Institutional Money Could Drive Bitcoin To a $1 Million Valuation by 2033: Bernstein

Bitcoin is looking increasingly ready for primetime.

Bitcoin could be headed for the stratosphere, according to a new report by Bernstein. The global investment firm is predicting that the world’s top digital asset could hit $200,000 by 2025, $500,000 by 2029 and—no, you’re not seeing things—$1 million per token by 2033. This decade-long rally, Bernstein analyst Gautam Chhugani writes, will be largely driven by institutional investors as the Bitcoin ETFs are approved at major wirehouses and private bank platforms.

These bold predictions were just one of the hot topics at a recent crypto gathering I had the pleasure to attend this week at Galaxy Digital’s New York headquarters. Galaxy’s billionaire founder and CEO, Mike Novogratz, was a gracious host to a small number of visitors hailing from broker-dealers, crypto exchanges, energy providers and everything in between.

The consensus among attendees is that Bitcoin is looking increasingly ready for primetime. Some big names have recently jumped on board, including Larry Fink, CEO of BlackRock, the world’s largest asset management company ($10 trillion in AUM), and even former President Donald Trump. They’ve been “orange pilled,” as the crypto crowd likes to say.

Bitcoin’s Path to $1 Million Depends on Clearer Regulations and Lower Rates

This wasn’t always the case. Just five years ago, Trump tweeted that he was “not a fan of Bitcoin and other Cryptocurrencies, which are not money.” Fast forward to today, and he now says that he wants “all the remaining Bitcoin to be MADE IN THE USA!!!” Both Trump and independent candidate Robert F. Kennedy Jr. are accepting Bitcoin as campaign donations.

For Bitcoin to really take off and hit those lofty price targets, two things need to fall into place: clearer regulations and lower interest rates. Clear rules will give both big institutions and everyday people more confidence to invest, while lower rates might make Bitcoin look more attractive compared to risk-off assets like cash and bonds.

Will Ethereum ETFs Attract Investors Beyond Bitcoin?

Bitcoin has been stealing the spotlight, but Ethereum isn’t too far behind. ETFs that track the world’s number two crypto are coming, with several firms just waiting for the green light from the Securities and Exchange Commission (SEC).

The big question is: Will people buy in? Do regular investors need to look beyond Bitcoin?

Ethereum has some advantages over Bitcoin, like smart contracts and decentralized apps. But it lacks Bitcoin’s compelling story and star power, and its daily trading volume is roughly half that of Bitcoin’s. These factors could sway investor interest as Ethereum ETFs hit the market.

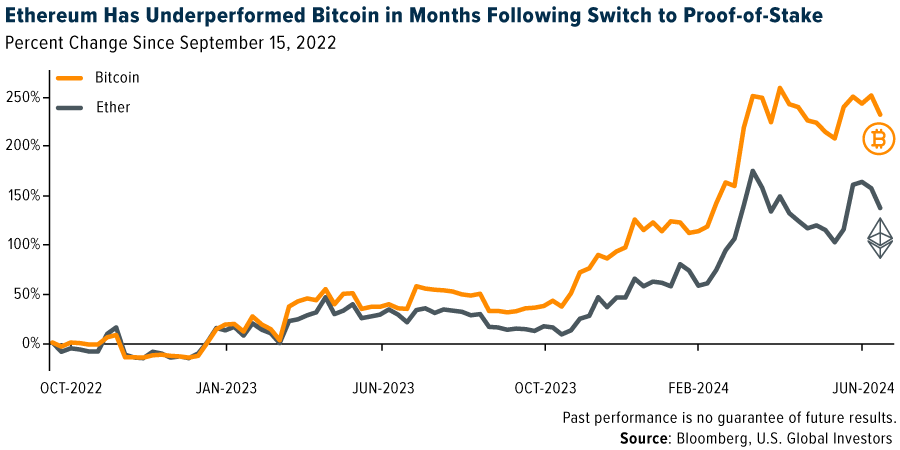

There’s also the fact that Ethereum switched its consensus protocol from proof-of-work (PoW) to proof-of-stake (PoS) a little over two years ago. The “Merge,” as it’s called, drastically improved efficiency, but investors don’t appear to place too much of a premium on this. Since the Merge, Ethereum has underperformed Bitcoin.

The Growing Distrust in Government and Its Potential Impact on Bitcoin

Blockchains are often called “trust machines,” but the challenge is getting more people to trust them. A big hurdle has been the lack of interest from big institutions. But here’s the kicker: Trust in traditional institutions is crumbling, which—while worrisome for the country—could be constructive news for decentralized assets like Bitcoin.

A recent survey by the Partnership for Public Service found that only 23% of Americans trust the federal government, down from 35% in 2022. Even worse, only 15% think the government is transparent, and a whopping 66% see it as incompetent. These numbers show people are losing faith in centralized systems, which could push them towards alternatives like Bitcoin.

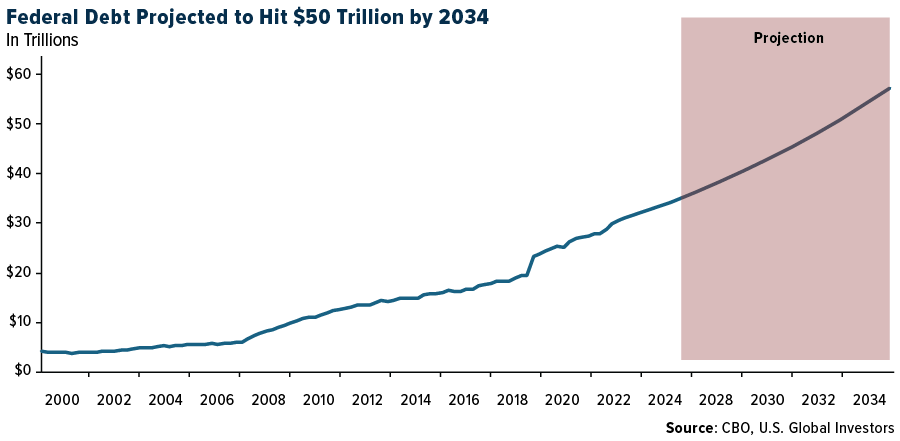

The government’s debt situation is a huge part of the problem. In a new report, the Congressional Budget Office (CBO) predicts that public debt will skyrocket from $34.8 trillion today to a head-spinning $50.7 trillion by 2034, when debt is expected to hit 122% of the U.S. economy. This ballooning debt makes a strong case for financial innovation and diversification, potentially boosting Bitcoin’s appeal.

Voters Want Crypto-Savvy Officials

Conversely, crypto knowledge is increasingly being seen as a political asset. A recent Grayscale-Harris survey found that three in four people want political candidates to be up to speed on innovative tech including Bitcoin and Ethereum. Over half of likely voters said they’d be more likely to support candidates who understand and advocate for crypto.

Taking his cue, perhaps, from Trump and RFK Jr., President Joe Biden seems to be warming up to digital assets. There’s talk of a “Bitcoin roundtable” in D.C. next month, suggesting that the administration may be keen to engage with the crypto community.

Nvidia: The New Market Cap Leader

In a related development, Nvidia, a key player in artificial intelligence (AI) and computing, briefly became the world’s most valuable listed company this week, highlighting the broader technological shift that’s likely to drive both AI and cryptocurrency adoption.

At its peak, the company was valued at approximately $3.4 trillion, which is larger than both the French and U.K. stock markets.

#Nvidia is now worth more than the entire stock market in #France or the #UK. pic.twitter.com/dSWNzeka57

— Holger Zschaepitz (@Schuldensuehner) June 19, 2024

Nvidia lost its number one status on Friday as investors took profits, but I don’t believe we’ve seen the last of it. As one CFRA Research analyst put it, the chipmaker “will be the most important company to our civilization over the next decade as the world becomes more AI-drive.”

Indeed, the financial world is on the cusp of major changes, from Bitcoin’s potential price explosion to Ethereum’s ETF prospects and the AI revolution. Growing distrust in traditional systems, coupled with regulatory developments and changing investment trends, points to a new era of financial innovation.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.45%. The S&P 500 Stock Index rose 0.61%, while the Nasdaq Composite was flat. The Russell 2000 small capitalization index gained 0.79% this week.

- The Hang Seng Composite gained 4.27% this week; while Taiwan was up 3.33% and the KOSPI rose 0.94%.

- The 10-year Treasury bond yield rose 3 basis points to 4.25%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Sun Country, up 22.6%. According to Raymond James, outbound travel remains resilient, having recovered to 120% of 2019 in May, albeit down from the post-COVID peak of 126% in February. Inbound recovery also stepped up to 91% in May, which is still down from the post-COVID peak of 96% in March.

- Barge market capacity trends remain favorable, reports Bank of America, and 25% of existing vessels are set to be sidelined for dry dock surveys over the next two years, further exacerbating market tightness.

- According to Morgan Stanley, Delta Air Lines will be flying its largest ever domestic schedule, increasing seat capacity by 10% year-over-year. The group is encouraged by Delta’s decision to increase capacity into the winter months when leisure travel typically slows down from the summer peak as it remains clear that consumers prioritize travel.

Weaknesses

- The worst performing airline stock for the week was Norwegian Air, down 8.1%. As reported by JPMorgan, U.S. airlines have struggled since mid-May – driven by American Airlines’ guide down, citing weaker-than-forecasted domestic pricing environment. Still, the bank views American’s guide down as mostly indicative of its corporate strategy shift, compounded by supply/demand imbalance in some end markets, not indicative of broader industry demand, which by the group’s data points, remains strong.

- Port congestion has returned to the spotlight with the Red Sea crisis leading to heavy congestion in major Asian hubs like Singapore, reports JPMorgan. The disruptions are likely to get worse before the situation gets better due to a peak season order rush, spillover effects to other downstream ports and industrial actions at ports.

- European airlines have been turbulent over the past month on concerns over pricing and a softening of passenger demand. Recent commentary from the LCCs, and Ryanair, has focused on a more mixed pricing outlook for short-haul leisure, reports JPMorgan. However, pricing for Network Carriers in the second quarter could end up softer than expected on elevated capacity growth, a mixed demand backdrop by long-haul route/cabin, and any impact from LCC discounting/short-haul leisure weakness.

Opportunities

- Bank of America feels key positive catalysts for EVA Airways include summer peak travel demand boost starting from June, inflection in air cargo yields, potential changes to China’s visa policy allowing recovery in Chinese inbound and transit demand, and upside to 45% payout ratio given EVA’s strong balance sheet with net cash of NT$11 per share.

- Naria purchased 9.9% of Golar’s common shares in the open market. Half of the position was purchased shares, and the other half is an option that will be settled within 60 days. Stifel sees several possibilities including Perenco potentially trying to buy Golar, or Perenco making a strategic investment to get access to future Golar units.

- Singapore Airlines’ management is constructive about its revenue outlook, reports UBS. On the passenger side, passenger demand and forward booking remain strong, which could support a higher passenger load factor and yield. At the same time, management sees benign competition so far, citing continuous supply chain disruptions while constraint of air traffic rights could weigh on the industry flight supply, which might provide a floor support to the flight price.

Threats

- Boeing has delivered 131 total aircraft year-to-date as 737 MAX production has slowed. The 2024 year-to-date deliveries compare to 206 deliveries in the same timeframe in 2023. Airbus leads Boeing with 256 deliveries year-to-date, as it continues to take share from Boeing. Boeing has recorded 142 total orders year-to-date, a decline from 223 orders in the same period in 2023, according to UBS.

- UBS feels shippers appear to be pulling forward container imports to the East Coast ahead of the September 30 expiration of the current ILA labor contract. Dockworkers could strike on October 1 if a new contract agreement is not reached. Recent comments from the ILA union leadership indicate a willingness to strike and they note shipper concerns about slowdowns could also drive pre-shipping.

- Aero Analysis Partners expects 737’s deliveries to range between 25-28 aircraft in June, exceeding the 19 737s delivered in May. If these numbers prove accurate, second quarter deliveries will approach the 66 MAXs delivered in the first quarter of 2023. Considering that production and deliveries typically experience a surge in June due to the traditional quarter-end push, the group expects fiscal year 2024 output to fall below 300 units and deliveries to range between 300-330 aircraft.

Luxury Goods and International Markets

Strengths

- Ferrari announced the opening of a solar-powered factory at its historic Maranello site, planning to produce its first wholly electric car by 2026. The new facility, partially powered by over 3,000 solar panels, will also manufacture high-voltage batteries, electric motors, and axles. Ferrari aims for electric and hybrid models to make up 60% of its production by 2026 and 80% by 2030.

- Bank of America’s latest Global Fund Manager Survey revealed U.S. investors are the most bullish since November 2021. However, sentiment is still not yet extreme, despite cash levels falling to 4%, the lowest since June 2021. Investors are the most overweight in stocks and underweight in bonds since November 2022, as a soft landing has become the consensus view and hard landing expectations have hit new lows. Inflation remains the biggest tail risk.

- Aston Martin, car maker, was the best-performing S&P Global Luxury stock, gaining 12.9% in the past five days. Shares gain after the new Aston Martin Vantage GT3 recorded its first international triumph just four months after being unveiled to the world at Silverstone, with an outstanding GT300 Class victory in Japan’s most prestigious endurance racing championship – the AUTOBACS SUPER GT Series. The success also marks the British ultra-luxury brand’s first-ever win in the series.

Weaknesses

- Golden Goose Group SpA postponed its Milan listing at the last minute due to concerns that the stock would fall on its debut. The trendy Italian footwear label, which retails sneakers starting at around $500, had spent upwards of 10 months preparing for a listing that it hoped would bring in over $600 million. According to the Financial Times, seven banks had lined up to build its initial public offering book, which was oversubscribed.

- The preliminary June Eurozone Manufacturing PMI unexpectedly dropped to 45.6 from 47.3 in May, falling short of Bloomberg economists’ estimates for a higher reading of 47.9. A number above the 50 level indicates expansion, while a reading below 50 represents contraction in manufacturing activity.

- RealReal, an online marketplace for resale of luxury goods, was the worst-performing S&P Global Luxury stock, losing 16.3% in the past five days. Share declined after eBay announced increasing its assortments to some luxury items.

Opportunities

- A report from the Global Business Travel Association (GBTA) says that global business travel spending is expected to surpass 2019 levels in 2024, reaching $1.5 trillion, compared to $1.4 trillion in 2019. The upward trend is expected to continue into 2027. It could grow to $1.8 trillion by 2027, benefiting the luxury sector.

- The Wall Street Journal reported that American tourists are becoming Europe’s new engine. While Germany’s economy is flatlining, Spain is Europe’s fastest-growing big economy. Nearly three-quarters of the country’s recent growth and one in four new jobs are linked to tourism. In Greece, an unlikely economic star since the pandemic, as many as 44% of all jobs are connected to tourism.

- Automobili Pininfarina, owned by India’s Mahindra & Mahindra, is working on the world’s most expensive sport utility vehicle. The company plans to introduce a four-seat crossover within a year, Chief Executive Officer Paolo Dellachà said in an interview. The price tag will be between €400,000 and €1 million, surpassing Ferrari NV’s Purosangue, which starts at around €380,000.

Threats

- Bain, the luxury consultancy group, predicted in its Spring update on Tuesday that the luxury sector will grow between 0% and 4% this year, at a slower pace than in previous years. The personal luxury goods market grew 8% in 2023 and 13% in 2022. In a more optimistic scenario, with a probability of only 10%, Bain sees growth at 6%, still below the previous year.

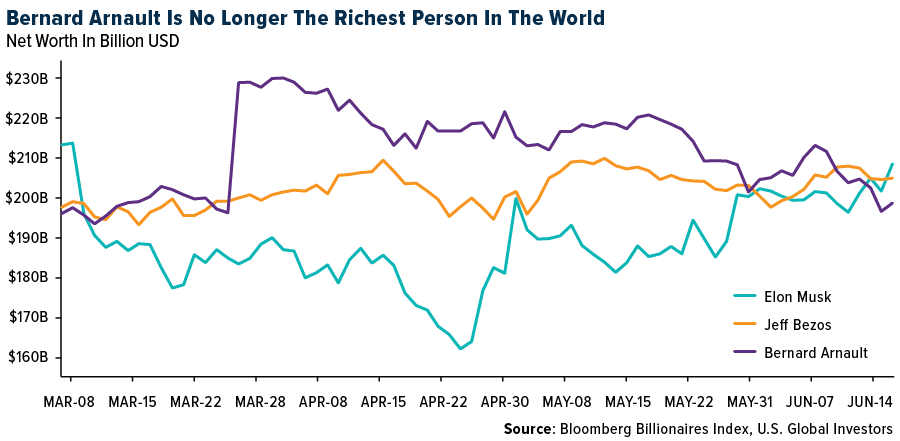

- The owner of the luxury conglomerate Louis Vuitton, Bernard Arnault, is the third richest person in the world. His net worth slid with the recent correction in LVMH’s share price due to concerns about a slowdown in sector growth. Elon Musk, the 52-year-old CEO of Tesla, took the lead again, with a net worth of $210.108 billion on June 18.

- Following the far-right Rassemblement National’s sweeping victory in the European elections, Emmanuel Macron has decided to dissolve the Assemblée Nationale for the first time since 1997. France is holding snap parliamentary elections, and for the first time in France’s post-war history, opinion polls show the far right could win. Many luxury stocks are listed on the Paris Stock Exchange. The new parliamentary elections are scheduled to be held on June 30 and July 7.

Energy and Natural Resources

Strengths

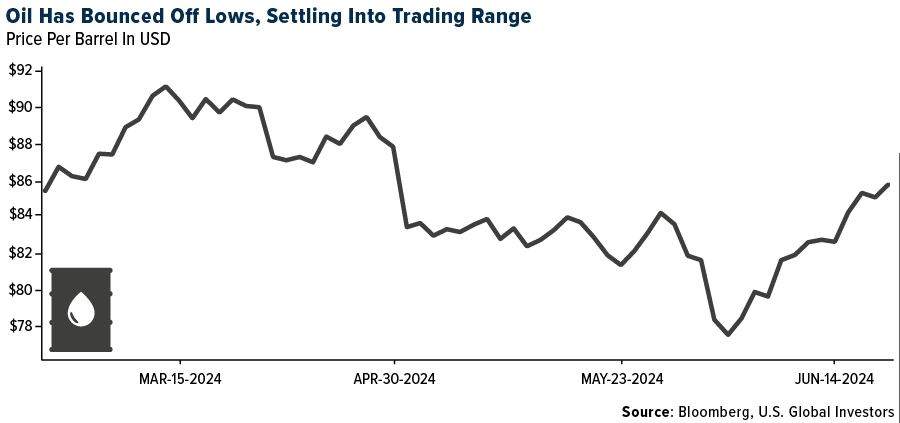

- The best performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, rising 4.21%. Both lead and zinc also demonstrated strong performance this week, but copper was noticeable absent. Oil edged higher after its biggest weekly advance since early April, extending a short-covering rally as traders weighed a raft of data from China. Brent traded above $82 a barrel after climbing 3.8% last week, the first weekly gain in four, according to Bloomberg.

- According to Bank of America, cyclone damage to South32’s GEMCO operations in Australia had major implications for the global manganese market. The latest indication from South32 is that GEMCO will be off until 2025. With 10% of global manganese ore supply offline, the market has tightened materially.

- China’s energy use per person surpassed Europe’s for the first time last year as demand from technology and manufacturing industries continued to climb. The country ramped up coal-fired generation but also added more renewable capacity than the rest of the world combined, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was lumber, dropping 9.01%. With the release of housing starts and building permits data this week showing their lowest levels of activity since mid-2020, lumber prices have weakened with the reduced demand outlook. Copper extended four weeks of declines after Chinese economic data highlighted persistent weak spots in the metal’s biggest market. Copper fell as much 1.1% to $9,631 a ton on the London Metal Exchange (LME), heading for its lowest close in two months, according to Bloomberg.

- The fundamental environment looks somewhat challenging for refiners, with year-over-year (YOY) gasoline demand and diesel demand tracking 2.5% and 5.5% below last year, respectively, since the end of March. Refinery utilizations in the mid-90th percentile and clean product inventories have risen by 13 million barrels over the past three weeks.

- Steel Dynamics expects second-quarter profitability for the steel operations segment to be meaningfully lower quarter-over-quarter on lower selling prices and flat volumes. Management noted hesitancy among steel buyers due to lower scrap prices

Opportunities

- Morgan Stanley’s review of 2024 proxy filings generally showed more limited changes to compensation packages versus 2023, but they support continued discipline for the industry. The average weighting of free cash flow (FCF) has risen by around three times since 2019. Environment, Health & Safety (EHS), including emissions reduction targets, roughly doubled over the same period. At the same time, production and growth targets have been de-emphasized.

- Bill Gates said he is prepared to invest billions of dollars into a next-generation nuclear power plant project in Wyoming to meet growing U.S. electricity needs. TerraPower, a startup founded by Gates, broke ground for construction of its first commercial reactor last week in Wyoming, according to Bloomberg. The next day, at the American Nuclear Society’s annual conference, representatives from the technology industry, which is seeing exponential growth in demand for AI and thus their data centers need cheap reliable electricity to operate efficiently, were present. However, Briana Kobar, head of energy market innovation at Google, commented during a panel discussion at the conference that “the entities best suited to take on timeline risk and construction risk are not the off-takers.” This points to a funding problem the industry faces. The Biden administration intends to provide up to $900 million to spur the initial development of small modular reactor technology.

- China has ramped up imports of copper scrap as smelters seek alternative raw materials to offset tight supplied of mined ore. The world’s biggest refined copper producer took in nearly 1 million tons of scrap in 2024’s first five months, putting imports on pace for the strongest year since 2018, according to Bloomberg.

Threats

- According to UBS, substitution is likely to remain a theme that will erode copper demand. The pressure to substitute copper with aluminum in electrical applications becomes more prominent when the copper/aluminum ratio approaches 4x (currently at 3.85x). Demand destruction and substitution are factors that are likely to prevent structural deficits in the medium term for copper.

- The U.K. Labour Party’s proposed £6bn additional “windfall” tax is a material number for the U.K. North Sea industry. It represents a 40% increase on the current forecast for total tax generated by the U.K. North Sea, but a 60-65% increase in the windfall element alone. This sum is equivalent to 35% of forecast investment over the next five years. Stifel sees this amount as impossible to raise without having a significant impact on investment.

- China’s aluminum production hit a record last month as smelters brought back idled capacity, potentially setting up the market for further declines after prices hit a two-year high in May. Heavy rains have improved hydropower reserves in Yunnan and allowed smelters to recommence operations after drought sapped their electricity supply in recent years. Another 330,000 tons of capacity is expected to resume in the southern province this month, according to Bloomberg Intelligence.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Ethereum Name Service (ENS), rising 28.62%.

- MicroStrategy bought approximately $786 million in Bitcoin with the proceeds raised from the sale of convertible notes. The company acquired 11,913 Bitcoin between April 27 and June 19, according to a filing Thursday with the U.S. Securities and Exchange commission. The purchases raise the company’s overall holdings to 226,331 Bitcoin, which are valued at about $14.9 billion.

- The tax charges brought by the Federal Inland Revenue Service (FIRS) of Nigeria against Binance executives Tigran Gambaryan and Nadeem Anjarwalla have been dropped. The FIRS agreed to revise the charges so that it serves only Binance through its local representative, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was LayerZero, down 11.54%.

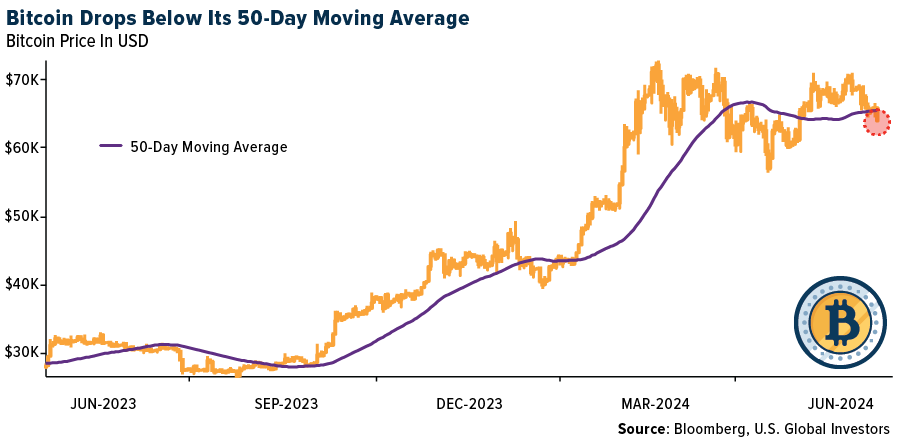

- Bitcoin touched a one-month low as outflows from digital-asset investment products and the prospect of higher-for-longer U.S. borrowing costs sapped the cryptocurrency market, reports Bloomberg. The largest digital asset fell as much as 3.2% on Tuesday reaching a level last seen in mid-May, as well as crossing its 50-day moving average.

- The Bloomberg Galaxy DeFi Index of digital coins involved in decentralized finance fell 6.1% this week. The index fell to 856, as of Friday, down from 911 a week earlier. The Galaxy Bitcoin Index declined 5.5% during the same period while the Ethereum Index dropped 7.8%, writes Bloomberg.

Opportunities

- An exchange-traded fund (ETF) investing in Bitcoin listed on Australia’s main stock market for the first time ever, adding to a wave of similar launches this year in the U.S. and Hong Kong. As reported by Bloomberg, the VanEck Bitcoin ETF debuted Thursday on the exchange operated by ASX Ltd.

- Tether Holdings has created a new synthetic dollar that is backed by gold. The token was created on the company’s new Alloy by Tether platform and will trade as a USDT via smart contracts on the Ethereum Mainnet blockchain, writes Bloomberg.

- Deutsche Telekom, the German-based telecommunications provider that ranks as the largest in Europe, will soon mine Bitcoin according to remarks made by the head of one of their subsidiaries, Bloomberg reports.

Threats

- The UK’s financial watchdog and London police arrested two people in connection with an alleged illegal cryptocurrency exchange worth more than $1.3 billion. The Financial Conduct Authority said Thursday the pair were released on bail and the investigation is ongoing. The suspects’ offices were raided, and police seized devices in searches of two London properties, writes Bloomberg.

- A local Chinese bank uncovered an embezzlement and money laundering scheme involving its two former executives, a former shareholder, and other suspects, using cryptocurrency to launder funds, writes Bloomberg. The report noted that the illegally converted funds amounted to 1.8 billion yuan.

- Venezuelan activists and policy analysts are calling for tougher sanctions and investigations into how President Nicolas Maduro’s government is using cryptocurrencies to get around international restrictions. The U.S. reinstated gold and oil sanctions on May 31 after Maduro failed to honor an agreement to allow fairer elections, according to Bloomberg.

Defense and Cybersecurity

Strengths

- The Royal Australian Air Force’s first uncrewed maritime reconnaissance aircraft, the Northrop Grumman MQ-4C Triton, arrived in Australia on June 16 after a trans-Pacific flight. This comes following months of testing in the U.S. and is set to enhance maritime surveillance capabilities, particularly over Australia’s northern approaches.

- Rheinmetall AG announced that it received its largest order ever from the Bundeswehr for ammunition worth up to EUR 8.5 billion, aimed at replenishing stockpiles for Germany and its allies, supporting Ukraine and achieving an annual production capacity of up to 200,000 projectiles. The news comes while the company is also partnering with Anduril Industries to develop a counter small unmanned aerial air defense system.

- The best performing defense stock this week was Archer Aviation, rising 15.46% after announcing an air mobility network in the San Francisco Bay Area with a key hub at Kilroy Oyster Point.

Weaknesses

- Swedish authorities accused Russia of interfering with the country’s satellite networks shortly after Sweden joined NATO. The Swedish Post and Telecom Authority has requested the International Telecommunications Union to address the issue, which has also affected other European nations, disrupting communications and broadcasting.

- Ukrainian President Volodymyr Zelenskyy’s attempts to garner support from key Global South nations at a Swiss summit have largely failed, with several significant countries, including India, Brazil, Indonesia and South Africa, not signing the final statement. This highlights the challenges Ukraine faces in securing broader international backing against Russia’s invasion.

- The worst-performing stock this week was Virgin Galactic, falling 18.63% despite signing a new contract with the International Institute for Astronautical Sciences for a research mission involving three astronauts, led by Kellie Gerardi, aboard the Delta Class spaceship to expand on previous fluid behavior experiments in microgravity.

Opportunities

- Symantec’s three key security solutions—Endpoint Security, Network Protection and Data Loss Prevention Cloud—have passed a rigorous Australian government assessment, proving they meet high security standards to protect sensitive public sector information. This helps ensure these solutions are highly effective in safeguarding critical data and systems against cyber threats.

- Green Hills Software and Mercury Systems announced the verification phase for providing airworthiness evidence for the INTEGRITY-178 tuMP safety-critical RTOS on 11th Gen Intel Core i7 processors. This will support U.S. Army aviation and other programs with reduced risk and faster deployment, with production systems expected by the end of next year.

- Hanwha Aerospace, showcasing its K239 Chunmoo rocket artillery system at Eurosatory, sees potential sales in Norway and Sweden, with its short delivery times and competitive pricing offering an edge over rivals such as Elbit Systems and Rheinmetall, while emphasizing its open architecture and manufacturing reliability.

Threats

- Homeland Security Secretary Alejandro Mayorkas reported an increase in foreign terrorist threats due to renewed ISIS activities and Middle East unrest linked to the Israel-Hamas war, marking a shift from the department’s recent focus on domestic extremism.

- Shortly after midnight on May 23, several masked men in boats removed orange navigational aids on the Narva River, a boundary between Estonia and Russia. The actions were clearly visible to Estonian authorities due to the twilight and have since been interpreted by Estonia as a deliberate signal of intent amid a series of hybrid attacks designed to provoke and destabilize the Baltic region, which is now seen as a second front in the West’s conflict with Moscow.

- The “Three Brotherhood Alliance” in Myanmar accused the junta of violating a China-brokered ceasefire in June, causing civilian casualties and launching air and drone strikes. This comes despite a truce agreed upon in January following months of fighting.

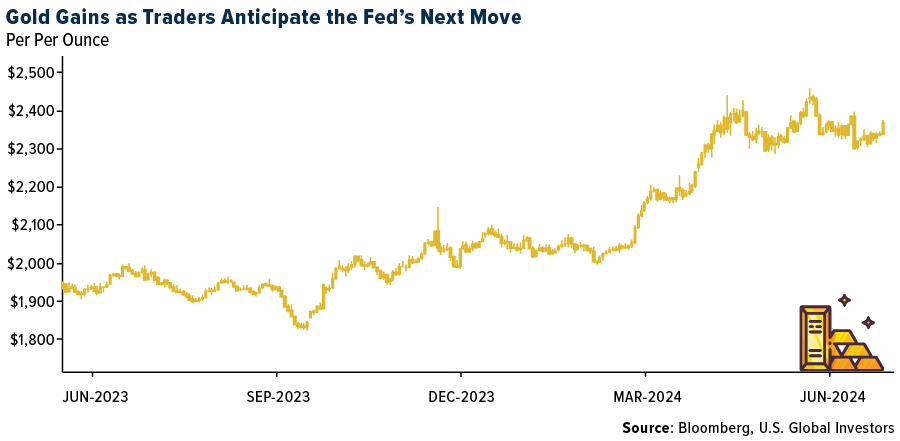

Gold Market

This week gold futures closed the week at $2,349.10, down $13.60 per ounce, or 0.58%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.57%. The S&P/TSX Venture Index came in off 0.59%. The U.S. Trade-Weighted Dollar rose 0.24%.

Strengths

- The best-performing precious metal for the week was platinum, up 3.94%, largely due to the declining demand trend for electric vehicles, which translates to more demand for platinum group metals in the short term. According to Bank of America, China gold ETFs continued to see inflows, adding $253 million and marking the sixth consecutive month of inflows. Gold ETF buying in China is driven by weak equities, a weakening local currency, and decreasing bond yields. Chinese gold ETF holdings are now at a record high.

- During fiscal Q1 2025, Asante Gold produced 53,379 gold equivalent ounces, compared to 51,372 gold equivalent ounces in fiscal Q1 2024. The increase in gold production was primarily the result of increased ore processed and gold recovery at Chirano, according to Bloomberg.

- Pan American Silver provided an exploration update that showcases the potential for meaningful resource growth at several assets. New drill results from Jacobina, El Peñon, La Colorada and Huaron continue to demonstrate the potential for resource replacement, with La Colorada and El Peñon showing particularly significant potential, according to Bank of America.

Weaknesses

- The worst-performing precious metal for the week was gold, down 0.58%. Stronger-than-expected manufacturing activity, expanding for a second month, and services data, at its highest level in two years, prompted a selloff in gold as we closed out the week. According to the World Gold Council (WGC), about 20 central banks surveyed expect to increase their bullion holdings over the coming year, so there still appears to be a strong floor being set by market forces.

- According to Bank of America, there is somewhat more subdued investor interest in gold. The price rally has run out of steam in recent weeks, and risk reversals show less interest in buying upside. This confirms that a Federal Reserve rate cut might well be necessary to trigger enough investor purchases for the yellow metal to move higher again.

- Polished natural diamonds are in a downward spiral, with prices still falling in June across all sizes. More importantly, Morgan Stanley sees little evidence that prices are at an inflection point, with the world’s largest diamond jewelry retailer, Signet, stating that 1Q24/25 same-store sales fell by 9% year-over-year.

Opportunities

- According to BMO, Snowline Gold announced a maiden resource estimate at the Valley Gold Deposit located within the Rogue Project. This was highlighted by an indicated resource of 76 Mt at 1.66 g/t gold, resulting in 4.05 million ounces, and an inferred resource of 81 Mt at 1.25 g/t gold, resulting in 3.26 million ounces.

- Scotiabank initiated coverage of Snowline Gold with an Outperform rating and C$9 price target. The company’s flagship project is Rogue, an exploration stage gold project in the Yukon, that the firm calls “one of the most exciting gold discoveries in recent years,” citing long intervals of near-surface gold mineralization encountered over a large target area, multiple areas remaining open, and many nearby targets requiring follow-up exploration work.

- Harmony Gold’s total group production for the year ended June 30 is expected to exceed the guidance of 1.55 million ounces, while all-in-sustaining costs will come in comfortably below 920,000 rand per kilogram as guided, according to Bloomberg.

Threats

- Scotia expects Agnico Eagle Mines to update costs and capital based on (1) a higher gold price, which impacts royalties, (2) FX USD/CAD previously at 1.30 (2024 guidance is 1.34), and (3) adjustments for inflationary pressures. It is important to note that costs will be impacted by changes in the gold price, exchange rate and inflation assumptions. They expect total cash costs to increase from the all-in sustaining cost (AISC) of $943 per ounce reported in 2022.

- According to Bank of America, China’s physical markets are a bit subdued but remain supported overall, highlighting that jewelry sales keep hovering around seasonal highs. Similarly, China’s domestic market keeps trading at a premium over international prices. Incidentally, China’s silver market is well bid too, as domestic prices are trading at a premium. This is rare, and reversion to the mean is possible.

- Fitch affirmed the Kinross Gold issue-level rating on the senior unsecured credit facility, senior unsecured term loan and senior unsecured notes at BBB. The ratings and outlook reflect Fitch’s view that Kinross will maintain an average mine life of at least 10 years, an average cost position in the second quartile of the global cost curve and an average annual production of at least 2 million gold equivalent ounces. Additionally, the ratings and outlook consider that the company will prioritize debt repayment while EBITDA net leverage is above 1.7x and generally manage EBITDA leverage below 2.3x. These could be aggressive assumptions.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024):

Delta Air Lines

American Airlines

Ryanair Holdings

Singapore Airlines

Boeing

Ferrari NV

Tesla

LVMH Moet Hennessy Louis Vuitton

Asante Gold Corp.

Snowline Gold Corp.

Harmony Gold Mining Co. Ltd.

Agnico Eagle Mines Ltd.

Kinross Gold Corp.

Las Vegas Sands Corp.

Sun Country Airlines Holdings

Norwegian Air Shuttle ASA

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Bloomberg Galaxy Defi Index (DEFI) is a capped market capitalization-weighted index targeting the rapidly expanding universe of decentralized finance.