Is This the End of the Petrodollar?

[responsivevoice buttontext=”Listen to the Commentary”]

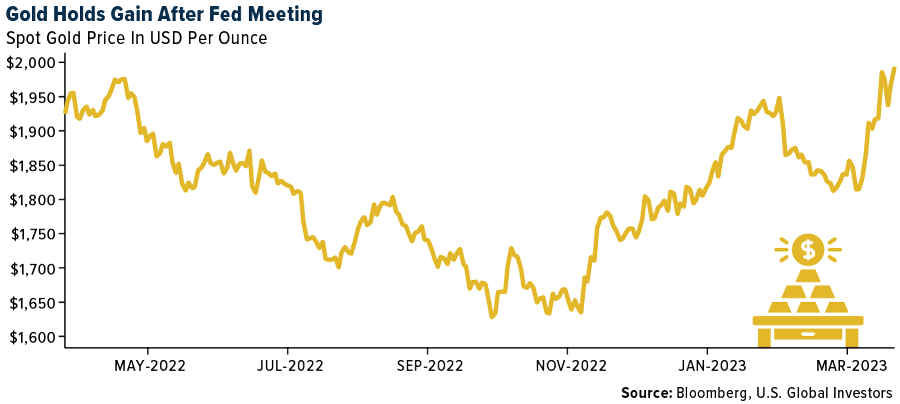

While most investors were fixated on Jerome Powell & Co. this week, trying to gauge the Federal Reserve’s next moves in light of recent bank failures, something interesting occurred in Moscow.

During a three-day state visit, Chinese President Xi Jinping held friendly talks with Russian President Vladimir Putin in a show of unity, as both countries increasingly seek to position themselves as leaders of what they call a “multipolar world order,” one that challenges U.S.-centric alliances and agreements.

Among those agreements is the petrodollar, which has been in place for over 50 years.

In case you’re wondering, “petrodollars” are not a real currency. They’re simply dollars being used to trade oil. Early in the 1970s, the U.S. government provided economic aid to Saudi Arabia, its chief oil-producing rival, in exchange for assurances that Riyadh would price its crude exports exclusively in the U.S. dollar. In 1975, other members of the Organization of Petroleum Exporting Countries (OPEC) followed suit, and the petrodollar was born.

This had the immediate effect of strengthening the U.S. dollar. Since countries around the world had to have dollars on hand in order to buy oil (and other key commodities such as gold, also priced in dollars), the greenback became the world’s reserve currency, a status formerly enjoyed by the British pound, French franc and Dutch guilder.

All things must come to an end, however. We may be witnessing the end of the petrodollar as more and more countries, including China and Russia, are agreeing to make settlements in currencies other than the U.S. dollar. This could have wide-ranging implications on not just a macro scale but also investment portfolios.

Dawn for the Petroyuan?

Putin couldn’t have been more explicit. During Xi’s state visit, he named the Chinese yuan as his favored currency to conduct trade in. Ever since Western sanctions were levied on the Eastern European country for its invasion of Ukraine early last year, Russia has increasingly depended on its southern neighbor to buy the oil other countries won’t touch.

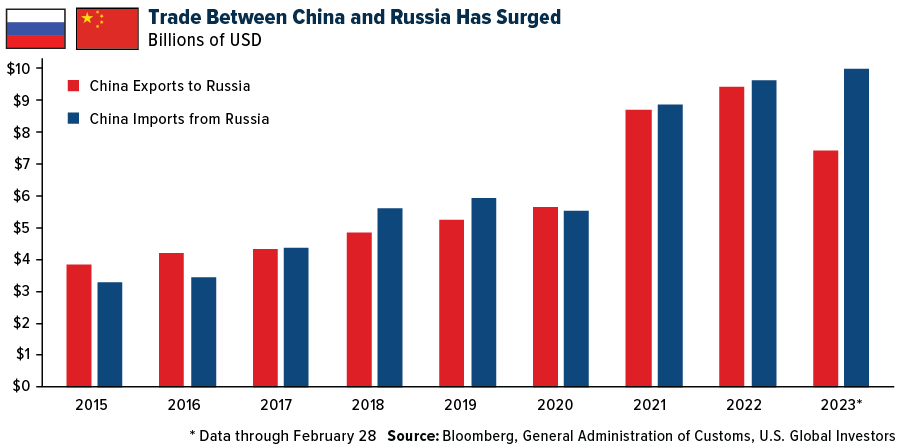

In just the first two months of 2023, China’s imports from Russia totaled $9.3 billion, exceeding full-year 2022 imports in dollar terms. In February alone, China imported over 2 million barrels of Russian crude, a new record high.

Except that now, the yuan is presumably being used to make these settlements.

As Zoltar Pozsar, New York-based economist and investment research director at Credit Suisse, put it recently: “That’s dusk for the petrodollar… and dawn for the petroyuan.”

U.S. Dollar Still the World’s Reserve Currency, but Its Dominance Is Slipping

Before you dismiss Pozsar’s comment as an exaggeration, consider that other major OPEC nations and BRICS members (Brazil, Russia, India, China and South Africa) are either accepting yuan already or strongly considering it. Russia, Iran and Venezuela account for about 40% of the world’s proven oilfields, and the three sell their oil in exchange for yuan. Turkey, Argentina, Indonesia and heavyweight oil producer Saudi Arabia have all applied for admittance into BRICS, while Egypt became a new member this week.

What this suggests is that the yuan’s role as a reserve currency will continue to strengthen, signifying a broader shift in the global power balance and potentially giving China a bigger hand with which to shape economic policies that affect us all.

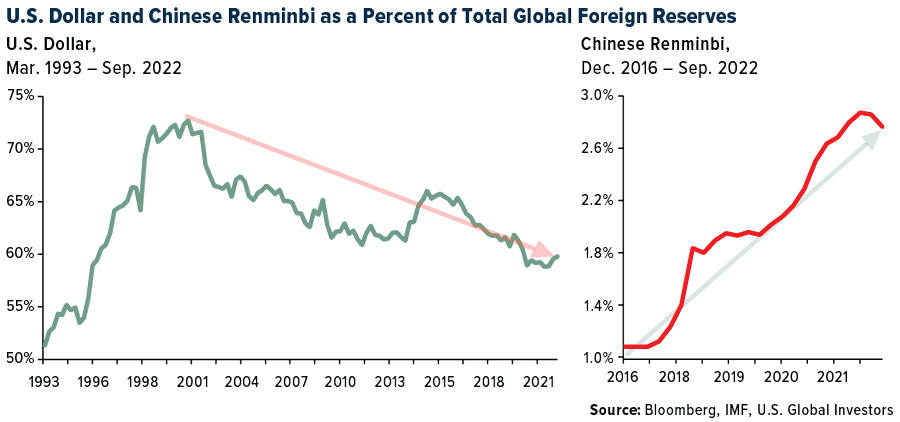

To be clear, the U.S. dollar remains the world’s top reserve currency for now, though its share of global central banks’ official holdings has slipped in the past 20 years, from 72% in 2001 to just under 60% today. By contrast, the yuan’s share of official holdings has more than doubled since 2016. The Chinese currency accounted for about 2.8% of reserves as of September 2022.

Russia Diversifying Away from the Dollar by Loading Up on Gold

It’s not all about the yuan, of course. Gold has also increased as a foreign reserve, especially among emerging economies that seek to diversify away from the dollar.

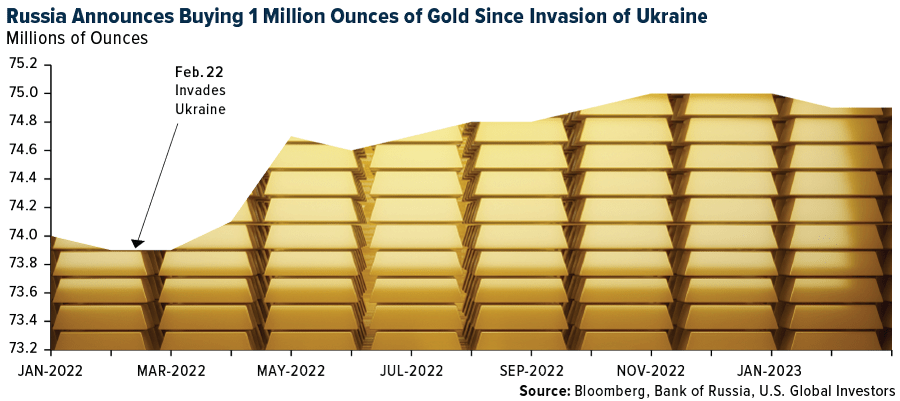

This week, Russia announced that its bullion holdings jumped by approximately 1 million ounces over the past 12 months as its central bank loaded up on gold in the face of Western sanctions. The bank reported having nearly 75 million ounces at the end of February 2023, up from about 74 million a year earlier.

Long-Term Implications for Investors

The implications of the dollar potentially losing its status as the global reserve are numerous. Obviously, there may be currency risks, and a decrease in demand for U.S. Treasury bonds could result in rising interest rates. I would expect to see massive swings in commodity prices, especially oil prices, which could be an opportunity if you can stomach the volatility.

Gold would look exceptionally attractive, I think. A significant decrease in the relative value of the dollar would be supportive of the gold price, and I would be surprised not to see new highs. It’s for reasons like these that I always recommend a 10% weighting in gold, with 5% in physical bullion and the other 5% in high-quality gold mining equities. Be sure to rebalance at least on an annual basis. [/responsivevoice]

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.18%. The S&P 500 Stock Index rose 1.24%, while the Nasdaq Composite climbed 1.66%. The Russell 2000 small capitalization index gained 0.33% this week.

- The Hang Seng Composite gained 2.00% this week; while Taiwan was up 2.99% and the KOSPI rose 0.80%.

- The 10-year Treasury bond yield fell 5 basis points to 3.374%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Bombardier, up 8.5%. According to JPMorgan, Chase credit card data has consistently been 15-20% higher versus 2019 levels to start the year. While costs will continue to be in focus, the bank believes messaging of consistent willingness of consumers to travel should give some confidence to investors who, as of late, have been focused on the uneasy macro backdrop, with any uptick in business travel an incremental positive.

- According to a Goldman Sachs’ shipping review, the bank’s conclusions include, 1) Container demand: while end-market inventory is still high, new export orders picked up, 2) Container supply: high new ships capacity to be launched amid alliance break-up and fragmented market, 3) U.S. port congestion continues to ease, and 4) Ground cargo transport indicates domestic logistics recovery well on track after China’s reopening.

- Bombardier is significantly raising its 2025 financial targets, which come well above expectations. With significantly higher revenue forecasts ($9 billion versus prior guide of $7.5 billion) the company is driving higher EBITDA and higher free cash flow (FCF). FCF, which had been previously set at $500 million for 2025, has been increased an impressive 80% to $900 million. Leverage, as a result, is forecasted by management to be in the 2.0x-2.5x range (from 3x prior).

Weaknesses

- The worst performing airline stock for the week was Azul, down 8.9%. System net sales fell 1.2% versus 2019 for the week compared to up 3.0% last week. The decline was driven by both pricing and volumes with domestic worse than international. This is the softest week of net sales growth versus 2019 this year, outside of holiday shifts, and the regional banking headlines could have driven a near term softening in booking trends.

- Consumers’ need for moving goods around has decreased, and major shipping liners have thusly cancelled voyages and removed vessels from the global trade fleet. Denmark-based Maersk has reacted most strongly by removing far more vessels than competitors, writes Alphaliner in its latest newsletter. A total of 35 large commercial ships have been removed from the global fleet and are now classified as idle. Seventeen of these are either owned or rented by Maersk.

- According to Bank of America, Intra-Europe net sales fell 17 points to -23% versus 2019 and were 4% higher this week. International net sales declined by 14 points to -15% versus 2019 and were up 2% this week.

Opportunities

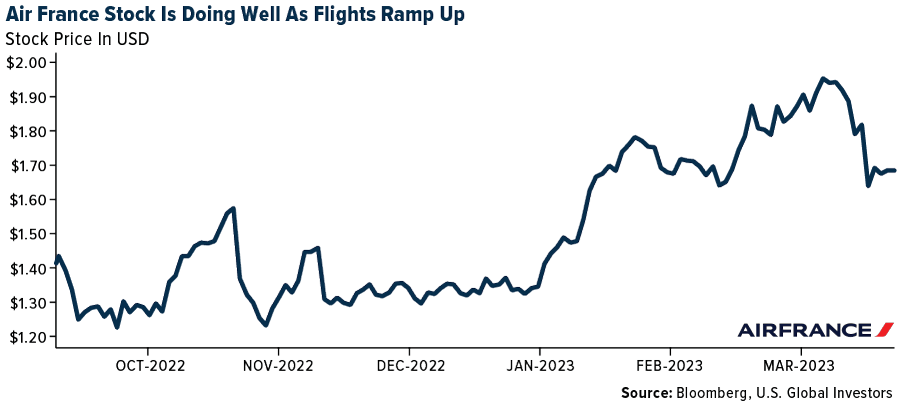

- Air France-KLM will operate services back at pre-pandemic levels this summer as demand for travel remains strong and daily flights resume to China after it scrapped Covid restrictions. The airline group will serve 191 destinations from April to October, with as many as 835 flights a day.

- Customers that need transportation of perishable goods like frozen food, fresh fruits or pharmaceutical drugs across the oceans will now be able to see data updates on temperature and humidity within hundreds of thousands of reefers. The Danish shipping group Maersk is rolling out a new and upgraded IT solution for its customers and partners, including freight forwarders.

- According to Reportur, IATA`s (International Air Transport Association) Americas vice-president, Mr. Peter Cerda, stated he estimates an upgrade of Mexico back to Category 1 aviation safety standards from U.S. Federal Aviation Agency (FAA) in the fourth quarter of this year. This would enable Mexican airlines to start adding back frequencies to the Mexico-U.S. market again.

Threats

- Weaker-than-expected fourth quarter 2022 profits in Taiwanese airlines suggests the reversal of cargo profit boom can outpace better passenger earnings. Cargo-focused airlines with more advanced passenger recovery will be the first to see softening revenue/earnings momentum.

- Switzerland’s central bank has decided to step in to save Credit Suisse, which is the largest ship finance provider for Greek shipowners (who represent 25% of global vessel fleet) and also tenth largest ship finance provider globally. As of end-2021, Credit Suisse accounted for 11% of the Greek ship lending market, and its ship finance exposure to Greek shipowners represented more than 50% of total shipping lending of $10 billion. For Korea shipbuilders, historically, European shipowners account for 60% of new shipbuilding orders.

- The parked airline fleet was 15.2% of total fleet, significantly above 6.8% in March 2019. There is significant improvement from mid-April 2020 peak of 61.7%, and since March 2022 of 18.6%. While the negative impacts from the pandemic were softer on freighters versus the passenger fleet, parked freighters have increased considerably in recent months. Parked freighter fleet was 14.6% of total freighter fleet as of March 2023 versus 9% on March 2022.[/responsivevoice]

Luxury Goods and International Markets

Strengths

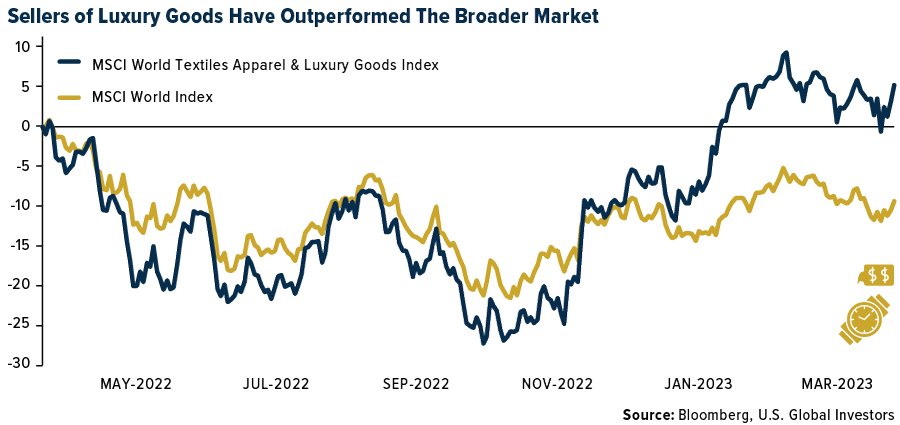

- The reopening of China’s borders has been positive for luxury goods, in particular because the Asian nation is one of the leaders in the global luxury space. Based on a survey from Bloomberg Intelligence, around 92% of mainland residents are considering at least one domestic or international trip in the following months, and about 47% plan to travel more than twice. In addition, the recovery in the luxury sector is clear, with sales in China and Hong Kong increasing by double digits last month. Asian residents are also looking to buy luxury goods abroad for less, taking advantage of the strength of their currency.

- Owners of luxury watches, based in Switzerland and Japan, have made the highest returns compared to collectors in other parts of the world, according to data from the trading platform Chrono24. Collectors from these regions recorded profits, on average, of 40% since the date of purchase, collectors from the Netherlands recorded 24% returns, while the value of watches owned by German collectors gained 25%. It is interesting to note that both Switzerland and Japan are major watch-producing countries.

- Nio Inc., a Chinese electric car maker, was the best performing S&P Global Luxury stock for the week, gaining 9.6%. Company management said that Nio is planning to double its sales this year. It is currently producing six electric vehicle (EV) models and two more are planned to come out later this year.

Weaknesses

- According to Bloomberg, luxury goods sales in Korea have been decreasing this year due to high inflation and the deterioration in household income. Luxury goods sales in the first two months of 2023 reported 5%-5.8% growth compared to growth of 21%-48% reported in the same period for 2022. Another reason for a decrease in sales is South Korean tourists buying luxury goods in Japan due to a weak Japanese yen.

- The recent banking trouble in the United States and in Europe prompted the Federal Reserve to hike interest rates by 25 basis points instead of 50 basis points. This increase represents a new range of 4.75%- 5%, the highest level since October 2007. However, there is still a high risk of inflation not easing, and credit conditions could be tightened further, slowing down economic growth, and putting pressure on consumer spending.

- Faraday Future Intelligence was the worst performing S&P Global Luxury stock for the week, losing 17.6%. Shares fell sharply despite the company announcing production started for the long-awaited FF 91 Futurist car on March 29. This model will compete with high-end luxury cars like Ferrari, Maybach, Rolls Royce, and Bentley.

Opportunities

- Bernard Arnoult, LVMH’s CEO, is looking for ways to enter the luxury hotel industry in South Korea, where the demand for luxury hotels has increased since the pandemic ended. This week in Seoul, he met the Korean retail and distribution industry’s top executives to seek ways of how LVMH-owned hotel brands can be added to the Korean market. The company wants one of its hotel brands, the Cheval Blanc, well-known in Paris for its spa run by Dior, to enter the market first. The cheapest room at this hotel costs 2.6 million won ($1,989) per night.

- As a result of Russia’s invasion of Ukraine and the sanctions Europe imposed on Russia, France has had to reroute its exports away from Russia, significantly increasing shipments of champagne to the Gulf nations in 2022. According to the Comite Champagne, French exports to Turkey increased by 120% last year while the country delivered almost 1.9 million bottles to the United Arab Emirates, a 75% increase from 2021, according to Bloomberg. Champagne is a luxury item and the war in Europe prompted the region to expand and enter new markets.

- Prada announced on its LinkedIn profile this week the reinforcement of its partnership with Adobe to improve its customer experience, offering their customers the real-time personalization of its products across all digital and physical retail channels. Prada will incorporate the customer data platform suite as part of its services. Its Marketing Director, Lorenzo Bertelli, announced this as part of its corporate strategy to engage, connect and reach new clients.

Threats

- According to an article from London’s CNN, confidence in the European capital bonds market is weakening due to the write-off of $17 billion of Credit Suisse Group (CSFB) bonds (AT1 Bonds) by UBS Group as part of its takeover strategy. These kinds of bonds started to be popular in Europe in 2008 after the global financial crisis, becoming a popular form of additional protection for banks in times of crisis. However, those are higher risk bonds and $17 billion AT1 bonds were wiped from CSFB after UBS on Sunday announced a takeover with the help of Swiss National Bank for 3 billion Swiss francs ($3.25 billion), representing a 60% price discount to CSFB’s closing price on Friday.

- The banking crisis could put pressure on American and European luxury goods shoppers. Although the super-wealthy haven’t been necessarily impacted by higher inflation levels, they could be affected by the bank crisis that started in the U.S. with SVB collapsing last week. The luxury industry notoriously does well when its customers feel happy and wealthy. Leading luxury companies such as LVMH and Gucci, have become concerned about the decrease in shoppers’ interest in buying their products, as was the case in 2008 during the financial crisis. If the banking crisis worsens, the luxury goods sector could correct more than the broader market.

- Bloomberg economists are expecting personal income in the United States to weaken. They are also predicting personal spending to drop, negatively affecting the luxury sector. Data will be released on the last day of the quarter, March 31.[/responsivevoice]

Energy and Natural Resources

Strengths

- The best performing commodity for the week was tin, rising 8.79%. This was followed by the strong weekly performance of copper, lead and aluminum too, largely on the slightly dovish Federal Reserve remarks surrounding this week’s lift in interest rates by 0.25%. Fed fund futures were indicating the market expects the Fed to cut rates by year-end, although it doesn’t seem likely.

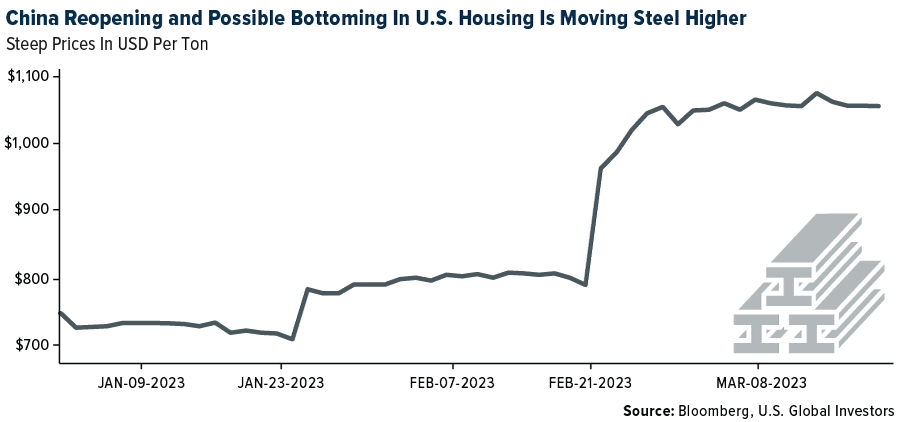

- The U.S. spot steel price increased further over the past two weeks, driven by another announced price increase, with prices up 5.5% to $1,160 per ton. Spot steel prices are now up $540 per ton, or 87% since November. Looking ahead, with lead times extended into May (and still extending), scrap prices are likely to be flat-to-higher in April, inventories at service centers still relatively lean, and underlying demand reportedly still largely healthy.

- In Europe, cement costs rose by around a third last year, while certain countries saw significantly larger rises. As a result of limited supply and outright shortages, cement prices in the U.S. are rising at a 15% annual pace. Construction contractors, who had expected the end of input-cost inflation, have instead been forced to deal with another year of escalating cement costs, or risk doing without. The largest cement producers in the world, many of which are European, can hardly believe their good fortune.

Weaknesses

- The worst performing commodity for the week was crude palm oil, dropping 10.41% on its biggest weekly slump since November, largely on the negative sentiment surrounding the banking crises. Soybean oil dropped to a 23-month low. Chinese lithium carbonate prices dropped another 5-10% as bearish sentiment persists, though hydroxide prices were only down 2% on relatively resilient demand.

- Fertilizer equities were down sharply for a second week, dragged lower by broad materials weakness brought on by the bank crises and concerns about weaker economic growth, although phosphate and potash prices were also lower on slow demand. Urea prices rebounded from last week’s decline, as U.S. spring season demand has started to emerge and UAN has stayed firm, but global ammonia prices continued lower.

- Uranium spot prices declined slightly this past week amid uncertainty in the financial markets before partially recovering as fears of a global banking crisis eased. In particular, the Sprott Trust continues to trade at a discount and has not made any significant purchases in March after being active in February.

Opportunities

- Fundamentally, copper supply issues are easing, and demand is slowly picking up, driven by China. The impacts of China’s property sector stimulus from 2022 are slowly starting to show in construction activity data for the first two months of the year. This is seen with an 8% year-over-year increase in housing completions and an improvement in housing under construction, which was down 9.4% year-over-year compared to a 50.8% year-over-year decrease in December 2022.

- It’s still hard to guess exactly how large a demand driver marine fuel can be for methanol, but it’s going to be at least a very positive contributor, potentially quite material (it can push up ammonia demand too). Methanol burns cleaner than diesel and emits fewer emissions. By the end of the decade, MAN Energy Solutions expects dual fuel engines that can use methanol to represent a low-single-digits percentage of the global ship fleet.

- The U.S. dollar could decline as the Federal Reserve’s aggressive rate-hike cycle draws to a close, which will be a “strong tailwind for commodities markets,” predicts Australia & New Zealand Banking Group Ltd. According to experts Daniel Hynes and Soni Kumari, the majority of internationally traded commodities are priced in the U.S. dollar, hence a declining dollar results in lower comparable prices for commodities. According to a March 23 report, markets are already pricing in a halt to federal funds rate rises and the potential for reductions in the second half. This year, they said, the commodity price-U.S. dollar link might reemerge, helping raw materials including gold.

Threats

- The move to alternative energy sources throughout the world hasn’t discouraged Jean Paul Prates, the leader of Brazil’s state-controlled oil giant. The leading producer of fossil fuels in South America, according to him, should maintain raising production for many years to come. Petrobras CEO Prates stated in an interview in Rio de Janeiro that “We will gain market share.” “We could be the last country in the world to produce oil,” he added. His claim of Brazil’s desire reflects Saudi Arabia’s position, which holds that expanding the use of fossil fuels is consistent with a global ambition to achieve net zero carbon emissions. Several disagree, notably the International Energy Agency, who maintains that no one should aspire for more crude output if the world is to meet its climate targets.

- China’s trade with Sub-Saharan Africa far outpaces U.S. trading relationships and that has the current administration scrambling to shore up relations with mineral rich countries that China already has a beachhead in. The U.S.-China rivalry includes a race to secure minerals that are critical to a green energy transition.

- Iron ore prices will drop to about $100 a ton by the last quarter of the year as China steel demand slows down in the second half, the Commonwealth Bank of Australia said in a note, pointing out that demand from China, as opposed to seaborne supplies, will determine prices.[/responsivevoice]

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Mask Network, rising 34.86%.

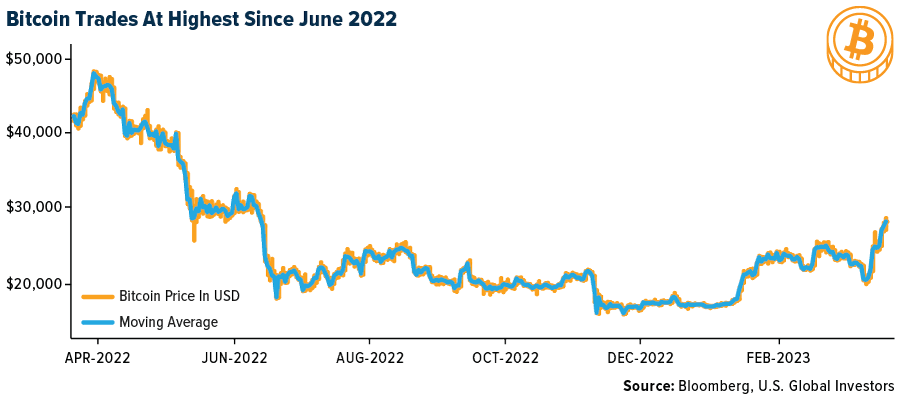

- Turmoil in the banking sector, hotter-than-expected inflation data, and renewed hopes for a dovish Federal Reserve, has Bitcoin reaching levels not seen in about nine months. Bitcoin topped $28,000 for the first time since June 2022, reports Bloomberg, and is now up more than 70% since the start of the year.

- Bombardier is significantly raising its 2025 financial targets, which come well above expectations. With significantly higher revenue forecasts ($9 billion versus prior guide of $7.5 billion) the company is driving higher EBITDA and higher free cash flow (FCF). FCF, which had been previously set at $500 million for 2025, has been increased an impressive 80% to $900 million. Leverage, as a result, is forecasted by management to be in the 2.0x-2.5x range (from 3x prior).

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Arbitrum, down 88.33%.

- Investors withdrew $375 million from crypto-focused exchange traded products (ETFs) during the past month and $147.5 million in the past year, according to data complied by Bloomberg.

- Tokens associated with crypto entrepreneur Justin Sun dropped sharply after the U.S. Securities and Exchange Commission charged him and three of his companies with offering and selling unregistered securities, as well as price manipulation. TRX, the token associated with the Tron network that Sun started, dropped around 12%, reports Bloomberg.

Opportunities

- Cryptocurrency-exposed stocks rose after Bitcoin extended its gains for a fifth consecutive session, reports Bloomberg, with the digital asset reaching levels not seen in nine months. Bitcoin is up 70% so far this quarter putting it on track for its best quarter since March 2021.

- A pair of former Jefferies Financial group executives at Crossover Markets Group have launched a cryptocurrency exchange aiming for high-frequency traders, with the backing quant investing giant Two Sigma and other firms in traditional finance and digital assets. The startup, named CROSSx, raised $6.35 million in seed rounding, writes Bloomberg.

- The forces that have re-awakened crypto prices have aroused activity in the digital-assets derivatives market too. Open interest in Bitcoin options has skyrocketed with the number of contracts rising to an all-time high in recent days, according to derivatives exchange Deribit, writes Bloomberg.

Threats

- Bitcoin pulled back from its highest price level since June and smaller cryptocurrencies slumped after the Federal Reserve’s interest-rate increase eased speculation that looser monetary policy would fuel demand for digital assets. Bitcoin dropped 3.5% after climbing to as high as $28,913, writes Bloomberg.

- A new investigation claims that Binance’s billion-dollar security protocols are being manipulated by users around the world through inside help. According to a CNBC investigation, employees and volunteers at Binance have allegedly been aiding customers in China to subvert the exchange’s Know Your Customer Controls.

- Terraform Labs co-founder Do Kwon was charged by U.S. prosecutors with orchestrating a yearslong cryptocurrency fraud that wiped out at least $40 billion in market value, reports Bloomberg. His indictment Thursday evening by the U.S. attorney’s office in Manhattan capped a dramatic day that began with the news that Kwon, already a fugitive, had been arrested in Montenegro.[/responsivevoice]

Gold Market

This week gold futures closed at $1,996.80, up $6.60 per ounce, or 0.33%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 3.72%. The S&P/TSX Venture Index came in up only 1.12%. The U.S. Trade-Weighted Dollar fell 0.56%.

Strengths

- The best performing precious metal for the week was silver, up 3.53%. Over the past two weeks, total known ETF holdings of silver dropped by more than 16 million ounces, or more than 2%, but the silver price gained over 14%. The price of gold rose as the dollar weakened for a sixth straight day, writes Bloomberg, with traders betting that the Federal Reserve’s aggressive monetary-tightening cycle is nearing an end. Data on Thursday showed U.S. initial jobless claims unexpectedly declined last week, underscoring the ongoing tightness of the labor market and complicating growing bets of Fed rate cuts.

- Evolution Mining has announced the start of underground production at its fully owned Cowal gold mine in New South Wales, Australia. The Australia-based gold mining company said that the milestone has been achieved three months earlier than the previously announced target of the June 2023 quarter.

- Gold prices could surpass the record set at the height of the Covid-19 pandemic if ongoing turmoil in the banking sector persists and global central banks downshift their interest-rate hiking cycle, according to Sprott Inc. The haven asset briefly rose above $2,000 an ounce this week for the first time in a year as a deal to buy Credit Suisse Group AG failed to calm fears over the global banking industry.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.33%. South African power challenges point to a tighter platinum group metals (PGM) market. Several miners are subject to load curtailments, often at short notice, at the request of state-owned energy operator Eskom. The industry needs power for smelting, refining and hoisting, meaning less power availability and lower refined volumes, all else equal.

- First Majestic Silver announced it is “temporarily” suspending mining activities and reducing the workforce at its Jerritt Canyon mine, effective immediately, due to a combination of ongoing challenges at the mine which include contractor inefficiencies, inflationary cost pressures, lower-than-expected head grades, and multiple extreme weather events affecting northern Nevada.

- Fortuna Silver reported updated mineral reserves and resources as of December 31, 2022; gold and silver reserves declined year-over-year by 14% and 22%, respectively. Combined proven and probable reserves were reported at 2.8 million ounces gold and 20.1 million ounces silver versus reserves at December 31, 2021, of 3.1 million ounces gold and 25.9 million ounces silver.

Opportunities

- Franco Nevada is seeing a lot of opportunities to add assets to its portfolio as the cost of funds for developers continues to increase. The team is looking at mostly mid-sized deals (under $400 million) in the precious metals space (both primary gold producers and by-product precious metals from other producers), with project financing type transactions currently trending in the market. Franco’s preference is for precious metals deals, but it will consider a non-precious metals deal if the deal makes sense.

- According to Bank of America, sensitivity to the gold price for producers is largely driven by: 1) the cost base, i.e. higher cost producers offer more torque as they benefit from the most margin expansion in an upswing in gold prices, and 2) financial leverage; producers with higher levels of debt (i.e. enterprise value with a higher component of debt) also offer more torque to the gold price.

- Joseph Sitch is co-CIO of the Global Multi-Strategy Fund alongside Victor Smorgon’s chief executive Peter Edwards. Joseph has led the $200 million fund to a net return of over 40% a year, including an outsized 102.3% in financial 2021, and 47.5% in the year ended last June 30. Joseph’s reason for targeting Australian-domiciled miners is they are not as exposed to a stronger U.S. dollar, meaning domestic miners should remain profitable during periods when the greenback is weighing on U.S. dollar gold prices, but the Australian currency is holding up. The fund’s near-10% exposure to Australian gold has paid off as the commodity price hit a 12-month high of US$2,009 an ounce this week, and more importantly, the Australian dollar gold price topped $3,000 for the first time. Mr Sitch believes those prices are still not being factored into the valuations of locally listed gold companies.

Threats

- Since Sibanye’s investor day, where management outlined its medium- to longer-term expectations, it has largely missed its production and unit cost guidance in all three key operating divisions (SA gold, SA PGMs and U.S. PGMs). The poor operating performance has been attributed to issues such as load shedding, industrial action, skills shortages, flooding, safety stoppages and operational challenges. Bloomberg reported blackouts have reduced the size of the South African economy by almost a fifth since Eskom started rationing electricity around 2008. The IMF reduced its forecast for growth in South Africa to 0.1% from 1.2% this week, largely due to the power outages.

- According to Bank of America, royalty and streaming (R&S) stocks offer the least sensitivity to rising gold prices owing to the limited operating costs associated with the business model (no cost on royalties, typically low fixed costs on streams).

- RBC reduced its PGM basket price forecasts by 20% between 2023-2030 to reflect a faster than previously expected decline in ICE vehicle sales. RBC, however, expects PGM markets to shift back to modest deficits in the second half of the year, as vehicle sales recover from current levels and as supply risks persist. The group sees palladium and rhodium moving to perpetual surpluses from 2025.[/responsivevoice]

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/30/22):

Fortuna Silver Mines

Franco-Nevada Corp.

Newmont Corp.

Sibanye Stillwater Ltd.

Bombardier Inc.

Air France-KLM

AP Moeller-Maersk

LVMH Moet Hennessy

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries.