It’s Time to Reconsider Airline Stocks. Here Are Four Reasons Why.

As we move into the final stretch of 2024, many investors may be asking themselves: Is it time to give airline stocks another look? According to a new report from Bank of America (BofA), the answer might very well be yes

Despite the turbulence the airline industry has faced in recent years—from pandemic shutdowns to winter storms to rising fuel prices—the winds may finally be shifting in the industry’s favor. With fuel costs easing and pricing power returning, there are several reasons to believe that now could be an ideal time to reconsider the sector.

Let’s walk through the reasons why BofA analysts believe airline stocks are ready to take off again, and why I agree.

Tailwinds for the Airline Industry

BofA points to four key tailwinds that could help the airline industry outperform in the coming months. These factors are worth paying attention to for those who might have written off the sector too soon:

1. Steady TSA Throughput Despite Lower Capacity

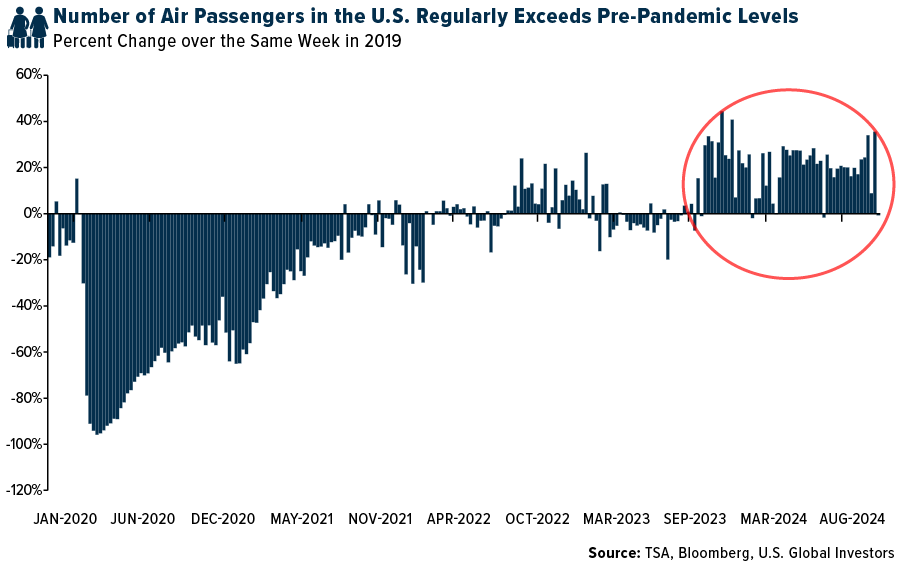

Data from the Transportation Security Administration (TSA) shows that flight demand has remained strong, despite airlines reducing their overall capacity. This is crucial because it indicates that people are still flying even though airlines are offering fewer seats. Less capacity combined with solid demand is typically a recipe for improved pricing power, which can support earnings.

Today, the TSA regularly clears over 2.5 million people to fly every day, exceeding pre-pandemic figures, and in July, a new record was set when 3 million passengers were screened in a single day. As you can see below, passenger volumes in the U.S. now regularly exceed pre-pandemic levels.

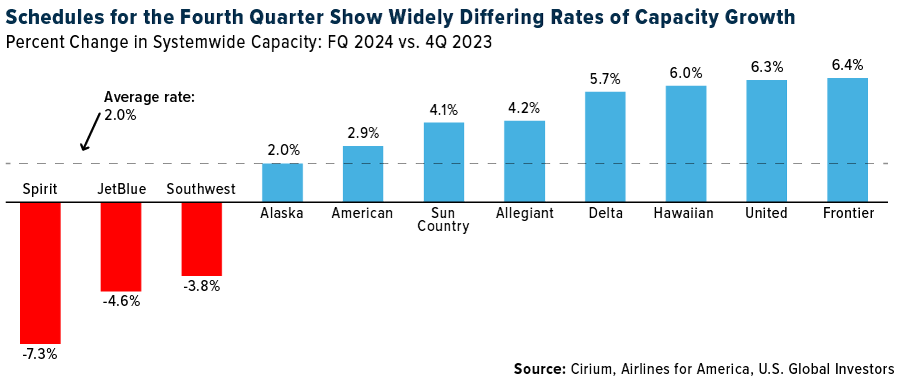

2. Decelerating Domestic Capacity

U.S. airlines are cutting back on domestic capacity. Why? The oversupply of seats during the summer months led to lower fares and compressed margins, even though travel demand was strong. By trimming capacity, airlines can drive up fares without chasing customers away. It’s a classic supply and demand play, and if demand holds steady, we could see a nice bump in revenue for airlines, especially as we move into the fall.

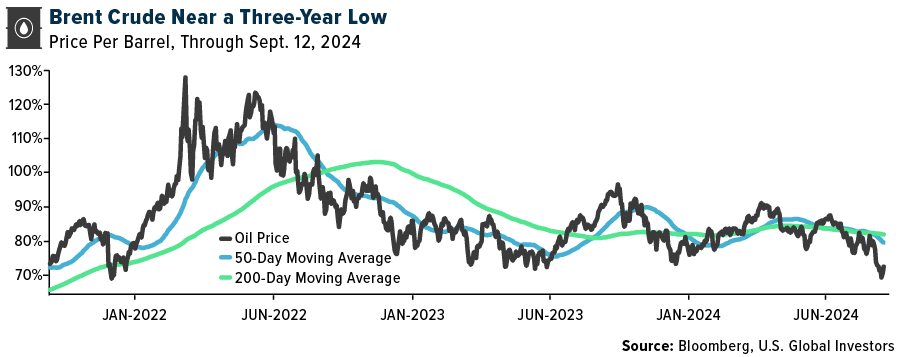

3. Lower Fuel Prices Boosting Earnings

Fuel is one of the biggest expenses for airlines, accounting for 20% to 30% of their total costs. After a period of rising fuel prices, we’re now seeing some relief, which is great news for the airline industry.

BofA has raised its earnings estimates for several airlines, including United and Alaska Airlines, due to recent declines in fuel prices. Lower fuel costs, combined with higher ticket prices, could help airlines retain profitability and possibly beat earnings expectations in the fourth quarter.

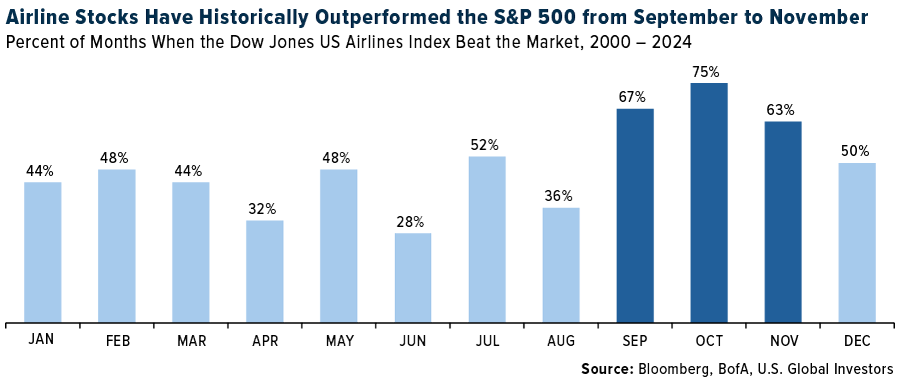

4. Seasonal Outperformance in the Fall

Historically, airlines tend to outperform in the fall. According to BofA’s analysis of the Dow Jones U.S. Airlines Index since 2000, the second half of the year has typically been the stronger half for airlines. The industry has outperformed the S&P 500 in three of the last six months of the year—namely September, October and November. If history is any guide, investors who get in now could see some attractive returns by the end of the year.

Airlines Are Playing the Long Game

Beyond the immediate tailwinds, the airline industry is positioning itself for long-term success. Carriers have been using their cash flow to make critical investments, such as expanding their workforces, renewing their fleets and upgrading their IT systems.

And they’re doing this while paying down debt. U.S. airlines had $143 billion in debt on their books at the end of 2023, down from $168 billion at the end of 2021, according to BofA. That’s still higher than pre-pandemic levels, but it’s a significant improvement and a sign that the industry is serious about managing its balance sheets.

Airlines are also retiring older, less efficient aircraft and replacing them with newer, more fuel-efficient models, which should help reduce operating costs even further. In March, American announced it would be purchasing 260 new aircraft from Boeing, Airbus and Embraer to meet growing demand. This came after United’s October 2023 announcement that it would be buying 110 aircraft from Boeing and Airbus.

Airlines Adjusting to New Realities

As much as we love to think about air travel as a simple business of getting people from point A to point B, it’s a lot more complicated than that. Airlines need to strike a balance between offering enough seats to meet demand and keeping prices high enough to make a profit.

Delta, for example, moderately raised its full-year expectations to between $5 to $7 per share, despite some challenges earlier in the year, including the CrowdStrike hack. Alaska has also raised its earnings outlook thanks to strong summer demand and lower fuel costs. Even budget carriers like Frontier are seeing better-than-expected margins on capacity cuts.

In my view, the ability to adjust and adapt is what makes the airline industry an interesting investment opportunity right now. The airlines that can best manage their capacity, keep their costs under control and maintain pricing power will be the ones that outperform.

A Value Play in the Making

For value-conscious investors, the airline industry could be particularly appealing right now. Airline stocks are trading at attractive price-to-earnings ratios compared to other sectors, and given the potential for earnings growth in the fourth quarter and beyond, this could be an interesting time to consider adding airlines to your portfolio.

As always, timing is important. With steady TSA throughput, decelerating domestic capacity, falling fuel prices and seasonal trends all pointing toward a strong second half for the airline industry, now may be the perfect opportunity to climb aboard.

If you would like more information on how to begin investing in the global airline industry, please send an email to info@usfunds.com with the subject line “Airlines.”

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.60%. The S&P 500 Stock Index rose 4.05%, while the Nasdaq Composite climbed 5.95%. The Russell 2000 small capitalization index gained 4.20% this week.

- The Hang Seng Composite gained 8.86% this week; while Taiwan was up 1.51% and the KOSPI rose 1.22%.

- The 10-year Treasury bond yield fell 5 basis points to 3.658%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Frontier, up 15.2%. According to TD, Alaska Air reiterated its outlook for ASM and CASM. However, the carrier now expects RASM up 2%, fuel of $2.65, and earnings per share (EPS) between $2.15 and $2.25.

- According to ISI, freight has been front-running a potential strike by pulling forward cargo and shifting volumes to the West Coast (East Coast up 10% year-to-date and West Coast up 20% year-to-date). However, underlying domestic demand is somewhat soft.

- At Southwest Airlines, six directors are to retire in November and Chairman Gary Kelly will retire immediately after the 2025 annual meeting. The Board intends to appoint four new independent directors, potentially including candidates proposed by Elliott Investment Management L.P. The Board reiterated its support for Bob Jordan as CEO.

Weaknesses

- The worst performing airline stock for the week was Ryanair, down 5.0%. According to Bank of America, airline stocks were nearly flat at -0.2% in August compared to the S&P 500’s 2.3%. Southwest was the only carrier to outperform the S&P, while American outperformed the group. Year-to-date through August, the group is now -0.9%, underperforming the S&P 500’s 18.4% return.

- The latest Drewry’s Container Index was down 8% week-over-week and the decline widened, reports Morgan Stanley. European shipping routes were down 12-14%, seeing a relatively steeper decline than North American shipping routes.

- Boeing’s IAM 751 union has voted to strike. The vote was 96% in favor of striking and 95% for rejecting the contract. A statement from Boeing says the company is ready to get back to the table to reach a new agreement, according to UBS. Boeing has proposed a four-year contract that includes a 25% general wage increase, a $3,000 ratification bonus, overtime/healthcare/retirement benefits, and a Boeing guarantee to build the next plane in Puget Sound.

Opportunities

- According to Morgan Stanley, 63% of consumers are planning to travel in the next six months, which is a tick up from 60% last month and this time last year (58%). Like their previous surveys, mid and upper-income households continue to display higher intentions to travel compared to lower income households, though travel intentions among higher-income consumers this month ticked up noticeably to 89% compared to 81% last month.

- Cointainer shipping operators are reporting a surge in second quarter profitability, reports Morgan Stanley, but spot correction continued. Capesize bulker spot rates picked up, supported by tight supply and commodity shipment demand. Tanker rates stayed soft during the low season but stronger than their traditional seasonality.

- Bank of America sees tailwinds for the airline industry. This includes TSA throughput data (a real-time measure of demand) remaining steady despite lower industry capacity, along with domestic capacity continuing to decelerate. Lower capacity is helping prices at a time when fuel is falling, the group added, bolstering earnings, and lastly, airlines typically outperform in the fall.

Threats

- Spirit Airlines released an 8-K on Tuesday night noting an extension of the deadline for completing debt re-negotiations that would trigger the expiration date of the credit card processor agreement to be moved up to year-end. Specifically, the deadline has been extended from September 20 to October 21, according to Raymond James.

- Bank of America sees growing risk of disruption to U.S. east coast port operations with the existing agreement set to expire in three weeks, with reports suggesting the sides remain far apart of key issues like pay and automation. In addition, 20% of global seaborne car carrier flows involve trade to/from the U.S. with U.S. east coast ports representing 55% of the U.S. car carrier trade.

- Air Canada announced it is finalizing contingency plans to suspend most of its operations, noting talks continue between the company and the Air Line Pilots Association (ALPA) – representing more than 5,200 pilots at Air Canada and Air Canada Rouge – but the parties remain far apart, according to CIBC. Unless an agreement is reached, beginning on September 15, 2024, either party may issue a 72-hour strike or lockout notice, which would trigger the carrier’s three-day wind-down plan.

Luxury Goods and International Markets

Strengths

- U.S. household wealth reached a new record of $163.8 trillion last quarter, fueled by rising real estate values and gains in the stock market, according to data released by the Federal Reserve on Thursday. The increase in net worth, up from $161 trillion at the end of the first quarter, was primarily driven by a $1.8 trillion boost in real estate holdings and a $700 billion increase in equity holdings.

- Industria de Diseno Textil, a company best known for its brand Zara, reported that sales increased year-over-year. The Spanish clothing company’s net sales were 18.07 billion euros, compared with 16.85 billion euros a year ago.

- RH, formerly know as Restoration Hardware, a home furnishing store, was the best performing S&P Global Luxury stock, gaining 27.8%. Shares gained after the company reported an earnings beat and said it continues to see healthy demand for its furniture and home furnishing

Weaknesses

- U.S. business confidence in China has dropped to a record low. The China Business Report reveals that the percentage of American companies viewing China as a top investment destination has decreased to 13%, down from 17% last year. Concerns about U.S.-China trade tensions and weakening economic activity are contributing to the cautious outlook among American investors.

- The European Central Bank (ECB) has lowered its growth projections for the region over the next few years. The bank now forecasts GDP growth of 0.8% for 2024, down from a 0.9% projection made three months ago.

- BMW was the worst-performing S&P Global Luxury stock, losing 6.2% in the past five days. The company cut its full-year guidance, saying it now sees earnings signifinatly lower than a year ago.

Opportunities

- As anticipated, the European Central Bank has reduced its main deposit rate by 25 basis points, lowering it from 3.75% to 3.50%. The bank forecasts slower economic growth in the euro area, which could lead to another rate cut next month or potentially even more significant reductions later in the year.

- A Mid-Autum Festival, viewed as the second most important holiday in China, will run from September 15 to 17. This festival is a significant cultural event marked by gift-giving, family reunions, and celebrations, which often includes the exchange of high-end gifts and luxury items. It has the potential to boost both travel and consumer spending during this period.

- LVMH, the Paris-based luxury company, is in talks to become a major sponsor of Formula One, which will allow the company to promote its major brands on the racetrack. If agreed, a potential deal could be announced before the end of the year and the Formula One season.

Threats

- Due to economic slowdown and higher inflation in the past few years, some high spending customers cannot afford to spend like they used to, turning to less expensive brands like clothing store Zara and jewelry brand Pandora. These brands, offering more budget-friendly options, have seen significant growth. Shares of Pandora and Zara have outperformed luxury giants like Hermès, LVMH and Richemont.

- Tesla remains a leader in the EV market, but competition is intensifying. Kia has launched a Tesla Competitive Bonus Program, providing a $1,000 discount for Tesla owners who switch to a new Kia EV6, and a $9,000 discount on the larger EV9. Meanwhile, Lucid Motors is gearing up to launch its electric Gravity SUV, which will compete directly with Tesla’s Model X.

- Barclays and RBC have downgraded their ratings on Burberry and Kering, while also reducing price targets across the luxury sector, leading to a decline in share prices for luxury brands. Carole Madjo, an analyst at Barclays, following a recent trip to China, forecasts that the weakness in the luxury market there appears to be structural rather than cyclical, cutting both names to underweight from equal weight.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was Palladium, rising 19.2%. According to Bank of America, the U.S. DOE issued a permit for 1.4 million tons per year Altamira LNG for exporting LNG to non-FTA countries. This is the first such approval since the current administration’s ‘pause’ in January.

- Tin has been the outperformer in the base metals complex on a series of supply disruptions, according to Bank of America. The supply issues have also been mirrored in a recent survey by SMM, which notes that operating rates of tin smelters in Yunnan and Jiangxi fell to just 36.01%, with companies participating in the survey highlighting that feedstock supply was extremely tight, making procurement difficult.

- Oil prices climbed more than 2% on Wednesday, driven by fears of lengthy production shutdowns in the U.S. offshore oil patch, which Hurricane Francine was barreling through on the way to landfall in Louisiana, according to Reuters.

Weaknesses

- The worst performing commodity for the week was lumber, dropping 3.38%. According to Goldman, U.S. natural gas prices have remained under pressure. This is largely driven by a combination of cooler-than-average weather, stronger-than-expected production, and Tropical Storm Francine expected to make landfall this week, likely further reducing power demand and potentially impacting LNG exports out of the Gulf.

- According to Bank of America, against the backdrop of slower global economic growth and a softer demand profile (esp. China), oil demand growth is likely to be dominated by non-OECD Asia, with China playing a smaller role than in the past decades. Meanwhile, Brazil, Guyana and the U.S. should deliver the majority of non-OPEC supply growth, while OPEC+ will holds back production.

- Sibanye Stillwater Ltd. plans to cut platinum and palladium production in the U.S. by up to 45% due to slumping prices and rising operational costs, with output expected to drop by 200,000 ounces by 2025. This comes as a weakness for platinum and palladium markets, as reduced production signals declining profitability and increasing vulnerability to price drops, especially considering the broader market challenges posed by the rise of electric vehicles. This lessens demand for these metals in traditional emission control devices, as cited by Bloomberg.

Opportunities

- In UBS’s view, most of the correction in copper has likely played out with LME copper holding technical support levels around $9,000 per ton. They cannot rule out a break below August lows ($8,700 per ton), but with fundamentals stabilizing in the group’s view, copper is likely to find a floor at $8,700-9,000 per ton and could be an attractive medium-term entry point.

- Russian President Vladimir Putin has suggested limiting uranium exports in retaliation for Western sanctions, raising concerns about global supply shortages. This move presents an opportunity for uranium prices to rise, as Western countries scramble to secure alternative sources, and uranium stocks, like NexGen Energy and Cameco, have already seen a surge in anticipation of supply disruptions, Bloomberg reports.

- Europe is preparing for the potential end of Russian gas deliveries through Ukraine as the current transit deal is unlikely to be renewed by December, raising concerns about energy security during the winter. This comes as an opportunity for the price of natural gas, says Bloomberg, which will be artificially elevated from Europe’s newly placed demand.

Threats

- Recently, Chinese steelmaker Baowu warned of a “long and harsh winter” ahead for the steel industry. A combination of pressured demand due to an ailing China property sector, negative steelmaker margins, steel production cuts, high iron ore port inventories and seasonally higher iron ore shipments should lead to a negative backdrop for iron ore, according to Bank of America.

- Based on latest assessments, the 90th percentile for iron is $85 per ton, with a further 120Mt (6%) buffer of supply >$80 per ton. The responsive tail of the cost curve has kept dips short-lived in recent years reports Goldman, but cracks in demand may be deepening.

- Schlumberger NV’s breakthrough in direct lithium extraction (DLE) technology could flood the market with lower-cost lithium, reducing the need for traditional, more expensive extraction methods. This increase in supply could drive down lithium prices, posing a significant risk to speculators and investors who depend on higher prices fueled by scarcity and slower production, Bloomberg reports.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Nevos Network, rising 79.17%.

- State Street Global Advisors and Galaxy Asset Management are launching a trio of cryptocurrency-focused exchange-traded funds, reports Bloomberg, even as investors pull back from spot Bitcoin funds. State Street and Galaxy’s partnership is offering its first funds into a steady stream of outflows from U.S.-listed spot Bitcoin ETFs.

- Crypto asset manager Grayscale Investments said it has begun to offer the Grayscale XRP Trust, helping to send the price of the seventh largest digital asset up by almost 10%. The trust aims to provide investors with the opportunity to gain exposure to the token that powers the XRP Ledger, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Arweave, down 5.86%.

- Former Co-CEO of Alameda, Caroline Ellison, will face sentencing on September 24 in a New York courtroom. The fraud charges against Ellison include two counts of conspiracy to commit wire fraud, two counts of actual wire fraud and one count of conspiracy to commit money laundering, writes Bloomberg.

- The Bloomberg Galaxy DeFi Index of digital coins involved in decentralized finance fell 4.1% this week, reports Bloomberg. The index fell to 600 down from 626 a week earlier.

Opportunities

- Uniswap is once again making headlines as it experiences a price surge following a significant legal settlement with the U.S. Commodity Futures Trading Commission, writes Bloomberg. This surge is renewing excitement around the DeFi world and fueling interest in the new projects that are set to launch on the platform.

- Payments in Singapore using stablecoins reached a record high of almost $1 billion in the second quarter, led by transactions at merchant outlets. Businesses use the tokens because of “efficiency and low cost,” according to an article published by Bloomberg.

- ParaFi Capital is tokenizing a minority portion of its latest venture-capital fund which closed in May. The LP interest will be available on the Securitize platform and run on the Avalanche blockchain, according to Bloomberg.

Threats

- Consumers lost more than $5.6 billion last year through cryptocurrency-related fraud, according to an estimate from the FBI. This is a 45% jump from 2022. The FBI internet crime complaint center received nearly 69,500 complaints from consumers in the U.S. and abroad last year, according to an article published by Bloomberg.

- EToro USA agreed to pay $1.5 million and allow American customers to only trade a handful of cryptocurrencies on its platform to settle U.S. SEC allegations that it operated as an unregistered broker and clearing agency, Bloomberg reports. The social trading and investment platform entered a cease-and-desist order without admitting or denying the allegations.

- The federal judge who’s overseeing the criminal cases involving FTX fraud grilled a former executive in an extraordinary court hearing Thursday, accusing him of lying and threatening to sanction his lawyers. Judge Kaplan grilled Salame under oath for over 30 minutes in his Manhattan courtroom.

Defense and Cybersecurity

Strengths

- RTX, formerly Raytheon Technologies, secured a $1.1 billion contract modification for additional air-to-air missile production, including support hardware, with work to be completed by 2028. This involves foreign military sales to countries such as Bahrain, Canada, Japan and Ukraine.

- QinetiQ U.S. has won a multi-year contract from General Atomics to provide control hardware, software, assembly and modernization for the Electromagnetic Aircraft Launch System and Advanced Arresting Gear for the future U.S. Navy aircraft carrier USS Doris Miller.

- The best performing stock in the XAR ETF this week was Rocket Lab USA Inc., rising 28.40%. The company hired former Rivian executive Frank Klein as COO to apply his car manufacturing expertise to the space industry.

Weaknesses

- Russian forces have intensified their assault on the eastern Ukrainian city of Pokrovsk, cutting off water supplies and damaging key infrastructure while also launching a counterattack in the Kursk region. Ukrainian officials urge remaining residents to evacuate amidst worsening conditions.

- U.S. Secretary of State Antony Blinken announced that Russia has received ballistic missiles from Iran for use in Ukraine, despite U.S. warnings, prompting new sanctions against Tehran.

- The worst performing stock in the XAR ETF this week was Huntington Ingalls Industries, falling 2.85%. The company is facing pressure to improve labor productivity amid strong Navy ship demand, leading JPMorgan to downgrade its stock rating to neutral while raising the target price to $285.

Opportunities

- Rheinmetall has partnered with Finnish startup ICEYE to integrate high-resolution satellite data into battlefield systems, enhancing Western military capabilities and securing exclusive distribution rights for ICEYE’s satellites in Germany and Hungary.

- Lockheed Martin and Tata Advanced Systems Ltd. have signed an agreement to expand their collaboration on the C-130J Super Hercules tactical airlifter, including establishing a Maintenance, Repair, and Overhaul (MRO) facility in India. This will expand production for the Indian Air Force’s Medium Transport Aircraft program, and further strengthening defense ties between India and the U.S.

- DARPA awarded BAE Systems’ FAST Labs a $4 million contract for Phase 1 of the Artificial Intelligence Reinforcements (AIR) program, which aims to advance AI-piloted fighter jets by solving data processing and decision-making challenges in air combat. This builds on previous successes like the ACE program’s AI-human dogfight simulations using F-16 testbeds.

Threats

- Dozens of anti-war protesters were arrested in Melbourne after a rally against a defense expo escalated into violent clashes with police, resulting in the use of rubber bullets and tear gas, protesters hurling projectiles, and widespread disruption, including the targeting of trucks and the shutdown of city roads.

- Syrian officials accused Israel of launching missile strikes that killed 16 people and wounded 36, escalating tensions between the two countries. The strikes targeted multiple areas, including military sites in Masyaf, and were part of Israel’s broader effort to disrupt arms transfers from Iran to Hezbollah.

- Israel stated it is “highly likely” that its military accidentally shot and killed American-Turkish citizen Aysenur Ezgi Eygi during a protest in the West Bank, while targeting a main instigator of the violence.

Gold Market

This week gold futures closed the week at $2586.50, down $85 per ounce, or 3.4%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 9.56%. The S&P/TSX Venture Index came in up 6.46%. The U.S. Trade-Weighted Dollar rose .08%.

Strengths

- The best performing precious metal for the week was palladium, up 19.2%. According to Bank of America, assets under management in physically backed ETFs have bottomed out, suggesting a more broad-based increase in exposure to the yellow metal from Western investors, which have been somewhat absent from the market earlier this year.

- Probe Gold overall resources in the Val d’Or East have nearly doubled (+92%) from 5.2 Moz to 10.0 Moz, reports Canaccord. This is impressive growth which the company achieved through successful expansion and conversion drilling; acquisitions made since its last resource update in 2023.

- Andean Silver announced an +80% increase in the Cerro Bayo resources to 91M ounces (previous: 50M ounces), which is above Canaccord’s expectations of 70-80Moz.

Weaknesses

- The worst performing precious metal for the week was gold, down 3.36%. Ascot owns the Premier Gold Project in northwestern British Columbia. Management announced it was suspending operations as the mill cannot be filled and funding is required to complete an estimated three to six months of development.

- According to Bank of America, Kinross Gold released the results of a Preliminary Economic Assessment on its Great Bear gold mining project located in northwestern Ontario, Canada. From a production point of view, the results are below the bank’s forecasts and what it believes to be consensus expectations, both in terms of total production and average annual production.

- Royalty stocks underperformed the traditional gold miners, reports Scotia, albeit the large-cap royalty companies outperformed the broad U.S. equity market indices over the past three months. Scotia’s top picks in this space are Wheaton Precious Metals and Triple Flag.

Opportunities

- The current gold/silver ratio at 89 is above the long-term trendline, reports Bank of America, which indicates the gold/silver price ratio should currently be around 83. With gold now at $2,497 per ounce, this long-term trendline implies that the price of silver is undervalued versus gold and should be around $30 per ounce, suggesting 7% from the current level.

- According to UBS, AngloGold made a firm offer to buy Centamin for $2.5 billion in a predominantly script transaction that included $145 million in cash. The offer represented a premium of 37% to Monday’s closing price of 120 pence for Centamin. This implies a $2,700 per ounce gold price environment over the medium term.

- Positioning on silver has been more bullish by Bank of America due to its link to green technologies. The bank sees upside potential for both precious metals in the next 18 months but believes silver should outperform gold because it is more sensitive to manufacturing activity.

Threats

- According to UBS, for Bellevue Gold, the A$146m equity raise will pay down A$120 million debt and lift liquidity from A$76 million to A$102 million. By restructuring the debt profile, Bellevue will be able to self-fund its growth targets. However, the requirement for further significant capex was a key surprise in the update.

- Bloomberg covered ETFs have reduced their silver holdings by 19,769 troy ounces in the latest trading session, adding to concerns that increased selling could put downward pressure on silver prices. This reduction in demand poses a threat to silver investors, as continued sales could lead to further price declines in the market.

- According to Bank of America, Pan American Silver announced its annual reserve and resource estimate update. Adjusting for asset sales, total contained silver and gold reserves declined 4% and 11% year-over-year to 468 million ounces and 6.9 million ounces, respectively.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Alaska Air

Southwest Airlines

Boeing

Spirit Airlines

Air Canada

Industria de Diseno Textil

LVMH

Zara

Tesla

Kering

Cameco

NexGen Energy

Schlumberger

Kinross Gold

Wheaton Precious Metals

Triple Flag

AngloGold

Centamin

Bellevue Gold

Pan American Silver

JetBlue Airways Corp.

American Airlines Group Inc.

Sun Country Airlines Holdings

Allegiant Travel Co.

Delta Air Lines Inc.

United Airlines Holdings Inc.

Frontier Group Holdings Inc.

Airbus SE

Embraer SA

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Drewry World Container Index (WCI) measures the bi-weekly ocean freight rate movements of 40-foot containers in seven major maritime lanes.

The Dow Jones US Total Market Airlines Index is constructed and weighted using free-float market capitalization and the index is quoted in USD.