Key Takeaways from 2024’s Top 3 Most-Read Frank Talks

As the year comes to a close, it’s always insightful to take a step back and reflect on what resonated most with readers and investors.

In 2024, the three most-read Frank Talks covered topics that not only captured the financial zeitgeist but also, I hope, offered actionable insights for investors. Let’s look back these stories and explore why they struck a chord.

#3: How Kamala Harris’s Support for Price Controls Could Impact Inflation (August 2024)

Vice President Kamala Harris’s support for price controls and a tax on unrealized gains drew significant attention in August, when she was officially nominated as the Democratic candidate for president. I said then that these policies have the potential to reshape the U.S. economy—and not for the better.

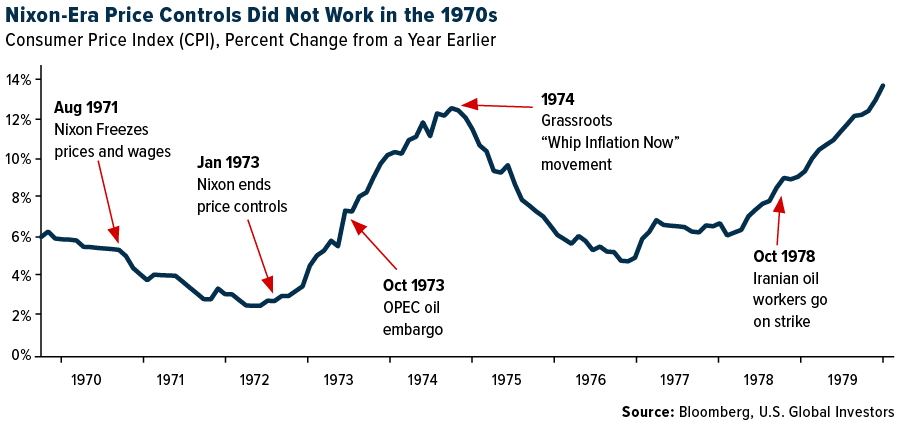

History provides us with numerous cautionary tales of price controls. Richard Nixon’s 1971 price freeze, though initially popular, ultimately ushered in a decade of stagflation that chipped away at Americans’ living standards.

The reason for this is simple: Price controls distort the balance of supply and demand. Artificially capping prices, whether for rent or gasoline, sends the wrong signal to consumers and producers, exacerbating scarcity and discouraging investment.

Harris’s proposed tax on unrealized gains was equally concerning. Taxing assets that haven’t been sold yet risks driving capital out of the U.S., weakening our financial system and leading to a “millionaire migration” to more tax-friendly jurisdictions. Supporting free markets and limited government intervention is essential to preserving economic prosperity.

#2: The Top 10 Nations Buying Gold: A Portfolio Strategy You Can Follow (October 2024)

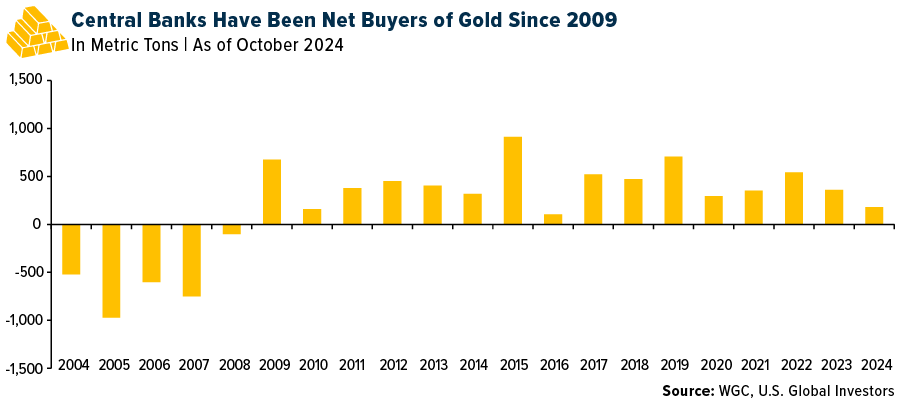

In this Frank Talk from October, I highlighted the top 10 countries that have aggressively accumulated gold over the past decade, based on data from the World Gold Council (WGC). With over 36,000 metric tons in reserves—representing about one-fifth of all the gold ever mined—central banks worldwide have demonstrated their trust in gold as the ultimate safety net.

The top buyers include emerging market economies such as China, India and Turkey, as well as smaller nations like Hungary and Singapore. Russia topped the list, adding over 1,200 metric tons in the past decade, a strategy likely influenced by Western sanctions. Meanwhile, China has quietly built its reserves to over 1,200 metric tons, signaling its intention to reduce reliance on the U.S. dollar.

The big question for investors is: If it’s good enough for central banks, shouldn’t it be good enough for you?

#1: A New Driver of Gold? (January 2024)

Taking the top spot is a Frank Talk from the beginning of the year that explores a possible shift in the forces driving gold prices. Historically, gold’s performance has been closely tied to real interest rates, but a report by BMO Capital Markets suggested that this relationship has weakened, with a new driver taking its place: central bank diversification away from the U.S. dollar.

As I’ve already pointed out, emerging economies, particularly China, have been at the forefront of this trend. The People’s Bank of China (PBoC) has consistently added to its gold reserves since late 2022, helping push global central bank purchases to record levels.

In the article, I also highlighted a strong U.S. economic backdrop, with robust GDP growth and improving consumer sentiment. Despite these positive indicators, firms like JPMorgan and UBS were bullish on gold, forecasting price increases as central banks continued to accumulate and investment demand returned.

Looking Ahead to 2025

At U.S. Global Investors, our mission is to provide you with the insights and tools you need to build a successful investment strategy. As we look ahead to 2025, I encourage you to continue exploring the topics that matter most to your financial journey.

Here’s to another year of informed investing!

The Consumer Price Index measures change over time in the prices paid by consumers for a representative basket of goods and services.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.