Stephen Harper’s Blueprint for Economic Growth and Middle-Class Prosperity

This week, at the North American Blockchain Summit in Dallas, Texas, I had the distinct privilege of moderating a fireside chat with former Canadian Prime Minister Stephen Harper.

Our conversation explored how blockchain technology can strengthen the economy, increase transparency and create new investment opportunities.

One standout moment was Harper’s reflection on the role the middle class plays in winning elections. In his 2018 book Right Here, Right Now, the prime minister urged fellow conservatives to focus on pragmatic solutions to everyday problems faced by the middle class. That was the key to winning elected office, he said.

He’s absolutely right. Here in the U.S., the middle class drove much of the enthusiasm for President-elect Donald Trump and his “America First” policies. Exit polls show that Trump overwhelmingly won the vote of those without a college education and those making between $30,000 and $49,000.

A Tale of Two Prime Ministers

Harper also spoke of his commonsense, fiscally conservative approach to dealing with the 2008–2009 global financial crisis. Canada, believe it or not, was the only G7 country that fully regained and even surpassed the business investment that was lost during the recession.

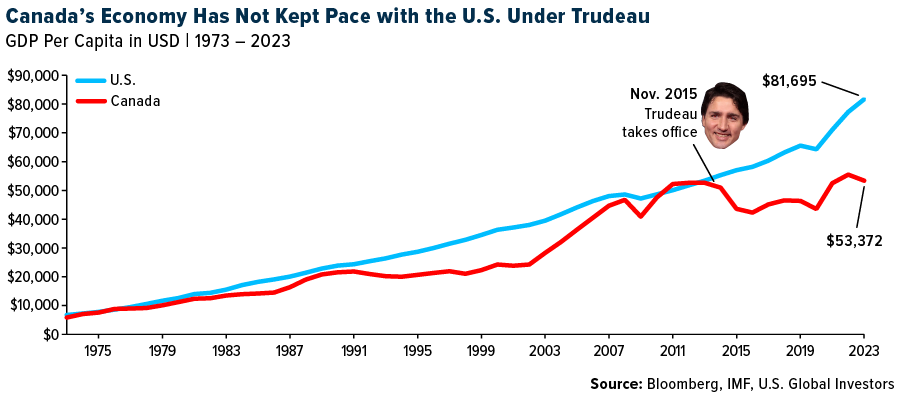

Unfortunately, my dear home country’s economy has struggled greatly under current Prime Minister Justin Trudeau, who has prioritized social issues over solutions to middle-class problems. During Trudeau’s administration, annual GDP-per-capita growth has averaged just 0.3%. Canadians are now significantly poorer than their U.S. counterparts.

The DOGE Initiative: Cutting Costs and Regulations

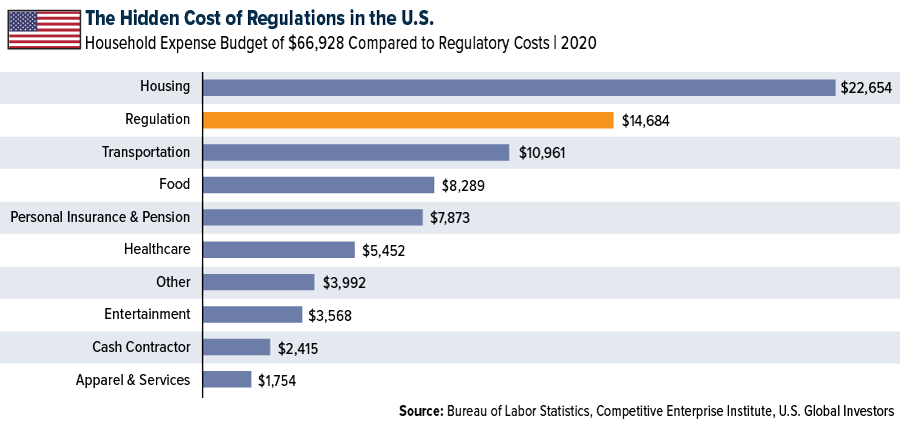

Harper’s insights tie directly into the economic anxieties felt by many working-class Americans. U.S. national debt now tops $36 trillion. Federal regulations cost approximately $2.1 trillion every year, representing around 7% of the country’s GDP, according to the Competitive Enterprise Institute (CEI).

This places a significant strain on middle-class households. The CEI estimates that the average American household pays over $14,500 annually in “hidden” regulatory taxes, exceeding what they spend on nearly every other expense except housing.

Trump’s decision to form the Department of Government Efficiency (DOGE), co-chaired by Elon Musk and Vivek Ramaswamy, aims to alleviate this burden. In a WSJ op-ed this week, Musk and Ramaswamy describe their mission to cut wasteful government spending and regulations and massively deduce headcount:

“DOGE intends to work with embedded appointees in agencies to identify the minimum number of employees required at an agency for it to perform its constitutionally permissible and statutorily mandated functions.”

This reminds me of how Musk addressed runaway spending at Twitter, now rebranded as X, after he acquired the platform in April 2022. The Tesla chief reduced the company’s workforce by about 80%, yet X continues to operate just as well as ever.

Gold and Bitcoin

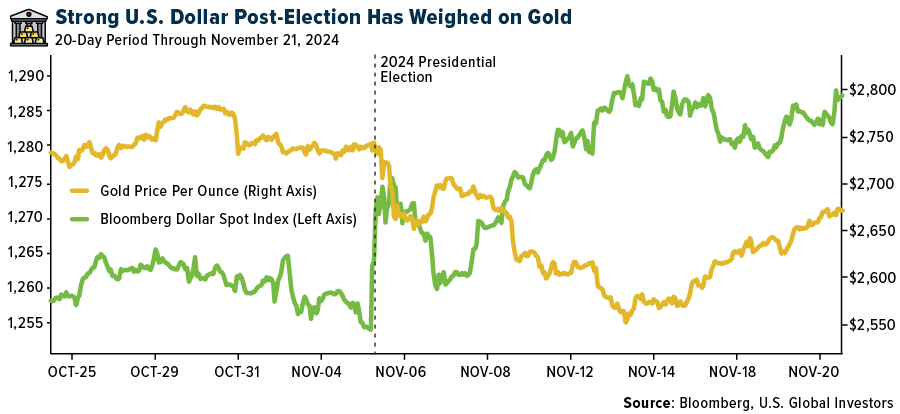

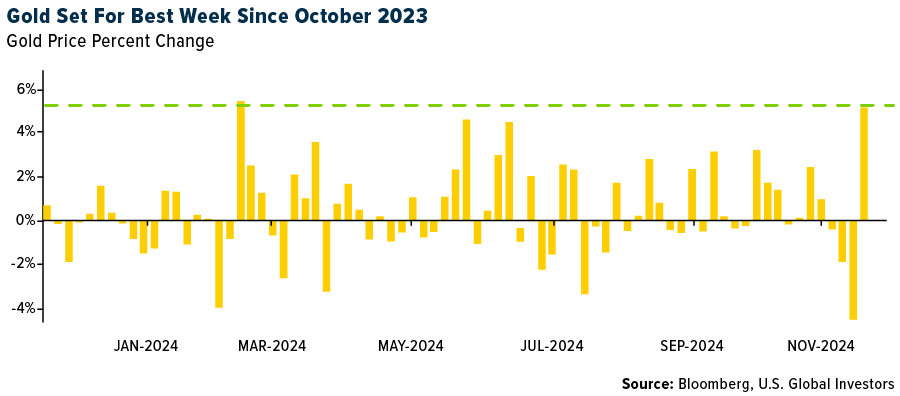

Economic uncertainty has led investors to seek safe havens. Gold has been one of the strongest-performing commodities in 2024, rising more than 31%. As you can see in the chart, the yellow metal took a hit after the election when the U.S. dollar rallied, weighing on commodities priced in the greenback.

This week, Goldman Sachs forecast that gold could reach $3,000 an ounce by the end of 2025, supported by demand from central banks, geopolitical tensions and investors hedging against economic volatility.

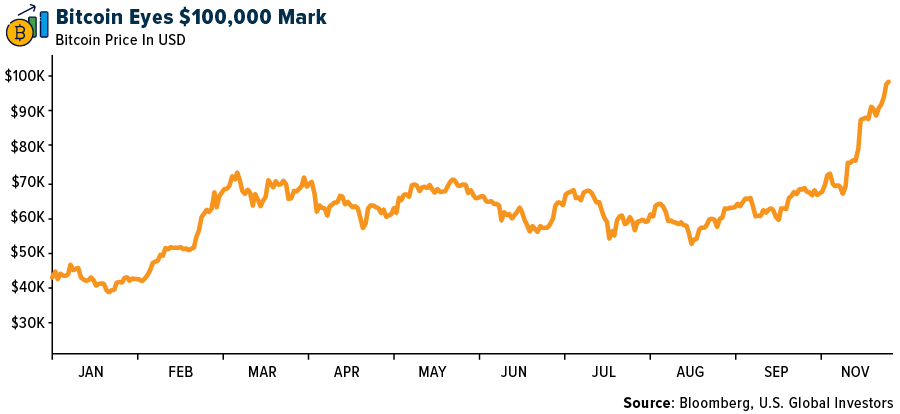

Meanwhile, Bitcoin continues to hover near the historic $100,000 level as Trump’s promise to turn the U.S. into the world’s “Bitcoin superpower” lights a fire under investors.

Senator Cynthia Lummis’s recent proposal to sell federal gold reserves to purchase Bitcoin has sparked debate. While Bitcoin’s potential is undeniable, I believe the U.S. would be unwise to abandon its gold, a cornerstone of financial stability for over 5,000 years.

Going forward, I believe that diversification remains key, especially as geopolitical tensions support the need for safe-haven assets like gold and Bitcoin.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.24%. The S&P 500 Stock Index fell 2.08%, while the Nasdaq Composite fell 3.15%. The Russell 2000 small capitalization index lost 3.99% this week.

- The Hang Seng Composite lost 8.43% this week; while Taiwan was down 3.44% and the KOSPI fell 5.63%.

- The 10-year Treasury bond yield rose 13 basis points to 4.44%.

Airlines and Shipping

Strengths

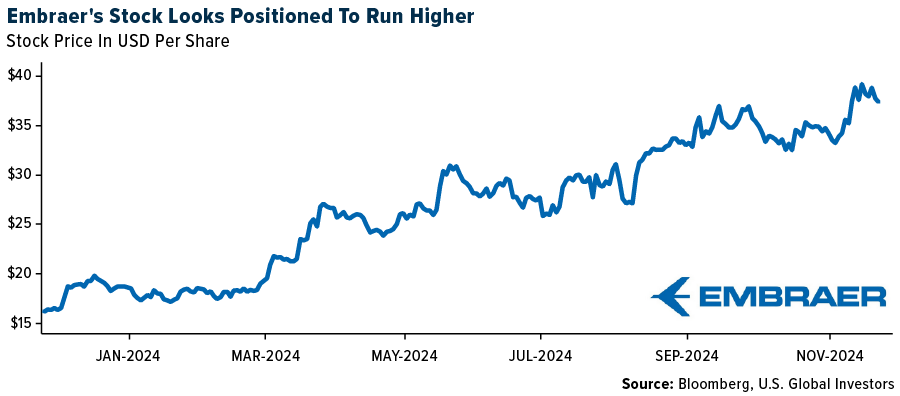

- The best performing airline stock for the week was Bombardier, up 15.0%. Embraer held its annual Investor Day where the company noted its backlog is $22.9 billion, up 30% year-over-year and at a record. Embraer is investment grade by Fitch and S&P – Moody’s may be there soon. Its net debt/EBITDA is 1.3X this year and down to 0.5X next year.

- According to UBS, global new ship orders slowed to 5.1M tons (-41% year-over-year), which is not surprising given strong year-to-date orders and capacity constraints. 10M24 orders are now at 136.1M tons (up 30% year-over-year), already achieving 107% of its 2024E forecast.

- The U.S. Bureau of Labor Statistics reported that airline fares were up 3.2% month-over-month, ticking up sequentially for the third month in a row. September airfares inflected positively year-over-year for the first time since March 2023 and October airfares continued to tick up positively, up 4.1% year-over-year.

Weaknesses

- The worst performing airline stock for the week was Frontier, down 17.7%. According to Bank of America, Boeing’s 737 production remains sluggish, with no rollout activity reported so far in November. Boeing has begun implementing layoffs, starting with over 400 employees as part of its plan to cut 10% of its workforce, equivalent to 17,000 jobs.

- It has been a rough few months for tanker equities, reports Stifel. Since the beginning of the quarter, the S&P has been up 1.9%. However, in that time, average U.S.-listed tanker stocks are down, on average, 22.6%. Specifically, product tanker names are down 29.8%, crude tanker names are down 16.6%, and companies with mixed tanker fleets are down 19.8%.

- Spirit has commenced a prearranged chapter 11 process. As a result of the chapter 11 filing, Spirit was delisted from the NYSE. The company expects that its common stock will continue to trade in the over-the-counter marketplace through the chapter 11 process. The shares are expected to be cancelled and have no value as part of Spirit’s restructuring.

Opportunities

- JetBlue management is looking at Spirit planes when they become available. Spirit has taken out 20% of capacity from hubs and are talking to American Airlines about rekindling a business relationship. Crack spreads are similar among regions (New York versus Gulf Coast), which minimizes a disadvantage they had.

- According to the Financial Times, air freight players are scrambling to reroute planes and cash in on elevated freight rates out of China ahead of Black Friday and the Christmas shopping season. The freight rate for flying goods from Asia to the U.S. has surged, with the average spot price in October up 49% from a year ago to $5.46 a kilogram, according to market analytics firm Xeneta.

- Brazilian Airlines will boost capacity during summer peak season,focusing on international routes. According to the Brazilian Airlines Association (Abear), the three main carriers will offer 29.8 million seats in the period extending from December 28 to February 28, increasing seats offered by 12% year-over-year and flights by 11% year-over-year.

Threats

- Frontier lowered system capacity by 460 basis points (bps) and 180bps in February and March, respectively, reports Bank of America. The cuts follow several weeks of reductions to fourth quarter 2024/first quarter 2025 capacity as the airline moderates its growth rate. First quarter 2025 capacity growth is currently tracking toward 7.9% year-over-year.

- Global air cargo demand slowed to mid-single digit year-over-year growth, reports Bank of America. The slowdown appears to be driven by tougher comps with checks suggesting eCommerce demand out of China and semiconductor/electronics exports from Taiwan and Korea remain strong.

- According to RBC, WestJet’s announcement of 10% seat capacity growth for the summer of 2025 as a negative for Air Canada, given its view that meaningful capacity increases across the industry will apply pressure to yields into next year. Domestic capacity at WestJet is expected to increase 12% with double-digit increases in total seat capacity across 10 major Canadian airports, including Montreal and Ottawa.

Luxury Goods and International Markets

Strengths

- Viking Holdings Ltd. reported significant financial growth in the third quarter of 2024, with total revenue increasing by 11.4% to almost $1.7 billion, adjusted gross margin growing by 12% to $1.1 billion, and net income turning from a loss of $1.2 billion in 2023 to a profit of $375 million in 2024.

- Year-to-date, stocks listed in the United States, as measured by the S&P 500 Index, have significantly outperformed those in Europe, as reflected by the STOXX Europe 600 Index. The S&P 500 has risen by more than 24% so far, driven by strong performance expectations in financials and industrials, fueled by economic growth and deregulation.

- Williams-Sonoma was the top-performing stock in the S&P Global Luxury sector, gaining 31.6% in the past five days. The home furnishing company reported a strong third quarter with a 7% earnings-per-share increase, a 17.8% operating margin, and executed a $533 million stock buyback, indicating robust financial performance and market confidence. Shares gained almost 28% in a single day of trading on Wednesday.

Weaknesses

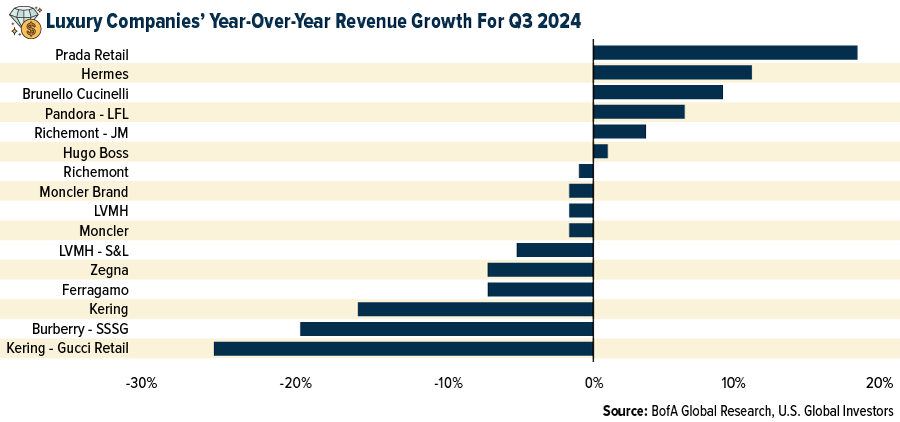

- All luxury companies have now reported their third-quarter earnings and the the luxury sector saw a 3% decline in revenue in the third quarter, a drop from a 1% increase in the second quarter of this year. Prada and Hermes delivered the strongest results, while Kering and Burberry were the weakest performers.

- Apple experienced a double-digit, year-over-year drop in iPhone sales in China due to increased local brand competition. Huawei, Apple’s local compettitor, saw a 7% increase in sales, driven by price reductions on its Pura 70 and Mate 60 models.

- Cettire, the Australian online apparel retailer, was the worst-performing stock in the S&P Global Luxury Index, dropping by 20%. The decline followed Citibank’s analyst initiating coverage of the company with a sell rating. The analyst at Citi believes that tighter distribution channels among luxury brands, combined with overall weaker demand for luxury goods, led to the Sell recommendation.

Opportunities

- This week, news surfaced that the incoming administration at the White House plans to introduce federal regulations for fully self-driving vehicles. This move would mark a significant step toward easing U.S. rules for autonomous cars, with Tesla likely to benefit the most. As a result, shares of the electric vehicle maker saw an increase.

- For the first time, Milan’s Via Monte Napoleone has surpassed New York and London to become the world’s most expensive shopping street. This rise is fueled by a surge in wealthy tourists and intense competition among luxury brands for upscale retail spaces.

- In the United States, the busy holiday shopping season is kicking off with two major holidays: Thanksgiving and Christmas. Amazon has announced that its Black Friday Week event will begin on November 21, 2024, featuring millions of deals across over 35 categories, including electronics and home goods. The event will run through Cyber Monday on December 2.

Threats

- Last week, Bank of America hosted its annual Consumer Discretionary Conference in the heart of Paris, held at a luxury hotel. While the venue was fitting, the mood at the event was far less upbeat. Presenting companies expressed concerns over the uncertain pace of recovery in China and raised questions about the potential for a trade war between Europe and the United States under the new administration.

- European stocks, home to many luxury companies, declined following America’s decision to allow Ukraine to use long-range missiles for strikes on Russia. Geopolitical tensions escalated as the Russia-Ukraine conflict intensified. Additionally, the President of Russia signed a decree permitting the use of nuclear weapons in the event of a large-scale attack on the country.

- Back in 2023, Bain-Altagamma Luxury Goods Company was projecting mid-single-digit growth in 2024, after a 12% rise in 2023. However, China will end this year down between 20% to 22%. The results in 2024 will be weaker than expected with only about a third of luxury brands growing revenues in 2024, which compares to 66% that showed positive revenue growth in 2023. Bain predicts 4% growth in 2025.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 11.09%. Natural gas futures surged to their highest price in a year, as traders anticipate a shift from unusually warm autumn weather to colder temperatures in the coming weeks. December futures closed at $3.193 per million BTU, about twice the low reached in late March, after a warm winter left a surplus of unburned heating fuel, according to the Wall Street Journal.

- According to Morgan Stanley, the near-term outlook for the European gas market has tightened further. Storage levels are dropping quickly, demand remains strong, and LNG imports are still down year-over-year. The increased likelihood of no Russian gas flows next year is putting additional pressure on the market.

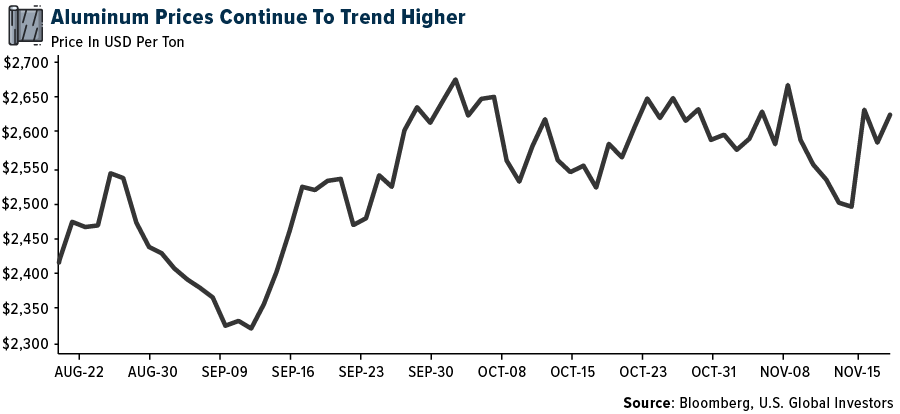

- Aluminum resumed gains amid concerns that global supplies will tighten following China’s removal of an export tax rebate, while a weaker dollar supported metals overall. Beijing’s overhaul of tax relief for overseas shipments aims to ease industrial overcapacity and reduce trade tensions with the U.S. and Europe. Aluminum, given China’s dominance in exports, has been the most affected, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was crude palm oil, dropping 8.13%, as demand in India, the largest importer of edible oils, is expected to drop over the winter season, Bloomberg reports. Oil edged higher on the heighted conflict in Ukraine but there are concerns about excess supply and weak Chinese demand. A slower-than-usual selling pace for Angolan crude was the latest signal of weak Chinese demand, and the International Energy Agency has warned that global oil markets face a sizeable surplus next year, the article explains.

- At least three Russian refineries have halted processing or reduced operations due to heavy losses from export curbs, rising crude prices, and high borrowing costs, according to five industry sources. The closures highlight the challenges facing Russia’s refining industry, including Ukrainian drone attacks, Western sanctions forcing discounted fuel sales, and high interest rates, according to Reuters.

- Most steel sheet prices resumed the downward trend over the past week, according to BMO, with market participants attributing the softness to persistent demand weakness, increased supply, and flat scrap prices.

Opportunities

- The uranium spot price is down 15% year-to-date to $77 per pound, but risk-reward may be starting to turn more positive as supply challenges mount. The supply side is tightening up, with challenges at Niger and junior miners ramping up more slowly than expected. Russia’s export restrictions to the U.S. should support contracting activity, although they see the ban as manageable with redirection of trade flows, according to Morgan Stanley.

- Exxon Mobil Corp. has signed a preliminary agreement to provide battery metal lithium to an LG Chem Ltd. plant in the U.S., strengthening the oil major’s role in the domestic critical minerals supply chain. The multiyear deal will cover the supply of as much as 100,000 tons of lithium carbonate from Exxon’s planned project in the US to the South Korean company’s cathode plant in Tennessee, which broke ground last December, Exxon said in a statement.

- The decline in activity at Russia’s Belokamenka LNG production facility due to Western sanctions presents an opportunity for other LNG-producing nations to fill the gap in global supply and capture a larger share of the market. Novatek PJSC’s LNG production facility appears to be mothballed with nighttime light intensity at its lowest level since 2019. With Russia’s LNG expansion plans stalled, countries with established or emerging LNG capabilities can leverage this disruption to increase exports and strengthen their position in the energy market, Bloomberg writes.

Threats

- Lithium production in Zimbabwe has increased from 1Kt in 2020 to 150Kt this year (the global market is 1.2Mt), one reason the raw material is oversupplied and has been under pressure. Zimbabwe has a relatively complex royalty system, and miners are now looking to change this to profit-based payments, with the Chamber of Mines highlighting that“the government captures a higher share of revenue when lithium prices are high, while providing relief when prices drop,” Bank of America writes.

- Bank of America also sees rising iron ore surpluses potentially reaching 190Mt next year. Hence, the bank keeps its cautious view on iron ore in 2025. Should high-cost miners fail to cut production, they see a risk of prices dropping to $75 per ton next year.

- Northvolt AB, with just one week of cash on its balance sheet, has filed for bankruptcy in the U.S. after being unable to secure new funding. Northvolt’s filing showed $5.84 billion in debt and about $30 million in available cash. The company’s biggest shareholder is Volkswagen, where Northvolt was seen as the new independent supply chain for EVs in Europe to counter the dominance of the well-established Chinese and South Korean battery companies, as reported by Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Mantra, rising 121%.

- Cryptonews.com reported that Mastercard and JPMorgan’s integration of the Multi-Token Network (MTN) with the Kinexys platform highlights a significant advancement in blockchain technology, enabling faster and more transparent cross-border payments. This collaboration demonstrates the power of blockchain solutions in improving settlement efficiency and addressing time zone challenges for global businesses.

- The recent surge in Bitcoin prices, driven by supportive regulatory expectations under the incoming Trump administration and increased corporate adoption, highlights the growing institutional interest in cryptocurrency. With Bitcoin nearing $100,000 and major firms like Charles Schwab preparing to offer spot crypto trading, the market is poised for further expansion and mainstream acceptance, Barron’s writes.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Peanut the Squirrel, falling 41%.

- The rise of memecoins, like Quant and Just a Chill Guy, while generating substantial returns, exposes the crypto industry’s darker side, including speculative behavior, harassment and negative optics that undermine trust and mass adoption. These incidents risk fueling regulatory scrutiny and damaging the public perception of crypto, potentially hindering the industry’s broader growth and adoption, the DailyCoin advises.

- The BIS report highlights a significant weakness in the DeFi ecosystem, as institutional players dominate liquidity provision on platforms like Uniswap, leveraging advanced strategies that outmaneuver retail participants. This institutional edge undermines DeFi’s promise of inclusivity, leaving retail traders with lower profitability and raising questions about whether decentralized exchanges truly level the playing field.

Opportunities

- Bloomberg reports Charles Schwab’s plan to offer spot cryptocurrency trading once U.S. regulations ease, presents a significant growth opportunity, aligning the firm with increasing demand for crypto investments among retail investors. This move would enhance Schwab’s competitive positioning against newer platforms like Robinhood and Webull, while tapping into the rapidly expanding crypto market.

- Gary Gensler’s departure as SEC Chair in January 2025 opens the door for potential regulatory reforms that could be more favorable to the crypto industry. This transition creates an opportunity for the industry to advocate for clearer, less restrictive regulations and foster growth under new leadership, according to Bloomberg.

- Goldman Sachs’ plan to spin out its digital-assets platform offers an opportunity to revolutionize financial markets by leveraging blockchain technology for faster, more efficient, and secure trading and settlement processes. With the backing of major financial institutions and potential regulatory support under the incoming Trump administration, this innovation could drive widespread adoption of distributed ledger technology across the global derivatives economy.

Threats

- MicroStrategy’s stock plummeted 30% from its recent record high following bearish comments from Citron Research, citing overvaluation and detachment from Bitcoin fundamentals. The company’s reliance on maintaining a lofty premium to Bitcoin for stock performance poses a significant risk, especially with alternative Bitcoin investment options like ETFs gaining traction, reports Barron’s.

- The theft of 342,000 Ether by North Korean-affiliated hacker groups Lazarus and Andariel, highlights the ongoing threat of cyberattacks targeting cryptocurrency exchanges, undermining trust and security in the digital asset market. Such high-profile incidents risk deterring institutional adoption and exposing vulnerabilities that could lead to increased regulatory scrutiny and compliance challenges for the crypto industry, Bloomberg reports.

- Barron’s writes the extreme volatility in MicroStrategy stock, with gains of nearly 700% this year before sharp pullbacks, highlights its dependence on Bitcoin’s price and signals the potential for a speculative bubble. Such dramatic swings evoke parallels to the Dotcom bust, raising broader concerns about market instability and the risks of a sharp correction impacting investor confidence.

Defense and Cybersecurity

Strengths

- Kongsberg Defense & Aerospace, a unit of Kongsberg Gruppen, secured a NOK 12 billion contract with the Dutch government to deliver air defense systems starting in 2028.

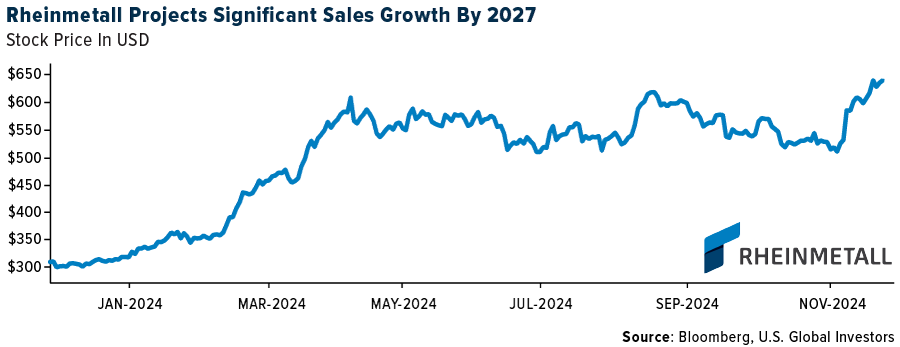

- Rheinmetall projects €20 billion in sales by 2027, driven by increasing Western defense budgets, U.S. market expansion, and innovation in air defense and land systems. This positive forecast all comes while targeting an 18% operating margin and significant contract wins.

- The best performing stock in the XAR ETF this week was Archer Aviation Inc., rising 46.96%, after presenting promising commercial opportunities and addressing FAA concerns at the Barclays Global Auto and Mobility Conference.

Weaknesses

- Russia has used, for the first time, the newest intercontinental ballistic missile called “Oreshnik” in Ukraine. This missile has the capability to carry explosive fragmentation charges as high as a nuclear weapon and can attack a target with a speed of 1.2-1.8 miles per second. This makes the weapon hard to capture by any modern air defense systems.

- Two undersea Internet cables in the Baltic Sea were damaged, sparking European investigations into possible sabotage linked to Russian hybrid warfare. Attention is focused on a Chinese cargo ship near the area, while officials and companies cited physical damage and raised concerns over recent infrastructure attacks.

- The worst performing stock in the XAR ETF this week was General Dynamics, falling 2.15%, after little to no news.

Opportunities

- Lockheed Martin, in collaboration with the U.S. Army, successfully completed a production qualification flight test for the Precision Strike Missile (PrSM), confirming its readiness for large-scale production and its role in modernizing long-range precision strike capabilities.

- AeroVironment agreed to acquire BlueHalo in an all-stock deal worth $4.1 billion, creating a combined defense technology company expected to significantly expand its market and generate over $1.7 billion in revenue annually.

- Northrop Grumman’s delivery of the Stand-in Attack Weapon test missile to the U.S. Air Force marks a major milestone in its development, leveraging advanced technologies like AARGM-ER and F-35 integration to address Anti-Access/Area Denial challenges. This highlights its potential for future defense contracts and rapid deployment by 2026.

Threats

- Ukraine conducted its first missile strike on Russian territory using U.S.-supplied ATACMS missiles, targeting a military warehouse in Bryansk. This comes as Russia expands its nuclear doctrine to include responses to conventional attacks, signaling escalating tensions amidst the ongoing conflict.

- Russia’s updated nuclear doctrine under President Vladimir Putin lowers the threshold for using tactical and strategic nuclear weapons, shifting the policy to respond to conventional attacks on Russian territory or allies. This signals a deterrence strategy aimed at limiting Western support for Ukraine and asserting Russia’s power.

- The International Criminal Court has issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu, former Defense Minister Yoav Gallant, and Hamas military chief Mohammed Deif for alleged war crimes and crimes against humanity related to the ongoing conflict in Gaza.

Gold Market

This week gold futures closed at $2,733.80, up $140.20 per ounce, or 5.41%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 8.13%. The S&P/TSX Venture Index came in up 2.53%. The U.S. Trade-Weighted Dollar rose 0.79%.

Strengths

- The best performing precious metal for the week was palladium, up 6.96% after getting shellacked 13% in the prior week’s election turmoil. In the prior week, gold posted its biggest weekly drop since 2021, only to have its biggest weekly surge this week since March of this year as tensions escalate around the Russia-Ukraine conflict. Longer-range missiles are now being deployed, with Russia asserting that countries that supply these long-range missiles are fair targets for Russia to attack.

- Pan African Resources was the best performing gold stock in the major gold stock indexes with European buyers bidding up the stock over 22% this week on the risk of elevated conflict with Russia. OceanaGold and IAMGOLD both gained more than 15% with the rebound in gold stocks.

- According to Bank of America, the increase in gold of over $450 per ounce over just a six-month period is historically rare and is, in their view, emblematic of the importance of investment buying, particularly by western investors, which they think is very well captured by global gold ETF holdings of gold.

Weaknesses

- The worst performing precious metal for the week was platinum, but still up 2.62%. According to Bank of America, 10 of the 17 precious metals stocks covered underperformed the S&P/TSX Global Gold Index, despite most delivering solid Q3’24 numbers. Helping to explain the average underperformance, those that missed or reduced guidance experienced more significant underperformance than those that beat or improved guidance experienced outperformance.

- Ramelius Resources COO Duncan Coutts stepped down to pursue other opportunities, but he will remain at the company until early December.Peter Ganza has been appointed acting COO.

- Resolute Mining said Chief Executive Officer Terry Holohan and two other employees have been released from detention in Mali, just days after the gold mining company agreed to pay about $160 million to resolve a tax dispute with the government. Holohan and his colleagues were detained more than a week ago after he traveled to the country for meetings with tax and mining authorities, according to Bloomberg.

Opportunities

- MicroStrategy shares tumbled after Andrew Left’s Citron Research said in a post on X that it’s betting against the software company, which has effectively transformed itself into a Bitcoin investment fund. The stock fell as much as 10% in intraday trading Thursday, reversing a gain of nearly 15% from earlier in the session, according to Bloomberg. The company has become a serial issuer of debt and now equity to buy more Bitcoin. With each equity issue the price of Bitcoin gets bid up to higher levels and then the cycle is repeated. Also, short interest is rising in this name, and this will eventually be an opportunity for gold.

- Newmont agreed to sell its Musselwhite gold mine in Ontario to Orla Mining for up to $850 million as part of a divestment campaign designed to boost shareholder returns. The deal will raise Newmont’s gross proceeds from sales of non-core assets to more than $2 billion, it said in a statement on Monday.

- Silver presents a compelling opportunity as resilient ETF holdings signal strong investor confidence, despite recent price volatility. With bullish outlooks for gold and increasing ETF inflows during price pullbacks, silver appears poised for further gains, building on its impressive 30% year-to-date growth.

Threats

- Bank of America notes the 1.1-million-ounce decline in global gold ETF holdings of gold since the recent peak of 84.1 million ounces, a decline that accelerated with the conclusion of the U.S. election.

- According to Bloomberg, hedge fund managers have cut their bullish bets on gold to a 15-week low in light how resilient stock markets and in particular Bitcoin have performed as of late.

- The discovery of a massive gold deposit in China’s Hunan province could poses a potential threat to global gold markets as the discovery is estimated at 300 tons but is at a depth of around 2,000 meters. It could disrupt supply dynamics if China is able to produce more gold domestically, especially if development proves feasible. Three hundred tons of gold is roughly 9.6 million ounces which is slightly more that 1/10 of the all the gold held in ETFs.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Boeing

Embraer

Spirit Airlines

JetBlue

American Airlines

Air Canada

Frontier

Viking Holdings Ltd.

Hermes

Prada

Kering

Tesla

Amazon

Pan African Resources PLC

OceanaGold Corp.

IAMGOLD Corp.

Ramelius Resources Ltd.

Resolute Mining Ltd.

Newmont Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The STOXX Europe 600 is a broad measure of the European equity market.

The S&P/TSX Global Gold Index is designed to provide an investable index of global gold securities. Eligible Securities are classified under the GICS.