The Looming Debt Ceiling Crisis: What It Means for the U.S. Economy and Global Markets

Every couple of years, it seems, the world watches in apprehension as the U.S. president and Congressional leaders play chicken over the nation’s debt limit.

Every couple of years, it seems, the world watches in apprehension as the U.S. president and Congressional leaders play chicken over the nation’s debt limit. If the so-called ceiling can’t be raised, the U.S. Treasury risks running out of cash, and the country could default on its debts.

This would result in a series of potentially “cataclysmic” events, according to a new dystopian report by Moody’s Analytics. Credit rating agencies would immediately downgrade Treasury debt, followed by U.S. financial institutions, nonfinancial corporations, municipalities and more.

In Moody’s worst-case scenario, an economic downturn triggered by a U.S. default would rival that of the global financial crisis. As many as 7.8 million jobs could be lost, and stocks would fall by almost a fifth, erasing $10 trillion in U.S. household debt. The contagion would spread to global markets.

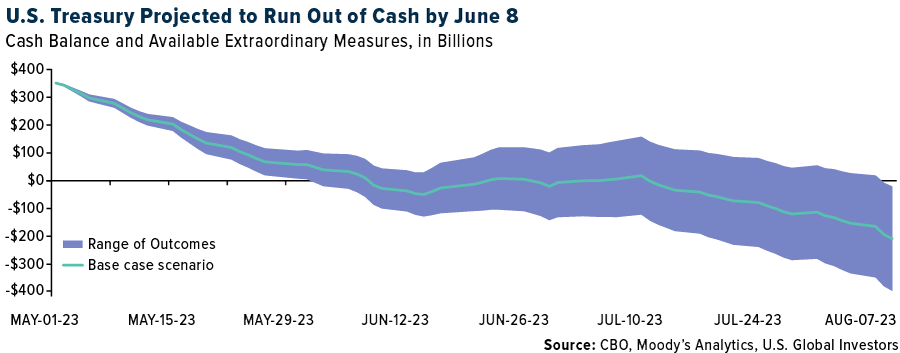

Oh, and did I mention that President Joe Biden and Speaker Kevin McCarthy have until June 8—less than a month from now—to find common ground? That’s when the Treasury’s coffers run dry if no progress is made, based on Moody’s estimates.

My gut feeling is that an agreement will be reached before it’s too late. As was the case in past showdowns, the political wrangling is more Kabuki theater than anything else. At the same time, Biden and McCarthy are playing with fire.

Debt Ceiling Reform, Spending Reform

So why does the United States put itself, and global onlookers, through this every few years? The U.S. is one of the very few countries on the planet that has a debt ceiling, and of those that do, none seems to allow it to threaten economic stability.

Is it time we scrapped the debt limit altogether?

I would be in favor of debt ceiling reform if it did two things: 1) remove the serious threat of a government default, and 2) hold lawmakers accountable by automatically triggering spending cuts if the ceiling were reached.

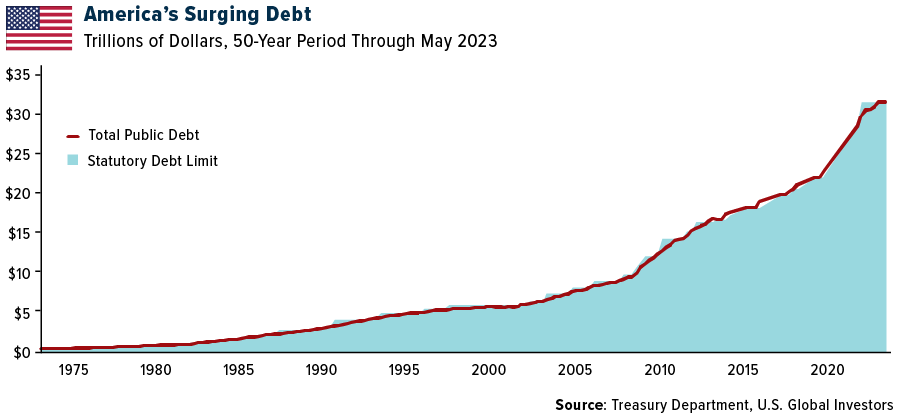

Spending is precisely what needs to be addressed. Today the national debt stands at $31.7 trillion, or 120% of U.S. gross domestic product (GDP). For the past 20 years, during Republican and Democrat administrations alike, the U.S. government has run an average annual deficit of almost $1 trillion. Much of this is due to the steep interest payments on public debt, which are now as much as the country’s spending on defense.

Simply put, it’s unsustainable.

I urge everyone to read Stanley Druckmiller’s recent comments on the nation’s out-of-control spending and, specifically, entitlements. Earlier this month, the billionaire investor spoke at the Student Investment Fund Annual Meeting at USC Marshall’s Center for Investment Studies (CIS), where he shared some startling statistics. For instance, the U.S. spends six times as much per senior as it does per child, and in 25 years, its spending on seniors will account for 70% of all tax revenues.

“It is time that we let go of the false pretense that cutting entitlements is a choice. It is not,” Druckenmiller said. “Either we cut them today, or we will have to cut them much more tomorrow.”

You can read his keynote here.

68% Probability of Recession?

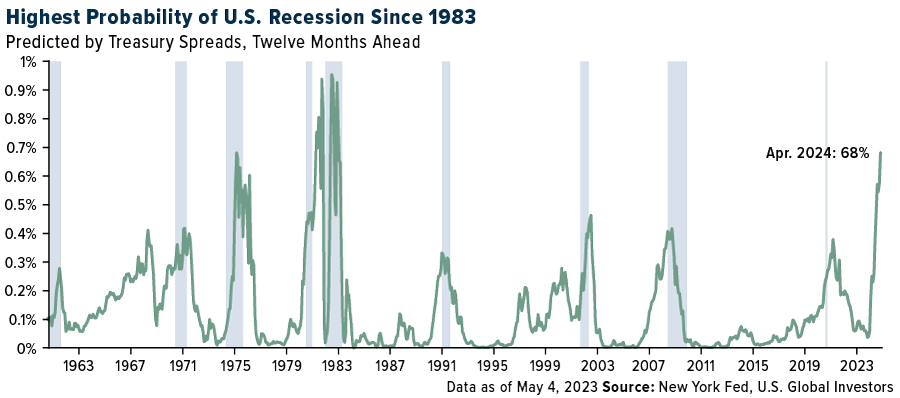

Leaving aside the debt ceiling drama for a moment, investors still have a potential recession to prepare for. Based on Treasury yield spreads, the Federal Reserve Bank of New York now puts the probability of a recession in the next 12 months at 68%. That’s the highest monthly reading since 1983.

The Fed’s tightening program appears to be nearing an end as inflation continues to cool and economic growth slows. That presents its own risks, based on historical precedent. Over the past 70 years, a pause in rate hikes was followed by an economic recession 75% of the time, with an average lag of six months.

If we follow the same playbook, we may be looking at a full-blown recession by the end of the year. As always, getting exposure to gold and gold mining stocks, I believe, is a wise and rational strategy to manage this risk.

Discover the lucrative world of luxury goods stocks in this video! Despite the challenges of the pandemic, the global luxury market continues to thrive. Join us as we explore four compelling reasons why investing in luxury goods stocks can be highly profitable.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.