The Yield Curve Inversion Just Ended, but Economic Risks Remain

The U.S. economy may be heading into choppy waters, and investors might be wise to buckle up.

Recent data suggest that the winds of recession could be gathering, with declines in U.S. manufacturing, a softening labor market and worrisome signs from the bond market all pointing to possible trouble ahead.

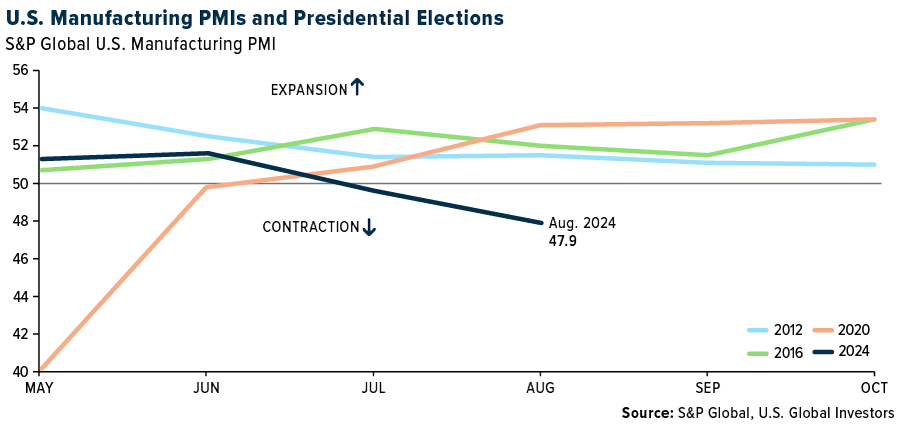

Manufacturing production signaled a significant weakening in demand in August. The S&P Global U.S. Manufacturing PMI posted a reading of 47.9, its lowest in 2024 so far. Any PMI below 50 indicates contraction, and this is now the second consecutive month of declines.

Weakness in manufacturing isn’t just a concern for the stock market. The industry is contracting at a time when Kamala Harris, the incumbent presidential candidate, is hoping to run on the administration’s economic success.

If Harris takes office at a time when the business cycle is faltering, she’ll face an uphill battle with a slowing jobs market, lagging home sales and a Federal Reserve caught between a rock and a hard place on interest rates. Geopolitical risks also continue to swirl in the background, creating even more uncertainty.

But the U.S. isn’t alone in this struggle. In August, the JPMorgan Global Manufacturing PMI fell to 49.5, an eight-month low. Out of 31 countries surveyed, 18 showed deterioration in manufacturing conditions, including those in the euro area and Japan. The slowdown isn’t confined to our shores—it’s a global issue that could have ripple effects on trade, jobs and investment opportunities.

Mixed Signals with a Darkening Cloud

The U.S. labor market has long been a source of strength for the economy, but it, too, is starting to send worrying signals. August’s jobs report was underwhelming, and while the unemployment rate is still relatively low, it may be on the rise, ticking up to 4.3% in July. This increase triggered what’s known as the Sahm rule, a little-known but highly accurate recession indicator named after former Federal Reserve economist Claudia Sahm. As I discussed with you last month, the rule has successfully predicted every U.S. recession since 1970, so when it’s activated, people take notice.

Payroll gains have also slowed over the past several months, and many economists expect that we’ll see downward revisions in the number of jobs added. All of this is happening as inflation remains a persistent thorn in the side of policymakers, complicating the Fed’s job as it tries to balance controlling prices with avoiding a deeper slowdown in the economy.

Sahm herself has expressed concern that the Fed might not be acting quickly enough to avoid a recession. “The Fed can no longer afford to move gradually,” she said recently in an interview with Goldman Sachs. “Twenty-five basis point cuts would probably suffice to avoid the worst possible economic outcomes, but these cuts have to be delivered decisively, not gradually.”

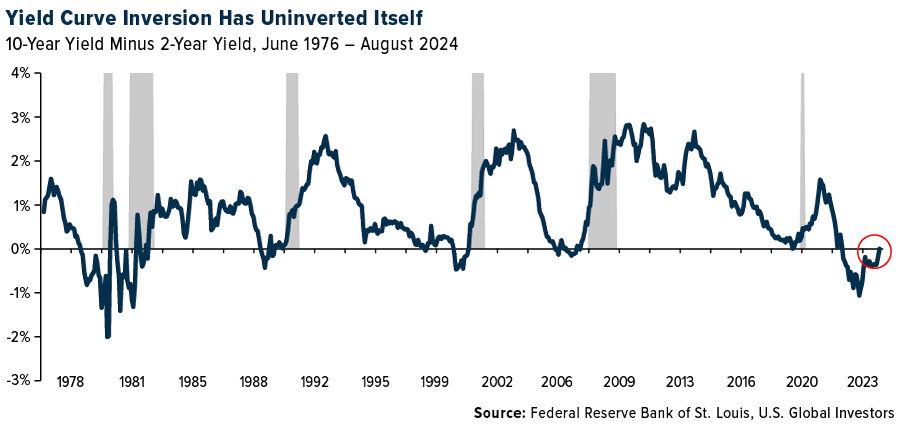

The End of the Yield Curve Inversion That Just Wouldn’t Quit

One of the most reliable recession indicators over the last 50 years has been the yield curve, and this week, it turned positive again for the first time in over two years. An inverted yield curve, where short-term rates are higher than long-term rates, has preceded every U.S. recession since the 1970s. This occurs because market participants, anticipating future rate cuts to combat a downturn, drive long-term rates lower.

Typically, the spread between the 10-year and two-year Treasury notes is used to gauge this inversion.

Before this week, the yield curve had been inverted for a staggering 783 consecutive days, the longest such period in U.S. history. Although the inversion has recently “uninverted,” meaning long-term rates are no longer lower than short-term rates, the damage may already be done.

Historically, there’s been about a 12-month lag on average between the first inversion and the onset of a recession. But this can vary. For instance, the curve first inverted in January 2006, roughly two years before the financial crisis began in 2008. If history is any guide, the prolonged inversion we just experienced could be setting the stage for another economic downturn.

A 30% Decline in the S&P 500?

What does all this mean for investors? According to Peter Berezin, Director of Research at BCA, it may be time to rethink your portfolio strategy. Writing in the Financial Times, Berezin says that now may be the moment to rotate out of stocks and into bonds. For the last two years, stocks have been the place to be, but with a recession looming, Berezin believes bonds will soon offer a better risk-reward balance.

In a recessionary scenario, Berezin expects the S&P 500’s forward price-to-earnings ratio to fall from 21 to 16, with earnings estimates dropping by 10%. This would bring the S&P down to 3,800—an almost 30% decline from current levels. It’s a sobering prediction, but one that can’t be ignored, especially given the headwinds facing the global economy.

The Fed’s Next Move

The Federal Reserve has been in a rate-hiking cycle for over two years now, but with economic data weakening, many expect that rate cuts are on the horizon. The first cut is anticipated to come at the September 18 FOMC meeting, with a reduction of 0.25% to 0.50%. While some might hope that this will stave off a recession, it’s important to remember that rate cuts take time to filter through the economy.

There’s also the risk that the Fed could be too slow in its actions. Sahm, Berezin and others argue that decisive cuts may be necessary to avoid the worst outcomes. The longer the Fed waits, the harder it will be to reverse the course of a slowing economy.

As always, I remain optimistic about the long-term potential of the U.S. economy, but the short-term outlook is uncertain. Now may be the time to reexamine your portfolio and prepare for the possibility of a slowdown. History shows that recessions are an inevitable part of the business cycle, but they can also present opportunities for savvy investors who are prepared.

Stay focused, stay informed and as always, happy investing!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.93%. The S&P 500 Stock Index fell 4.28%, while the Nasdaq Composite fell 5.77%. The Russell 2000 small capitalization index lost 5.65% this week.

- The Hang Seng Composite gained 6.06% this week; while Taiwan was down 3.74% and the KOSPI fell 4.86%.

- The 10-year Treasury bond yield fell 18 basis points to 3.722%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Tongcheng Travel, up 6.50%. Cathay Pacific announced the repurchase of all warrants that were issued during the Covid pandemic. This effectively eliminates 6% share dilution that would arise from the exercise of warrants. The total consideration of the warrant repurchase would be in a range between HK$15.3 billion and HK$18.8 billion, which could be well covered by Cathay Pacific’s free cash flow (FCF) in 2024E, according to UBS.

- As it relates to the transportation sector, September is typically a stronger month for volume and pricing momentum, as the period represents the beginning of the traditional peak season. Added on to the current 2024 mix, reports ISI, is a likely close and divisive Presidential election, a potential labor disruption at East and Gulf Coast ports (for the first time since 1977), and geopolitical uncertainty (specifically as it relates to trade flows).

- JetBlue increased the mid-point of the year-over-year revenue guide for third quarter 2024 by 2.75 ppts, with 1-2 ppts driven by JetBlue specific benefits. Approximately one point from incremental demand stemming from last month’s CrowdStrike debacle, and three-fourths of a point to improved Latin American demand, according to JPMorgan.

Weaknesses

- The worst performing airline stock for the week was Air Transport Services, down 12.5%. According to Valor Economico, Azul started a round of talks with bondholders to raise more funds using its logistics subsidiary, Azul Cargo, as collateral. The article states that the company is trying to raise $800 million and that the willingness of the bondholders to release more funds is linked to the airline’s ability to reach an agreement with lessors. Azul was downgraded by S&P to CCC+ from B-.

- Following the strong start to the year, tanker shipping rates have eased sequentially during the second quarter through the third quarter of this year, year-to-date, in-line with typical summer low seasonality. The soft rates were mainly impacted by the extension of OPEC+ output cuts and China’s weak import demand, reports JPMorgan.

- United Airlines flight attendants voted in favor of strike authorization. The Association of Flight Attendants-CWA, which includes over 28,000 United flight attendants, saw over 90% participation in the vote with nearly 100% of the votes in favor of the strike authorization. United flight attendants filed for mediation with the NMB over eight months ago, reports Morgan Stanley, and have been working under an amendable contract for almost three years.

Opportunities

- This week, Frontier Airlines announced 11 new routes to 15 different airports ahead of consumers making holiday plans in the upcoming months, according to Morgan Stanley.

- Ton-mile growth is poised to be sticky, led by complex geopolitical issues, while the anticipated OPEC+ planned output hike could provide additional support. Supply remains tight considering a subdued tanker order book and progressive scrapping of older vessels. JPMorgan reaffirms its view that tanker shipping demand-supply fundamentals remain supportive for earnings in the near term.

- For Ryanair, Morgan Stanley assumes the company returns €4.1 billion to shareholders for FY2025-2028 via dividends (€1.6 billion) and buybacks (€2.5 billion), representing 23% of its current market cap. Under this scenario, Ryanair will still build a net cash position of €3 billion by the end of this period. This would open another 17% of the market cap to be retired (bringing total cash returns to 40% of market cap).

Threats

- Air Canada is working on a pilot labor deal, according to TD. Management has been reported to have raised its offer to 30% over four years, including 20% in year one. The airline announced a flexible rebooking policy to accommodate those traveling between September 15 and September 23. In addition, 9.3% of the airline’s flights and ASMs in the third quarter are scheduled on those dates, per Cirium data.

- The global tanker shipping fleet is relatively old, with the proportion of old vessels expected to increase in 2029. Management indicated that it would continue to modernize and upgrade the existing fleet, reports JPMorgan, including the use of scrubbers and other technologies.

- Cathay Pacific announced it is carrying out an inspection of its entire Airbus SE A350 fleet as a precautionary measure following some engine issues. The news comes after discovering an engine component failure on a recent flight to Zurich. The airline has cancelled several flights while the investigation is being carried out; the component failure is said to be the first of its type on any A350 aircraft worldwide.

Luxury Goods and International Markets

Strengths

- Marriott International, Inc. recently celebrated a major milestone with the opening of its 9,000th property: the St. Regis Longboat Key Resort, a luxurious new addition on Florida’s Gulf Coast. This new resort highlights Marriott’s continued expansion in the luxury hotel market, currently including these seven luxury brands (St. Regis, JW Marriott, Ritz-Carlton, Ritz-Carlton Reserve, The Luxury Collection, W Hotels, and EDITION) with 522 properties across 72 countries and territories.

- The Mercedes-Benz EQS 680 Maybach, featuring a 122kWh battery and a range of 611km, was launched in India, marking the first-ever Maybach EQS for the country and introducing high-tech features including a Hyperscreen.

- Cettire, an online marketplace, was the best-perfoerming S&P Global Luxury stock, gaining 37.7% for the week. Shares gained after the founder of the company, Dean Mintz, bought back 11 million shares.

Weaknesses

- Luxury stocks dropped again this week because of concerns about slowing demand in China. Consumers there are spending less than before, which is affecting luxury brands. Despite recently performing better than other luxury stocks, Hermes saw a decline this week and fell behind Tesla in terms of performance over the past month.

- The Global Manufacturing PMI dropped to 49.5 in August from 49.7 in July. This decline reflects slower manufacturing activity and weaker economic growth prospects. Specifically, the Manufacturing PMI in China, the EU and the United States fell further into contraction territory, signaling a continued slowdown in these regions.

- RealReal, an online marketplace, was the worst-performing S&P Global Luxury stock, losing 13.1% in the past five days. The decline in shares was sharp and occurred with very little news coverage.

Opportunities

- Tesla is planning to launch the advanced driving assistance systems called Full Self Driving (FSD) in China and in Europe in the first quarter of next year. Once approved, the FSD could be a boost to sales ahead of Chinese competitors who are also working on similar self-driving solution programs.

- There are rumors that China is preparing to cut interest rates on as much as US$5.3 trillion (S$6.9 trillion) of mortgages in two steps to lower borrowing costs for millions of families. Financial regulators have proposed reducing rates on outstanding mortgages nationwide by a total of about 80 basis points. The first cut may come in the next few weeks, while the second move would take effect at the beginning of 2025.

- Bank of America strategists, led by Sebastian Readler, believe that the recent underperformance of European luxury and semiconductor stocks, driven by concerns about China’s economy, presents a buying opportunity. As China’s economic growth slows, there are expectations that the government might introduce more stimulus measures. Important economic data from China is set to be released next week, and if the data is weaker than anticipated, the likelihood of rate cuts by the Chinese government will increase.

Threats

- Tiffany, the leading jewelry brand owned by LVMH, is planning to give up about half of its space at the two-floor store in Shanghai’s Hong Kong Plaza, which opened with much fanfare in late 2019. The store will be vacated later this month, raising concerns about weakening consumer spending in China.

- Bloomberg reported that China’s gray market is taking over luxury brand online sales. The gray market involves selling brand new, authentic products at significant discounts. This trend is growing as Chinese consumers become more frugal. For instance, some popular luxury items are available on the Dewu app. with discounts of up to 66%.

- More Swiss watchmaking companies are seeking government financial aid due to declining demand. This state program helps companies retain jobs and avoid permanent layoffs. Around 40 companies in a key hub for watch components have applied for this short-term work compensation, up from just five applications at the beginning of the year.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 7.33%, as the fuel set a record on August 1 for volume of gas burned to generate electricity, the latest in a string of records, as reported by Bloomberg. While temperature records are not soaring in the U.S. some speculate that AI demand for computational power is pushing up demand and power prices.

- U.S. Steel may get a bid from Cleavland Cliffs Inc. after its share price collapsed following the news that Nippon Steel Corp. would be blocked from acquiring this U.S. asset. CEO Lourenco Goncalves told CNBC on Thursday that Cleavland Cliffs would absolutely make a bid if the Nippon deal fell through.

- As a byproduct of oil refining, there may be one bright spot. U.S. ethylene spot prices were down 5.4% this week to 29.81 cents per pound, but the current 45-day weighted average remains at two-year highs of 30 cents per pound. Per CMA, August contract prices settled up 0.75 cents per pound to 33 cents per pound.

Weaknesses

- The worst performing commodity for the week was iron ore, dropping 9.85%. Iron ore dropped to a two-week low after losing its hold above $100 a ton, as China’s steel market shows few signs of a revival. Futures in Singapore fell as much as 2.7% on Tuesday, adding to Monday’s 4.2% slump — the biggest daily drop in three months. Disappointing Chinese manufacturing and property data has bolstered bears who see little chance of a meaningful recovery in demand, Bloomberg reports.

- Oil fell as Chinese demand concerns outweighed supply disruptions in Libya. Global benchmark Brent dropped below $72 a barrel and West Texas Intermediate traded near $67 a barrel. A further contraction in factory activity in China and a deepening property crisis are continuing to drag on the country’s economy, threatening growth targets, writes Bloomberg.

- OPEC+ agreed to postpone its planned oil supply hike on Friday by two months, reports Bloomberg, but that did not shore up the oil price with it losing another 2% on Friday. Both China and the U.S., the top two oil consumers, show slower growth prospect, raising fears about demand. There’s also been a steady rise in crude production in the world’s largest economy in recent years, adding supply pressure to global balances, as reported by Bloomberg.

Opportunities

- European gas prices stand out, having rallied over 15% quarter-to-date. This is unusual given the summer season and European gas storage approaching record levels ahead of the winter. However, Europe’s gas price seasonality has been turned on its head with its reliance on LNG imports competing against less price-elastic buyers in Asia, according to Bank of America.

- If you are bullish on copper and looking for an entry point, the opportunity just got a little more exciting, if you don’t agree with Goldman Sachs Group’s analysts Samantha Dart and Daan Struyven (who cut their 2025 copper price forecast to $10,100 a ton compared to a previous target of $15,000 a ton). The analysts cite shrinking demand in China. Copper has slumped nearly 20% since the end of May, potentially setting up a contrarian trade.

- Chile’s Codelco, seeking to retain the title of the world’s top copper supplier, made a $500 million offer to buy a stake in a mine run by Teck Resources Ltd., people with knowledge of the matter said. The proposal to acquire a 10% stake in the Quebrada Blanca mine from fellow state firm Enami is before the latter’s board, Bloomberg reports.

Threats

- UBS’s previous work suggested spodumene break-even costs might have been as high as $1,000 per ton. This continues to fall, and the Zimbabwean spodumene mines UBS visited largely have costs of $500-$750 per ton.

- Chinese lithium producer Tianqi confirmed headwinds to prices, noting that “At the end of February 2024, lithium carbonate prices quickly rebounded after a post-holiday dip due to reduced demand during the Spring Festival holiday. From March to April 2024, prices stabilized at around RMB110,000 per ton, mainly driven by supply constraints in the short-term following announcements from Australian miners of production cuts and environmental concerns in Jiangxi Province.

- The U.S. has not historically funded natural resource projects to secure key supplies of metals, but China has been very active funding projects. On Thursday, President Xi Jinping unveiled a raft of economic sweeteners for Africa, explains Bloomberg, showcasing China’s commitment to strengthening its sway over a continent that’s key to his geopolitical ambitions. Xi vowed to provide $50 billion in financial support at the ninth triennial Forum on China-Africa Cooperation held in Beijing on Thursday. That included a pledge to triple China’s credit lines to the continent to $30 billion.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Helium, rising 15.49%.

- German industrial giant Siemens AG said Wednesday that it issued a 300-million-euro ($330 million) digital bond on blockchain rails as part of a European Central Bank (ECB) trial. Major German financial institutions invested in the bond, according to Bloomberg.

- Snoop Dogg and filmmaker Robert Rodriguez are asking fans to invest in their upcoming projects, tapping a new way to raise funds for artists, reports Bloomberg. The rapper and the director of Spy Kids have partnered with Republic, an investing platform that has raised $3 billion for companies spanning tech, real estate, gaming, sports and crypto.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Beam, down 22.59%.

- Bitcoin flirted with a one-month low this week, reports Bloomberg, amid a wider retreat from riskier investments in global markets due to fears about the economic outlook. Bitcoin slid more than 4% at one point on Wednesday before paring a part of the decline.

- Andreessen Horowitz ditches Miami two years after opening its office. The departure underscores the potential weakness of Miami’s crypto staying power after the city lured a rush of finance and tech companies over the past couple of years, according to an article published by Bloomberg.

Opportunities

- Nasdaq is seeking approval to launch and trade Bitcoin options, writes Bloomberg, which follows an announcement by the NYSE earlier this year that was looking to list Bitcoin index options. The proposed Nasdaq Bitcoin Options Index is in partnership with index provider CF benchmarks and would track the CME CF Bitcoin Real Time Index operated on the CME, writes Bloomberg.

- Brad Garlinghouse, the CEO of Ripple, said that the company is “very close” to launching its U.S. dollar-pegged stablecoin. As reported by Bloomberg, in the previous month, the cross-border payment firm announced that it began testing RLUSD on two blockchain networks.

- Robot Ventures, an early-stage investor in crypto startups such as EigenLayer, Lido Finance and Flashbots, raised $75 million for its latest venture-capital fund. Crypto venture investing has recovered this year with token prices up significantly since their low point nearly two years ago, writes Bloomberg.

Threats

- Decentralized finance protocol Penpie, built on top of tokenized yield platform Pendle, suffered an exploit on Wednesday. The alleged exploiter drained roughly $27 million of crypto assets including various types of stake ether, Ethenas, and wrapped USDC stablecoin from the protocol, according to Bloomberg.

- Crypto investment firm Galois Capital Management will pay a $225,000 fine over SEC allegations that it broke rules for safeguarding client assets, reports Bloomberg, including holding some of them in accounts with the now-bankrupt exchange FTX. The SEC, in addition, said Galois misled investors about how much notice they needed to give to redeem funds.

- The United States CFTC recovered $18 million worth of digital assets tied to an alleged commodity pool Ponzi scheme. Oregon man Sam Ikkurty was accused of defrauding investors from a purported “crypto hedge fund,” reports Bloomberg. Ikkurty promised to return net profits but never did and failed to tell investors that the fund’s performance fell 98.99%.

Defense and Cybersecurity

Strengths

- Kongsberg has signed a NOK1 billion contract with Australia to deliver Joint Strike Missiles (JSM) for the F-35A, enhancing Australia’s long-range strike capabilities against land and sea targets.

- AeroVironment Inc. won a record $990 million U.S. Army contract, leading to a stock upgrade and an increased price target from analysts.

- The best performing stock in the XAR ETF this week was Lockheed Martin, rising 0.30% after the U.S. announced a potential military aid package to Ukraine involving JASSM missiles.

Weaknesses

- RTX Corporation was fined $200 million by the U.S. Department of State for 750 violations of the Arms Export Control Act and the International Traffic in Arms Regulations, including unauthorized exports of defense articles and technical data to 32 countries, including China.

- Russian missile and drone attacks across Ukraine killed at least seven people in Lviv, injured dozens and caused widespread damage to residential buildings, schools, and medical facilities. This comes following a devastating strike in Poltava that left over 50 dead.

- The worst performing stock in the XAR ETF this week was V2X Inc., falling 16.15%, after V2X announced a public offering of 2 million shares of common stock by a selling stockholder, (with no shares being sold by V2X or proceeds received from the offering).

Opportunities

- Lockheed Martin’s stock has surged after the U.S. announced a potential military aid package to Ukraine involving JASSM missiles, with further gains expected if the U.S. approves their use. This reflects the company’s overall 40% increase since the start of the war.

- Honeywell has completed its $1.9 billion cash acquisition of CAES Systems Holdings, expanding its defense and space portfolio and boosting its Aerospace Technologies business.

- The F-16’s new Integrated Viper Electronic Warfare Suite (IVEWS), capable of countering advanced threats and enhancing survivability to fifth-generation levels, has begun flight testing after successful ground tests. Operational assessments are expected by late 2024.

Threats

- Police in Munich fatally shot an 18-year-old Austrian gunman near the Israeli Consulate on Thursday, believing he may have been planning an attack on the consulate on the 52nd anniversary of the 1972 Munich Olympics attack, though no one else was harmed.

- Israeli Prime Minister Benjamin Netanyahu faces growing criticism for maintaining troops at the Gaza-Egypt border, which has delayed a cease-fire deal with Hamas. Thousands of Israelis protested and joined a nationwide strike, mourning the loss of six hostages and pressuring the government to prioritize securing their release.

- The ousting of Prime Minister Sheikh Hasina by a student-led protest movement in Bangladesh has exposed widespread anti-India sentiment, straining the relationship between the two nations as the new government reassesses its ties with New Delhi.

Gold Market

This week gold futures closed at $2,525.80, down $1.80 per ounce, or 0.07%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 5.77%. The S&P/TSX Venture Index came in off 4.00%. The U.S. Trade-Weighted Dollar fell 0.50%.

Strengths

- The best performing precious metal for the week was gold, off just 0.07%. According to CIBC, Lundin Gold produced 245,000 ounces gold, tracking in line with full-year production guidance of 450,000-500,000 ounces. First half of 2024 AISC of $872 per ounce compared well to guidance of $820-$890 per ounce.

- Harmony Gold Mining Co. said its profit in the last fiscal year likely rose 78% after it increased output as bullion prices notched successive records. The company expects to post earnings per share (EPS) of as much as 13.88 rand ($0.78) for the 12 months through June, up from 7.80 rand in the same period a year earlier, according to a statement released on Monday. However, Harmony warned that costs could rise in the double-digits range in the current year, which took the wind out of the share price.

- Gold has held steady in the $2,500 an ounce range, plus or minus, for the last month. The Federal Reserve is expected to lower interest rates at the September meeting, but it’s debatable whether the Fed would cut a full 50 basis points (bps) versus a more gradual 25 bps pace. Lower rates are often seen as bullish for non-interest-bearing gold, according to Bloomberg. Holdings in gold ETFs expanded again in August.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.16%, on no specific headlines other than perhaps the weaker employment data as of late. The U.S. Mint says American Eagle gold coin sales totaled 10,500 ounces in August, according to figures on its website. Sales compare with 22,500 oz in July and 94,500 oz in August 2023, according to previously released data.

- UBS sees increased risk for further potential value erosion at Sibanye Stillwater. The group believes management is likely to embark on further capital raising exercises, capacity closures and/or project capex deferrals to try and reduce debt levels and limit the cash burn.

- The sudden collapse of Victoria Gold Corp.’s Eagle Mine is part of a long and ugly history in northern Canada. To this day, Canada’s federal government is still cleaning up arsenic and cyanide spills from mines that were abandoned by their owners decades ago. Victoria Gold’s Eagle Mine, which closed in June after its gold-processing facility collapsed and spilled cyanide into the surrounding rivers, will cost about C$150 million ($111 million) to restore, according to Bloomberg.

Opportunities

- First Majestic Silver Corp. agreed to buy all the issued and outstanding common shares of Gatos Silver Inc., a silver dominant producer with a 70% interest in Chihuahua, Mexico mine. Gatos shareholders will receive 2.550 common shares of First Majestic for each share held; consideration implies a total offer value of $13.49 per share based on the September 4 closing price, reports Bloomberg.

- Goldman’s preferred near-term long is gold. It remains the bank’s preferred hedge against geopolitical and financial risks, with additional support from imminent Fed rate cuts and ongoing EM central bank buying. The group, therefore, has a long gold trade recommendation.

- Allied Gold disclosed it was in the process of arranging a $225-$275 million funding package for its Kurmuk development project in Ethiopia, with terms scheduled to be formalized this month. Funding consists of a $125-$175 million stream plus a $75-$100 million gold prepay agreement. Ethiopia is a less common jurisdiction for foreign mining investment in Africa, and the project lies on the border with Sudan. RBC expects geopolitical risk factors to limit the breadth of potential buyers.

Threats

- Sibanye Stillwater is guiding group FY25 unit costs +7 to +11% year-over-year. This guidance stood out, not only as it sits above SA mining inflation, but in contrast to key peers who have actively driven cost savings initiatives given marginal sector economics, according to JPMorgan.

- Gold prices are near a record high above $2,500 an ounce, marking a stellar year for gold bugs. But one top investment strategist believes that gold’s epic run may soon be coming to an end, Bloomberg reports. Jim Paulsen, a 40-year market veteran who worked for two decades with Wells Fargo and was most recently chief investment strategist at The Leuthold Group before retiring, argues that gold prices will fall even as the Fed cuts rates because gold has already rallied, and recession fears are fading.

- UBS maintains its “sell” rating on Northam Platinum as Northam’s valuation metrics are not yet supportive and could see further derating given the poor cash conversion and potential for value erosion if spot PGM prices prevail. The absence of material restructuring initiatives versus peers implies potential for deteriorating efficiency metrics on a relative basis, with limited further medium-term growth potential on offer from the current base.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Cathay Pacific

United Airlines

Frontier Airlines

Ryanair Holdings

Marriot International

Tesla

Hermes

LVMH

Lundin Gold

Harmony Gold Mining

Victoria Gold Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.