rose by 10%. Volkswagen’s sales in China declined 13%.

- Remy Cointreau and Pernod Ricard experienced a sell-off this week after China announced retaliatory tariffs on imports of brandy from Europe. Starting October 11, importers of EU brandy will face tariffs as high as 39%.

- Tesla was the worst-performing stock in the S&P Global Luxury Index, losing 12.8% this week. Shares declined on Friday after investor disappointment with the Robotaxi event.

Opportunities

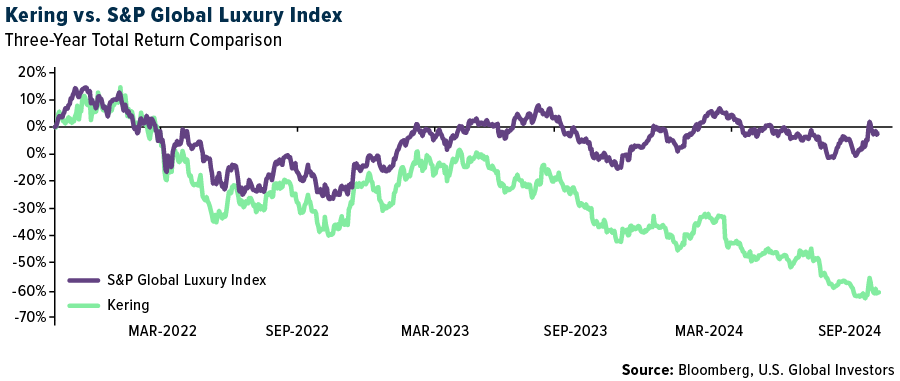

- Kering has appointed Stefano Cantino as the new CEO of Gucci, which contributes approximately two-thirds of the company’s operating profits. Kering has faced challenges, particularly with Gucci’s performance, leading to a downturn. As a former LVMH executive, Cantino is expected to revitalize the brand, potentially paving the way for a turnaround in performance and price recovery.

- Zuzanne Push from UBS highlights that the significance of Chinese customers as a driver of luxury industry growth has been diminishing over the years. According to UBS analysts, Chinese consumers have contributed about 25% of growth since 2015, and around 10% growth from 2019 to 2023. In contrast, American consumers have taken the lead, accounting for approximately 30% of growth since 2019.

- The optimism surrounding the recently announced Chinese stimulus quickly faded due to a lack of updates on the implementation process and the absence of further specific measures targeting the troubled economy. However, if the government takes further action and introduces more targeted measures, the market is likely to react positively, which could boost consumer sentiment. The finance minister is scheduled to hold a press conference this Saturday.

Threats

- In the United States, September’s core inflation increased by 0.31% month-over-month, surpassing the consensus estimate of 0.2% and aligning with August’s rise. On an annual basis, core inflation reached 3.3%, marking the first increase since March 2023. While experts anticipate that the Federal Reserve may soon be in a position to cut rates again, persistent inflation could hinder the Fed’s decision-making.

- Germany’s economy, Europe’s largest, is expected to shrink by 0.2% this year, revising an earlier prediction of a 0.3% expansion and marking a second consecutive year of contraction. This is due to weak domestic and foreign demand, high interest rates and costly energy. However, the economy is expected to return to growth of 1.1% in 2025.

- According to China’s culture and tourism ministry, the number of domestic trips and total travel expenditure during the week-long National Day Golden Week holiday surpassed last year’s figures. However, per capita spending remained below pre-pandemic levels, coming in 2.09% lower than the same period in 2019, based on Reuters’ calculations. Despite the optimism surrounding stimulus measures ahead of the Golden Week holiday, consumer spending remained cautious.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was wheat, rising 1.65%, as dry weather in Argentina has stimmed crop growth and Russian shelling of the Ukrainian port of Odesa has limited the ability to export wheat. Globally, wheat stockpiles are at a nine-year low, as reported by Bloomberg. In other news, Shell Plc saw continued strong performance from its natural gas and upstream businesses in the third quarter, even though oil-refining margins declined.

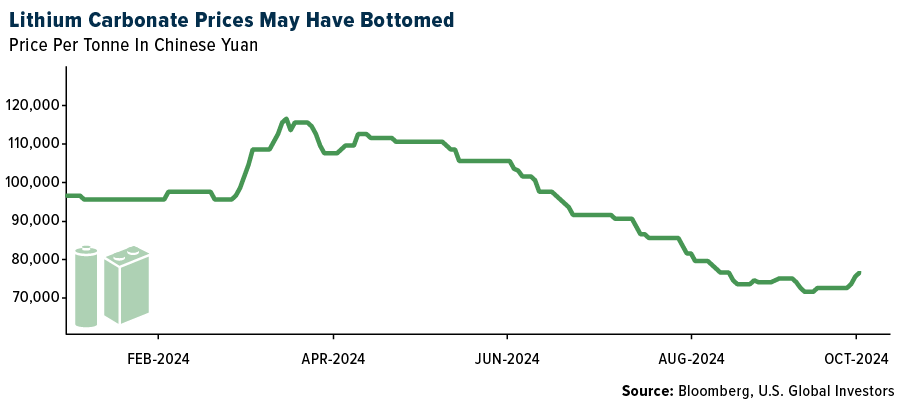

- Lithium carbonate prices have risen month-on-month for the first time since May 2024. The increase in prices in September was driven by the announcement of China’s new stimulus package aimed at aiding the recovery of its economy, alongside the impact of recent mine closures, according to Bloomberg.

- Uranium purchases by the Sprott Physical Uranium Trust had been tepid year-to-date, with purchases being largely absent since mid-June. That said, buying resumed at the end of September, with 300,000 pounds of uranium purchased from the spot market since then. This, potentially, partially explains the recent stabilization in the price, which is currently at $82 per pound, according to Morgan Stanley.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 7.85%, as power outages in Florida dented demand, along with a greater-than-expected storage add that left the market few incentives to rally. On average, stockpiles are running higher than average this year due to a no-show winter last year, Bloomberg reports.

- Iron ore prices continue to be hurt by weakening sentiment. While the impacts on physical demand are less clear, a weak steel market, particularly in China, will continue to impact the market.

- Brent oil dropped below $80 a barrel as China’s top economic planner ended a highly anticipated briefing on Tuesday without new stimulus measures, reports Bloomberg, sparking a risk-off mood across markets. West Texas Intermediate traded below $76 a barrel.

Opportunities

- Voters in Kazakhstan, the world’s top uranium miner, held a referendum last weekend in which 71% of the voters backed the construction of a nuclear power plant. Kazakhstan is Central Asia’s largest oil producer and hasn’t used nuclear power since 1999 but is now grappling with power shortages due to older unreliable power stations and an energy intensive crypto industry. On Friday, Japan’s biggest business lobby Keidanren asked the government to include nuclear power in its national energy strategy, which is currently under review.

- According to Bloomberg, Google is working with utilities in the U.S. and other countries to assess nuclear power as a possible energy source for its data centers, underscoring surging interest in using atomic energy to feed the artificial intelligence boom. “In the U.S., in highly regulated markets where we don’t have the opportunity to directly purchase power, we are working with our utility partners and the generators to come together to figure out how we can bring these new technologies — nuclear may be one of them — to the grid,” said Amanda Peterson Corio, global head of data center energy at Alphabet Inc.’s Google.

- Rio Tinto Group has agreed to buy Arcadium Lithium Plc in an all-cash deal valuing the U.S.-listed miner at $6.7 billion, expanding its grip on the battery metal and stepping back into the M&A fray with its biggest deal in 17 years, writes Bloomberg.

Threats

- Elliott Investment Management lost its UK appeal over the London Metal Exchange’s controversial decision to halt a runaway short squeeze in the nickel market, Bloomberg reports. The LME successfully saw off the appeal by the U.S. hedge fund in a ruling that backed the wide discretion offered to the exchange to suspend the market and cancel trades in 2022.

- Brazil’s weekly imports of LNG have soared as heat and droughts have increased the demand for air conditioning while water reservoirs have shrunk such that hydroelectric power has fallen 19% over the last 30 days. While this is an opportunity for sustained natural gas demand it’s an abrupt shock to their infrastructure needs.

- According to Bloomberg, global oil supplies face the highest risk in decades amid conflicts involving key producers Iran and Russia, said veteran commodities analyst Jeff Currie. Current geopolitical turmoil poses an especially dangerous scenario, he speculated.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Neiro, rising 74.64%. Nearly half of hedge funds focused on traditional asset classes now have exposure to cryptocurrencies, reports Bloomberg, as increased clarity around regulations and the launch of ETFs in the U.S and Asia draw more investors into the asset class. Among hedge funds trading in traditional markets, 47% had exposure to digital assets, up from 29% in 2023 and 37% in 2022.

- South Korea’s top financial watchdog said it would reevaluate lifting the existing ban on local spot cryptocurrency ETFs and institutional accounts on crypto exchanges. According to local news agency News1, the FSC will review the current ban.

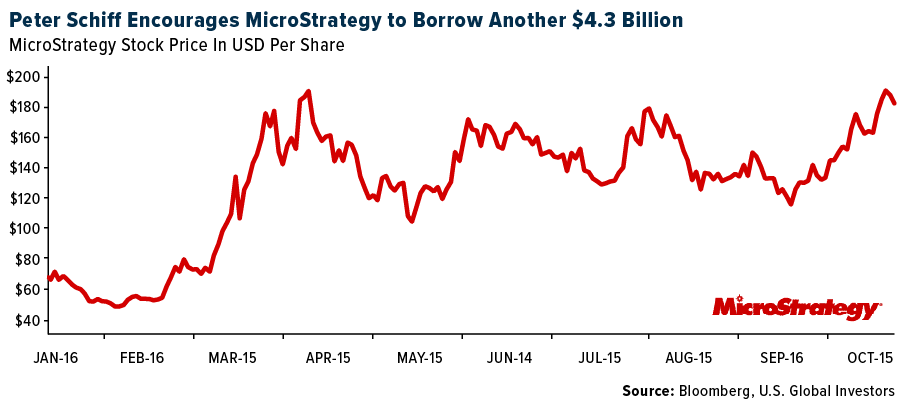

- Renowned economist Peter Schiff poked fun at Michael Saylor recommending that the MicroStrategy boss buy the huge stash of Bitcoin that the U.S government planned to sell, writes Bloomberg. Schiff took to X to express his views on the U.S. government’s decision to sell 69,370 BTC it had seized from the dark web marketplace, the Silk Road.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Stacks, down 11.04%.

- Caroline Ellison has agreed to transfer nearly all her available cash and assets to FTX trading to settle a bankruptcy court lawsuit and further extricate herself from Sam Bankman-Fried’s crypto empire. The deal settles litigation filed last year to recover about $30 million in payments and FTX securities, writes Bloomberg.

- An art gallery was accused of selling over $13 million worth of NFTs showing eagles in various fashions. The proposed class of 36 plaintiffs says that Eden Gallery and Gal Yosef engaged in a “rug pull” by collecting millions from investors. The suit alleges the defendants committed common law fraud, were unjustly enriched, and violated the New York business code, reports Bloomberg.

Opportunities

- The German investment outfit Lennertz & Co. is set to become one of the largest fund of funds operating in the blockchain space as the firm seeks to raise $165 million for its third crypto-focused vehicle, according to Bloomberg. As a fund of funds, rather than investing directly in portfolio companies or token deals, Lennertz invests in other firms including well-known crypto venture capitals, writes Bloomberg.

- Bitwise Asset Management said Friday that it filed to convert three of its crypto futures ETFs to a rotation strategy based on market trends. The conversion involves shifting exposure between cryptocurrencies and U.S. Treasuries, according to Bloomberg.

- Crypto exchange Binance is set to list Ethereum Layer 2 network Scrolls’s native token SCR for pre-market trading, writes Bloomberg, claiming to be the first platform to do so in an announcement earlier this week. Prior to the pre-market listing, the project will also be added to Binance Launchpool.

Threats

- Three market making firms allegedly promised to gin up an avalanche of fake trades to boost the value of NexFundAI’s cryptocurrency token, according to Bloomberg. Representatives of ZM Quant, CLS Global and MyTrade, were among 15 crypto promoters and trades charged with market manipulation and fraud in a wide-ranging probe prompted by a tip from the U.S. SEC.

- The U.S. SEC has accused Chicago-based Cumberland DRW LLC with operating as an unregistered dealer in over $2 billion of crypto assets offered and sold as securities, according to an article published by Bloomberg.

- The U.S. asked that a Wall Street rapper who pleaded guilty to a money-laundering conspiracy in one of the biggest crypto heists ever spend 18 months in prison after she provided “substantial assistance” to the government. Prosecutors recommended the sentence after Heather Morgan, who dubbed herself the “Crocodile of Wall Street,” helped investigators as part of a plea agreement last year, writes Bloomberg.

Defense and Cybersecurity

Strengths

- Kongsberg Defence & Aerospace received a €193 million order from Lithuania’s Ministry of National Defense to supply additional NASAMS air defense systems as part of Lithuania’s ongoing equipment upgrade.

- BAE Systems received a $184 million contract modification from the U.S. Army to produce 48 additional Armored Multi-Purpose Vehicles.

- The best performing stock in the XAR ETF this week was Triumph Group Inc., an aircraft components maker, rising 19.14%. The company is exploring a potential sale with interest from strategic buyers and private equity firms, amid rising aerospace industry dealmaking, while its shares surged following the news.

Weaknesses

- Defense stocks in Europe fell as Ukrainian President Volodymyr Zelenskiy presented his “victory” plan to EU leaders, signaling potential flexibility on ending the war, while companies like Rheinmetall, BAE Systems, Saab and Dassault Aviation saw notable declines.

- U.S. Vice President Kamala Harris declined to commit to supporting Ukraine’s bid to join NATO. This emphasizes that any negotiations with Putin must include Ukraine, while the Biden administration views Ukraine’s membership as a longer-term possibility.

- The worst performing stock in the XAR ETF this week was AAR Corp., falling 6.06%. AAR Corp. and other suppliers of United Airlines may see stock movement after United’s earnings report on October 15.

Opportunities

- Northrop Grumman has integrated AI into its FAAD ABM air defense system, enhancing its capability to counter UAS threats by streamlining decision-making and enabling real-time weapon-target pairings. The system allows operators to engage UAS swarms more efficiently with a single click on a mobile tablet, improving response during high-stress, multi-target scenarios.

- Lockheed Martin has appointed Chauncey McIntosh as vice president and general manager of the F-35 Lightning II Program, succeeding Bridget Lauderdale, who will retire after 38 years with the company. McIntosh brings over 20 years of experience in program management, engineering and business leadership to the role starting December 1.

- Thales has secured a contract with the Canadian government to supply its Sophie Ultima Handheld Thermal Imager to the Canadian military, with the equipment being manufactured and maintained in Canada to enhance the local supply chain.

Threats

- Iran and Oman have begun their first-ever joint military drills, focusing on counterterrorism and urban warfare, involving ground forces, police and air units from both countries.

- Amid growing tensions between Israel and Iran, President Biden is urging restraint, while Israel prepares for a potential surprise strike in response to a recent missile attack. This comes despite U.S. concerns over escalating the conflict.

- South Korea’s defense chief has indicated that North Korea is likely to send troops to Ukraine in support of Russia, further solidifying its alliance with Moscow and distancing itself from South Korea. Meanwhile, tensions continue to rise between the two Koreas.

Gold Market

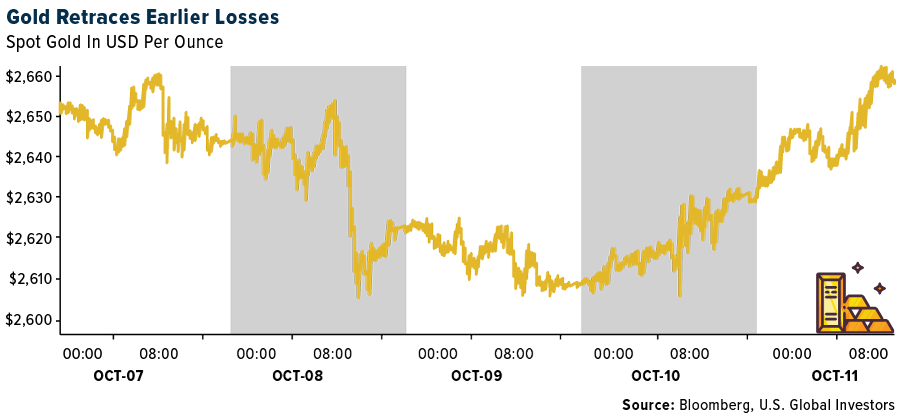

This week gold futures closed the week at $2,673.10, up $5.30 per ounce, or 0.20%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 0.68%. The S&P/TSX Venture Index came in up 1.71%. The U.S. Trade-Weighted Dollar rose 0.42%.

Strengths

- The best performing precious metal for the week was palladium, up 7.31%, perhaps on continued accumulation by the palladium ETFs. For instance, the abrdn Physical Palladium Shares ETF has seen its shares outstanding increase by 72% in 2024. Despite a slight fall in the price of palladium since the start of the year, money is flowing into this fund.

- According to Business Times, global central banks currently hold some 1.16 billion ounces of gold that are collectively worth more than $3 trillion, according to new data from the International Monetary Fund (IMF). The yellow metal now accounts for just under one-fifth of the $15.45 trillion worth of foreign exchange reserves held by the world’s central banks.

- K92 Mining delivered one of the strongest operational results in its history, reports Stifel. Production of 44,300 ounces gold was a strong beat to the estimated 31,600 ounces gold. Positive grade reconciliation and higher-grade stopes mined in the third quarter were the reasons for the strongest gold head grade since the fourth quarter of 2020. The share price rose nearly 16% on the production beat.

Weaknesses

- The worst performing precious metal for the week was silver, down 1.93%, after four weeks of consecutive gains. Gold fell early in the week as the dollar continued to push higher and U.S. inflation came in hotter than expected. Despite the negative print, gold pushed higher on Thursday and even more so on Friday. The yellow metal essentially ended the week flat, unfazed by the headlines as the market seems to be anticipating higher prices.

- Dundee Precious Metals’ third quarter production results came in below RBC’s estimates, driven by operational challenges at Ada Tepe. Full-year guidance was reiterated, with increased production at Ada Tepe anticipated in the fourth quarter on higher grades and improved fleet availability.

- Aris Mining reported third quarter 2024 gold production of 54,000 ounces, which missed expectations. Due to the lower-than-expected production, the company decreased the 2024 production guidance at Segovia to 185,000-195,000 ounces from 200,000-220,000 ounces.

Opportunities

- Over the weekend, OceanaGold revealed that its Waihi and Macraes mines have been selected as part of a list of 11 mining projects under the New Zealand Government’s Fast-Track Approvals Bill. The bill establishes a new permitting framework for major development initiatives. It is anticipated that the Fast-Track Approvals Bill will be enacted later this year and will feature an expert panel tasked with evaluating the projects and advising the joint Ministers on approval decisions, reports Scotia.

- Mexico’s plan for a ban on open pit mining was not included in a list of 100 pledges outlined by incoming President Claudia Sheinbaum on October 1, the day of her inauguration. Sheinbaum signaled in her campaign that she supported the policies of her predecessor, President Andrés Manuel López Obrador — also known by his initials AMLO — who took a hard line on the mining sector, including pushing for a ban in Mexico’s legislature. While analysts said they still expect Sheinbaum to hew closely to AMLO’s policies, the new president may take a different approach on certain issues, reports S&P, including her predecessor’s proposal to ban open pit mining.

- According to Canaccord, gold and gold equities have consistently outperformed during QE cycles. Further, supporting the gold price is the sharp increase in U.S. debt levels. The Congressional Budget Office recently raised its forecast for the U.S. deficit to $2 trillion for 2024, around 7% of GDP, with deficits expected to average 6.3% of GDP over the next decade.

Threats

- West African Resources saw its shares plunge by as much as 25% after reports emerged that the Burkina Faso government plans to revoke mining permits. Multiple news outlets, including Reuters, cited President Traore’s recent radio address, in which he suggested that the government is targeting miners who have not complied with the Mining Code. Speaking on the two-year anniversary of his takeover, Traore stated, “We know how to mine our gold, and I don’t understand why we should let multinationals do it… We are going to withdraw mining permits.”

- Equinox Gold issued 24.8 million shares to satisfy the conversion of a $130 million convertible held by Ninety Fourth Investment Company. However, BMO was immediately engaged by Ninety Fourth to offer the shares in a secondary placement as they wanted cash and not shares. Equinox did not receive any proceeds from the offering.

- After briefly arresting four Barrick Gold employees, the government of Mali is seeking $512 million in back taxes and dividends from the company under the revised mining code. B2Gold, Resolute Mining and Allied Gold have already come to a settlement and Barrick was the only major mining company left to come to terms with the government, hence the arrest. Malian officials have said companies can accept the new law or leave the county.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Qantas Airways

Spirit Airlines

Delta Air Lines

Frontier Airlines

Tesla

Carnival

BMW

Mercedes

Volkswagen

Pernod Ricard

Kering

Shell Plc

K92 Mining

Dundee Precious Metals

Aris Mining

OceanaGold

West African Resources

Barrick Gold

Resolute Mining

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.