Periodic Table of Commodity Returns Revels Winners and Losers for 2024

At the start of every year, we publish our popular Periodic Table of Commodity Returns, an interactive infographic of the gains and losses across the commodities market. Gold stood out as a bright spot in 2024, delivering one of its best annual performances in over a decade, while industrial and agricultural commodities faced significant challenges.

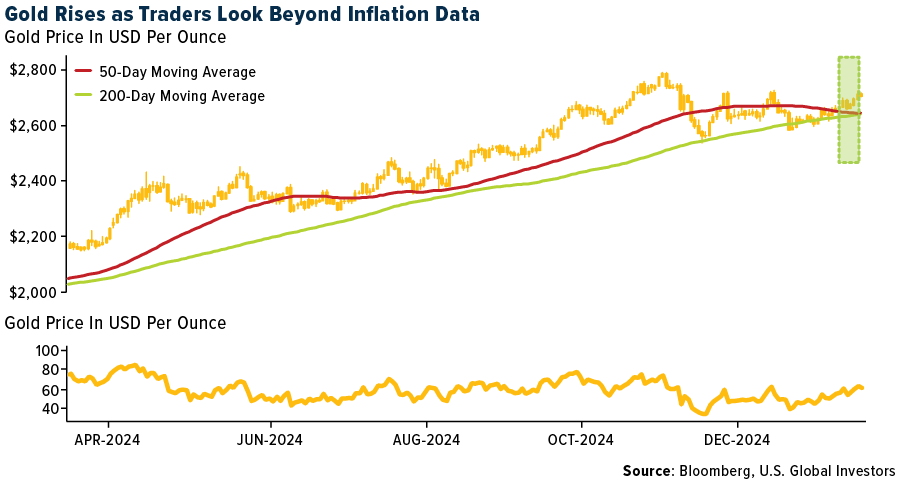

Up an eye-popping 27.2% last year, gold’s performance made clear its enduring role as a safe haven. Central banks continue their aggressive purchases, seeking diversification in an increasingly uncertain global economy. Meanwhile, inflationary pressures and a growing U.S. deficit have further boosted the appeal of the yellow metal, helping it outpace the S&P 500 in 2024.

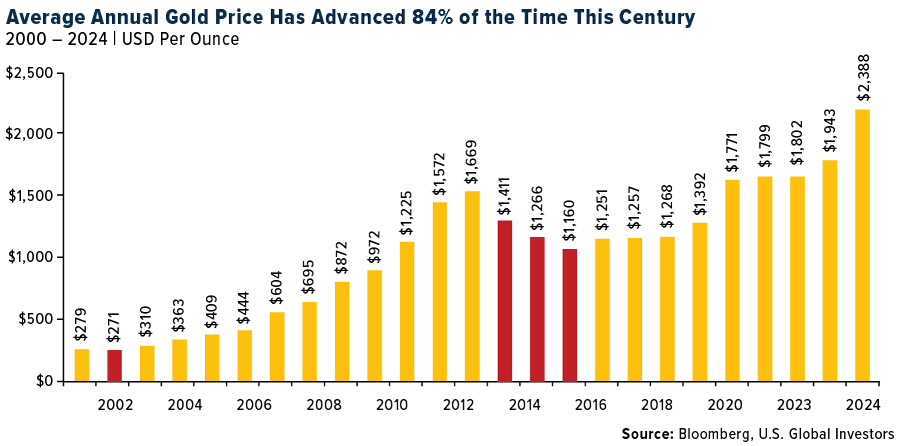

On a year-over-year basis, the average annual price of gold has now advanced 84% of the time this century, notching 21 positive years out of the past 25 years. For the second straight year, gold was the best performing commodity.

Silver also posted strong gains in 2024, climbing 21.7%. I believe the metal’s outlook for 2025 is even brighter. Industrial demand for silver, fueled by its critical role in solar panels and electrification, is expected to set new records. Its dual demand as both a precious and industrial metal places silver in a unique position to outperform gold in the year ahead.

Mixed Manufacturing Results Raises Potential Concerns for Industrial Metals

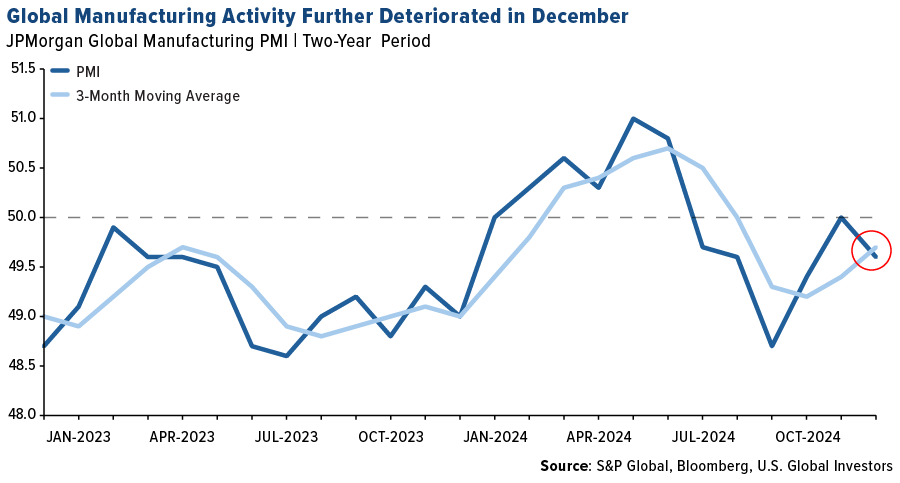

The global manufacturing sector, a bellwether for commodity demand, ended 2024 on a weak note. The JPMorgan Global Manufacturing PMI dipped into contraction territory in December, signaling declining output and new orders. This weakening trend points to a sluggish start for 2025, raising concerns about the demand for key industrial commodities such as copper, aluminum and nickel.

China, the world’s largest consumer of metals, was an unexpected bright spot as its manufacturing sector showed modest expansion. However, the broader outlook remains cautious, with business sentiment reaching a three-month low.

Clean Energy Boom Highlights Need for Investment in Mining Projects

Commodities tied to clean energy and electrification showed resilience in 2024, despite the global manufacturing slowdown. Copper and aluminum posted gains of 2.2% and 7.7%, respectively, supported by demand from renewable energy projects, electric vehicles and grid modernization efforts. Bloomberg New Energy Finance (BNEF) reported robust growth in clean energy deployment last year, with solar installations up 35% and energy storage installations surging by 76%.

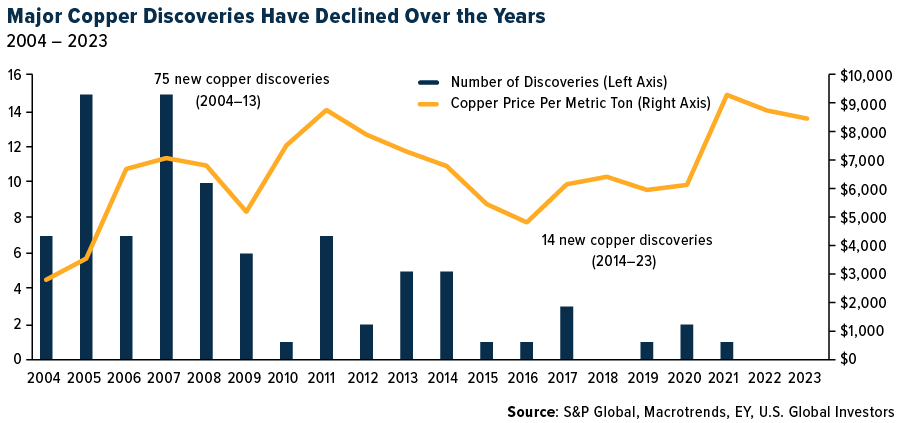

Meeting the exponential demand for metals critical to the energy transition will require significant investment in exploration and production. Ernst & Young (EY) projects that achieving global net-zero goals will necessitate 41 million metric tons of copper annually by 2050, a massive target given the lack of substantial new mining projects. According to S&P Global, only 14 new copper projects were discovered between 2014 and 2023; that’s significantly lower than the 75 new discoveries that were made between 2004 and 2013.

While energy transition metals show promise, other commodities faced sharp declines in 2024. Natural gas prices plunged nearly 71%, weighed down by mild weather in Europe. Agricultural commodities also struggled, with wheat and corn falling 40.9% and 28.8%, respectively. Lithium, a key component of electric vehicle batteries, saw a significant drop of 21.8%, reflecting temporary oversupply and slowing demand growth in China.

Interest Rate Uncertainty Adds Pressure to Commodity Outlook

The outlook for 2025 presents several headwinds for commodities. President-elect Donald Trump’s plans to expand fossil fuel production and roll back electric vehicle (EV) mandates may slow progress on the energy transition. Proposed tariffs on China and other trading partners could further disrupt global trade, potentially reducing demand for industrial and energy commodities. Wood Mackenzie warns that these protectionist measures could shave 50 basis points off global GDP growth, with significant implications for oil and gas consumption.

Interest rate policy adds another layer of complexity. While the Federal Reserve is expected to cut rates in 2025, the pace of easing may fall short of market expectations. Higher rates for longer could weigh on economic activity and dampen demand for raw materials.

Gold and Silver to Maintain Their Roles as Safe Haven Assets

Despite the challenges, long-term opportunities remain abundant. Gold and silver are likely to retain their appeal as hedges against uncertainty, while metals like copper and nickel stand to benefit from ongoing investment in electrification and clean energy infrastructure.

The Periodic Table of Commodity Returns highlights the cyclical nature of markets and the importance of staying informed. As 2025 unfolds, investors can position themselves to weather the challenges ahead and seize opportunities in the next phase of the global economy.

To view the 2025 Period Table of Commodity Returns, click here!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 3.69%. The S&P 500 Stock Index rose 2.91%, while the Nasdaq Composite climbed 2.45%. The Russell 2000 small capitalization index gained 3.96% this week.

- The Hang Seng Composite gained 2.73% this week; while Taiwan was up 0.59% and the KOSPI rose 0.31%.

- The 10-year Treasury bond yield fell 13 basis points to 4.622%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Tripadvisor, up 11.8%. According to TD, system-wide U.S. capacity is scheduled to increase 0.9% year-over-year in the first quarter of 2025, with domestic up 1.4% and international down 0.2%. Legacy carriers are scheduled to grow first quarter capacity by 2.8% year-over-year, LCCs are scheduled to shrink capacity by 1.9% year-over-year, and ULCCs are scheduled to shrink capacity by 4.4% year-over-year in the first quarter.

- Ocean volumes increased 5.3% year-over-year, globally, in November with Port of LA volumes up 16% year-over-year supported by front loading given U.S. East Coast port strike risks and looming U.S. import tariff hikes. Congestion is at 8.7%, up 110 basis points (bps) versus November, according to Bank of America.

- The airline fares component of the U.S. Consumer Price Index rose by 7.9% year-over-year and 3.9% month-over-month in December. This was the fourth month in a row of positive year-over-year increases and the fifth month of positive month-over-month increases, explains TD.

Weaknesses

- The worst performing airline stock for the week was Air Canada, down 7.3%. Norwegian Shuttle is now forecasting a group operating profit (EBIT), for the full year of 2024, of approximately NOK 1,850M. The deterioration is predominately the result of balance sheet adjustments relating to the weakening of the NOK against the U.S. dollar during the fourth quarter, which increases fuel costs.

- New sanctions were imposed on 183 vessels that have shipped Russian crude. The ships were responsible for more than 1.4 million barrels per day of Russian exports and more than 40% of the seaborne trade. According to Stifel, virtually all this volume was transported to China and India.

- As reported by Raymond James, Ryanair average fuel cost/pax are stepping up 3%, reflecting EU/U.K. SAF mandates effective CY2025. JP Morgan is indicating that Air France’ fuel costs will go up by 7% for the same reason.

Opportunities

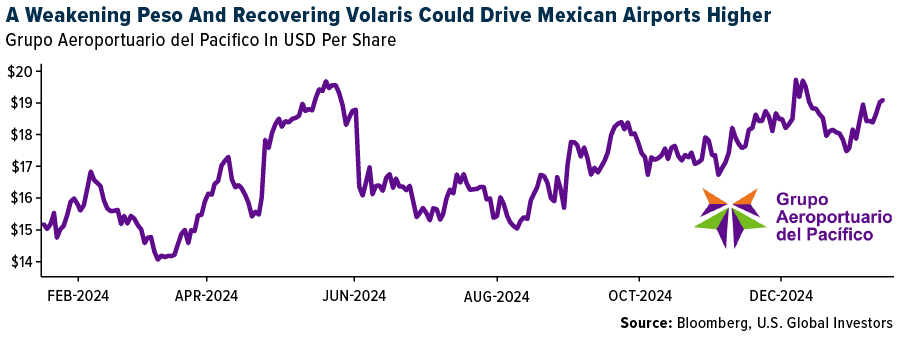

- Bank of America estimates that Mexican airports will deliver year-over-year 2025 traffic growth of 4.8%, driven by nearshoring coupled with the following tailwinds: 1) expected end of airline capacity constraints related to Airbus engine recalls in the second half of 2025; 2) higher Mexico tourism competitiveness due to the Peso depreciation.

- According to Morgan Stanley, UPS domestic flight count increased 24% this month and year-over-year growth slowed to 15%. FedEx domestic flight count increased 6% sequentially this month and is down 30% year-over-year. Flight counts appear to be increasing.

- Chinese outbound traveler volume recovered to 80% of the 2019 level, according to UBS, mainly driven by relaxing visa policies and increasing international flight volume. By demographics, younger generations are becoming the main force of outbound travel, with post-90s/00s generations accounting for over 50% of the outbound travelers in 2024.

Threats

- UBS reports that Ryanair may have to increase prices by over 10% alone between now and 2030 to offset environmental cost headwinds. Indeed, in terms of IATA’s roadmap to net zero transition between 2024-2050, the group thinks transition costs will be $5 trillion while the capex needed will be $4-8 trillion due to capital investment for SAF facilities.

- Bank of America expects a correction in ocean rates later in 2025, given the group’s estimate of potentially 4 to 8.5% oversupply depending on Red Sea/U.S. tariff scenarios. Futures imply a 41% decrease in Europe rates between now and February-end, followed by a 29% decline by April.

- According to Morgan Stanley, American Airlines had the highest percent of cancelations occurring over the past week at 8.4%. Delta Air Lines also had an increase in cancelations over the past week, at 6.6% of scheduled flights.

Luxury Goods and International Markets

Strengths

- The Paris Stock Exchange, home to luxury brands like Hermes, Louis Vuitton, and Kering, became the best-performing market, boosted by strong sales from Cartier, parent company of Richemont. On Thursday, shares surged 18%, lifting other stocks as well. LVMH reclaimed its position as Europe’s largest listed company, with a market cap surpassing $360 billion, ahead of Novo Nordisk at $353 billion.

- China reported stronger-than-expected economic growth in 2024, with GDP rising 5.4%, surpassing the anticipated 5.0%. Industrial production and retail sales also exceeded expectations. However, the property market continues to show signs of weakness.

- Star Entertainment, an Australian casino and gaming company, was the top-performing stock in the S&P Global Luxury sector, rising 28.3% over the past five days. This rebound comes after a 42% drop in shares the previous week. Last week, the company reported a cash loss of approximately $35 million per month.

Weaknesses

- China’s population declined for the third consecutive year, with the mainland population dropping by nearly 1.4 million to 1.408 billion in 2024. Deaths totaled 10.9 million, surpassing births at 9.54 million. Demographers cited by Bloomberg predict that the number of newborns will continue to decrease this year.

- The final CPI data for the Eurozone was reported at 2.4%, confirming a regional uptick in prices. In the United States, December CPI came in at 2.9%, slightly above the previous 2.7%.

- Signet Jewlers, an Australian online marketplace for the sale of luxury goods to customers worldwide, was the worst-performing stock in the S&P Global Luxury Index, falling 24.9%. The company reported weak performance during the crucial holiday shopping period, which led to a sharp decline in investor confidence.

Opportunities

- The luxury sector has seen a strong start to the new financial year. Brunello Cucinelli reported an 11.6% sales increase in the fourth quarter, raising its revenue growth guidance to 11-12% for 2024. Richemont’s sales grew by 10% during the holiday season, driven by high demand for Cartier jewelry in the Americas and Europe. LVMH will release its financial results on January 28, and its performance may reflect stronger results across the sector, supported by increased spending during the holiday season.

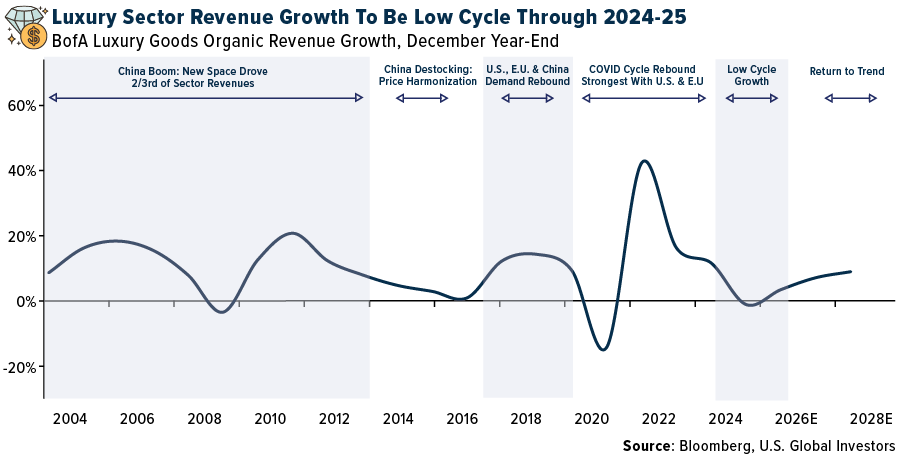

- Bank of America forecasts that luxury sector revenue growth will return to positive territory in 2024, with an expected increase of 3%, following a 2% decline last year. The broker anticipates a slow and gradual recovery, with the majority of growth driven by strong spending in the United States, while European spending is projected to rise by 2%

- This week, China introduced new measures to boost spending in its culture and tourism sectors amid sluggish consumption. Local authorities are urged to offer coupons, rewards, and discounts, and invest in cultural and tourism products. Domestic tourism spending reached 2.7 trillion yuan (RM1.7 trillion) in the first half of 2024, a 19% increase from the previous year, according to the Ministry of Culture and Tourism.

Threats

- The second-hand resale market for luxury items is expanding, impacting profits for original producers. Starting this week, Walmart, which tries to better compete with Amazon and other rivals, will begin selling pre-owned brands such as Chanel, Prada, and Fendi, with prices ranging from hundreds to thousands of dollars.

- Global inflation is anticipated to stay elevated until at least 2028, according to a quarterly survey by the German Ifo Institute and Swiss Economic Policy Institute published this week. Economists forecast an average inflation rate of 3.5% in three years, only slightly below the 3.9% anticipated for 2025. Almost 1,400 experts from 125 countries took part in the survey in early December.

- Volatility may increase with the upcoming transition to a new administration in the White House. Donald Trump’s inauguration, scheduled for next week, is expected to bring a range of policy changes and introduce uncertainties across multiple sectors. These changes could impact both domestic and international issues, and the full extent of their effects will likely unfold over time as new policies are implemented and adapted.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was iron ore, rising 4.76%, on comments that Rio Tinto sees signs the Chinese property market is stabilizing. A nickel sulphate futures contract has been launched by Abaxx Exchange in Singapore to meet growing demand for battery ingredients and address price divergence between types of the metal. Nickel sulphate is used to make batteries for electric vehicles, according to Bloomberg.

- Oil rallied to the highest level in five months as a fresh wave of U.S. sanctions against Russia’s energy industry threatened to crimp supplies from one of the world’s top producers. The U.S. imposed its most aggressive and ambitious sanctions yet on Russia’s oil industry, targeting large exporters, insurance companies and more than 150 tankers, according to Bloomberg.

- Copper extended this year’s rally following a report the incoming Trump administration will slowly ramp up trade tariffs rather than impose sizable levies in one go. The report said the approach was aimed at boosting negotiating leverage and helping to avoid a spike in inflation, but the proposal is still in its early stages, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was sugar, dropping 5.20%, on news that abundant rain in Brazil is expected to increase the global sugar surplus. First Quantum Minerals Ltd. was downgraded by Canaccord Genuity analyst Dalton Baretto, who cited the recent company update which implied lower copper production, higher costs and a $500 million funding gap in their forward guidance.

- Chile cut its copper production projection for the coming decade, adopting a more conservative approach that may see analysts tweak their own global supply models. The top-producing nation now expects output to be 5.54 million metric tons by 2034, according to a study released Wednesday by state copper commission Cochilco, according to Bloomberg.

- European gas fundamentals look tight, not only for winter but summer as well. Storage is 15% lower than last year on strong demand and lower supply. Europe will need to import 35% more liquified natural gas (LNG) year-over-year over summer to meet the November 90% storage fill target, according to Morgan Stanley.

Opportunities

- The risks to Goldman Sach’s $70-85 Brent range forecast are skewed to the upside in the short term. They estimate that Brent could rise just above the top of their range if Russian production briefly falls by 1 million barrels per day (mb/d) and to $90/bbl in a combined scenario where Iran supply also falls 1 mb/d.

- Indonesia’s government has shown increased concern with the country’s nickel production, also because those tons oversupplied the global market. But if based on their performance evaluation, we will cut,” further. If the reduction in quota was converted into a corresponding decline of mine production, this would eliminate the surplus, according to Bank of America.

- Yesterday, CNBC reported that Cleveland-Cliffs (CLF) and Nucor (NUE) are exploring a joint acquisition proposal for U.S. Steel (X). According to reports, CLF would acquire X at a price in the “high $30 per share” range, sell the Big River Steel (BRS) electric arc furnace (EAF) assets to NUE, and retain the blast furnaces (BFs). If such a proposal materializes, it could present advantages for CLF, NUE and X, while potentially benefiting the broader U.S. flat-rolled steel industry through increased consolidation.

Threats

- The seaborne iron ore market will become gradually oversupplied this year as new mines kick-start and China’s steel consumption declines, according to analysts at BRS Shipbrokers. Global iron ore availability will increase, driven by Simandou and mines including Australian Western Range coming online in 2025, analysts at BRS said in a research note.

- UBS expects Europe to get through this winter without severe disruption, but their model shows much lower exit storage levels this winter in the low 40%, versus 68% in late March 2024. This means that refilling of storage to reach the EU’s storage target of 90% will be a tougher task, supporting prices in the next injection season.

- Bloomberg calculates that apparent oil demand in China, the world’s biggest importer, fell 2.7% in 2024, to 14.03 million barrels per day. Outside of Covid this was their second biggest drop ever. What’s driving the declining crude demand in China is the rapid growth of their electric vehicle (EV) market. China is expected to buy 65% of all electric vehicles sold globally in 2025. Another caveat is that 90% off all EV sales in China were from domestic automaker in 2024 versus 2020 when China’s share was only 33%. Ford, GM and other international auto makers will likely wind down their vehicle manufacturing plants, should internation relations decline further.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Fart Coin, rising 65.08%.

- Intesa Sanpaolo SpA has made its first spot Bitcoin purchase, buying roughly 1 million euros ($1 million) worth of the original cryptocurrency, as Italy’s largest banking group pushed deeper into the asset class. Intesa bought 11 Bitcoin, according to the investment head of digital trading and reported by Bloomberg.

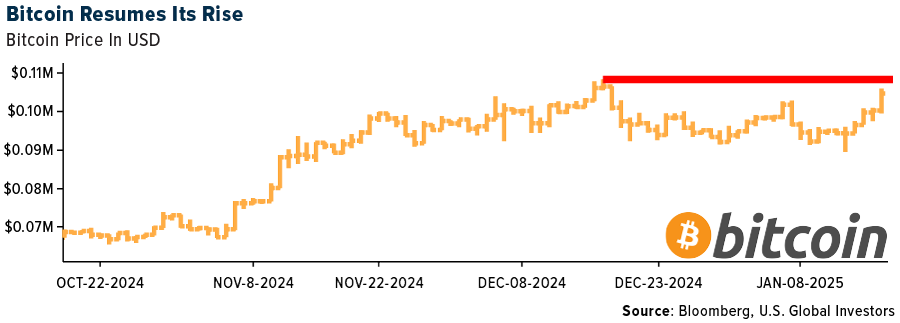

- Bitcoin appears to be back on track toward record highs with the second presidential inauguration of pro-crypto Donald Trump. Bitcoin has climbed around 12% since Sunday putting it on pace for the biggest weekly gain since election week, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was ai16z, down 22.37%.

- Bitcoin slumped to an almost two-month low as investors dumped riskier assets following a sharp rise in bond yields. Bitcoin dropped as much as 4.4% to $90,199 on Monday, reports Bloomberg, the lowest since November 18. Stronger than expected U.S. jobs data on Friday prompted traders to curtail bets that the Fed may cut interest rates soon.

- The NFT market faced its most challenging year since 2020, according to a new report from blockchain analytics platform DappRadar, which noted a 19% drop in trading volumes. The report revealed that NFT sale counts dropped significantly in 2024, falling to 49.8 million from 60.6 million in 2023, according to Bloomberg.

Opportunities

- Bitcoin climbed past $100,000 again after softer-than-expected U.S. inflation helped to rekindle demand for riskier assets ranging from equities to cryptocurrencies. The correlation between Bitcoin and a gauge of U.S. technology stocks has hit a two-year high, writes Bloomberg, as the equity market’s reaction to U.S. inflation data on Wednesday helped set a stronger tone for digital tokens.

- Swiss state-owned bank PostFinance AG expanded its digital asset offering by introducing staking, allowing holders of the second-biggest cryptocurrency Ether to earn passive income. Post Finance will add staking for other tokens soon, according to Bloomberg.

- Komainu Holdings, a cryptocurrency custodian backed by Nomura Holdings, has raised $75 million from Blockstream Capital Partners. Pending regulatory approvals, the funding will be used to support Komainu’s global expansion as well as to integrate technologies.

Threats

- Singapore and Thailand have moved to block prediction markets platform Polymarket, adding to the regulatory hurdles facing the venue that surged in popularity during the U.S. election. Singapore’s Gambling Regulatory authority blocked access to Polymarket in December as it was deemed to be providing unlawful gambling, writes Bloomberg.

- Prediction market Kalshi Inc. and the CFTC head back to court on Friday to argue whether trading on political markets should be banned. Election-themed derivatives contracts like Kalshi’s catapulted to public prominence ahead of the November U.S. elections, where they accurately predicted that President Donald Trump would win a second term, writes Bloomberg.

- NFTs sold by Tennis Australia for nearly 1.5 million euros have tanked in value amid reports the organization has walked away from its NFT project. More than 9,000 of the NFTs have shed up to 90% of their value since the launch in 2022 by Tennis Australia, writes Bloomberg.

Defense and Cybersecurity

Strengths

- Taiwan Semiconductor Manufacturing Co. reported October-December revenue of NT$868.5 billion ($26.3 billion), a 39% year-over-year increase and above the NT$854.7 billion average estimate. This contributes to a 34% annual revenue rise to NT$2.894 trillion in 2024, surpassing its 30% growth target.

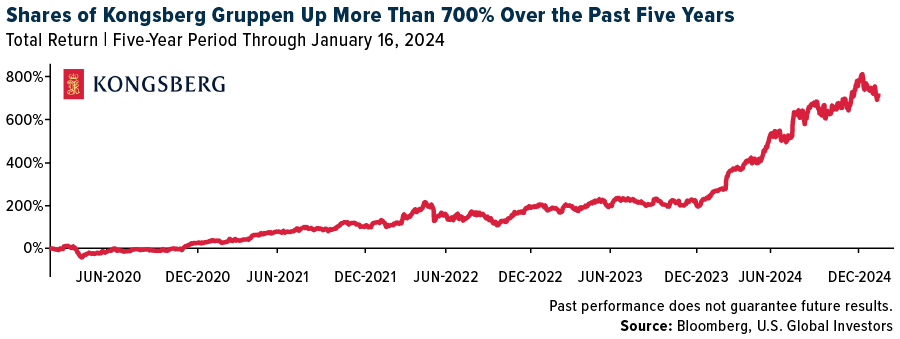

- Kongsberg Gruppen ASA has delivered extraordinary returns, with its share price climbing 728% over five years, closely tracking its 51% annual earnings per share (EPS) growth, and achieving an impressive total shareholder return (TSR) of 921%.

- The best performing stock in the XAR ETF this week was Cadre Holdings, rising 19.16%, after announcing a definitive agreement to acquire two Carr’s Group engineering units for £75 million ($91.5 million) in cash, expanding its international presence and entering new nuclear market product categories.

Weaknesses

- China’s recent unveiling of two potential sixth-generation stealth fighter jets highlights a growing arms race with the U.S., as Lockheed Martin and Boeing compete to develop America’s own next-generation fighters under the NGAD program, expected by the 2030s. Lockheed Martin announced that it met its 2024 delivery target by providing 110 F-35 Lightning II stealth fighters, including 22 in December, bringing total deliveries to over 1,100—the highest for any fifth-generation aircraft.

- Israeli Prime Minister Benjamin Netanyahu cited last-minute issues with Hamas as delaying a ceasefire and hostage release deal, while Israeli airstrikes killed at least 72 in Gaza, after the ceasefire deal had been approved.

- The worst performing stock in the XAR ETF this week was Rocket Lab, declining 10.81%, after ending the previous week up large, perhaps indicating some correction.

Opportunities

- Cisco unveiled AI Defense, a security solution leveraging technology from its Robust Intelligence acquisition to safeguard AI applications against cyber threats, data leaks, and misuse, ensuring secure AI development and deployment.

- CrowdStrike launched its Insider Risk Services, combining its Falcon platform with tailored assessments and expert-led responses to combat insider threats, which cost businesses an average of $16.2 million annually.

- The satellite segment is expected to dominate the $3.3 billion space electronics market, which is projected to grow to $5.4 billion by 2031 at a CAGR of 5.04%. This is driven by over 6,000 satellite launches anticipated between 2020 and 2027 and rising investments in satellite-based applications.

Threats

- The Airbus CEO warned that Europe has two years to align its rival fighter jet programs, FCAS and GCAP, to avoid wasting billions on duplicate efforts and ensure efficient use of defense budgets.

- President Donald Trump aims to replicate his Gaza ceasefire success in Ukraine, but challenges include ongoing Russian attacks, Putin’s tough peace terms, and his demand to curb Ukraine’s military and NATO ties, complicating Trump’s push for swift resolution.

- Ukraine faced widespread power outages and significant infrastructure damage after a massive Russian missile and drone attack targeting its energy sector, with over 40 missiles and 70 drones, prompting calls for enhanced air defense and regional military responses.

Gold Market

This week gold futures closed at $2,738.30, up $23.30 per ounce, or 0.86%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.23%. The S&P/TSX Venture Index came in up 1.60%. The U.S. Trade-Weighted Dollar fell 0.27%.

Strengths

- The best performing precious metal for the week was gold, up 0.86%. Bullion traded at over $2,700 an ounce, after the consumer price index — which excludes food and energy costs — rose 0.2% following four months of gains of 0.3%. Gold climbed to the highest in a month after a surprise slowdown in U.S. inflation revived expectations for Federal Reserve rate cuts this year, reports Bloomberg.

- According to BMO, Mandalay Resources reported fourth quarter 2024 gold equivalent production of 25,000 ounces. On an annual basis, the company produced 97,000 ounces of gold, which approached the high end of its annual production guidance of 90,000-100,000 ounces. Mandalay has coproduct grades of 5% antimony that significantly enhances its importance to Western interest with China cutting of antinomy exports.

- Catalyst Metals rose over 15% this week on plans to double production on the plutonic gold belt by bringing in three mines into production for A$31 million over the next 12 to 18 months. The Plutonic East mine remains on schedule for first production in March 2025. K2 and Trident remain on track along with a 180,000-meter exploration drilling program.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.16%, on weak auto demand numbers for November and rising U.S. inventories on dealer lots. On Friday, Kazakhstan announced they would be selling about $6 billion in gold bullion per year in a bid to prop up their national currency, the tenge. Initially the gold price fell about $10 per ounce but recovered as the trading day started.

- According to Morgan Stanley, challenging demand fundamentals across the supply chain prompted major rough diamond suppliers over 2024 to cancel/delay sight sales and cut prices. January polished prices remain 16-26% lower year-over-year, according to Rapaport.

- According to Scotia, B2Gold reported Q4/24 production results of 186,000 ounces gold, 4% below their estimate of 193,000 ounces and achieving the lower end of the 800,000-870,000 ounce guidance range. According to Bloomberg, Eldorado Gold slipped after saying the Skouries project in Greece is experiencing slower-than-planned progress due to limited availability of construction workers. Management announced lower-than-expected spending in the fourth quarter for the Skouries project due to a delayed ramp up to the planned 1,300 site personnel, with about 1,050 personnel on site at year-end.

Opportunities

- Canaccord believes valuations for gold equities remain relatively attractive, particularly given the backdrop of all-time high gold prices. Gold equities are currently trading at price-to-net asset value (P/NAV) ratios of 0.64x, with an average implied gold price of US$2,165/oz—representing a 20% discount to the spot price. A reversion to historical gold-to-gold equity averages suggests potential upside of 33% and 47% for the VanEck Vectors Gold Mines ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ), respectively.

- Gold is in an interesting spot as Trump’s second term looms. Central banks are buying, while investors try to second-guess the Fed about how many rate cuts are due this year. Trump’s trade and foreign-policy agendas — when they take initial form after Jan. 20 — are likely to lead to volatility, especially for lofty stocks, according to Bloomberg.

- Gold’s biggest annual gain since 2010 will be followed by fresh record highs later this year as trade and geopolitical uncertainties help drive demand for the haven asset, UBS Group AG predicts. The metal has edged higher so far this month — trading near $2,670 an ounce — after jumping 27% in 2024. While a stronger dollar and elevated US yields will be headwinds in the first half of this year, that will be more than offset by demand for bullion as a diversifier, pushing prices to $2,850 by year-end, UBS said.

Threats

- According to Stifel, i-80 Gold amended the terms for its $65 million convertible debentures due in February 2027. Although this 15% dilutive move is a step in the right direction, the company needs a cash injection now. They model the company needing to raise $25 million this quarter with another $60 million by year-end and an additional $70 million by mid-2026 to repay the Orion debt.

- According to BMO, for 2025, Aris Mining production guidance was somewhat disappointing as Segovia’s 2025 guidance (210,000-250,000 ounces) was lower than previously disclosed. Additionally, cost estimates (AISC guidance of $1,450-1,600 per ounces) were higher than expectations.

- Barrick Gold said it is suspending mining operations in Mali after the government started removing gold from the nation’s biggest mine in the latest escalation of a months-long dispute. The world’s number two gold producer is stopping activity at the vast Loulo-Gounkoto complex, the firm said in a statement on Tuesday, according to Bloomberg.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Mandalay Resources Corp.

Catalyst Metals Ltd.

Eldorado Gold Corp.

Aris Mining Corp.

Barrick Gold Corp.

Norwegian Shuttle

Ryanair

Air France

Delta Air Lines

American Airlines

Kongsberg Gruppen ASA

Lockheed Martin

Airbus

Hermes

Louis Vuitton

Kering

Richemont

Prada

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.