The Real Reason Why 50 Million Americans Will Be Betting on the Super Bowl

[responsivevoice buttontext=”Listen to the Commentary”]

As I write this, more than 22,000 people are believed to have lost their lives due to the 7.8-magnitude earthquake that struck southern Turkey and northern Syria on Monday, with millions more affected.

Even with aid being provided by numerous countries, recovery efforts are hampered by frigid temperatures and crumbling infrastructure, particularly in northern Syria, which has already been devastated by years of civil war.

As many of you know, we invest in Turkey, where stock trading has been halted until February 15 in response to a steep selloff. We’re closely monitoring the situation and are in contact with analysts who can provide us with “boots on the ground” knowledge and insight. We’ll likely have more to say next week.

On behalf of everyone at U.S. Global Investors, I wish to extend my deepest sympathies to all who have been affected.[/responsivevoice]

* * *

[responsivevoice buttontext=”Listen to the Commentary”]

This Super Bowl will also be remembered, I believe, as a major turning point in sports betting in the U.S. More than 50 million American adults are expected to bet on the game, the most ever and a remarkable 61% increase from last year. Betters could collectively wager as much as $16 billion, according to the American Gaming Association (AGA).

So why is this happening? An obvious contributor is the growing availability of online sportsbooks like DraftKings, FanDuel and others. Five years ago, the Supreme Court overturned a 1992 federal law that banned gambling on sports, and today, sports betting is legal in more than 30 states plus Washington, D.C., with several more debating it in state congresses.[/responsivevoice]

Is Sports Betting Legal in Your State?

As of January 31, 2023

[responsivevoice buttontext=”Listen to the Commentary”]

Availability to gambling aside, I think there’s more going on when it comes to explaining the large volume of people participating this year.

Record-High Percent of Americans Predict Stock Declines in First Six Months of 2023

Simply put, people are disappointed with how the stock market has performed over the last 12 months, and they feel jaded by stubbornly high inflation and rising interest rates. Take a look at the returns for companies that advertised during last year’s Super Bowl:

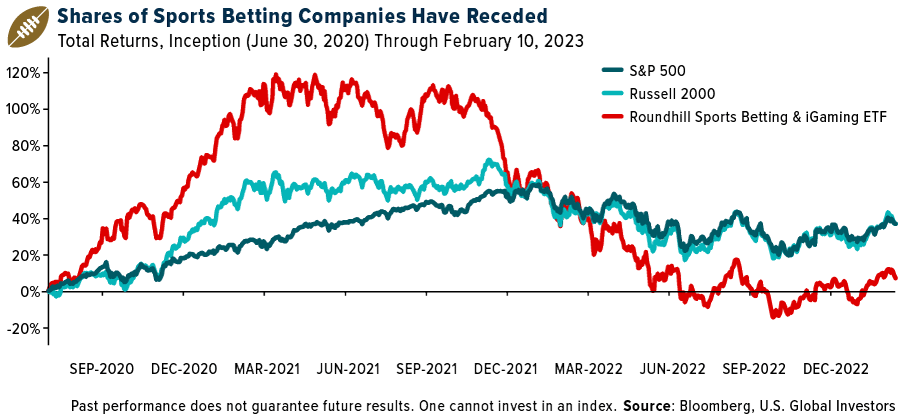

Even betting on the sports betting platforms themselves has been mostly unprofitable. The Roundhill Sports Betting & iGaming ETF, launched in June 2020, rallied during the pandemic months when households were saving money on eating out and attending live events, but shares have since receded as personal savings rates have returned to pre-pandemic lows.

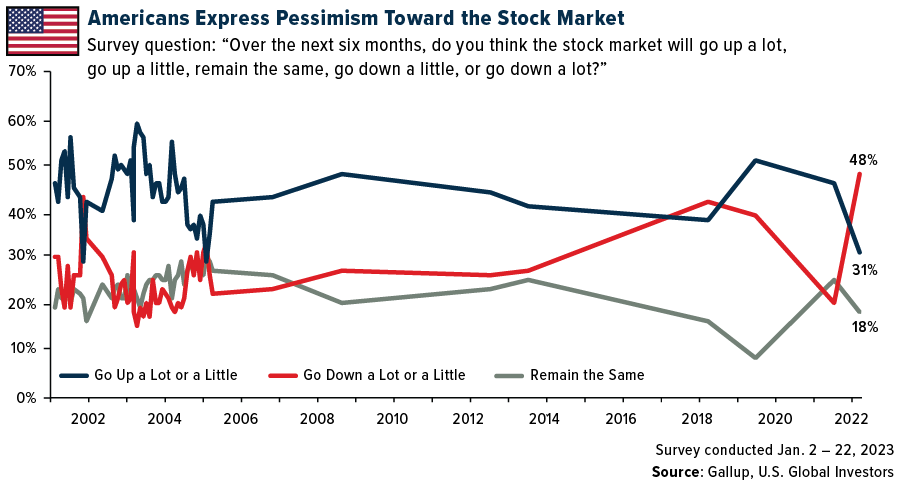

According to a recent Gallup poll, a vast majority of Americans now believe that consumer prices will continue to tick up this year, and nearly 50% predict that stocks will fall in the first half of 2023. That’s a record-high percentage of people expressing pessimism toward the stock market since the firm began asking the question more than 20 years ago.

Taken together, some people may believe that the only way to grow their money right now is to score big on the Super Bowl or other sports event. An estimated 58% of Americans own stocks, which is still a much larger share than those planning to bet in the Super Bowl, but market volatility and economic uncertainty have understandably dented people’s perception of traditional investing.

No Crypto Ads Expected During Super Bowl

The same goes for the crypto industry, which saw a number of scandals and upheavals in 2022 and ended the year down 70%, as measured by the Bloomberg Galaxy Crypto Index. Last year’s Super Bowl was nicknamed the “Crypto Bowl” due to the innumerable ads for Coinbase, Crypto.com, eToro, FTX and others.

In a remarkable about-face, no crypto firm will run ads during this weekend’s Super Bowl. What a difference 12 months can make.

Instead, viewers can expect to see commercials for food and beverage companies, automakers, movie studios and streaming services.

The cost of a 30-second commercial during the 2023 Super Bowl, by the way, is anywhere between $6.5 million and $7 million, a new all-time high. Since the first Super Bowl in 1967, ad prices have increased more than 16,000%.

Another Sign of a Potential Recession: Tighter Lending Standards

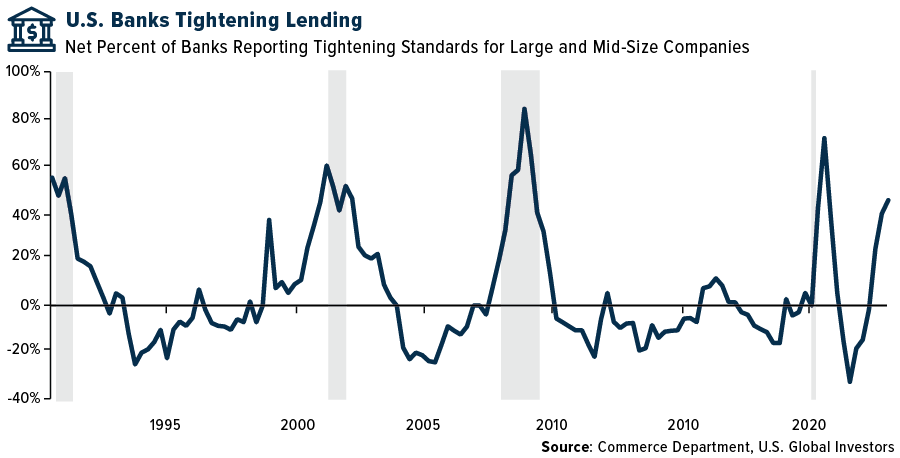

Recession risks are indeed rising, despite the strong jobs market in the U.S. As investment banking company Piper Sandler points out in a research note, every recession has been preceded by three things: 1) rising interest rates, 2) an inflation spike, and 3) tighter lending standards.

All of the attention has been on rates and inflation, but tighter bank lending can be just as meaningful.

Take a look below. The percentage of banks in the U.S. reporting tighter lending standards has continued to increase since the third quarter of 2021, and as of the latest reading, some 45% of banks are saying that they’re slowing the rate of business loans.

A spike in tighter lending standards has historically coincided with economic downturns, as you can see; Piper Sandler says it stands by its forecast for a recession to hit in the second half of 2023.

I think it’s important, then, to proceed with caution. To state the obvious, gambling and sports betting are not the same as investing. You can lose your principal in a matter of seconds betting on a game, with no chance of seeing it ever again.

On the other hand, the value of your stocks can decline, but at least there’s hope of breaking even if you simply refrain from selling at a loss.

Upcoming Webcast!

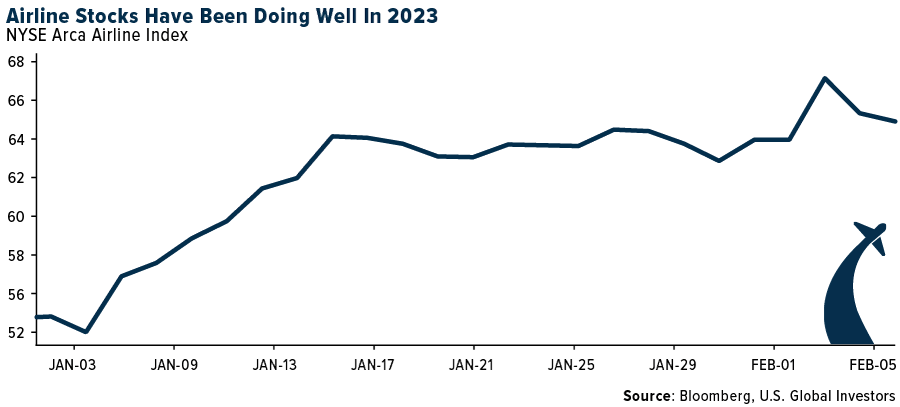

Please join me for a webcast to discuss how airlines are performing and ways to incorporate this industry into your portfolio! The webcast will take place on Tuesday, February 14, at 1:00pm Central time. Save your spot by emailing info@usfunds.com with the subject line “airlines webcast.”[/responsivevoice]

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.17%. The S&P 500 Stock Index fell 1.11%, while the Nasdaq Composite fell 2.41%. The Russell 2000 small capitalization index lost 3.36% this week.

- The Hang Seng Composite lost 2.37% this week; while Taiwan was down 0.10% and the KOSPI fell 0.43%.

- The 10-year Treasury bond yield rose 21 basis points to 3.7444%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Boeing, up 3.3%. Sun Country reported adjusted earnings per share (EPS) of $0.13, better than FactSet consensus of $0.11. The beat versus consensus was primarily due to higher revenue. The company introduced operating margin guidance of 15% to 20%, well ahead of FactSet consensus of 10.3%.

- Euronav, a Belgian international shipping enterprise, posted fourth quarter 2022 EPS of $0.85, coming in ahead of the $0.80 consensus. The first quarter-to-date spot rates achieved by the energy shipping fleet (50% at $54,000-55,000 per day) also point to another strong quarter, which, based on views of supply and demand for the sector over the next few years, confirms the early stages of a likely extended period of robust earnings and cash flow generation.

- In January, airline stocks gained 18.6% and outperformed the S&P 500 by 12.4% following the market trend of buying the 2022 laggards. First quarter 2023 revenue guidance has generally been better-than-expected, driving higher valuation multiples in January.

Weaknesses

- The worst performing airline stock for the week was Azul, down 24.2%. SkyWest reported fourth quarter 2022 results well below consensus, primarily due to contractual changes with its legacy carrier customers which increase current rates but also trigger changes in revenue recognition. Specifically, SkyWest deferred $70 million in revenue in the fourth quarter, for which cash was received.

- Maersk reported fourth quarter 2022 results that missed consensus estimates and issued a new fiscal year 2023 EBITDA guidance of $8-$11 billion that missed estimates, too. Fourth quarter EBITDA hit $6,517 million (-18% year-over-year) versus Bloomberg consensus estimates.

- Like other airlines, Frontier’s orderbook has been pushed out a quarter due to Airbus delivery delays, resulting in 2023 capacity growth coming down by 5 points to +23-28% from +32%. This puts upward pressure on unit costs in the first half of 2023 as the company now expects CASM-ex to be modestly above 6 cents in 2023.

Opportunities

- 2022 saw a strong international traffic recovery for Asia Pacific airlines from 7% of normal in January 2022 up to 40% by December 2022. AAPA sees international traffic back to 75% of normal by the third quarter of 2023 with North Asia leading the recovery and India and ASEAN still having room to grow. And with China’s policies rapidly relaxed, AAPA sees that total traffic could recover to pre-Covid levels by mid-2024.

- Mr. Andrew Matters, Head of Economics at the IATA, shared his outlook for the air cargo market. He thinks the air cargo market is in a transition period to normality in 2023. He believes air cargo revenue will still be 50% higher than 2019 levels in 2023. After this oversupply period, Matters expects positive trends from e-commerce to support air cargo demand in the long term.

- Total orders for aircraft grew 10% in 2022 versus 2021, primarily driven by Airbus. While Boeing orders fell 15% versus 2021, Airbus increased its orders by 40% versus 2021, driven by a large increase on the A320 family. The A321 was the aircraft that received the largest orders. Boeing’s order decline was driven by a decrease on 737MAX orders (-25% growth year-over-year).

Threats

- RBC believes investors are underwriting a more consistent improvement in supply chain execution that they believe is unlikely. After the 2022 supply chain issues, RBC anticipates steady improvement, but also believes that as Boeing looks to push production rates up on the MAX and 787, there will be incremental cracks in the supply chain.

- Mr. Jun Cen, General Manager at Shanghai Hasheng Supply Chain, spoke at a key conference recently. Key takeaways include: 1) the 2023 average freight rate (both air and ocean) could come below that in 2019 (pre-Covid) given weak demand; but could potentially recover to pre-Covid levels in 2024; 2) freight rates in the first quarter are expected to remain weak before a potential stabilization in the second quarter, and 3) volume growth in SE Asia has been strong but weak in Asia-EU/ Trans-Pacific routes – to name a few.

- According to Goldman, February kicks off one of the two seasonal maintenance periods for refineries in the U.S., which will go through April. During this period, the bank expects jet fuel crack spread volatility will likely continue as small changes to jet fuel yield can drive material changes in jet fuel crack spreads. While spikes in the cost of jet fuel typically have a negative impact on short-term earnings, historically these spikes have been short-lived and have had no discernible impact on the U.S. airlines.[/responsivevoice]

Luxury Goods and International Markets

Strengths

- Consumer sentiment in the U.S. improved in early February with the University of Michigan’s Consumer Confidence Index rising to 66.4 from 64.9 in January. This reading came in better than the market expectation of 65.

- Cruise liners recorded further gains this week. Royal Caribbean outperformed, gaining more than 7% in a single day on Tuesday, after reporting fourth-quarter financial results and providing an upbeat outlook. The company reported a lower quarterly net loss than expected, with total revenue per passenger up 3.5% year-over-year, and load factors in line with the guidance of 95%. Bookings have been strong as well and are improving.

- Paradise Co., a South Korean gaming company that operates casino facilities in South Korea and Kenya, was the best performing S&P Global Luxury stock for the week, gaining 5.42%. The South Korean government is considering lifting the short-term visa restrictions for Chinese nationals.

Weaknesses

- Capri, a luxury store offering apparel, footwear, and accessories, recorded weak quarterly results and management cut guidance. Company revenue was weighed down by a 7.2% decrease in sales at Michael Kors. Capri, which also owns the Versace and Jimmy Choo brands, cut its outlook for its current quarter, and now sees revenue of $1.28 billion versus previous forecasts of about $1.5 billion.

- This week, consulting firm Bain-Altagamma published its China Luxury Report 2022. Overall, personal luxury goods in mainland China were down 10% year-over-year in 2022, versus 42% compound annual growth rates (CAGR) for 2019-2021 and 26% for 2016-2019. Covid disruptions, weaker consumer sentiment due to setbacks in the real estate market, a negative economic outlook and higher unemployment, all significantly impacted spending.

- Faraday Future Intelligence was the worst performing S&P Global Luxury stock for the week, losing 37.13%. Shares plummeted despite the company saying it had secured $135 million from new and existing investors to begin making and delivering its first electric vehicles.

Opportunities

- Valentine’s Day is celebrated around the world in different ways and continues to be a holiday when people like to give each other gifts. With consumer spending on the rise, luxury goods and services could likely benefit from shopping sprees around this holiday.

- Travel between mainland China and Hong Kong fully resumes on Monday. People can move freely without presenting PCR Covid tests and there is no limit on border crossings. Bloomberg predicts that Hong Kong sales of luxury goods by brands such as Richemont, Burberry, Kering and LVMH, could rise more than 18% year-over-year in 2023, lifted by stronger travel and increased spending. In addition, PricewaterhouseCooper (PwC) predicts that China’s luxury goods market could grow to 816 billion yuan (about $112 billion) by 2025, or approximately 25% of the total global market.

- Bloomberg economists predict that January inflation in the United States will drop to 6.2% from 6.5% in December. January data will be released next week, on February 14. Europe will likely have passed its peak in inflation as well. The Eurozone reported its January CPI reading at the beginning of February at 8.5% year-over-year (down from 9.2% in December), but it remains way above its central bank target of just 2%.

Threats

- Southern Turkey and Northern Syria were struck with two powerful earthquakes, collapsing many buildings, and killing thousands of people. Rescue efforts will continue, but conditions are tough and for those still trapped underneath rubble, it is a fight against the time. Equites trading in Turkey were halted on Wednesday. Bloomberg reported that Turkey’s public spending on Monday’s quakes may be equivalent to 5.5% of GDP.

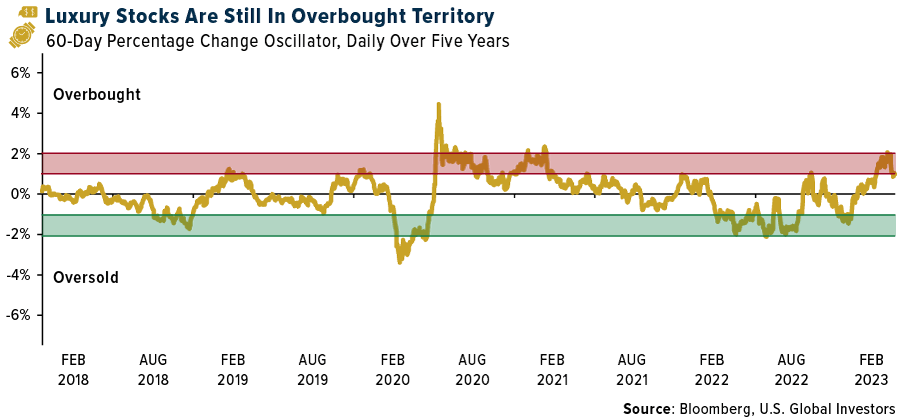

- As expected, luxury stocks corrected in the past week, and we predict more short-term downside to follow. At the beginning of last week, the S&P Global Luxury Index touched the upper bound of the oscillator’s overbought territory, +2 sigma. As of this Friday, luxury stocks remain in overbought territory, but just at +1 sigma, which is the lower bound of the overbought territory. After a strong fourth quarter of last year and year-to-date performance, more corrections could follow.

- Shares of Watches of Switzerland, the top Rolex seller in the United Kingdom, dropped sharply on Thursday after the company reported much weaker sales of luxury watches and jewelry, particularly in the United States. Weaker-than-expected sales for the fiscal third quarter could be a warning sign of a potential slowdown in the popular luxury watch market that has been driven mostly by U.S. consumers buying high-end mechanical timepieces during the pandemic.[/responsivevoice]

Energy and Natural Resources

Strengths

- The best performing commodity for the week was WTI crude oil, rising 8.72%. Oil prices got an extra boost on Friday when Russia announced that beginning in March, it will cut its oil output by 500,000 barrels per day in retaliation for Western trade sanctions. OPEC+ group, led by Saudi Arabia, stated it would not boost production to offset Russian supply cutbacks.

- Natural gas finally got a bid with its first weekly positive change in price since mid-December, reports Bloomberg. The catalyst was likely the partial reopening of Freeport LNG’s facilities, which has constrained some domestic gas from reaching international markets where prices are higher.

- The uranium spot market continued to see solid demand this past week, supported by significant Sprott activity, as the trust briefly traded at a premium to NAV. In the news, the U.S. and the European Union are discussing sanctions on Russian nuclear-related imports.

Weaknesses

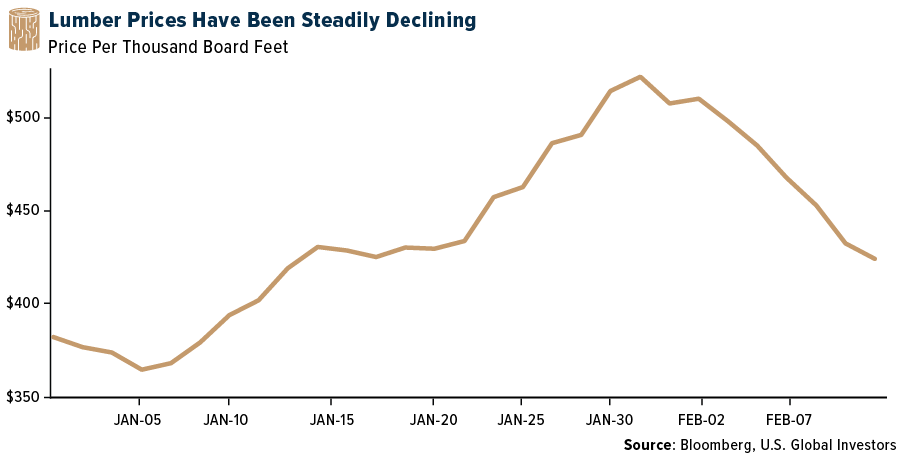

- The worst performing commodity for the week was lumber, dropping 15.63%. Canadian lumber producer Canfor announced a $20-30 per ton price hike for February deliveries. This follows Canfor’s decision to close one-third of its capacity, reducing Canadian production. The industry may need more help as the optimism over dropping rates has really chipped into the lumber price.

- After a short stint of relative stability, lithium carbonate prices in China resumed their descent. Platts reported that battery grade carbonate prices ended the week at $67,914, down from $70,716 per ton on Monday, a drop of 4% on the week. Benchmark Minerals attributed weak demand sentiment post-Lunar New Year as the reason for the new pressure on prices.

- Turkey is a key participant in both the steel and scrap market and suffered a major earthquake recently. The country is the biggest source of imports into the EU with a share of around 15% of finished steel product imports in the first 11 months of 2022. With respect to the U.S., though Turkey accounted for only 4% of the total finished steel imports, the country accounted for 30% of total rebar imports into the U.S.

Opportunities

- According to Bank of America, a look across fourth quarter 2022 trading statements published so far confirms the group’s expectations for refining margins offering upside to consensus. On average in the fourth quarter of 2022, the bank increased 40% sequentially, with Galp showing the largest uplift. Shell and OMV results also confirmed expectations for high utilization rates. Inventory levels in diesel across the European product market sit 25% below 2015-2019 average levels and 15% below 2020 levels.

- The European Union and G7 countries have agreed to implement a price cap of $100 per barrel on Russian products that trade at a premium to crude, such as diesel and gasoline, and $45 per barrel for products that trade at a discount, such as fuel oil and naphtha. As for the previous $60 per barrel price cap on Russian crude, this price cap also prohibits Western insurance, shipping, and other companies from financing, insuring, trading, brokering, or carrying cargoes of Russian oil products unless they were bought at or below the set price caps.

- Oil consumption in China, the world’s biggest importer, is rising strongly following the ending of coronavirus lockdowns, according to OPEC member Kuwait. “There is pent up demand that accumulated over the pandemic,” Sheikh Nawaf Al-Sabah, chief executive officer of Kuwait Petroleum Corp., told Bloomberg TV in Bangalore, India. “Now, with the opening up, we’re seeing an increase in demand that is sustainable. This is not a dead-cat bounce.”

Threats

- Americans are driving more on less gasoline. The U.S. EIA reported that in the first 11 months of 2022, American drivers used 10,000 barrels per day less gasoline than in the corresponding period the year before and 540,000 barrels per day less fuel than in 2019—a surprisingly weak outcome given that Americans collectively traveled more last year than in 2021 and drove a similar number of miles as in 2019.

- According to Morgan Stanley, recent rains are unlikely to resolve drought conditions in Argentina. As a result, the group thinks that cultivated acreage and yields will be worse than previous expectations in the country, the world’s third largest soy producer and fourth largest corn producer. Morgan Stanley is revising its soy and corn price estimates.

- The U.S. is planning to impose a 200% tariff on Russia-produced aluminum as soon as this week, although it is not official yet. If the speculation comes to be true, the punitive tariff will effectively end U.S. imports of the metal from Russia. Currently, U.S. aluminum imports from Russia account for only 3% of the metal. Shipments of aluminum to LME warehouses have surged to beat the tariff deadline.[/responsivevoice]

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Graph, rising 63.78%.

- MakerDAO, the decentralized finance giant that facilitates the generation of the DAI stablecoin, is releasing a lending platform that will rival Aave, one of Ethereum’s largest DeFi products. Spark protocol will be a front-end app that allows users to interact with DAI in the form of borrowing, lending, and staking, writes Bloomberg.

- betting the city’s pro-crypto pivot foreshadows an easing of the ban on virtual coins in mainland China.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Fantom, down 30.88%.

- Kraken, one of the world’s largest cryptocurrency exchanges, is embroiled in a probe by a top U.S. financial regulator over whether it broke securities rules related to certain offerings to American clients. The SEC’s probe into whether Kraken offered unregistered securities is at an advanced stage and could lead to a settlement in coming days, writes Bloomberg.

- Argo Blockchain, the Bitcoin mining firm facing a class action lawsuit alleging it misled investors, said two of its top executives and a board member are stepping down. CEO and Chairman Peter Wall and CFO Alex Appleton have resigned to “pursue other opportunities,” argot said in a statement, writes Bloomberg.

Opportunities

- Bitcoin miners Hut 8 and US Bitcoin Corp are merging in an all-stock deal after a prolonged slump in cryptocurrency prices heaped pressure on the industry, reports Bloomberg. The combined company will have a market cap of about $990 million and will have access to roughly 825 megawatts of “gross energy” across six sites.

- Binance has taken its largest share to date of the market for trading cryptocurrencies after scooping up the majority of the business from defunct rival exchange FTX, writes Bloomberg.

- Liquidators in the Bahamas, tasked with winding up the Caribbean outpost of Sam Bankman-Fried’s collapsed crypto empire, are readying the sale of a vehicle portfolio as they seek to generate cash to return to creditors. FTX Digital Markets owned a fleet of vehicles used by employees with a book value of $2.4 million, according to the liquidator’s report and Bloomberg.

Threats

- Kraken will pay $30 million to settle SEC allegations that the company broke U.S. securities rules with its crypto-asset staking products and will discontinue them as part of the agreement with the regulator, writes Bloomberg. The SEC alleged that Kraken’s staking service was an illegal sale of securities in a lawsuit filed in federal court Thursday, the article explains.

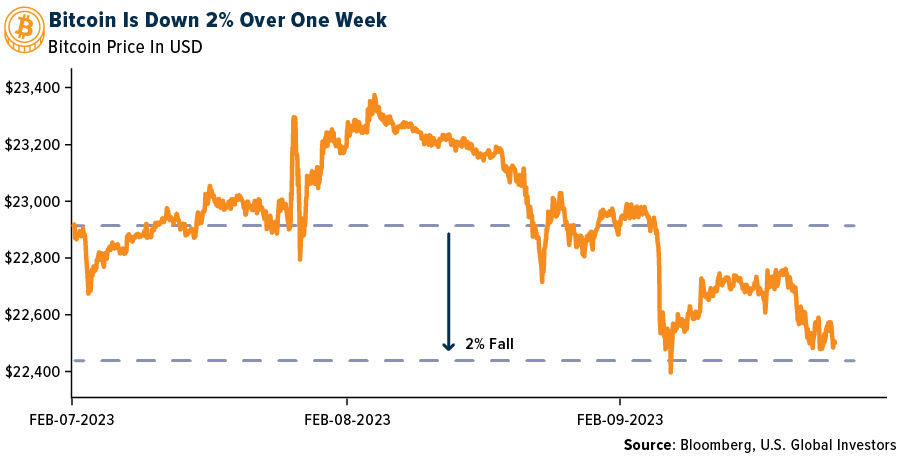

- Bitcoin is down about 2% for the week after rallying over 40% to start the year.

- Bitcoin’s new-year rebound has hit the buffers, hampered by a crypto crackdown in the U.S. and fears that higher-for-longer interest rates will sap investor appetite for speculative assets, reports Bloomberg. The largest token’s 6% three-day retreat is the worst over such a timespan since December.[/responsivevoice]

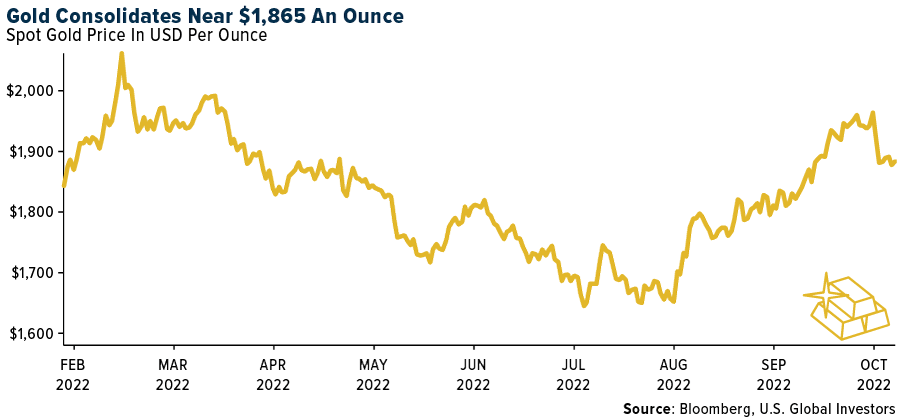

Gold Market

This week gold futures closed the week at $1,875.40, down $1.20 per ounce, or 0.06%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.04%. The S&P/TSX Venture Index came in off 1.08%. The U.S. Trade-Weighted Dollar rose 0.64%.

Strengths

- The best performing precious metal for the week was gold, but still off 0.06%. The merger of Newmont and Newcrest will be the largest gold company in the world, with a market cap of $57 billion, total gold reserves of 155 million ounces, total resources of 333 million ounces and a mine life of 17 years. The new company would also produce silver, zinc, lead and copper, and non-gold components would remain less than 20% of annual revenue over the next three years, according to Scotia.

- Burkina Faso’s military rulers are seeking to process more of its gold locally to ensure control over the country’s main source of revenue, writes Bloomberg, following a drop in output. Production sank 15% last year as the government battled a sprawling Islamist insurgency, with attacks increasingly targeting the mining industry. The West African nation, which exports most of its gold, is now looking to build a refinery to boost the value it gets from mining the commodity.

- China raised its gold reserves for a third straight month as central banks worldwide bolster their holdings of the safe-haven asset. The People’s Bank of China (PBOC) increased reserves by about 15 tons in January, according to data on its website on Tuesday, pushing its total to 2,025 tons. In the prior two months, it added a combined 62 tons.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.83%, following Nornickel’s forecast for just a 300,000-ounce deficit for 2023 versus its November forecast, which projected a deficit of 800,000 ounces. Impala Platinum’s first half 2023 gross refined production declined 9% year-over-year to 1.48 million ounces and missed consensus by 5%. Key production misses came from Impala, Marula and Two Rivers, which were all down year-over-year and 5-8% below consensus.

- SSR Mining released production results for the fourth quarter that were below expectations, resulting in higher costs. Guidance for 2023 was within guidance, but costs for 2023 were higher than the Street too. The stock sold off as much as 10% intraday.

- Gold was steady near the lowest close in a month, reports Bloomberg, as poor risk sentiment in equity markets boosted the dollar. European stocks and U.S. futures dropped on Friday as the mood in markets turned bearish, the article explains, pushing up the dollar and capping gold.

Opportunities

- Canaccord remains bullish on gold in 2023. The group’s macro view hasn’t changed since it published its 2023 outlook. The Federal Open Market Committee’s (FOMC) 25-basis-point increase was in line with expectations, and the market continues to price-in a terminal rate of 5%. Despite the short-term pullback, Canaccord thinks gold and gold equities have more room to run ahead of a Fed pause with a non-trivial chance of a recession emerging.

- Speaking to Business Insider, David Rosenberg warned that the S&P 500 could tumble 30% to around 2,900 points, a U.S. recession is only starting and unemployment could surge. As a defensive move, Rosenberg suggested investors own gold, bonds and low-risk stocks to weather the downturn, but he ruled out Bitcoin and other crypto assets as sensible ways to preserve your assets

- B2Gold Corp., a Canadian gold miner with assets in Africa and the Philippines, is looking to buy struggling smaller metals producers and distressed assets to expand and diversify operations. “We are very seriously looking at mergers and acquisitions and finding the next company to make a friendly offer to,” Chief Executive Officer Clive Johnson said in a Tuesday interview in Cape Town.

Threats

- UBS views Newmont as focused on executing its own portfolio of growth projects (Ahafo North, Tanami 2, Yanacocha, etc.) with limited interest in transformational M&A. Further, the debate around the company’s dividend, capex and cost guidance have not yet been settled. The NCM announcement adds another variable to the price/cost/free cash flow considerations they have been working on.

- Anglo American Platinum Ltd., the number one platinum miner by value, said investor payouts will drop as worsening power outages in South Africa curb output and push up costs. “Will our investors continue to get their returns? Yes, they will, but the size of returns will be slightly softer,” Chief Executive Officer Natascha Viljoen said in an interview.

- With the release of full-year financials, other gold company updates are often to be expected, including outlook updates for 2023 and beyond. Based on some early 2023 guidance updates and overall market sentiment, there is seemingly some fear that updated company outlooks will trend towards more negative than positive adjustments as companies continue to factor in further potential cost pressures.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/30/22):

OMV Petrom SA

Newmont Corp

Impala Platinum Holdings

SkyWest

Maersk

Frontier Airlines

Airbus

Boeing

Capri

Richemont

Burberry

Kering

LVMH

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions.

The Bloomberg Galaxy Crypto Index is designed to measure the performance of the largest cryptocurrencies traded in USD.

The S&P Global Luxury Index is comprised of 80 of the largest publicly-traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.