The Diminishing Impact of the January Effect

The January effect, named for the market anomaly where stock returns in January are typically higher than in other months, has been a subject of interest since it was first documented in 1942.

Traditionally, this effect has been attributed to tax-loss harvesting at the end of the year, where investors dump their laggards to offset capital gains tax liabilities, leading to a December selloff. This is followed by a buying spree in January, as investors repurchase stocks, boosting demand and prices.

Other explanations for the January effect include the influx of cash from year-end bonuses into the stock market, the rise of tax-sheltered retirement accounts (IRAs, 401(k)s, etc.) and the prevalence of new investment instruments and regulatory changes.

Then there’s also a perceived increase in investment activity as people follow through on New Year’s resolutions to invest more. January, after all, has long been associated with fresh starts and positive animal spirits. A recent YouGov poll found that about a third of American adults made New Year’s resolutions for 2024.

From Leader to Laggard

The January effect was a pronounced trend in the past, but in more recent years, it’s delivered diminishing returns.

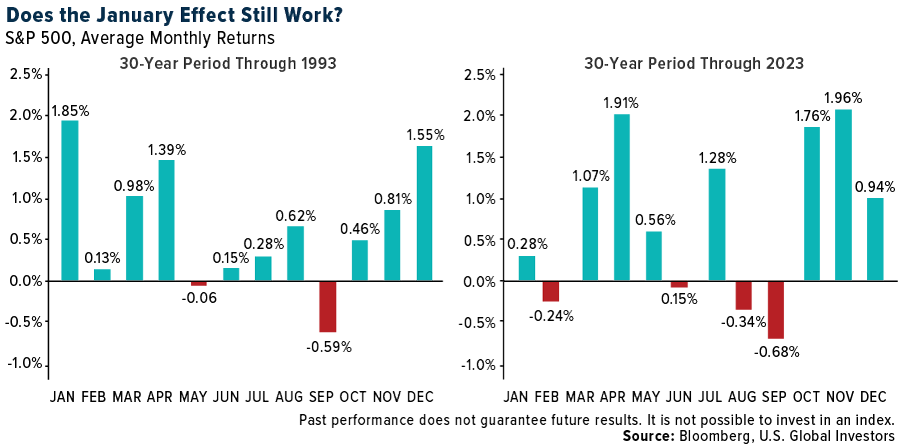

Take a look at the visual below. It shows average monthly gains for the S&P 500 during two time periods: the 30-year period through the end of 1993, and the subsequent 30-year period through the end of 2023. As you can see in the bar chart on the left, January was the top month for returns, with stocks rising 1.85% in value on average. That’s well above December, the number two month, when they were up an average 1.55%.

Something shifted over the next 30 years, though, and January no longer ranked first, falling to the eighth best month with stocks advancing only 0.28%.

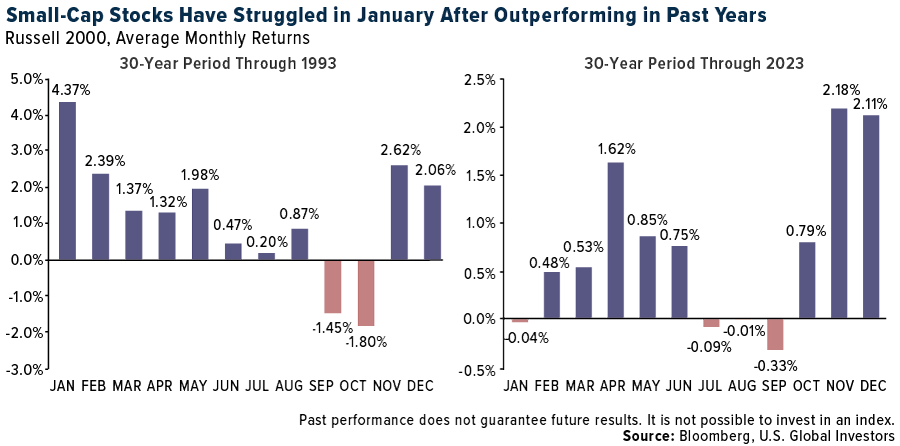

The same observation can be made with regard to small-cap stocks. During the pre-1993 period, the Russell 2000 easily outperformed during the month of January, rising an astonishing 4.37% on average.

This huge monthly gain deteriorated to a slight loss over the next 30 years, and November and December became the hands-down leaders.

So what happened? Perhaps nothing. Perhaps the phenomenon is still in effect, it just shrunk to have a shorter duration.

That’s what Nicholas Moller and Shlomo Zilca concluded back in 2006. A close examination of the anomaly revealed that the January effect is now primarily concentrated in the first half of the month, with a reversal in the trend observed in the latter half. If we focus on the first half of January, Moller and Zilca write, “the basic forces that drive the January effect still persist and are as strong as they have been in the past.”

Even so, I encourage investors and traders to approach this phenomenon with a healthy dose of skepticism. I believe participants are better served by keeping their eyes on market fundamentals and long-term macroeconomic trends instead of trying to exploit an increasingly questionable anomaly.

The 2024 Election Year: A New Layer of Complexity

As you’ve heard me say a number of times, government policy is a precursor to change, and if that’s the case, 2024 is poised to bring about plenty of change that investors need to be aware of. Depending on the source, between 40 and 50 national elections are scheduled to take place this year, making it the biggest year on record for national elections.

Bloomberg Economics calculates that voters in countries representing 41% of the world’s population and 42% of its gross domestic product (GDP) have the opportunity to choose new leaders this year. That includes voters in the U.S., who appear headed for another rematch between former president Donald Trump and incumbent Joe Biden.

Other big-name leaders facing reelection in 2024 are India’s Narendra Modi, Venezuela’s Nicolas Maduro and rivals Vladimir Putin of Russia and Volodymyr Zelenskyy of Ukraine.

Historically, election years have been favorable for stock markets. Since 1928, the S&P 500 has advanced 7.5% on average during these years, while stocks recorded positive gains 75% of the time, according to RBC Wealth Management.

But again, relying solely on historical patterns can be misleading. I believe it’s far more important to understand the underlying economic indicators, company performance and broader market trends that drive long-term value. Investors should also prioritize portfolio diversification, ensuring a mix of assets that align with their risk tolerance and investment goals.

As always, I recommend a 10% weighting in gold, with half invested in physical gold (bars, coins, jewelry) and the other half in high-quality gold mining stocks, mutual funds and ETFs.

Gold was the best performing commodity of 2023, rising 13.10%. Learn how other materials did in our updated, interactive Periodic Table of Commodities Returns. Click here!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.34%. The S&P 500 Stock Index rose 1.84%, while the Nasdaq Composite climbed 3.09%. The Russell 2000 small capitalization index lost 0.02% this week.

- The Hang Seng Composite lost 1.72% this week; while Taiwan was down 0.04% and the KOSPI fell 2.06%.

- The 10-year Treasury bond yield fell 10 basis points to 3.942%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Airbus, up 6.8%. Delta Air Lines closed out 2023 by doubling its quarterly profit, reports CNBC, as travel demand – particularly for international trips – helped drive record revenue in the year. CEO Ed Bastian said continued strong travel demand could boost earnings this year.

- According to Goldman, for Chinese ports, the bank continues to expect stable domestic ASP in 2024 without seeing any downward pricing pressure, while overseas ports could raise ASP in line with inflation. Goldman also has an optimistic volume outlook with low single-digit year-over-year throughput growth in 2024.

- Air Canada (AC) reported its operational performance during the year-end holiday travel season, noting a strong peak travel period (December 18, 2023 – January 6, 2024). CIBC highlighted that AC noted it flew 2.6 million customers during the peak travel period, up 10% year-over-year. The carrier’s on-time performance was 70%, up from 40% in 2022 and 54% in 2019. The average delay was 37 minutes, down 43% year-over-year and down 10% from 2019 levels.

Weaknesses

- The worst performing airline stock for the week was JetBlue, down 12.5%. Alaska Airlines cancelled 160 total flights, affecting roughly 23,000 guests and many crew members. The carrier is identifying necessary cancellations and expects the disruption to last through at least mid-week. Eighteen of Alaska’s 737-9 MAX aircraft received in-depth inspections as part of heavy maintenance checks and initially remained in service. These aircraft have now also been pulled from service until details about possible additional maintenance work are confirmed with the FAA.

- According to Morgan Stanley, FedEx Express plans to cut the minimum number of flight hours for pilots by 13% and encourage 400 senior members to retire early to alleviate an overstaffing issue due to ongoing suppressed parcel volumes. The company is now looking to retire pilots early as contract conversations have renewed. Pilots are compensated based on the minimum number of hours required by the contract regardless of the number of hours they have flown.

- JetBlue announced that current President & COO, Joanna Geraghty, will succeed CEO Robin Hayes, effective February 12. While the leadership succession is not a surprise and is positive in terms of Geraghty being the first woman airline CEO, the timing is. The change comes potentially ahead of a merger with Spirit and at a time domestic LCCs are experiencing relatively challenging earnings set up.

Opportunities

- According to Bank of America, United Airlines has been opportunistic post-pandemic by being first mover in the transatlantic and focusing on premium products, helping to drive 2023 estimated revenues 24% ahead of 2019, versus peers 16% ahead. Similarly, the gauge has been a strategic focus with average seats per departure up 19% versus 2019. While the bank expects international trends to normalize this year, it has forecast that the carrier will continue to drive outsized revenue growth versus its peers.

- According to Morgan Stanley, container shipping rates have risen significantly due to shipping blockages in the Suez Canal. Spot rates for shipping goods in a 40-foot container from Asia to Northern Europe have increased 173% to $4,000 and rates from Asia to North America’s east coast have risen 55% to $3,900, amidst ongoing geopolitical disruptions since mid-December. Suez Canal transits were down 28% year-over-year in the 10 days leading up to January 2, as global shipment firms pause and/or re-route their Red Sea shipments.

- According to Goldman, for Air China, the bank highlights that passenger traffic during the Spring Festival could hit a record high for the industry and expects Air China will outperform the industry with domestic/international capacity reaching 140%/80% of 2019 levels. Goldman also expects further increases in international business after the Spring Festival and believes it’s doable to achieve full recovery for international capacity around mid-2024.

Threats

- According to RBC, the FAA has issued a grounding order for the 171 MAX 9 aircraft in operation. The FAA has indicated that it is focused on the Alaska event, and not looking at the broader MAX program, which is a positive for Boeing. Initially, both Alaska and United had accelerated inspections on existing aircraft and had even planned to bring some of the aircraft back into service after inspections. However, RBC now believes both United and Alaska are taking a more cautious approach to the return to service timing for their MAX 9 aircraft even though a significant number of aircraft have been inspected.

- According to UBS, East Coast ship backlogs increased from 5 to 30, marking the single-largest weekly East Coast backlog rise seen since introducing the congestion index back in November 2021. While the reasoning for this sudden rise in backlogs is not yet completely clear, UBS notes that it could be partly attributable to a combination of global scheduling disruptions related to Red Sea disruption, higher demand related the typical pre-Chinese New Year shipping rush which tends to occur in January, in anticipation of the more-limited Chinese port operations in early February given the holiday, and improving daily transits via the Panama Canal.

- According to JPMorgan, as an example of further regulatory implications, certification of both the MAX 7 and MAX 10 has continued to slip, and the recent accident likely reinforces the FAA’s desire to ensure that every “i” is dotted and every “t” crossed before signing off on these aircraft. More concretely, the bank doubts this door plug issue applies to the MAX 7, given its size, though it could be relevant for the MAX 10 in certain configurations.

Luxury Goods and International Markets

Strengths

- Macau’s casino industry is off to a robust start to 2024, displaying impressive performance within the S&P Luxury Index. The resurgence follows a period of stringent restrictions that had previously hampered the gaming hub’s operations. Year-to-date, MGM China has seen a notable 6.25% increase in its shares, while Wynn Resorts has recorded a 3.1% rise, and Las Vegas Sands has shown a 1.2% uptick in its stock value.

- Chinese carmakers exported 3.83 million passenger cars in 2023, a 62% increase from the year before, the China Passenger Car Association (CPCA) estimated during a press conference. This marks the first time its exports have surpassed those of Japan, making China the world’s biggest car exporter. Chinese brands also outsold foreign carmakers inside China, taking 52% of the domestic market, up 4.6 percentage points from the year before.

- Deckers Outdoor Corporation, a footwear and accessories retailer, was the best performing S&P Global Luxury stock, gaining 8.3% in the past five days. UBS raised the price target from $745 to $865. Shares closed at $706.65 on Friday. The company reported strong Ugg boots sales during the holiday season.

Weaknesses

- December headline CPI in the United States increased 0.3% month-over-month versus 0.2% consensus, up from November’s 0.1% reading. Annualized CPI increased to 3.4% month-over-month versus 3.2% consensus. Now the rate cuts expected in March may be pushed forward to a later time, as more work may need to be done by the Federal Reserve Bank to bring it down to 2%.

- Goldman Sachs analysts have cut their 2024 growth forecast for the global luxury industry to 6% from 8% but see the trend improving in the second half of the year. The broker expects weaker demand and recommends holding companies more exposed to the affluent client base.

- Lucid, a California-based electric mobility ecosystem company, was the worst performing S&P Global Luxury stock, losing 20.5% in the past five days. Lucid announced the production of only 8,428 cars in 2023, with sales of 6,001 out of those. Slow production and high costs are putting pressure on the company’s shares.

Opportunities

- The luxury housing market in 2024 is set to be defined by a growing demand for sustainable homes, as revealed by Sotheby’s International Realty’s Luxury Outlook report. Buyers are increasingly focused on properties located in lower-risk areas and those designed with eco-conscious features, such as environmentally friendly heating systems and electric car charging capabilities in garages. The luxury housing market is expected to stabilize in 2024, offering a sense of normalcy and relief to wealthy buyers and sellers.

- JD Sports, Primark, and Inditex are all focusing on expanding their presence in the U.S. market by opening new stores. JD Sports aims for category leadership with a multi-brand strategy, while Inditex plans to open or extend 30 large units in the U.S. as part of a 14% increase in capital spending for fiscal 2024. Primark, under ABF, is also investing in additional stores in the U.S., reaching 60 units and expanding to Texas.

- In 2023, the luxury market in Saudi Arabia reached a total worth of USD 19.23 billion, primarily fueled by increasing disposable incomes and a rising appetite for luxury products among consumers. With ongoing efforts toward economic diversification within the nation, the market is poised for continued expansion during the forecast period from 2024 to 2032, with an anticipated compound annual growth rate (CAGR) of 7%.

Threats

- The resale value of top-selling electric vehicles in the U.S. dropped by 28% in 2023, according to data from CarGurus and HSBC, signaling a slowdown in the EV market’s growth. In the UK, the value of used EVs fell by approximately 20%, significantly higher than the 3.7% drop in the overall used car market. These declining resale values may make new EVs less affordable compared to traditional petrol or diesel vehicles, affecting leasing prices and potentially forcing carmakers to cut prices in response to market competition from cheaper Chinese models.

- European apparel store-based retailers, including brands like M&S, H&M, Inditex, LPP, and ABF Primark, experienced strong recoveries in 2023. This was driven by consumers returning to physical stores searching for new clothes as offices reopened, coupled with e-commerce becoming less attractive due to added delivery and return fees. Bloomberg Intelligence warned regarding retailers’ sales prospects in 2024 as they face challenging comparisons with the previous year’s sales boost driven by inflation, which is unlikely to be replicated.

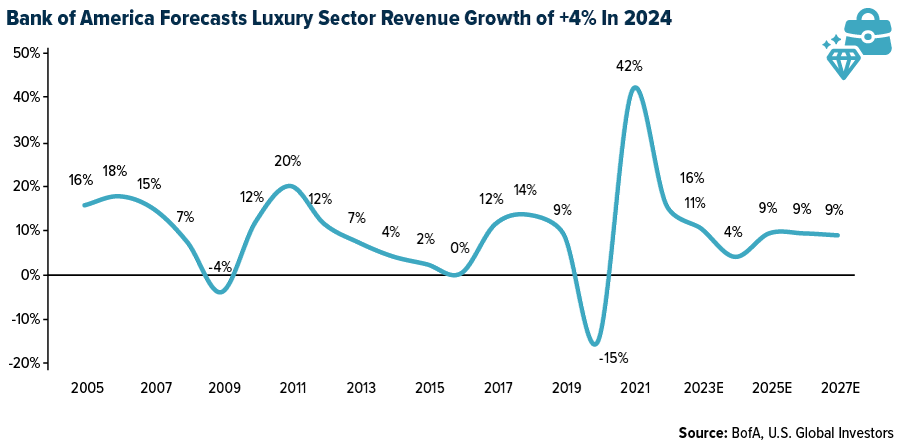

- Bank of America published a 100-page report on the luxury sector this week titled “Darkness Before Dawn”. Despite the recent correction in luxury equities, it may still be too early to buy as investor sentiment has not bottomed out yet, the broker says, predicting the sector to grow only 4% in 2024, with much of the growth taking place in the second half of the year.

Energy and Natural Resources

Strengths

- The best performing commodity for the week week was natural gas, rising 16.25%.as proxied by the Sprott Physical Urainum Trust. This week the Energy Department announced they were soliciting bids for U.S. uranium enrichment. According to Bloomberg, about $500 million is available to spend on uranium enrichment courtesy of the Inflation Reduction Act (IRA). In addition, late in the week, NAC Kazatomprom, the world’s largest uranium producer, announced 2024 production will drop due to difficulties in getting enough sulfuric acid which is used to isolate the heavy metal.

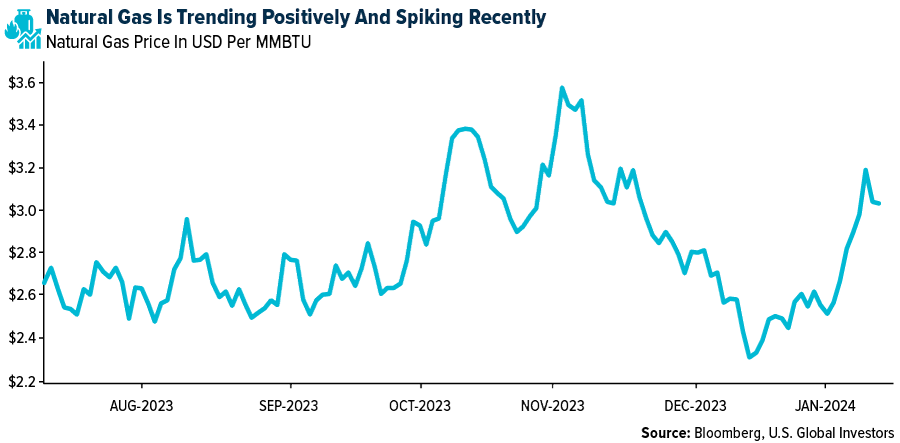

- Natural gas prices surged in a major about-face from December’s plunge as forecasts showed intense cold across the northern tier of the U.S. into late January. Futures for next-month delivery jumped as much as 14%, the most since July 2022, before paring gains. A midday update to a U.S. government weather model showed temperatures up to 20 degrees below normal in parts of the Midwest later this month, according to commercial forecaster Maxar Technologies.

- Chesapeake Energy Corp. agreed to acquire rival Southwestern Energy Co. for about $7.4 billion in an all-stock deal to create one of the largest U.S. natural gas producers. Oklahoma City-based Chesapeake will pay $6.69 per share, it said Thursday in a statement. The transaction is expected to close in the second quarter, subject to regulatory approvals.

Weaknesses

- The worst performing commodity for the week was DCE Iron Ore Futures, dropping 3.99%,following a drop in prices in the previous week post an 18-momth high in prices. Singapore stockpiles rose for a sixth straight week, signaling deteriorating demand. According to JPMorgan, lithium markets remain under pressure starting 2024 with spodumene and carbonate both down 7%-8% year-to-date (YTD). The move has been driven by weaker electric vehicle (EV) sentiment and oversupply concerns. JPMorgan feels as though high-cost producers will continue to be challenged, prompting some to idle operations.

- A substantial cut in official oil pricing to Asia by OPEC+ leader Saudi Arabia has reinforced signs of a softer physical market in the key region. Saudi Aramco cut the official selling price for its flagship Arab Light crude to a $1.50-a-barrel premium to the regional benchmark for February, the lowest level since November 2021. The $2-a-barrel reduction was deeper than had been foreseen, and follows a weakening of spot differentials for Middle Eastern crudes due to lackluster Chinese appetite and increased global supplies.

- North Asian liquefied natural gas (LNG) prices fell to the lowest in nearly seven months as an outlook for milder weather and high inventories reduced the need to buy more fuel for winter. Spot rates dropped to about $9.80 per million British thermal units on Tuesday, the lowest since mid-June, according to traders.

Opportunities

- Bank of America says it is constructive on uranium prices, currently trading at a 15-year high of $97.45 per pound, given an increasingly tight spot market. The bank expects the market to remain tight into 2025 when new mined supply is forecast to finally provide relief from lack of supply. With inventories evidently lower than we had previously believed and production slippages a risk, they increase their uranium price forecasts to $105 per pound (+34%) in 2024 and $115 (+53%) in 2025, with no change to mined supply or demand forecasts.

- Cleveland-Cliffs attempted a $50-per-ton price hike (first since December 6) for sheet products with a targeted minimum HRC base price of $1,150 per ton. They note the latest benchmark HRC reported by SMU last week was $1,045 (+$5 week-over-week), with Platts unchanged at $1,100. Meanwhile, lead times have continued to soften with those for HRC last reported at 6.3 weeks, down from 6.9 weeks, but still healthy and above the typical 4–6-week range.

- Norway is set to become the first country to open its seas to commercial deep-sea mining, despite concerns about the industry’s potential to destroy marine life. While some deep-sea mining tests have been allowed to run on a small scale, no country has yet allowed commercial exploitation of its deep-sea floors. The proposal, which is up for a parliamentary vote, is expected to pass without opposition on Tuesday as it has received cross-party support, the BBC reported Monday. It could open 108,000 square miles of Norway’s national waters to commercial deep-sea mining. The industry would seek to collect rare minerals like lithium, scandium and cobalt from nodules and crust found on the ocean floors, the BBC says.

Threats

- Oil dropped after Saudi Arabia cut official selling prices for all regions, underscoring a worsening global outlook and outweighing concern over Red Sea tensions and supply disruptions in Libya. Global benchmark Brent fell below $78 a barrel, after rising 2.2% last week.

- The Suntracs construction union in Panama began demonstrations at the shuttered copper mine run by First Quantum, according to a separate union representing mine workers. Protesters are blocking access roads to the site, where the Canadian company still has some workers and installations, Michael Camacho, a spokesman for the Utramipa mining union, said in a text message Tuesday.

- Russia’s refined fuel exports extended gains to the highest since early April on a four-week average basis, driven by bigger diesel flows. Oil product shipments averaged 2.8 million barrels a day in the four weeks to January 7, according to data compiled by Bloomberg from analytics firm Vortexa. That is about 99,000 barrels, or almost 4%, higher than the previous week.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Ethereum Name Service, rising 80.10%.

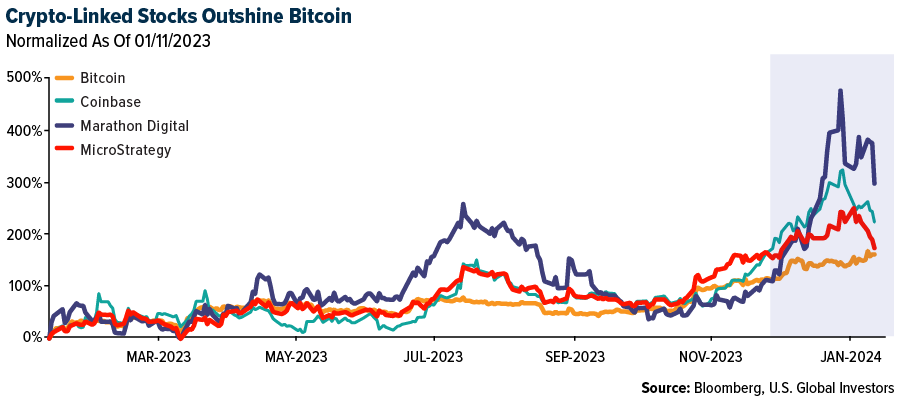

- Competition among prospective Bitcoin ETF issuers intensified this week leading up to the eventual approval of the funds by the U.S. SEC, as companies further slashed fees in a bid to make their products more attractive to investors, writes Bloomberg.

- Believe it or not, Ether emerged as one of the biggest beneficiaries of the decision by U.S. regulators to approve the country’s first spot Bitcoin ETF this week. Ether rose 9% in the 24 hours following the announcement to $2,585, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Klay, down 20.62%.

- Some stocks linked to cryptocurrencies reversed early gains from SEC approval of spot Bitcoin ETFs. Shares in Coinbase Global and Robinhood Markets, for example, were among the stocks that fell on Thursday, writes Bloomberg.

- South Korea sought to choke off a potential flood of speculative cash heading to U.S. spot Bitcoin ETFs, reports Bloomberg, stoking confusion and roiling a slew of stocks. The Financial Services Commission said that brokering such ETFs may violate the existing government stance on virtual assets and capital markets law, the article explained.

Opportunities

- Bitcoin pushed past $49,000 for the first time since December 2021 as trading commenced on the first U.S. ETF that invests directly in the biggest cryptocurrency, Bitcoin, according to Bloomberg.

- Ethereum is emerging as the big winner from the U.S. approval of spot Bitcoin ETFs, writes CoinDesk, and one reason could be the potential for a spot Ether ETF next. In fact, BlackRock had previously filed an S-1 form with the U.S. SEC.

- Circle Internet Financial said it had confidentially submitted plans to launch an IPO, more than a year after it scrapped a bid to list its shares via a blank-check deal. The $25 billion stablecoin provider filed a draft registration statement with the U.S. SEC, writes Bloomberg.

Threats

- Leading up to the approval of spot Bitcoin ETFs this week, the U.S. SEC’s X account (formerly Twitter) was compromised on Tuesday with a fake post claiming that the agency had green lit plans to approve the funds, writes Bloomberg.

- X has removed support for NFT profile pictures which is unsurprising given other social networks have also wound down their NFT experiments. The value of some of the high-priced tokens, such as the Bored Ape Yacht Club, have plummeted from the peak.

- Cathie Wood of ARK Invest said she was taken aback by the U.S. Securities and Exchange Commission Chair Gary Gensler’s statement shortly after the agency approved around a dozen ETFs that will directly hold Bitcoin. “He just denigrated the whole crypto space. I couldn’t believe it,” Wood said in a Bloomberg Radio interview.

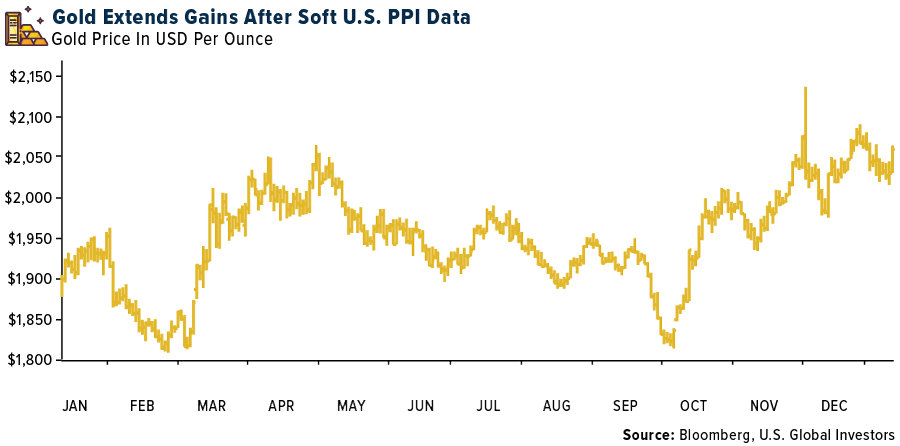

Gold Market

This week gold futures closed the week at $2,051.40, up $1.60 per ounce, or 0.08%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.45%. The S&P/TSX Venture Index came in up 0.88%. The U.S. Trade-Weighted Dollar rose 0.02%.

Strengths

- The best performing precious metal for the week was gold, up 0.08%, but just slightly, as a soft PPI data for December amped up expectations of interest rate cuts. In addition, U.S.-led airstrikes on Houthi rebel targets in Yemen likely raised demand for precious metals this week. Vizsla Silver reported an increase in resources at its flagship Panuco project in Mexico. The updated estimate outlined a 48.7% increase in indicated resources to 155.8 million ounces of silver equivalent contained within 9.5 million tons of ore grading 511 grams per ton silver equivalent.

- According to BMO, Sandstorm announced it sold 23.3k ounces GEOs in the fourth quarter of 2023, above the company’s estimate for 21.3k ounces GEOs during the quarter. Preliminary revenue during the fourth quarter is $44.5 million, while the cost of sales, excluding depletion, is for $4.9 million.

- According to Stifel, K92 Mining released fourth quarter production and operational results. Production came in at 39.1k ounces gold, 21% higher than the expected 32.0k ounces gold. Full-year production of 117.6k ounces gold beat the downwardly revised annual guidance of 111-116k ounces gold. The underground mine development rate was a quarterly record of 2,649m – a 19% increase year-over-year and quarter-over-quarter and ongoing improvements are expected as new equipment arrives.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.65%, as most industrial metals fell in price on weaker sentiment toward economic growth. According to Bank of America, against continued uncertainty on when the Federal Reserve will cut rates and with EURUSD back at levels from late-November, investors have broadly stayed on the sidelines. This shows that assets under management at physically backed ETFs have flat lined, although they are no longer falling as fast as earlier in 2023.

- Gold resumed its slide after whipsawing moves at the end of last week, with a recent rebound in the dollar and U.S. bond yields posing a threat to the precious metal’s appeal. Spot gold prices fell as much as 0.9%, coming back under pressure after choppy trading as investors parsed U.S. jobs and services data for clues on the likely timing and size of Federal Reserve interest-rate cuts.

- So far in January, silver has been materially underperforming gold. The Gold/Silver ratio has shot up to 89, the highest since March 2023, indicating that at present silver’s bullish drivers are losing the battle. Industrial and jewellery fabrication demand are exposed to several risk factors this year. Global silver demand is estimated to have fallen by 10% last year to 1,143 million ounces and could be lower again this year if photovoltaic installations slow following the surge in 2023 and other industrial applications see a decline.

Opportunities

- Scotia continues to expect margins to be supported by the robust gold market. The group also believes that sticky inflationary pressures will persist (such as labor cost inflation) especially in tight markets like Canada and the U.S., leading to flat or higher costs year-over-year. 2024 could see a continuation of active M&A for Scotia’s coverage universe.

- Morgan Stanley argues that gold is fairly valued at around $2,025 per ounce. Non-commercial net longs are the highest since May 2022, gold’s sensitivity to real yields is fading and geopolitical risk remains elevated, but seems largely priced in. However, as the year progresses, if gold’s safe haven premium holds, the risk-reward is probably more skewed to the upside. Looking back to 1990, gold has been on average 6% higher 30 days after the first rate cut. On top of this, even with a shallower regression line, a 100 basis point drop in real yields would imply another 5% upside for gold, while the bank would expect central bank buying to remain strong, supporting physical demand too.

- India’s reliance on imports of silver paste, a key material for making solar modules, highlights the challenges of localizing the solar supply chain. Silver paste is the largest component of the cash costs in converting photovoltaic wafers to cells, and accounts for about 7% of module cost currently. India’s solar manufacturers imported record-high volumes of silver paste in the first nine months of 2023, according to a Bloomberg NEF analysis of third-party trade data.

Threats

- This week the SEC gave the green light to the creation of Bitcoin ETFs and in no time flat, billions of dollars crossed hands for Bitcoin in lieu of cash. Bloomberg reported that during a recent interview on CNBC’s Squawk Box, Blackrock CEO Larry Fink drew a parallel between Bitcoin and gold, stating that Bitcoin is “no different than what gold represented for thousands of years.” Fink also argued Bitcoin is unique because it has a limited supply, unlike gold. Since the launch of this major liquidity event for Bitcoin trading on Thursday, Bitcoin has fallen more than 6% while gold is up more than 1.5%. Betting on gold for the next 1,000 years might be the safter wager.

- According to Bank of America, palladium has been under pressure on a confluence of factors, including rising EV penetration rates. With palladium demand driven to 90% by car manufacturers, this is a structural headwind. Touching on the dynamic, Heraeus notes that the “Loss of EV subsidies in Germany may slow conversion from gasoline light vehicles. In December, the German government prematurely ceased its EV subsidy programme after the government budget was left €60 bn short following a court ruling. The programme was intended to be in place until the end of 2024 and provided up to €4,500 toward the purchase of a personal electric vehicle”.

- Newmont shut a mill at its Telfer mine in Western Australia due to safety concerns over tailings facilities, The Australian reports, citing a company spokesman. The mill is unlikely to return to operation until at least the end of the month, with potential for the shutdown to last as long as eight weeks, the paper says, citing unidentified people familiar with the matter.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2023):

Air Canada

Delta Air Lines

Alaska Airlines

FedEx Corp

JetBlue Airways Corp.

Boeing

Las Vegas Sands

Sprott Physical Uranium Trust

Chesapeake Energy Corp.

Cleveland-Cliffs Inc.

Sandstorm Gold

K92 Mining

Newmont Corp

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization.