Is Europe Changing Its Tune on Nuclear Power?

Winter is coming for Europe, and energy prices are soaring as international sanctions on Russia curb the supply of natural gas...

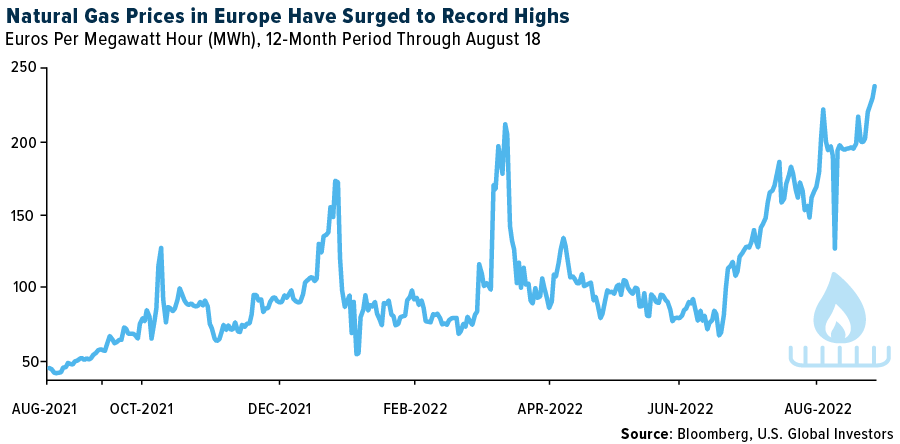

Winter is coming for Europe, and energy prices are soaring as international sanctions on Russia curb the supply of natural gas, on which many European Union (EU) countries have increasingly become dependent. Continental gas spot prices and futures have already hit record highs, and this week, the massive Russian gas provider Gazprom warned that prices could surge a further 60% by the chilly winter months.

As I’ve pointed out before, this is a short-term crisis exasperated by Europe’s long-term climate agenda.

Similar to investing, diversity is key, and I believe nuclear should be part of the mix along with renewables and traditional sources of electricity.

Fortunately, some European governments are coming around to the same realization. Germany had plans to close its three remaining nuclear reactors by the end of this year, but due to the anticipated winter energy crisis, the country now allegedly will keep them operating. France, where nuclear already provides 70% of electricity generation, will build six more reactors and extend the lifetime of some existing plants. The United Kingdom wishes to boost its nuclear power from 16% of all electricity generation to 25% by 2050.

European Wind and Solar Replacing Nuclear Capacity, Not Fossil Fuels

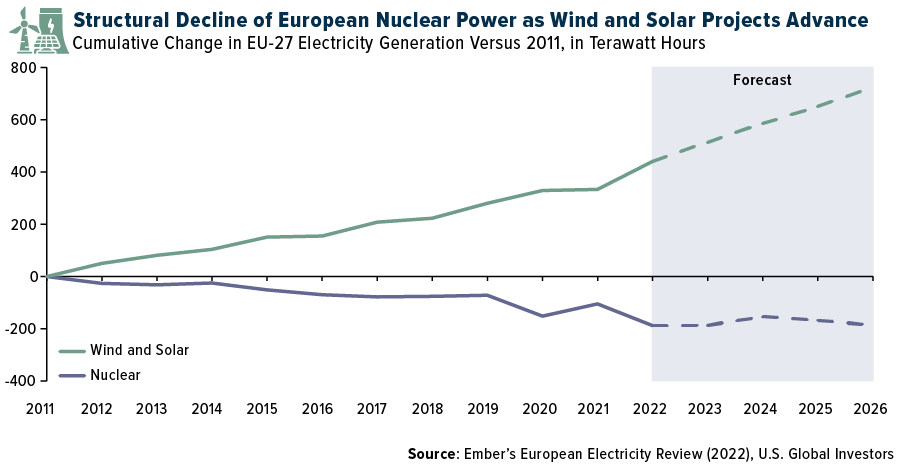

This would mark a welcome reversal of current trends. Globally, nuclear energy as a share of total global electricity production has been steadily declining for close to 30 years, from a high of 17.44% in 1996 to under 10% today.

Take a look at the chart below, courtesy of Ember, a London-based energy think tank. New wind and solar capacity in Europe has expanded rapidly, and is forecast to continue doing so, to the detriment of nuclear power. According to Ember, “over 75% of the growth in wind and solar power output in 2022 will replace nuclear output, not fossil fuels,” which is clearly counterproductive to the EU’s mission of achieving net zero carbon emissions.

Among the Safest Sources of Energy

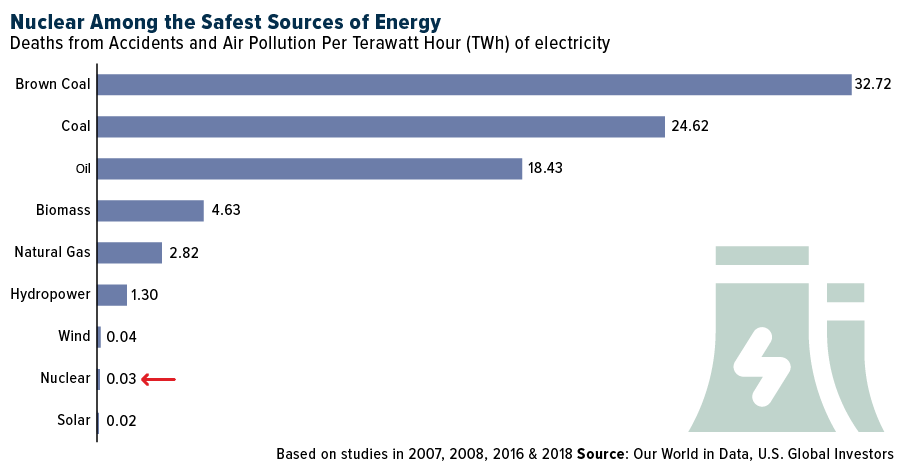

To be clear, nuclear power emits zero greenhouse gases. In fact, according to numerous studies, nuclear ranks somewhere in between wind and solar in terms of its safety to not just workers but also surrounding communities. Even when you factor in the tragic disasters at Chernobyl in 1986 and Fukushima in 2011, nuclear causes an estimated 0.03 deaths per terawatt hour (TWh). That’s 94 times fewer deaths than what natural gas is estimated to cause due to accidents and emissions and over 1,000 times fewer deaths than what is believed to be caused by lignite, or “brown coal,” the lowest grade of coal.

This is where nuclear power is very much like commercial flying. Public opinion of both industries is often influenced by high-profile, though exceedingly rare, accidents, even though flying is statistically the safest form of long-distance travel.

That’s not to say nuclear is risk-free, of course. There’s mounting fear right now that Europe’s largest reactor, in Zaporizhzhia, Ukraine, could be damaged in the ongoing conflict between the country and Russia, which would result in a “technological disaster,” warns Russia’s Security Council secretary.

Hotter-than-average temperatures this summer have also been a challenge for some European power plants. This week in France, electricity output had to be reduced at a number of facilities because the temperatures of the Rhône and Garonne rivers are too high to sufficiently cool the reactors.

A Crisis Full of Opportunities

I don’t speak Japanese, but I’ve read before that the word crisis is written by combining the symbols for danger and opportunity.

This is certainly a precarious situation for Europe. Germany, its largest economy and the most dependent on Russian gas, faces a potential recession if supply continues to drop. An economic pullback of this magnitude could spread across the continent and even hop the Atlantic to North America.

At the same time, this could be a major opportunity for both sides of the ocean. The U.S. is now exporting more gas to Western Europe than to Russia, with a single shipment reportedly managing to net as much as $200 million in profit.

As for Europe, I believe this crisis could be an opportunity to rethink and retool its energy strategy. A net zero carbon goal is admirable, but real people and families are feeling the pinch of higher energy costs, which, sadly, may have further to climb before this year is out.

Are you on Twitter? Be sure to follow U.S. Global Investors by clicking here!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.16%. The S&P 500 Stock Index fell 1.21%, while the Nasdaq Composite fell 2.62%. The Russell 2000 small capitalization index lost 2.94% this week.

- The Hang Seng Composite lost 2.00% this week; while Taiwan was up 0.78% and the KOSPI fell 1.39%.

- The 10-year Treasury bond yield rose 13 basis points to 2.973%.

Airlines and Shipping

Strengths

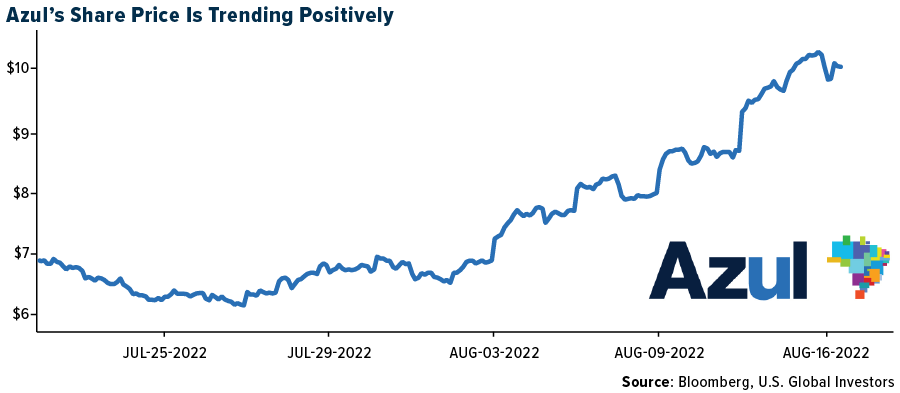

- The best performing airline stock for the week was Turkish Air, up 9.8%. Brazilian carrier Azul released its second quarter results with operating income of BRL136 million, beating consensus estimates of BRL51 million, leading to a 3.5% operating margin. Record revenue came in at BRL3.9 billion (up 131% year-over-year, beating consensus by 2%) on the back of much higher capacity and a remarkable 53% increase in yield, reflecting higher fuel cost per liter (up 81% year-over-year).

- Shipping giants Maersk and Hapag-Lloyd AG suggest the compliance to new environmental regulations through “slow steaming” (i.e., lower operating speed) could reduce effective capacity by 5-15% in 2023-2024, to offset new vessel delivery during the same two-year period.

- As seen throughout the summer, there has been a big share shift from domestic to international travel, with international sales nearly fully recovered, down only 3.8% versus 2019 (compared to domestic net sales down 14.3%). This week, international volumes improved to -11.3% versus 2019 (and versus -13.3% last week) while pricing stepped up 8.4% versus 2019 (versus up 6.8% last week).

Weaknesses

- The worst performing airline stock for the week was Mesa Air, down 13.9%. Airfares were down sharply in July, an indication that inflation has taken its toll on flight demand. According to CPI data released Wednesday by the Bureau of Labor Statistics, July airfares dropped 9.6% from June. The seasonally adjusted month-over-month drop, which accounts for the fact that airline tickets are usually slightly cheaper in July than June, was 7.8%. Still, the average airfare in July was 27.7% above the 2021 level, reflecting a massive surge in flight demand as Covid-19 restrictions disappeared.

- Spot freight rates, including the Shanghai Container Freight Index (SCFI), have been on a decline for nine consecutive weeks, altogether down 15% including last Friday’s 5% drop. The soft pricing trend has captured investor attention and reignited interest in shorting this space, in light of sluggish Transpacific peak-season demand so far.

- Among the major U.S. airlines, American Airlines and Southwest Airlines have had the highest percentage of cancellations occurring over the past week (for the second consecutive week), at 5% and 3% of captured flights, respectively (versus 4% the previous week for both airlines).

Opportunities

- JPMorgan retains its conviction that Qantas Airways will outperform based on continued strong recovery in domestic air travel and a gradual return to international travel. The bank also points to the airlines’ ability to recoup higher operating costs through a mix of higher ticket prices and capacity adjustments, along with de-leveraging of the company’s balance sheet resulting in net debt at A$4 billion as factors that look promising.

- A Regional Airline Association (RAA) report cites that new pilot certificates averaged 6,335 per year for the decade prior to 2020, with new certificates issued falling to 4,000 in 2020 and under 5,000 in 2021. The industry is on track to produce nearly 10,000 newly certified pilots in 2022, but still not sufficiently making up for the gap lost during the pandemic.

- Besides recent comments made by global transport and logistics company Kuehne + Nagel (K&N), A.P. Moeller Maersk CFO Patrick Jany recently indicated spot freight rates could eventually stabilize at a higher level above pre-COVID-19, and higher than the cost levels (in contrast to views for a return to loss-making for liners).

Threats

- Pilots at Breeze Airways, the startup led by David Neeleman, have voted for union representation. Breeze, which launched service in May 2021, plans to file a legal challenge to the election. It is unusual for an airline at this early stage to be unionized. The biggest negative impact of unionization is the loss of nimbleness, which is particularly important for start-ups still trying to establish a niche and foothold.

- According to Delta Airlines, as labor contracts delayed by the pandemic are finally amended, there will be significant inflation felt across the industry, requiring offsets from operating improvements and high fares.

- About 16,000 workers at British Airways are to receive a pay raise worth as much as 13%, reversing cuts imposed during the Covid pandemic. Union leaders said the deal arose after the threat of strike action earlier this summer by check-in staff, which resulted in a pay agreement that is being extended across the workforce. It is understood that the deal will apply to about 16,000 non-management workers across the company.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was Turkey, gaining 5.4%. The best performing country in Asia this week was the Philippines, gaining 2.7%.

- The Russian ruble was the best performing currency in emerging Europe this week, gaining 3.5%. The Pakistani rupee was the best performing currency in Asia this week, gaining 2.1%.

- Hungary and Romania reported strong economic growth. Hungary recorded gross domestic growth (GDP) of 1.1% in the second quarter, above expected expansion of only 0.50%. Romania reported GDP expansion in the second quarter of 2.1%, while most Bloomberg economists were expecting a contraction of 0.20%.

Weaknesses

- The worst performing country in emerging Europe for the week was the Czech Republic, losing 3.2%. The worst performing country in Asia this week was Hong Kong, losing 1.5%.

- The Hungarian forint was the worst performing currency in emerging Europe this week, losing 4.9%. The South Korean won was the worst performing currency in Asia this week, losing 2.8%.

- This week China reported weaker economic data. Retail sales in July increased only 2.7% on a year-over-year basis while an increase of 4.9% was expected by Bloomberg economists. Industrial production increased 3.5% in July versus an expected 4.3%. Residential property sales declined 31.4% year-over-year, and property investment shrank 6.4% year-to-date, below an expected decline of 5.7%.

Opportunities

- Turkey equites have gained almost 40% year-to-date while the Turkish lira depreciated 26% against the dollar. In recent years, the performance gap between the lira and equites have widened as the central bank in Turkey has been cutting rates weaking its currency. Now, it looks like the lira has found its bottom and the gap soon may start to close. When foreign buyers start coming in, the stocks could take off, despite recent outperformance.

- This week China surprised by cutting its one-year, medium-term facility rate by 10 basis points to 2.75% from 2.85%. Next week the one- and five-year rates could be cut by 10 basis points as well. The PBOC is working on providing a $148 billion bailout fund for real estate projects and the government will take initiatives to boost customer spending.

- Central emerging Europe’s broker, Wood & Company, believes that Polish inflation (CPI) is approaching a turning point, predicting the base inflation to enter a downward trend in August-September. Polish food prices growth is expected to continue to decelerate month-over-month. In addition, the energy process should stabilize, as companies suggest that room for transferring rising costs on consumers is shrinking.

Threats

- After China reported weaker economic data this week, brokers cut the Asian nation’s GDP forecasts. Goldman Sachs lowered its full year forecast to 3.0% from 3.3%. ING’s forecast fell to 4.0%, TD Securities to 2.9%, and Nomura to 2.8%. The Chinese government wants the economy to growth at a faster pace of 5.0-5.5%. This growth rate may not be reached in the current year.

- Hot weather and droughts are being reported around the world and China is no exception. China’s Sichuan province has ordered factories to shut down from August 15 to 20 in 19 out of 21 cities in order to preserve energy for residential use. A wide range of supply chains will be impacted including lithium, polysilicon, battery, auto, technology, fertilizer, and steel.

- The war in Europe has escalated to another next level following attacks on Russian in Crimea. The latest incidents in Crimea took place on Tuesday when a fire caused multiple explosions in a Russian ammunition depot. Crimea is a popular tourist destination on the Black Sea, but emerging reports are claiming Russians are leaving Crimea. Ukraine vows to retake Crimea from Russia, which has been under Russian control since 2014.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was cotton, up 6.83%, as severe droughts and heat has scorched the crop in the U.S. With America being the largest exporter of cotton, there could be further gains in the price, however analysts are seeing cooling demand for new clothing in the face of a recession. U.S. natural gas consumption was up 9% (up 6.6 billion cubic feet per day (Bfc/day) year-over-year this past week on the back of higher power demand. On a week-over-week basis, total demand was 1.8 Bcf/day higher, also driven by an increase in power demand.

- Asian liquefied natural gas (LNG) prices extended a rally to the highest level in five months as a global supply crunch shows no sign of easing. The Asian benchmark spot LNG price jumped above $52 per million British thermal units on Monday, the highest level since early March when Russia’s invasion of Ukraine upended energy markets.

- Base metals prices have markedly improved since the early July lows, an average of 20%, with zinc leading the way, up 26% on tightening supply and refining challenges in Europe. Copper is up 15% as inflation and recession fears wane and the strong fundamental outlook for the metals complex regains investor focus. There has been improving Chinese data, with PMI entering expansionary territory after the government approved a massive $223 billion stimulus package.

Weaknesses

- The worst performing commodity for the week was lumber, down 11.47%, potentially reflective of the sales of existing homes in July on Thursday, as the selloff began and continued through Friday. Potash NOLA barge prices are lower this week to $685 per ton, reflecting import tons prices ($50 per ton) lower versus the recently concluded summer fill program price of $735 per ton. In Brazil, potash prices are lower this week, averaging $900 per ton, and down from $1,000 per ton a month ago. Domestic prices in Brazil are closer to $820 per ton. In China, potash inventories at the port are holding around 1.85 million tons compared to 2 million tons one year ago.

- Oil extended losses at the start of the week as traders weighed concerns about Chinese demand and the prospect for more Iranian supply. West Texas Intermediate dropped near $88 a barrel, falling as much as 4.3%, with markets selling off as China’s surprise cut in key interest rates boosts support for an economy hit by virus lockdowns and property woes. The nation’s apparent oil

demand last month was about 10% lower year-on-year. - China’s steel output is likely to remain low for the rest of 2022, even as mills ramp up production in August following a drop in July, because of weak demand in the country’s property sector, market sources said. China’s pig iron output dropped 3.6% year-on-year to 70.49 million tons in July, while crude steel output fell 6.4% year-on-year to 81.43 million tons, data from the National Bureau of Statistics showed. The volumes declined for the second straight month amid sluggish demand and poor steel profit margins.

Opportunities

- According to ISI, few of the drivers of the first-half rally in energy have dissipated and the group argues the outlook for crude for the remainder of the year is particularly positive from here. Geopolitical risk has certainly not abated as Europe is entering a season of extreme energy insecurity and the challenges of the supply side remain. OPEC+ raising the quota was a nice idea but spare capacity is fixed and dwindling, Russia sanctions across the EU will take some bite in the first half of next year, and it’s hard to fathom a lower China demand quote for 2023 versus the extended lockdowns of 2022.

- Spanish energy and environment minister Teresa Ribera said that a new gas pipeline to France could be ready within nine months. Her comments follow discussions earlier in the week between Germany, France, Spain, and Portugal over a new pipeline linking the Iberian Peninsula to Germany. Spain has significant spare LNG regasification capacity but limited pipeline capacity to export gas to France currently.

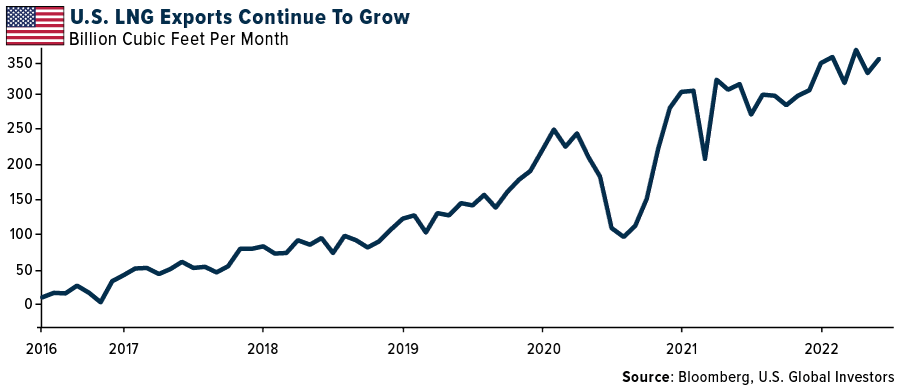

- The EIA forecasts average U.S. LNG exports of 10.0 billion cubic feet per day (Bcf/day) in the third quarter of 2022, 11.2 Bcf/day for 2022 (up 14% year-over-year), and 12.7 Bcf/day in 2023 (up 13% year-over-year). Increased exports are driven by new export capacity and anticipated resumption of service on Freeport LNG. In the first half of this year, the U.S. became the largest LNG exporter in the world.

Threats

- Leading indicators signal moderated U.S. long steel demand growth. Non-residential construction represents the largest U.S. consumer of steel, where “project starts” drive construction spending and steel production/demand. On a national basis, U.S. non-residential building construction starts were down 5% year-over-year in June after 14 consecutive months of growth, while U.S. infrastructure construction starts were down 30% year-over-year.

- According to JPMorgan, for refining, while hurricane season is off to a slow start, the NOAA still expects an above average activity level this season, which could impact utilizations if a major storm makes landfall along the Gulf Coast. Of course, weather is unpredictable by nature and could ultimately be a non-factor this year, but the bank does think the potential for hurricanes could pull down the risk-weighted third quarter utilization expectation relative to guided levels.

- Copper has rallied with macro risk-on sentiment, but disruptions are also tightening supply. During second quarter results season, an analysis of 16 companies covering 39% of global mined copper shows a 2.4% cut to fiscal year 2022 guidance. If one dives further into the numbers, every company except Freeport implies stronger output in the second half of the year, suggesting downgrades could be more of a mark-to-market. In fact, collectively, second quarter output is expected to be a large 16% or 625,000 tons higher than the first half of the year.

Luxury Goods

Strengths

- Based on an article from Vogue Business, in order to reach new consumers from Gen Z and the Millennial market sector, Salvatore Ferragamo closed an essential partnership with Farfetch, a Portuguese digital luxury platform based in London. With this alliance, the company hopes to position itself to expand brand awareness and digital presence. As part of the partnership, Ferragamo will use the Farfetch platform solutions and include more products in its marketplace.

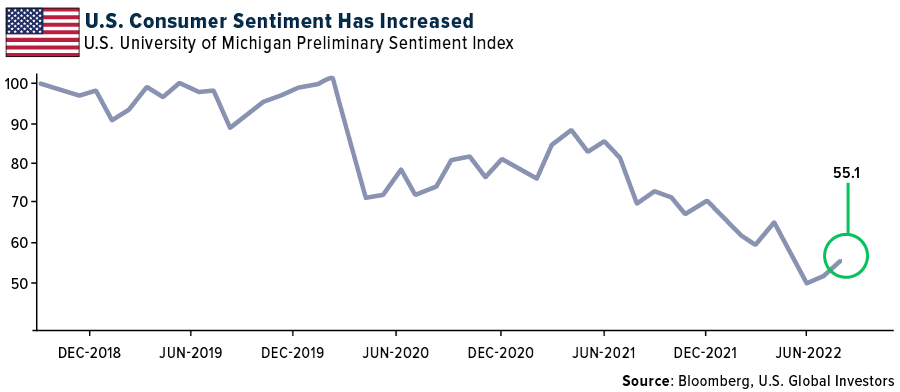

- According to Bloomberg, the University of Michigan Consumer Sentiment Index, which shows consumer behavior related to discretionary expenditures, has increased. For August, it was reported at 55.1 versus a consensus of 52.5, and a previous month reading of 51.5. The increased reading points to consumer interest to expend money, including luxury goods. The United States remains one of the leading global luxury goods markets.

- Treasury Wine Estates, an Australian wine manufacturer, was the best performing S&P Global Luxury stock for the week, gaining 8.49%. The company’s shares rose to the highest level in two years this week, reaching $13.53, and reported sales above estimates.

Weaknesses

- This week, China reported industrial production increased 3.5% in July versus an expected 4.3%. Residential property sales declined 31.4% year-over-year, and property investment shrank 6.4% year-to-date, below the expected decline of 5.7%.

- Year-over-year retail sales in China in the month of July were reported at 2.7%, which is 12.9% lower than the previous month (3.1%) versus a consensus of 4.9%. The retail sales weakness indicates selling new and used products to the general public for personal or household consumption has decreased. This consumption also includes for luxury goods items, particularly as China is the most significant global luxury market other than the U.S.

- Faraday Future Intelligent Electric, a mobility ecosystem company, was the worst performing S&P Global Luxury stock for the week, losing 25.65%. The company reported a net loss of $142 million and an accumulated deficit of $3.2 billion, as of June 30. The company tripled its net loss in the second quarter.

Opportunities

- As reported by CNBC, Apple is looking for a solution to the current supply chain issues in China due to its zero-Covid policy that has resulted in several lockdowns impacting the production and delivery schedule of different companies worldwide. Apple is planning to move its production of Apple Watches, HomePods, and MacBooks to Vietnam. This action means a risk reduction of supply chain issues and a better customer service experience regarding product inventory and reasonable prices.

- Fast fashion is becoming a challenge for luxury brands, primarily due to prices. It is also an environmental concern for the global fashion industry as a whole, where Gen Z is the most significant consumer. Looking for a solution, Thredup, one of the leading secondhand retail platforms, launched a Fast Fashion Confessional Hotline to reduce the impact. This line from ThredUp aims to help consumers make better choices, that many confessing in a recent ThredUp survey, they want to do. The idea here is to balance their behaviors with their values when it comes to buying.

- The adoption of cryptocurrencies as a payment method has opened for many brands a new category of clients and a new loyalty strategy offering consumers an alternative to pay, according to recent market trends. According to Bloomberg, the Maldivian Luxury Resort chain, Soneva, recently began accepting both Bitcoin and Ethereum as a payment method. The move reflects how the luxury industry (not just companies that offer products, but services too) is adjusting to new worldwide market demands.

Threats

- China is the largest luxury goods market worldwide; any action taken against this country could impact the global luxury industry regarding consumption levels or luxury companies’ growth. Thanks to China’s zero-Covid policy and the energy supply shortage, according to CNBC, Goldman Sachs and Nomura cut China’s GDP outlook for 2022. Goldman Sachs reduced its forecast from 3.3% to 3%, while Nomura reduced its forecast from 3.3% to 2.8%.

- This week, China reported Covid cases at a three-month high due to an outbreak in the Hainan province. China reported 3,424 new infections across the country. Thousands of medical workers have been sent to Hainan to support the health emergency. The outbreak represents a potential threat to the global supply chain thanks to the zero-Covid policy that ends on lockdown, which also means a decrease in purchasing among consumers.

- August preliminary Manufacturing PMIs will come out next week. The Eurozone Manufacturing PMI will likely fall further into contractionary territory, below the 50 mark, while the U.S. Manufacturing PMI should remain above the 50 level, meaning it will stay in expansionary territory. China’s manufacturing production most likely will remain below the 50 mark, following a weaker reading in July of 49.0 due to ongoing problems reopening its economy after the latest Covid lockdowns.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Chilz CHZ, rising 21.88%.

- Crypto.com said it received approval from the U.K.’s Financial Conduct Authority to be registered as a crypto-asset service provided in the country, a key step to expanding operations there. The CEO of Crypto.com Kris Marszalek said that “the U.K. has become a strategic, important market for the firm and one of the most important markets globally for crypt0,” according to Bloomberg.

- Kansas City Chiefs’ quarterback Patrick Mahomes is getting behind NFT firm Dapper labs, making him one of the first major celebrities to endorse a crypto company after the industry’s dramatic crash. The company hopes Mahomes will drive fan engagement with in-product features and events, among other things, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Convex Finance CVX, down 28.24%.

- Coinbase shares fell as much as 7% upon announcing in a blog post that it will temporarily pause new Ethereum and ERC-20 token deposits during the Merge. Deposit and withdrawal pause is a temporary precautionary measure, according to Bloomberg.

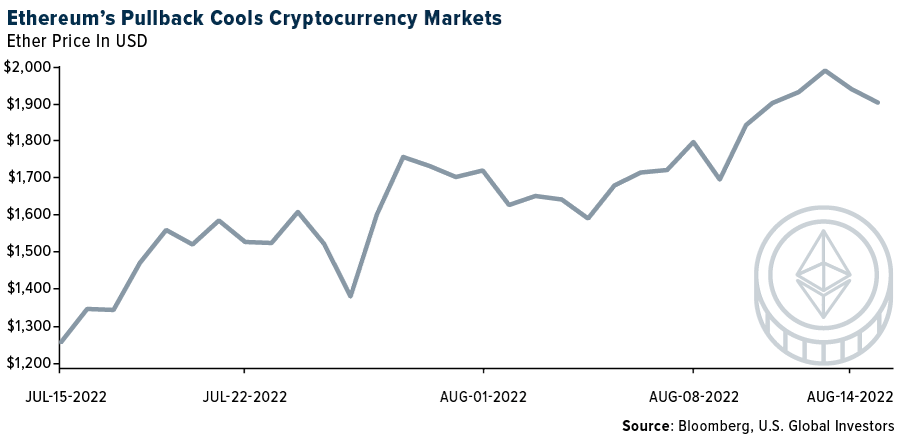

- Ether, which led gains amid optimism over the blockchain software update known as the Merge, was down almost 2% to $1,904. It touched $2,000 last Saturday and has surged about 75% since mid-June. The token has dropped after reaching $2,000, cooling the crypto markets.

Opportunities

- The core developers working on the much-anticipated software upgrade of the Ethereum blockchain, firmed up September 15 as the likely official date of the so-called Merge. This is possibly the final forecast for the timing of the upgrade, which will make the network more energy efficient, according to a developer’s conference call Thursday, writes Bloomberg.

- CME Group, a derivatives marketplace, plans to launch options on Ether futures tied to the dollar on September 12. These new contracts deliver one ether futures, sized at 50 ether per contract and based on the CME CF Ether-Dollar Reference Rate. The new contracts will also expand CME Group’s existing suite of crypto options contracts, which include Bitcoin options as well as micro-sized Bitcoin and Ether options, writes Bloomberg.

- BKCoin Capital, a digital assets hedge fund, is planning to expand into ETF trading and move transactions to traditional exchanges, where crypto-tracker products are listed. The fund’s strategy will be able to capture the differences in prices of passive ETFs that track crypto and the spot market, writes Bloomberg.

Threats

- The value of funds lost to cryptocurrency hacks has soared this year as decentralized-finance protocols have become an easy target for attackers, a report from blockchain analysis firm Chainalysis show. Around $1.9 billion worth of digital tokens has been stolen in hacks this year through July, up 58% from the same period of 2021, Bloomberg reports.

- Regulators at the Federal Reserve have a blunt warning for banks looking to take advantage of new opportunities that involve cryptocurrencies: make sure they’re legal first. As reported by Bloomberg, the central bank on Tuesday released a supervisory letter that recommended steps that lenders overseen by the Fed should take before getting involved in the digital asset industry.

- Cryptocurrencies suffered a sharp selloff as global markets retreated on the back of growing uncertainty about the direction of monetary policy. Bitcoin tumbled as much as 8.3% reaching the lowest level since late July. Ether and smaller virtual coins saw sharper declines. Avalanche, Cardano, and Solana fell more than 10% at one point, writes Bloomberg.

Gold Market

This week gold futures closed at $1,760, down $55.10 per ounce, or 3.03%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 6.40%. The S&P/TSX Venture Index came in off 4.49%. The U.S. Trade-Weighted Dollar soared 2.32%

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| Aug-14 | Retail Sales YoY | 4.9% | 2.7% | 3.1% |

| Aug-16 | Germany ZEW Survey Expectaions | -52.7 | -55.3 | -53.8 |

| Aug-16 | Germany ZEW Survey Current Situation | -49.0 | -47.6 | -45.8 |

| Aug-16 | Housing Starts | 1,527k | 1,446k | 1,599k |

| Aug-18 | Eurozone CPI Core YoY | 4.0% | 4.0% | 4.0% |

| Aug-18 | Initial Jobless Claims | 264k | 250k | 252k |

| Aug-23 | New Home Sales | 575k | — | 590k |

| Aug-24 | Durable Goods Orders | 0.8% | — | 2.0% |

| Aug-25 | Hong Kong Exports YoY | — | — | -6.4% |

| Aug-26 | Initial Jobless Claims | 252k | — | 250k |

| Aug-26 | GDP Annualized QoQ | -0.8% | — | -0.9% |

Strengths

- The best performing precious metal for the week was gold, but still off 3.03%, with the strong surge in the U.S. dollar. Aya Gold & Silver released its first quarter production and financials this week. Production came in higher than expected at 459,000 ounces to consensus of 389,000 ounces, due to higher head grade from mine development work completed in the first quarter and additional equipment onsite. Financials also beat with adjusted earnings per share (EPS) of $0.02 versus consensus of ($0.01); operating cash flow was $0.04, above consensus of $0.01.

- K92 Mining reported second quarter 2022 earnings with AISC of $893 per ounce, 26% below consensus of $1,207 per ounce, once again, showcasing the increasing economies of scale, which may continue in the future. Importantly, the strengthening balance sheet ($82 million cash at quarter-end, with no debt), ideally positions K92 to invest in its planned growth.

- Centerra Gold announced the appointment of Paul Chawrun as its new COO, effective September 6. Mr. Chawrun was most recently COO of Teranga Gold, and Credit Suisse views his technical expertise as positive for advancing Centerra’s Goldfield project.

Weaknesses

- The worst performing precious metal for the week was silver, down 8.47%, moving with the drop in gold. Gold fell this week, following four straight weeks of gains, as investors assessed signs that China’s economy is struggling to recover ahead of minutes from the Federal Reserve later in the week. Bullion fell as much as 1.1% on Monday, after the longest run of weekly gains in almost a year, as it came under pressure from the stronger dollar. The precious metal has gained amid cooling inflation in the U.S., which backs the case for the Fed to be less aggressive in raising borrowing costs.

- Orla Mining reported strong second quarter numbers, with record production and lower-than-expected costs. Earnings, however, were a miss. In a quarter that saw consumable costs spike for many industry peers, Orla was able to reassuringly maintain its 2022 cost and production guidance.

- Steppe Gold reported its second quarter financials after pre-reporting production of 10,300 ounces last month. Adjusted EPS was $0.05 versus consensus of $0.07; operating cash flow was $0.06 per share versus consensus of $0.11 per share. The miss was driven by timing of sales and higher processing costs, somewhat offset by lower taxes and depreciation along with a higher realized gold price.

Opportunities

- RBC anticipates incremental addition of larger-cap names back into the GDXJ ETF in part driven by 1) greater investor interest in larger, more liquid names and 2) continued industry consolidation, particularly within the Intermediate space. The appetite for acquisitions to gain significant market presence appears to be back on the menu.

- Millennium Precious Metals published the first drill results from its Wildcat property that returned good grades, with mineralization confirming strong continuity, no overburden, and rock competency. While continuity should support a high degree of resource conversion from inferred low overburden results in a low strip ratio, which in conjunction with favorable pit angles arising from rock competency, ultimately highlights the potential for low mine operating costs.

- Gold Road Resources acquired another 4.67% of De Grey Mining, bringing its ownership stake to 19.99%. Gold Road noted it does not intend to make a takeover bid for De Grey. It’s an interesting situation. Gold Road can continue to creep up in ownership, in limited steps over time, without making a compulsory offer. The company may, in some way, be competing with the royalty companies in that it could offer cash for just an equity share in the project’s future gold production. De Grey likely has no interest in such a deal structure as this has been one of the most significant gold discoveries in recent years.

Threats

- Zimbabwe’s gold miners say they can only invest the $1 billion required for development over the next five years if they can retain a greater share of their foreign exchange earnings. In January 2021, Zimbabwe’s central bank announced that exporters must hand over 40% of their foreign currency earnings, which is then paid out in the local currency. Isaac Kwesu, CEO of the Chamber of Mines of Zimbabwe, said the government should ease those rules as local financial markets have limited capacity to finance such large capital requirements.

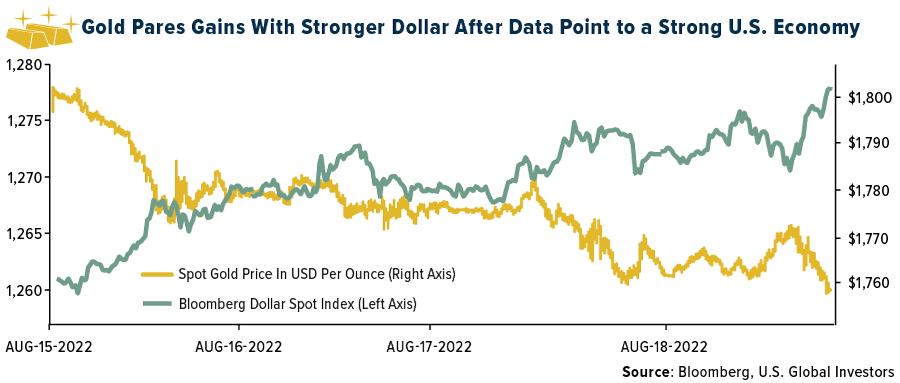

- Gold pared gains as the dollar advanced after latest data pointed to a still-healthy U.S. labor market, reports Bloomberg, potentially leaving the door open for the Federal Reserve to continue carrying out an aggressive path of interest rate hikes. Applications for U.S. unemployment insurance fell for the first time in three weeks. Gold’s main headwind “has been continued dollar strength only being partly offset by softer yields,” said Ole Hansen, Saxo Bank head of commodity strategy. “The claims support the strong job market view, giving the Fed room for more aggressive rate hikes.”

- Pure Gold Mining’s gold production dropped 42% to 3,509 ounces following disruptions linked to “significant cash preservation measures” Pure Gold introduced while it negotiated financing agreements in May. The company reported second quarter revenue of $8.53 million, which is down 43.5% year-over-year.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/22):

Azul SA

Apple

AP Moeller Maersk

Hapag-Lloyd AG

American Airlines

Southwest Airlines

Kuehne + Nagel International

Delta Airlines

K92 Mining

Aya Gold & Silver

Millennium Precious Metals

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The Michigan Consumer Sentiment Index (MCSI) is a monthly survey of consumer confidence levels in the United States conducted by the University of Michigan.

The Bloomberg Dollar Spot Index tracks the performance of a basket of 10 leading global currencies versus the U.S. Dollar.