Markets in 2024 Surge Despite Election Uncertainty and Global Risks

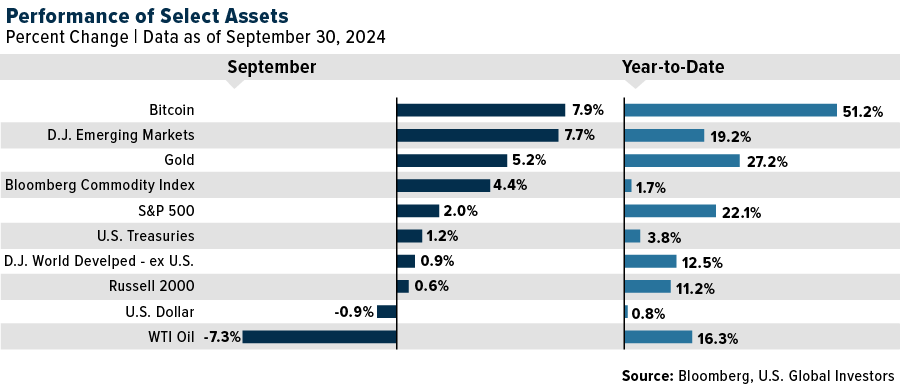

As we approach the final stretch of 2024, much of the nation’s focus is on the upcoming U.S. presidential election. But while the political landscape remains uncertain, the markets are painting a different picture. September, traditionally a sluggish month for global equities, delivered an unexpected surge.

The S&P 500 gained 2.02%, marking its strongest September since 2013. This brought its year-to-date return to 22.08%, making 2024 the best presidential election year for stocks in almost 90 years (more on that).

Bitcoin has been another standout performer. Once viewed with skepticism by traditional investors, the digital currency posted a nearly 8% gain last month, bringing its year-to-date growth to an astonishing 51%. With central banks adopting a dovish stance, the dollar has weakened, prompting investors to seek alternative assets like Bitcoin and gold as hedges against inflation and uncertainty.

What’s driving this unexpected rally? The answer lies in the coordinated efforts of central banks across the globe, which have begun cutting interest rates and injecting liquidity into the markets. This has fueled optimism, lifting a wide range of asset classes, from stocks to gold to digital currencies.

Best Election Year for Stocks Since 1936

Election years often bring volatility as markets grapple with the uncertainty surrounding potential changes in leadership, but 2024 has proven to be an outlier. Central bank easing has provided a powerful tailwind, helping to stabilize markets and lift stocks higher, despite lingering concerns over who will occupy the White House next year.

In fact, 2024 is shaping up to be the best presidential election year for stocks in nearly 90 years. By the end of September, the S&P 500 had risen more than 22%, the highest returns during an election year since 1936. Investors have embraced the Federal Reserve’s commitment to looser monetary policy, which has kept market sentiment buoyant despite the political backdrop.

Services Drive Economic Growth as Manufacturing Contracts

Beneath the surface of these impressive market gains, however, lies a more complex picture of the U.S. economy. It’s a tale of two sectors: while services continue to thrive, manufacturing is struggling.

The U.S. services sector—which accounts for nearly 80% of the country’s GDP—has now expanded for 20 consecutive months. New orders continue to grow, driven by steady consumer demand and a reduction in interest rates, which has made borrowing more affordable for businesses and households alike, according to S&P Global. Despite some moderation from the 14-month high we saw in August, the sector looks strong, providing a foundation for economic stability.

In contrast, the manufacturing sector is showing signs of strain. The end of the third quarter saw manufacturing dip deeper into contraction territory. Slowing demand, both domestically and internationally, has weighed heavily on the sector, and many analysts are pointing to broader economic challenges as the cause. The uncertain outcome of the upcoming election has only added to the unease, as companies hold off on major investments until they have a clearer sense of the country’s political direction.

Lingering Effects of Port Strike Could Impact Holiday Supply Chains

In addition to domestic economic concerns, several external factors threaten to disrupt the positive momentum we’ve seen in the markets.

Hurricane Helene, for instance, serves as a reminder of the unpredictable risks posed by Mother Nature.

The storm caused what could amount to $34 billion in total economic losses, with insured damages expected to exceed $6 billion.

The recent resolution of the dockworker strike at East Coast and Gulf ports—a potential “man-made disaster,” according to President Joe Biden—is a welcome development, but its impact will likely linger.

The strike, which disrupted one of the busiest shipping periods of the year, created a huge backlog of goods waiting to be processed. Major retailers like Walmart, Ikea and Home Depot, which rely heavily on these ports for imported goods, were among the hardest hit.

Given port strikes are now in top of mind, visual below outlines U.S. companies with largest imports to East and Gulf Coast ports over past year (from September 2023 thru September 2024) per @importgenius

— Liz Ann Sonders (@LizAnnSonders) October 1, 2024

@DataArbor pic.twitter.com/xCCZ6Wusya

As operations resume, shipping giants such as Maersk and Hapag-Lloyd have warned that freight costs are likely to rise as a result of the delays. While the strike itself has ended (for now), the fallout could affect supply chains well into the fourth quarter, particularly as retailers ramp up for the holiday season.

Record Holiday Sales Expected as Retailers Offer Deep Discounts

Despite these challenges, there’s still reason for optimism as we head into the holiday season. Adobe is forecasting a record $240.8 billion in online holiday sales, an 8.4% increase over 2023. Electronics and apparel are expected to be the standout categories, driven by deep discounts as retailers aim to move inventory.

As we move into the final quarter of 2024, there’s much to be hopeful about. Central bank easing has provided a strong foundation for market growth, and the holiday season promises to deliver robust consumer spending.

At U.S. Global Investors, we believe in taking a long-term view. While the short-term outlook remains favorable, it’s essential to stay diversified and prepared for whatever the future may hold. As always, our focus is on helping investors navigate both the opportunities and challenges ahead.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.59%. The S&P 500 Stock Index rose 0.62%, while the Nasdaq Composite climbed 0.95%. The Russell 2000 small capitalization index fell 0.14% this week.

- The Hang Seng Composite gained 4.82% this week; while Taiwan was up 2.99% and the KOSPI rose 2.18%.

- The 10-year Treasury bond yield rose 1 basis point to 3.757%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Frontier, up 20.0%. According to Raymond James, Frontier/JetBlue are notable beneficiaries from Spirit capacity cuts. Southwest is a distant number three beneficiary. Spirit cut another 10 points of capacity from the December schedule.

- Bank of America reported that the cargo upcycle continued into September 2024 with demand trending higher by double digits year-over-year, outpacing supply growing mid-single digits year-over-year. Strong demand is keeping cargo yields 7.5% year-over-year higher and 45% above 2019 levels, as of the first week of October.

- Airline stocks were up 16.0% in September, outperforming the S&P 500’s 2.0% return. American Airlines, Southwest Airlines and Spirit Airlines were the only airlines to underperform the group, according to Bank of America. Year-to-date, the group is now up 14.9%, still underperforming the S&P 500’s 20.8% return. Buy-rated United Airlines and Delta, two of the most profitable airlines in the industry, now lead the group in performance at 38.3% and 26.2%, respectively.

Weaknesses

- The worst performing airline stock for the week was Spirit, down 30.7%. Wizz now expects GTF engine-related issues to last three to four years, says Bank of America. It still expects 40-45 average groundings over the next 18 months. Wizz has identified 4.5% of additional costs which are not covered by the P&W compensation and impact fiscal year 2025 profits.

- USEC port workers have agreed to return to work until January 15 and resume negotiations following port owners offering a 62% pay hike over six-years. A resumption of strikes can’t be ruled out later down the line with automation still an issue – but Taft Hartley powers remain unused, meaning the President can send workers back for 80 days in the event of any future strike, according to Bank of America.

- Allegiant had the highest percentage of cancellations occurring over the past week at nearly 8% of captured flights, Morgan Stanley reports, which is not surprising as Hurricane Helene significantly impacted Florida airports and other Southern states. Spirit Airlines had the second highest percentage of cancellations at 3.5% of captured flights.

Opportunities

- KLM has unveiled a comprehensive set of initiatives designed to enhance its operating results by €450 million in the short term. Aligned with the Group’s ambition, these measures aim to achieve a structural profit margin exceeding 8% by 2026-2028. Key to this strategy is a targeted 5% increase in labor productivity by 2025, as highlighted by Morgan Stanley.

- Bank of America anticipates a near-term positive surprise in demand, while projecting a more subdued cargo demand outlook for 2025, with growth expected to be just 1% year-over-year. This forecast reflects anticipated shifts in eCommerce towards ocean shipping due to De Minimis reforms.

- The historical seasonal outperformance of airline stocks is from September to November, Bank of America notes. 2024 saw the strongest September relative to the S&P 500 since 2009, supporting the historical seasonal trend. Looking ahead, the bank notes that October is typically the strongest month of the year relative to the S&P 500, outperforming the market 75% of the time.

Threats

- The Competition Bureau of the Canadian Government has obtained two court orders requiring Air Canada and WestJet Airlines Ltd. to provide information for its market study into competition in Canada’s airline industry. This is the first time the Bureau has used its new information gathering powers in a market study.

- According to UBS, the longer the Boeing strike, the longer the restart. Labor requires recertification and training, aircraft need treatment if placed in storage, there is risk some employees do not return to work, supply chain start/stop risk, and the added FAA requirements could slow the process.

- According to Cirium, Airbus experienced a decline in deliveries in September, with a total of 44 aircraft delivered, down from 47 in the previous month. For the quarter, Airbus delivered 168 aircraft, slightly below the 181 reported last quarter and the 172 delivered in the third quarter of 2023. Following a downward revision of its guidance from 800 to 770 deliveries, the company now faces the challenge of increasing its delivery rate to 93 aircraft per month for the remainder of the year to meet its revised target.

Luxury Goods and International Markets

Strengths

- Tesla’s third-quarter deliveries rose to 462,890 vehicles, a 6% increase from the previous year, bolstered by incentives such as low-interest financing and lease deals. The company discontinued the model that used lithium iron phosphate battery cells from China, making the $42,490 Model 3 Long Range Rear Drive the most affordable Tesla option available now.

- LVMH has acquired a minority stake in French Bloom, a non-alcoholic sparkling wine brand, marking its first venture into the non-alcoholic space and reflecting the growing demand for alcohol-free alternatives.

- Li Auto, a Chinese EV maker, was the best-performing S&P Global Luxury stock, gaining 19.2%. The company reported stronger deliveres in September, up 48.9% year-over-year.

Weaknesses

- The property market in China is on a downturn. September data revealed that the value of new home sales from the 100 largest property developers in China fell by 37.7% year-over-year, a sharper decline compared to the 26.8% drop in August.

- Nike shares sold off as sales declined more than expected. Third quarter earnings per share (EPS) fell 26%, beating views, but sales slumped 10% to $11.6 billion. Softness continues to persist in North America and China, which saw geographic revenue decline 11% and 3%, respectively. Nike withdrew its full-year guidance and postponed its investor day due to its transitional period to incoming CEO Elliott Hill.

- Aston Martin was the worst-performing stock in the S&P Global Luxury index, plummeting 32.5%. Shares dropped 24% on Monday after the company said it will most likely sell 1,000 fewer cars than expected in the reminder of 2024.

Opportunities

- Bank of America’s research team noted that China is facing its worst consumer down-cycle since the country’s entry into the World Trade Organization in 2001. Year-to-date retail sales have reached a 20-year low (excluding the COVID-19 pandemic). However, the recent stimulus from the Chinese government has provided a positive boost in sentiment.

- The timing of the stimulus in China was crucial for boosting morale and increasing spending, as it coincided with the Golden Week holiday, a period known for heightened travel and expenditure. The country recorded a staggering 21.4 million railroad trips on the first day of Golden Week, bolstering confidence that consumers may be more willing to spend.

- LVMH has signed a $1 billion sponsorship deal with Formula One, replacing Rolex with brands like Louis Vuitton, Moët Hennessy and TAG Heuer, effective from 2025. LVMH and Formula One stated that further details of the partnership will be announced early next year.

Threats

- Despite hopes for an improvement in China’s economic situation following the stimulus announcements, luxury stocks with greater exposure to China are likely to report weaker results than in the second quarter. A recovery in earnings per share for consumers will take some time.

- In September, major economies showed weak manufacturing activity, with the U.S. manufacturing PMI at 47.3, the Eurozone at 45, and China at 49.8. PMIs below 50 indicate contraction in manufacturing, while those above 50 signal expansion.

- Tensions in the Middle East escalated as Iran launched missiles at Israel in response to Israel’s limited ground invasion of southern Lebanon. This development spurred a rally in oil prices, fueled by concerns over potential threats to Iranian facilities, despite bearish news from Saudi Arabia, where a minister cautioned that oil could drop to $50.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was West Texas Intermediate (WTI) crude oil, rising 9.21%, on fears that Israel may retaliate against Iranian petroleum facilities in response to a retaliatory missile attack that Iran had conducted. The potential for an expanding battle front spiked oil for its biggest weekly gain in two years.

- According to Goldman, Indian copper and steel demand is running at one and a half times GDP. Driving this growth is a $1.3 trillion plan for infrastructure and strong power growth targets, including 500 gigawatts (GW) of renewable energy. According to JP Morgan, there is physical de-stocking in copper, aluminum and steel. Since July, the rate of copper de-stocking has significantly exceeded the five-year average, and visible copper inventory has fallen rapidly to five days of China consumption.

- Bloomberg reports that the dramatic increase in solar capacity in Europe should be ample enough to offset most of their expected demand growth in electricity. Germany led the region with the biggest growth in solar power. The expansion of solar power is upending traditional energy economics in Europe where solar power is cheaper than nuclear or fossil fuel.

Weaknesses

- The worst performing commodity for the week was coffee, dropping 4.38%, after the European Commission decided to delay by one year a landmark deforestation law that was creating bottlenecks in Europe for both coffee and cocoa products. According to Bank of America, uranium spot and term market activity has been softer than expected in 2024 due to a pull-back in U.S. fuel buyer activity on uncertainty around availability of Russian origin enriched uranium, and “threat” of increased supply from Kazakhstan.

- According to UBS, iron ore remains weak. They say: 1) Iron ore inventories at ports in China have lifted during 2024 and over recent weeks stabilized at 150 million tons 2) Steel production remains weak year-to-date 3) Steel exports from China have lifted materially in Aug to 106 million tons per year, despite steel prices in key export markets being soft.

- According to JP Morgan, gasoline cracks have remained below 2022 and 2023 levels for most of the year and are currently in the middle of five-year ranges on the East Coast and near the bottom on the Gulf Coast. Gasoline cracks have ticked down from $21/bbl in 2Q to $17/bbl in 3Q on the East

Opportunities

- According to Goldman, oil prices remain sensitive to supply disruption risks. Investors are focused on 1) potential downside risks to Iran supply (following a 1 million barrels per day (mb/d) increase in their Iran crude production nowcast over the past two years), 2) potential additional declines in Red Sea oil flows (additional redirection could (temporarily) boost oil prices by reducing inventories on land), and 3) the unlikely tail scenario of an interruption of trade through the Strait of Hormuz.

- Korea Zinc, which is fending off an unsolicited bid for control from a private equity firm, has roped in Bain Capital to buy back up to 18% outstanding shares of the Seoul-listed company. In a regulatory filing on Wednesday, Korea Zinc and buyout shop Bain offered 830,000 won per share to buy back shares of the company, a 10.7% premium over the 750,000 won of sweetened offer from its largest shareholder Young Poong and private equity firm MBK Partners, according to Bloomberg.

- IsoEnergy and Anfield Energy announced that they have entered into a definitive agreement where IsoEnergy will acquire all the issued and outstanding common shares of Anfield by way of a court-approved plan of arrangement. Anfield owns 100% of the Shootaring Canyon Mill, located in southeastern Utah and one of only three licensed, permitted and constructed conventional uranium mills in the United States, as well as a portfolio of conventional uranium and vanadium projects in Utah, Colorado, New Mexico and Arizona.

Threats

- According to JP Morgan, gas storage is 7% above the five-year average. The Energy Information Administration (EIA) reported a 47 Bcf storage build, which compares to last year’s 90 Bcf build and the five-year average build of 87 Bcf.

- This week, BloombergNEF published its Transition Metals Outlook, estimating the mining industry will require $2.1 trillion in investments by 2050 to meet raw material demands for a net-zero emissions world. Critical metals like aluminum, copper and lithium face supply shortages, with potential deficits starting as early as this year. The report stresses the importance of recycling and government policies to bolster the supply chain and support growing demand for low-carbon technologies.

- This week, reports emerged during LME Week that warehousing firms like Istim Metals, which stores nearly 50% of LME metals, are under fire for manipulating fees and delaying metal withdrawals. These practices, reminiscent of past controversies with Metro, have sparked new concerns about market distortions, particularly in the aluminum sector, as delays and high re-registration fees continue to drive up costs. Complaints to the UK Financial Conduct Authority have highlighted the ongoing market inefficiencies caused by these warehousing tactics.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was FTT, rising 59.51%.

- PayPal Holdings completed its first business payment using its proprietary stablecoin to demonstrate how digital currencies can be used to improve often-clunky commercial transactions. As reported by Bloomberg, PayPal paid an invoice to Ernst & Young LLP on September 23 using PYUSD, the stablecoin the firm launched last year.

- Bitcoin miner TeraWulf has sold its 25% equity interest in a Nuclear-powered Bitcoin mining facility for approximately $92 million, reports Bloomberg, as it seeks to fund the expansion of high-performance computing and AI data center hosting services.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Notcoin, down 27%.

- Bitcoin exchange-traded funds in the U.S. saw outflows of $242.6 million on Tuesday in their worst day since September 3. The outflows snapped an eight-day streak of inflows as BTC lost as much as 6% amid an acute sharpening of tensions in the Middle East, writes Bloomberg.

- Bitcoin mining companies saw a key measure of profitability reach the lowest point in recent record during September, according to JPMorgan Chase. Daily block reward gross profit declined 6% month-over-month in September, writes Bloomberg, reaching the lowest point on recent record.

Opportunities

- China’s over-the-counter cryptocurrency brokers are attracting unprecedented inflows, reflecting a hunger for alternative investments amid a weak equity and property market in a struggling economy. As reported by Bloomberg, inflows topped $20 billion in each of the three quarters through June.

- PayPal Holdings will now permit merchants to buy, hold and sell cryptocurrency from their business accounts, expanding on the payment firm’s already-available consumer offerings. PayPal has allowed consumers to buy, hold and sell digital crypto via their PayPal and Venmo accounts since 2020, writes Bloomberg.

- Bitcoin is on course for one of its biggest September gains as a global wave of interest-rate cuts by the U.S. Federal Reserve helps the largest digital asset to buck a seasonal jinx, Bloomberg reports. Bitcoin is up over 10% this month, contrasting with an average 5.9% decline in September.

Threats

- Futures tied to major tokens saw over $450 million in long liquidations in the past 24 hours as bitcoin plunged, leading to losses among major tokens. CoinGlass data shows that bitcoin traders betting on higher prices lost over $122 million while bets on ether lost nearly $100 million. Smaller alternative tokens recorded over $85 million in liquidations, Bloomberg reports.

- Bitcoin fell by the most in almost a month as riskier assets slumped while the conflict in the Middle East escalated, undercutting the argument that the digital asset is a refuge. Cryptocurrencies slumped alongside equities as investors retreated to safer corners of the market, according to Bloomberg.

- Coinbase will delist all unauthorized stablecoins from its crypto exchange in the European Economic area by year-end. The EU is set to fully implement new rules to oversee the crypto industry, known as MiCA, by the end of this year, Bloomberg reports.

Defense and Cybersecurity

Strengths

- The U.S. Air Force awarded Lockheed Martin a $3.23 billion contract to produce joint air-to-surface and long-range, anti-ship missiles for several countries, with work continuing through 2032. This comes as Lockheed develops advanced missile systems for future defense capabilities.

- RTX’s Raytheon unit secured a $192 million contract from the U.S. Navy to upgrade the Next Generation Jammer Mid-Band electronic warfare system. This extends its frequency range to counter additional threats, with the work expected to continue through 2027.

- The best performing stock in the XAR ETF this week was Leonardo DRS Inc., rising 8.90%, after it opened a new facility at Aberdeen Proving Ground to enhance collaboration on defense programs, including C4ISR systems, electronic warfare, and force protection technologies.

Weaknesses

- During a major ballistic attack on Israel, Iran claimed to have destroyed 20 F-35 fighter jets, while Israel reported that Iran attempted to strike its Dimona nuclear facility. In response, Israel is preparing to target Iran’s nuclear sites, with ground clashes also erupting in Lebanon. Israel has declared the UN Secretary-General persona non grata.

- AAR Corp. is reportedly under investigation by the SEC and DOJ for alleged bribery schemes, with senior leadership, including the Chief Ethics and Compliance Officer and General Counsel, visiting the SEC in August, according to Hunterbrook Media.

- The worst performing stock in the XAR ETF this week was National Presto, falling 3.40% on little news.

Opportunities

- European energy and defense stocks rose amid escalating tensions in the Middle East following Iran’s missile attack on Israel, boosting oil prices, while airline stocks declined due to increased geopolitical uncertainty affecting travel.

- Rheinmetall has partnered with Honeywell to develop advanced vehicle systems and secured a major Danish defense contract for 16 Skyranger 30 air defense turrets, with deliveries expected between 2026 and 2028.

- SpaceX successfully launched its Crew 9 spacecraft to return two stranded astronauts from the International Space Station, following a delay caused by Hurricane Helene.

Threats

- German prosecutors arrested a Chinese woman, Yaqi X, for allegedly spying on weapon shipments through Leipzig airport and passing the information to Jian G., a Chinese secret service agent and former assistant to a far-right European Parliament lawmaker.

- The Sudanese Armed Forces launched a major offensive in Khartoum, seizing key bridges and conducting airstrikes, while fierce battles continue with the paramilitary Rapid Support Forces. No clear victory has been declared yet.

- Ukraine has lost one of its very important cities, Vuhledar. Russian forces have increased the speed of capturing new Ukrainian territory; they are advancing as fast as they did at the beginning of the war in 2022. The Kursk operation seems to have been unsuccessful; Ukrainian forces were pushed back, and Russian forces have gained the upper hand.

Gold Market

This week gold futures closed the week at $2,670.90, up $2.80 per ounce, or 0.10%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 2.49%. The S&P/TSX Venture Index came in up 2.08%. The U.S. Trade-Weighted Dollar rose 2.09%.

Strengths

- The best performing precious metal for the week was silver, up 2.06%. Silver just wrapped up a fourth quarterly gain, the longest run for the precious metal since 2011. A fifth advance over the final three months of the year looks to be a decent prospect. The drivers here are familiar, and rest more on silver’s role as a financial asset than its use as an industrial input; a Federal Reserve that is cutting interest rates, a weaker U.S. dollar, and rising ETF holdings will combine to lift prices, according to Bloomberg.

- Coeur Mining announced its intention to purchase 100% of SilverCrest Metals in an all share transaction, again highlighting the rarity of companies that have greater than 50% of their revenue coming from silver, while most silver is produced on a by- or coproduct gold or lead production. Two other companies that are silver dominant are Aya Gold & Silver Inc. and Vizsla Silver Corp.; these might be names that SilverCrest’s investors may rotate into so they can maintain their high silver exposure.

- Hungary’s central bank has raised its gold reserves, citing the precious metal’s role as a haven amid rising market uncertainty, according to National Bank of Hungary statement. The central bank raised its gold reserve by more than 10 times in 2018 to 31.5 tons and then tripled it in 2021, according to Bloomberg.

Weaknesses

- The worst performing precious metal for the week was palladium, down 1.85%, perhaps on signs of weaker automobile sales. Gold has faced headwinds from a rapidly strengthening dollar this week as traders have ramped up their wagers on more dovish pivots by the Japanese and United Kingdom central banks this month. Despite a +2% surge in the dollar, gold futures held firm for the week.

- According to Morgan Stanley, South African gold economics remain marginal. The gold price has traded in a relatively tight range around cost curve support since the middle of 2023. It currently sits 3% below the December 2023/ June 2024 range.

- According to Bank of America, the latest estimate from energy analysts Ember predicts solar installations reaching 334 gigawatts (GW), and globally for 29% growth year-on-year. In metal terms, solar silver demand is expected to rise by 20% year-on-year to 232 million ounces. The lower growth rate in silver demand versus installations is a result of thrifting to reduce the metal usage intensity per GW. Thrifting is not new but may not noticeably affect an unsatiable demand for clean renewable energy.

Opportunities

- According to BMO, Osisko Gold Royalties remains active with corporate development and deploying capital into new investment opportunities. The Dalgaranga gold project benefits from existing infrastructure, and production from an underground operation is expected within the next two years with an anticipated life of +12 years.

- Costco Wholesale is expanding its precious metal offerings to now include one-ounce platinum bars on its website available for purchase online only to loyalty members. In April, Costco struck gold with sales of one-ounce gold bars that were generating monthly sales of $200 million. They next rolled out a package of 25 one-ounce silver bars priced as a lot for $675, initially. Precious metals are finally catching a bid with a new customer base.

- Goldman raised their gold price forecast from $2,700 per ounce to $2,900 for early 2025, for two reasons. First, their economists now look for faster declines in short-term interest rates in the West and China. Goldman’s forecast of central bank and other institutional demand in the London over-the-counter (OTC) market shows that purchases remained strong through July, averaging 730 tons annualized year-to-date, or about 15% of global annual production estimates, with a large contribution from China.

Threats

- Cash must still be tight at some operations, as Equinox Gold announced an equity offering to pay off a $130 million convertible note held by Ninety Fourth Investment Company LLC and BMO Capital Markets, then placed the new issue with other investors as the debt holder wanted cash, not shares. Equinox Gold did not receive any proceeds from the offering. It’s just another example of companies using equity to make debt disappear.

- Two North Carolina mining operations that produce more than 80% of the world’s high-purity quartz, a material critical to the solar and semiconductor industries, have now been halted for almost a week due to Hurricane Helene. Reports on Friday, indicate only minor damage to mine site facilities but surrounding roads and infrastructure challenges could slow some shipments, but it was unlikely there would be a major supply disruption, as reported by Bloomberg.

- Allied Gold also came to the market this week with an overnight marketed placement of C$192 million at a share price of C$3.10 to fund their growth initiatives, including all rights and obligations. Yes, it was just a month ago that Allied Gold struck a protocol agreement with the Malian government for a one-time upfront (undisclosed) cash payment to settle all outstanding disputes, allegations, audits and assessments, including those related to tax, customs levies, maintenance and management of the mine and satellite areas, will be settled. It’s not clear how much of the proceeds will be devoted to settling with the Malian government.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

American Airlines

Southwest Airlines

Spirit Airlines

United Airlines

Delta Air Lines

Wizz Air

Allegiant Air

Boeing

Airbus

Coeur Mining Inc.

SilverCrest Metals Inc.

Aya Gold & Silver Inc.

Vizsla Silver Corp.

Osisko Gold Royalties Ltd.

Tesla

LVMH

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Dow Jones Emerging Markets Index aims to provide 95% market capitalization coverage of stocks traded in emerging markets.

The Bloomberg Commodity Index (BCOM) is a financial benchmark that provides exposure to physical commodities through futures contracts. It’s designed to be a diversified index that doesn’t have any one commodity or sector dominate it.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index.

The Dow Jones Developed Markets ex-U.S. Index is designed to measure 95% of the market capitalization of stocks traded in developed markets, excluding the U.S.

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index.

The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies.