The Transition to Electric Vehicles and Renewables Will Test Global Commodity Supply

It’s believed that to meet this goal, two out of every three passenger vehicles manufactured in the U.S. would need to be electric models.

This week, the Biden administration proposed aggressive new tailpipe emissions standards that, if enforced, would leave carmakers with no other choice than to produce electric vehicles (EVs) almost exclusively by 2032.

Under the proposal, among the toughest in the world, carbon dioxide emissions from new cars and light trucks would need to be reduced an ambitious 56% in less than 10 years. It’s believed that to meet this goal, two out of every three passenger vehicles manufactured in the U.S. would need to be electric models.

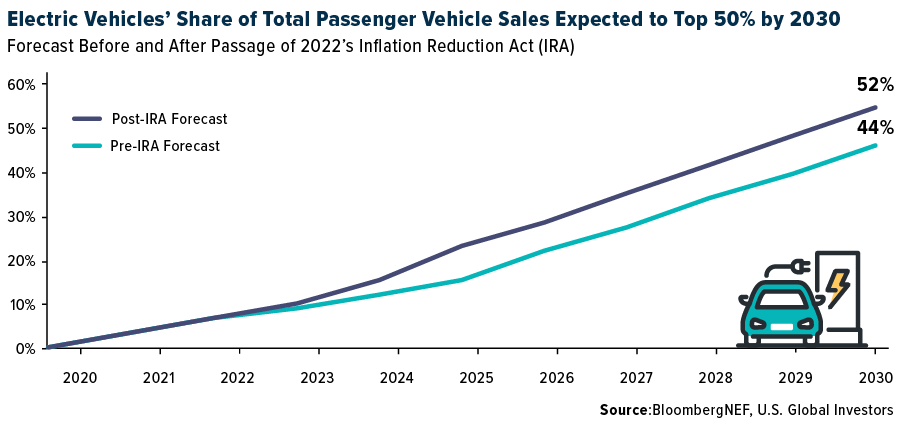

That’s a tall order. Today, EVs represent around 8% of total auto sales in the U.S. By the end of the decade, they’re forecast to account for a little over half of all sales. That’s up from an earlier forecast of 44% due to last year’s passage of the Inflation Reduction Act (IRA), but it’s still well below the 66%-67% that the administration’s proposal mandates.

As I’ve said many times before, government policy is a precursor to change, and if this proposal sticks, we may see some dramatic changes to our nation’s roads, power grids and charging stations in the coming years.

Profiting Off the Supply-Demand Imbalance

Many consumers and elected officials will very likely oppose the upcoming changes, but investors—particularly metals and mining investors—could be looking at once-in-a-generation investment opportunities.

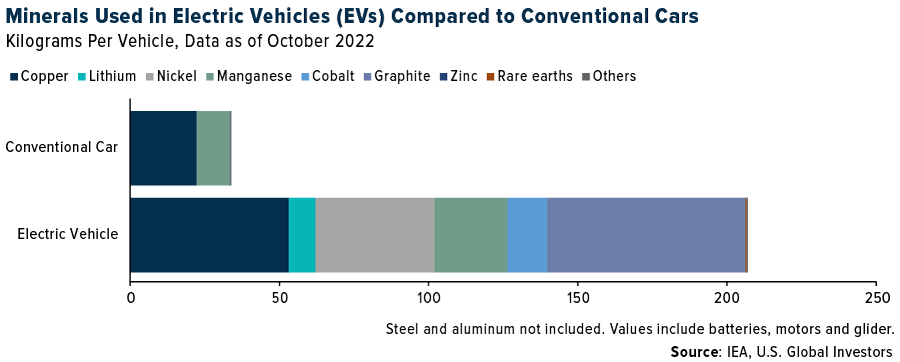

Compared to traditional internal combustion engine (ICE) vehicles, EVs require a vastly greater number and greater amounts of key materials. Based on the latest figures from the International Energy Agency (IEA), a typical electric vehicle—including its battery—contains 207 kilograms of minerals, or six times the amount in a conventional car. There’s roughly two and a half times as much copper, and more than twice as much manganese. EVs also require lithium, nickel, cobalt, graphite and rare earths—minerals which aren’t typically found in traditional vehicles.

Acquiring sufficient amounts of these materials to electrify America’s fleet of light cars and trucks will prove to be the greatest test of our commitment to the energy transition. It may pose an even greater challenge than the need to build out the U.S. power grid, manufacture enough batteries and install enough charging stations.

Supply-demand imbalances are a headache for manufacturers and can drive up prices for consumers, but for investors, they can be highly profitable. I recommend investors consider getting exposure to mining companies that produce the metals and minerals that will increase in demand as EVs steadily replace conventional vehicles—copper, lithium, nickel and cobalt in particular.

Silver Is Breaking Out

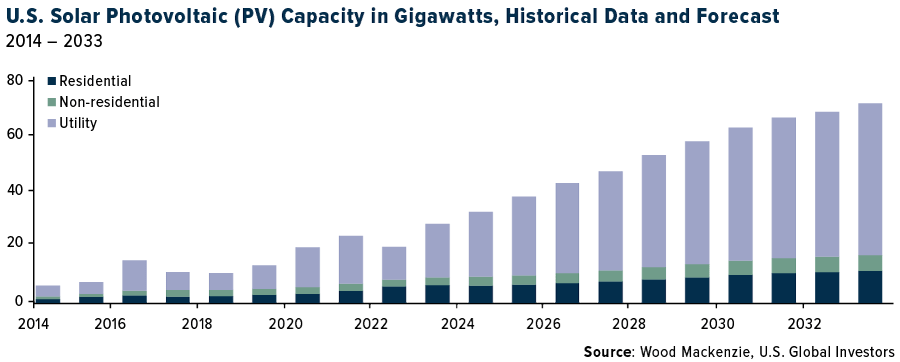

And then there’s silver. Although the white metal isn’t used in the production of EVs, it can be found in solar photovoltaic (PV) cells, which we’ll also be seeing more of in the coming years due to the energy transition.

Last year, solar power accounted for half of all new electricity-generating capacity in the U.S., marking the fourth straight year that solar beat other power sources in terms of added capacity, according to a report by Wood Mackenzie. The firm estimates that by 2033, cumulative U.S. solar installations will stand at 700 gigawatts, five times more than the 141 gigawatts of solar capacity today.

Like EVs, new solar installations will require vast amounts of metals and minerals, silver in particular. In fact, a study published late last year predicts that, by the year 2050, approximately 85%-98% of current global silver reserves will be consumed by the solar panel industry, creating a “significant silver demand risk.”

Again, today’s investors could be in a position to capitalize on tomorrow’s supply-demand imbalances by getting exposure to physical silver and silver miners.

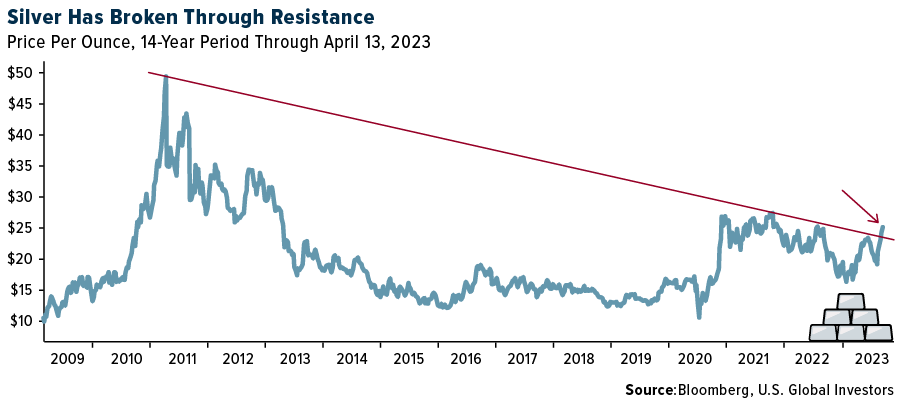

In the short term, silver looks very attractive on a technical basis, having just broken through strong resistance going back to 2011, when it hit its all-time high of $49 per ounce. Today the metal is trading at roughly half that price, so it still has a long way to go, but this week’s price action is constructive.

The 14-day relative strength index (RSI) shows that silver is extremely overbought, and we saw some profit-taking on Friday, pushing the metal down as much as 2.5% at its low. Some investors may consider buying these dips.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.20%. The S&P 500 Stock Index rose 0.79%, while the Nasdaq Composite climbed 0.29%. The Russell 2000 small capitalization index gained 1.55% this week.

- The Hang Seng Composite gained 0.94% this week; while Taiwan was up 0.59% and the KOSPI rose 3.26%.

- The 10-year Treasury bond yield rose 11 basis points to 3.5%.[/responsivevoice]

.Airlines and Shipping

Strengths

- The best performing airline stock for the week was Azul, up 9.6%. Airline operations have improved over the first quarter, with fewer weather and FAA events, and more conservative planning leading to higher completion factors. Industry completion factor was 160 basis points (bps) higher year-over-year and 110 bps higher quarter-to-quarter.

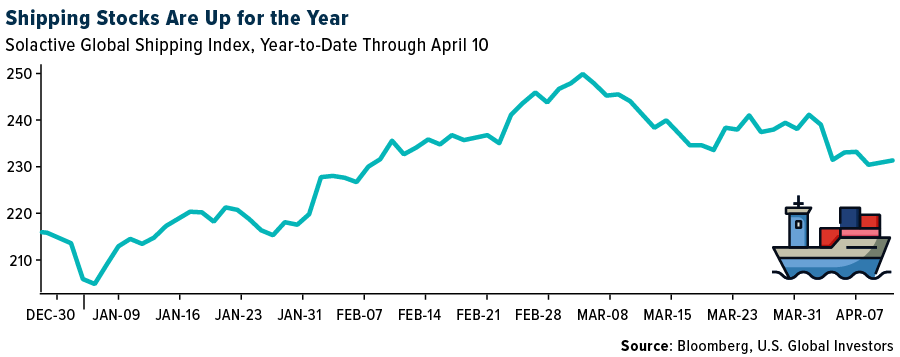

- JPMorgan highlights: 1) a notable uptick in spot freight rates after a 42-week decline, with the Shanghai Container Freight Index (SCFI) recording two consecutive week-over-week gains; 2) a recovery in charter rates across all vessel types with longer duration fixtures, noting the charter rates led the decline during last year’s spot freight rate plunge.

- United Airlines announced the expansion of its summer schedule by 25% compared to last year to meet the increasing demand for international travel, now flying to 114 different international cities this summer. This includes 25 new routes including new service to Malaga, Dubai and Stockholm and expanded service to Australia. United has also increased daily flights to popular cities including London-Heathrow and Tokyo, along with introducing service to more “unique” locations including Amman, the Azores, Palma de Mallorca and Tenerife.

Weaknesses

- The worst performing airline stock for the week was American Air, down 8.7%. System net sales fell 1.5% versus 2019 for the week compared to -0.6% last week. Volumes declined sequentially (-9.2% versus 2019 compared to -8.8% last week) along with a modest deceleration in pricing (+8.4% versus 2019 compared to +9.0% versus 2019 last week). In general, the recent system data is similar to the trend established over the last four weeks and is softer than the January/February trend.

- Based on Clarksons data, the weekly newbuild price index rose to 165.56 (+5% year-over-year) as of March 31, 2023. In particular, the newbuild price index for liquified natural gas (LNG) carriers and tankers rose to 181 (+12% Y/Y) and 196 (+7% Y/Y), respectively. The price of a large-sized LNG carrier increased to a record high of $254 million as of March 31, 2023. Despite the sequential slowdown in new orders and correction freight rates, this strong pricing profile is mainly attributable to the very tight shipyard slots at the major shipbuilders.

- Domestic airline net sales have decelerated 550 basis points (bps), while international net sales have decelerated 250bps since mid-March. There are generally more off-peak leisure periods between now and Memorial Day, so there is greater risk for the domestic, leisure-oriented airlines into 2Q23.

Opportunities

- According to travel data provider OAG, announced seat supply on Japan-China routes between April and August 2023 is approximately 30% of the 2019 average, and the firm expects a recovery to around 50% in the summer as airlines add more flights. Although some travel restrictions continue (on group tours to Japan for Chinese citizens, short-term visas for Japanese citizens visiting China), labor shortages in ground handling on the Japan side are a major bottleneck according to Chinese airlines, and this is holding up increases in flights on Japan routes.

- Morgan Stanley’s quarterly shipper survey supports the out-of-consensus view for a freight cycle inflection in the second half of 2023. The biggest incremental positive takeaways are on the overall macro and inventory levels. The shipper outlook on the overall macro improved sequentially for the second straight quarter, following five successive quarters of declines. Inventory levels took a sharp step lower: net inventories moved down sharply while net ordering remains similar to last quarter, but still in negative territory. Inventory levels should be normalized soon and if the consumer holds up in the second half, conditions are ripe for a restocking up-cycle.

- ISI is modeling base jet fuel 27% lower year-over-year in the second quarter versus +5% in the first quarter. Typically, the year-over-year change in fuel price leads the change in unit revenue growth. However, the U.S. industry has very limited ability to fly lower yielding routes in what remains a constrained backdrop.

Threats

- The Bank of America’s weekly airline bookings data has slowed since mid-March by 400bps, and the bank has become a bit more cautious on second-quarter revenues, lowering revenue estimates by 150-200bps across the large carriers. While 2023 earnings move higher because of a 30% decline in jet fuel since mid-January, EBITDAR multiples (earnings before interest, taxes, depreciation, amortization and restructuring or rent costs) can stay low when revenues decelerate.

- UPS Teamsters rallied in Boston ahead of negotiations for a new labor contract that begins on April 17. The teamsters’ national master agreement with UPS is the largest private-sector collective bargaining agreement in North America, representing over 340,000 package delivery drivers and warehouse logistics workers. UPS Teamsters have said that if a deal is not reached by the contract’s expiration on July 31, they will strike. The biggest focus is to ensure full-time drivers who use their own vehicles are reimbursed by the company on a per-mile basis and that 22.4 drivers are compensated as full-time employees.

- According to JPMorgan, domestic booked revenue is showing meaningful deceleration, to the point that second-quarter year-over-year domestic revenue growth may emerge only slightly positive. At this stage, the bank does not view this as definitive evidence of cooling travel demand; rather, it believes it largely reflects geographic trends beginning to normalize after last year’s period of significant abnormality. Not surprisingly, this also implies that pending revenue guides from the Big 3 will handily exceed those of domestic-focused names.

Luxury Goods and International Markets

Strengths

- Inflation continues to ease in the United States. The month-over-month Consumer Price Index was reported at 0.1% in March, below the expected 0.2% and below the prior month’s reading of 0.4%. Year-over-year inflation declined from 6% to 5%, and it was reported slightly below the expected reading of 5.1%. It is the slowest annual CPI increase since May 2021, according to Yahoo Finances.

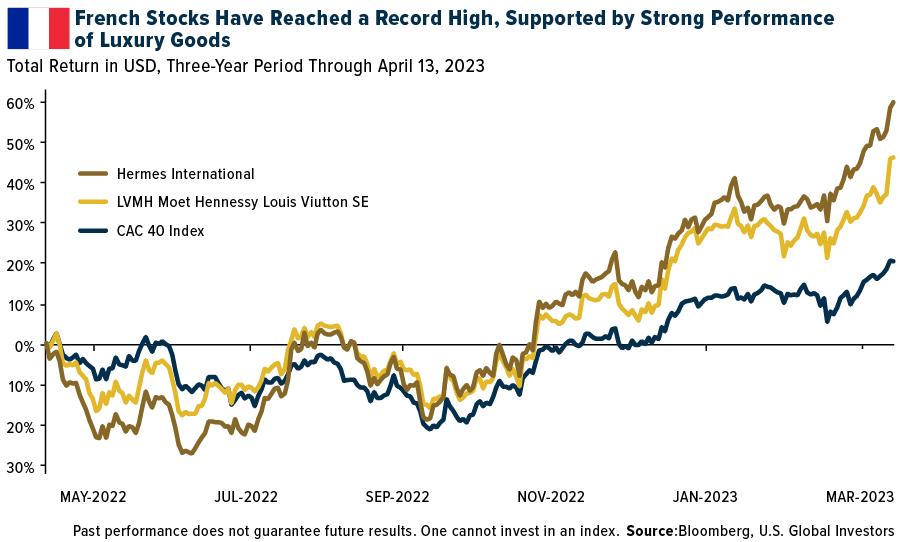

- The French CAC 40 Index, which reflects the performance of the 40 largest traded shares listed on Euronext Paris, reached a record high this week supported by a strong performance of luxury stocks. The two largest index members are LVMH and Hermes, whose shares gained 34.2% and 39.3% respectively.

- Christian Dior, apparel, footwear & accessories design, was the best-performing S&P Global Luxury stock for the week, gaining 9.0%. The company reported 21 billion euros in revenue in the first quarter of 2023, up 17% compared to the same period last year. Asia experienced a significant rebound following the lifting of covid related restrictions.

Weaknesses

- The global slowdown in demand for personal computers has caused computer shipments to decline drastically. According to Bloomberg, the shipments of PC makers dropped by 29% to 56.9 million units, under the 2019 levels. Apple Inc. is leading with the company reporting a shipment drop of 40.5% in the first quarter. Other market leaders, such as Lenovo Group and Dell Technologies, reported more than 30% drops, and HP shipments were down by 24.2%.

- Amazon CEO Andy Jassy told CNBC that while consumers are spending, they are much more careful about what they are spending on. On the enterprise side, most companies are focusing on cutting costs and saving money. Amazon announced that it will start charging customers for returns via UPS in some cases.

- Faraday Future Intelligence was the worst-performing S&P Global Luxury stock for the week, losing 7.6%. The company further postponed the delivery date of the long-awaited FF 91 car. Faraday initially planned to begin production of the FF91 electric car in the spring of 2022 followed by deliveries in late 2022.

Opportunities

- Luis Vuitton’s fashion and leather goods unit posted organic sales growth of 18% in the first quarter, almost twice what analysts were expecting. The strong company sales were supported mostly by strong buying by Chinese customers. The company’s Chief Financial Officer, Jean-Jacques Guiony is “extremely optimistic” for China this year. Other luxury firms exposed to the region will benefit from the China reopening story.

- According to a Bloomberg Intelligence report, Hong Kong retail sales could increase more than 30% this year. Chinese tourism levels increased by 1.1 million people traveling to Hong Kong in February, up by about 296% from the previous month. The luxury goods industry is one of the leading beneficiaries considering Asia and especially China as one of the top luxury goods markets worldwide.

- The luxury industry is becoming a key source of growth in several industries worldwide. According to Morgan Stanley, luxury demand will represent 20% of hotel industry revenue due to people’s increased desire to travel and have new experiences besides the growing middle class worldwide and the demand from China. Those aspects will fuel the hotel market. The report shows luxury and lifestyle represent just 4% of hotel industry revenue.

Threats

- Per our in-house technical indicators, selected luxury names have reached oversold territory, and a short-term pullback is expected. Year-to-date luxury stocks, as measured by the S&P Global Luxury Index, have gained almost 17%, far outpacing gains in the S&P 1500 Index, Dow Jones Industrial Average Index and even the precious metal that luxury buyers love, gold.

- France, home to many luxury companies, continues to witness strikes against President Macron’s pension law, with gatherings becoming more destructive and violent. Striking workers disrupted garbage collection in Paris and blocked river traffic on part of the Rhine River. On Thursday, Bloomberg reported that protestors briefly stormed the headquarters of luxury goods company LVMH.

- Kering, a global luxury giant, will report first-quarter results on April 25, and Barclays predicts that the company will report flat organic growth at both Kering and core brand Gucci, weighed down by negative trends in the United States. The broker remains cautious of Gucci’s recovery in China and is worried about the weakening consumer trends in the United States. The company’s price target was lowered to EUR 588, from EUR 595.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising 8.94%, perhaps on speculation of lower mortgage rates. Oil is notching its fourth weekly gain with prices well supported by the surprise 1 million barrel per day OPEC+ supply cuts. Declining U.S. stockpiles, weaker flows from Russia and the Iraqi Kurdistan pipeline dispute have also contributed to a firming oil market. Recession signals are flashing, so the price strength in oil could wane later in the year.

- Hudbay Minerals reached an agreement with Copper Mountain Mining to combine the two companies with a takeover offer at a 23% premium to the 10-day volume weighted average share price. The combination creates a copper-focused company with scale and now has an operating copper mine in Canada to compliment its South American mines. In a sidenote, Institutional Shareholder Services has endorsed Glencore’s proposed takeover of Teck Resources, citing their plan to give shareholders a cleaner exit from coal. Teck’s largest B-class shareholder is China Investment Corp. and favor the Glencore deal, too, according to Bloomberg, they just expect a higher price from Glencore.

- Enerplus Corp. Chief Executive Officer Ian Dundas says that oil and gas drillers are finally seeing their costs stabilize, which has restrained profits and production. The turnaround in costs may let producers refocus on growing production.

Weaknesses

- The worst performing commodity for the week was lithium hydroxide, dropping 5.10% as more supply is slated to take the squeeze out of high prices. Goldman’s China Basic Materials team has noted that steel order books have been weaker than expected, which have translated in reduced appetite from steel mills to restock (inventories peaked at lower than the previous year’s level). At the same time, positive sentiment towards iron ore and steel in China on the back of the re-opening has been weakening, as investors realize consumption is likely to benefit a lot more than commodities that depend on fixed asset investment and real estate, like iron ore/steel.

- Global inventories of crude petroleum explain why OPEC+ curtailed production earlier this month. According to OilX, OECD stockpiles increased by over 130 million barrels from the end of 2022 to February 2023. Statistics suggest that government reserve releases last year contributed to the expansion, which has now halted. World markets should be oversupplied by over 2 million barrels a day.

- U.S. spot market pulp price erosion continued through March as a second biweekly survey closed down by $10-$35 per ton across four key grades of pulp, leading the month to tumble a total of $35-$80 per ton versus closing February levels, according to Fastmarkets’ PPI Pulp & Paper Week surveys. Weakening demand for incremental tonnage and oversupply has led domestic spot prices down for eight straight months, and April is expected to decline once again, according to market participants.

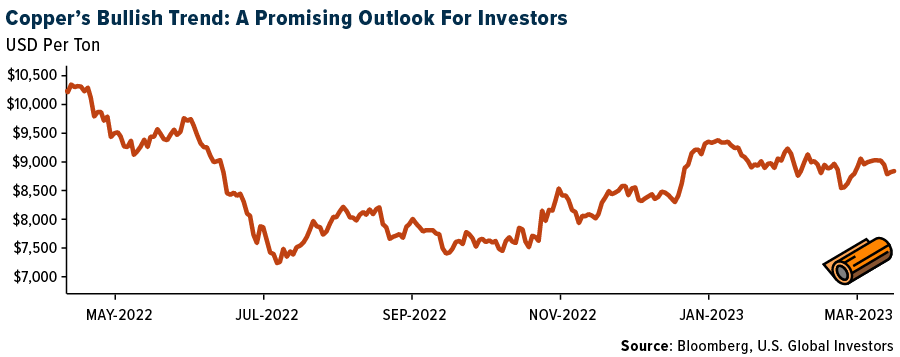

Opportunities

- According to CIBC, with copper trading at close to $4.00 per pound, it seems evident that the large players with deep knowledge of the copper markets believe there is valuation upside at current spot prices, a strong positive for long-term copper price sentiment. Year-to-date economic data from China has been better than expected, which has supported copper prices sooner than expected, and can potentially represent upside to H2/23 and 2024 expectations.

- Canadian Solar Inc. intends to double its panel production capacity and triple its cell output over the next year. According to a release, the company’s CSI Solar unit would increase panel output to 75 gigawatts per year by March 2024, up from 32.2 gigawatts at the end of 2022. Cell output will increase from 19.8 gigawatts to 60 gigawatts. Ingot and wafer capacity will increase by roughly 150% to 50 gigawatts per year. Total worldwide installations may increase by as much as 39% to 355 gigawatts in 2023.

- Exxon Mobil may purchase Pioneer, a Permian oil company, in its biggest acquisition since the XTO buyout. The Wall Street Journal said that the acquisition will cut Exxon’s methane intensity and consolidate Permian output. The firms’ methane reduction goals match. Both want to cease regular flaring by 2030 or five years early and rely on electrification to green their Permian operations. Exxon stopped Permian unconventional flaring but needs better leak control. Exxon plans to decrease 43,000 metric tons by 2024 to avoid the methane charge. Pioneer may stay exempt by cutting 580 metric tons. The target’s sustainable barrels can complement Exxon’s $17 billion low-carbon solutions business’s low-emission Permian feedstock.

Threats

- The new tailpipe emission rules proposed by the EPA to stifle auto pollution and spur electric vehicle growth could result in a 1.6 million barrel per day decline between 2027 and 2055, roughly 10% of daily U.S. crude processing as calculated by Bloomberg This would.be a major blow to U.S. refiners and biofuel makers. In total, oil demand would shrink by an estimated 17 billion barrels through 2025.

- The White House’s climate czar lambasted Republican plans to dismantle parts of its hallmark climate law as President Joe Biden prepares to make the historic policy crucial to his projected reelection push. “There is no question of where congressional Republicans want to drive our country, and that’s back to the sidelines on the clean energy transformation that’s taking place around the world,” Biden’s national climate advisor Ali Zaidi told Bloomberg News on Tuesday. Zaidi’s remarks came weeks after House Republicans voted to abolish major parts of the Inflation Reduction Act, which funded at least $370 billion to battle climate change and promote sustainable energy.

- Warren Buffett’s Berkshire Hathaway Energy (BHE) is pushing legislation in Texas that would overhaul how the Texas electric grid works. The legislation is a response to the electricity blackouts across the state two years back. The plan as envisioned would have the State of Texas fund the construction of a legion of natural gas-fired power plants that could be tuned on if the grid comes under strain and BHE could get paid to manage the plants but would not be exposed to any construction costs. Estimated costs range from $10 to $18 billion which would fall onto taxpayers. This would be a switch from the traditional model of having private companies provide power to the grid, at the lowest competitive costs. BHE is the only industry voice lobbing for the Senate Bill 6 and the Republican led senate and house both want to get more power generation from conventional energy at the expense of the public health and apparently our wealth.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Injective, rising 47%.

- The Arkansas House of Representatives and Senate have both passed a bill aimed at protecting the local crypto mining activities. Known as the Arkansas Data Centers Act of 2023, the legislation protects crypto miners from discriminatory regulations and taxes with clearer guidelines.

- Cryptocurrency-exposed stocks rose in U.S. trading on Tuesday as Bitcoin traded above $30,000. Among crypto-exposed stocks moving higher were Riot, up 7.5%, Marathon Digital, up 7.4%, MicroStrategy, up 6.5% and Coinbase, up 4.9%.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Enjin coin down 11%.

- Venture capitalists are continuing to pull back from crypto, an industry that’s been plagued by scandals, market turndown and regulatory uncertainty. Global venture capital (VC) funding for the industry fell to $2.4 billion in the quarter, an 80% decline from its all-time high of $12.3 billion during the same period last year, writes Bloomberg.

- Reddit users are complaining about the lack of spam or bot prevention amid the launch of the social media platform’s latest non-fungible token (NFT) collection, writes Bloomberg.

Opportunities

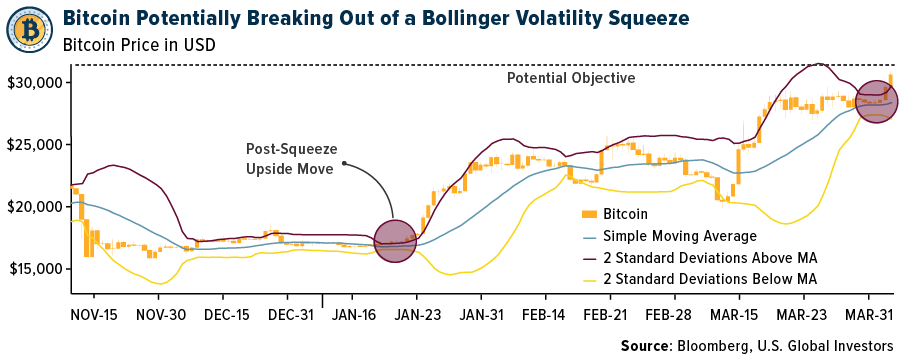

- Bitcoin climbed over $30,000 for the first time since June 2022, bolstered by bets on easier monetary policies that have made cryptocurrencies standout performers this year. Bitcoin is now up 82% since December 31, handily beating the Nasdaq 100 tech index’s 19% gain writes Bloomberg.

- Galaxy Digital founder Mike Novogratz said he expects gold, the euro, Bitcoin and Ether to outperform competing investments as the Federal Reserve moves towards easing its interest-rate increases.

- A key developer of the Ethereum blockchain said a widely anticipated software upgrade of crypto’s most important commercial highway had been implemented and that the network was stable. The so-called Shaghai update enables investors to queue up to withdraw Ether coins that they pledge to help operate the network in return for rewards, a process called staking, writes Bloomberg.

Threats

- Decentralized exchange SushiSwap has fallen victim to an exploit which led to the loss of more than $3.3 million from at least one user. The exploit involves the RouterProcessro2 contract.

- The Texas Senate passed a bill that will cap how much Bitcoin miners can participate in demand response programs, under which they get paid to curtail their operations at times of high energy demand. Bill SB 1751 passed the Senate with only one vote against and is now heading to the House. If approved, it will have to be signed into law by Texas Governor Greg Abbott.

- Bitcoin may be at a nine-month high, but El Salvador’s total holdings are still worth 29% less than what the government paid for, writes Bloomberg.

Gold Market

This week gold futures closed the week at $2,019.20, down $7.20 per ounce, or 0.36%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.42%. The S&P/TSX Venture Index came in up 1.92%. The U.S. Trade-Weighted Dollar fell 0.25%.

Strengths

- The best performing precious metal for the week was platinum, up 3.74%. The Gold/Copper ratio has been on an upward trend since mid-March as gold has outperformed copper. The ratio is now approaching the recent highs seen last July when recession fears were rising but well off the levels seen in early 2020. Gold has seen support from safe haven demand and falling U.S. yields, while copper has seen more sideways performance as investors weigh up global economic growth risks against supply disruptions and China’s reopening.

- Royal Gold reported first-quarter stream segment results. Stream sales were 60,800 ounces versus consensus of 57,000oz (6% higher), with stream deliveries of 57,800oz, 1% higher than consensus. Overall, gold inventories were 11% lower at 25,500oz.

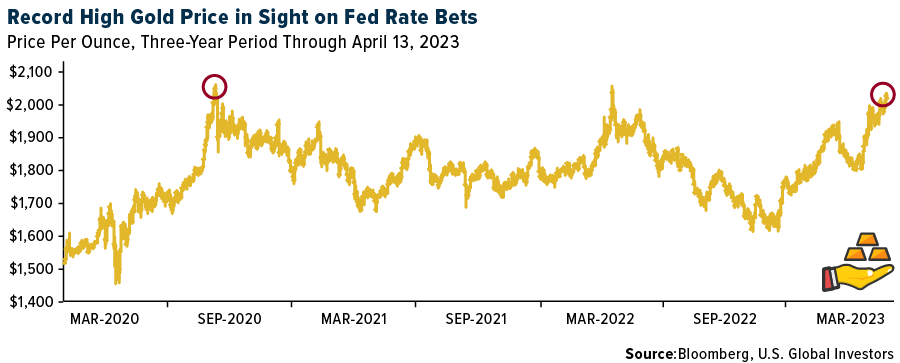

- Gold extended gains above $2,000 an ounce, inching closer to a record as investors awaited U.S. inflation data that may offer fresh insight into the Federal Reserve’s next rate move. Bullion rose for a second day to trade about 3% below a record set in 2020.

Weaknesses

- The worst performing precious metal for the week was gold, but down just 0.36%. Global platinum production declined by 5.7% to 5.8 million ounces (moz) in 2022, with combined output from South Africa and the U.S. declining from 4.7moz in 2021 to 4.4Moz in 2022. Looking ahead, global platinum production is expected to recover in 2023, up by 3.1% to 6.1moz. While South Africa is expected to contribute the majority of this growth, a marginal increase is also expected from the U.S. In South Africa, growth will be mainly supported by an expected increase in production from Impala, coupled with Sibanye Stillwater’s Marikana and Rustenburg Complex.

- Evolution Gold provided an update on the March quarter, which highlighted gold and copper production that was below expectations at 163,900oz and 9,700 tons, respectively. Annual guidance was moved from approximately 720,00oz gold at cash costs of A$1,240/oz to approximately 660,00oz gold at cash costs of A$1,390/oz.

- K92 Mining announced first-quarter production of 21,500oz gold, 1.7 million pounds copper and 29,900oz silver. The company expects second-quarter production to be moderately below budget, with the second half being the strongest and 2023 production within the bottom half of the guidance range.

Opportunities

- A story on Bloomberg highlights potential opportunity for gold to take investor confidence up a notch in terms of technical signals to watch for next week. Over the last three years, gold has traded above $2,000 per ounce three times but in the previous two instances, gold didn’t stay above this technical hurdle for very long before the rally failed. The longest span was five days, so with the current price run we are now on four days above $2,000. While it’s only a technical trading level, gold bulls would love to have $2,000 become the new floor in gold prices and not the ceiling.

- Scotia expects higher gold prices to boost margins and cash flow as companies begin to report results later this month; however, much of the benefit from higher metals prices is likely to fall into the second quarter (assuming metals prices remain at elevated levels).

- Newmont Corp. has increased its record offer for Australian competitor Newcrest Mining Ltd. to A$29.4 billion ($19.5 billion) to create a precious metal powerhouse. Two months after Newcrest rejected Newmont’s $17 billion all-stock offer, the amended deal would give Newcrest shareholders 0.4 shares in the world’s largest gold miner. Newcrest can pay a $1.10 franked special dividend under the arrangement. That is A$32.87 per share, a 46% premium to Newcrest’s undisturbed price before February’s offer. It could be the largest gold mining takeover.

Threats

- British money supply economist Simon Ward correctly predicted sky-high inflation before anyone else did is sounding the alarm that central bankers have raised interest rates too far as money supply in the U.K., eurozone and U.S. is collapsing. When the pandemic hit central banks’ vast quantitative easing programs and sharp rate cuts led to double-digit money supply growth in the U.S. and Europe. A year later we had double digit inflation. Today, money supply is plummeting. M1 narrow money, cash and overnight deposits, is negative for the first time since the eurozone block formed in 1999. M2 growth. M2, which measures cash in circulation, plus dollar in the bank and money market accounts, in U.S. recently contracted and suggest recession, disinflation and deflation.

- Bank of America believes Kinross could be weaker-than-expected on continued inflationary cost pressures and seasonal production weakness at the North American mines, and tie-ins for the Tasiast expansion to 24,000 tons per day, which Kinross expects to reach design throughput by mid-year. Kinross has the highest debt in their coverage and will be susceptible to any downward pressure on the gold price.

- The largest cyclone to hit Western Australia in over a decade is anticipated to impact Newcrest Mining; it may be the worst storm in over a decade. It will be category 4 and operations at the Telfer gold mine are on pause. Hopefully this cyclone will not create significant damage, people will stay healthy and business will return to normal.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/22):

Royal Gold Inc.

Impala Platinum Holdings Ltd.

Sibanye Stillwater Ltd.

K92 Mining Inc.

Newcrest Mining Ltd.

Kinross Gold Corp.

United Airlines Holdings Inc.

United Parcel Service Inc.

Hermes International

LVMH Moet Hennessy Louis Vuitton

Apple Inc.

Kering SA

Christian Dior SE

Azul SA

American Airlines Group Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Shanghai Shipping Exchange Containerized Freight Index reflects the spot rates of Shanghai export container transport market. It includes both freight rates (indices) of 15 individual shipping routes and a composite index.

The Solactive Global Shipping Index is a rules-based index that seeks to provide exposure to a global portfolio of companies identified as being engaged in the water transportation industry.

The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. No security can have more than a 24% weighting.

The CAC 40 is a free float market capitalization weighted index that reflects the performance of the 40 largest and most actively traded shares listed on Euronext Paris and is the most widely used indicator of the Paris stock market.