Lithium Leads the Charge (Again): A Look at the Commodity Market in the First Half of 2023

The second half of 2023 has officially begun, meaning it’s time for us to reflect on the commodities market so far this year

The second half of 2023 has officially begun, meaning it’s time for us to reflect on the commodities market so far this year. To view our interactive, updated Periodic Table of Commodities Returns, click here.

In the first half of the year, lithium increased by 10.81%, making it the best-performing commodity and one of only two that recorded a positive return, the other being gold. Every other commodity that we follow lost ground during the six-month period as global manufacturing activity receded and China’s economy, historically a major demand engine, delivered a disappointing rebound after ending three years of pandemic lockdowns.

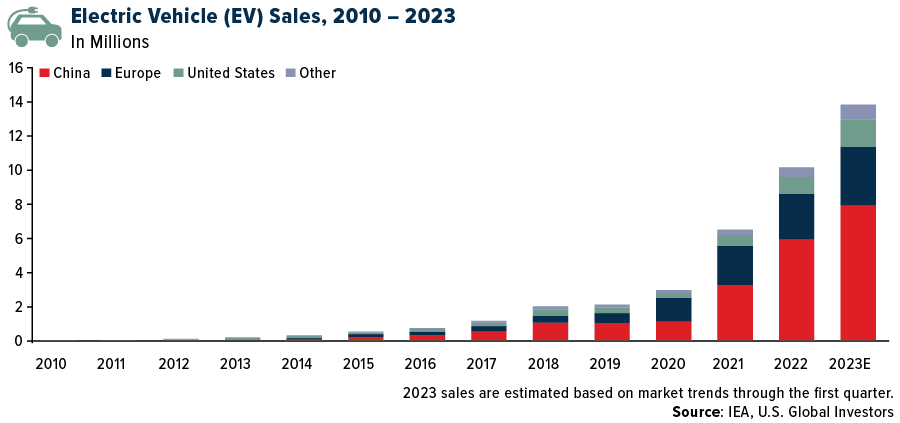

So why was lithium up in the first six months of 2023? In a word: batteries. The lightweight metal, the top performer in 2021 and 2022, is a key component of the boom in electric vehicle (EV) sales.

First-quarter EV sales suggest a promising year for the market, with a predicted global sales figure of approximately 14 million vehicles. This would mark a robust 35% increase from 2022, raising the global electric sales share to about 18%, according to the International Energy Agency (IEA).

China, the world’s number three supplier of lithium after Australia and Chile, remains the largest EV market. Tesla’s production in the country rose nearly 20% last month, aiding in the company’s record-breaking quarterly sales. The Elon Musk-led manufacturer, our favorite EV play, delivered 93,680 cars from its Shanghai factory in June, a significant increase from the 78,906 units in the same month last year and 77,695 vehicles in May.

Other car companies are rapidly shifting from combustion engine models to EVs or hybrids, boosting demand for lithium. Lamborghini, for instance, announced last year that it plans to invest at least 1.8 billion euros ($2 billion) to create a hybrid lineup by 2024 and to introduce its fully electric model by the end of the decade. The Volkswagen-owned company reported that its final gas-burning models are now sold out for the remainder of production.

Hedging with Gold

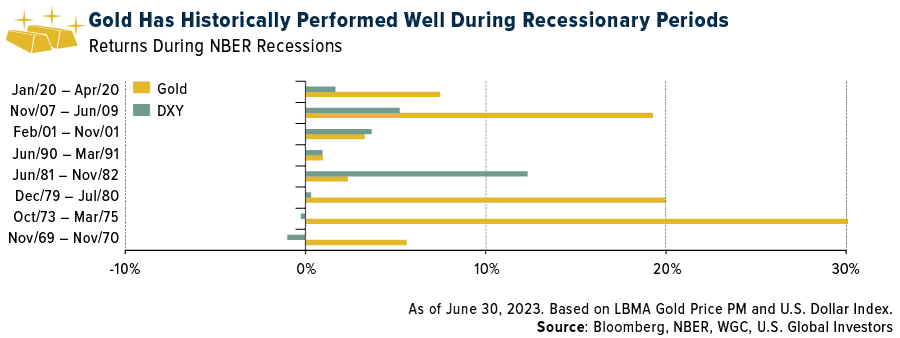

Gold also delivered a positive return in the first half, rising 4.93% and outperforming most other major assets. Its value was supported by a stable U.S. dollar and continued demand from central banks. The yellow metal was also sought by investors as a portfolio diversifier, particularly during the mini-banking crisis in March.

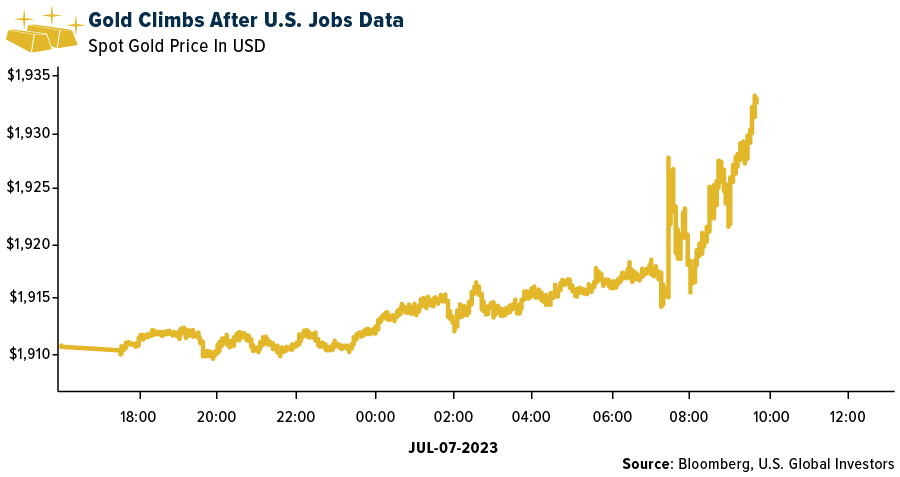

Central banks may be nearing the end of their interest rate tightening cycle, with the Federal Reserve expected to hike rates possibly one more time, especially after June’s strong jobs numbers, reported today. The market consensus suggests a mild economic contraction in the U.S. after the Fed pauses, along with slow growth in other developed markets.

Given its robust performance in the first half, the yellow metal is projected to remain supported in the second half of the year by factors such as India’s stronger economy, potential Chinese economic stimulus and continued hedging strategies. If the risk of recession persists, gold could see greater upside potential due to increased demand for high-quality, liquid assets, according to the latest report by the World Gold Council (WGC).

Monthly PMIs Could Be Pointing to an Economic Contraction

If the monthly PMIs (purchasing manager’s indices) are any indication, a recession could indeed be in the cards in the coming months. The Global Manufacturing PMI fell to 48.8 in June from 49.6 in May, extending a period of contraction for the 10th straight month. A reduction in factory output due to dwindling new orders and mounting pessimism drove this past month’s decline, impacting key regions such as the U.S., the eurozone, Canada, Japan and others.

As I’ve said many times before, we believe the global PMI to be a forward-looking economic indicator.

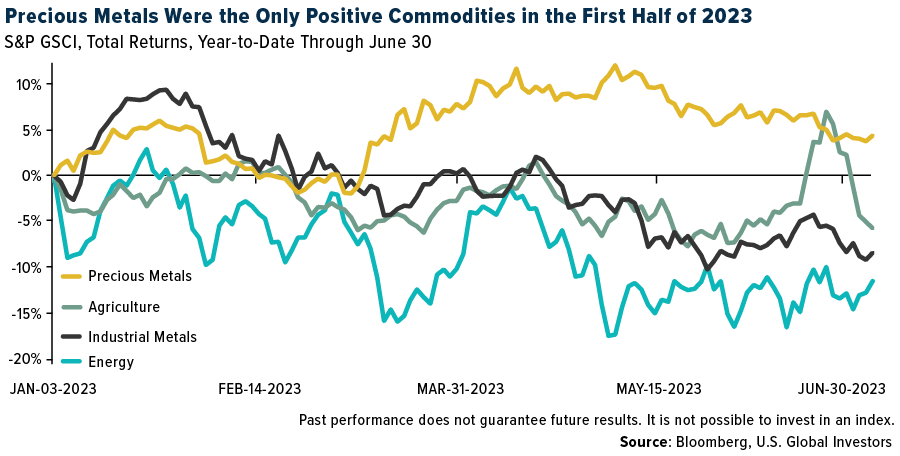

This is particularly true of commodity prices, which largely slumped in the first half. Year-to-date through the end of June, agriculture commodities fell 5.77%, industrial metals lost 9.55% and energy, including oil and natural gas, retreated 11.56%. Precious metals were the only positively performing group.

Notably hit were metals like iron ore and copper, significant indicators of cyclical portions of the global economy such as construction and manufacturing. These sectors are currently experiencing recessions in many regions.

A slowdown in China’s property market, which directly impacts demand for construction materials like steel, aluminum, copper and nickel, also contributed to the declines. Despite output cuts by the Organization of Petroleum Exporting Countries (OPEC), the downturn in oil prices is primarily due to weak energy consumption, especially in Europe, and China’s increased focus on coal production amid an energy crisis.

Global Oil Demand to Plateau?

Looking ahead, global oil demand is projected to plateau over the next decade before entering a period of decline, largely due to increasing vehicle efficiency and the use of alternative energy sources, according to a new report by BP. The British oil and gas company expects the decline to be more pronounced after 2035, with projections for 2050 ranging from 20 to 75 million barrels per day (Mb/d), depending on the extent of global commitment to net-zero emissions.

Emerging economies will maintain or slightly increase their oil consumption in the first half of the forecast period, contrasting with accelerating declines in the developed world. As a result, these economies will increase their share of global oil demand from 55% in 2021 to approximately 70% by 2050, BP writes.

The first half of 2023 saw lithium and gold rise as the only two commodities with positive returns, driven by the booming electric vehicle (EV) market and global economic uncertainties, respectively. However, most commodities struggled due to weakening global manufacturing and demand. Investors, therefore, may want to closely monitor lithium and gold, while adopting a cautious stance towards other energy commodities as the world moves towards a greener future.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.96%. The S&P 500 Stock Index fell 1.08%, while the Nasdaq Composite fell 0.92%. The Russell 2000 small capitalization index lost 1.22% this week.

- The Hang Seng Composite lost 2.41% this week; while Taiwan was down 1.49% and the KOSPI fell 1.47%.

- The 10-year Treasury bond yield rose 22 basis points to 4.06%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Turkish Air, up 11.1%. The latest European passenger trends remain strong with air passengers at 93% of pre-pandemic levels in May, up from 89% in April, after strengthening on a month-over-month basis for 13 of the last 17 months.

- Looking at the bellwethers in the space, FedEx’s monthly flight activity has stabilized down by mid-teen-digit percentages over the past four months, while UPS is down mid-single-digit percentages over this same period. Looking at the raw data, on a seven-day rolling basis, FedEx’s flight activity has hovered consistently at 650 flights since June 6 versus 567 flights the first week of June. UPS saw a similar trend, with flight activity hovering consistently over 500 flights versus 450 flights entering June.

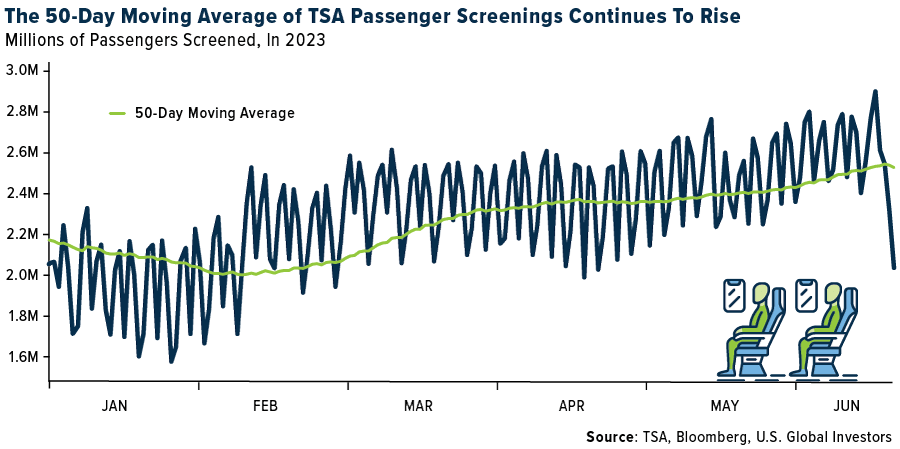

- Even with the New York-area meltdowns, over 5.2 million people went through TSA checkpoints, up 11.6% year-over-year. In the past week, there have been 15.6 million people going through TSA checkpoints, a year-over-year increase of 12% and an increase of 3.3% from the same days in 2019.

Weaknesses

- The worst performing airline stock for the week was Azul, down 13.2%. ATC staffing issues and a system outage, along with a string of severe summer storms at a time of increased risk of crews reaching mandatory flight hour limits, led to significant cancellations in the Northeast. Operational recovery was most challenged at United Airlines, albeit continuing to improve through Friday. Based on an estimated 13,500 cancellations, there may be a potential $200-400M EBIT impact in the second quarter of this year.

- A European ‘freight recession’ continues to bite with European air cargo volumes down 5% year-over-year to 84% of 2019 levels in May. Freight trends are also in decline on West Coast ports but stronger in Asia. Cosco Shipping reported monthly throughput up 5.7% year-over-year (to 106% of 2019 levels). This compares to -0.5% year-over-year to 103% of 2019 levels year-to-date.

- U.S. airline pricing decelerated (down 3.7% versus 2019 compared to up 12.5% last week). On average, over the past two weeks, system net sales declined 4.4% versus 2019, a deceleration from the prior two weeks at -2.6%.

Opportunities

- Airline web traffic increased 8% year-over-year for the week, compared to flat year-over-year traffic (+25% versus ’19) in the trailing four-week period. However, operational disruptions may positively impact web traffic growth.

- After hitting a 2.5 year low in mid-May, the Evercore ISI Air Cargo Cos. Survey has rebounded over the past seven weeks and moved up from 50.8 to 51.5. Following a steady week, international volumes, which trended lower since mid-December, have shown improvement over the past three weeks, moving up from 50.0 to 51.3.

- Based on current scheduling data, third quarter 2023 capacity is scheduled up 13% year-over-year (10% domestic, 20% international), down 10 basis points. Second quarter planned capacity was up 12% year-over-year (+8% domestic, +23% international) versus up 13% in the first quarter of 2023.

Threats

- Raymond James continues to view the elimination of the NEA as a net negative for American Airlines. If the JetBlue-Spirit merger gets approved, the NEA will not be revived regardless of the outcome of the appeals process. However, if the JetBlue-Spirit merger is blocked and American wins its appeal, then there is hope for the NEA.

- The increase in shipping traffic to the West Coast is small in magnitude, but the increase could be related to shippers beginning to divert freight away from Canadian West Coast Ports (Vancouver and Price Rupert) as they look to avoid potential disruptions caused by the longshoreman labor strike that was initiated over the weekend. While some near-term diversion may continue between Canada and alternative U.S. ports (mainly LA/LB), the scale of trade and its importance to Canada likely increases political pressures to ensure an agreement is eventually reached.

- Indian domestic air traffic has persisted through June at 4% above 2019 average on the back of surging demand during school holidays and tighter supply as Go First stops selling tickets since May. Meanwhile, Monsoon season is expected to drive stronger international outbound demand through August, especially for transit hubs including Mumbai, which should support strong ticket prices. However, airlines may still face an upside price cap as the Ministry of Civil Aviation continues to monitor airfare prices.

Luxury Goods and International Markets

Strengths

- Tesla delivered roughly 18,000 more vehicles than analysts were expecting in the most recent quarter, reports Bloomberg, and over 43,000 more than in any previous quarter. The carmaker produced more than 920,500 cars during the first half of the year and should get to its target of 1.8 million this year. Tesla is planning to sell much more this year as it reduces prices and qualified for up to $7,500 in federal tax credits in the U.S.

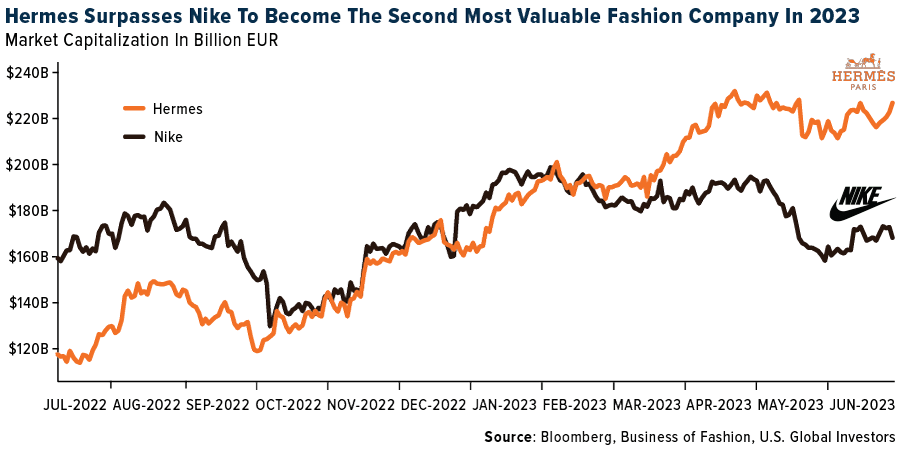

- In early 2023, Hermès’ market capitalization surpassed $200 billion for the first time and overtook that of Nike Inc., making it the world’s most valuable fashion company after LVMH. According to Business of Fashion, a combination of high profitability and steady growth has long made the company a darling of investors.

- Lucid Group Inc (a luxury car maker) was the best performing S&P Global Luxury stock in the past five days, gaining 8.13%. Shares continued to move higher after the company partnered with Aston Martin last week along with some significant insider buying.

Weaknesses

- Apple’s decision to reduce Vision Pro production targets from 1 million to 400,000 units in 2024 highlights a weakness in meeting demand, compounded by a delayed launch and missed sales opportunities. The 13.8% year-over-year revenue drop reported by Foxconn, a major iPhone assembler, suggests potential disadvantages in Apple’s supply chain and manufacturing operations. Additionally, the reported delay of the Apple Watch Ultra until 2026 due to manufacturing challenges, combined with Apple’s high valuation and slowing earnings growth, raises concerns about financial sustainability.

- Retail sales in the Eurozone came in weaker than expected, declining 2.9% year-over-year while a drop of only 2.7% was expected. PMI data was also reported weaker than expected. Final Manufacturing PMI dropped to 43.4 versus the expected 43.6. The Composite PMI crossed below the 50 mark and now remains in contractionary territory.

- Star Entertainment Group Ltd (Australian operator of hotels and casinos), was the worst performing S&P Global Luxury stock in the past five days, losing 9.1%. Shares dropped after the company started a Board renewal process on July 5.

Opportunities

- Lululemon’s community activations present a significant opportunity for the brand’s growth strategy, particularly in its active regions such as Greater China. With a remarkable 79% surge in revenue in the first quarter, Lululemon’s engagement with consumers through events like Pilates classes and live music parties establishes deeper connections and holistic relationships. This approach not only drives brand awareness and purchases but also gives Lululemon a strong competitive advantage within its peer group, supporting its ambitious goal of reaching $12.5 billion in revenue and quadrupling international net revenue by 2026.

- Volkswagen’s partnership with Mobileye offers an opportunity to advance its autonomous driving goals by testing retrofitted electric vehicles in Austin, leveraging Mobileye’s technology and benefiting from favorable regulations. The aim is to bring fully autonomous vehicles to the market as a scalable product.

- Coty’s upward revision of its fourth quarter guidance, projecting a potential sales growth of up to 15%, reflects the company’s robust momentum in both the Prestige segment and the Chinese market. Additionally, Coty’s strategic plans to reduce leverage to 3x by December and further to 2x by the end of 2025 create favorable conditions for long-term success. These initiatives present promising opportunities for sustained growth and prosperity.

Threats

- One significant threat to the luxury sector’s revenue is the potential impact of protests in France, leading to store closures and a decline in store traffic from locals and tourists. According to UBS analysts, France holds a crucial position in the luxury market, accounting for approximately 6% of its sales. The cancellation of Celine’s Paris fashion show and the estimated higher revenue exposure of companies like Hermes International, EssilorLuxottica, Prada, and Louis Vuitton to France, further highlight the vulnerability of the luxury sector to these challenges.

- Edmond de Rothschild Private Banking reduced exposure to luxury stocks in May due to their high valuations, with Louis Vuitton shares up 25% (PE: 24), Hermes up 34% (PE: 48), and Richemont gaining 24% (PE: 20). The decision was influenced by a market rally losing momentum, amidst concerns over the U.S. slowdown and China’s reopening, leading to a shift toward a defensive portfolio. The bank anticipates a flat performance for U.S. equities and expects European stocks to stagnate or decline by up to 5%.

- The economic data in the U.S. released this week showed strength. The ADP employment change was much higher than expected, and some other data also surpassed expectations. However, despite the positive data, the markets reacted negatively. The Federal Reserve stated that there was no intention to increase rates further, but inflation remains strong and persistent, posing a potential threat that the Fed may adopt a more hawkish stance.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was tin, rising 6.50%, perhaps on supply worries with China moving to control its exports of gallium and germanium (which are important inputs for the semiconductor industry). Oil is heading for a second weekly gain as OPEC+ leaders Saudi Arabia and Russia look to reduce crude supplied to the market. Oil is still down about 10% this year but producers have largely remained disciplined on expansion plans.

- Oil demand in the U.S. surged to the highest seasonal level in 16 years in April, thanks to record consumption of natural gas liquids such as ethane, a feedstock

for plastics. The monthly figure for total oil demand climbed to 20.45 million barrels a day in April, data from the U.S. Energy Information Administration showed, an upward revision of 4% from the agency’s weekly estimates. Gasoline demand remained below 2019 levels, however, as did other road fuels. - China’s coal buyers should slow purchases from abroad to avoid hurting domestic suppliers, the China Coal Transport and Distribution Association has recommended. Asia’s largest economy imported 182 million tons of the fuel in the first five months of the year, almost 90% more than the same period in 2022, customs data show. The purchases were driven by the prospect of a hotter-than-usual summer, Beijing’s determination to minimize blackouts, and a drop in seaborne coal prices.

Weaknesses

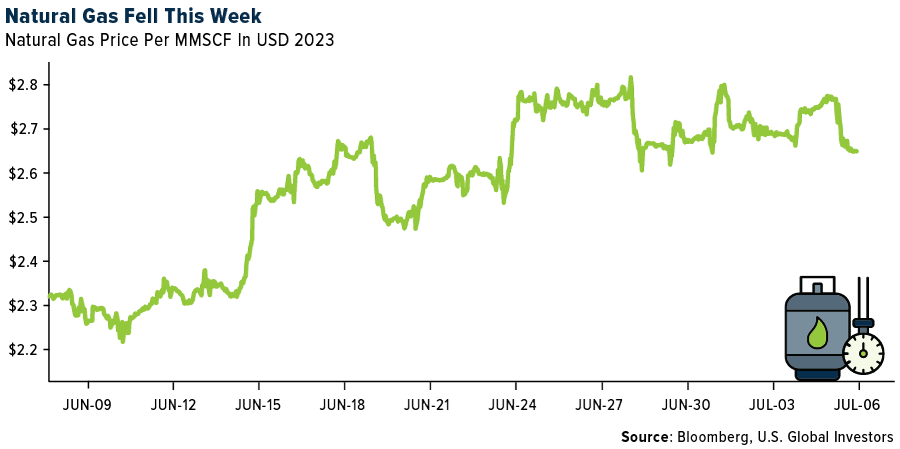

- The worst performing commodity for the week was natural gas, dropping 8.22%, after last week’s heat dome across Texas dissipated, reducing the need for gas fired generators to power peak demand on the grid. However, Bloomberg reported that global temperatures hit a record on Thursday, replacing the previous records set on Monday and Tuesday of this week. The extreme weather may put more pressure on global leaders to curb greenhouse gas emissions generated from burning coal, oil, and natural gas that trap heat in the atmosphere.

- Zinc prices have now fallen 22% year-to-date, driven by the unfolding global manufacturing recession, reflected in average (U.S., Europe, China) headline manufacturing PMIs that trade at contractionary levels below 50. Going forward, beyond the demand weakness, zinc also looks challenged on mine supply increases, which could lift the market out of deficit into 2024. As such, zinc has among the weakest fundamentals of the mined commodities.

- According to UBS, individual NGL component pricing implies the average second quarter 2023 Mont Belvieu barrel declined 18% sequentially and 50% year-over-year to $21.44/bbl. This would equate to 29% of WTI versus 39% of WTI in the second quarter of 2022. All NGL prices were down sequentially, but the higher end of the barrel saw the biggest declines after being a source of stability in the first quarter of 2023. In the second quarter, Normal Butane and Iso Butane were down 26.5-28.5%, while Propane declined 18% with the steepest decline in June as stockpiles continued to build.

Opportunities

- The chemical sector “found its stride” versus the market with stocks up 4.1% versus the S&P 500 up 0.3% and the XLB up 2.2%. The winners were broad based but in general were tied to one of two angles: they had direct or indirect housing exposure, or they were names investors “bought the miss” where earnings preannouncements had taken place or investors thought they “might take place.” While the housing angle of that outperformance was not particularly surprising as new home build data and housing inventory data (which supports potential existing home sales) has been coming in less bad than feared.

- The U.S. Department of Energy (DOE) announced that contracts have been awarded for the acquisition of 3.2 million barrels of U.S. produced crude oil for the Strategic Petroleum Reserve (SPR). It said that purchases were made for an average price of about $71.98 per barrel, which is lower than the average of about $95 per barrel that SPR crude was sold for in 2022. Moreover, the DOE also said that it plans to announce another RFP for the purchase of crude oil for delivery in October and November. So far this year, the U.S. has bought 6 million barrels for the reserve after selling a record 180 million barrels last year.

- Lumber shipments were up 10.7% month-over-month, with increases in softwood shipments (+8.9%) and hardwood shipments (+13.1%). According to RISI, prices continue to be driven down by abundant supply and widespread spot market availability.

Threats

- According to UBS, LNG export demand growth may bring balances back to the five-year average in fiscal year 2025. However, with the group’s outlook showing balances 1.0-1.5Bcfpd oversupplied through mid-2024, it sees downside risk to the price forecast if supply is not reduced and Winter does not deliver above average demand.

- Nickel prices on the London Metal Exchange (LME) dipped below $20,000 per ton for the first time in nearly 12 months toward the end of June, as subdued demand-side fundamentals in the world’s major economies combined with still-growing Indonesian supply to drive a sharp sell-off this year. Nickel supply has far outpaced demand since 2022 and the structural surplus has increased this year as a result of weak demand from the stainless-steel sector in Asia and Europe, even as appetite from the electric vehicle (EV) battery sector continues to be resilient.

- The speedy return of idled Chinese aluminum capacity due to rains filling up hydro reservoirs is putting more pressure on the metal that has been in retreat since late January. About 15% of production capacity in Yunnan province could be restored this quarter, meaning China’s total output may rise 4% from the previous three months, Bloomberg Intelligence said in a note by analyst Yi Zhu.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Maker, rising 22.16%.

- Galaxy Digital Holdings rose 13% to C$6.46, higher than any close since October 31, from C$5.73. Trading volume was 923,287 shares, 16% above the 20-day average while the stock has been up for a fifth straight day, according to Bloomberg.

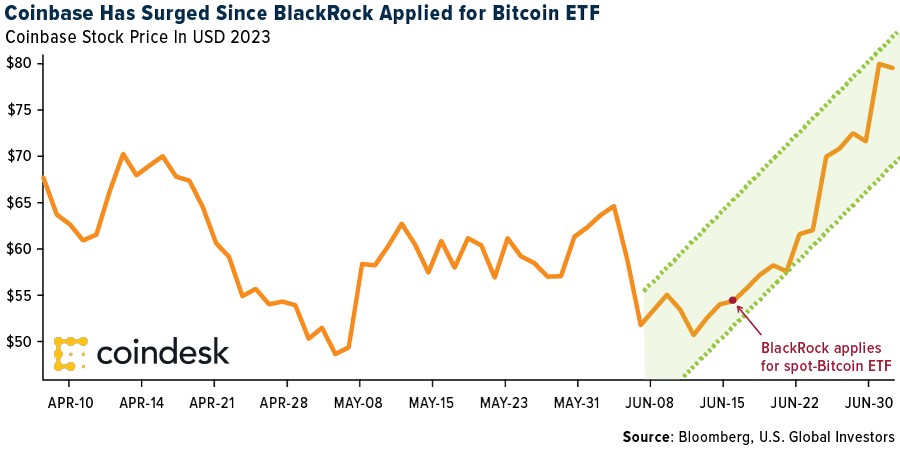

- Bitcoin advanced to a fresh high after several giants of traditional finance sought permission to launch spot exchange-traded funds (ETFs) on the token in the U.S., fueling optimism about digital assets gaining more mass-market appeal, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was ApeCoin, down 17.51%.

- Earnings from NFT royalties hit their lowest volume since 2021, according to crypto data firm Nansen.

- Binance’s offices in Australia were searched by the country’s financial markets regulator as governments around the world turn up the heat on the biggest cryptocurrency exchange, writes Bloomberg.

Opportunities

- Since June 6, when the SEC accused the company of illegally operating an unregistered securities exchange, shares of Coinbase have soared 55% through Monday’s close, writes Bloomberg.

- Bitcoin’s fortune is no longer tied to sentiment in the U.S. stock market. The 90-day rolling correlations of changes in Bitcoin’s spot price to changes in the Nasdaq 100 has declined to near zero. That’s the lowest in two years, writes Bloomberg.

- BlackRock CEO Larry Fink called Bitcoin an “international asset” and said he wants to use its heft to make it less expensive and easier to invest in, writes Bloomberg.

Threats

- Denmark’s financial watchdog ordered Saxo Bank to dispose of its own holdings of crypto assets, saying banks aren’t allowed to conduct proprietary trading under current regulations, writes Bloomberg.

- Binance executives are exiting as regulatory heat on the exchange grows. Patrick Hillmann, Binance’s chief strategy officer who joined in 2021, tweeted he was leaving “on good terms.” Steven Christie, senior vice president for compliance, and Hon Ng, general counsel, have also left, writes Bloomberg.

- A crypto service used to move tokens between blockchains suffered an unexplained outflow of assets worth more than $120 million and have been moved to an unknown address, writes Bloomberg.

Gold Market

This week gold futures closed the week at $1,931.20, up $1.80 per ounce, or 0.09%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 1.66%. The S&P/TSX Venture Index came in off 0.98%. The U.S. Trade-Weighted Dollar fell 0.62%.

Strengths

- The best performing precious metal for the week was palladium, up 2.25%, despite hedge funds boosting their net bearish positioning to a record high going back to 2009, according to Bloomberg. Gold caught a break on Friday with the weaker-than-expected change in nonfarm payrolls, perhaps taking some pressure off the Federal Reserve to hike rates again. China, for an eighth consecutive month, has added to its gold reserves. Holdings rose by 680,000 ounces or about 23 tons. Since the country’s buying resumed in November of last year, it has added approximately 183 tons to the total stockpile of 2,330 tons.

- Following the sale of the Boungou and Wahgnion mines, Endeavour Mining updated its 2023 full-year production and AISC guidance to adjust for the assets sales, decreasing production to 1,060 – 1,135k ounces from 1,325-1,425k ounces with AISC improving by $45 per ounce to $895 – $950 per ounce.

- Silver Lake’s gold sales of 83,500 ounces were 13% above consensus and 33% higher quarter-over-quarter. This was enough for full year 2023 guidance to be met with 260,400 ounces. Higher grades drove the beat.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.09%. Osisko Gold Royalties announced the surprise departure of President and CEO Sandeep Singh, effective immediately. Paul Martin will step into the role as the interim CEO while the board undertakes a search for a new permanent President and CEO. This will create some near-term uncertainty, particularly given the relatively limited associated details.

- Security issues in Mexico have likely erased as much as 10% of the value of mineral production at many mining projects in the area, Reuters reported, citing Jaime Gutiérrez, the president of CAMIMEX, the country’s main mining chamber.

- Freeport Indonesia, a unit of Freeport-McMoRan, said this week that it has not yet obtained a government permit to continue exporting its materials, reports Reuters. This risks overcapacity at its storage facilities in the eastern region of Papua.

Opportunities

- De Beers (Anglo’s diamond subsidiary and 11% of Anglo NPV) struck a new agreement with the Government of Botswana (GoB) after three years of delays. Up to now, the GoB has directly sold 25% of the output of (De Beers’ Botswana diamond subsidiary) Debswana; with De Beers selling the remaining 75%. Under the new agreement, the GoB will sell 30% of Debswana’s output, rising by 2% a year to 50% at the end of the 10-year agreement.

- Changes to solar panel technology are accelerating demand for silver, a phenomenon that is widening a supply deficit for the metal with little additional mine production on the horizon. Silver, in paste form, provides a conductive layer on the front and the back of silicon solar cells. But the industry is now beginning to make more efficient versions of cells that use a lot more of the metal, which is set to boost already-increasing consumption. Solar is still a small part of overall silver demand, but it is growing. It is forecast to make up 14% of consumption this year, up from around 5% in 2014, according to a report from The Silver Institute, an industry association.

- Goldman expects ongoing interest in Australian gold assets following recent activity, with increasing focus on emerging, high-margin mid-caps or synergistic opportunities as broader industry consolidation continues. This comes with favorable near-term FCF yields (10%) and valuations more fairly priced (1x NAV) on its $1,700 per ounces LT gold price.

Threats

- Talks this week between Newmont management and workers at Mexico’s biggest gold mine failed to resolve a strike that has lasted nearly a month. Company and union representatives sat down on Monday without settling a dispute over a profit-sharing arrangement, Newmont’s Peñasquito mine posted on its Facebook account, citing unrealistic union demands. The union sought a 16% share of profit to workers, lower than the 20% initial demand, which was double the percentage in a contract signed last year, Newmont said.

- Mali’s military leader Assimi Goita appointed Amadou Keita as minister of mines in a government reshuffle on Saturday, according to a presidential decree. Keita replaces Alousseni Sanou, who is also finance minister and who stood in for former mines and energy minister Lamine Traore after he resigned on May 31. Traore stepped down after power cuts in the West African nation fueled discontent and hampered businesses. Mali is one of Africa’s top gold producers and home to mines operated by companies including Barrick Gold, B2Gold Corp,

Resolute Mining and AngloGold Ashanti. - Hedge funds are lining up to short palladium as weak global demand points to a potential oversupply of the precious metal. Money managers’ net positioning in the palladium futures and options market was the most bearish on record last week, according to data from the Commodity Futures Trading Commission

going back to 2009. The driver was a 14% increase in short selling by the funds from the week before.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2023):

FedEx Corporation

United Parcel Service

United Airlines

Cosco Shipping

American Airlines

JetBlue Airways

Tesla

Hermes

Lululemon

Volkswagen

Richemont

Louis Vuitton

Osisko Gold Royalties

B2Gold

Resolute Mining Ltd

AngloGold Ashanti Ltd.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The LBMA Gold Price is administered independently by ICE Benchmark Administration (IBA).

The U.S. Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies.

The S&P GSCI is widely recognized as a leading measure of general price movements and inflation in the world economy.