Major Mining Firms Are Investing Billions in Zambia’s Copper Industry

This week I had the privilege of participating in a YPO (Young Presidents’ Organization) event held in Victoria Falls, Zimbabwe. One of the main topics of discussion was investment opportunities in neighboring Zambia, a country that, despite its challenges, is a rising star on the African continent, due largely to its copper exports. I was honored to meet Zambian President Hakainde Hichilema, whose pro-business and reform-oriented stance has attracted attention from international investors since his inauguration in August 2021.

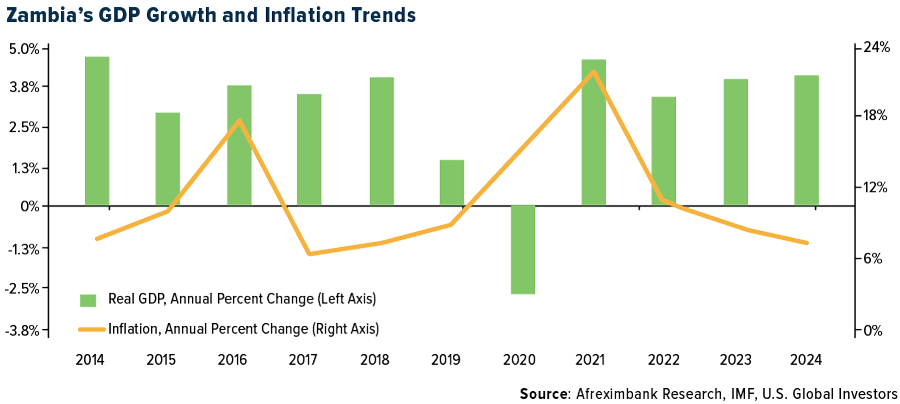

Zambia, a landlocked country in south-central Africa and the continent’s 17th largest, has shown remarkable resilience. It has a common law judicial system, the same as the U.K. and the U.S. Economic growth exceeded 4.7% in 2022, despite the pandemic, the Ukraine war and other challenges.

The Role of Copper in Zambia’s Economic Resilience

Central to Zambia’s economic stability is its mining sector, which accounted for 17.5% of the country’s GDP and over 70% of foreign exchange earnings in 2021. Copper, the country’s main export, plays a pivotal role in this regard.

As many readers are aware, copper has emerged as an indispensable resource as the world accelerates its transition to renewable energy sources. The red metal’s conductivity and versatility make it crucial for various applications, from electric vehicles (EVs) to solar panels and wind turbines. Zambia’s ambition to produce 3 million tonnes of copper annually by 2032, up from around 800,000 tonnes today, highlights the metal’s importance going forward.

In the early 1990s, we were seed investors in Randgold Resources, as we believed in founder Mark Bristow’s vision. Randgold was purchased in 2019 by Barrick Gold, which has a plan to double its copper production by 2029, according to May’s investor presentation.

Major Investments Fuel Zambia’s Mining Boom

Top-tier mining firms recognize this potential and have announced significant investments in the country. Barrick committed nearly $2 billion in October 2023 to boost copper production at its Lumwana mine. A year earlier, First Quantum Minerals unveiled a $1.35 billion investment over 20 years in its Kansanshi mine and an ambitious solar and wind energy project to power its operations.

Another significant aspect of Zambia’s investment appeal is its potential for surplus hydropower, which accounts for over 80% of the country’s energy mix. Zambia shares several large dams with Zimbabwe, and the possibility of harnessing this surplus energy for data centers presents a compelling investment opportunity. Given the increasing demand for data storage and processing capabilities, particularly in Africa, this could be a game-changer.

Hakainde Hichilema: From Business Leader to Reformist President

As I said, I had the honor of meeting President Hichilema, who’s introduced a renewed sense of optimism in Zambia. He holds a Bachelor of Arts in Economics and Business from the University of Zambia and an MBA in Finance and Business Strategy from the University of Birmingham in the UK. Before his political career, he served as CEO of Grant Thornton Zambia.

Hichilema’s pro-business approach, coupled with his commitment to economic reforms and anti-corruption measures, has steadily made Zambia an attractive destination for investors. His administration’s efforts to stabilize the economy, enhance governance and foster a conducive business environment are particularly noteworthy.

President Hichilema’s pro-America stance is another factor that I think could reassure investors. His administration has been actively courting foreign investment, emphasizing the importance of partnerships with American businesses.

Finally, Hichilema has taken steps to push back against Chinese influence, by renegotiating mining contracts, increasing transparency, diversifying investment and restructuring debt.

Independence Day Travel Expected to Reach All-Time High in 2024

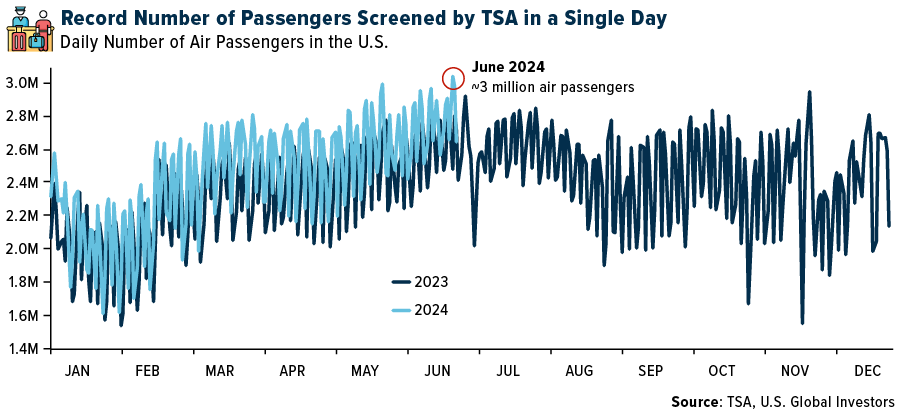

As someone who’s done a lot of traveling this summer, the record-breaking volumes have been impossible to ignore. On Sunday, June 23, the Transportation Security Administration (TSA) broke its record for most people screened on a single day, with nearly 3 million individuals passing through airport security.

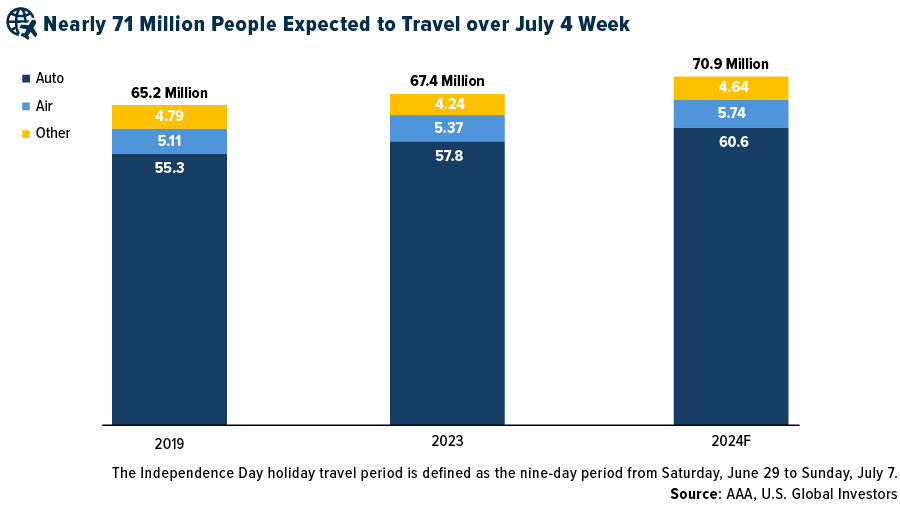

The trend is expected to continue. According to the American Automobile Association (AAA), a projected 70.9 million travelers will head 50 miles or more from home over the Independence Day holiday period, marking a significant increase from previous years. Air travel, in particular, is setting new records, with 5.74 million people expected to fly to their July 4 destinations.

Having experienced the busyness of airports firsthand, I’m happy to see such vibrant economic activity. The bustling airports and high travel volumes are clear indicators of a strong economy. This surge in travel not only benefits the transportation and tourism sectors but also contributes to the broader economic recovery.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average fell 0.08%. The S&P 500 Stock Index fell 0.08%, while the Nasdaq Composite climbed 0.24%. The Russell 2000 small capitalization index gained 1.27% this week.

- The Hang Seng Composite gained 4.30% this week; while Taiwan was down 0.95% and the KOSPI rose 0.49%.

- The 10-year Treasury bond yield rose 12 basis points to 4.385%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Air Transport Services, up 7.9%. According to National Bank Financial, Pearson security avoided a strike. The deal, reached just before the strike deadline, promises a 24% pay increase over the next three years.

- The Shanghai Containerized Freight Index (SCFI) extended its rally for the eleventh consecutive week, bringing cumulative gains since end-March 2024 to 101%. The strong near-term demand visibility (i.e. healthy vessel utilization for the next four weeks) and tight supply are expected to add further momentum to spot rates, according to JPMorgan.

- International travel demand has indeed remained resilient as the number of U.S. citizen departures to international regions has continued to trend above both 2019 and 2023 levels. U.S. departures came in up 11% year-over-year and up 20% versus 2019 in the month of May. While the number of non-U.S. citizen international arrivals into the United States remains below 2019 levels, May 2024 arrivals continue to close the gap, coming in up 13% year-over-year and down 9% versus 2019, reports Morgan Stanley.

Weaknesses

- The worst performing airline stock for the week was Airbus, down 13.4%. Southwest Airlines is lowering October system capacity by 260 basis points (bps), reports Bank of America, while United and Alaska both lowered November system capacity by 250bps and 240bps, respectively. Reductions were primarily driven by domestic flying.

- The “Big Three” West Coast Ports (L.A., Long Beach and Oakland) reported May 2024 traffic, with combined inbound loaded containers, down 3% year-over-year, which is below the pre-pandemic five-year average of positive 2% year-over-year. Sequentially, the combined data was down 5% month-over-month, which is below the five-year average (typically up 12% month-over-month), according to Goldman.

- Airbus cut fiscal year 2024 aircraft delivery guidance to 770 from a prior 800 target on a mix of supply chain issues centered around engines, aerostructures, and cabin equipment. Management is also delaying its A320 production target of 75 per month by one year to 2027.

Opportunities

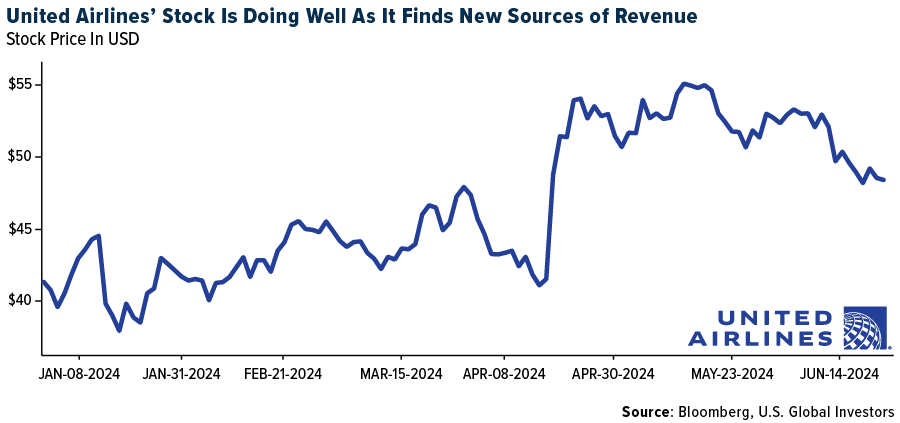

- United Airlines announced the launch of Kinective Media this month. The base case is that Kinective Media could generate annual revenues of over $90 MM in revenue with EBITDA margins over 70%, reports Cowen. Using 6X revenue (more typical for advertising) implies a valuation of $550 MM.

- An outright ban on the imports of LNG from Russia by the EU would cause a big impact. If LNG sanctions were implemented, like those in place for oil, it could have a much more dramatic impact on LNG shipping. Shifting the 5% of global LNG that moves to Europe from Russia instead to China, India, Brazil, etc., could, in Stifel’s view, drive demand for 30-50 additional LNG tankers against a trading fleet of about 655 vessels. Stifel expects this would cause a swift and material increase in LNG shipping rates.

- Elliott Investment Management said that Southwest is “led by a team that has proven unable to adapt to the modern airline industry; the company’s release today seems to admit as much by stating that the revenue guidance reduction was the result of complexities in adapting to the current environment – complexities that Southwest’s peers seem able to adapt to.” The group feels fundamental leadership change is urgently needed at Southwest.

Threats

- Hong Kong’s resident air departures appear to be softer than Morgan Stanley had expected, partly dragged by macro headwinds. The group sees rising competition risk, reflected in Cathay’s passenger load factors – in May 2024, passenger load factor (PLF) on routes to most destinations except for the U.S. fell below 2019 levels, despite Cathay’s capacity not having yet resumed to pre-Covid levels.

- The rising tanker orderbook has been starting to worry some tanker equity investors, with the total increasing from 5% to 10% of the current fleet resulting in flashbacks to dramatic cycle conclusions of the prior 15 years. ISI, too, feared that they could set their watch to a capacity-induced end to the tanker market upturn shortly.

- Canadian workers union Unifor announced on June 23, 2024, that 1,350 of its members at Bombardier are on strike after the union and company could not reach an agreement by the strike. Negotiations are still ongoing, according to Goldman.

Luxury Goods and International Markets

Strengths

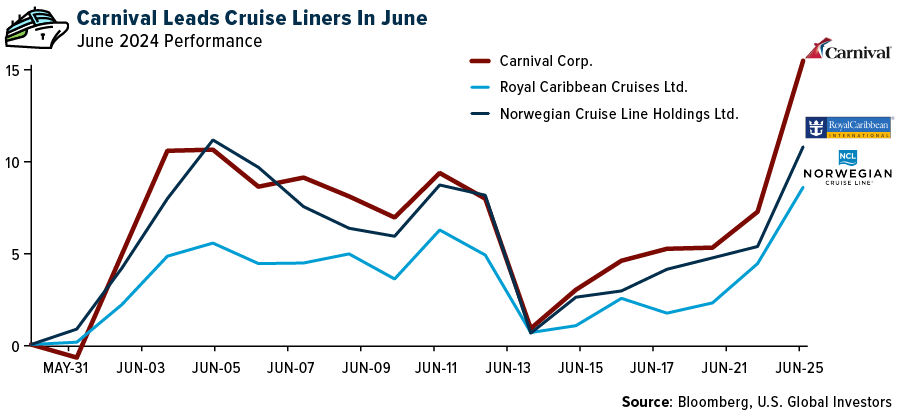

- Carnival Corporation reported strong financial results, announcing earnings per share in the second quarter of 0.11 cents, while a loss of 0.3 cents was expected. The company’s CEO cited that positive trends seen in the second quarter are expected to continue into the next quarter. Carnival shares gained 8.7% on Tuesday, also leading cruise liners’ returns month-to-date.

- Singapore is the most expensive city in the world for spending on luxury goods. Hong Kong rose one spot to second place and London secured the third spot, according to an annual report by Swiss wealth manager Julius Bear Group Ltd. Europe, the Middle East and Africa went from being the most affordable region in 2023 to the most expensive, with significant price increases and every European city moving up in rankings.

- Faraday Future Intelligence, an EV maker, was the top-performing S&P Global Luxury stock, rising 29.15% over the past five days. The company received approval for continued listing from the Nasdaq Stock Exchange. It was previously in danger of being delisted, due to a share price loss of 99% in one year.

Weaknesses

- Industrial profits in China rose at a reduced pace in May. Earnings rose just 0.7% year-over-year in May to follow a 4% rise in April. Profits in the period from January to May rose 3.4% year-over-year from 4.3% in the period from January to April. Oil refiners showed a profit decline of 178% year-to-date versus 2023, and coal firm profits fell 32%, according to FactSet.

- United States consumers are less confident on the current state of the economy, according to the latest Consumer Confidence Index reading, released by The Conference Board (CB) this week. The Consumer Confidence Index fell to 100.4 in June, declining from 101.3 in May (revised downward from an initial reading of 102.00).

- Nike was the worst-performing S&P Global Luxury stock, losing 22.44% in the past five days. Thursday after market close, Nike reported quarterly sales that missed estimates. Revenue fell 1.7% to $12.6 billion for the fiscal fourth quarter that ended May 31, missing the average analyst estimates. The results show the weakness that Nike has reported in recent quarters is persisting.

Opportunities

- Bernard Arnault, owner of LVMH, took a personal equity stake in Richemont, Bloomberg reported. LVMH is Europe’s third-most-valuable company, with a market capitalization of about EUR366 billion ($391 billion) while Richemont’s market cap stands at around 84.7 billion Swiss francs ($91.3 billion). Richemont’s intent is to stay independent, but only time will show if Bernard Arnault will eventually move to purchase it. His last major acquisition was the $16 billion purchase of Tiffany more than three years ago.

- Capri shares traded higher after Wells Fargo upgraded the handbag and accessories company to overweight from equal weight, seeing potential rewards outweighing risks. Capri shares declined almost 40% year-to-date due to concerns regarding whether Tapestry’s acquisition of the company will proceed. Capri shares are trading at around $32, significantly lower than the $57 Tapestry’s bid.

- Bloomberg reported that Chinese shoppers are big fans of LVMH’s products. CEO of the company, Bernard Arnault, visited China last year with his two sons when large groups of people came out to see him. A few even asked him to bless their babies, he told Bloomberg in an interview. “It was a little strange for me,” he said.

Threats

- Ahead of the second quarter reporting season, JPMorgan cut estimates for Richemont by 1%, mostly due to weakness in China and predicting more downturn in Specialist Watchmakers dragged by higher exposure to the country. The company is expected to report its latest quarterly earnings on July 16. In addition, this week LVMH’s price target was cut at both Barclays and Oddo, with analysts expecting the luxury goods firm’s growth to be muted during the second quarter.

- According to the median forecast of 22 economists surveyed over June 17-24, China’s economy may expand 5%, up from 4.9% projected in May. However, economists have pared back their expectations for retail sales growth, a key driver of consumer spending, projecting weaker demand as sharp housing construction continues, according to a Bloomberg survey.

- The final June Manufacturing PMI for the Eurozone will most likely remain well below the 50-mark, indicating weakness in manufacturing activities in the region. The preliminary data, released earlier in the month, showed the PMI declining to 45.6 in June from 47.3 in May. A reading above 50 indicates expansion while a reading below the 50 level indicates contracation.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was sugar, rising 5.95%, despite Brazil reporting a 22% jump in sugar production for the first half of June. With three weeks of summer now in the books, year-over-year gasoline demand has shown an improving trend since being down 3% on Memorial Day weekend, with the most recent data pulling flat year-over-year, according to JPMorgan.

- Traders are becoming more positive about the outlook for European diesel and Brent crude futures, posting significant weekly increases in both benchmarks. Speculators last week registered the biggest-ever weekly addition in net-bullish bets in ICE gasoil, which is Europe’s diesel benchmark. The same gauge for Brent futures and options rose the most since October when measured by the number of contracts — an increase of about 68,000 lots — and saw the biggest rise on record in percentage terms, reports Bloomberg.

- Oil was steady near its highest close in eight weeks amid simmering geopolitical tensions from Yemen to Russia, Bloomberg reports. Brent crude traded near $86 a barrel, after settling at the strongest level since late April. Oil is on track for a monthly gain, with prompt time spreads widening in a bullish backwardation structure, signaling tightening supply.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 7.90%, on ample supplies, particularly in Texas at the Waha hub where natural gas prices turned negative for a second time this week despite record power demand. Fertilizer equities are firmly in the summer doldrums with limited interest while fertilizer prices continue to trade mixed and crop prices decline. Phosphate prices continue to lead, with an ongoing recovery, as demand has returned in a tight market, but stretched affordability and potential for supply (China, Morocco, Saudi) keep RBC’s enthusiasm tempered.

- The decline in spot Hot-Rolled Coil (HRC) index prices accelerated over the past two weeks, with the HRC price in the Midwest dropping 6% to $695 per ton as spot supply continued to outpace demand given persistent buyers’ strike, says BMO.

- A deadly factory blaze has revived concerns over battery safety in South Korea, a key global supplier of lithium-ion cells used in everything from electric vehicles to energy storage systems. The fire and a series of explosions at a lithium battery plant south of Seoul killed 23 workers and left eight injured on Monday, Bloomberg reports.

Opportunities

- Japanese trading house Mitsui & Co. bought a shale gas asset in Texas that it seeks to bring to full-scale development after 2026. Mitsui’s U.S.-based subsidiary purchased the 46,500-acre asset named Tatonka in Texas from Sabana LLC and Vanna LLC, it said Monday, without disclosing a price. As reported by Bloomberg, in this case the the customer could be thought of as taking direct ownership in the asset, potentially to protect themselves from future price hikes in natural gas and to have security of supply.

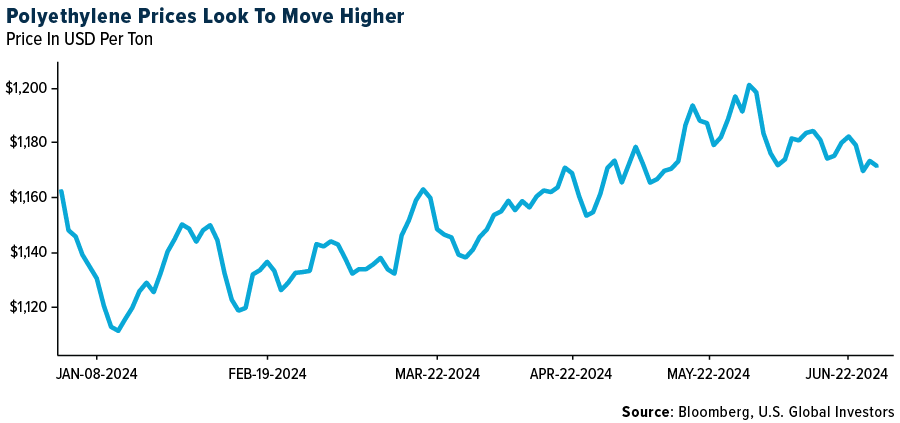

- Morgan Stanley thinks global polyethylene markets have firmly bottomed out (i.e., trough global effective capacity utilization rate of 86.8% in 2023), and the group’s base case assumes a modest slope of improvement between now and 2026 to an 88% utilization rate.

- Exxon Mobil Corp. signed a preliminary agreement to supply South Korean battery-maker SK On Co. with lithium from a deposit it is developing in Arkansas, deepening the oil major’s connections to the rapidly growing electric-vehicle industry. The multiyear deal will cover the sale of as much as 100,000 tons of lithium and will support Exxon’s ambition to supply raw materials for about 1 million EV batteries a year by 2030, according to Bloomberg. This is a strong statement from Exxon, in that they are still moving forward on their energy transition while others are back peddling.

Threats

- Lithium industry watchers hoping the battery metal was poised to rebound from an epic slump have been hit by the realization that prices have fallen again this month, with inventories piling up as electric vehicle demand signals stay gloomy. Spot prices of lithium carbonate in China have slid to the lowest since August 2021 and the most-active futures on the Guangzhou exchange have lost 12% so far this month, Bloomberg reports. Consumers have balked at the high price “only” strategy the auto industry has tried to roll out in America. Elsewhere, China’s BYD sells a compact EV for $12,000.

- Adding to the relatively downbeat message from flash manufacturing PMI readings, inventories of industrial metals are rising — particularly in Asia. Stockpiles of aluminum, copper, and nickel all hit multiyear highs at locations registered with the London Metal Exchange. That is worrying at a time of year when drawdowns are more typically expected, explains Bloomberg.

- Goldman expects petrochemical margins to remain relatively low versus history and feels global petrochemical utilization rates are likely to stay relatively depressed in the coming years following the significant wave of steam cracker additions since 2020.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Kaspa, rising 23.04%.

- Ether briefly pared losses after a report said that the U.S. could approve exchange-traded funds holding the second-largest cryptocurrency by as soon as July 4. The SEC and fund companies are in the final stages of talks, writes Bloomberg.

- Solana staged its biggest rally in more than a month after VanEck, an exchange-traded-fund issuer, submitted a filing for a product based on the digital asset, Bloomberg reports. The token rose as much as 11%, the highest since May.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Gnosis, down 13.14%.

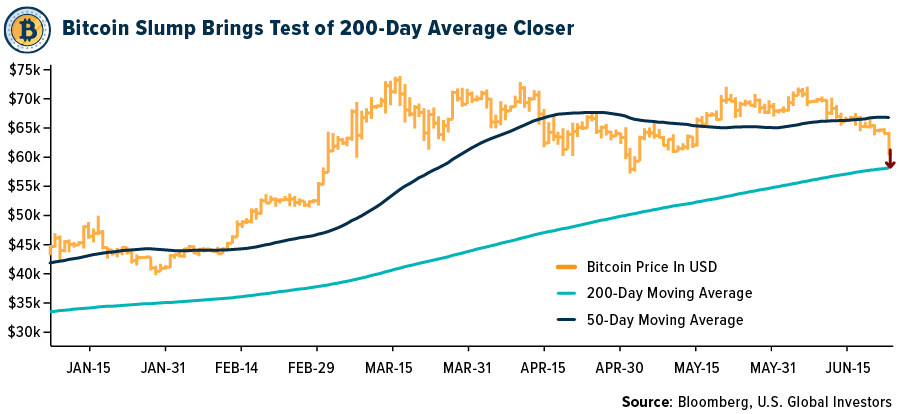

- Losses are piling up in the crypto market after its second-worst weekly decline of 2024. Bitcoin hit a record of $73,798 in March, Bloomberg reports, but is trailing traditional investments such as stocks, bonds and gold this quarter. The 200-day moving average at about $57,500 is in focus now as a possible zone of support.

- Billionaire Steven Cohen’s venture capital arm, Point72 Ventures, is pivoting away from fintech and crypto after laying off its five investors focused on these areas. The departures include three fintech-focused investors and two investors on Point72 Ventures’ digital assets team, according to Bloomberg.

Opportunities

- State Street Global Advisors and Galaxy Asset Management are developing a cryptocurrency exchange-traded fund aimed at shielding investors from the industry’s famous volatility. The planned fund would target the “digital-asset ecosystem” by investing in a combination of crypto-linked equities and other ETFs that hold physical Bitcoin or futures, writes Bloomberg.

- Bybit surpassed Coinbase in March to become the world’s second-largest cryptocurrency exchange after Binance, Bloomberg reports. The launch of spot Bitcoin ETFs in the U.S. helped Bybit double its market share to 16% in March from 8% in October 2023.

- Jesse Powell, founder of Kraken cryptocurrency exchange, announced on X that he has donated $1 million to former U.S President Donald Trump’s campaign. Trump has recently expressed strong support for the blockchain and crypto industry, according to Bloomberg.

Threats

- Bitcoin investment products saw around $600 million in outflows for a second consecutive week, the most over a two-week period since the U.S. approved ETFs to hold cryptocurrency in January, reports Bloomberg.

- Coinbase Global sued two federal financial regulators in a bid to obtain records on their policing of crypto trading, Bloomberg reports, the latest twist in a series of legal fights between one of the largest crypto platforms and Washington agencies.

- The SEC sued crypto firm Consensys for failing to register as a broker. The firm broke rules by failing to register as a brokerage in addition to collecting millions of dollars in fees, writes Bloomberg.

Defense and Cybersecurity

Strengths

- U.S. Army Secretary Christine Wormuth inspected a modernized shell manufacturing plant in Mesquite, TX, reports the Wall St. Journal, designed to boost U.S. production of 155mm artillery shells from 30,000 to 100,000 per month by 2025. Production is reliant on advanced equipment from foreign suppliers like Turkey to meet increased demands triggered by the conflict in Ukraine.

- L3Harris Technologies has secured an up-to-$871 million contract from the U.S. Army to supply M762A1 and M767A1 Electronic-Time Fuzes over five years, bolstering U.S. and allied munitions inventories.

- The best performing stock in the XAR ETF this week was Cadre Holdings Inc., rising 7.32%, after Cadre Holdings held its Investor Day on June 12, 2024, where CEO Warren B. Kanders and other executives highlighted the company’s operating model. There was particular focus on innovation to maintain market leadership, and a discussion of future opportunities for acquisitions and organic growth, emphasizing the company’s commitment to delivering exceptional performance for shareholders.

Weaknesses

- Islamic terrorists killed at least 20 people, including 15 police officers, a priest, and several civilians, AP News reports, in coordinated attacks on churches and synagogues in Dagestan. The attacks resulted in a total of 16 people hospitalized and six militants killed.

- Two subsidiaries of Lockheed Martin have agreed to pay $70 million to settle allegations that they overcharged the U.S. Navy for aircraft parts through a scheme involving inflated subcontracting costs. This was originally brought to light by a whistleblower and involved actions taken by United Technologies’ divisions before Lockheed’s acquisition.

- The worst performing stock in the XAR ETF this week was Virgin Galactic Holdings Inc., falling 11.45%, as put options volume increased, with the negative trend continuing.

Opportunities

- The U.S., Japan and South Korea have condemned the growing military cooperation between Russia and North Korea, calling it a threat to stability and peace. This comes following an agreement between Vladimir Putin and Kim Jong Un to support each other in case of attack, which is seen as advancing munitions transfer to aid Russia’s war on Ukraine.

- Mark Rutte, the Dutch prime minister, was appointed Wednesday by NATO ambassadors as the alliance’s next secretary general, reports AP News, its top civilian post. Rutte is scheduled to head the world’s biggest military organization from October.

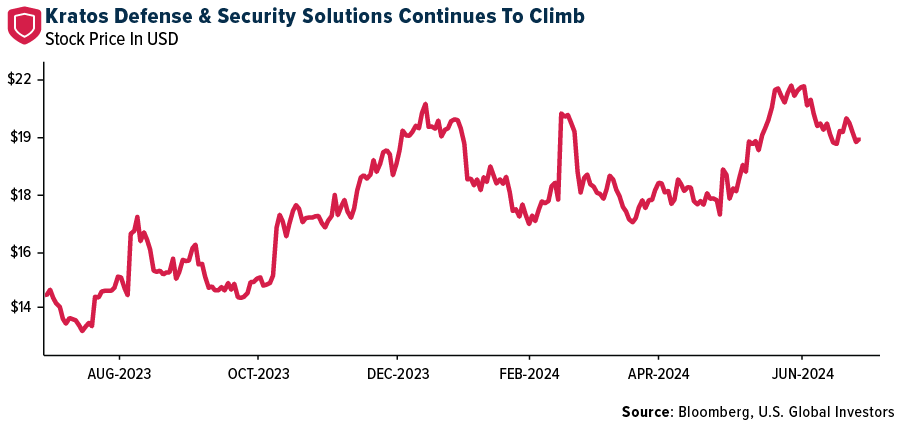

- Kratos Defense & Security Solutions successfully launched and flew its Erinyes™ Hypersonic Test Bed on June 12, 2024, demonstrating a new platform for hypersonic experimentation and contributing to advancements in defense technology. The company’s share price continues to climb following the news.

Threats

- Google Maps recently spotted a top-secret U.S. submarine prototype, the Manta Ray, at Port Hueneme, CA, reports The Economic Times, which had just completed testing. It is designed for rapid global deployment using modular subsections, highlighting the U.S. Navy’s strategic focus on advanced drone technology to counter Russian and Chinese submarine operations.

- Israeli Prime Minister Benjamin Netanyahu plans to redeploy military forces to the northern border to address rising tensions with Hezbollah after concluding operations in Gaza, while seeking U.S. support to prevent an all-out war with the Iran-backed group.

- Norway’s largest private pension fund, KLP, sold its stake in Caterpillar Inc., worth $69 million, due to concerns that the company’s equipment is used for demolishing Palestinian homes and infrastructure in the West Bank and Gaza, potentially contributing to human rights abuses.

Gold Market

This week gold futures closed the week at $2,335.10, down $3.90 per ounce. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.22%. The S&P/TSX Venture Index came in off 0.16%. The U.S. Trade-Weighted Dollar rose slightly, up 0.09%.

Strengths

- The best performing precious metal for the week was paladium, up 5.23%, perhaps in response to Sibanye Stillwater’s announcement of curtailing production unless the price improves. The amount of gold reserves parked overseas by the Reserve Bank of India dropped to the lowest level in six years at the end of March–47% of the total—since it started accumulating the precious metal in December 2017, according to Bloomberg.

- Gold erased some of Friday’s losses as the dollar weakened. The precious metal edged up to trade above $2,320 an ounce. Prices fell the most in two weeks after strong U.S. services activity highlighted the potential challenges in cutting interest rates. Higher rates are generally bearish for non-interest-bearing gold, according to Bloomberg.

- Exchange-traded funds (ETFs) added 231,696 troy ounces of gold to their holdings in the last trading session, bringing this year’s net sales to 4.74 million ounces, according to data compiled by Bloomberg.

Weaknesses

- The worst performing precious metal for the week was silver, down 1.69%. Several indicators point to cooling gold demand from the Chinese jewelry sector in the last two months. Withdrawals by wholesalers from the SGE fell to 82 tons in May. The latest reporting from large jewelry retailer Chow Tai Fook showed no quarter-on-quarter growth in “gold jewelry and products” from mainland stores to date in the second quarter, according to Bank of America.

- Platinum jewelry demand has been in decline despite platinum’s growing discount to gold in the last few years. Headwinds for Chinese platinum jewelry demand is three-pronged. A relatively sluggish economy, an aging population and high youth unemployment have resulted in a shift in jewelry sales patterns, according to Bank of America.

- According to Bloomberg, shares of Victoria Gold plunged the most on record after suspending operations at its flagship mine in Canada’s Yukon following a heap leach failure. Its stock fell as much as 87% to $1 a share, its lowest since December 2002, in Toronto on Tuesday, a day after the Canadian bullion producer disclosed the incident at its Eagle Gold Mine. Victoria Gold has about C$235 million of outstanding debt relative to its C$75 market capitalization.

Opportunities

- Snowline Gold provided a maiden resource with details on the different zones by grade and tonnage. Notably, Scotia thinks the near surface high-grade comprising 39 million tons at 2.35 grams per ton (g/t) gold could sustain production for 10 years under a 10K tons/day scenario or four years under a 25K tons/day scenario. The total resources identified was 7.3 million ounces at a grade of 1.45 g/t gold, which is an attractive target for development of a larger scale mine at 300,000 plus ounces per year.

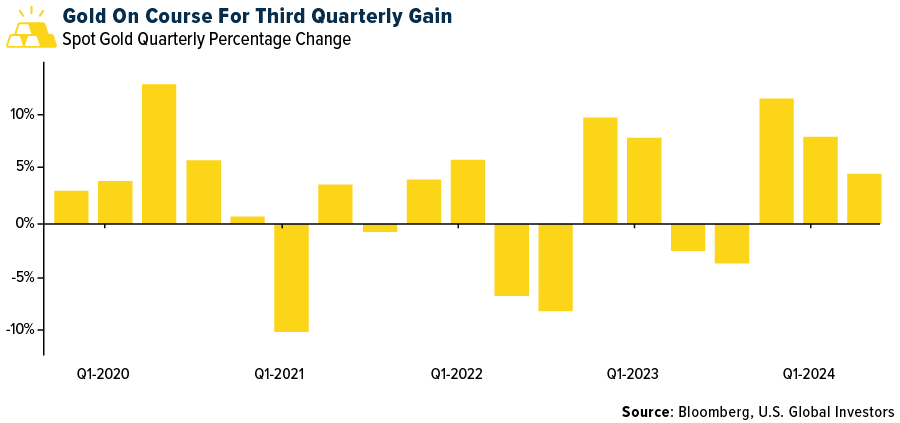

- Bank of America believes gold can hit $3,000/ounce over the next 12-18 months, although flows do not justify that price level right now. Achieving this would require non-commercial demand to pick up from current levels, which in turn needs a Federal Reserve rate cut to happen. Ongoing central bank purchases are also important, and a push to reduce the share of USD in foreign exchange portfolios will likely prompt more central bank gold buying. BNP Paribas’s David Wilson, senior commodity strategist at the bank, noted that long term, growing demand for silver for use in the energy transition will help it “partially delink from being a cheap gold proxy,” with few primary silver mines around the world to meet a growing demand for the metal.

- According to Bank of America, with respect to the non-core asset sale process at Newmont, both Akyem and Telfer are expected to be concluded, with proceeds paid-out, in the second half of 2024. The Akyem process was described as “competitive” and expected to be paid all in cash; Telfer might be a mix of cash and equity. The non-core North American asset sales are more likely to conclude in early 2025, with cash payment preferred, though NEM might consider equity.

Threats

- Evolution Mining provided a growth capex outlook for Cowal of $1 billion over the next five years, double Bank of America’s prior estimate. Additionally, mining cost guidance was provided, highlighting that all-in sustaining cost (AISC) will rebase higher at A$1,700/ounce. Consensus estimates for AISC at Cowal sit at $1,550/ounce over FY25/26 and are yet to fully incorporate the higher cost base.

- To interest-rate strategists at Barclays watching the presidential debate Thursday night, the trade was clear: Buy inflation hedges in the U.S. Treasury market. With former President Donald Trump appearing more likely to unseat Joe Biden in the November 5 election, the market should “be pricing in a considerable risk of higher-than-target inflation in the coming years,” Barclays strategists Michael Pond and Jonathan Hill said in a note. They suggest investors consider five-year Treasury inflation protected securities, or TIPS, that should outperform a straight five-year Treasury note. Outside of the Barclays’ recommendation, hard assets versus financial assets may also complement your portfolio.

- Sibanye Stillwater will put the Stillwater palladium mine in the U.S. on care and maintenance if “there’s no correction in the price,” Chief Executive Officer Neal Froneman said at a conference in London.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.