President McKinley’s Tariff Mishap Could Be a Warning Sign for Trump’s Trade War

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign imports. The McKinley Tariff Act of 1890 raised import duties to an average of 50%, one of the highest levels in U.S. history.

The logic was simple: If foreign goods were more expensive, Americans would buy domestic products, fueling economic expansion.

But the results were not so simple. Instead of strengthening America’s trade position, the tariff triggered retaliation from other nations. Prices rose, particularly for middle- and lower-income Americans, and political backlash followed. In the 1890 midterm elections, voters revolted: McKinley lost his seat, and Democrats took control of the House.

At the time, some Republicans dreamed of annexing Canada, believing that the economic pressure would push Canadians to seek statehood. Instead, the tariff had the opposite effect—Canadian nationalists rallied against what they saw as economic coercion. The country deepened its ties with the British Empire, reinforcing the very trade barriers the U.S. sought to disrupt.

Tariffs, Trade Deficits and Consumer Confidence

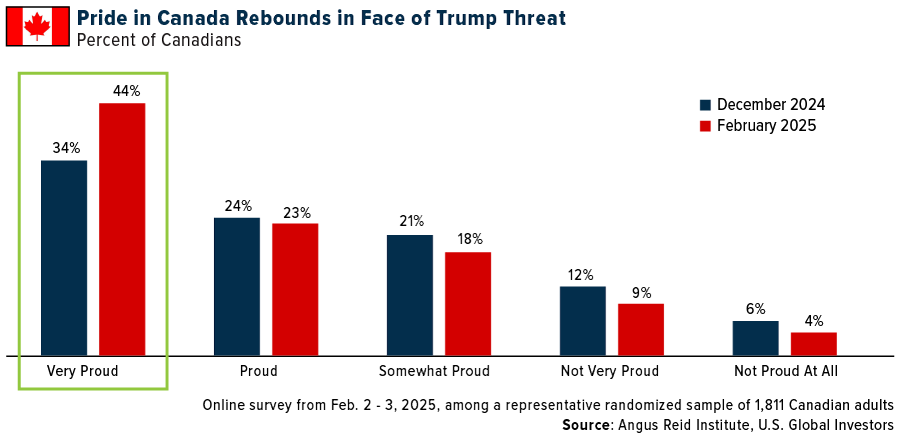

Fast-forward to today, and we’re seeing some eerily similar trends, starting with an increase in Canadian pride. Due to some of President Donald Trump’s antagonistic rhetoric, we saw Canadians boo the U.S. national anthem during the 4 Nations Face-Off hockey game last week, and a recent poll shows that Canadian pride has jumped 10 points since December 2024.

Trump has made tariffs a cornerstone of his economic strategy, arguing they will bring jobs back to America and reduce the trade deficit. But just like in McKinley’s time, history suggests tariffs don’t actually reduce trade deficits—they often increase them. Why? Because tariffs discourage trade on both sides, leading to fewer exports and fewer imports.

The data backs this up. According to the Peterson Institute for International Economics (PIIE), countries with higher tariffs tend to have larger trade deficits, not smaller ones. And while tariffs may benefit specific industries in the short term, they also raise costs for American consumers and businesses, leading to lower consumer spending and weaker confidence in the economy.

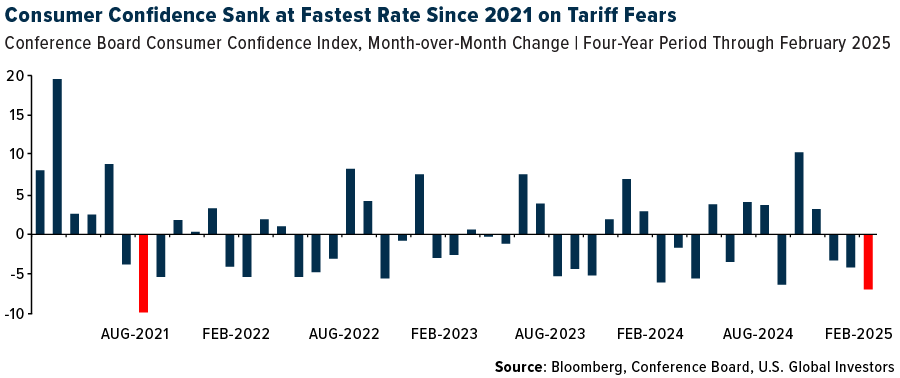

That’s exactly what we’re seeing today. Consumer confidence has been falling, with the Conference Board’s index dropping seven points in February, the largest decline since August 2021.

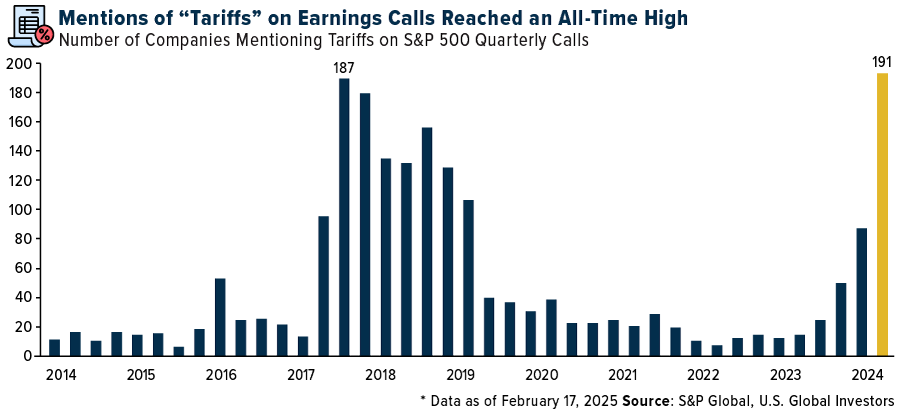

Investors are paying attention: During recent earnings calls, S&P 500 companies mentioned “tariffs” a record 191 times, more than in 2018 or 2019, when Trump first imposed duties on Chinese goods.

Personal computer (PC) and printer manufacturer HP Inc., for instance, warned shareholders during its earnings call this week that “the current U.S. tariff increases on China” would weigh on profitability this year.

How Investors Should Think About Tariffs

I often say that it’s the policies that matter, not the political parties. That said, here are three things to keep in mind when evaluating tariffs:

1. Tariffs Are a Tax—And Taxes Raise Costs

It doesn’t matter who pays the tariff initially—whether it’s foreign exporters or U.S. importers—the additional cost eventually hits Americans’ pocketbooks. History shows that tariffs lead to higher prices for goods, which can hurt economic growth over time.

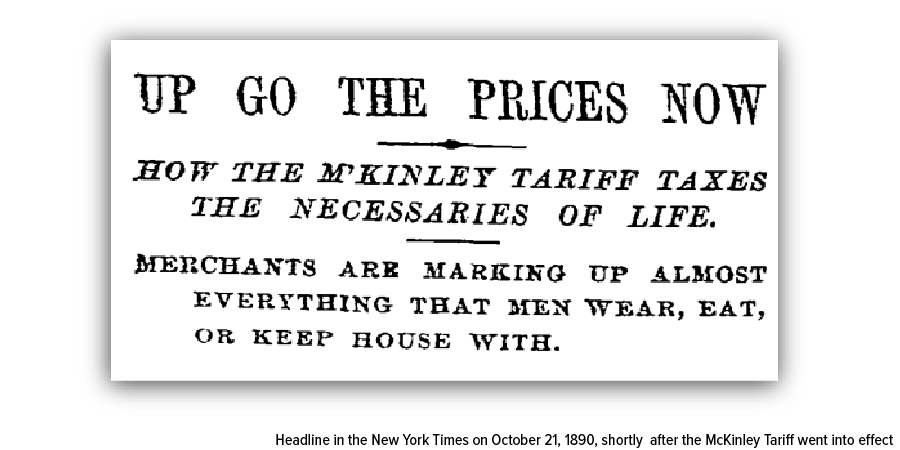

In October 1890, shortly after the McKinley tariff went into effect, the New York Times reported that companies in multiple industries were raising consumer prices across the board, including those in men’s and women’s clothing, groceries, tinware, clocks, books and more.

We’re seeing similar concerns today, with businesses warning about price hikes on everything from electronics to automobiles.

2. Trade Volatility Hurts Business Confidence

When tariffs are used unpredictably, companies hesitate to make long-term investments. This uncertainty can slow hiring, delay capital spending and force businesses to look for alternatives—whether that means shifting supply chains out of China or investing in automation rather than workers.

Investors should watch sectors most affected by tariffs, such as automotive, manufacturing and energy, where companies are exploring mergers and acquisitions (M&A) to hedge against trade risk.

3. Global Trade Relationships Matter

Canada is the United States’ largest trading partner, accounting for $413 billion in imports and $349 billion in exports in 2024. The U.S. also relies heavily on Canadian energy imports, including crude oil, natural gas and electricity.

The unintended consequence of aggressive trade policies could be that Canada—and other key partners—look elsewhere, just as they did after the McKinley Tariff. Several Canadian politicians are now advocating for new pipelines to coastal export terminals, reducing dependency on the U.S. market. Once those trade routes shift, they are not easily reversed.

Investing Without Bias

The lesson here isn’t that tariffs are inherently bad, nor is it to criticize President Trump. The point is that we, as investors, must think independently and assess policies based on their actual effects, not just their stated goals. History has shown that tariffs often come with unintended consequences, and we’re seeing echoes of the McKinley era today.

Markets thrive on certainty, and tariffs introduce uncertainty. While they may benefit select industries in the short run, they often result in higher consumer costs and slower economic growth. If McKinley were alive today, he might remind us that by 1901—just a day before his assassination—he had abandoned his hardline tariff stance in favor of reciprocal trade agreements. That shift, too, is a lesson in economic pragmatism.

History doesn’t repeat, but it often rhymes—and smart investors know when to listen.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.95%. The S&P 500 Stock Index fell 0.98%, while the Nasdaq Composite fell 3.47%. The Russell 2000 small capitalization index lost 1.47% this week.

- The Hang Seng Composite lost 2.58% this week; while Taiwan was down 2.85% and the KOSPI fell 4.59%.

- The 10-year Treasury bond yield fell 2 basis points to 4.203%.

Airlines and Shipping

Strengths

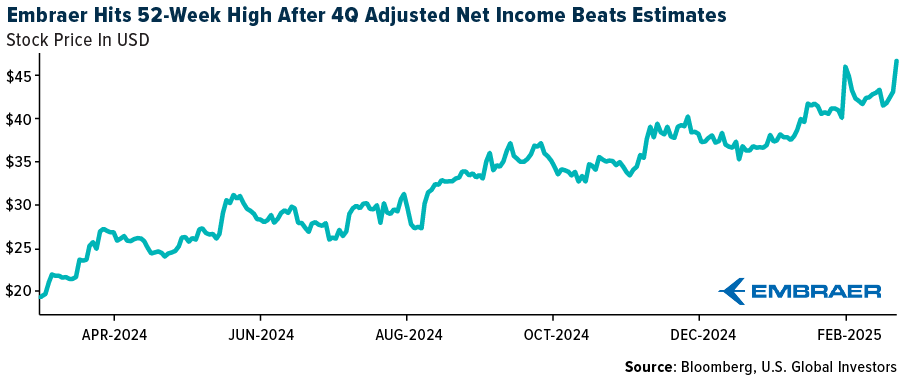

- Embraer hit a 52-week high after the company reported adjusted net income for the fourth quarter that beat the average analyst estimate. Adjusted net income was $173 million versus $77 million year-over-year, estimate was $120.0 million. Net revenue was $2.31 billion, 17% year-over-year, while the estimate was $2.3 billion, writes Bloomberg.

- Air travel in China surged in early 2025, reports the IATA, with over 26.2 million trips by plane for the Chinese New Year holiday. That represents a 4 percent increase from the same time in 2024.

- Reuters reports that over 45,000 U.S. dockworkers ratified a new six-year contract this week, securing a 62% wage increase and preventing disruptions until 2030. The agreement, which was reached in October, ended a three-day strike that had caused shipping price hikes and cargo backlogs at numerous ports.

Weaknesses

- A South Carolina man who stripped naked and assaulted a federal officer at Indianapolis international airport in 2023 has been sentenced to 33 months in federal prison. After passing through a screening machine at the checkpoint, the machine indicated that the man required additional screening of his chest, groin, and buttocks, according to Bloomberg.

- Turkish Airlines reported net income for the full year that missed the average analyst estimate. Net income was 113.4 billion liras, down 30% year-over-year, while the estimate was 117.6 billion liras, Bloomberg reports.

- Gatwick Airport’s second runway delayed by the Transport Secretary despite her pledge to “defy eco-warriors” on the €2.2 billion expansion. As a result, she extended the deadline for the final decision by nine months to October 27, according to Bloomberg.

Opportunities

- According to Simple Flying, Air Service One’s analysis reveals that 2024 marked the first year since the pandemic that European air traffic surpassed pre-2019 levels. However, individual countries show differing recovery rates, with Greece and Poland seeing the best rebounds, both exceeding 2019 traffic by around 21%. Notably, Albania experienced the most significant growth, with a remarkable 220% increase despite being a smaller market.

- Elon Musk’s SpaceX is working to deploy Starlink satellite internet terminals to help upgrade the U.S. Federal Aviation Administration’s airspace system, Bloomberg reports. This effort raises concerns about potential conflicts of interest for Musk’s businesses, as Verizon Communications was awarded a $2 billion contract in 2023 for similar infrastructure improvements. Musk recently approved the shipment of 4,000 Starlink terminals to the FAA, with one already installed for testing at the agency’s air-traffic control lab in Atlantic City.

- JetBlue Airways said Thursday it will start a new daily summer seasonal route between New Hampshire’s Manchester Boston regional airport and New York’s John F. Kennedy international airport. The route will run daily from June 12 to October 25 using the airline’s Airbus A320 aircraft, JetBlue said in a statement.

Threats

- LNG shipping stocks have experienced heightened volatility recently, with the UP-World LNG Shipping Index (UPI) dropping 1.79%, reflecting broader market trends. Concerns over U.S. policy shifts have increased investor caution, although LNG shipping could benefit from these changes, explains Hellenic Shipping News.

- More than 1,000 Syrians died by execution, torture or maltreatment at a military airport outside Damascus, according to a new report that traced their deaths to seven suspected grave sites.

- Since Christmas Day, four commercial jets have crashed, killing 300 people and injuring many others. Images of the explosion over the Potomac after a Black Hawk helicopter collided with a plane, and of a Delta flight upside down on the runway in Toronto have spooked people of their next trip, writes Bloomberg.

Luxury Goods and International Markets

Strengths

- Eurozone business confidence improved, with the European Commission’s economic sentiment indicator rising to 96.3 from 95.3 in January, attributed to falling interest rates. Year-to-date Europe, as measured by the STOXX 600 Index, gained 10.5% while stocks listed in the United States only gained 1.2% during that same time period.

- European luxury stocks gained momentum as Kepler Cheuvreux reinstated a positive outlook on the sector. The firm upgraded shares of LVMH, Kering, and Burberry to a “buy” rating, while also raising price targets for Richemont, Prada, and Moncler.

- Li Auto, a Chinese EV manufacturer, was the top-performing stock in the S&P Global Luxury Index, with a 15.7% increase over the past five days. JPMorgan upgraded Li Auto shares to an “overweight” rating, saying the company could double its sales by 2027.

Weaknesses

- In the United States, the Conference Board’s Consumer Confidence Index dropped by 7.0 points to 98.3 in February, marking the most significant monthly decline in over four years. This downturn is attributed to concerns over persistent inflation and potential trade conflicts under President Trump’s administration.

- Shares of Ferrari dropped this week after news emerged that the Agnelli family is selling a stake valued at around 3 billion euros. The billionaire family will remain Ferrari’s largest shareholder, retaining approximately 33% of voting rights. Additionally, Ferrari plans to buy back about 10% of the shares sold.

- Lucid Group, a U.S. EV manufacturer, was the worst-performing stock in the S&P Global Luxury Index, dropping 32.6%. Lucid reported better-than-expected revenue of $807.8 million for 2024 (up 36% from 2023), and the company’s net loss widened by 8.2% to $3.06 billion. Peter Rawlinson, Lucid’s CEO, unexpectedly stepped down from his position.

Opportunity

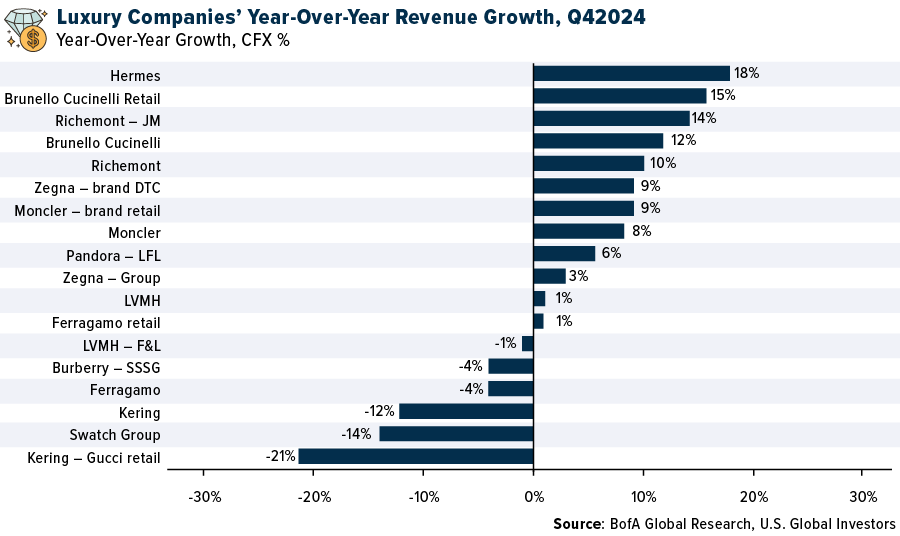

- Bank of America research shows that the fourth-quarter earnings season exceeded expectations, with luxury revenue growing by 1%. The firm believes the worst of the luxury demand decline is behind us and predicts stronger revenue going forward. However, the group warns that luxury stocks have already gained 15%, with significant variations in revenue among top performers and laggards.

- Many luxury brands are lowering prices to attract aspirational buyers, particularly those impacted by high inflation and rising interest rates. Burberry has been successful with this strategy. Ahead of the holiday season, the company adjusted its pricing structure to reach a broader audience, offering more accessible products. As a result, Burberry saw its first new customer growth in two years in December and a 4% increase in third-quarter store sales across America.

- Tiffany & Co. is preparing to open a new store in Brazil, bringing the total number of its locations in the country to five. The luxury market in Brazil has shown consistent growth in recent years. In 2023, the sector grew by 30%, followed by an 11.7% increase in 2024. The forecast for this year is 15% growth, according to an annual survey by the Brazilian Association of Luxury Brands and Companies.

Threats

- Strong demand for luxury goods in America had previously supported high-end brands; however, recent trends in the U.S. consumer sector show signs of decline. Retail sales in January fell by 0.9%, and consumer confidence dropped by nearly 10% in February.

- Germany has a new Chancellor, Friedrich Merz, following last week’s elections. This shift could bring changes to transatlantic relations, with his policy agenda focusing on reducing personal and corporate taxes, cutting regulations, and implementing a stricter immigration policy. However, the process of forming a new government may be challenging due to a fragmented political landscape. The Christian Democratic Union/Christian Social Union (CDU/CSU) secured 28.5% of the vote, the Alternative for Germany (AfD) received 20.8%, and the Social Democratic Party of Germany (SPD) gained 16%.

- Xiaomi, a Chinese EV manufacturer, slashed the price of its luxury electric sedan, the SU7 Ultra, by 35% in an effort to compete with other EV makers like BMW, Audi, Mercedes, and Tesla in the market. Following the price cut announcement, Xiaomi received 6,900 orders within just 10 minutes, gaining market share from foreign companies.

Energy and Natural Resources

Strengths

- The best-performing commodity for the week was lumber, which rose 12.25%. Lumber prices soared this week on a 13-point drop in the Bankrate 30-year fixed mortgage. In addition, there was a devastating fire that gutted the Jamesville Lumber Company and its lumber yard in North Carolina on February 25, 2025, destroying an estimated 50,000 board feet of inventory, as reported by Bloomberg. The blaze, sparked by an electrical fault, tightened an already strained supply chain—exacerbated by tariffs on Canada, a major lumber supplier.

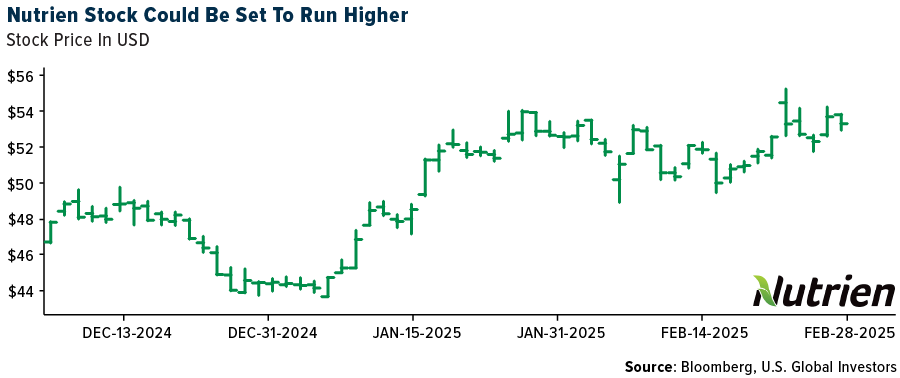

- Nutrien showcased its market resilience this week, leveraging its leadership in nitrogen and potash as New Orleans urea stabilized at $387-$403 per short ton, while inland prices surged—western Canada hit C$860 per metric ton, per Bloomberg. Potash remained firm amid tariff concerns and Uralkali’s supply curtailments. Meanwhile, the company’s timely TSX approval for a renewed share repurchase program enhances financial flexibility, positioning it to capitalize on tightening global fertilizer markets despite India’s delayed urea tender.

- The Democratic Republic of the Congo has finally moved to enforce a long-planned state monopoly to control production of hand-dug cobalt, broadening its efforts to boost prices for the battery metal by restricting global supplies. Entreprise Generale du Cobalt is now the only entity allowed to export so-called artisanal cobalt. At the same time, the government also imposed a four-month suspension on cobalt exports of any kind, in a move that could cause prices to skyrocket.

Weaknesses

- The worst-performing commodity for the week was wheat, dropping 8.07%. Wheat headed for its biggest weekly declines in roughly eight months on the outlook for robust supply and on concerns around the fallout from President Donald Trump’s tariffs. Both Beijing and Mexico are big buyers of U.S. wheat and corn, and tariffs could cause a retaliation against American farm products, Bloomberg reports.

- Silver’s long-term underperformance versus gold weakened precious metals sentiment, with Bloomberg’s Ven Ram noting on February 27, 2025, that silver’s 1.43% inflation-adjusted return since 1950 lags gold’s 2.45%, dragging confidence in the broader market. With silver being more volatile, there are opportunities for big, short-term gains or losses.

Opportunities

- IsoEnergy Ltd. has successfully closed its previously announced bought deal financing, raising C$20 million through the sale of 5.3 million flow-through common shares at C$3.75 per share. The company plans to use the proceeds for eligible Canadian exploration expenses, specifically for flow-through critical mineral mining expenditures related to its uranium projects in Saskatchewan and Quebec. Additionally, IsoEnergy completed a concurrent non-brokered private placement with NexGen Energy Ltd., issuing 2.5 million common shares at C$2.50 per share for gross proceeds of C$6.3 million.

- President Trump’s focus on domestic copper production presents a significant opportunity for the U.S. mining industry, particularly as global demand for copper is expected to rise due to electrification and energy transition trends. This policy shift could revitalize American copper mining and processing capabilities, addressing the current lag in smelting and refining capacity. As international agreements like those with Ukraine face challenges, emphasizing domestic mining could further boost U.S. copper production, per Bloomberg.

- Saudi Arabia’s Minister of Mining, Bandar Al-Khorayef, emphasized diversification at the BMO Global Metals, Mining & Critical Minerals Conference this week, announcing that the Kingdom aims to reduce its oil reliance by unlocking its $2.5 trillion mineral wealth, particularly gold, copper and critical metals like lithium.

Threats

- Nitrogen prices risk disruption as India delays its urea tender, per Bloomberg Intelligence’s Weekly Wrap on February 24, 2025, threatening exporters like Yara and Nutrien with oversupply if the world’s second-largest importer shifts to domestic production, up 33% in five years. This uncertainty could depress global prices despite inland gains.

- Lithium faces a looming supply glut as Albemarle’s Silver Peak Mine expansion in Nevada, announced this week, adds 1,053 acres of public land to its 6,462-acre operation, despite an ongoing environmental review by the BLM with a decision not due until 2026. This push, alongside the Rhyolite Ridge project’s recent approval in October 2024, risks flooding the market with lithium by 2027, threatening price stability for producers as battery demand projections remain uncertain.

- Corn prices risk further collapse due to a bumper U.S. harvest forecast, with the USDA projecting a 5% yield increase for 2025 this week, reported by Reuters, pressuring futures down 8%. This oversupply threatens agribusiness giants like Archer-Daniels-Midland, potentially slashing revenues as global demand struggles to absorb the excess amid trade uncertainties.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Story IP, rising 16.79%.

- Uniswap Labs, the creator of the largest decentralized trading platform on Ethereum, said the Securities and Exchange Commission (SEC) has closed its investigation into the company with no enforcement action. The SEC had alleged that Uniswap Labs operated as an unregistered broker and exchange and issued and unregistered securities, but these claims have been dropped.

- Mara Holdings shares are up 11% in premarket trading after the crypto mining firm reported total revenue for the fourth quarter that beat the average analyst estimate. Revenue growth was driven by a significant increase in the company’s hash rate (up 44% y/y) and a higher Bitcoin price, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Raydium, down 48.56%.

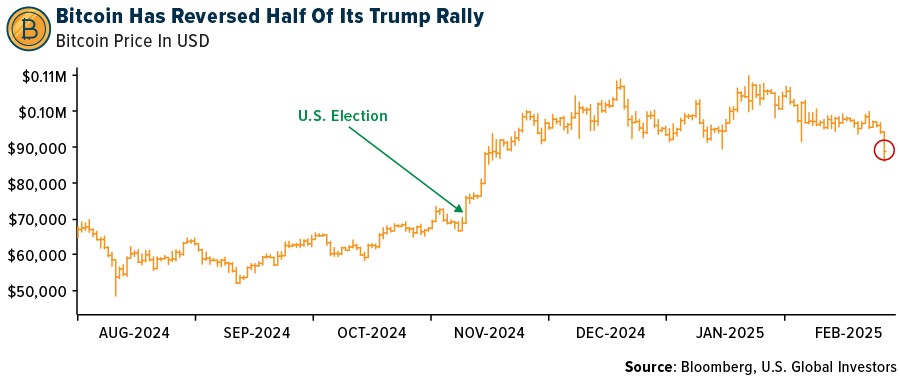

- With the so-called “Trump bump” fading across markets, Bitcoin options are showing that investors and traders are hedging against a decline in the cryptocurrency to levels last seen just after Election Day. The open interest for put options with a strike price of $70,000 is the second highest among all contracts expiring on Feburary 28, according to data from Derbit, writes Bloomberg.

- Investors withdrew over $1 billion from spot Bitcoin exchange-traded funds (ETFs) in one day, the largest outflow since last January. The outflows are likely due to hedge funds unwinding a trading strategy that exploits price differences between spot and futures markets, and/or newer crypto investors panicking and selling.

Opportunities

- Bitwise Asset Management has raised $70 million in a new funding round, backed by high-profile investors like MassMutual and MIT Investment Management. The funds will be used to bolster the company’s balance sheet and contribute to internal initiatives.

- Crypto infrastructure builder Consensys said the SEC has agreed in principle that the securities enforcement case concerning its MetaMask business should be dismissed. The SEC has dismissed or put on hold at least seven cases of investigations in the last three years week, according to Bloomberg.

- The world’s largest asset manager is finally allowing Bitcoin into its $150 billion model-portfolio universe. BlackRock is adding a 1% to 2% allocation to the $48 billion iShares Bitcoin Trust ETF in its target allocation portfolios that allow for alternatives.

Threats

- The GitHub code you use to build a trendy application or patch existing bugs might just be used to steal your Bitcoin or other crypto holdings. A report warned users of a “GitVenom” campaign that’s been active for at least two years but steadily on the rise, involving planting malicious code in fake projects on the popular code repository platform.

- Bitcoin tumbled below $90,000 to hit the lowest level since mid-November, as the rally that followed Donald Trump’s election to the White House reverses under the weight of his trade tariffs and a string of industry setbacks. Bitcoin dropped as much as 7.6% and traded around $83,000 after U.S. markets closed on Wednesday.

- A rout in Bitcoin deepened on Friday as investors rushed to safe assets in the wake of President Donald Trump’s latest tariff threats, marking a dramatic reality check for one of the most popular Trump trades. Bitcoin tumbled as much as 7.2% on Friday to the lowest since early November and is down some 27% since it hit an all-time high less than six weeks ago, writes Bloomberg.

Defense and Cybersecurity

Strengths

- Nvidia Corporation provided exceptionally strong forward guidance with projected first-quarter revenue of $43 billion, supported by record-breaking performance, including 78% year-over-year revenue growth and the successful launch of its Blackwell product line.

- The UK will increase its defense budget to 2.5% of GDP by 2027, funded by cutting foreign aid from 0.5% to 0.3%. This has sparked a political debate and a ministerial resignation amid broader European military spending rises.

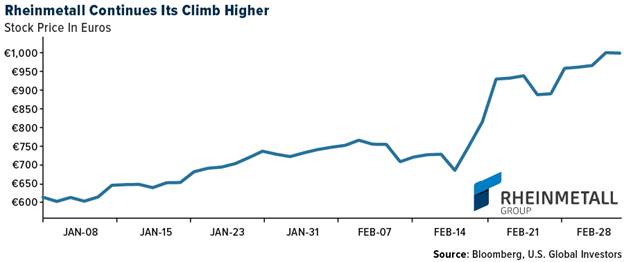

- The best performing stock in the global defense sector this week was Rheinmetall, up 11.47%.

Weaknesses

- Tech stocks fell sharply on February 27, led by an 8% drop in Nvidia despite strong earnings, as investors worried about overvaluation and the sustainability of AI-driven growth, causing a broader selloff in semiconductor stocks and a 2.8% decline in the Nasdaq. Additional pressure came from trade concerns after Trump’s tariff announcement and weaker economic data, including rising jobless claims, further dampening market sentiment.

- Microsoft has canceled leases for AI data centers in the U.S. due to potential oversupply and concerns about AI demand. Meanwhile, Alphabet is under scrutiny for its significant AI spending, with plans to increase investment to $75 billion this year.

- The worst performing stock in the global defense sector for the week was Nvidia, down 10.62%.

Opportunities

- Safran announced it would supply Geonyx Inertial Navigation Systems to the Finnish Defense Forces for artillery systems from 2024 to 2031, enhancing navigation and targeting capabilities.

- European defense stocks are surging, led by a 45% rally in Rheinmetall, as investors bet on increased military spending for Ukraine. Concerns remain over valuations while follow-through on commitments temper enthusiasm.

- Thales has signed an MOU with Qatar Airways to establish a service hub in Doha for inflight entertainment maintenance, repair, and support.

Threats

- CrowdStrike’s 2025 Global Threat Report highlights a 150% increase in Chinese cyber espionage activities in 2024, while Radware reports a 550% surge in web DDoS attacks. This is driven by geopolitical tensions and AI technology, with Ukraine being the most targeted nation.

- A report revealed that Boeing and other western companies’ aircraft parts reached Russian airlines through Indian intermediaries, despite sanctions, highlighting India’s role as a transit route for these shipments.

- North Korea has sent additional troops to Russia despite suffering heavy casualties in Ukraine, with its soldiers re-entering frontline combat in the Kursk region in exchange for food, oil, and military technology from Moscow, according to South Korea’s intelligence agency.

Gold Market

This week gold futures closed the week at $2,862.20, down $91.00 per ounce, or 3.08%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher/lower by 3.64%. The S&P/TSX Venture Index came in off 3.59. The U.S. Trade-Weighted Dollar rose .92%.

Strengths

- The best-performing precious metal this week was gold, despite experiencing its first weekly loss due to tariff threats against Canada and Mexico, set to take effect on March 4. These threats led to a stronger U.S. dollar, which put pressure on gold. However, a sharp decline in Bitcoin, which lost 27% of its all-time high, triggered billions in redemptions from various Bitcoin ETFs. As a result, gold bullion ETFs benefited from this asset rotation.

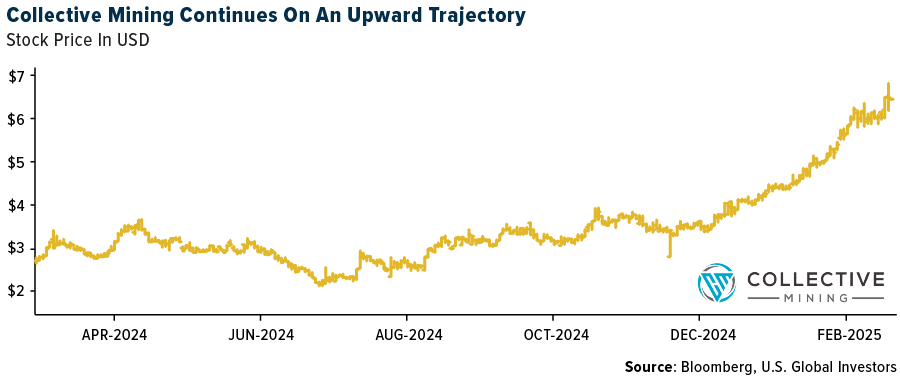

- Collective Mining Ltd. reported its best drill intersection at the Apollo system this week, with drill hole APC104-D5 intersecting 106.35 meters at 9.06 g/t gold equivalent (AuEq) within 497.35 meters at 3.01 g/t AuEq, highlighting the potential for high-grade sub-zones that could enhance the project’s overall grade and size. This breakthrough underscores Collective’s ability to unlock significant value at Guayabales, reinforcing its position in the gold exploration sector.

- Silver inventories at Comex (New York) have risen to a record high as the metal pushes prices month-over-month. The CME Group warehouse has reported 403.2 million ounces as of February 27 – a record high amount of silver stored, reports Bloomberg.

Weaknesses

- Gold jewelry demand in China slumped 11% in 2024, with high bullion prices above $2,800 per ounce further denting consumption this week, per a World Gold Council update. This persistent weakness threatens a key physical demand driver, exposing the market to reliance on investment flows amid a property crisis and equity underperformance.

- Franco-Nevada Corporation disclosed a $100 million write-down on February 26, 2025, tied to ongoing delays in restarting Cobre Panama (130-150k oz potential), as noted in its latest SEDAR filing and a Mining.com article. This setback, impacting its 112M oz AuEq portfolio, weakens near-term GEO growth and pressures its premium 1.05-1.15x P/NAV valuation.

Opportunities

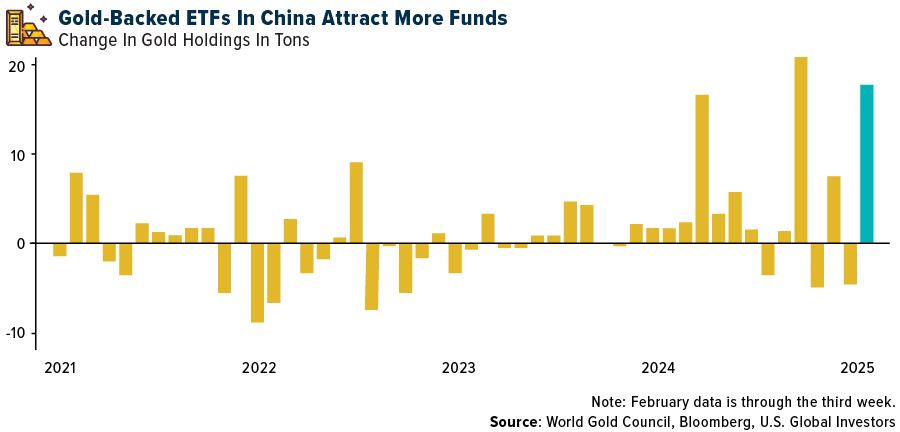

- Gold-backed ETFs in China swelled with 17.7 tons of inflows in the first three weeks of February, nearing a record 20.9 tons, driven by a pilot program allowing insurers to buy gold for the first time, as reported by Bloomberg this week. With banks like Goldman Sachs forecasting prices to $3,100-$3,300 per ounce by year-end, this surge reflects gold’s rising role as a hedge against currency depreciation and a diversification tool.

- Gold prices stand to gain as investors pulled a record $3 billion from U.S.-listed spot bitcoin ETFs this week, with $750 million exiting on February 26 alone, per Etf.com, while pouring $4 billion into gold ETFs amid crypto’s slump and a $1.5 billion Bybit hack reported last week. This shift, driving the SPDR Gold Trust (GLD) up 8.6% year-to-date against bitcoin’s decline, offers a prime opportunity for gold to climb toward $3,000 per ounce as risk-off sentiment and distrust in digital assets bolster its safe-haven appeal.

- Allied Gold launched a $500 million joint venture with UAE investment fund Ambrosia Investment Holding, targeting untapped high-grade deposits in Allied’s Mali operations, as announced on their website. With a combined 2.7M oz Au resource potential and gold prices staying above $2,800 per ounce, this partnership could boost production and re-rate Allied Gold’s valuations.

Threats

- Fortuna Silver Mines Inc. flagged a $20 million budget cut to its 2025 exploration plans on February 26, per its SEDAR filing and Mining.com, due to gold price volatility risks below $2,660/oz impacting its 83% gold-heavy revenue. This reduction threatens its 400-450k oz AuEq output and 0.83x P/NAV if Diamba Sud and Kingfisher development falters.

- Trump’s tariff threats intensified this week, Bloomberg reported, noting plans for Canada and Mexico tariffs next week, driving gold’s rally to pause near $2,865 per ounce after hitting $2,956.19. This volatility, coupled with a rising dollar, poses a near-term risk to gold’s momentum, potentially triggering profit-taking in precious metals markets.

- Silver’s long-term underperformance versus gold was highlighted this week by Bloomberg, despite a 0.95 correlation, silver’s cyclical volatility has left investors who bought at 1980’s $50/oz peak with losses, unlike gold’s 2.45% inflation-adjusted return since 1950. This disparity, detailed in Bloomberg’s Markets Live blog, threatens silver’s appeal as a gold proxy, potentially dragging sentiment in the broader precious metals market if gold’s rally falters.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.