Nuclear Power: A Game-Changer for Data Centers in the AI Era

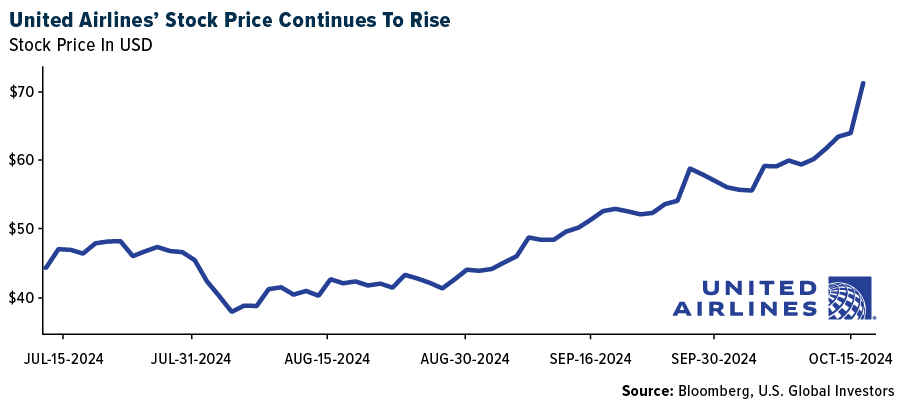

Shares of United Airlines surged this week after the company announced a $1.5 billion share buyback program, its first since 2020. The stock closed up more than 12% on Wednesday, making it the day’s best-performing S&P 500 stock.

I believe United’s buyback program makes a lot of sense. It highlights executives’ confidence in the company’s future growth, for one.

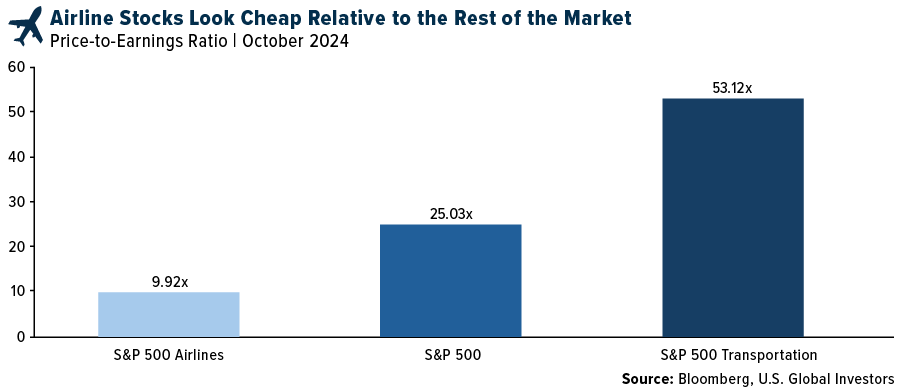

Airline stocks also remain cheap relative to the market, presenting an incredible value opportunity. As of this month, the S&P 500 Airlines Index had a low price-to-earnings (P/E) of 9.92. Compared to the S&P 500, airline stocks are 2.5 times cheaper. Compared to transportation stocks—which include not just commercial jets but also rail, trucks, logistics and ride-hailing services—airline names are about five times cheaper.

Keep in mind that the second half of the year has historically been a strong period for airline stocks. According to Bank of America’s analysis, the industry has outperformed the S&P 500 in the months of September, October, and November in recent years.

Nuclear Energy Stocks Surge as Tech Giants Invest in the Future

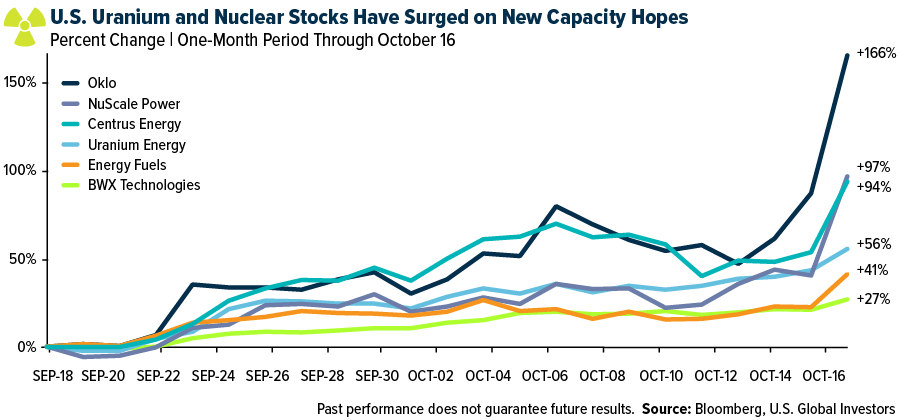

If you’ve been paying attention to the markets, especially in recent months, you’ve likely noticed something interesting happening with nuclear energy stocks. Shares of companies involved in uranium and nuclear, like NuScale Power, Oklo, Cameco and Centrus Energy, have been surging, driven in large part by groundbreaking nuclear energy deals with major tech firms.

This trend isn’t just another market blip—it’s part of a larger movement that has far-reaching implications for investors, especially as we enter the age of artificial intelligence (AI). Nuclear energy truly appears to be staging a major comeback.

The AI Boom and the Need for Power

You don’t have to be a tech expert to know that AI is changing everything. From self-driving cars to advanced data analytics, artificial intelligence is quickly becoming a key part of our modern economy, valued at $184 billion today. But what many people don’t realize is just how much electricity is required to power the data centers that make AI possible.

Companies like Microsoft, Amazon and Google are racing to build out data centers capable of handling this incredible demand, and they need a lot of energy to do it. By one estimate, data centers could consume up to 9% of the United States’ electricity by 2030, more than double what they’re using today. That’s a staggering amount of power, and it raises serious questions about how we’re going to meet that demand in a way that’s both reliable and sustainable.

Here’s the thing: Renewable energy sources like wind and solar, as popular as they are, simply aren’t enough to get the job done. They’re intermittent, meaning they can’t provide electricity 24/7. That’s where nuclear comes in.

The Nuclear Renaissance

For years, nuclear power has been out of favor in the U.S. High costs, regulatory hurdles and the public’s lingering fears from accidents like Chernobyl and Fukushima have kept many from embracing it.

But times are changing. This week alone, we saw two major announcements that signal what I believe is a new era for nuclear energy in the U.S.

Amazon signed agreements to support the construction of several new Small Modular Reactors (SMRs) in the Pacific Northwest. These reactors, owned and operated by Energy Northwest, will eventually generate enough power to serve the needs of over 770,000 U.S. homes. Meanwhile, Google announced a partnership with Kairos Power to bring 500 megawatts of SMRs online by 2035.

Perhaps the most eye-catching deal came from Microsoft, which made headlines for partnering with Constellation Energy to revive the Three Mile Island nuclear plant—yes, that Three Mile Island, renamed as Crane Clean Energy Center. Microsoft is betting $1.6 billion to restore the plant by 2028 and secure carbon-free energy for the next 20 years.

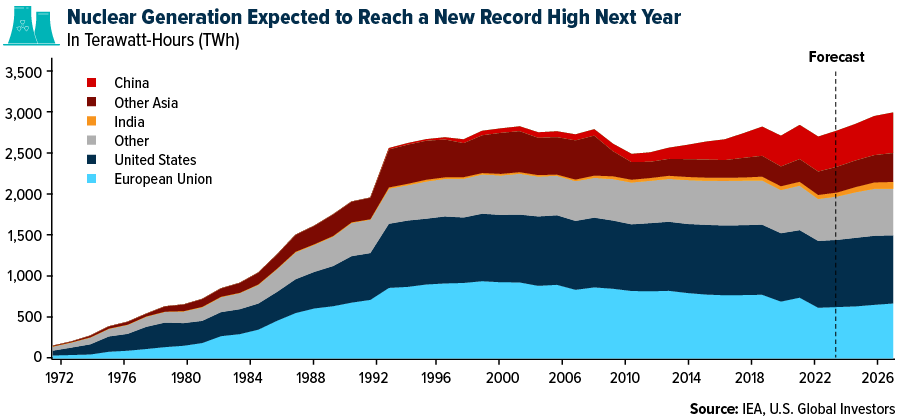

Add all this up, and 2025 is expected to usher in a record amount of nuclear generation, with more than half of it coming from China and India, according to the International Energy Agency (IEA).

A Golden Opportunity for Investors

What’s driving these tech giants to invest in nuclear? Simple: Nuclear power offers reliable, clean energy 24/7, making it potentially capable of meeting the enormous demands of AI-driven data centers. The Electric Power Research Institute (EPRI) recently released a report showing that data centers’ electricity consumption could more than double by 2030. As demand skyrockets, traditional renewables like solar and wind won’t be able to provide the uninterrupted power that companies like Amazon, Microsoft and Google require.

In the long run, these tech companies are likely making smart bets. Bain & Co. forecasts that U.S. energy demand could outstrip supply in just a few short years. By 2028, utilities will need to increase annual electricity generation by up to 26% to keep pace with projected demand. Nuclear power is uniquely positioned to fill the gap, and it’s no wonder Wall Street has started to take notice.

Since Microsoft’s nuclear deal with Constellation was announced, stocks in companies like Oklo have skyrocketed. Oklo, which is backed by OpenAI CEO Sam Altman, has surged more than 166% in the month through mid-October. Other nuclear stocks, including NuScale and Centrus Energy, have also seen impressive gains. For investors looking for exposure to the energy sources that will power the AI age, nuclear might just be the next big thing.

The Long Road Ahead

Nuclear power is not without its challenges. Building new plants is still incredibly expensive, and the industry has been plagued by cost overruns for years. Just look at Microsoft’s deal with Constellation—according to Morgan Stanley, Microsoft is paying at least 100% over market rates for the power they’ll get from Three Mile Island.

But given the powerful demand trends we’re seeing, this could actually turn out to be a bargain a few years down the road. Nuclear energy provides reliable, carbon-free power at a scale that renewables simply can’t match, and with global data center energy consumption expected to double by 2027, we believe that the value proposition for nuclear is only going to grow stronger.

What This Means for You

So what does all of this mean for investors? With the AI revolution driving massive demand for electricity, nuclear power is well-positioned to be a major player in the energy market for decades to come. The entire U.S. energy sector, in fact, is going to need a significant overhaul to meet future demand. The U.S. operates the largest nuclear fleet in the world with 94 reactors, but that’s not going to be enough. To ensure our energy security and to meet our carbon reduction goals, I believe we should significantly expand the current fleet.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 0.96%. The S&P 500 Stock Index rose 0.85%, while the Nasdaq Composite climbed 0.80%. The Russell 2000 small capitalization index gained 1.87% this week.

- The Hang Seng Composite lost 10.14% this week; while Taiwan was up 2.56% and the KOSPI fell 0.12%.

- The 10-year Treasury bond yield fell 3 basis points to 4.10%.

Airlines and Shipping

Strengths

- The top-performing airline stock for the week was Frontier, rising by 21.1%. According to Bank of America, Boeing has issued an S-3 registration statement worth up to $25 billion, which includes senior and subordinated debt, common and preferred stock, depository shares, stock purchase contracts, and stock purchase units. Additionally, as part of this shelf offering, Boeing secured a $10 billion credit agreement with a consortium of banks.

- Between January and September this year, Chinese shipyards signed 52% more orders year-on-year for green vessels, reports Morgan Stanley. According to China’s Ministry of Industry and Information Technology, the volume of orders accounted for 75% of all orders globally for ships able to run on alternative fuels.

- United Airlines reported third quarter earnings per share (EPS) of $3.33, which came in ahead of consensus of $3.17. According to Morgan Stanley, cargo revenue was well ahead, up 25% year-over-year, and on the expense side, better-than-expected fuel and other operating expenses drove most of the outperformance versus estimates. Management announced a new share repurchase program for up to $1.5 billion.

Weaknesses

- The worst performing airline stock for the week was Spirit, down 8.7%. According to Bank of America, TSA throughput decelerated to -3.1% on a trailing seven-day basis from -0.8% last week. October’s average TSA throughput growth is tracking -2.5%, below October domestic capacity growth of 1.4%.

- According to Stifel, since the beginning of 2021, the cost to build a tanker has risen 54%, while five-year-old ships have seen 92% inflation. In dry bulk, newbuldings are 49% higher with five-year-olds up 84%. Newbuild containers are up 56% and secondhand ships are up 66%, while the prices of new LNG carriers are up 41% and VLGC gas carriers are up 73%.

- Allegiant Air had the highest percentage of cancelations occurring over the past week, reports Morgan Stanley, at nearly 23% of captured flights, as Hurricane Milton significantly impacted Florida. JetBlue had the second highest percentage of cancelations at nearly 9% of captured flights, followed by Spirit Airlines at 7.5% of captured flights.

Opportunities

- United Airlines will fly its largest ever Transatlantic schedule in Summer 2025, according to Morgan Stanley. Last week the carrier announced 760+ weekly flights to over 40 destinations across the Atlantic, in addition to servicing eight new cities, marking the largest international expansion in its history.

- According to Bank of America, air cargo demand remains strong at 10% year-over-year for October. Air cargo freight rates have also started October strong, tracking at up 6% year-over-year so far, with North Asia continuing to lead with rates up 11%/16% year-over-year, respectively.

- Indian airlines should remain in a good spot from a demand-supply point of view for the next four to six quarters, says JPMorgan. Industry consolidation as well as supply tightness should keep industry load factors elevated at 87-88% until fiscal year 2025. This should drive a healthy yield environment, and even crude prices are starting to ease.

Threats

- “More and more airlines are avoiding German airports or canceling important connections,” Lufthansa CEO Spohr said in an interview with Bild am Sonntag. “I am very worried about the connection of our business location.” Spohr criticized additional planned regulations, such as a quota for e-fuels that are meant to lower carbon dioxide emissions but are not yet available in sufficient quantities. As a result of the regulations, “the quality of connections to many important economic regions is declining,” the CEO explained.

- According to Morgan Stanley, container spot freight rates on the main trades out of Asia continued to fall this week, as the resumption of operations at U.S. East and Gulf coast ports have eased industry congestion fears. “Ocean freight rates to both coasts had been easing in the lead up to the strike, continued to do so during the closures, with rates more than 30% below highs reached in July, and should continue to ease now that the strike is over,” said Freightos lead analyst Judah Levine.

- As reported by Aero Analysis Partners/AIR (AAP/AIR), 737 production remains at a standstill, with deliveries declining sharply, as only one 737 has been delivered as of mid-October. Shifting to inventory levels, this week saw a decrease to 146 undelivered 737s from the 158 reported during the same period last month.

Luxury Goods and International Markets

Strengths

- The best performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, rising 2.31%. This boost was largely driven by Alphabet’s Google noting that nuclear power is a key part of their strategy to get 24/7 clean energy to operate their artificial intelligence (AI) centers and had made an investment into Kairos Power for the development of several small modular reactors. Elsewhere, Japan’s Chugoku Electric Power is planning to restart its nuclear reactor in early December, which will help increase the nation’s power supply during the winter months, according to Bloomberg News.

- Alumina prices have taken a significant upward swing, driven by Chinese futures climbing above RMB4,500/ton. This marks the highest point since the 2018 Alunorte outage, signaling strong demand in both domestic and international markets, as noted by analysts from BMO.

- In a landslide shift in domestic mineral investments, GM announced they will acquire a 38% asset level ownership in the Thacker Pass lithium deposit in Nevada for $625 million in cash and letters of credit. Just as Rio Tinto’s takeover of Arcadium Lithium secures their supply link for the future, GM has made the same move.

Weaknesses

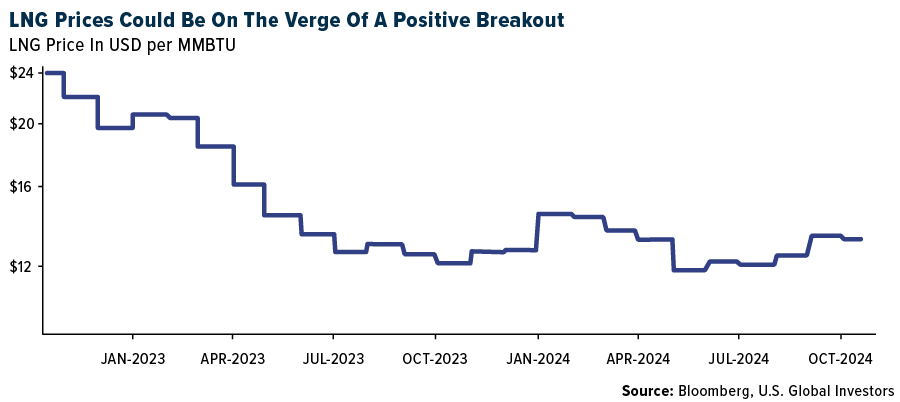

- The worst performing commodity for the week was natural gas, dropping 13.72%. The decrease in prices was largely driven by an oversupply resulting from the expansion of liquefied natural gas (LNG) projects and weak global demand, as the world shifts toward greater electricity usage, highlighted by the International Energy Agency’s forecast, reported by Bloomberg.

- Iron ore and base metals like copper, aluminum and zinc experienced significant selling pressure as Chinese risk assets faced market doubts about the effectiveness of pro-growth measures. Copper prices are approaching their lowest levels since late September, a period marked by China’s announcement of stimulus measures aimed at boosting the economy, according to Bloomberg News.

- Oil prices plummeted by as much as 5%, with West Texas Intermediate (WTI) nearing $70 a barrel. This decline came after reports that Israel may avoid targeting Iran’s oil infrastructure, easing concerns over potential supply disruptions, while the International Energy Agency projected a supply glut in the early part of next year, Bloomberg reported.

Opportunities

- Japan is poised to increase its purchases of LNG for emergency reserves, raising annual purchases from three to 12 cargoes. This move is seen as a strategic measure to protect against unexpected supply disruptions, as reported by Reuters, positioning Japan to play a larger role in global LNG trade.

- Germany has allocated €2.8 billion ($3.1 billion) in subsidies through its climate protection contracts to support industries like chemicals, metals and glass in transitioning to greener energy. This funding is part of a broader strategy to help energy-intensive industries adopt cleaner technologies and meet the country’s climate goals, according to Bloomberg News.

- Electricity demand in the U.S. is expected to surge over the next five years, with some regions seeing growth as high as 15%. This increase will be driven by factors such as manufacturing in the Southeast, data centers in the Midwest and Mid-Atlantic and the electrification of transportation and heating in New England, as detailed in a report by Wood Mackenzie, Bloomberg notes.

Threats

- Indonesia’s government has placed restrictions on nickel production at the Weda Bay mine, the world’s largest nickel mine. Despite the mine operator Eramet seeking to increase production to 60 million tons in the coming years, the Mines Ministry has limited output to 32 million tons annually for the next two years, creating potential supply shortages, as reported by Bank of America.

- Copper treatment and refining charges remain very low, barely covering the cost of processing concentrates, with current quotations at $7.50/mt and 0.75 cent/pound. This has discouraged smelters from securing additional supply from mines, which could lead to supply bottlenecks if prices don’t improve, according to Bank of America.

- Although oil prices have been volatile due to turmoil in the Middle East, many traders remain bearish on the market’s outlook for 2025. Concerns are growing that global oil supply will exceed demand, particularly with increases in production from countries outside OPEC, Bloomberg reports.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, rising 2.31%. This boost was largely driven by Alphabet’s Google noting that nuclear power is a key part of their strategy to get 24/7 clean energy to operate their artificial intelligence (AI) centers and had made an investment into Kairos Power for the development of several small modular reactors. Elsewhere, Japan’s Chugoku Electric Power is planning to restart its nuclear reactor in early December, which will help increase the nation’s power supply during the winter months, according to Bloomberg News.

- Alumina prices have taken a significant upward swing, driven by Chinese futures climbing above RMB4,500/ton. This marks the highest point since the 2018 Alunorte outage, signaling strong demand in both domestic and international markets, as noted by analysts from BMO.

- In a landslide shift in domestic mineral investments, GM announced they will acquire a 38% asset level ownership in the Thacker Pass lithium deposit in Nevada for $625 million in cash and letters of credit. Just as Rio Tinto’s takeover of Arcadium Lithium secures their supply link for the future, GM has made the same move.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 13.72%. The decrease in prices was largely driven by an oversupply resulting from the expansion of liquefied natural gas (LNG) projects and weak global demand, as the world shifts toward greater electricity usage, highlighted by the International Energy Agency’s forecast, reported by Bloomberg.

- Iron ore and base metals like copper, aluminum and zinc experienced significant selling pressure as Chinese risk assets faced market doubts about the effectiveness of pro-growth measures. Copper prices are approaching their lowest levels since late September, a period marked by China’s announcement of stimulus measures aimed at boosting the economy, according to Bloomberg News.

- Oil prices plummeted by as much as 5%, with West Texas Intermediate (WTI) nearing $70 a barrel. This decline came after reports that Israel may avoid targeting Iran’s oil infrastructure, easing concerns over potential supply disruptions, while the International Energy Agency projected a supply glut in the early part of next year, Bloomberg reported.

Opportunities

- Japan is poised to increase its purchases of LNG for emergency reserves, raising annual purchases from three to 12 cargoes. This move is seen as a strategic measure to protect against unexpected supply disruptions, as reported by Reuters, positioning Japan to play a larger role in global LNG trade.

- Germany has allocated €2.8 billion ($3.1 billion) in subsidies through its climate protection contracts to support industries like chemicals, metals and glass in transitioning to greener energy. This funding is part of a broader strategy to help energy-intensive industries adopt cleaner technologies and meet the country’s climate goals, according to Bloomberg News.

- Electricity demand in the U.S. is expected to surge over the next five years, with some regions seeing growth as high as 15%. This increase will be driven by factors such as manufacturing in the Southeast, data centers in the Midwest and Mid-Atlantic and the electrification of transportation and heating in New England, as detailed in a report by Wood Mackenzie, Bloomberg notes.

Threats

- Indonesia’s government has placed restrictions on nickel production at the Weda Bay mine, the world’s largest nickel mine. Despite the mine operator Eramet seeking to increase production to 60 million tons in the coming years, the Mines Ministry has limited output to 32 million tons annually for the next two years, creating potential supply shortages, as reported by Bank of America.

- Copper treatment and refining charges remain very low, barely covering the cost of processing concentrates, with current quotations at $7.50/mt and 0.75 cent/pound. This has discouraged smelters from securing additional supply from mines, which could lead to supply bottlenecks if prices don’t improve, according to Bank of America.

- Although oil prices have been volatile due to turmoil in the Middle East, many traders remain bearish on the market’s outlook for 2025. Concerns are growing that global oil supply will exceed demand, particularly with increases in production from countries outside OPEC, Bloomberg reports.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Cat in a Dog’s World, rising 36.37%.

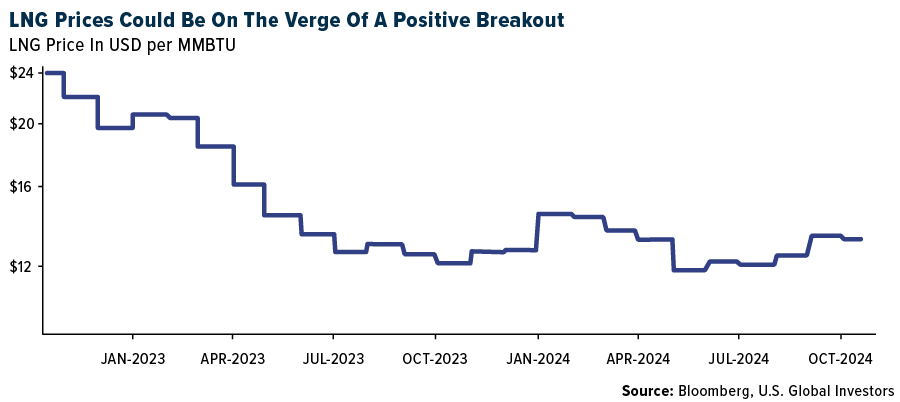

- A Bitcoin rally is grabbing the spotlight, writes Bloomberg, in part because some investors view the climb as a sign that markets anticipate a victory for pro-crypto Republican candidate Donald Trump in the U.S. presidential election. The digital asset is up about 13% in the past seven days, well ahead of a global stock gauge and gold. Billionaire Stanley Druckenmiller cited crypto as among the indicators that markets are pricing in a win for the former president, the article continues.

- Crypto enthusiasts sent another $7.5 million in digital currencies to President Donald Trump’s campaign between July and the end of September, Bloomberg reports. The numbers show momentum among Trump supporters to part with their crypto holdings and send them to the Republican presidential nominee.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was MANTRA, still up 6.30%.

- FTX’s former engineering chief asked a judge not to send him to prison for the collapse of the cryptocurrency exchange. Nishad Singh’s lawyers told a Manhattan federal judge in a memo filed that he deserves leniency in light of his limited role in FTX’s implosion, according to an article written by Bloomberg.

- Italy plans to raise the capital gains tax on Bitcoin to 42% from 26%, writes Bloomberg, part of efforts to finance expensive election promises while cutting the fiscal deficit. Italy’s announcement come as the EU is preparing to fully implement the bloc’s sweeping crypto regulations, a package known as MiCA, at the end of the year.

Opportunities

- Stripe Inc., the payments company founded by billionaire brothers Patrick and John Collison, is in advanced talks to acquire venture-backed fintech platform Bridge. Stripe has been in talks to acquire the San Antonio, Texas-based company, which is designed to allow businesses to create, store, send and accept stablecoins like Tether’s USDT and Circle’s UDSC, writes Bloomberg.

- Bitcoin bulls are setting their sights again on the record highs reached in March with optimism building around riskier assets and the looming U.S. elections. Bitcoin gained as much as 2.9% to $68,376 on Wednesday before paring the increase to trade around $67,800, writes Bloomberg.

- Crypto exchange Kraken launched its wrapped bitcoin token kBTC. The token will be available on both Ethereum and OP Mainnet and will be backed 1:1 with bitcoin. The bitcoin token will be custodied in Kraken Financial the exchange’s U.S.-qualified custody solution, writes Bloomberg.

Threats

- Video-game developer FractureLabs filed a lawsuit against Jump Trading, accusing one of the cryptocurrency industry’s biggest market makers of “fraud and deceit” by manipulating the price of a token used in an online game. According to the suit, Jump concealed its true intent to use the initial offering of DIO as an opportunity to “pump and dump” the token along with HTX, writes Bloomberg.

- Bitcoin miner MARA is warning that AI mirrors 2000s Internet boom. In a recent interview with analyst at research and brokerage firm Bernstein, Fred Thiel the CEO of the bitcoin miner, said the current AI environment resembles the early 2000s internet boom, and many companies, particularly smaller players, risk overbuilding infrastructure without sufficient demand, Bloomberg reports.

- DeFi infrastructure must undergo significant evolution to effectively compete with traditional financial systems and achieve widespread adoption. Although decentralized finance holds great potential, current platforms lag in critical aspects such as liquidity, speed, and cross-chain compatibility, according to Bloomberg.

Defense and Cybersecurity

Strengths

- At the Association of the United States Army’s (AUSA) annual meeting this month, Elbit Systems of America announced the upcoming completion of its SIGMA 155mm/52 caliber self-propelled artillery system, designed to fill a critical gap in U.S. Army’s artillery capability, with enhanced range and mobility compared to the aging M109 platform.

- AMD is positioning itself as a key competitor to Nvidia in the artificial intelligence (AI) chip market, showcasing its Instinct MI300X and new MI325X chips, which offer a balance of performance and cost-effectiveness for AI infrastructure. While Nvidia’s Blackwell chip still dominates in flagship performance, AMD’s strength in “performance-per-dollar per watt” is attracting hyperscalers and data centers, giving it potential to capture a larger market share.

- The best performing stock this week was Rocket Lab, rising 11.44%, after it added a new mission to its 2024 launch schedule, marking its fastest contract-to-launch turnaround with a commercial mission set to launch within three days.

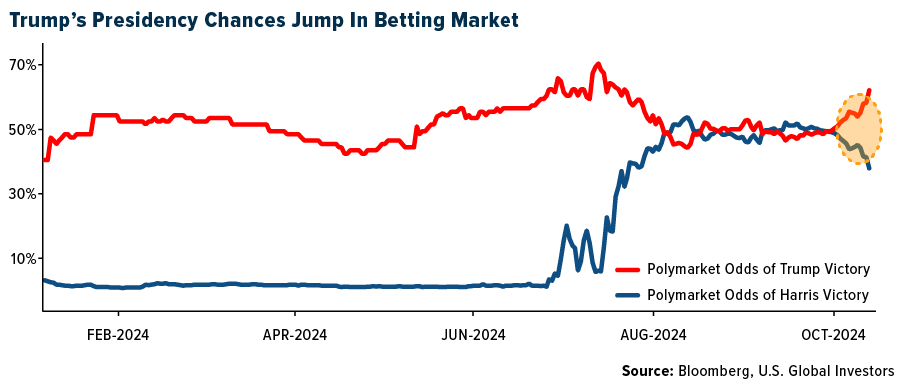

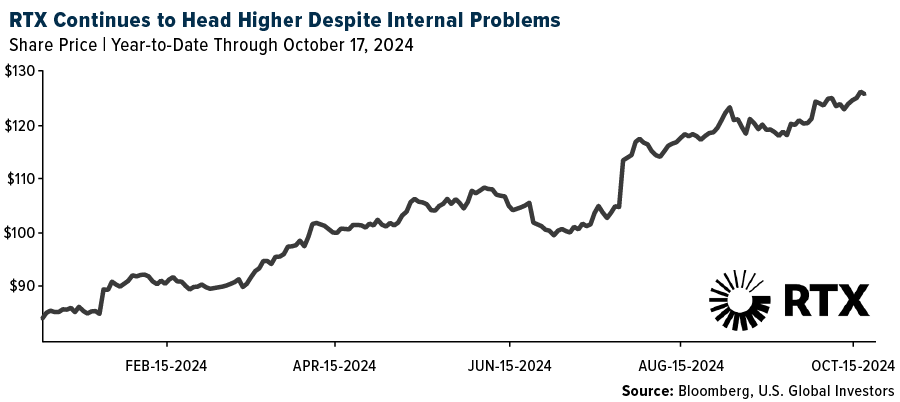

Weaknesses

- Defense contractor RTX, formerly known as Raytheon, agreed to pay over $950 million and undergo three years of independent monitoring to settle U.S. Justice Department charges related to inflated federal contracts and foreign bribery involving a Qatari official.

- North Korea blew up parts of inter-Korean roads in a symbolic defiance after accusing South Korea of flying drones over Pyongyang. This prompted South Korea to fire warning shots and designate border cities as a risk zone. Pyongyang mobilized 1.4 million people last week.

- The worst performing stock this week was Astronics Corp, falling 6.81%. Current CFO David Burney will retire on January 3, 2025, and Nancy Hedges will take over as CFO starting January 4, 2025.

Opportunities

- The U.S. has deployed a Terminal High-Altitude Area Defense (THAAD) battery, produced by Lockheed Martin, to Israel along with 100 troops, as part of its efforts to bolster Israel’s missile defense amid rising tensions with Iran. This deployment underscores the U.S.’s commitment to defending Israel and will enhance the country’s missile-defense shield alongside systems like David’s Sling and the Arrow interceptors.

- Thales SA has successfully tested an AI-powered autonomous drone swarm, capable of operating without a continuous datalink, enhancing its drone warfare capabilities.

- NATO’s new chief, Mark Rutte, called for increased defense production among member states and confirmed that the alliance is on track to meet a €40 billion spending goal for Ukraine this year. Ukrainian President Volodymyr Zelenskiy presented his “victory plan” to lawmakers, reaffirming his stance on not conceding territory and pushing for Ukraine’s future membership in NATO.

Threats

- Labour MPs have called for the party to return a £4 million donation from hedge fund Quadrature Capital, which holds shares in companies linked to Israel’s military actions in Gaza, sparking controversy over the party’s funding sources.

- The Biden administration is discussing imposing country-specific limits on the sale of advanced AI chips by Nvidia and other American companies, particularly focusing on Persian Gulf nations, to address national security concerns.

- Israel is weighing U.S. concerns regarding a planned strike on Iran, focusing on military targets and avoiding nuclear and energy facilities, but maintains its right to act independently to address the Iranian threat.

Gold Market

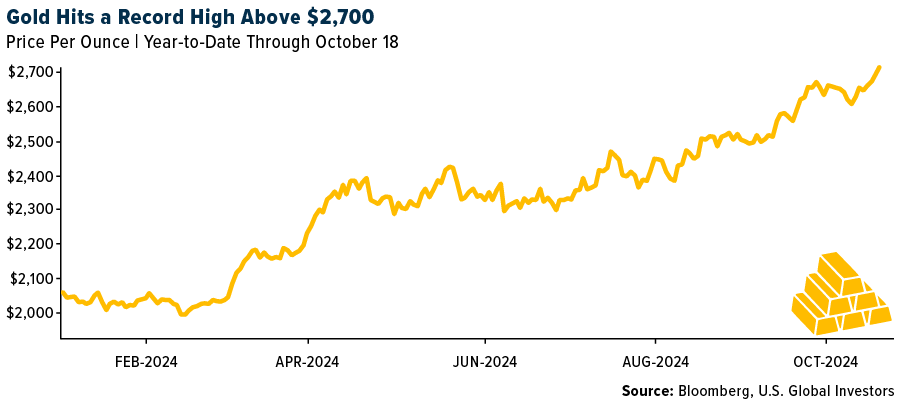

This week, gold futures closed at $2,734.20, up $57.90 per ounce, or 2.16%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 7.70%. The S&P/TSX Venture Index came in up 2.68%. The U.S. Trade-Weighted Dollar rose 0.59%.

Strengths

- The best performing precious metal for the week was silver, up 6.63%. A survey conducted during the London Bullion Market Association’s conference in Miami revealed that participants expect gold prices to increase by 10% over the next 12 months, with silver expected to gain over 40%, which indicates a stronger outlook for silver, according to Bloomberg. Gold hit a new record high on Friday, while silver is still significantly below its previous all-time highs on near $50 per ounce.

- Central bank gold purchases have been a key driver of the metal’s record-breaking rally this year. In a rare move, central bank officials from Mexico, Mongolia and the Czech Republic openly praised the value of increasing gold holdings, signaling their growing interest in bullion, Bloomberg reported.

- The World Gold Council (WGC) noted that global physically backed gold ETFs attracted $1.4 billion in inflows during September. This marked a reversal of the outflow trend seen throughout 2024, with Europe being the only region still showing year-to-date outflows, according to Bank of America.

Weaknesses

- The worst performing precious metal for the week was palladium, but still up 1.37%. Silvercorp’s Q2 production for fiscal year 2024 was 1.66 million ounces, slightly below BMO’s forecast of 1.84 million ounces. Lower throughput at Ying and reduced silver grades, alongside weaker lead and zinc output due to lower grades, negatively impacted overall production, according to BMO.

- Equinox Gold reduced its 2024 production guidance for the Greenstone project from 175-205K ounces to 110-130K ounces. The company’s Q3 production of 42.5K ounces was well below CIBC’s estimate of 58.3K ounces, largely due to lower-than-expected average processed grades, according to CIBC.

- Calibre Mining’s share price took a hit, dropping as much as 13%, on Friday when they reported lower-than-expected gold production, due to higher-than-expected historical artisanal mining on the initial benches of the Volcan open pit. Calibre also lowered their production guidance for 2024.

Opportunities

- Spot gold prices are projected to hit all-time highs of approximately $3,000 per ounce by 2025. This bullish outlook is supported by potential interest rate cuts, growing geopolitical concerns and a rise in portfolio diversification, as suggested by a report by consultancy Metals Focus.

- According to RBC, silver has matched gold’s year-to-date gains of +30%, despite experiencing higher volatility. With the gold/silver ratio currently over 85:1—well above the 10-year average of 65:1—silver has room to rise further, potentially pushing the price over $40/oz if it reaches the 2020 ratio peak, according to RBC.

- Gold is expected to break out of its recent slump and move higher, fueled by central bank demand and increasing political uncertainty in the U.S. A 5.2% jump in September marked the largest monthly gain since March, largely due to the Federal Reserve’s surprise 50-basis-point rate cut, Bloomberg reported.

Threats

- U.S. coin sales have been hovering near multi-year lows, with investors selling off coins as gold prices rise. This increased secondary supply during the rally is typical, but Bank of America believes that another catalyst may be needed to draw more investors into the gold market, although they remain optimistic about their $3,000 per ounce price forecast.

- Barrick Gold reported disappointing Q3 production figures, with 943,000 ounces of gold and 106 million pounds of copper. RBC noted that the company’s all-in sustaining cost (AISC) midpoint was 6% above consensus, and achieving full-year gold production guidance may prove difficult without significant Q4 output increases, according to RBC.

- China’s non-monetary gold imports dropped from an all-time high in Q1 2024 to multi-year lows over the summer. This decline followed government signals of another round of monetary and fiscal stimulus, which lifted equity markets and may limit gold’s near-term upside potential, according to Bank of America, though prices are still expected to hold above $2,000/ oz.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Boeing

United Airlines

Allegiant Air

JetBlue

Spirit Airlines

Deutsche Lufthansa

Amazon.com Inc.

Ferrari NV

LVMH

Brunello Cucinelli SpA

Silvercorp Metals Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The S&P 500 Airlines Index is a capitalization-weighted index with a base level of 10 for the 1941-43 base period.

The S&P Transportation Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS Air Freight & Logistics, Airport Services, Cargo Ground Transportation, Rail Transportation, Highways & Rail Tracks, Marine Transportation, Passenger Airlines and Passenger Ground Transportation sub-industries.