Is This the End of Globalization?

Globalization in all its forms, from social to economic to political, has been on the rise since about the 1970s, and I genuinely believe it’s had more benefits than drawbacks on average. Although it may seem like an April Fool’s joke right now, the real cost of finished goods has trended down over the decades, and there’s evidence that the world has become more peaceful, with fewer wars and war-related deaths than in years past.

It goes without saying that the events of the past two years, including the U.S.-China trade war, Covid pandemic and now the Russia-Ukraine war and international sanctions, have challenged the merits of globalization. Inflation is at a 40-year high and Western Europe is facing a serious energy crisis, prompting policymakers and multinational companies to rethink supply chains that crisscross the globe and sourcing materials and labor from unfriendly jurisdictions.

Russia’s invasion of Ukraine “has put an end to the globalization we have experienced over the last three decades,” says Larry Fink, cofounder and CEO of BlackRock, the world’s largest asset management firm. In this week’s letter to shareholders, he adds that “companies and governments will also be looking more broadly at their dependencies on other nations” as a result of not just the war but also the pandemic. “Nearshoring,” the practice of moving business operations closer to home, could benefit Mexico, Brazil and even the U.S.

China Exporting Lockdowns

An important country Fink does not mention is China, but it’s key to understanding the consequences of unchecked globalization. China has long been the world’s factory. Of the 10 busiest seaports in the world, six are in the Asian country. An estimated one-third of global shipping passes through the South China Sea.

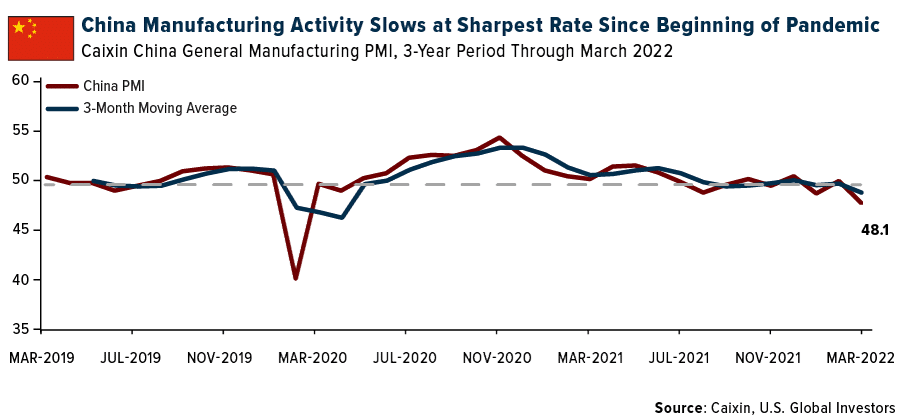

Today we’re seeing the risks of depending so heavily on one country for the movement of goods. China is experiencing an unexpected surge in Covid cases, and since it has a zero-Covid policy, it’s shut down businesses, factories and warehouses, particularly in Shanghai, a major port city that’s home to more than 26 million people. These lockdowns were reflected in the March reading of the Caixin China General Manufacturing PMI, which showed manufacturing activity slowing at the sharpest rate since the beginning of the pandemic two years ago.

China was one of six countries whose Manufacturing PMIs were below the key 50.0 mark in March, the others being Turkey, Mexico, Myanmar, Kazakhstan and, with a reading of 44.1, Russia. This was enough to drag down global factory activity, as measured by the JPMorgan Global Manufacturing PMI, to an 18-month low of 53.0.

Expect Higher Shipping Costs

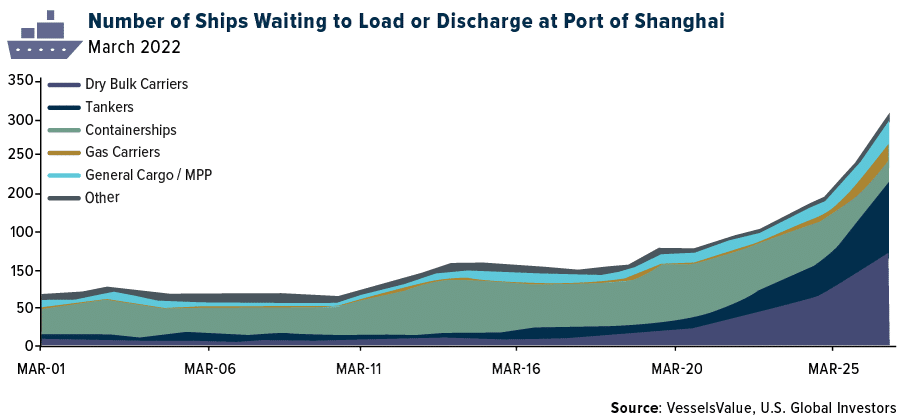

Even though the Port of Shanghai, the world’s busiest port, has reportedly remained open, a shipping logjam is worsening as trucks are not available to move product. According to data from VesselsValue, port congestion is at an all-time high, with the number of ships waiting to load and unload going parabolic.

Shipping giant Maersk warned clients this week that the lockdowns will likely result in even higher shipping costs, writing that “there will be longer delivery times and a possible rise in transport costs such as detour fees and highway fees.” These extra fees will, in turn, be passed down the supply chain to the end consumer, who’s already having to deal with rampant inflation.

Gold and Silver Look Attractive

With shipping rates on the rise, I would be taking a long look at container shipping stocks, including Maersk. The group generated record profits last year as rates tripled on a pandemic-related demand explosion. Global disruptions, from the ongoing pandemic to war in East Europe, means that rates may stay elevated for some time longer.

Precious metals, including gold and silver also continue to look attractive. As of yesterday’s close, gold posted its best quarter since June 2020 on safe-haven demand.

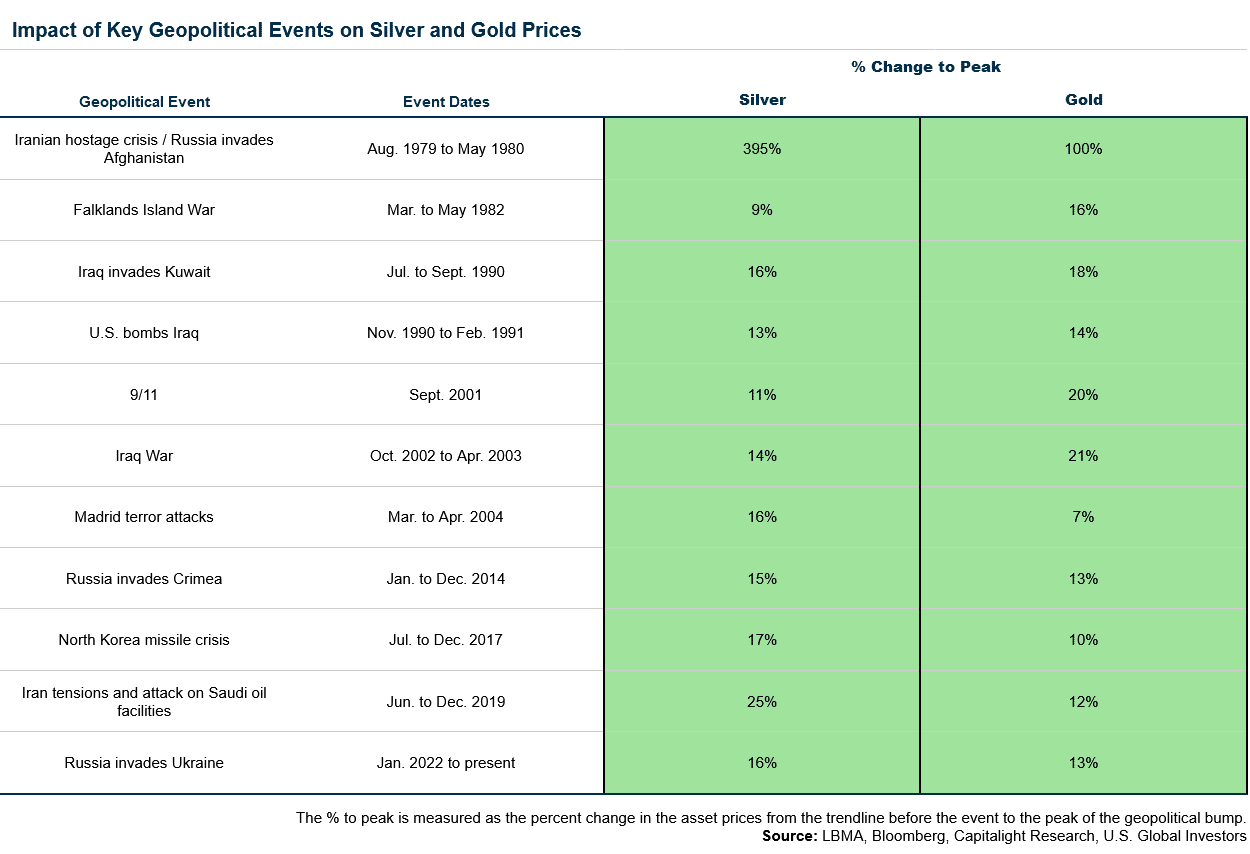

A report by Capitalight Research this week included a compelling table of gold and silver’s performance during select geopolitical crises. The two metals advanced in every instance going back to 1979-1980’s double-whammy Iranian hostage crisis and Russia’s invasion of Afghanistan. In that case, gold doubled in price while silver increased as much as 395%.

Although returns haven’t been as strong during later events, they’ve been in the respectable double digits, highlighting the metals’ haven status. Since Russia invaded Ukraine in January, silver has increased 16%, gold 13%.

Analysts at Capitalight say “that if the current crisis escalates to nuclear/chemical warfare that the price of gold and silver could double.” No one wants to see that, obviously, but I believe it’s only smart to have a hedge in case of such an event.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 0.12%. The S&P 500 Stock Index fell 0.05%, while the Nasdaq Composite rose 0.65%. The Russell 2000 small capitalization index gained 0.47% this week.

- The Hang Seng Composite gained 3.03% this week; while Taiwan was down 3.26% and the KOSPI fell 7.98%.

- The 10-year Treasury bond yield fell 10 basis points to 2.372%.

Airline Sector

Strengths

- The best performing airline stock for the week was SAS, up 16.2%. European airline bookings strongly rebounded in the week, after declining for two weeks following the invasion of Ukraine. Total weekly bookings reached their highest level since the beginning of the pandemic, while both intra-Europe and international average fares have recovered to 2019 levels. Intra-Europe net sales increased by 20 points to -31% versus 2019, with 18% week-on-week growth. International net sales were up by 19 points to -30% versus 2019, with 13% growth this week.

- Last week, Airlines for America’s Board of Directors sent a letter to the White House urging for the removal of both pre-departure COVID testing and the federal mask mandate. The letter was signed by the heads of 10 major commercial and cargo airlines. In the letter, the companies state that these restrictions are no longer aligned with the realities of the current epidemiological environment.

- Air Canada’s projected corporate travel in 2023 could recover to 80% of 2019 levels, according to the company’s Investor Day presentation on March 30. Leisure demand is expected to surpass 2019 levels by that time.

Weaknesses

- The worst performing airline stock for the week was Air New Zealand, down 9%. Air France-KLM announced a surcharge for long-haul ticket prices given soaring fuel costs, as per media reports. The charge was effective from March 25. For KLM, the charge varies between destination and cabin class, and would add EUR40 to an economy flight between Amsterdam and New York and EUR100 for business class. The company has a fuel hedge ratio of 72% in the first quarter, falling to 28% in the fourth quarter.

- Jet fuel prices have climbed by 86% year-to-date. Historically, airlines have passed on around half of fuel price increases through ticket fares over time. This year will be more challenging, though, as demand is still recovering and there is potential for excess capacity in Europe.

- March global airline scheduled capacity was reduced another 1% this week bringing it down to 69% recovered to 2019. APAC cut March another 2% putting the region at 54% recovered while Europe pulled in 1% putting the region at 70% recovered. April scheduled capacity was cut 3% to 74% and May also saw a 3% cut in capacity, with Europe’s 5% cut the main driver though most other regions also saw 2%-3% cuts.

Opportunities

- U.S. airlines’ trailing seven-day website visits improved this week by 14% versus 2019. This week, Southwest Airlines’ trailing seven-day website visits stepped up 20% versus 2019 (compared to up 9% last week) primarily due to its St. Patrick’s three-day sale from March 15-17, which featured flights from as low as $44 one-way.

- Southwest debuted its widely broadcasted new fare category dubbed “Wanna Get Away Plus” that will go on sale in June. The new fare category will allow same-day changes without paying a fare difference and the ability to transfer unused credits to another traveler.

- There are encouraging signs of easing travel restrictions with notable developments in Asia. Singapore announced its border reopening to vaccinated travelers as of April 1, and Hong Kong will lift flight bans on nine countries on the same day. However, China and Japan remain under harsh restrictions.

Threats

- System net sales modestly stepped back for the first time this year to -16.6% versus 2019 for the week, compared to down -15.4% last week. Total volumes fell to -14.0% but pricing momentum continued with system pricing now at -3.1% versus 2019. While international volumes and pricing were steady week-over-week, domestic volume improvement took a pause.

- Last week, bookings through small travel agencies jumped above 2019 levels for the first time, but this week there was a slight deceleration versus 2019. However, pricing continues to improve in all corporate channels with domestic small corporate pricing now above 2019 levels. In terms of leisure bookings, domestic leisure volumes stepped back to -6.1% versus 2019, but pricing improved up 7.9%.

- European airlines will find it more challenging to pass on higher fuel costs this year, given the inflation impact on consumers and plenty of supply. Around one-third of the increase in fuel costs is passed on in higher fares, driving estimated 2022 revenue up by 3% on average and EBITDA down by 21%. European airlines are far more exposed to fuel prices than before the pandemic, with hedging coverage of 50% on average this year, well below pre-crisis levels.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was Russia, gaining 11.6%, however the Moscow Stock Exchange remains closed to foreign investors. The best performing country in Asia this week was Pakistan, gaining 3.7%.

- The Russian ruble was the best performing currency in emerging Europe this week, gaining 20.72%. The Philippine peso was the best performing currency in Asia this week, gaining 1.0%.

- Eurozone Manufacturing PMI remains strong. The S&P Global Eurozone Index was reported at 56.5 in March, below the February reading of 57.0 but above the 50 level that separates growth from contraction.

Weaknesses

- The worst relative performing country in emerging Europe for the week was the Czech Republic, gaining 2.0%. The worst performing country in Asia this week was Taiwan, losing 0.29%.

- The Romanian leu was the worst relative performing currency in emerging Europe this week, gaining 0.64%. The Pakistani rupee was the worst performing currency in Asia this week, losing 1.06%.

- China Manufacturing PMI and Service PMI both crossed below the 50 level that separates growth from contraction. Manufacturing PMI fell to 49.5 in March from 50.2 in February. The Service PMI declined to 48.4 from 51.0. In emerging Europe, Manufacturing PMI in Russia fell deeper into contractionary territory. Manufacturing PMI in Turkey also fell below the 50 level in March.

Opportunities

- The slump in China’s home sales deepened in March despite recent policy support. Bloomberg reported sales for the country’s 100 largest property firms fell 53% year-over-year in March, the steepest drop this year. However, March sales increased 27% month-over-month from February, which may be an early sign that the easing of regulations on the property sector may gradually lead to a recovery.

- On Friday, Chinese tech stocks rallied premarket on news that authorities in China are preparing to give U.S. regulators full access to auditing reports of the majority of the 200-plus companies listed in New York as soon as mid-this year. This week, the SEC added more names to the list for potential de-listing, including Baidu. In 2020, Chinese firms with U.S.-listed shares were given three years to comply with the rules to have more disclosures. If China allows companies to release more information as required by the SEC, technology stocks may rally, avoiding de-listing from U.S. stock exchanges.

- This week’s talks over Russia and Ukraine were more constructive and brought some positive surprises. Russia said to withdraw some fighters from Kyiv and near the capital region. The corridor was also opened to allow people from Mariupol to leave the city which is still under heavy bombarding. On Monday and Tuesday, talks between Russia and Ukraine were held in Turkey and on Friday they resumed via teleconference. A peace agreement is long awaited by the people of Ukraine and the financial markets.

Threats

- China released weaker Manufacturing PMI data in March, and we may see further declines in the months ahead due to the worsening COVID situation in the mainland. Shanghai, a city of 26 million people, was put on lockdown this week due to spiking cases. The city is home to the world’s largest container shipping port, contributing 3.8% to Chinese GDP.

- Inflation keeps moving higher. Eurozone inflation spiked to 7.5% versus the expected 6.7% and February’s 5.8%. In Poland, prices increased 10.9% year-over-year, above the expected 9.8% increase and the prior month’s 8.5%. Inflation will continue to rise, and central banks will have to continue hiking rates.

- According to the Institute of International Finance, Russia is set to erase 15 years of economic gains by the end of 2023 after its invasion of Ukraine. The economy is expected to contract 15% in 2022, following by decline of 3% in 2023, leaving GDP where it was about 15 years ago.

Energy & Natural Resources

Strengths

- The best performing commodity for the week was iron ore, up 8.94%. Iron ore futures rose as a pickup in industrial profits in China boosted the outlook for restocking demand next month, even as a resurgence in virus cases prompted lockdowns in some cities. Chinese industrial companies’ profits grew at a faster pace in the first two months of the year, as earnings at energy and raw materials enterprises rose on higher commodities prices, official data showed. Investors are expecting steel consumption to improve seasonally from April and after the virus-related restrictions are lifted.

- To help the European Union (EU) replace imported Russian gas, the U.S. will aim to supply an incremental 15 bcm of liquified natural gas (LNG) by the end of 2022 and 50 bcm by 2030. The U.S. has already re-directed a material amount of LNG to Europe with 60% of exports on track to reach the EU versus 30% in 2021, with utilization largely “maxed-out.” Longer-term, the U.S. could lead LNG development with 62 million tons per year of capacity expansion by 2025.

- Chemical volumes continue to improve. Chemical railcar shipments for the week were up 8.4% year-to-year and shipments year-to-date are 9.9% higher. March shipments are 13.7% higher year-to-year.

Weaknesses

- The worst performing commodity for the week was crude oil, down 12.60%. Oil slumped as Moscow said it would sharply cut military operations near the Ukrainian capital of Kyiv, after negotiators from Ukraine and Russia wrapped up discussions in Turkey aimed at de-escalating the war. West Texas Intermediate (WTI) erased earlier gains to trade down as much as 5% in New York, before then paring some of those losses. Russia’s defense minister said his country will cut military activity near Kyiv and Chernihiv. The country’s negotiator said a meeting between Presidents Putin and Zelensky is possible, according to Tass.

- Russian tankers carrying oil chemicals and oil products are increasingly concealing their movements, reports Bloomberg, a phenomenon that some maritime experts warn could signal attempts to evade unprecedented sanctions prompted by the invasion of Ukraine. Last week, there were at least 33 occurrences of so-called “dark activity” — operating while onboard systems to transmit their locations are turned off – by Russian tankers, said Windward Ltd., an Israeli consultancy that specializes in maritime risk using artificial intelligence and satellite imagery.

- Nickel traded lower in extremely illiquid trading in London this week, leaving the market stuck in limbo once again in the wake of this month’s massive, short squeeze, reports Bloomberg. Just 420 contracts changed hands in the first four hours of trading, as prices slumped to track overnight losses on the Shanghai Futures Exchange. Nickel, which is used in stainless-steel and electric-vehicle batteries, has dropped about 10% over two days, the article continues.

Opportunities

- Bank of America had the opportunity to hear from chemical industry executives as well as consultants about the path to “net zero” and expectations for the years ahead. Reducing emissions is clearly a key priority for major chemical companies, with a consensus among senior executives that a predictable and realistic regulatory framework as well as carbon trading schemes are needed to achieve 2050 targets. For now, the path forward is different for each company, with some focusing on using renewable energy, while others are highlighting the need for small modular nuclear reactors.

- Front month Henry Hub gas prices rallied 15% higher last week to $5.50 per MMBtu, on tight inventories (17% below the five-year normal). This near-term tightness, coupled with growing optimism around potentially more supportive domestic policy and long-term demand growth from additional LNG exports bodes well for future pricing. Europe’s transition away from Russian gas adds significant demand to an already tight global LNG market while existing U.S. export facilities already run at close to maximum capacity.

- Fertilizer prices continue to spike to records as Russia’s invasion of Ukraine puts a massive portion of the world’s fertilizer supply at risk, adding to concerns over soaring global food inflation. A gauge of prices for the nitrogen fertilizer ammonia in Tampa surged 43% to $1,625 per metric ton Friday, a record for the 29-year-old index. Production outages and tight global supply are driving the jump, according to a note from Bloomberg Intelligence.

Threats

- Oil retreated as China’s worsening virus resurgence raised concerns about demand in the world’s biggest crude importer, and as worries spread over a broader economic slowdown. WTI and Brent futures fell more than 4% each after authorities in Shanghai said they will lock down half of the city in turns for mass COVID testing. Growth risks from inflation and tightening monetary policy also hit sentiments, pushing down sovereign bonds. Goldman cut its oil price forecast for the second half of this year by $10 to $125 a barrel.

- Not to be left behind in the scramble to get a piece of the inflation pie, the Panama Canal Authority proposed a comprehensive restructuring of its toll system on Friday. Although the new toll system may be less complex, the net effect is on average tolls to rise by 8% for certain sectors, according to Bloomberg. The new system is based on vessel capacity and fixed tariffs per transit. Initial analysis suggests car carrier, chemical and LNG tankers and vessels carrying bulks like coal or grain would impact market prices by up to 0.7%. However, container ships, which are the canal’s largest customer, could be impacted by up to 8%. These containers carry lots of retail products within and its likely the added costs will show up on the price sticker.

- While the grain markets are focused on near-term supply issues resulting from the Russia/Ukraine conflict, the backwardation in grain futures could be overlooking the potential for significantly lower global crop production in 2022, as many regions of the world will not be able to afford or even access fertilizer. While the price quadrupling of all three primary fertilizer nutrients in the last 18 months is not an affordability issue for large U.S. and Brazilian farms, much of the world, particularly for niche crops in Africa, Central America, and Southeast Asia, will not have access or be able to afford fertilizer this year.

Domestic Economy & Equities

Strengths

- Continuing claims were reported at 1,307,000, better than consensus that called for 1,355,000 and below the prior week’s downwardly revised 1,342,000. This was the lowest weekly reading for this measure since late 1969.

- Preliminary S&P Global Manufacturing PMI was reported at 58.5, above the expected reading of 56.6 and above February’s 57.3. Service PMI improved as well, coming in at 58.9, above the expected reading of 56.0 and above February’s 56.5.

- Nielsen Holdings, an information service company, was the best performing S&P 500 stock for the week, gaining 22.67%. Shares gained more than 20% on Tuesday after an announcement was made that the company will be acquired by Brookfield, Elliott at $28 per share.

Weaknesses

- Weekly initial jobless claims came in at 202,000, above consensus for 195,000 and last week’s upwardly revised 188,000.

- Personal spending was reported higher by just 0.2% month-over-month, below forecasts for a 0.7% monthly rise. However, January spending was revised up to 2.7% month-over-month versus the prior 2.1% pace.

- Embecta Corporation, a medical equipment provider, was the worst performing S&P 500 stock for the week, losing 24.88%. Shares sold off in the first day of trading after the company was spun off of Becton Dickinson.

Opportunities

- The White House announced a massive release from America’s Strategic Petroleum Reserve (SPR), potentially 1 million barrels of oil every day for six months, in order to combat high crude prices and increase global supply. Overall, around 180 billion releases would be the largest in SPR’s history.

- Bloomberg economists predict initial jobless claims to decline further next week when data comes out on April 7. Jobless claims are expected to fall to 200,000 from 202,000. Continuing claims will likely fall as well.

- Service PMI should remain unchanged above the 50 level when the data comes out next week on April 5. Bloomberg economists predict the index to remain at 58.8.

Threats

- Ed Hyman from Evercore ISI believes that GDP will decline to 3% in 2022. GDP could slow enough to be reflected in weaker demand. Last year, the Untied States economy grew by 5.5%.

- Russian attacks in Ukraine have continued despite Russia’s pledge earlier this week to scale back its campaign in parts of the country. Reuters reports that Ukrainian President Zelensky said on Friday that Ukrainian forces are preparing for new Russian attacks in the southeast region.

- Next week, minutes from the last FOMC meeting may reveal banks’ desire to hike rates. Federal Reserve Chairman Jerome Powell said, “Inflation is much too high” and that the Fed will take “necessary steps” to address it. The mid-March rate increase was the first in more than three years. Powell noted that rate rises could go from traditional 25 basis points moves to more aggressive 50 basis points moves, if necessary.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Digital Fitness, rising 1,263.81%.

- Cryptocurrencies are rapidly becoming more mainstream within the Canadian financial landscape. Regulators in the country have remained fairly proactive in their approach and have managed to tweak the existing laws to accommodate crypto and Web 3.0. As for Alberta, the oil-rich Canadian province has welcomed many Bitcoin miners after the mass exodus from China, and many of them found a home there due to the abundance of natural gas and related infrastructure.

- VanEck predicts that Bitcoin would be worth at least $1.3 million if considered a global reserve currency, writes CryptoSlate. The ongoing war in Ukraine has firmly placed the importance of assets like Bitcoin and gold in the front seat of the global financial system. VanEck believes that under an extreme scenario where gold or Bitcoin becomes the reserve currency of the world, the value of the digital asset could fall between $1.3 million to $4.8 million.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Geojam Token, down 67.70%.

- Bitcoin’s latest rally has brought the digital asset to technically overbought levels, based on its RSI score of 71. Assets are considered overbought if its relative strength index (RSI) crosses above 70 and oversold if it falls below 30, writes Bloomberg. Overbought levels tend to bring out projections for short-term breathers.

- The SEC is pressing firms to account for cryptocurrency assets they’re holding on behalf of customers on their balance sheets. A growing number of crypto trading platforms are safeguarding digital assets for their users and maintaining the cryptographic keys necessary to access the tokens. However, platforms aren’t disclosing those activities, which can increase the chances of financial loss in the event that assets are stolen or misused to investors, write Bloomberg.

Opportunities

- Coinbase Global is set to close the acquisition of 2TM, a Brazilian holding that controls Latin America’s largest crypto brokerage Mercado Bitcoin by the end of April. The talks, which began last year, are part of Coinbase’s push to broaden operations in an increasingly competitive market, reports Bloomberg. Brazil’s crypto unicorn would give Coinbase the leverage needed to secure a market leader position in Latin America.

- The Texas cryptocurrency industry is lobbying state lawmakers to introduce legislation that would eliminate taxes on sales of flared gas that’s used to mine Bitcoins, seeking to reduce costs and lure more miners to the Lone Star State, writes Bloomberg. The Texas Blockchain Council, the crypto’s lobbying arm, wrote a draft bill that it hopes will be introduced in the next legislative session.

- The Ukrainian government raised more than $600,000 through an NFT sale that will be used to rebuild museums, theaters and other cultural institutions destroyed since Russia’s invasion, writes Bloomberg. Ukrainian Meta-History NFT Museum sold 1,282 artworks on its first day of sales, raising 190 Ether cryptocurrency tokens for the Ministry of Digital Transformation of Ukraine.

Threats

- Hackers stole about $600 million from a blockchain network connected to the popular Axie Infinity online game in one of the biggest crypto attacks to date. The hacker attacked the Ronnie bridge which lets people convert tokens into ones that can be used on another network, according to Bloomberg. The incident that drained 173,000 Ether and $25.5 million USDC in two transactions happened on March 23 but wasn’t discovered until six days later.

- Banks should be careful before getting involved in trading Bitcoin-linked futures and other crypto-derivative products, acting Comptroller of the Currency Michael Hsu said. Big banks, including Goldman Sachs, are looking to make markets in crypto-linked derivative products for their clients even though global financial regulators are still evaluating capital levels that would be needed to safely manage crypto exposure, writes Bloomberg.

- Bored Ape Yacht Club, the largest NFT project by market cap, has confirmed its Discord channel was compromised by a hacker who infiltrated Yuga Labs’ Discord channel, which hosts member of the Bored Ape Yacht Club. The hacker posted a phishing link masquerading as a stealth NFT mint into the Mutant Ape Kennel club channel, according to Bloomberg.

Gold Market

For the week going into the close, gold futures were at $1926.50, down $33.30 per ounce, or 1.70%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 1.62%. The S&P/TSX Venture Index came in up 1.25%. The U.S. Trade-Weighted Dollar fell 0.22%.

| DATE | EVENT | Actual | Prior– | Survey |

|---|---|---|---|---|

| Mar-28 | Hong Kong Exports YoY | 8.9% | 0.9% | 18.4% |

| Mar-29 | Conf. Board Consumer Confidence | 107.0 | 107.2 | 105.7 |

| Mar-30 | Germany CPI YoY | 6.2% | 7.3% | 5.1% |

| Mar-30 | ADP Employment Change | 450k | 455k | 486k |

| Mar-30 | GDP Annualized QoQ | 7.0% | 6.9% | 7.0% |

| Mar-31 | Initial Jobless Claims | 196k | 202k | 188k |

| Mar-31 | Caixin China PMI Mfg. | 49.9 | 48.1 | 50.4 |

| Apr-1 | Eurozone CPI Core YoY | 3.1% | 3.0% | 2.7% |

| Apr-1 | Change in Nonfarm Payrolls | 475k | 431k | 678k |

| Apr-1 | ISM Manufacturing | 59.0 | 57.1 | 58.6 |

| Apr-4 | Durable Goods Orders | -2.2% | — | -2.2% |

| Apr-7 | Initial Jobless Claims | 199k | — | 202k |

Strengths

- The best performing precious metal for the week was gold, but still off 1.70%. Seven out of the top 10 gold producers beat analysts’ normalized earnings per share (EPS) expectations for fourth quarter 2021, according to an assessment by S&P Global Market Intelligence. The best quarterly performer among 10 selected top gold miners was Saudi Arabian Mining Company, with actual fourth-quarter 2021 EPS 33.9% higher than S&P Capital IQ mean consensus estimates. Saudi Arabia’s state miner reported a record net profit of 5.23 billion riyals for 2021, after two years of losses.

- Total known ETF holdings of gold surged 5.30% in March to over 105.7 million ounces with the onset of the Russian invasion of Ukraine and are up 8.06% in total for the first quarter of 2022. Sales by the U.S. Mint of American Eagle gold coins surged 74% to 155,500 ounces in March compared to February and noted annual year-over-year sales were up 3.5% in the first quarter.

- Polyus Finance PLC, the U.K. finance arm of Russian gold miner Polyus PJSC, said on Wednesday that the Bank of New York Mellon confirmed the release of the payment of the main amount and coupon for Eurobond due March 28, reports MarketWatch. The Russian gold miner said it has the intention to comply with its debt obligation in time.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.07% and back to pre-Ukraine invasion levels. Pure Gold Mining Inc. said that it is seeking additional financing in the next 30 days to fund operations and service interest on its debt, and that it requires around $50 million in external financing over the next six months. The company said that if the additional financing were not received in the short term, it would not be able to meet its obligations, resulting in a default.

- Barbara (SBM) dropped as much as 4% after its fiscal year 2022 gold guidance for its Simberi operations in Papua New Guinea missed analysts’ expectations. SBM sees full year gold production of 275,000 to 290,000 ounces. The miner expects Simberi to produce 25-30,000 ounces of gold at an AISC A$3,200-A$3,600 per ounce. The target falls short of consensus expectations for 38,000 ounces at A$1,886 per ounce.

- Sibanye Stillwater slid as much as 8.6%, the most in over a month, as platinum and palladium prices dropped. The stock was downgraded to “hold” by HSBC as a result.

Opportunities

- Negotiations with the Kyrgyz government over Kumtor continue to move forward, following reports over the last several months; however, a final agreement is not done yet. Any deal may include the cancellation of 77 million Centerra Gold shares (26%) that the Kyrgyz government controls.

- Although a sharp slowdown in global growth would be a temporary headwind for mining equities, the commodity cycle will not die until supply growth comes, and that is years away, Jefferies says. The U.S. bank expects the mining sector to continue to materially outperform the market, driven by an expansion of what are currently extremely low price-to-earnings ratios. “Our base case assumption is that commodity markets will enter a demand soft patch soon, but we believe the risk to this is increasingly to the upside. The best idea, in our view, is to stay long and ignore the volatility, if possible,” Jefferies says.

- The gold industry is betting that the blockchain will help to keep illicit bullion bars out of the international market. The London Bullion Market Association (LBMA) and World Gold Council (WGC) are developing a digital system to track gold through the supply chain, the organizations said in a joint statement on Monday. Using a blockchain-backed ledger, the Gold Bar Integrity Program will capture the transaction history of bullion from mine to vault, they said.

Threats

- Global mining capital expenditure is at prior recessionary levels when adjusted for the size of the industry today and remains far below the peak levels of 2011-2013 despite record-high prices for most mined commodities and strong balance sheets, Jefferies says. The U.S. bank attributes this to geopolitical risks, a rising cost of capital, ESG constraints, a lack of quality projects, the recognition that supply growth kills prices and pressure from shareholders to use cash for capital returns.

- Traders have priced in a full 200 basis points (bps) of additional interest rate hikes in 2022. According to Bloomberg, the shift came after an economist at Citigroup predicted that multi-decade high inflation would trigger the Federal Reserve to boost its rate hikes to 50 bps at each of the next four meetings. Consumers’ long-run inflation expectations were last at 3% in March, as measured by the University of Michigan, relative to current one year inflation expectations of 5.4%.

- Kinross previously reported the suspension of its Russian operations on March 2. The potential monetization of this portfolio may enable the company to realize economic value and provide closure to Kinross’ uncertain long-term business outlook in-country. According to The Fly, Kinross is in exclusive talks with Fortiana Holdings, but it is unclear what risks and challenges may be associated with this divestiture plan under current sanction conditions, and Kinross notes that any divestiture agreement would require Russian government approval.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2021):

Air Canada

Air France

Southwest Airlines

AP Moller-Maersk A/S

St. Barbara Ltd.

Sibanye Stillwater Ltd.

Centerra Gold Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Europe 350 Index is a stock index of European stocks. It is a part of the S&P Global 1200.

Basis points (BPS) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument