The Power of Loyalty in Driving the Airline Industry Forward

Airlines were one of the hardest-hit industries at the start of the pandemic, with the five-member S&P 500 Passenger Airlines Index collapsing over 31% in 2020.

Airlines were one of the hardest-hit industries at the start of the pandemic, with the five-member S&P 500 Passenger Airlines Index collapsing over 31% in 2020. This made the group the worst-performing S&P 500 industry for the year, outside of oil and gas.

The selloff also created an exciting investment opportunity that many young and nontraditional investors, locked down at home and with record disposable income, took advantage of. According to data from Robinhood, the commission-free securities trading platform preferred by millennial and Gen Z investors, distressed airline stocks became one of the year’s breakout hits, with trading volumes hitting historic levels.

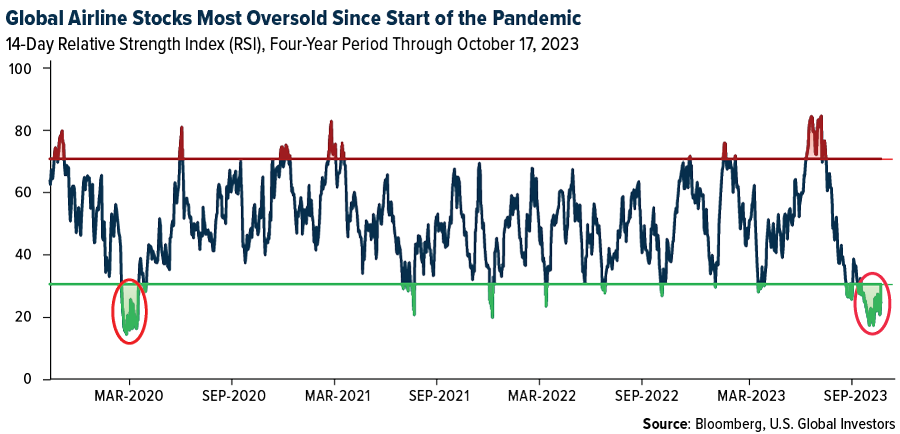

I believe airline stocks appear just as attractive today as they did in 2020. The 14-day relative strength index (RSI) shows that these equities are more oversold now than at any other time since the pandemic first grounded commercial aircraft. Had you bought shares of global airlines in March 2020, when the RSI fell under 20, you would have seen returns of approximately 130% over the next 12 months.

Will the same happen again this time?

Amid War and Rising Costs, U.S. Air Travel Continues to Soar

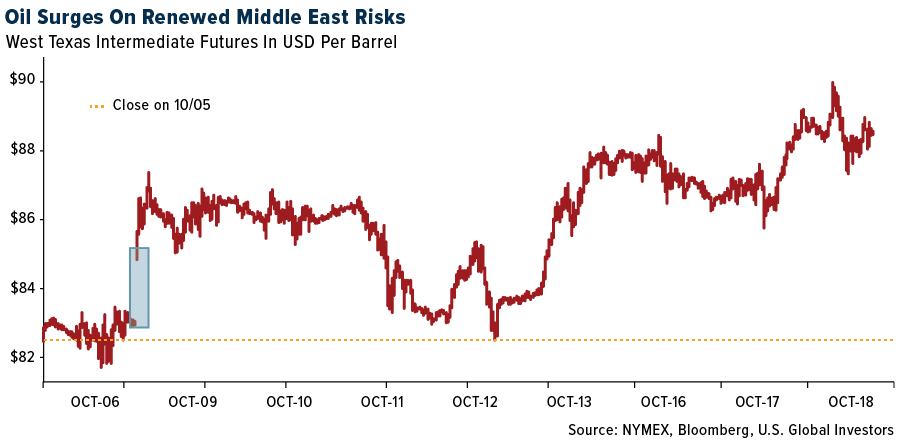

It’s important to keep in mind that the causes of both selloffs are vastly different. Whereas commercial air travel across the globe came to a screeching halt in 2020 due to the spread of an as-yet unknown virus, carriers today are grappling with a Middle East at war, spiking fuel prices and persistently high borrowing costs.

United Airlines said as much during its third-quarter earnings call this week. Despite reporting record profits in the quarter ended September 30, shares of United tumbled 9.6% on Wednesday after it warned shareholders it lowered fourth-quarter projections due to the Israel-Hamas War and oil prices topping $90 per barrel.

Like many other airlines, United has suspended flights to Tel Aviv amid the two-week-old conflict that’s already taken thousands of lives, including approximately 30 American lives. The company said it won’t resume flights to the Israeli city “until conditions allow,” according to reporting by Bloomberg.

The war is certainly a headwind to travel demand, especially if it expands beyond Israel and Gaza’s borders and/or is drawn out longer than anticipated (did anyone expect the skirmish between Russia and Ukraine to still be raging over a year and half later?).

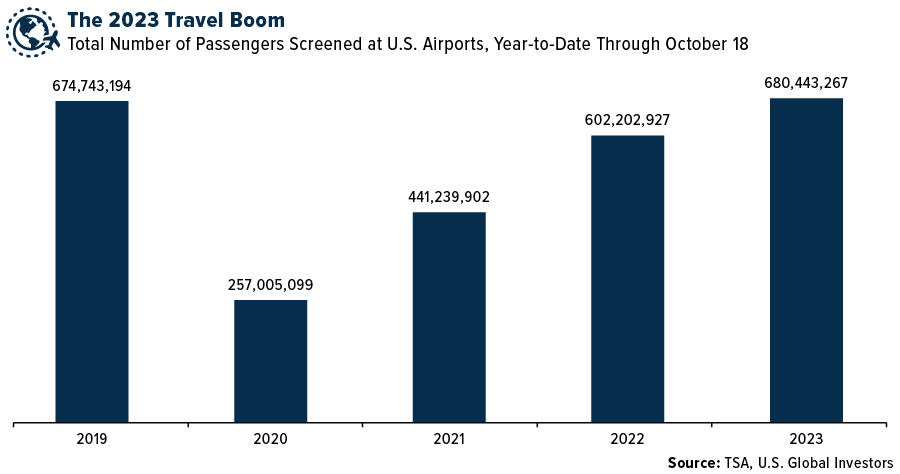

For the time being, however, U.S. consumers don’t appear ready to change their travel habits just yet, even as an overwhelming majority (85%) of Americans say they’re concerned the Israel-Hamas War could escalate to a Middle East-wide engagement, according to a Quinnipiac poll, and even as the State Department issues a “worldwide caution” for U.S. citizens planning to travel overseas. Since October 7, when Hamas attacked Israel, the Transportation Security Administration (TSA) has screened more passengers per day than they did on corresponding days in 2019. So far this year through October 18, millions more people have boarded commercial planes in the U.S. compared to the same period four years ago.

How Airlines Are Leveraging Rewards and Co-Branded Credit Cards

Another reason we like airlines is due to their resilience and ability to adapt. This isn’t the first time that the industry has faced and prevailed over a challenging international business climate. Carriers have managed to do this thanks in large part to the implementation of new revenue streams, including loyalty programs and co-branded credit cards.

Co-branded cards have gained a lot of traction in the broader travel sector, airlines specifically. These cards enable consumers to earn loyalty points and other perks, potentially improving customer retention. A couple of examples you might be familiar with are Southwest’s Rapid Rewards and American Express’ Delta Skymiles.

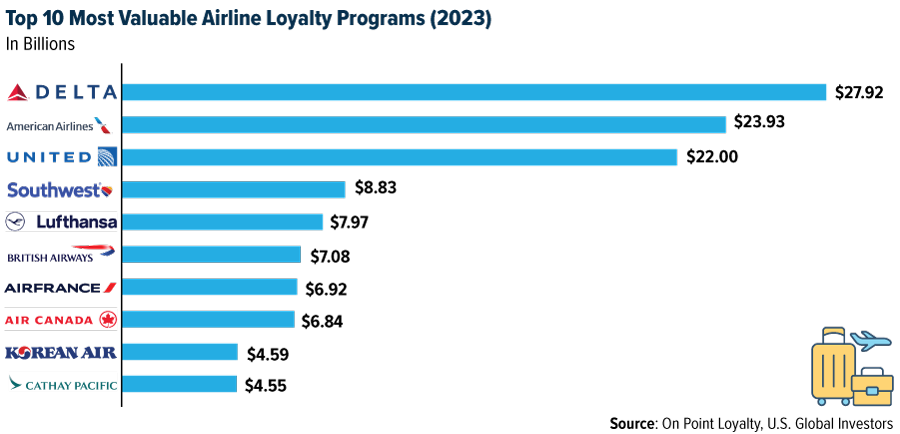

These loyalty programs are big business, accounting for roughly 40% to 50% of airlines’ market value in 2019, according to consultancy firm LTIMindtree. That year, United generated $5.3 billion from the sale of miles, representing a significant portion of its revenue. Delta followed a similar trajectory, selling $4 billion in airline miles to banks, equal to 14% of its operational revenue.

Below are the top 10 most valuable airline loyalty programs in billions of dollars, as of this year. The data comes courtesy of On Point Loyalty, which analyzed 170 commercial passenger airlines, using over 50 primary variables for each program:

As I’ve said before, ancillary revenue generators such as credit cards and other loyalty programs have become pivotal assets for airlines. With the significant value of these programs now clear, the airline industry is recognizing the vast potential they hold.

These are the top five airlines cashing in on non-ticket services… Watch the video by by clicking here!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.61%. The S&P 500 Stock Index fell 2.39%, while the Nasdaq Composite fell 3.16%. The Russell 2000 small capitalization index lost 2.26% this week.

- The Hang Seng Composite gained 5.26% this week; while Taiwan was down 2.04% and the KOSPI fell 3.30%.

- The 10-year Treasury bond yield rose 29 basis points to 4.91%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Japan Airport Terminal, rising 5.74%, on no real news. Despite a difficult macro environment for the sector, with rising jet fuel prices and Israel-Hamas conflict, airlines have managed to remain resilient and have adapted to the challenges – for the time being.

- Based on the latest State of Global Airlines Union report by Morgan Stanley, in the United States, travel has remained resilient year-to-date, according to TSA checkpoint data. The number of passengers flown has increased 1.1% compared with 2019 levels, and in September of this year, levels rose 4.1% compared with September 2022.

- According to Morgan Stanley, airline traffic in China continues to recover. The group sourced Air China Limited’s revenue passenger kilometer data (RPK) as one metric to prove the growth – returning to 89% of 2019 levels and hitting 90% in July. Regarding airport traffic, Beijing Capital International Airport reported a recovery to 58% of 2019 levels. Domestic traffic, specifically, recovered to 67%, while international and regional traffic recovered to 34% and 56%, respectively.

Weaknesses

- The worst performing airline stock for the week was Hawaiian Holdings, falling 13.34%. The company is set to report earnings on October 24 and Wall St. estimates aren’t looking too great. Hawaiian Holdings is expected to post a quarterly loss of $0.79 per share in its upcoming report, which represents a year-over-year change of about -426.7%.

- According to a Reuters article, American Airlines, in its financial reports this week, announced the cut of its 2023 profit forecast due to the impact of higher jet fuel prices and expensive labor contracts. The company now expects adjusted profits of around $2.25 per share versus its previous forecast of $3 to $3.75 per share. The company reported a net loss of $545 million for the third quarter of 2023.

- According to Bloomberg, shares of Air Canada reached a one-year low on Wednesday of $17.29, due to higher fuel costs, competition, and interest rates. A Raymond James analyst also reduced the earnings forecast for the airline.

Opportunities

- According to Bloomberg, starting January 1, 2024, Southwest Airlines, one of the leading low-cost U.S. airlines, will reduce the requirements for its Rapid Rewards loyalty program members to earn A-List and A-List preferred tier status. For example, members only need to fly 20 one-way qualifying flights (previously 25), to earn A-List status. To earn A-List preferred status, members now only need to fly 40 one-way qualifying flights, instead of 50.

- Based on a Wall Street Journal article, United Airlines announced a change in its boarding process for economy class passengers to offer a better user experience, reducing the boarding time by two minutes. The new initiative is called “Wilma,” or window, middle, aisle. When economy passengers board, those sitting in window seats will board first, then middle seats, and finally, aisle seats. Early access to the airplane is usually a perk for higher-paying customers, so this initiative looks to offer some fairness to all customers.

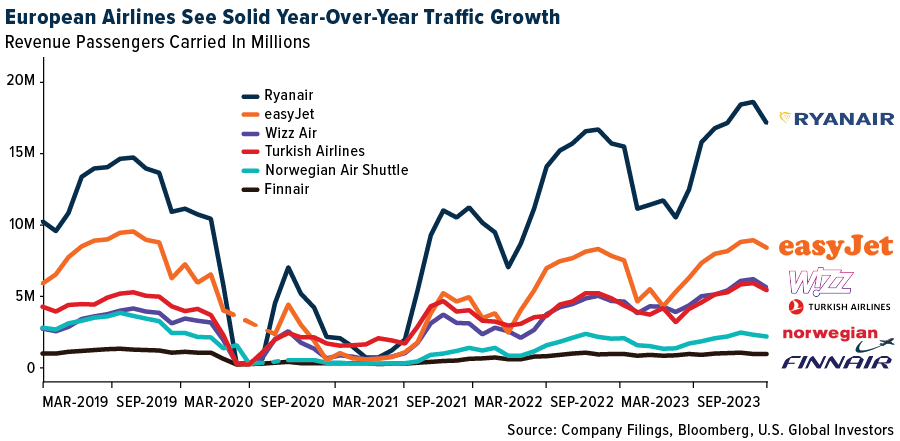

- Based on Bloomberg Intelligence research, European airlines have had solid year-over-year traffic growth through September 2023. For example, Ryanair increased by 9% from a year earlier, Wizz Air had a traffic increase of 21%, easyJet passenger growth was up 8%, and Turkish Airlines surpassed 22% for domestic traffic. These are just some of the positive cases across Europe. Despite the global economic slowdown, consumers still want to travel, evident not only in Europe, but worldwide.

Threats

- According to Bloomberg Intelligence, the Shanghai Containerized Freight Index reached its lowest level since 2020. Now, the Index is 83% lower than its January 2022 level. Europe-bound cargo rates remain weak, and analysts believe rates could continue downward in the following weeks. Consequently, the profits of companies such as COSCO, Evergreen, NYK, and others could be impacted.

- The 11 largest publicly listed container shipping companies have lost $135 billion of their stock valuations over the last year-and-a-half, reports Container-News.com, as investors dumped stocks as freight rates slumped. Among the carriers whose capitalization transcended $10 billion for the first time since 2022, were Taiwan’s Evergreen, Yang Ming, Wan Hai Lines and South Korea’s HMM, the article continues.

- Based on Bloomberg Intelligence research, United Airlines has been one of the most impacted carriers from the conflict in Israel. The carrier had about one-third of all direct flights from the U.S. to Israel in the third quarter, responsible for around 1.9% of its revenue. This equates to around $278 million. The conflict pressures not only United Airlines, but also the second carrier with the most routes to Israel, EL AI, the national airline, followed by Delta Air Lines with 20% of flights, and American Airlines with around 7% of routes.

Luxury Goods and International Markets

Strengths

- Las Vegas Sands reported third-quarter income from continued operations of $449 million, compared to a net loss of $380 million during the same period last year. Earnings came in at 50 cents, compared with a loss of 31 cents per share in the prior year. The company also announced a $2 billion stock buyback program. Shares gained after the company released its quarterly earnings following the market close on Wednesday.

- China reported stronger-than-expected economic data this week. The third quarter gross domestic product (GDP) in China expanded at 4.9% while a growth of only 4.5% was expected. Year-over-year industrial production and retail sales for September were reported above analysts’ expectations as well. The unemployment rate declined to 5.0% from 5.2%. However, the results in the property sector remain weak.

- Sleep Number, a U.S. mattress maker and wellness technology leader, was the best performing S&P Global Luxury stock, gaining 19.8% in the past five days. Shares gained sharply on Tuesday when the company unveiled a new research result linking sleep abnormalities with a risk of heart failure.

Weaknesses

- Tesla reported 66 cents earnings per share in the third quarter, below the expected 74 cents. Revenue reached $23.4 billion, below expectations of $24.06 billion. The company produced 435,059 cars globally during the quarter, declaring the first quarterly decline in car deliveries in a year. Free cash flow was reported at $800 million, down from $1 billion last quarter. Shares corrected when the company released its quarterly earnings after the market close on Wednesday.

- Salvatore Ferragamo reported a decline in sales for the first nine months of the year. The Italian luxury goods maker posted revenue of 844 million euros for the first nine months, down 8.3% from the same period a year ago. Sales in North America and Asia Pacific declined, and Europe was the only market in which the company reported growth.

- Lucid Group was the worst performing S&P Global Luxury stock, losing 17.5% in the past five days. The electric car maker declined after Tesla warned about the economy and the EV industry, in addition to the company struggling to boost production and deliveries, reports Motley Fool.

Opportunities

- UBS held a conference in New York this week focusing on Artificial Intelligence (AI) and its impact on creating value in fashion retail. Speakers emphasized how companies are adopting the concept of using AI in the retail space. Sales and customer experience, marketing, and product development will mostly benefit from the adoption of artificial intelligence. We are entering the industrialization area, explained UBS. Many luxury names are already using AI to promote their business, but a deeper understanding and further adoption of this technology is sure to follow.

- Pernod Ricard’s chief executive officer said he sees signs of a recovery after sales fell sharply in the United States and China last quarter. The Paris-based company expects positive annual sales growth in both markets, increasing in the range of 4-7%. Remy Cointreau, another distributor of high-end spirits, previously warned that higher prices and a weaker economy were hurting U.S. demand, but also predicted a recovery later this year.

- Brunello Cucinelli, best known for its high-end cashmere sweaters, reported third-quarter earnings revenue growth of 26% year-over-year, well above Bank of America’s luxury industry forecast of positive 4%. The company’s recent share price correction may be unjustified given the resilience of its business as a result of its exposure to a high-income consumer, according to Bank of America’s research team.

Threats

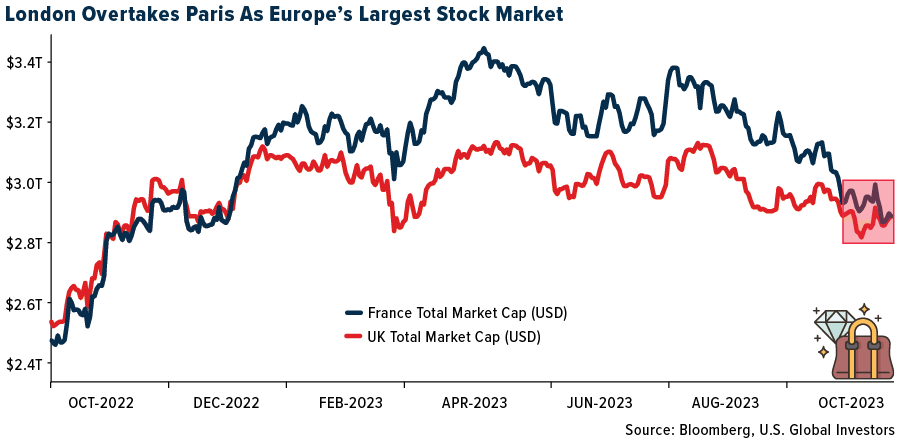

- The Paris Stock Exchange, where luxury names like Hermes and Louis Vuitton are listed, has lost its status as Europe’s biggest stock market. The London Stock Exchange, which is more exposed to commodity stocks and home to names like Shell and BP, overtook Paris. The shift in ranking comes as luxury stocks are under pressure due to concerns in China along with rising rates.

- Country Garden, a Chinese property developer, missed two coupon payments on Wednesday. The company was due to pay a $15 million coupon payment on a bond due in September 2025 when a 30-day grace period ended, but two bondholders told Reuters they were yet to receive it. Non-payment would put the developer at risk of default on its nearly $11 billion of outstanding offshore bonds and could trigger one of China’s biggest corporate debt restructurings, according to Reuters.

- Israel-Hamas tensions have spread to Europe, causing disruptions for locals and visitors. Local authorities have ramped up security as clashes erupted last weekend in London, Paris, Madrid, and Rome. In France, security threats have forced the evacuation of sites like the Louvre Museum, along with several airports. On Tuesday, Israel’s National Security Council issued a warning against travel to Turkey and Morocco, citing fears that Israeli travelers might be targeted. It urged all Israeli citizens in Turkey to leave as soon as possible.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, rising 7.99%. Uranium remains in the news as nuclear power will have to play a role in reducing greenhouse gas emissions. Coffee rose 6.88% as Barchart reports that shrinking coffee inventories are pushing prices higher. The International Coffee Organization reported in September that global coffee exports were down 5.7% year-over-year. Uranium almost beat out coffee’s price gains this past week and remains in the news as nuclear power will have to play a role in reducing greenhouse gas emissions.

- Chinese aluminum production reached a daily record in September, surpassing the previous high set in August, thanks to increased hydropower supply in southern regions like Yunnan. In contrast, steel output decreased due to shrinking margins and reduced construction activity, despite a steady demand for aluminum from China’s renewables sector. Additionally, oil refining and natural gas production hit daily records, while coal production increased despite mine accidents, demonstrating China’s efforts to balance its energy mix and meet rising power demand with less coal consumption.

- China’s Ministry of Ecology and Environment has instructed major industrial polluters, particularly in seven key industries like aluminum, cement, steel, and petrochemicals, to report their carbon emissions. These factories, emitting over 26,000 tons of CO2 equivalent annually, must validate their emissions data by December, a move aimed at aligning with China’s carbon market and helping Chinese exporters comply with the upcoming EU carbon tax.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 10%, on its eighth straight daily loss. Warmer temperatures and a bigger-than-expected storage report of recently injected gas supplies indicate ample supplies at this time, unlike crude oil markets.

- Glencore, the Swiss mining giant, plans to close its copper mining operations in Mount Isa by the end of 2025, resulting in the loss of approximately 1,000 jobs. The decision comes as part of cost-cutting efforts and is driven by the natural life span of the mines and declining copper grade. However, Glencore will maintain its copper smelter in Mount Isa and refinery in Townsville, with third-party work to ensure its profitability. The company’s zinc operations in Mount Isa will remain unaffected.

- Two years after President Joe Biden set a target of deploying 30 gigawatts of offshore wind capacity by 2030, the goal appears increasingly out of reach due to a series of setbacks, including rising costs and project cancellations. Analysts have significantly revised down their outlook for the U.S. offshore wind industry, with BloombergNEF now expecting only 16.4 gigawatts by the end of the decade, just over half of the original target. Despite challenges, the White House remains committed to advancing offshore wind opportunities, but industry developers are grappling with financial sustainability and increased costs.

Opportunities

- China is increasing its imports of aluminum, driven in part by a demand surge in green technologies. Chinese aluminum prices have remained stronger than global prices for months, and the higher imports reflect the contrast between the flagging global demand and resilient sectors in the Chinese economy, particularly in green industries like solar panels, wind turbines, and electric vehicles.

- Global demand for liquefied natural gas (LNG) is expected to surpass current projections, with a shortage of supply looming, according to Kenichi Hori, the president of Mitsui & Co., a prominent Japanese trading company. Hori emphasized that announced projects worldwide won’t adequately meet the supply needed for the energy transition, which will span several decades. As LNG is viewed as a cleaner fossil fuel option to reduce emissions, Mitsui & Co. is actively diversifying its energy sources, including renewable energy, ammonia, and hydrogen, as part of its transition from traditional energy to a low-carbon-intensive era.

- Crude futures hung close to $90 a barrel near the end of the week with Israel’s anticipated ground offensive into the Gaza Strip, along with U.S. efforts to prevent regional escalation, keeping the market on edge. The situation prompted increased activity in the options market as traders sought protection against potential price spikes, particularly in light of concerns about the Middle East’s geographical proximity to major oil-producing regions, even though there have been limited supply disruptions.

Threats

- Codelco, Chile’s state copper giant, continues to face challenges as it deals with an extensive overhaul of its aging mines and entry into the lithium market. After the resignation of its CEO and ongoing issues with production and debt, Codelco’s bonds have shown significant losses, making it difficult for investors to view them as a viable opportunity despite state backing.

- Citigroup Inc. analysts have predicted increased turbulence in metals prices over the next year due to declining global demand, as observed during the annual LME Week in London, where copper, aluminum, and zinc prices all experienced declines. The consensus at the event indicated a bearish macroeconomic outlook for the next 6-12 months, with expectations of falling metal prices. Citigroup expressed confidence in its forecast of copper falling to $7,500 a ton in the next three months, and the group noted that risks to its $8,000-a-ton forecast for average prices in the first half of 2024 were skewed toward the downside.

- Declining refining margins, especially due to falling gasoline prices, are beginning to affect the premiums at which physical crude oil cargoes trade, potentially impacting oil futures if this trend continues. For instance, in Europe, road fuel prices have slipped to a premium of just $4 a barrel above crude, a significant drop from over $30 in late August, contributing to a decline in refinery profits. If this situation persists, it could pose challenges for major oil-producing nations like Saudi Arabia and Russia, which have led OPEC+ efforts to cut oil flows to support prices.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Bitcoin SV, rising 56.84%.

- Bitcoin and other cryptocurrencies weakened on Thursday, but digital assets remained at relatively elevated levels as hopes persist that regulators will soon approve a spot Bitcoin ETF, a key catalyst for cryptos, writes Bloomberg.

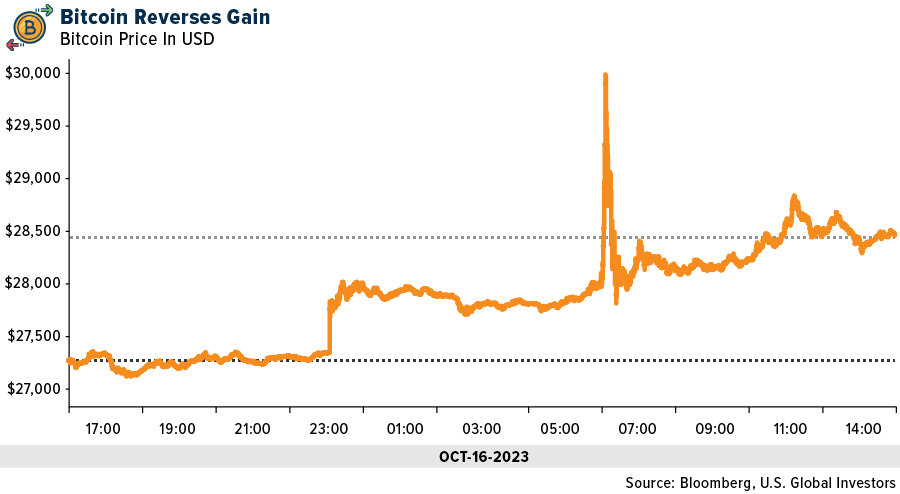

- Bitcoin topped $30,000 for the second time this week on growing expectations that another favorable court action raises the likelihood that an exchange-traded fund holding cryptocurrency will finally be approved, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Conflux, down 9.12%.

- New crypto regulations will wipe out the bulk of Australian-registered exchanges as they struggle to comply with the requirements designed to limit the scams and fraud rife throughout the industry. Crypto exchanges will soon be required to hold a financial services license issued by the Australian Securities and Investments Commission, writes Bloomberg.

- A key pillar of demand for Ether is weakening against a backdrop of elevated Treasury yields. The staking payout on pledged tokens has fallen to an annualized 3.5%, near the lowest in at least 10 months and well below a recent peak of more than 8%, according to Bloomberg.

Opportunities

- After months of declining volatility, Bitcoin traders experienced some of the wildest price swings they’ve seen in a while when a false report circulated saying that the U.S. had approved a long-awaited ETF. Bitcoin jumped more than 10% to $30,000 only to cut the gain by more than half a few minutes later, writes Bloomberg.

- Depository Trust & Clearing Corp agreed to buy startup Securrency Inc., part of the main U.S. stock-market clearinghouse’s drive to offer blockchain technology and services for functions like post-trade processing of tokenized assets, writes Bloomberg.

- The Federal Deposit Insurance Corp. plans to provide a firmer timeline for dealing with banks’ request to get involved with crypto, and to finish assessing the risks digital currencies pose to banks by early next year. The FDIC was responding to concerns highlighted in a report from the agency’s inspector general that the agency hasn’t done a full analysis of crypto’s risks to banks, writes Bloomberg.

Threats

- The European Union’s markets watchdog has called for crypto companies and national regulators to start preparing to meet the bloc’s new industry rules. The European securities and markets authority said on Tuesday that digital asset firms should apply for authorization with national regulators under the EU’s incoming Markets in Crypto-Assets regulation, writes Bloomberg.

- Geminin Trust Co. and Barry Silbert’s digital currency group were sued by New York’s top law enforcement officer for allegedly defrauding customers of $1.1 billion, escalating legal woes for two companies hit hard by last year’s plunge in cryptocurrency markets, writes Bloomberg.

- A Depression-era securities law is forcing courts to wrestle with what it means to sell securities in the age of YouTube and Instagram. Federal law has for decades allowed those who are defrauded or who bought an unregistered security to sue the seller seeking a refund. New kinds of investments have tested the definition of “seller,” according to an article published by Bloomberg.

Gold Market

This week gold futures closed the week at $1,991.40, up $40.90 per ounce, or 2.57%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.90%. The S&P/TSX Venture Index came in off 1.59%. The U.S. Trade-Weighted Dollar fell 0.45%.

Strength

- The best performing precious metal for the week was silver, rising 2.75%. Gold hit a 13-week high due to increasing geopolitical tensions and war between Israel and Palestine. Gold has historically functioned as a safe-haven asset and conflict has produced tremendous demand for the yellow metal. Unfortunately, if these sad events continue, the price of gold will likely continue to rise. However, gold equities are trailing the price change in bullion over the past month, perhaps seeing this as a short-term jump in gold, but also subject to a potential drop.

- The Indonesian mining company, PT Amman Mineral Internasional, which owns the country’s second-largest gold and copper mine, has experienced a remarkable 269% rise in its stock price since its record-breaking IPO in July. This surge in value has created six new billionaires, including the company’s chairman, Agus Projosasmito, whose stake is worth $2.7 billion. Notably, these newly minted billionaires share connections with Anthoni Salim, the head of the prominent Salim Group conglomerate, who also benefited from the company’s success, increasing his fortune by over $4 billion to $9.7 billion.

- Newmont has announced the resolution of the strike at the Peñasquito Mine in Mexico, as it reached a definitive agreement with the National Union of Mine, Metal, and Allied Workers of the Mexican Republic, which was subsequently approved by the Mexican Labor Court on October 13. Newmont’s focus is now on safely reinstating the workforce and achieving stable production levels at the Zacatecas-based Tier 1 operation, with a status update planned during the third quarter earnings call on October 26.

Weakness

- The worst performing precious metal for the week was palladium, dropping 3.55%, as hedge funds raised their net-short position to a record high. Newcrest Mining Ltd. reported a decrease in gold production for the first quarter, with 454,312 ounces produced, down 18% from the previous quarter. Additionally, copper production saw a 12% decrease with 30,624 tons produced, while all-in sustaining costs per ounce increased by 18%, and the AISC margin per ounce dropped by 34% in the same period. Newcrest also reaffirmed its 2024-year forecast, maintaining expectations for gold production between 2.00 million to 2.30 million ounces and copper production between 120,000 to 140,000 tons.

- Centamin PLC reported that profit and revenue decreased in its latest quarter as gold production fell by over 20%. However, the company reiterated full-year guidance, but is more likely to come in on the low end.

- Both Gold Fields Ltd. and Harmony Gold Mining Co. Ltd. were cut to underweight at Morgan Stanley earlier in the week after posting 25% and 26% price gains, respectively, in the prior week with the surge in gold.

Opportunity

- Delegates at the London Bullion Market’s Association annual conference were surveyed for their precious metals forecast of prices one-year out. For gold, the participants see prices at $1,990.30 an ounce next year, which is about 3% higher than current prices. The silver price is seen at $26.80, almost 14% higher. Palladium was forecast to be 10% higher but platinum was the standout precious metal with an expected 28% lift in price.

- Gold has reached a 13-week high, driven by robust demand from central banks and consumers in India and China, as well as a notable shift away from its traditional inverse correlation with real yields. While yields have begun to rise in various markets, gold continues to attract investors as a safe-haven asset, despite strong economic data in the United States and potential changes in the relationship between real yields and the precious metal. This deviation from historical correlations may sustain gold’s ongoing uptrend.

- Orla Mining boosted its forecast gold production by about 10%, from 110,000 ounces to 120,000 ounces for the year. Third quarter production was robust at 32,425 ounces. On Tuesday, Richard Gray raised his recommendation on the mining company to buy from market perform. Orla has seen a significant pullback in its share price post the September gold mining shows in Colorado on speculation that a potential acquisition is being contemplated.

Threats

- The iShares Gold Trust’s Relative Strength Index (RSI) has risen above 70, indicating potential overbought conditions, further supported by the stock closing above its upper Bollinger band. Over the past year, when the ETF crossed this threshold, it typically experienced an average 1.7% decline in the following 20 days, despite currently maintaining positions above its 200-day and 50-day moving averages.

- The dominant rise of silver jewelry, once considered out of fashion since the late 2000s, is now emerging as a formidable challenge to gold. Its resurgence since early 2023 threatens gold’s position as the precious metal of choice, with sales of silver increasing significantly, both in the mid-range and luxury sectors, as well as the second-hand market. As silver gains momentum and recognition, its sleek and modern allure could potentially lead to decreased demand for gold, posing a looming threat to gold prices.

- Petra Diamonds Ltd. reported full results of Tender 2 of fiscal year 2024 with disappointing results. Like-for-like diamond prices were down in the 16% -18% range, reflecting market weakness, as reported by Bloomberg. The sale was brought forward due to the rough diamond import moratorium in effect between October 15 to December 15, 2023, to better manage the balance between an oversupplied rough diamond market and consumer demand.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2023):

Delta Air Lines Inc.

American Airlines Group Inc.

United Airlines Holdings Inc.

Southwest Airlines Co.

Deutsche Lufthansa AG

Air France-KLM

Air Canada

Cathay PaSouthwest Airlines

Wizz Air

Ryanair Holdings

easyJet PLC

COSCO

Evergreen Marine Corp

Yang Ming Marine

Las Vegas Sands

Tesla

Pernod Ricard

Remy Cointreau

Brunello Cucinelli

Hermes

Louis Vuitton

Centamin Plc

Gold Fields Ltd.

Harmony Gold Mining

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The S&P 500 Airlines Index is a capitalization-weighted index.

This is a GICS Level 4 Sub-Industry group. The NYSE Arca Global Airline Index is a modified equal-dollar weighted index designed to measure the performance of highly capitalized and liquid global airline companies.

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions.