Things Are Looking Up for Commercial Airlines

As of December 16, the NYSE Arca Airline Index was up nearly 4.5% for the month. This follows a spectacular 41.9% increase in November--airline stocks' biggest monthly jump on record--and 1.6% increase in October.

Airline stocks are on track to record their third straight month of gains on hopes that the coronavirus vaccine will help normalize commercial air travel sooner rather than later. Investors are also betting that U.S. carriers may be in line to receive additional relief in the stimulus package currently being negotiated in Congress.

As of December 16, the NYSE Arca Airline Index was up nearly 4.5% for the month. This follows a spectacular 41.9% increase in November—airline stocks’ biggest monthly jump on record—and 1.6% increase in October.

A Congressional relief package has seen delay after delay, but a bill may be headed for President Donald Trump’s desk as soon as this week, according to reporting by Politico.

Such a bill would “probably” include between $17 billion and $25 billion for domestic airlines, write Bloomberg analysts Nathan Dean and Eric Kazatsky. Even if the current spending package doesn’t include airline relief, Dean and Kazatsky say they expect aid to come as early as the first quarter of next year, after President-elect Joe Biden takes office.

Billionaire investor Warren Buffett believes another round of fiscal stimulus is crucial to help U.S. businesses get to the end of the pandemic.

“We need another injection to complete the job,” the Berkshire Hathaway chief told CNBC this week. “Congress is debating that right now, and I hope very much that they extend the PPP (paycheck protection program).”

Buffett Still Wrong to Have Exited Airlines

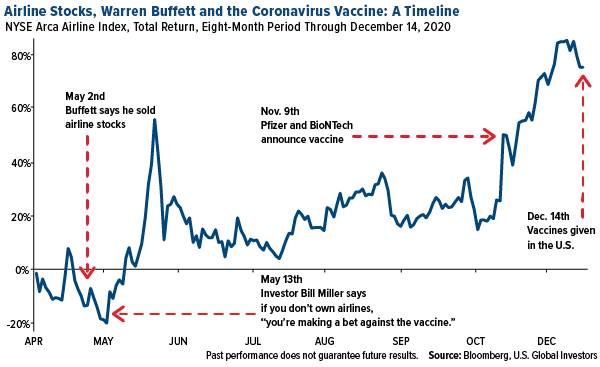

If you recall, Buffett announced in early May that he had dumped his entire position in the big four domestic airlines, following a collapse in share prices due to the pandemic.

Within three weeks, the decision cost him a cool $2.7 billion, according to Investor’s Business Daily (IBD). That amount has only increased since then. For the year, class A shares of Berkshire are down 1.6%, significantly underperforming the S&P 500, up 16.5%.

After news came out of his airline departure, the Oracle of Omaha was roundly criticized, and not just by me.

Bill Miller, the former chief investment officer at Legg Mason, said that if you don’t own airlines, “you’re making a bet against the vaccine.” Then, in June, day-trader Dave Portnoy posted a series of videos on Twitter wherein he took jabs at Buffett for missing a no-brainer opportunity.

“Warren Buffett is past his prime,” the Barstool Sports founder said in one of the videos. “He misread the market dramatically when he said get out of airlines.”

I think it’s safe to say that Miller, Portnoy and others have been vindicated. Only six months after Buffett made his exit, Pfizer announced that it had developed a safe, effective vaccine against COVID-19. A month after that, the vaccine was being administered to frontline medical workers.

Although it will likely be months before everyone in the U.S. has been inoculated—even longer for the rest of the world—I believe the airline industry may see immediate benefits.

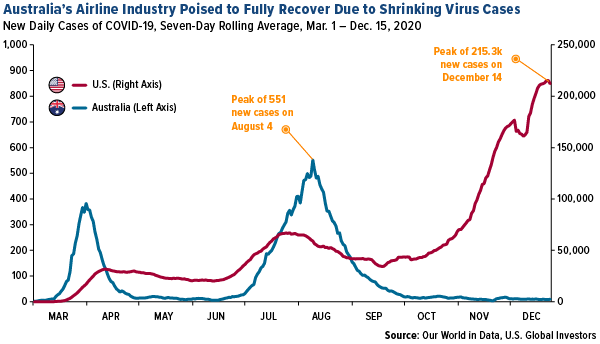

Don’t believe me? Look at Australia.

Domestic Air Travel Demand in Australia to Exceed Pre-COVID Levels

Thanks to its aggressive measures against the pandemic, Australia has experienced lower infection and death rates than many other high-income nations. On December 17, the country of 25 million reported only three new cases of COVID-19.

As a result, its domestic airline industry is close to full recovery and, by March, demand is expected to exceed pre-COVID levels.

That’s according to Jetstar, the low-cost carrier owned by Australia’s flagship Qantas Airways.

In a press release dated December 15, Jetstar says that it plans to operate more than 850 weekly flights across 55 routes by March 2021, or 110% of its schedule before the pandemic. By comparison, the U.S. is currently operating at about 42% capacity compared to the same time a year ago, according to U.K.-based OAG Aviation Worldwide.

Australia’s international borders remain closed—one of a number of actions the country took to contain the spread of the virus—meaning many residents with wanderlust “are set to explore places around the country they have never visited, which is great for local hospitality and tourism operators,” commented Jetstar CEO Gareth Evans.

Can the same thing happen here? I’m optimistic. Between the rollout of the vaccine and potential relief from Congress, I believe the airline industry is in a good position to rebound much faster than many people initially thought.

Wondering how you can participate? Watch my video below. Be sure to like and subscribe!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Airline Index is designed to measure the performance of highly capitalized and liquid U.S. and international passenger airline companies identified as being in the airline industry and listed on developed and emerging global market exchanges.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 9/30/2020: Qantas Airways Ltd.