Retailers to Roll Out the Red Carpet for High-Spending Chinese Tourists, Now Free to Travel Abroad

This week, thousands of Americans lived out a real-life version of Planes, Trains and Automobiles, the 1987 comedy that saw Steve Martin and John Candy trying to combat flight delays and cancellations and make it home in time for Thanksgiving dinner

This week, thousands of Americans lived out a real-life version of Planes, Trains and Automobiles, the 1987 comedy that saw Steve Martin and John Candy trying to combat flight delays and cancellations and make it home in time for Thanksgiving dinner

Unfortunately, many travelers didn’t experience the Hollywood ending they may have hoped for, with some families still stranded in airports and others separated from their luggage.

The overwhelming majority of the recent delays and cancellations were the result of Southwest Airlines’ unique flight network. Unlike the other major carriers, which use a “hub-and-spoke” model that forces planes and crew to regroup at select hub airports, Southwest uses a “point-to-point” model.

In many cases, point-to-point lets passengers fly direct without the need to change planes. This is one of the many reasons why customers enjoy flying Southwest, myself included.

The problem with this model is that when extreme weather triggers delays and cancellations, as it did this past week, planes, pilots and other crew members can find themselves scattered across the country. It becomes increasingly difficult for Southwest to marshal its troops, as it were, and the snowball grows in size.

Lawmakers and regulators have promised to investigate Southwest’s actions, and I think it’s safe to say we’ll see changes to Southwest’s scheduling system. That’s not necessarily a bad thing, especially if it helps improve the carrier’s already stellar customer service. Back in May, Southwest ranked first in customer satisfaction in the basic economy segment, according to J.D. Power.

We’ve had bouts of extreme weather before without carriers cancelling thousands of flights. Whether Southwest’s scheduling system is fully to blame or whether it’s aggressive unions, the kind imported from the European Union (EU), I’m not entirely certain.

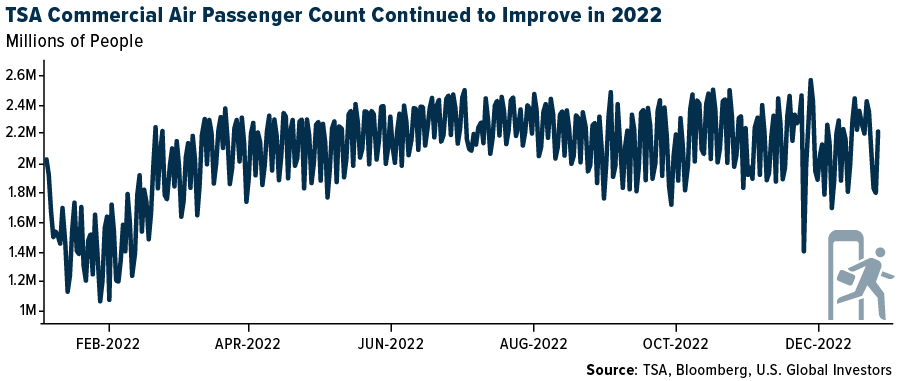

What I do know is that this mini-crisis is reminiscent of spring 2020, when carriers grounded countless planes in response to Covid. It was a fabulous buying opportunity then, and we may be looking at another one right now.

China Opens Its Borders Just in Time for the Lunar New Year

Staying on the topic of commercial aviation, the big news this week is that the government of China has finally agreed to relax a key portion of its zero-Covid policies, among the world’s most restrictive. Starting January 8, travelers flying into the country will no longer be required to quarantine. China will also begin issuing new passports and travel permits to Hong Kong.

It’s been a long three years, and travel demand has built up to epic proportions. According to Trip.com, China’s biggest online travel agency, bookings for outbound flights jumped an incredible 254% the day after the announcement was made that quarantine requirements would be lifted. Top destinations included Singapore, South Korea, Hong Kong, Japan and Thailand.

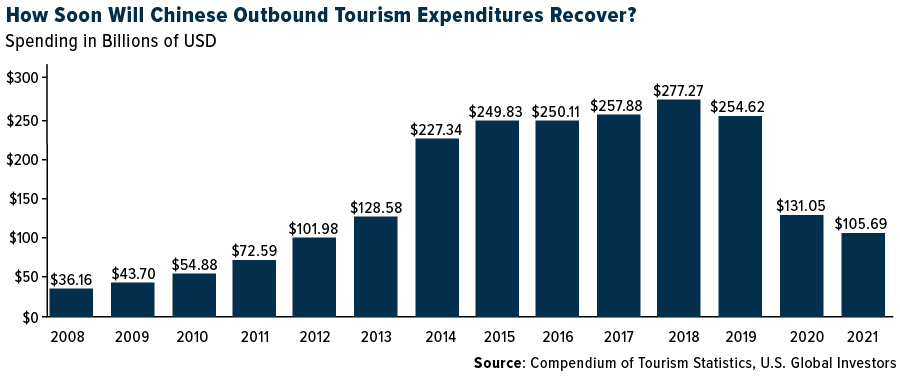

This is welcome news not just for Chinese travelers and airlines but also overseas retailers, particularly luxury goods retailers. The Chinese have historically been the world’s biggest spenders while traveling abroad, with expenditures topping $277 billion in 2018. This total fell to $105 billion by 2021, so I’m sure retailers will be rolling out the red carpet.

The Covid policy change was likely timed to give Chinese families a chance to book travel arrangements for the upcoming Lunar New Year, which starts January 22, 2023. In pre-pandemic years, this has been a time for people to travel abroad and visit family in what’s been called the largest annual human migration. In 2022’s Spring Festival travel rush, a little over 1 billion trips were believed to have been made, down from around 3 billion in pre-pandemic 2019.

China to Contribute 50% to Global Luxury Sales by 2030

Again, luxury retailers will be among the happiest to see the return of Chinese tourists, who have historically been the highest per-capita spenders on luxury goods. Chinese buyers often make most of their luxury purchases while in Europe, where they can shop tax-free using European rebates.

Over the past three years, European luxury retailers have had to rethink the shopping experience they offered, tailored in many ways to high-spending Chinese tourists. Many locations hired Mandarin-speaking staff, for instance, and prominently displayed products favored by Chinese travelers.

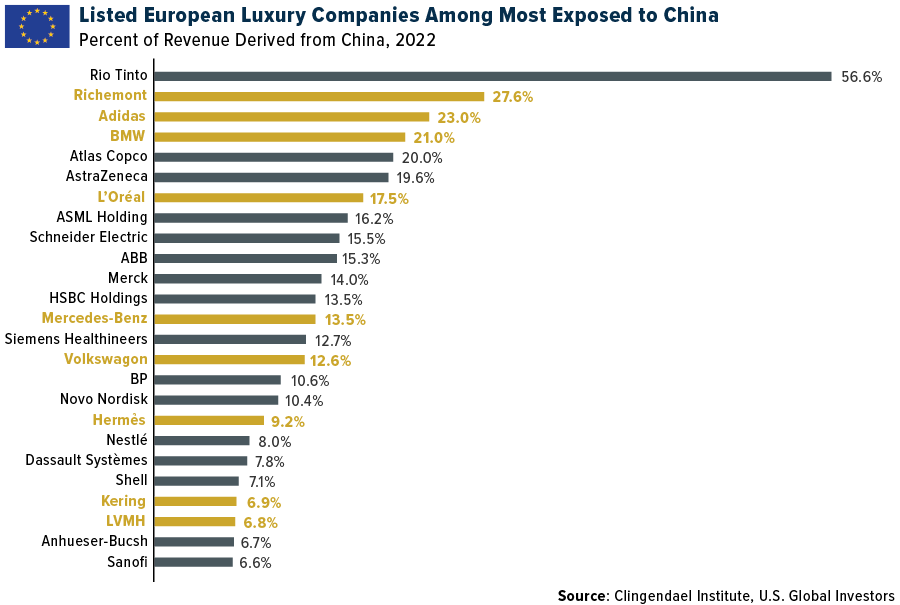

Take a look below. Of the 25 listed European companies with the greatest exposure to China, as many as nine could be classified as luxury goods makers. Switzerland-based Compagnie Financière Richemont, owner of Cartier, Piaget and other luxury brands, has the most exposure, with 27.6% of its revenues derived from China. This is followed by Adidas at 23.0% of its revenues, and BMW at 21.0%. LVMH, the world’s biggest luxury conglomerate—its brands include Louis Vuitton, Christian Dior, Hennessy, Tiffany and Sephora—has relatively low exposure at 6.8% of revenues.

LVMH’s chief, Bernard Arnault, recently surpassed Elon Musk as the world’s richest man, valued at more than $164 billion. This marks the first time that a European topped the list of billionaires.

Some people believe that European companies should decrease their exposure to China for political reasons, but I don’t think luxury firms in particular have much of a choice. Consumers from the Asian country are forecast to become the world’s largest luxury market, accounting for roughly 40% of all sales globally by 2030, according to Bain & Company.

Happy New Year! May 2023 bring you good health, wealth and happiness.

Index Summary

- The major market indices finished down this year. The Dow Jones Industrial Average lost 8.78%. The S&P 500 Stock Index fell 19.44%, while the Nasdaq Composite fell 33.10%. The Russell 2000 small capitalization index lost 21.56% this year.

- The Hang Seng Composite lost 17.99% this year; while Taiwan was down 22.40% and the KOSPI fell 24.89%.

- The 10-year Treasury bond yield rose 236 basis points to 3.88%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Turk Hava Yollari, up 397.60%. Airlines reported that traffic outside Asia is mostly recovered to (or within a few percentage points of) pre-pandemic levels. The airlines are seeing significant pent-up demand for travel, which they expect will continue into next year. There was some concern about a consumer recession given the inflationary pressures that all are feeling, but bookings still appear strong.

- Comments from Asian liners including COSCO and Yang Ming provide some optimism, as all of them do not expect normalized freight rates to go below operating break-even levels, even if near-term the rates overshoot on the downside, with such a view echoed by Mitsui O.S.K. Two key highlights: 1) Busier-than-expected intra-Asia peak season suggests activity is stabilizing; 2) Oversupply concerns in 2023/24 are likely to be partly mitigated by delivery slippages and “overdue” scrapping as IMO 2023 regulations are expected to have phased-in capacity reduction effects.

- The CPI Index for airfares continues to rise as airlines demonstrate pricing power benefiting from strengthening demand (including corporate recovery starting in late-March/April) and constrained supply. There does not appear to be any demand slowdown.

Weaknesses

- The worst performing airline stock for the week was Allegiant Travel, down 63.65%. China’s domestic air traffic fell to just 26% of 2019 levels, the worst level since the lockdowns in Wuhan (February 2020) and Shanghai (April 2022). Unsurprisingly, Beijing’s domestic traffic was most disrupted at only 10% of 2019 levels due to the political meetings, but other major cities like Shanghai and Guangzhou were just at 30% of normal traffic.

- The air cargo market is oversupplied possibly by as much as 9.7% as demand has fallen 5.5% when compared with the prior year. Capacity growth through dedicated freighters and passenger-to-freighter conversions continues with no moderation of supply anticipated in the near term. Air cargo spot rates have tumbled by two-thirds since December 2021.

- Airbus cut 2022 deliveries to 700 jets from 720 and pushed its production target of 65 A320s/month to early 2024 instead of summer 2023. Similarly, Boeing, citing supply chain disruptions, slowness of taking airplanes out of storage, and timing of deliveries to Chinese customers, lowered 737 deliveries to the low 400s for 2022 versus 500 at the beginning of the year.

Opportunities

- The International Air Transport Association (IATA) continues to see strong forward international air travel bookings, with the uncertain global economic outlook not yet eating into leisure travel spending. Asian airline travel should reach about two-thirds of pre-pandemic levels by the end of 2022, with momentum going into 2023 based on bookings which was highlighted by the Association of Asia Pacific Airlines (AAPA). Asian countries including Japan, Thailand and other ASEAN countries are in a race to revive inbound tourism. Business air travel is poised to remain resilient with Delta Air’s CEO expecting business air travel to unlikely fall further, as companies place greater emphasis on boosting their sales revenue.

- While the three shipping alliances (i.e., 2M, OCEAN, and THE) do not expire until the second half of the decade, it is increasingly likely that the industry will witness a reshaping of members of alliances, not the removal of the alliances. It is worth noting that the concept of alliances works best when all alliance members have aligned strategic interests, but liners are increasingly making different choices with some focusing on profitability and capacity expansion. Such internal strategic differences among the alliance members could set a scene for some changes which occur in the spring of 2024 as a baseline scenario.

- Morgan Stanley remains bullish on the air travel outlook for the third year in a row, but its order of preference again changes slightly. Legacies move to the top of its preference list – Delta is the new Top Pick. Low-cost carriers (LCCs) with idiosyncratic and cash return stories also remain high on the list. Ultra-low-cost carriers (ULCCs) will continue to benefit from the rising tide but have the toughest comp and potentially the least dry powder.

Threats

- Airlines continue to scale back presence at regional airports. Since the pandemic began, airlines have balanced route economics and hiring challenges, and flight schedules have dropped at regional airports. According to the Regional Airline Association, 76% of the 430 airports in the continental U.S. and Hawaii had fewer flights scheduled in 2022 compared to 2019. Small airports have lost an average of 34% of flight traffic while larger airports saw an average schedule shrinkage of 16%.

- Goldman expects container shipping to enter a downcycle with oversupply due to softened demand from the U.S. and Europe, relieved port congestion and new ship delivery. As a result, the bank forecasts fuel-adjusted shipping rates to peak in 2022. While shipping rates have started to correct, Goldman sees further downside to rates as the market is yet to recognize the high-capacity addition with 6%/4% (versus 2%/3% for demand) in 2023/24.

- According to a Morgan Stanley survey, over the past two weeks, travel spend intentions over the next six months ticked down across nearly every income bracket, with 53% of total respondents planning to travel over the next 6 months, down from 58% at the end of May. 2. The percentage of high-income consumers planning to cut back on travel due to inflation also increased 8% points (58% versus 50% in May). 3. Tourism/vacation, the most discretionary form of travel, and a leading indicator, saw the biggest m/m decline in respondent’s ‘reason’ for travel over the next six months. 4. Net travel spending intentions for domestic and international leisure together turned negative for the first time.[/responsivevoice]

[responsivevoice buttontext=”Listen to the SWOT”]

Emerging Markets

Strengths

- The best performing country in emerging Europe for the year was Turkey, gaining 196.6%. The best performing country in Asia this year was Indonesia, gaining 7.0%.

- The Russian ruble was the best performing currency in emerging Europe this year, gaining 3.1%. The Thailand baht was the best relative performing currency in Asia this year, losing 3.9%.

- Turkish equities surged this year, supported by domestic buying and the government’s measures to support the economy before next year’s elections. The central bank of Turkey cut its one-week repo rate from 14% at the beginning of the year to 9% while the country’s year-over-year inflation jumped to 84.39% in November. The Turkish lira depreciated against the dollar by 28.9%, supporting exporters’ profit margins.

Weaknesses

- The worst performing country in emerging Europe for the year was Romania, losing 2.5%. The worst performing country in Asia was South Korea, losing 24.4%.

- The Turkish lira was the worst performing currency in emerging Europe this year, losing 28.9%. The Indian rupee was the worst performing currency in Asia, losing 10.0%.

- This year, Russian equites became non-investible. The Moscow Stock Exchange shot down its doors to foreign trading and Russian GDRs and ADRs were delisted from exchanges after President Putin attacked Ukraine on February 24. Fund managers reported large losses in Russia, and those who were slow to sell Russian assets had to write them down to zero.

Opportunities

- Emerging markets should post solid growth next year, according to Société Générale. We may see a significant differential between emerging markets (EM) and developed markets (DM). The 2021-22 period has seen a differential north of 2 percentage points to the advantage of better developed market economic performance. The situation will now likely reverse, with the 3.8% growth in emerging markets contrasting with 1.2% growth in the developed world, SocGen’s cross-assets team write in their year-ahead EM Outlook 2023 report.

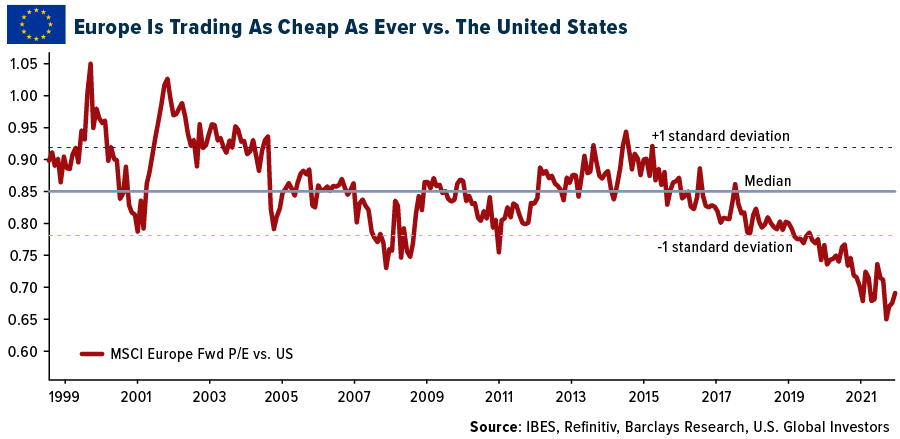

- The war in Europe, higher rates, a spike in energy prices and slowing global demand pushed European equities to a record low versus the United States. Europe could experience a deeper recession in 2023, but a lot of negative data is already priced in while the U.S. has more room for correction. Barclays believes that equities outflows in Europe look exaggerated, while U.S. looks more vulnerable to capitulation risk.

- China will drop quarantine requirements for all passenger arriving from outside the country starting January 8, 2023. Current policy asks people to quarantine for five days in a hotel and an additional three days at home. Further easing of travel restrictions and removing other covid related measures will allow the economy to grow at a faster pace.

Threats

- The war in Europe started at the end of February of this year, and it may last for years to come as both sides are not willing to come to a compromise. At the end of 2022, the Russian president visited neighboring country Belarus to raise worries that a new Russian ground offensive could aim again at Kyiv, only about 55 miles from the border. The Iskander tactical missile systems and the S-400 air defense systems that Russia has deployed to Belarus are fully prepared to perform their intended tasks, according to senior Belarusian defense ministry official.

- China’s recent steps to reopen its economy were welcomed by investors, with equites moving higher after years of strict zero-covid policy depressed the economy and hindered consumer sentiment. While the reopening should lead to normalization of economic conditions, many predict that the relaxed covid restrictions will cause the medical system to overheat and as many as two million people may die in China. Covid infections also may increase around the world with China passengers spreading the sickness. Shortly after travel covid restrictions were lifted in China at the end of the year, Milan airport in Italy reported that 50% of passengers arriving from China had tested positive for Covid.

- At the end of the year, China once again staged its largest military drills around Taiwan since Nancy Pelosi’s visit in August. Chinese military maneuvers were in response to U.S. provocations after Congress authorized increased funding for weapons assistance to Taiwan, according to FactSet. President Xi remains a close ally of President Putin despite heavy sanctions imposed on Russia after its attack on Ukraine. China may not be willing to take back Taiwan, especially with Russian forces unsuccessfully trying to grab land from Ukraine since February, but the threat of growing geopolitical tensions exists.[/responsivevoice]

[responsivevoice buttontext=”Listen to the SWOT”]

Energy and Natural Resources

Strengths

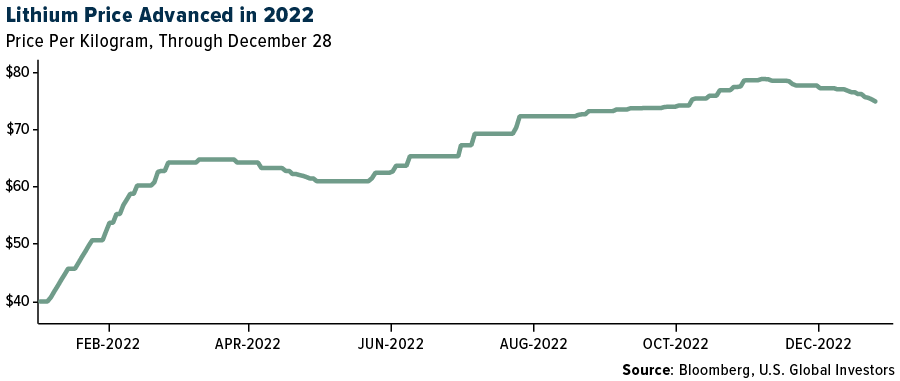

- The best performing commodity for the year was lithium carbonate battery grade, climbing 95.29% on the transition to building an electric vehicle future. Lithium prices continued to edge higher in the range of $76k-$80,000 per ton, though the prices increased at a slower rate. According to Benchmark, market participants reported cell manufacturers were limiting their production in November, which weighed on lithium demand sentiment, although this speculation has yet to be confirmed. The market participants noted the limited production could have been driven by the expectation of marginally lower demand in due to the cessation of the Chinese electric vehicle (EV) subsidies and Chinese New Year. With that said, demand in 2023 may remain robust on consumer preference and other government provided EV incentive programs.

- According to UBS, the long-term fundamentals for copper look compelling and arguably better now than six to nine months ago due to accelerated spending on the energy transition and potential delays to new projects. However, there is an inconsistency between expectations of easing physical tightness and consensus suggesting prices will not fall in 2023. Despite being more cautious than consensus near-term, the risk versus reward for copper/copper stocks is improving, and there might be a multi-year buying opportunity emerging over the next six to 12 months.

- According to Bloomberg, iron ore in China has surged to its highest level since August with its rapid Covid relaxation plan. Iron ore hit a multiyear low in November, but a steady stream of supportive policies from the government to boost the economy have lifted sentiment. Beijing’s effort to rein in a surging housing market, which accounts for 40% of steel demand, had the sector in the doldrums.

Weaknesses

- The worst performing commodity for the year was lumber, off 67.44% on rising interest rates making housing less affordable. UBS calculates that the European gas demand decline accelerated to -27% year-over-year in October, bringing the year-to-date decline to 13% versus 2021, or 10% vs. the five-year average. This was driven by the very warm weather across the region as well as weaker industrial demand. The preliminary data suggests that the decline in heating demand was consistent with the higher temperatures. Thanks in large part to this much lower demand, net injections into European gas storage remained above average in October, and the first net withdrawal of the season only happened earlier this week, two weeks later than usual. European gas storage utilization reached 96%, only a notch below the higher end of the historical range of 97% and well above the five-year average of 87%.

- According to J.P Morgan, steel prices in the U.S. have continued to fall from their peak with steel prices now around $889 per ton versus $1,780 at the end of September. Prices could continue to move slightly lower over the next several months. A combination of sharply rising input costs (mostly electricity and natural gas), falling steel prices and poor visibility on demand have prompted European steel mills to announce aggressive output cuts. Based on various industry reports and articles, a total of 16 million tons of crude steel equivalent or 7% of Europe’s capacity has been idled to-date.

- China Metals Group commented that China’s solar equipment sales are too dependent on overseas buyer taking 80% of sales. To make the solar cells, China imports more than 90% of its high purity quartz, according to Bloomberg. China dominates global supply chains in the silicon-based solar industry while China Metals suggests its supply chains should be focused on domestic sources and uses. Perhaps China believes all the solar cells it can make are needed domestically for its energy transition.

Opportunities

- According to J.P Morgan, commodities are on pace to deliver a second consecutive year of double-digit returns. As global growth slows in 2023 but commodity supply remains constrained and critically low inventories persist, commodity prices may stay elevated despite a decline in economic activity. As in 2022, they are most constructive about energy, but unlike 2021, returns will be driven by oil—especially if oil raises roll yields and generates a rebound in investor positioning—whereas U.S. natural gas prices are forecasted to decline 40% by year-end 2023.

- For the first time ever, green hydrogen is starting to compete on pure economics; in fact, it’s become a lower-cost alternative. This is still a nascent market, but green hydrogen is making headway around the world, and Europe is where the adoption curve is seeing the most potent boost.

- Conor Sen, Bloomberg Opinion columnist, penned a recent story on the Battery Belt that is taking shape in America with the rise in electrification of the auto industry. Interestingly, this new economic model won’t require a college degree as the ultimate qualification for these new jobs. Because of new batteries needed, the scale for these new plants is considerable and this has favored the Southern U.S. to some extent with wide open tracts of land still available near major population centers. Five multibillion-dollar battery plants have been announced in Georgia and adjacent South Carolina. Ohia and Indiana also have projects in the works. Senator Joe Manchin also secured Form Energy, an energy storage company backed by Bill Gates, to build a $760 factory in West Virginia. In total, as reported by NPR, there were $73 billion in planned battery plants announced in 2022, more than three times the previous record set in 2021. All of these plants have incentives to fill their supply chain through domestic production of the battery metals first in the U.S. or through our trading partners.

Threats

- Chilean copper production was down 9% and has been on a structural downtrend since 2018, against a structural uptrend of China refined production (i.e., China demand for copper continues to rise). Chile produces 30% of the world’s copper, of which a material amount goes to China for smelting and refining and in-China usage.

- Bloomberg reports that wholesale power prices jumped 65-fold in a day from $57 to $3,700 a megawatt-hour in Houston on December 23. Texas contracted for more than twice the amount of spare capacity to have on standby just in case there was a power shortage, perhaps pushing prices higher than they should be. Texas set a new power usage record with the recent cold snap, but at what costs?

- According to J.P Morgan, despite the positive move in nickel prices recently, the underweight stance on nickel remains firm, and the bank urges investors to sell into strength. They believe their core thesis is: (1) nickel to edge lower next year due to higher-than-anticipated supply from Indonesia and weaker demand; and (2) the cost structure for nickel to possibly be structurally higher due to higher energy costs and potential levies coming from Indonesia, lowering profitability despite higher nickel prices.[/responsivevoice]

[responsivevoice buttontext=”Listen to the SWOT”]

Luxury Goods

Strengths

- China is one of the leading luxury markets worldwide, so any decision taken there is a significant milestone for the global luxury sector. According to Bloomberg, Macau casinos/hotel operators were one of the best performing names among luxury stocks in the current year thanks to the government’s decision to relax its zero-covid policy. Macau is one of the leading attractions for locals and foreign tourism.

- Despite historically high inflation levels worldwide, people keep buying luxury goods as an investment in a tangible asset class and store of value. The sales of luxury watches, Rolex, have been on the rise. According to a Bloomberg article, the average Rolex price increased to more than $13,000 in February of this year compared to $5,000 in 2011. Rolex watches have outperformed other asset classes in recent years.

- MGM China Holdings was the best performing S&P Global Luxury stock for the year, gaining 81.72%. Macau shares gained after China started to relax its zero-covid policy, setting the stage for hotel/casino operations normalization.

Weaknesses

- According to Bloomberg, the consumer discretionary sector, which accounts for about 10% of the assets in the S&P 500 Index, was the second worst performing sector in 2022, losing 34.14%. Cars, household appliances, specialty items, luxury and leisure are all considered part of the consumer discretionary sector.

- Tesla’s shares sold off sharply this year due to weaker demand from China and Elon Musk’s decision to buy social media company Twitter for $44 billion, funding part of the deal by selling his Tesla shares. He began selling large blocks of Tesla stock in April 2022 to help finance his purchase of Twitter. He initially sold $8.5 billion shares in April, another $6.9 billion in August 2022, $3.95 billion in November and $3.6 billion in December for a total of around $22.9 billion. According to Bloomberg, Tesla’s market cap decreased from a little over $1 trillion in December 2021 to $353 billion in December 2022.

- Faraday was the worst performing S&P Global Luxury stock for the year, losing 94.65%. The company once again delayed the launch of its high-performance FF 91 car and had to raise money to fund the vehicle development. At the end of the year, the company announced that first deliveries of the car are expected before the end of April 2023, with production planned to begin at the end of March.

Opportunities

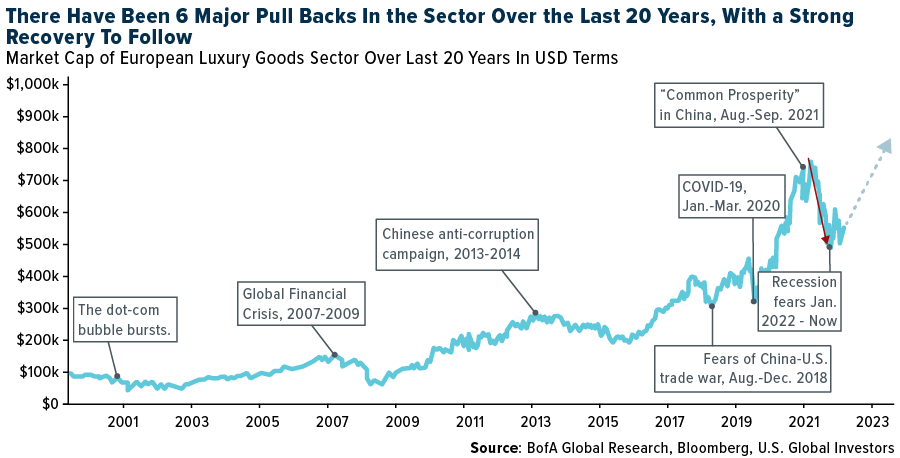

- The Bank of America Global Research Team believes that the luxury sector presents an attractive buying opportunity. In the chart below, you can see six prior major pullbacks in the luxury sector over the past 20 years. The most recent pullback has already resulted in a 24% decline for the sector since the beginning of the year and more than 35% since the November peak. In the past, strong pullbacks have led to a bounce.

- According to a joint forecast by analysts at Bain & Company and Altagamman, the luxury sector will expand at least 3% to 8% in 2023. It is also predicted that the sector will grow further, with Bain forecasting a sales increase of 60% from 2022 to 2030, supported by people becoming wealthier in regions including India, South Korea and Mexico, which will lead to about 10 million new luxury consumers per year.

- China will most likely continue to re-open its economy after almost three years of covid lockdowns. At the end of the year, it was announced that China will drop quarantine requirements for all passengers arriving from outside starting January 8, 2023. The current policy asks people to quarantine for five days in a hotel and an additional three days at home. Further easing of travel restrictions and removing other covid-related measures should spur consumer spending.

Threats

- The luxury sector will most likely expand next year but at a slower pace compared to 2022. Consumer spending on luxury items and services could be softer due to economists’ predictions about an upcoming recession in Europe and the U.S.

- Luxury goods and services recorded price increases this year and the trend may continue in 2023. The prices of “core” handbags from brands such as Chanel and Louis Vuitton have already increased 20% or more in the past two years, and brands are expected to boost prices on those items even further next year — particularly in Europe, where the depressed euro has made luxury goods comparatively cheap. Prices there could rise 15% next year, and in the mid-single digits in the U.S. and China, says Citi luxury analyst Thomas Chauvet.

- According to Bloomberg, the second-hand luxury watch market will reach 35 billion Swiss francs by 2030 from 20 billion francs today. This represents an increase of 75%, as reported by Deloitte and based on its consumer and watch brand executives survey. This comes as a wakeup call to luxury watchmakers, as sales in physical stores have seen a decline. This is one reason well-known brands like Richemont purchased Watchfinder & Co. as its secondary market sales channel.[/responsivevoice]

[responsivevoice buttontext=”Listen to the SWOT”]

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the year was GMX, rising 89.58%.

- The Russian invasion of Ukraine had a major impact on global markets this year, crypto included. Within days of the invasion, the Ukrainian government’s official Twitter account put out a post requesting Bitcoin and Ethereum donations with two wallet addresses. Donations flooded in, and within three days the government had raised over $30 million worth of Bitcoin, Ether, Polkadot and other digital assets writes crypto briefing.

- Yuga Labs’ acquisition of Larva Lab’s CryptoPunks and Meebits collections sealed Yuga’s crown as the world’s top non-fungible token (NFT) company, helping Bored Apes soar. Bored Ape community members were treated to the biggest airdrop of the year when ApeCoin dropped the following week, with holders of the original tokenized monkey pictures receiving six-figures payouts,, writes Crypto Briefing.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the year was Terra Luna, down 100%.

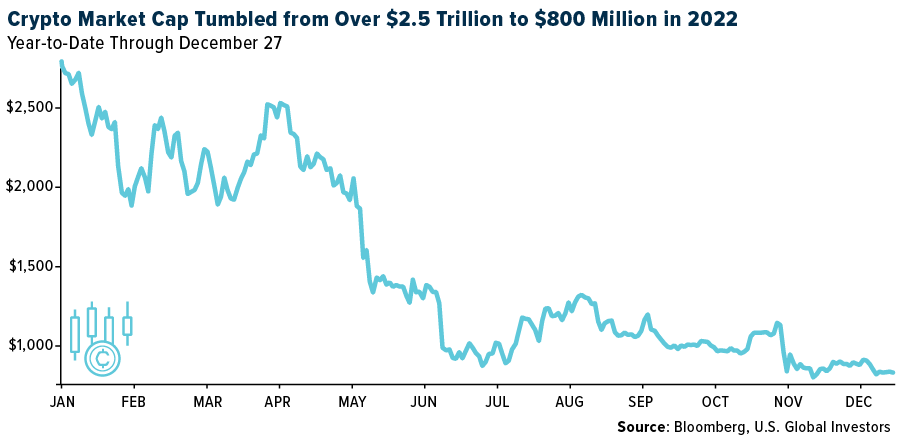

- Crypto prices plunged this year thanks to industry gaffes and the wider and damaging macroeconomic environment. The global crypto market capitalization plunged to below $800 million from over $2.5 trillion as cryptocurrencies entered a bear market in line with traditional markets, writes Bloomberg.

- Crypto suffered a number of high-profile hacks in 2022, but the nine-figure exploit that hit Axie Infinity’s Ronin bridge in March was the biggest. A group of attackers later identified by U.S. law enforcement as the North Korean state-sponsored Lazarus Group used phishing emails to gain access to five of nine Ronin chain validators.

Opportunities

- Ethereum’s switch to proof-of-stake from proof-of-work marked a massive reduction to the network’s energy footprint, ditching the power-hungry crypto mining system in favor of a new method for issuing and validating transactions on the blockchain. The Merge was completed in September.

- President Joe Biden issued an executive order directing almost all federal agencies, including Cabinet departments, to come up with comprehensive plans for U.S. crypto regulation and enforcement. Biden’s order was anticipated for months before it was finally signed in March, and when it landed it was generally seen as a boon to the industry, writes Crypto Briefing.

- The Central African Republic became the second country to adopt Bitcoin as a legal tender earlier this year, allowing around 5 million residents to use the flagship cryptocurrency alongside the country’s fiat currency. The move came after Central African Republic President Faustin-Archange Touadera signed a bill into law establishing a regulatory framework for Bitcoin as legal tender, according to Cointelegraph article.

Threats

- FTX’s collapse was a crime, not an accident, and Sam Bankman-Fried was a con man and fraudster of historic proportions. It is now clear that the FTX crypto exchange and the hedge fund Alameda Research was a house of lies and intended to steal money from both users and investors, according to CoinDesk.

- At the height of the crypto bull market, the Terra ecosystem was booming with talent and innovation. The native token of the terra blockchain had made its way to the top 10 cryptocurrencies by total market cap and Terra reach over 90% of TVL with more than $21 billion worth of assets in May 2022. That same month of May will be remembered as Terra’s collapse. The Terra token was supposed to maintain the peg of Terra’s algorithmic stablecoin — until it didn’t. Billions of dollars were wiped out from the market in just a couple of days and the flourishing ecosystem Terra had built was left for dead, according to Cointelegraph.

- The collapse of 3AC following heavy losses amid declining cryptocurrency valuations was one of the focal points on the onset of the crypto winter in recent months. Since then, a swathe of other prominent crypto firms have also filed for bankruptcy, including crypto lenders Celsius Network and Voyager Digital.[/responsivevoice]

[responsivevoice buttontext=”Listen to the SWOT”]

Gold Market

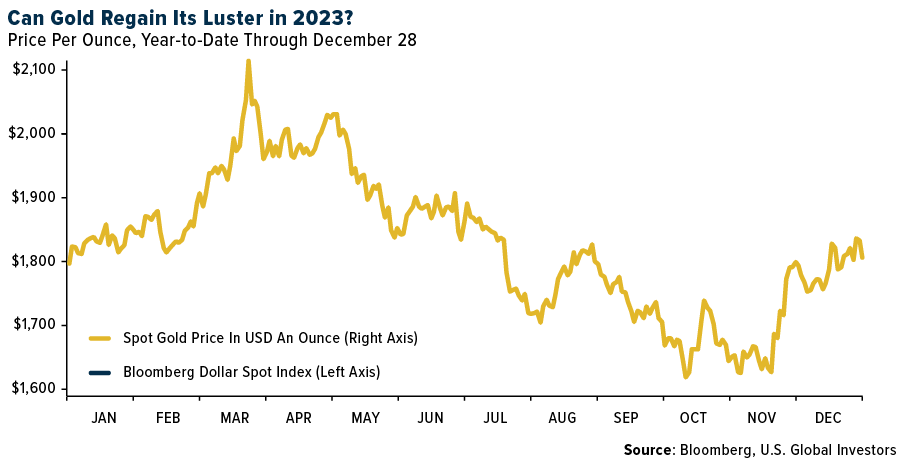

For the year gold futures closed the period at $1,890.10 down $13.80 per ounce, or 0.75%. Bitcoin fell more than a 64% loss for the year. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the year lower by 10.21%. The S&P/TSX Venture Index came in off 39.28%. The U.S. Trade-Weighted Dollar rose 8.17%.[/responsivevoice]

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| Dec-20 | Housing Starts | 1,400k | 1,427k | 1,434k |

| Dec-21 | Conf. Board Consumer Confidence | 101.0 | 108.3 | 101.4 |

| Dec 22 | GDP Annualized QoQ | 2.9% | 3.2% | 2.9% |

| Dec-23 | Durable Goods Orders | -1.0% | -2.1% | 0.7% |

| Dec-23 | New Home Sales | 600k | 640k | 605k |

| Dec-29 | Hong Kong Exports YoT | -16.2% | -24.1% | -10.4% |

| Dec-29 | Initial Jobless Claims | 225k | 225k | 216k |

| Jan-2 | China Caixin PMI Mfg | 49.1 | — | 49.4 |

| Jan-3 | Germany CPI YoY | 9.0% | — | 10.0% |

| Jan-4 | ISM Manufacturing | 48.5 | — | 49.0 |

| Jan-5 | ADP Employment Change | 145k | — | 127k |

| Jan-5 | Initial Jobless Claims | 230k | — | 225k |

| Jan-6 | Eurozone CPI Core YoY | 5.0% | — | 5.0% |

| Jan-6 | Change in Nonfarm Payrolls | 200k | — | 263k |

| Jan-6 | Durable Goods Orders | — | — | -2.1% |

[responsivevoice buttontext=”Listen to the SWOT”]

Strengths

- The best performing precious metal for the year was platinum, up 11.33% with most of the gains coming over the past quarter. The World Platinum Council expects a platinum deficit in 2023 with demand growing 19% and supply only rising 2%. According to UBS, there are three structural reasons in favor of gold: 1) Long-term investors and the official sector are gradually building gold allocations. Central banks have been net buyers of gold for more than a decade now, amid a broader trend of diversifying dollar-denominated reserves. 2) The proportion of gold holdings relative to overall assets held by institutional investors remains light, in their view, and they think it is likely held more for diversification and portfolio protection rather than expectations of outright material price appreciation. 3) Strong physical demand has also been a key factor affecting the relationship between gold and real rates, in their view. Key physical gold markets India and China have continued to buy large volumes of gold this year, helped by cheaper prices as gold came under pressure from macro forces.

- Deal flow for the royalty sector remains strong, with increased complexity in deal investment structures, partly due to intense competition between royalty companies for quality assets, and $1.2 billion of transactions announced since June 2022. Year-to-date, $2.9 billion has been deployed (one of the highest years on record), driven by sector consolidation. The current deal pipeline remains focused on precious metals streams and development projects.

- Russia’s Finance Ministry announced the doubling of the amount of Chinese yuan and gold it can hold in its national wealth fund. The upper limit for yuan share would be 60% and the upper limit for gold would be 40%. The fund held $186.5 billion in November. To further internationalize renminbi, China announced it will extend the trading hours for the onshore yuan to 3 a.m. local time the next day rather than 11:30 p.m. effective Jan. 3, according to the People’s Bank of China (PBOC).

Weaknesses

- The worst performing precious metal for the year was palladium, down 7.12% despite MMC Norilsk Nickel PJSC, which controls 40% of the global palladium market, noting global markets will face a sharp deficit in 2023. Perhaps the market expects some of the metal to reach the market through commodity rehypothecation, but electric vehicles (EVs) will start to gain more market penetration, limiting the need for palladium loaded with catalytic converters for gasoline engines. While gold is a traditional haven in times of economic distress, the precious metal has slumped over the past month in the face of the greenback’s relentless gains and hawkish moves by central banks.

- Cost inflation continues to be a key theme for the precious metal producers, and against that backdrop, the royalties as a group outperformed in 2021, down 4% on average versus the producers down 13% and gold 4%. So far in 2022, the royalty sector is down 2%, on average, against a flat gold price (+1%), and while slightly lagging the senior producers (+2%), they are outperforming the intermediate and junior gold producers, down 12% and 19%, respectively.

- The World Platinum Investment Council (WPIC) lowered its supply forecast to 7.78 million ounces as it expects lower output from South Africa and Russia. Additionally, the organization estimated supply at 8.18 million ounces earlier this year and Major South African producers are all lowering guidance. The WPIC sees sanctions impacting Russian output and has reduced its platinum surplus outlook to 627,000 ounces from 652,000 ounces.

Opportunities

- Mergers and acquisitions (M&A) will continue into 2023, with numerous senior companies having publicly commented on looking at M&A as part of their growth strategy. Transactions that provide diversification and less risk concentration would garner shareholder support. There may be further consolidations in the streaming space (between the smaller players) as these transactions are done to increase market cap in a business that allows for growth with synergies. According to RBC, valuations for these junior miners have approached lows not seen since 2015 when gold was $500 per ounce lower at $1,200, setting the stage for potential deals.

- Zoltan Pozsar of Credit Suiss penned an interesting report titled “War and Commodity Encumbrance” this week. At the heart of the work is how China has changed the structure of oil trade with Saudia Arabia in that the Shanghai Petroleom and Natural Gas Exchange will be fully utilized renminbi settlement in oil and gas trade, creating the dawn of the “petroyuan.” What will the Saudis do with the renminbi they accumulate from selling their oil? One obvious option is converting your it directly into gold on either the Shanghai Gold Exchange or the Hong Kong Gold Exchange, which have offered that convertibility option since 2016 and 2017, respectively. The new invoicing for all oil and gas in renminbi is expected to be completed over the next three to five years. Gold is likely to remain well bid as the dollar loses market share in world energy trade.

- And if you needed any more confidence to stay long gold, Mark Cuban, billionaire owner of the Dallas Mavericks said, “I want Bitcoin to go down a lot further so I can buy more.” Cuban had less flattering words for gold investors, but most people want the price of something they own to go up a lot, so they can sell it.

Threats

- According to Morgan Stanley, gold looks overvalued versus recent moves in real yields, although some support is coming through from still strong inflation and rising risks of recession, and sentiment could turn if rate expectations start to reverse.

- Late in the week, it was reported two B2Gold Corp employees were killed after armed robbers attacked a local bus transporting the employees from the Fekola Mine to Bamako, Mali. There were security forces on the transport bus, but the incident resulted in the death of two employees. All reports indicate this was not a terrorist incident, yet it underscores the risks involved in working in certain countries.

- Google searches for “diamonds” in the U.S. appear to have decoupled from their historical trend of sharply rising into the holiday season. This could be indicative of weakening consumer appetite for these stones, as evidenced by the softening for polished prices across the size spectrum as well as the weaker than expected DeBeers site sales.[/responsivevoice]

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/22):

Southwest Airlines Co.

Trip.com Group Ltd.

Compagnie Financière Richemont S.A.

Bayerische Motoren Werke AG

Mercedes-Benz Group AG

Volkswagen AG

Hermes International

Kering SA

LVMH Moët Hennessy Louis Vuitton S.A.

COSCO Shipping Holdings Co. Ltd.

Yang Ming Marine Transport Corp.

Mitsui OSK Lines Ltd.

Airbus SE

The Boeing Co.

Delta Air Lines Inc.

B2Gold Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.