The Surprising History of Tariffs and Their Role in U.S. Economic Policy

Markets, as we all know, don’t like uncertainty. And right now, there’s a lot of uncertainty surrounding U.S. trade policy.

While the Trump administration’s tariffs on Mexico and Canada have been delayed for a month, the 10% tariff on Chinese goods has gone into effect. The move has rattled markets, leaving many American businesses and consumers wondering what comes next.

Tariffs are a double-edged sword. On the one hand, they can serve as a powerful negotiating tool, as President Donald Trump has pointed out. The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By imposing tariffs, the U.S. can pressure trading partners into more favorable deals and protect domestic industries from unfair competition.

How Key Industries Could Feel the Impact

On the other hand, tariffs raise costs for businesses and consumers. About half of America’s annual imports—more than $1.3 trillion annually—come from China, Canada and Mexico.

Certain sectors will be hit harder than others. The automotive industry, for instance, relies heavily on parts from Mexico and Canada. Energy prices could spike as well, given that over 70% of U.S. crude oil imports come from these two countries. Gas prices in the Midwest alone could rise by as much as $0.50 per gallon, according to the Council on Foreign Relations.

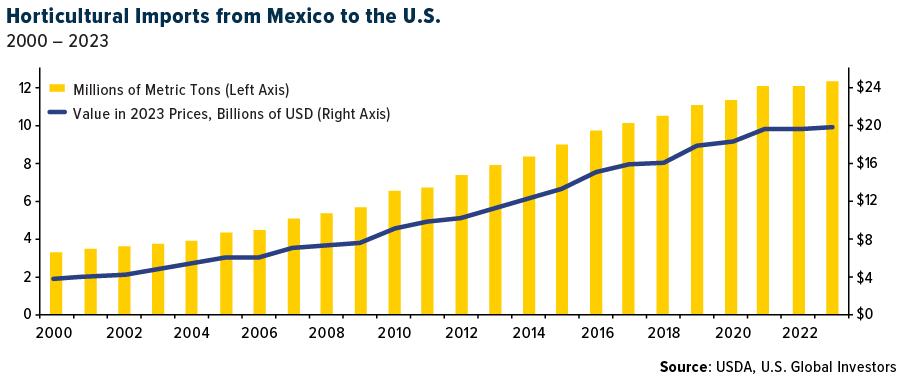

And then there’s food. Mexico supplies over 60% of the fresh vegetables and nearly half of all fruit and nuts consumed in the U.S. Higher import costs could mean higher prices at the grocery store.

A Historical Perspective on Tariffs

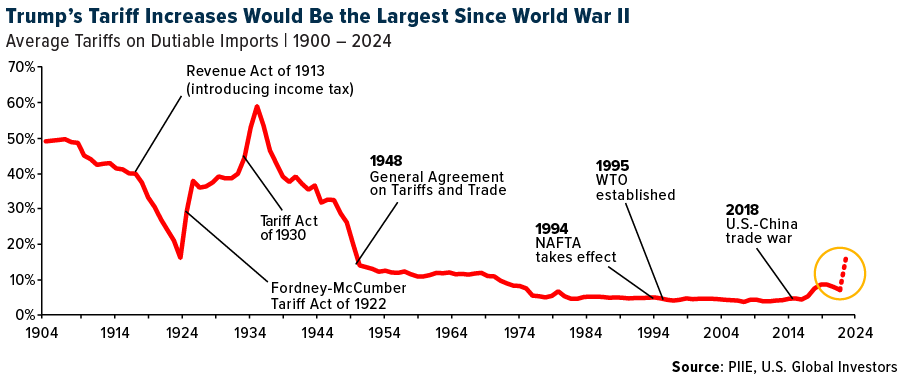

As a historical background, tariffs used to be a major source of government revenue. Between 1798 and 1913, they accounted for anywhere from 50% to 90% of federal income.

But times have changed. Over the past 70 years, tariffs have rarely contributed more than 2% of federal revenue. Last year, for example, U.S. Customs and Border Protection collected $77 billion in tariffs—just 1.57% of total government income.

Since the 1930s, the U.S. has moved away from protectionism in favor of trade liberalization. Agreements like the General Agreement on Tariffs and Trade (GATT) and its successor, the World Trade Organization (WTO), have dramatically lowered global tariffs. Today, roughly 70% of all products enter the U.S. duty-free.

Trump’s approach marks a shift back toward tariffs as a policy tool. And while it’s true that the U.S. has more leverage than most countries—many economies depend on access to the U.S. market—tariffs aren’t without consequences.

China has already retaliated, imposing its own tariffs on U.S. goods. These include a 15% duty on coal and liquefied natural gas (LNG), as well as 10% tariffs on agricultural machinery, crude oil and some vehicles. Beijing has also launched an antitrust investigation into Google—likely as a form of economic retribution.

The Case for a U.S. Sovereign Wealth Fund

In light of these developments, President Trump has floated an interesting idea: using tariff revenue to fund a U.S. sovereign wealth fund (SWF).

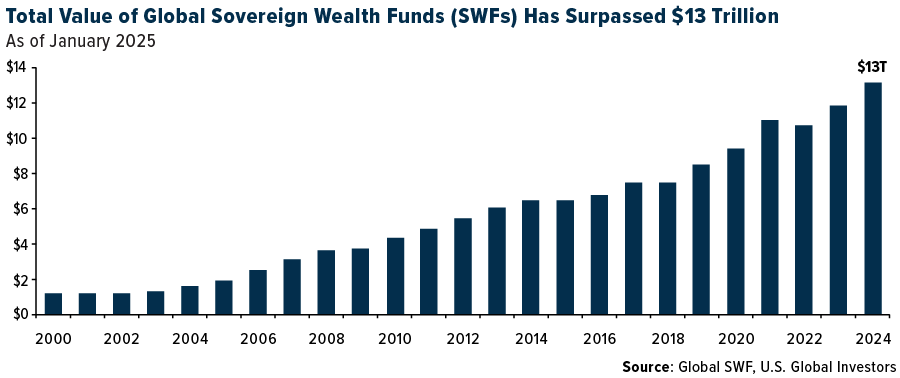

For those unaware, SWFs are government-owned investment funds, typically built from trade surpluses, resource exports or public savings. They serve as long-term savings vehicles, investing in assets like stocks, bonds and infrastructure to benefit future generations. Unlike pension funds, which individuals tap into for personal needs, SWFs are designed to generate national wealth.

Globally, SWFs hold just under $13 trillion in assets—more than ETFs, private equity or hedge funds.

The largest SWF belongs to Norway, which has accumulated a staggering $1.8 trillion thanks to oil and gas revenue. This fund owns roughly 1.5% of all publicly traded stocks worldwide, making it a financial powerhouse. Today, it’s worth four times the country’s GDP—comparable to the entire economy of Australia.

Could the U.S. benefit from a similar investment vehicle? An SWF could help finance infrastructure projects, advanced manufacturing, medical research, national security initiatives and more. If structured properly, it could provide long-term economic stability and reduce dependence on debt-financed government spending.

Could the U.S. Wealth Fund Hold Bitcoin?

Of course, there are challenges. Unlike Norway, the U.S. does not run a persistent trade surplus, nor does it generate excess revenue from oil exports. Most SWFs are built from surpluses, but the U.S. runs a trade deficit, meaning we import more than we export. Last year, the country ran a $1.2 trillion trade deficit, a new record.

An intriguing possibility is incorporating Bitcoin. Trump has previously hinted at the idea of a Strategic Bitcoin Reserve. This would align with broader trends of Bitcoin being treated as digital gold.

As always, the key takeaway is to remain diversified. Trade policy changes can create volatility, but long-term opportunities exist in sectors resilient to tariffs. Gold, energy, infrastructure and select equities may benefit from current market conditions.

Explore our interactive infographic about tariffs by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.