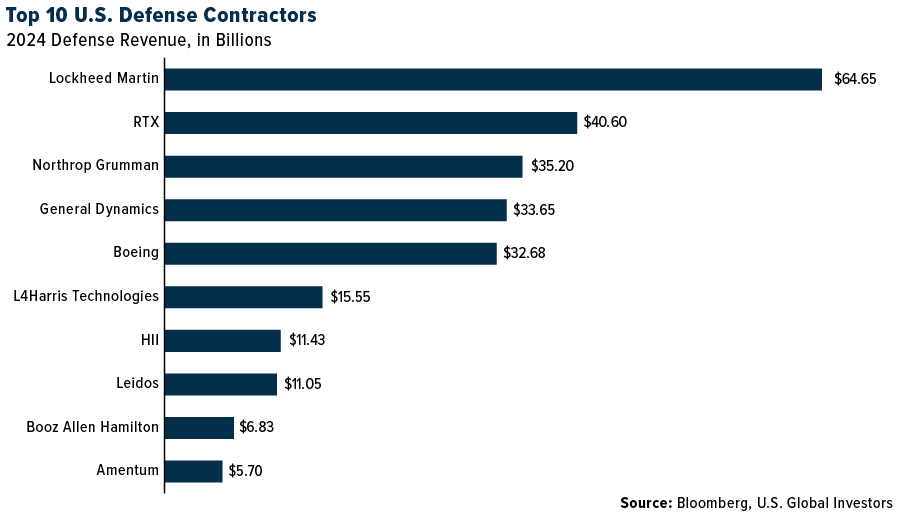

The Top 10 U.S. Aerospace and Defense Contractors

The aerospace and defense industry plays a pivotal role in both national security and the stock market. With U.S. defense spending leading the world, the largest contractors are well-positioned for growth amid rising global tensions.

Below, I rank the top 10 U.S. contractors by defense revenue, using 2024 data from Defense News. I believe these companies represent attractive opportunities for investors seeking exposure to the sector.

10. Amentum

Amentum, a leading provider of engineering and technical services, specializes in supporting government missions. The Virginia-based company’s $5.7 billion in defense-related revenue stems from key contracts with the Department of Defense (DoD) and other federal agencies. Amentum’s expertise spans logistics, cybersecurity and nuclear operations.

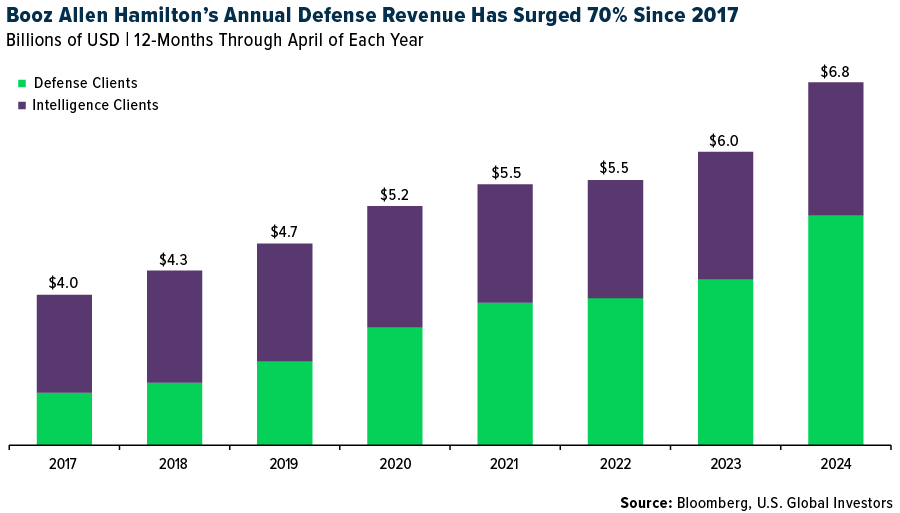

9. Booz Allen Hamilton

Booz Allen Hamilton has built its reputation as a leading provider of technology and consulting services for the DoD. The company leverages advanced capabilities in artificial intelligence (AI) and cybersecurity to address complex defense challenges. With $6.8 billion in defense-related revenue, Booz Allen’s strong cash flow and diversified portfolio make it an attractive investment in the defense space.

8. Leidos

Leidos specializes in IT services and solutions, providing support for mission-critical systems for both the DoD and other federal agencies. With $11.1 billion in defense revenue, the company’s expertise spans cybersecurity, data analytics and autonomous systems. Last year, Leidos secured major contracts like the Advanced Battle Management System (ABMS) and engineering services for the F-16 weapon system. Its consistent revenue growth demonstrates strong operational performance and future potential.

7. HII (Huntington Ingalls Industries)

HII is a leader in shipbuilding and defense technologies, generating $11.4 billion in defense-related revenue. As the sole builder of U.S. Navy aircraft carriers and a key supplier of nuclear-powered submarines, HII has expanded its capabilities in unmanned underwater vehicles (UUVs) and cybersecurity. Its strategic focus on naval innovation ensures its continued importance in U.S. defense operations.

6. L3Harris Technologies

L3Harris Technologies is known for its advanced communication systems, tactical radios and next-generation jamming technology. The Florida-based company’s $15.6 billion in defense-related revenue reflects its critical role in providing cutting-edge solutions to the U.S. military. Recent achievements include contracts for the Glide Phase Interceptor and acquisition of space exploration company Aerojet Rocketdyne. With an emphasis on margin expansion and cost efficiency, we believe L3Harris is well-positioned for continued growth.

5. Boeing

Boeing’s defense segment, which contributed $32.7 billion in revenue last year, complements its commercial aerospace business. Programs like the F-15EX fighter jet and satellite systems highlight Boeing’s engineering background. Despite challenges in its commercial segment, Boeing’s defense arm continues to drive innovation and secure key contracts.

4. General Dynamics

General Dynamics’ diverse portfolio spans combat vehicles, shipbuilding and IT services, generating $33.7 billion in defense revenue in 2024. Its Gulfstream aerospace division also contributes to its strength, although primarily in the civilian sector. The Virginia-based company’s shipbuilding division, which delivers submarines to the U.S. Navy, was just awarded a $188 million contract to aid Virgina-class submarines. With profitability expected to rise through improved margins, General Dynamics remains a cornerstone of U.S. defense capabilities.

3. Northrop Grumman

Northrop Grumman is at the forefront of aerospace and defense innovation, with $35.2 billion in defense revenue. Known for its contributions to nuclear modernization, the B-21 Raider stealth bomber and space systems, Northrop is a leader in cutting-edge defense technologies. The company has expanded its missile production capacity and bolstered its backlog through international sales and key programs like Sentinel.

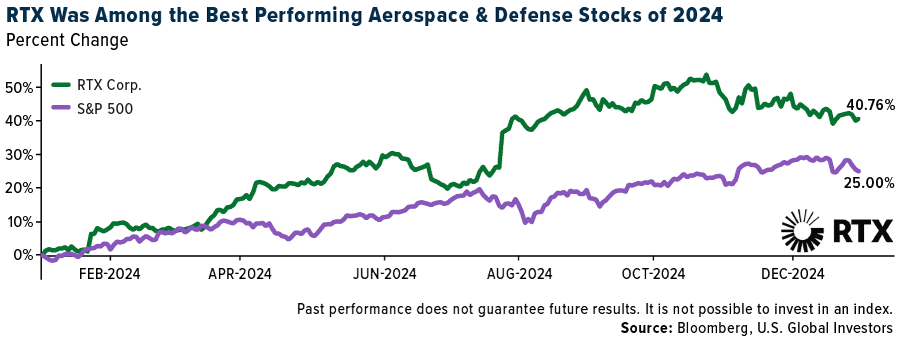

2. RTX

RTX specializes in missile systems, integrated defense solutions and advanced sensors, with $40.6 billion in defense revenue in 2024. Formerly known as Raytheon Technologies, the company’s notable projects include hypersonic weapons development and advanced air defense systems. RTX’s strategic divestitures also demonstrates its commitment to delivering shareholder value.

1. Lockheed Martin

Lockheed Martin stands as a giant in the defense sector, with a whopping $64.7 billion in defense revenue. The Bethesda, Maryland-based company’s iconic programs like the F-35 Lightning II fighter jet and advanced hypersonic weapons have solidified its dominance. Lockheed continues to expand its space division, announcing its acquisition of satellite firm Terran Orbital in August 2024. Its robust backlog and commitment to cutting-edge technology make it, I believe, a no-brainer for defense investors.

The Investment Opportunity

As geopolitical tensions continue to rise, we expect the demand for advanced military technologies to continue growing. By understanding the strengths and strategies of these top contractors, investors can make informed decisions to capitalize on this essential industry.

Interested in learning more? Get a special recording of me discussing today’s aerospace and defense industry with Lieutenant General (Retired) John Evans by emailing info@usfunds.com! Use the subject line “aerospace & defense.”

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.86%. The S&P 500 Stock Index fell 1.94%, while the Nasdaq Composite fell 2.34%. The Russell 2000 small capitalization index lost 3.49% this week.

- The Hang Seng Composite lost 3.92% this week; while Taiwan was up 0.45% and the KOSPI rose 3.02%.

- The 10-year Treasury bond yield rose 17 basis points to 4.76%.

Airlines and Shipping

Strengths

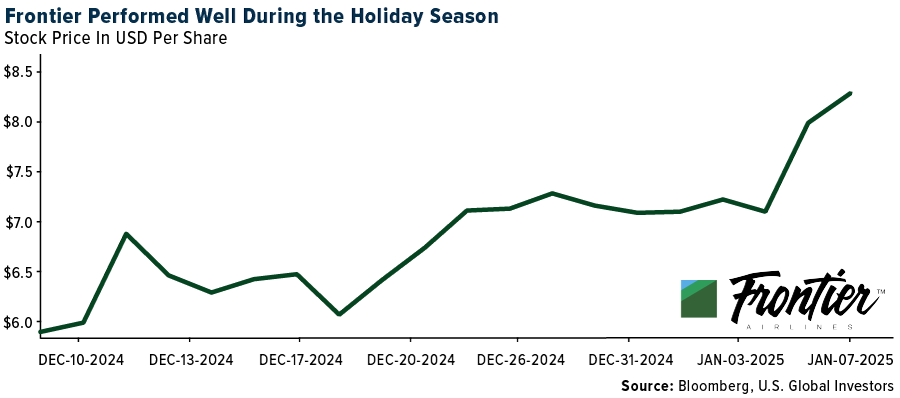

- The best performing airline stock for the week was Frontier, up 15.3%. According to UBS, Frontier now expects a fourth-quarter pretax margin of 4% versus 0-2% earlier, driven by its updated fourth-quarter RASM guide of 14% (versus 11-12% previously). Costs and ASM were also slightly better than the previous guide.

- The International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) reached a tentative deal on a new six-year contract, the ILA-USMX Master Contract, reports Bank of America. Both sides previously agreed on a sizable 62% wage increase over six years (to base rate of $63 per hour from $39 per hour, or a $4 per hour per year increase).

- November U.S. airfares continue to trend upwards. According to the U.S. Bureau of Labor Statistics, airline fares were up 0.4% month-over-month, ticking up sequentially for the fourth month in a row. November airfares continued to tick up positively, up 4.7% year-over-year.

Weaknesses

- The worst performing airline stock for the week was Make My Trip, down 9.2%. According to Raymond James, the DOT will fine JetBlue $2 million over chronic delays (routes of service at least 10X per month with arrivals >30 minutes late >50% of the time) on four routes between June 2022 and November 2023. This comes with $1 million of the fine to be applied toward past/future passenger compensation.

- Container shipping capacity grew by 10.1% last year, easily outstripping the 5.4% rise in container trade, but helped by the longer ton-mile factors. It is unlikely 2025 will be as strong as 2024, but with conditions already tight, it would not take much of a disruption and buildup of vessels waiting to offload to create pricing tension, according to Stifel.

- Lufthansa Germany mainline is experiencing excessive costs and low productivity, reports JP Morgan. This is due to aircraft delays, operational buffers, high airport costs, and aggressive wage inflation. One of the key drivers in 2025 will be staff costs due to 1): Pay increases from previous wage agreements at 5% and, 2) New hiring with Lufthansa targeting 10,000 additional group staff for 2025 estimated.

Opportunities

- According to Benzinga, the U.S. airline industry is gearing up for a blockbuster year in 2025, Morgan Stanley analysts say, predicting airline companies on the brink of what could be a “perfect storm of tailwinds that essentially propels the industry to make money.”

- Near-term spot freight rates are poised to increase further, says JP Morgan, driven by a surge in pre-tariff cargo front-loading ahead of Trump’s inauguration, an early Lunar New Year break, and the escalating threat of a U.S. East Coast port strike.

- The Bloomberg Second Measure Panel transactions data suggest year-over-year revenue growth accelerated by 400 basis points (bps) on average (ex-Alaska) in the fourth quarter relative to the third quarter. They believe the data provides a good directional read into airline revenues and has high correlation with reported revenues for several airlines (90%+), explains UBS.

Threats

- The IATA observed that the average age of the global fleet has risen to a record 14.8 years (versus 13.6 years from 1990-2024). The number of “parked” aircraft is 14% of the total fleet, which is up 4 points versus pre-pandemic, with half parked for engine inspections.

- Port labor negotiations are expected to resume January 7, according to Morgan Stanley. It was reported both sides have been informally talking for some time, although the official negotiations will resume ahead of the January 15 contract deadline. Shipping line operators have announced plans ahead of a potential strike with Hapag-Lloyd announcing container surcharges in the event of a strike and Maersk is urging shippers to clear out containers and return empty containers ahead of January 15.

- Indian carriers continue to gain share in international traffic – 25% of their international slots are not utilized. This will present increased competition to all other carriers that fly to India right now, according to Elara.

Luxury Goods and International Markets

Strengths

- The jobs market in the U.S. remains strong. Nonfarm payrolls increased by 256,000 in December, surpassing the expected 165,000, according to the Bureau of Labor Statistics. The unemployment rate unexpectedly dropped to 4.1% in December, down from 4.2% in November.

- Tesla released a new model Y in China, which is also available for purchase now in Australia and parts of Asia. The upgraded Model Y offers a range of up to 593 kilometers (368 miles), while the long-range version is said to reach 719 kilometers (446 miles) on a single battery charge.

- Real Real, online marketplace for sale of lxuruy goods in the United States, was the top-performing stock in the S&P Global Luxury sector, gaining 36.26% in the past five days. Wells Fargo said the company share could double due to structural changes.

Weaknesses

- Constellation Brands reported a sales and earnings miss for its fiscal third quarter and lowered its guidance. The company’s two business segments, beer and wine & spirits, have been on different trajectories. While beer sales have seen growth, the wine and spirits segment, which accounts for 15% of the company’s revenue, has been struggling.

- Noveber retail sales in the eurozone rose less than expected. Year-on-year growth in retail sales softened to 1.2% from 2.1% in October.

- Cettire, Austrailan online marketplace for sale of lxuruy goods to customer worldwide, was the worst-performing stock in the S&P Global Luxury Index, falling 14.5%. Shares declined despite low news activity.

Opportunities

- LVMH purchased a 12-bedroom villa in Cannes, France, known as Villa Bagatella, for 46.5 million euros to enhance its presence during major events like the Cannes Film Festival. The villa will be used for exclusive events and ummer rentals, reflecting a trend in a luxury retail toward experimantal marketing and real estate investmetns.

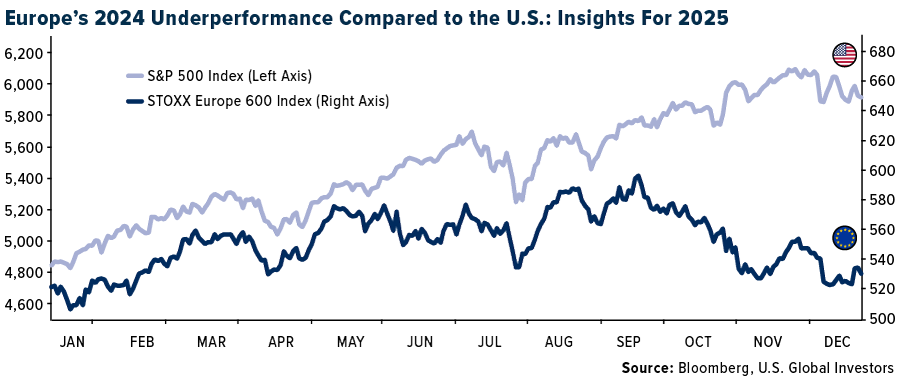

- Deutsche Bank predicts that European equities could outperform the U.S. market in 2025. Strategists led by Maximilian Uleer forecast a 15% rise in the STOXX 600 index, driven by improved economic prospects, diminishing political risks and potential Chinese stimulus. Many luxury companies are listed in Western Europe, particularly on the Paris and Milan stock exchanges.

- The head of luxury research at UBS, Suzanne Pusz, expects the luxury sector to grow by an average of 4% this year, up from no growth last year. While the sector is projected to grow, the growth will remain below the long-term average. Once again, stock selection will be crucial, as the performance differences between winners and losers may be significant. UBS favors Hermes and Richemont.

Threats

- The first full week of trading in the new year saw increased volatility in luxury stocks. On Monday, luxury sectors rose sharply due to rumors that President-elect Donald Trump might impose more targeted tariffs instead of the broad universal tariffs. However, later in the week, luxury stocks sold off after CNN reported that the incoming president was considering declaring a national economic emergency to justify universal tariffs. Political developments, new regulations and changes in policy may continue to drive volatility in equities.

- Tariffs may play an important role in retail profitability. Constellation Brands, a company that recently reported weaker financial results, may need to raise prices if Trump increases the import tax on goods from Mexico by 25%. Mexican beer accounts for 80% of Constellation’s sales, and according to Roth MKM analyst Bill Kirk, the company may have to increase prices by 12% to offset the new tax.

- France, Europe’s second-largest economy and home to many luxury stocks, is once again in the midst of tense budget discussions following Prime Minister Michel Barnier’s loss in a vote of no confidence. President Emmanuel Macron appointed François Bayrou as the new prime minister, while the newly appointed Finance Minister, Eric Lombard, is working to relaunch the budget process. This process will be crucial for determining the future of the new prime minister and could have significant implications for Macron’s presidency.

Energy and Natural Resources

Strengths

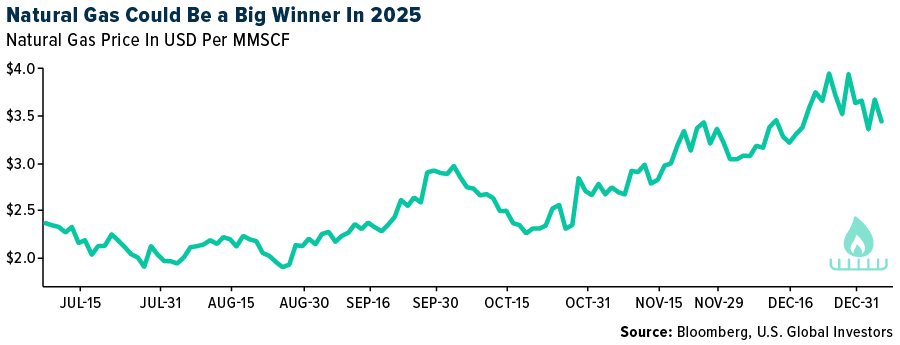

- The best performing commodity for the week was natural gas, rising 17.XX%. Raymond James projects U.S. natural gas prices to average $4 per million standard cubic feet (MMSCF), significantly above current futures levels. The energy sector continues to center on AI-related developments, as investors focus on the growing electricity demand driven by AI. Meeting this demand will require an all-encompassing strategy, leveraging natural gas, renewables, and, where feasible, nuclear energy—though the latter comes with long lead times and specific challenges.

- Global liquified natural gas (LNG) exports reached 107.5 million tons (mt) in Q4, matching the quarterly record and marking a 5.9 mt sequential increase, according to the latest Bloomberg data. This growth was supported by the ramp-up of LNG production in Congo and Altamira earlier in the year, de-bottlenecking efforts at Freeport LNG

- The world’s top cobalt producer achieved record-breaking output in 2024, driven by rapid scaling of its massive African mines. China’s CMOC Group announced on Monday that it produced 114,165 tons of cobalt last year, according to a stock exchange filing with preliminary data. This figure more than doubled its 2023 production and exceeded the company’s earlier 2024 guidance, which had projected a maximum of 70,000 tons, Bloomberg reports.

Weaknesses

- Sugar was the worst-performing commodity of the week, falling 3.XX%. Meanwhile, iron ore prices have declined to $99 per ton, with fundamental signals continuing to soften. Iron ore inventories at Chinese ports remain elevated at 145 million tons. Steel production is also seasonally moderating as mid-December approaches, and iron ore supply remains robust, with shipments from traditional markets up 2% in 2024.

- Nippon Steel’s thwarted bid to expand in the U.S. could mean tougher competition for Chinese mills in an already saturated global market. Creating an entity to compete more effectively with China, the world’s biggest producer and consumer of steel, was touted as a key rationale behind the Japanese firm’s proposal to purchase United States Steel Corp., according to Bloomberg.

- In October, the U.S. imported 90 tons of enriched uranium, a decrease of 38% compared to the previous month and 49% year-over-year. Year-to-date imports are also down 21% from the prior year. This decline reflects the substantial restocking that occurred in 2023 ahead of the U.S. ban on Russian uranium, implemented in August. Since the ban took effect, imports from Russia have dropped to zero, despite some U.S. utilities obtaining waivers, according to RBC.

Opportunities

- Refiners are likely to benefit in several ways under a Trump administration. President Joe Biden’s push for stricter Corporate Average Fuel Economy (CAFE) standards has directly impacted gasoline and diesel demand. A rollback of these standards and reduced support for electric vehicles under Trump could provide a boost to refiners. Additionally, refiners, as cash tax payers, stand to gain if the corporate tax rate remains unchanged at 21%, which UBS highlights as a significant positive.

- Constellation Energy agreed to acquire closely held Calpine for $16.4 billion to add scores of power generation assets across the U.S. as the nation’s electricity demand is forecast to surge. Constellation will pay a mixture of cash and stock, the companies said Friday in a statement. Constellation will also assume about $12.7 billion of Calpine’s net debt, according to Bloomberg.

- RBC spoke positively this week about the opportunity found in International Paper’s acquisition of DS Smith. International Paper’s $7.2 billion acquisition of DS Smith positions the company as a global leader in sustainable packaging, consolidating its presence in the U.S. and Europe, two of the largest markets for these materials. This move offers a prime opportunity to capitalize on the growing demand for environmentally friendly packaging.

Threats

- The United States’ reliance on discounted Canadian oil reached a record high of 4.42 million barrels per day last week; this reliance shows the supply that would be directly impacted from trade tensions and potential tariffs.

- At the end of 2024, following the failure to extend the transit of Russian gas via Ukraine, Russia further slowed pipeline gas flows into Europe, creating an incremental challenge to satisfy demand not only in the winter, but also to fill storage through 2025, according to RBC.

- The Panama government’s temporary closure of First Quantum’s 400,000-ton Cobre Panama mine was a key driver of copper’s rally in the first half of 2024. Building on this, the country’s Environment Ministry has launched a public consultation to assess environmental risks, propose mitigation measures, and evaluate the potential costs of a permanent mine closure. The consultation is set to conclude on February 7, according to Bank of America.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was XDC, rising 9.59%.

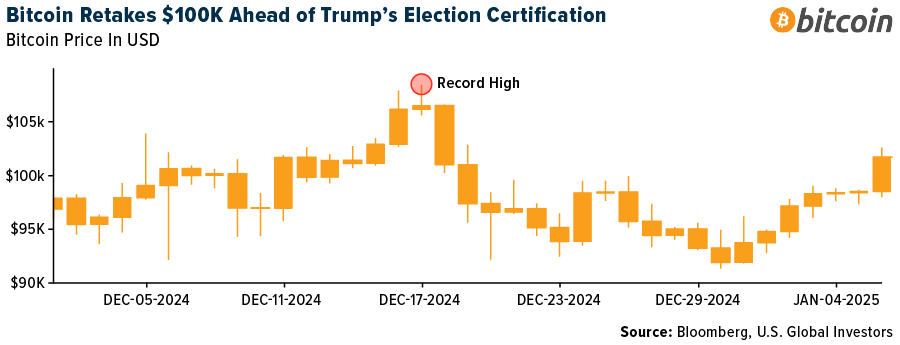

- Bitcoin pushed above $100,000 for the first time in two weeks as Donald Trump’s U.S. election victory was ratified. The popular digital asset rose as much as 2.8% to $101,180 on Monday, according to data compiled by Bloomberg.

- Digital-asset prime brokerage firm FalconX has acquired Arbelos Markets, a derivatives startup launched in 2023 by two crypto industry veterans. Terms of the transaction weren’t disclosed, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was RUNE, down 32.01%.

- Investors yanked a net $333 million from BlackRock’s iShares Bitcoin Trust ETF (IBIT) on Thursday, the most withdrawn from the record-breaking fund since its launch, according to Bloomberg.

- Terraform Labs co-founder Do Kwon pleaded not guilty to U.S. fraud charges tied to the $40 billion collapse of the TerraUSD stablecoin. Kwon entered his pleas Thursday before a U.S. judge in Manhattan, writes Bloomberg.

Opportunities

- The crypto trading and liquidity-providing firm GSR obtained approval from the UK’s financial industry regulator. The move gives GSR Markets UK Limited the green light to operate as a registered crypto asset business and to conduct, among other services, crypto trading for UK-based clients, writes Bloomberg.

- The Winklevoss twins’ Gemini Trust Co’s crypto exchange has made a slew of senior appointments in Europe as it seeks to grow its presence in the region this year under the bloc’s new regulatory regime, reports Bloomberg.

- Crypto prices are rising once again with many of the alternatives to Bitcoin outperforming on Thursday as investors expand their holdings at the start of the new year. Heading into the new year, market participants have started to diversify their exposure by allocating capital to representations of more speculative narratives, according to Chris Newhouse on a report published by Bloomberg.

Threats

- The Winklevoss twins’ Gemini Trust cryptocurrency exchange agreed to pay $5 million to end a commodity futures trading commission lawsuit, claiming it misled the derivatives regulator in a bid to launch the first U.S.-regulated Bitcoin futures contract, according to Bloomberg.

- Terraform’s Do Kwon will face a 2026 trial in New York on a U.S. fraud charge for the collapse of the TerraUSD stable coin in 2022. The U.S. district judge Paul Engelmayer scheduled the trial for January 26, 2026, writes Bloomberg.

- Bitcoin’s march back above $100,000 didn’t last too long. The token slid the most in more than two weeks on Tuesday, shows Bloomberg, joining a retreat in the U.S. stocks as fresh economic data sent Treasury yields soaring on Tuesday and Friday.

Defense and Cybersecurity

Strengths

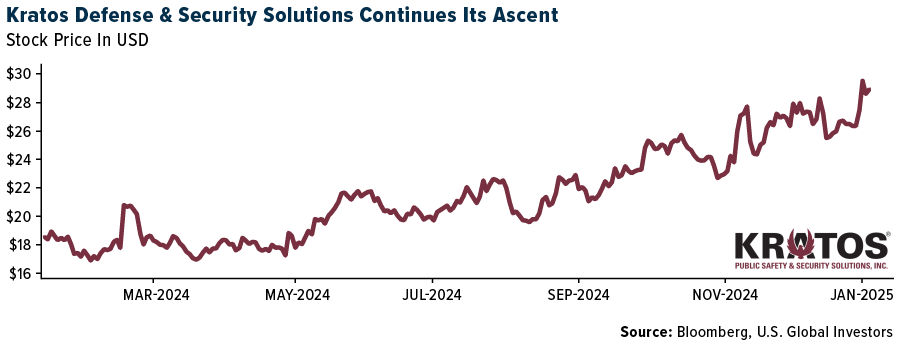

- Kratos Defense and Security Solutions was awarded a five-year, $1.45 billion contract under the MACH-TB 2.0 program to provide hypersonic flight-testing services for the U.S. Department of Defense, the largest award in the company’s history.

- The U.S. State Department approved a potential $3.64 billion sale of advanced air-to-air missiles to Japan, enhancing its defense capabilities, with RTX Corporation as the main contractor, and Congress notified on Thursday.

- The best performing stock this week was AAR Corp., rising 8.35% after the company reported better-than-expected Q2 earnings of $0.90 per share and $686.1 million in revenue, marking 26% sales growth driven by strong organic growth and improved margins.

Weaknesses

- North Korea test-fired a new hypersonic intermediate-range ballistic missile (IRBM) featuring advanced materials and solid-fuel technology, capable of reaching speeds of Mach 12 and a range of 3,000–5,500 km, marking a refinement of its strategic weapon systems.

- The devastating toll of at least 30 lives, including women and children, lost in Israeli strikes across Gaza earlier this week, coupled with missile attacks on Israel, underscores the urgent need for progress in the upcoming ceasefire talks in Qatar to prevent further civilian suffering and escalating violence.

- The worst performing stock this week was Archer Aviation. The stock declined 22.07% after JPMorgan downgraded the stock to neutral from overweight, despite raising its price target to $9 from $6.

Opportunities

- Northrop Grumman successfully tested a new solid rocket motor for the U.S. Navy’s extended-range and hypersonic missions.

- BAE Systems’ subsidiary Bohemia Interactive Simulations and Rheinmetall AG have partnered to develop advanced combat and firing simulators for the German Army’s Medium Forces using BISim’s VBS4 and Blue IG technologies.

- The Biden administration is negotiating with the Taliban to trade Americans detained in Afghanistan for at least one Guantanamo prisoner, Muhammad Rahim al Afghani, allegedly an Osama bin Laden associate, but no agreement has yet been reached.

Threats

- Ukraine claimed responsibility for a drone attack that caused a massive fire at a fuel depot in Russia’s Saratov region, disrupting logistics for a Russian strategic bomber, it was one of a key military fuel depot deep inside Russia.

- Taiwan suspects a Chinese-owned cargo ship deliberately damaged an undersea cable near its coast, highlighting the vulnerability of its communications infrastructure, though data was rerouted without disruption, as investigations involving multiple countries continue.

- The Government Accountability Office denied L3Harris’s protest regarding the HADES contract award to Sierra Nevada, allowing the Army to proceed with its plan to convert Bombardier’s Global 6500 business jets into a new spy plane platform.

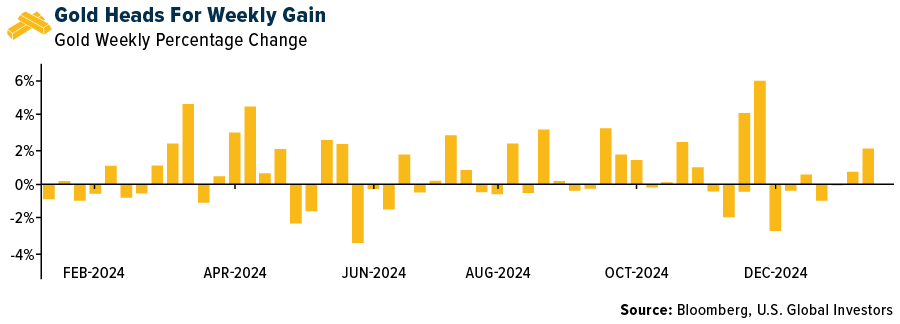

Gold Market

This week gold futures closed at $2,719.70, up $65.00 per ounce, or 2.45%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher/lower by 2.99%. The S&P/TSX Venture Index came in off 2.39%. The U.S. Trade-Weighted Dollar rose 0.60%.

Strengths

- Platinum was the best-performing precious metal of the week, rising 5.08%. K92 Mining reported record quarterly production for Q4 2024, with 53,401 ounces of gold, significantly surpassing RBC’s estimate of 29,404 ounces. The company also achieved record annual production of 149,515 ounces, a 27% year-over-year increase. Following the production beat, K92’s share price closed 15.58% higher.

- The World Gold Council (WGC) reports that global physically backed gold ETFs saw net inflows in December, reversing previous trends with an addition of $778 million. Asia and Europe led the inflows, while North America experienced modest outflows. Notably, 2024 marked the first positive December for global gold ETFs since 2019, with collective holdings increasing by four tons to a total of 3,219 tons.

- China’s central bank expanded its gold reserves for a second straight month in December, signaling renewed appetite after temporarily pausing purchases last year as prices soared. Bullion held by the People’s Bank of China rose to 73.29 million fine troy ounces in December, from 72.96 million in the previous month, according to Bloomberg.

Weaknesses

- Gold was the worst-performing precious metal of the week, though it still posted a gain of 2.45%. According to Canaccord, Bellevue Gold reported Q4 2024 sales of 26.2K ounces, falling short of the consensus estimate of 38K ounces—a 30% miss. All-in sustaining costs (AISCs) were not disclosed. Following the announcement, Bellevue’s share price dropped 13.54%.

- Goldman Sachs said it no longer sees gold reaching $3,000 an ounce by the end of the year, pushing the forecast to mid-2026 on expectations the Federal Reserve will make fewer rate cuts. Slower monetary easing in 2025 is set to crimp demand for bullion-backed exchange-traded funds, causing analysts to project prices to hit $2,910 an ounce by year-end, according to Bloomberg.

- The U.S. Mint says American Eagle gold coin sales totaled 412,500 ounces in 2024, compared to 1,092,000 ounces in 2023, according to Bloomberg.

Opportunities

- For those looking to use historical trends as an investment guide to start out the year, very few assets have done better than gold in January. Data going back 30 years show spot gold gains on average 2.23%. That is five times the historical monthly average for the other 11 calendar months and nearly a full percentage point above the 1.4% average gain for August, the second-best month, according to Bloomberg.

- State Street, which oversees a portfolio valued at $4.73 trillion USD ($7.6 trillion AUD), highlighted growing concerns over the potential return of high inflation, rising government debt and escalating geopolitical tensions under a Trump administration. These factors are expected to drive increased gold buying as a means to protect wealth and hedge against uncertainty. State Street’s chief gold strategist, George Milling-Stanley, remarked, “We don’t see this changing and expect the secular demand trends supporting gold’s price and its status as a safe haven to continue bolstering its appeal as a core portfolio asset, even if capital markets adopt a risk-on tone in 2025.”

- Money managers are seeing plenty of reasons to remain bullish on gold, following a stellar 2024 that saw the precious metal post its biggest annual gain since 2010. Bullion surged 27% last year, hitting record highs as it soared to almost $2,800 an ounce. Three main factors fueled the rally: large purchases by central banks, notably those in China and other emerging markets; the Fed’s monetary easing, which makes non-yielding gold more appealing; and the precious metal’s historical role as a haven amid ongoing geopolitical tensions, according to Bloomberg.

Threats

- Barrick remains restricted from shipping gold from its Loulo-Gounkoto mining complex in Mali. In addition, an interim attachment order has now been issued against the existing gold stock on site which prevents its export and disrupts normal operations. Barrick’s president and CEO Mark Bristow says the inability to ship gold not only affects operations but has broader implications for the local economy, the 8,000 employees and its many local service providers. If this issue is not resolved within the coming week, Barrick will have no choice but to temporarily suspend operations at Loulo-Gounkoto, according to Bloomberg.

- According to BMO, gold’s geopolitical risk premium could decline in 2025. A combination of the collapse of the Basha al-Assad regime, reduced influence of Iran and the suggestions of a possible deal between Russia and Ukraine all point to gold seeing less “safe haven” demand in 2025 compared to recent years.

- China’s 40% surge in electric vehicle sales in 2024, reaching nearly 11 million units, signals a steep decline in gasoline demand and threatens palladium usage in catalytic converters. As China’s oil demand peaks and rapidly declines, the shift toward EVs challenges both global oil markets and palladium producers.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Tesla Inc.

Constellation Brands Inc.

LVMH Moet Hennessy Louis Vuitton

Hermes International SCA

Cie Financiere Richemont SA

K92 Mining Inc.

Barrick Gold Corp.

Frontier Group Holdings Inc.

General Dynamics Corp.

The Boeing Co.

Leidos Holdings Inc.

Booz Allen Hamilton Holding Co.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 17 countries of the European region.