How Trump’s Second Term Could Impact Defense and Cybersecurity Spending

With President-elect Donald Trump set to assume office in January, the U.S. military and cybersecurity sectors could experience sweeping changes, creating opportunities for investors who recognize the long-term growth potential in defense and technology.

In his first term, President Trump left his mark on the U.S. military, establishing the Space Force and boosting defense spending to historic highs.

Now, as he prepares for his second term, his administration’s ambitious goals—such as potentially creating an Iron Dome Missile Defense Shield system—signal a renewed focus on military modernization.

Meanwhile, cyber threats have reached an all-time high, requiring unprecedented investment in cybersecurity infrastructure. For investors, these trends highlight two critical sectors poised for growth: traditional defense and the emerging field of cyber defense.

The State of U.S. Defense Spending

In 2023, U.S. military expenditure reached $916 billion, representing a staggering 40% of global military spending. As I shared with you earlier in the year, that’s more than the next 10 countries combined.

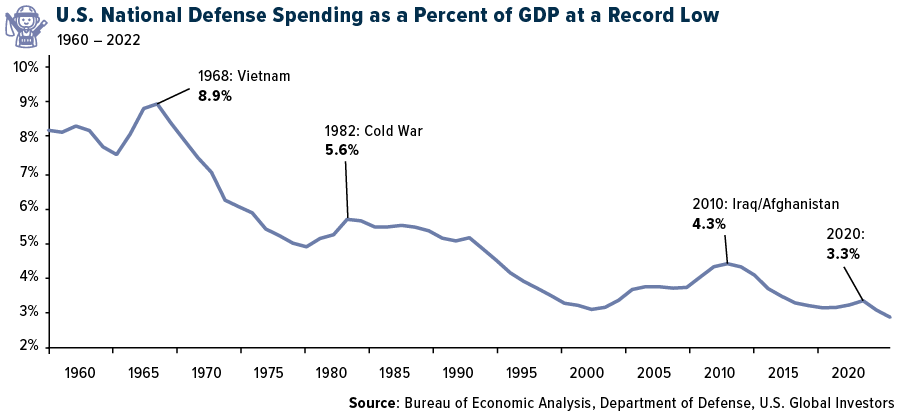

Despite this eye-popping figure, U.S. defense spending as a share of GDP has been falling steadily for decades and recently hit an historic low, a function of the U.S. economy growing faster than military spending.

I believe this highlights an important point: While the U.S. spends more on defense than any other nation, there’s still room for growth, particularly as new threats emerge on both physical and virtual battlefields.

The Congressional Budget Office (CBO) projects that military spending will increase 10% between 2028 and 2038, adjusted for inflation. But Republicans could accelerate this timeline, with bold initiatives like the proposed Iron Dome-style missile defense system.

NATO Members Expected to Boost Expenditures

The potential for increased defense budgets isn’t limited to the U.S. NATO allies, under renewed pressure from an incoming Trump administration, are likely to ramp up their own spending.

Germany, for example, has already met NATO’s 2% GDP defense target for the first time in decades, and public opinion now supports raising it even further to between 3% and 3.5%. Poland currently leads the alliance by spending a whopping 4.12% of GDP on defense, and next year, that figure is expected to rise to 5%.

Cybersecurity: The New Frontline

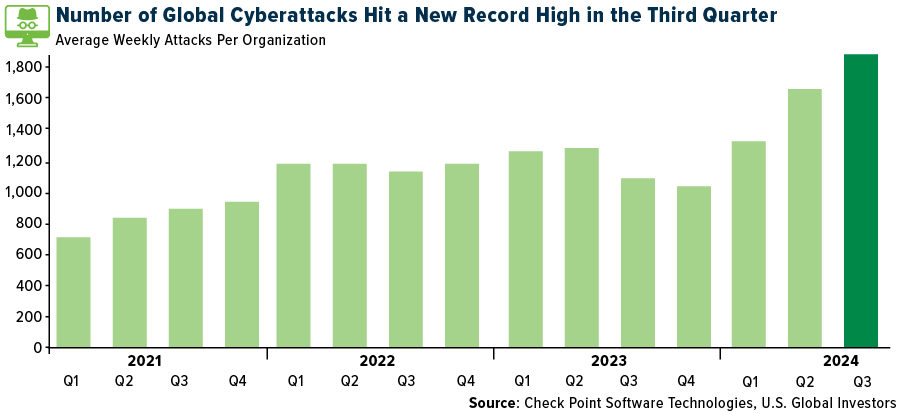

While traditional military spending captures the headlines, the cybersecurity sector represents an equally important—and arguably more urgent, I think—investment opportunity. Recent data by Check Point Software Technologies reveals that cyberattacks have skyrocketed, with the average number of weekly attacks climbing 75% globally year-over-year, to hit a record high of 1,876 per organization. In the U.S., attacks are up 56% from 2023 levels, averaging 1,300 per organization weekly.

The culprits aren’t just rogue hackers but state-sponsored actors from powerful nations like China, Russia and Iran, according to Microsoft’s Digital Defense Report 2024.

These adversaries are no longer content with merely breaching corporate networks. They target critical infrastructure, telecommunications and even political figures. A recent campaign by Chinese state-sponsored hackers infiltrated the phones of Trump, Vice President-elect JD Vance and Vice President Kamala Harris, underscoring the growing national security implications of these attacks.

As businesses, governments and individuals race to protect themselves from these threats, the need for robust cybersecurity will only increase. For investors, this means that companies developing cutting-edge technology to secure networks and data could be positioned for explosive growth.

Challenges and Opportunities

Defense and cybersecurity budgets tend to receive bipartisan support, but Trump’s return could supercharge growth. His track record—and his recent, controversial nomination of Fox News host Pete Hegseth as defense secretary—suggests a willingness to take bold steps to reshape the U.S. military and strengthen the nation’s defenses against 21st-century threats.

As we look ahead to 2024 and beyond, it’s clear that military and cybersecurity spending are on an upward trajectory. The challenges of tomorrow—whether they come in the form of hypersonic missiles or sophisticated cyberattacks—require innovative solutions and significant investment. For investors, this represents not just a challenge but an opportunity.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.24%. The S&P 500 Stock Index fell 2.08%, while the Nasdaq Composite fell 3.15%. The Russell 2000 small capitalization index lost 3.99% this week.

- The Hang Seng Composite lost 8.43% this week; while Taiwan was down 3.44% and the KOSPI fell 5.63%.

- The 10-year Treasury bond yield rose 13 basis points to 4.44%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was JetBlue, up 11.4%. According to Bank of America, IAG’s third-quarter 2024 EBIT of €2,013 million (+15% year-over-year) was 13% above consensus on better-than-expected unit revenue and costs. This was the largest EBIT beat among European airlines this quarter. Strong travel demand continues across IAG’s core markets, with weakness in China.

- Canada’s Federal Labor Minister has ordered the Canada Industrial Relations Board (CIRB) to intervene in labor disputes at Canadian ports in a move to impose binding arbitration. The decision will affect four BC ports, the Port of Montreal, and the Port of Quebec. The Canadian government has directed the CIRB to extend the term of the existing collective agreements until new ones are reached, according to CIBC.

- International travel demand has remained resilient, reports Morgan Stanley, as the number of U.S. citizen departures to international regions has continued to trend above both 2019 and 2023 levels. U.S. departures came in up 8% year-over-year and up 23% vs. 2019 in the month of October.

Weaknesses

- The worst performing airline stock for the week was Spirit, down 60%. According to CLSA, Singapore Airlines’ second-quarter fiscal 2025 results suggest non-fuel cost headwinds are becoming more prominent, with yield still under pressure. As they raise cost assumptions, they lowered the underlying profit forecast by 12-15% over the forecast period.

- The container shipping orderbook-to-fleet ratio continues to build, now 26% with a recent Hapag-Lloyd order for deliveries in 2027-2029, adding an incremental 1%. Nominal capacity growth in October was up 10%, according to JPMorgan.

- Spirit Airlines is preparing to file for bankruptcy protection after merger talks with Frontier Airlines broke down, the Wall Street Journal reports, citing people familiar with the matter. The ultra-low-cost carrier is in advanced discussions with bondholders to hammer out a bankruptcy plan that would have support from most creditors, the report said. Spirit is reportedly preparing for a bankruptcy filing within weeks.

Opportunities

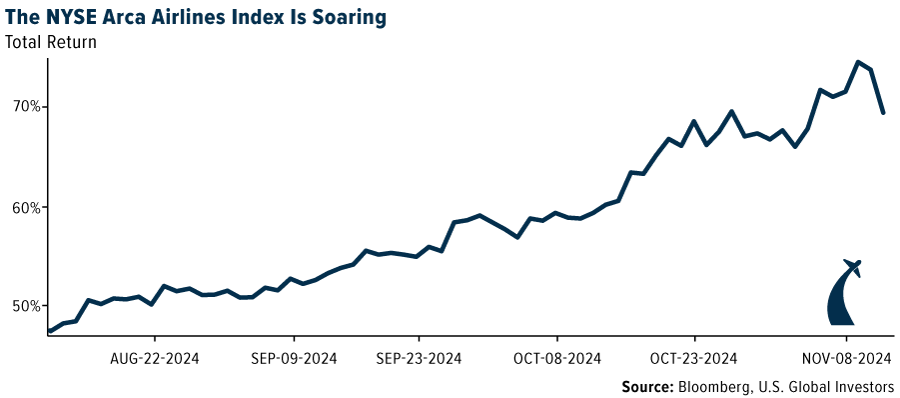

- Bank of America highlights that airline stocks have performed well since last week’s election, with the Dow Jones U.S. Total Market Airlines Index up 12% compared to the S&P 500 5% gain. Looking back at returns during the 2016 election, the best performance period for airlines was the month immediately following the election (up 21% vs. the S&P 500 up 6%).

- Over 70% of shippers did not see the election as a restocking catalyst, with the rest almost equally split between pulling forward and pushing back. 48% of total responses are looking to modestly or significantly ramp up ordering ahead of potential tariff risk. Another 24% are considering/undecided on their future course of action with only 28% of respondents not concerned about tariffs either way, according to Morgan Stanley.

- Cathay Pacific announced its proposal to repurchase the remaining convertible bonds, reports JPMorgan, totaling HK$6.74 billion. The convertible bonds have been a key overhang, capping Cathay’s share price performance within a narrow trading range over the past two years.

Threats

- AAP/AIR has shared insights regarding the potential sale of Boeing’s Jeppesen business. While AAP/AIR views the sale as beneficial in the near term – providing Boeing with needed cash as it ramps up deliveries following the IAM strike – it also notes potential downsides. Selling a profitable unit could be a missed opportunity, especially since Boeing may later need to acquire new software and technology for future aircraft at potentially higher prices.

- Express freight capacity is up 4.4% year-over-year, reports UBS, as the freight market gears up toward peak season. The divergence on intercontinental between air freight and Express growth may indicate some downtrading to deferred products away from Express.

- According to RBC, the 14 deliveries in the month are down 60% year-over-year, although the weak deliveries were expected given the strike. RBC believes investors were less focused on deliveries for October and instead focused on the production rate into 2025 (and the pace at which Boeing can ramp to pre-strike production levels). However, near-term cash expectations around remaining fourth quarter deliveries could be negatively impactful to the balance sheet.

Luxury Goods and International Markets

Strengths

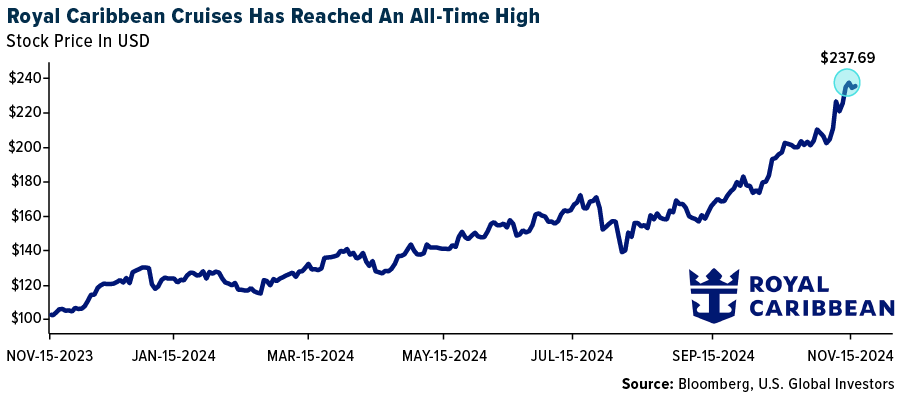

- In a remarkable display of resilience, Royal Caribbean Cruises stock, one of the top holdings in U.S. Global’s luxury-focused fund, has charted a course to an all-time high, reaching a price level of $237.69, reports Investing.com. The company has been experiencing a surge in demand, leading to a significant 17.8% year-over-year increase in third-quarter 2024 revenue, reaching a record $4.9 billion.

- Reliance, one of India’s largest retailers, has opened a new luxury beauty store at Jio World Plaza in Mumbai under its chain, Tira. The store features 15 exclusive boutiques, including brands like Dior, Estée Lauder, Yves Saint Laurent, La Mer, Prada, and Valentino, with Augustinus Bader available exclusively in India. Executive Director Isha Ambani said the store aims to redefine luxury beauty in the country.

- Burberry was the top-performing stock in the S&P Global Luxury sector, gaining 10.24% in the past five days. The performance came after its first-half retail sales exceeded expectations and analysts highlighted the new CEO’s strategy to refocus on the brand’s heritage and stabilize its performance despite ongoing challenges.

Weaknesses

- According to Bloomberg, JPMorgan increased its net short position in Salvatore Ferragamo, a popular Italian luxury brand, by 10% to 1.37 million shares. This highlights the group’s bearish stance on the stock, expecting its price to decrease.

- The Swiss luxury group Richemont, whose brands include names like Cartier, reported a decrease of 1% in its six-month revenue, missing analyst estimates. Its sales in China fell 27%, and watch sales slowed, reports Business of Fashion.

- Amorepacific was the worst-performing stock in the S&P Global Luxury sector, falling 12.14%, after it faced disappointing revenue growth in the third quarter 2024, with a 7% year-over-year decline when excluding COSRX. The move was driven by a 32% drop in domestic duty-free revenue and slower-than-expected growth in the U.S. market for COSRX.

Opportunities

- LVMH has named one of its billionaire owner’s sons as deputy chief of its wine and spirits division as part of a leadership reshuffle at the French luxury group, reports the Financial Times. Alexandre Arnault, the 32-year-old son of Bernard Arnault, will take up the role at Moët Hennessy in February after four years at New York-based jeweler Tiffany, which LVMH bought for $15.8 billion in 2021.

- Amazon’s telehealth service, One Medical, is adding a new option that will put it in direct competition with digital health company Hims & Hers, reports TipRanks.com, which offers medications and treatments for weight loss, mental health, and hair loss. The new Amazon One Medical service offers a subscription plan with low, upfront monthly pricing for a clinical visit, treatment plan, and free medication delivery. The service initially focuses on five conditions: anti-aging skin care treatment, men’s hair loss, erectile dysfunction, eyelash growth, and motion sickness.

- According to consulting firm Bain, the personal luxury goods market could gain 4% in 2025. The positive outlook comes on the back of reactions to the U.S. presidential elections, which could help stabilize the U.S. market in addition to the last stimulus launched by the Chinese government.

Threats

- Industry organizations like the Global Fashion Agenda and Fashion Revolution are not attending this year’s COP29 (the UN’s annual climate talks), focusing instead on other initiatives and urging brands to take more urgent action on sustainability, reports Yahoo! Finance. Kering, LVMH, and other luxury brands, including Stella McCartney, are also sitting out, with some calling for stronger commitments to renewable energy and cleaner supply chains. Fashion Revolution is advocating for brands to invest 2% of their revenue in sustainability efforts, the article continues.

- According to Bain & Company, sales of personal luxury goods could fall 2% this year due to a steep price hike and global economic uncertainty. It would be the first slowdown in demand in 15 years, excluding the Covid-19 lockdown period.

- Based on the last Oliver Wymar survey results, Chinese shoppers (especially millennials) are spending less on luxury goods and turning to more affordable options. In fact, 57% of respondents indicated their intentions to reduce international shopping budgets in 2025.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was coffee, rising 11.93%. Both coffee and cocoa surged this week as the European Parliament considers changes to its deforestation regulations that raise supply concerns. Aluminum prices jumped on Friday after China announce it would cancel a tax rebate on the metal that has fueled excess exports to world markets. This move will curtail China’s exports of aluminum and could be seen as a strategic trade to counter new tariffs.

- According to RBC, fertilizer equities were up along with broad market strength and a bump to potash equities, prompted by news that Belarusian President Lukashenko proposed a 10% production cut in coordination with Russia. Mr. Lukashenko made these statements in a meeting with potash-producer Belaruskali President Rybakov, but there have been no further details on a production cut or comments from Russian producers Uralkali and EuroChem.

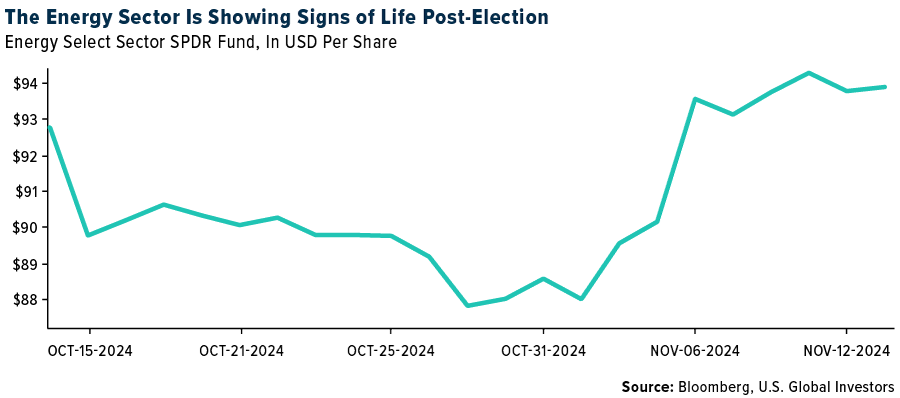

- According to JP Morgan, energy stocks have been big beneficiaries of the U.S. election results, with a number of energy indices beating the S&P 500 since November 5. However, copper miners have declined by more than 10%. While the market seemed to be pricing in a Trump 2.0 outcome over the past few weeks, many election observers were calling for a tight race as well as a split Congress.

Weaknesses

- The worst performing commodity for the week was cotton, dropping 5.92% as better weather in key growing regions boosts the outlook for stronger exports. Oil extended declines on a softer outlook for demand in China, the world’s largest crude importer. Recent data showed anemic Chinese consumer inflation in October and another decline in factory-gate prices, reflecting weak economic growth, according to Bloomberg.

- According to Reuters, more than a quarter of U.S. Gulf of Mexico oil and 16% of natural gas output remained offline in the aftermath of storm Rafael. There were over 480,000 barrels of oil and 310 million cubic feet of natural gas production shut-in, offshore regulator Bureau of Safety and Environmental Enforcement (BSEE) reported.

- Copper declined with other commodities after China’s debt swap plan disappointed investors. The world’s largest importer of the red metal announced a 10 trillion yuan ($1.4 trillion) program to refinance local government debt that will be provided through 2028, but stopped short of unleashing new stimulus, according to Bloomberg.

Opportunities

- Although economic growth in China has been near anemic, India has now surfaced at the leading source of oil demand growth in Asia, according to a U.S. Energy Information Administration (EIA) forecast. Liquid fuel consumption for transportation in India is expected to grow to 300,000 barrels a day while China’s growth has been revised to grow at less than 100,000 barrels a day. Rising electric vehicle (EV) ownership in China is also a factor in China’s reduced growth.

- Russia’s temporary restriction on enriched uranium exports to the U.S. creates an opportunity for American uranium miners to fill the supply gap and capitalize on reduced competition. This move could also support higher uranium prices as the market adjusts to the decreased availability of a major global supplier.

- American mining billionaire Robert Friedland plans to list his African iron ore company on the Australian Securities Exchange (ASX) next year and will use it to raise funds to acquire local critical minerals projects left unloved by the industry downturn. Mr. Friedland hopes to float Ivanhoe Atlantic before June, giving Australian investors exposure to Guinea’s Nimba iron ore project, according to Financial Review.

Threats

- Bank of America highlights several factors that could impact base metals. Ahead of the elections, President Trump signaled plans for a significant realignment of global trade through tariffs, which would likely pressure base metals prices. However, this impact could be partially offset if China ramps up its stimulus efforts. Additionally, the U.S. dollar has strengthened alongside higher interest rates, contributing to the underperformance of material stocks.

- A key segment of the U.S. crude oil market is indicating oversupply, hinting that a potential oil glut could arrive earlier than anticipated. The November-to-December WTI cash roll, which shows traders’ willingness to pay to extend positions into the next month, has shifted into a bearish contango structure for the first time since January, according to Bloomberg.

- The International Energy Agency (IEA) reported they expect global oil markets to face a surplus of move than 1 million barrels a day next year as Chinese demand remains lackluster. Toril Bosoni was interviewed on Bloomberg TV and noted that it’s possible that Chinese oil demand has peaked. Toril further noted that it’s not just a slowdown in the construction sector but a fundamental shift to electric vehicles and high-speed rail to move consumers throughout the country that is undermining demand growth.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Peanut the Squirrel, rising 1,517%.

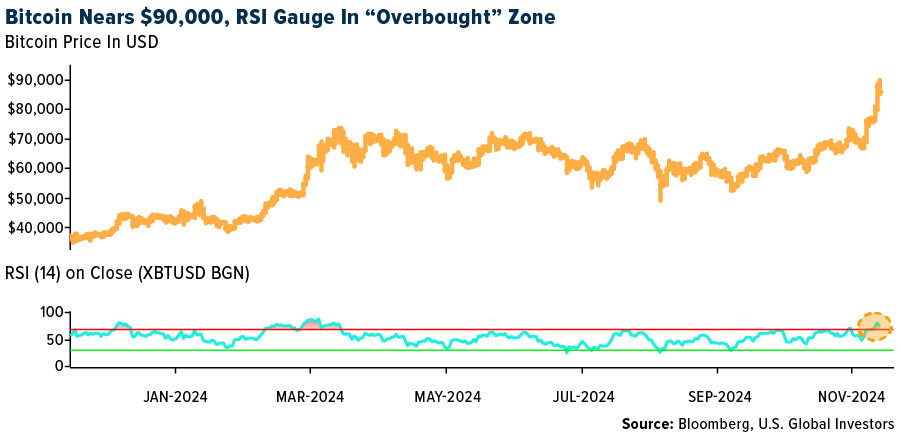

- Bitcoin’s record-breaking rally took the digital asset to $90,000 for the first time this week and lifted the overall value of the crypto market above its pandemic-era peak, writes Bloomberg. This comes as traders bet on a boom under President-elect Donald Trump. Bitcoin jumped about 32% since the election as Trump vowed friendlier crypto rules.

- Billionaire Elon Musk and entrepreneur Vivek Ramaswamy will lead a new Department of Government Efficiency (DOGE), reports Bloomberg, tasked to “dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure federal agencies,” President-elect Donald Trump announced Tuesday.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Monero, down 13.09%.

- Bitcoin’s stellar run is finally showing signs of losing steam. The cryptocurrency looks set to head lower as momentum players see similarities with the bearish setup from early August. The trigger looks to be Jerome Powell’s comment that the Fed doesn’t need to hurry to cut interest rates, according to an article published by Bloomberg.

- Michael Novogratz said there is a low likelihood that the U.S. will set up a Bitcoin strategic reserve as proposed by President-elect Donald Trump. “I still think it’s low probability,” Novogratz said during an interview Wednesday on Bloomberg Television.

Opportunities

- Bitcoin options traders buoyed by Donald Trump’s election victory are already eyeing a landmark price of $100,000 for the popular cryptocurrency. Investors are lining up bets that Bitcoin will pass the milestone as soon as the end of the year, writes Bloomberg.

- Intesa Sanpaola SpA is expanding the remit of its digital assets desk to handle spot trades with cryptocurrencies, the latest move deeper into the new market by a traditional bank. While the spot trading isn’t yet up and running, the desk has had the necessary internal approval and technical systems in place for about a month, Bloomberg reports.

- An ally of Donald Trump in the U.S. Senate has a plan for filling up the president-elect’s proposed strategic Bitcoin stockpile without adding to the government deficit, reports Bloomberg. The plan: Sell some of the Federal Reserve’s gold. Republican senator Cynthia Lummis of Wyoming plans to push forward with a bill to do exactly that when the new Congress is seated next year.

Threats

- Sam Trabucco, one of Sam Bankman-Fried’s inner circle friends, has agreed to hand over properties, including his yacht, to creditors of the FTX exchange. The former co-CEO of Alameda purchased the 53-foot boat for $2.51 million just before leaving the hedge fund in March 2022, Bloomberg writes. He has also agreed to give up legal title of his two apartments in San Fransisco that he purchased for $8.7 million.

- Roger Ver AKA Bitcoin Jesus is charged with evading more than $48 million in taxes for selling $240 million in tokens. It’s the most prominent case dealing solely with tax fraud and digital-asset sales, according to Bloomberg.

- An Ohio man who laundered more than $300 million of Bitcoin on behalf of drug traffickers and other criminals was sentenced to three years in prison after a judge granted him leniency for helping the U.S. prosecute other cryptocurrency cases. His helix services helped hundreds of drug dealers to operate for years with greater impunity and eased the movement of hundreds of millions of dollars, writes Bloomberg.

Defense and Cybersecurity

Strengths

- General Dynamics won a $5.57 billion contract with the U.S. Air Force for operations, maintenance and sustainment of mission partner environments, with completion expected by December 2035.

- The Missile Defense Agency awarded Northrop Grumman a $541 million contract modification to advance the development of the Glide Phase Interceptor, a U.S.-Japan partnership technology designed to detect and intercept hypersonic weapons, with work continuing in Arizona until 2029.

- The best performing stock in the XAR ETF this week was Rocket Lab USA, rising 40.64%, after third quarter revenue surged 55% to $104.8 million, beating expectations amid strong demand.

Weaknesses

- The U.S. has accused China of conducting a massive cyber-espionage campaign that compromised multiple telecommunications companies to target the phones of prominent political figures. This means the potential access of systems used for wiretapping, with the breach under ongoing investigation.

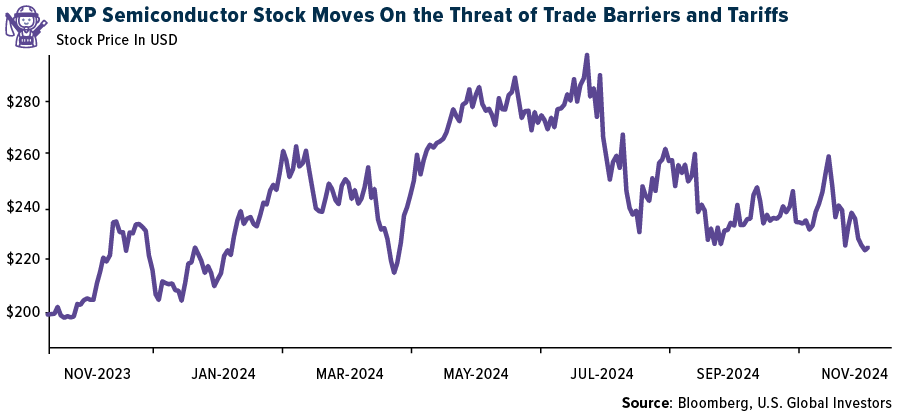

- The CEOs of European chipmakers NXP, Infineon and STMicroelectronics warn that increasing nationalistic industrial policies and fragmentation of chip production across regions will drive up costs, hinder global cooperation, and potentially make devices unaffordable. This is a concern heightened by Donald Trump’s re-election and the risk of import tariffs.

- The worst performing stock in the XAR ETF this week was V2X Inc., falling 14.37%, after a secondary public offering was priced at $61 per share, driven by growing concerns over the company’s reliance on government contracts. This negative impact on share price was amplified by Donald Trump’s announcement of the “DOGE Agency,” sparking speculation about stricter oversight and tighter controls, which adversely affected companies dependent on federal funding.

Opportunities

- L3Harris has partnered with the U.S. Navy to deliver the first Autonomous Undersea Vehicles (AUVs) powered by advanced lithium-ion batteries approved for submarine use, enhancing endurance, operational flexibility, and safety for undersea missions.

- Thales targets robust growth through 2028, aiming for 5-7% annual sales increases and higher EBIT margins across defense, cybersecurity, avionics, and space sectors. The growth target is driven by heightened global security demands.

- Donald Trump is expected to increase support for Israel, confront Iran, and expand the Abraham Accords, while his new administration signals a shift in U.S. Middle East policy with key pro-Israel appointments.

Threats

- JPMorgan CEO Jamie Dimon believes that the biggest threat facing the economy is not financial but geopolitical, warning that conflicts in Ukraine and the Middle East could spiral into World War III. Dimon says Russia, North Korea, Iran, and China are challenging post-WWII systems like NATO, and placing nuclear proliferation as a more immediate risk than climate change, though he holds out some hope that peace could still prevail.

- Russia has introduced a tiered payment system to increase compensation for soldiers wounded in the Ukraine war, with President Putin raising the one-time payment for those disabled by injuries to 4 million rubles, retroactive to the invasion’s start. This comes while also cutting benefits for lighter injuries amid rising defense costs and avoiding further mobilization.

- China’s sixth-generation fighter jet aims to close the technological gap with advanced stealth, AI, networked operations, and enhanced maneuverability, positioning it as a significant future force in air combat by 2035, with a prototype expected by 2028.

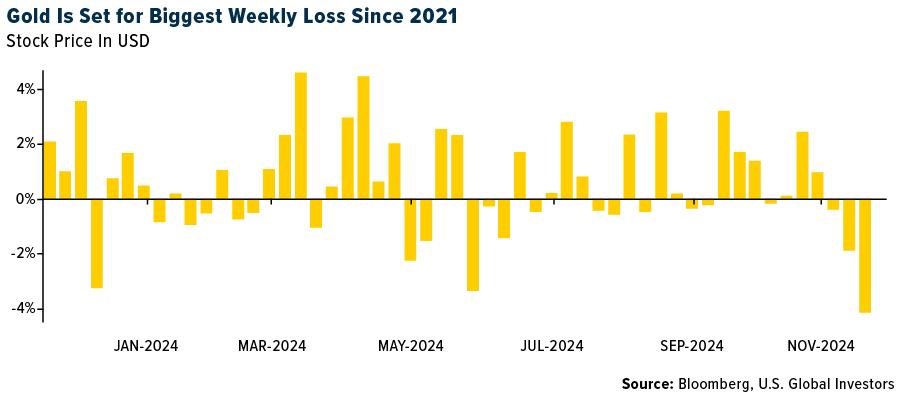

Gold Market

This week gold futures closed the week at $2,567.00, down $127.80 per ounce, or 4.74%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 9.28%. The S&P/TSX Venture Index came in off 2.96%. The U.S. Trade-Weighted Dollar surged 1.68%.

Strengths

- The best performing precious metal for the week was silver, but still down 3.56%. According to JPMorgan, Harmony published its first quarter 2025 operating update: 422,000 ounces of production is a beat and AISC is a beat (R1,026,137/kg). The company reiterated its fiscal year 2025 guidance across all metrics (production, AISC & grade). “We are well-positioned to execute our various life-of-mine extension projects and take our transformational international copper-gold projects up the value curve,” it said.

- The Silver Institute notes that, “The global silver market is set to record a physical deficit in 2024 for the fourth consecutive year. Record industrial demand and a recovery in jewelry and silverware will lift demand to 1.21 billion ounces in 2024, while mine supply will rise by just 1%.” The report went on to explain that exchange-traded products are on track for their first annual inflows in three years as expectations of Fed rate cuts, periods of dollar weakness and falling yields have raised silver’s investment appeal.

- Newcore Gold reported that it intersected 204 g/t over 1-meter, the highest-grade interval to date, and a second intercept of 3.36 g/t over 28 meters at its Enchi Gold Project in Ghana. There is currently a 10,000-meter program underway. The drill program will move inferred to indicated resources and likely expand the footprint of the deposit. Ghana and Cote d’Ivoire are two of the most favorable West African mining jurisdictions.

Weaknesses

- The worst performing precious metal for the week was palladium, down 4.51%. The world’s largest gold-backed ETF recorded its biggest weekly outflow in more than two years last week as Donald Trump’s decisive election win prompted traders to book profits. SPDR Gold Shares (GLD) saw an outflow of over $1 billion, the largest weekly fund outflow since July 2022, according to data compiled by Bloomberg.

- Despite the cut in interest rates last week, gold still slid back again this week on the comments from Jerome Powell that the Fed will be in no rush to cut rates given the strong performance of the economy. According to JPMorgan, COMEX Non-Commercial Gold positioning has fallen to 255,000 lots net long, which is the lowest since early August. Longs fell by 30,000 lots this week while shorts also moderated slightly.

- According to the Financial Times, shares of gold producer Resolute Mining plunged more than 30% on Monday after the company announced its chief executive Terence Holohan and two other employees had been detained in Mali. The executives were in the capital Bamako to discuss with officials “open claims made against Resolute” that the group “maintains are unsubstantiated,” said Resolute, which is listed in Sydney and London. $160 million dollars to resolve the tax dispute is the number that seems to be the price of their “bail.”

Opportunities

- Canaccord notes that following Trump’s 2016 win, the gold price corrected 12% in the first 45 days after the election, before going on to gain 68% over the remainder of his term (41% before COVID started). This next month-and-a-half or so is likely to present the market with a new entry point into gold, as the new Trump administration begins to implement policies that likely will disrupt the economic plans of some industries that are reliant upon imports and could heighten the inflation risks for the U.S.

- Silver was the best performer of the precious metals this week but still down. The silver market is expected to experience its fourth year of deficit production, but demand is still expected to grow. China started generating power from its first gigawatt-level offshore solar project. The project is about 5 miles off the coast of Shandong. By the end of 2025, Shandong plans to add more than 11 gigawatts of offshore solar with a goal of 42 gigawatts of ultimate capacity.

- Westgold Resources has materially increased its Starlight Mine Resource by 91%, including declaring a maiden open pit Resource. The increase has the potential to lift both: 1) the sustainable rate of site production, and 2) substantially extend mine life beyond five years, according to RBC.

Threats

- China’s Zijin Mining says the Buritica gold mine in Colombia suffers losses due to illegal mining, according to a statement. The losses are estimated to be around 3.2 tons of gold, valued around $200 million. The perpetrator of this seizure has been chalked up as the “Gulf Clan” – armed Colombian drug cartel. On another continent, the South African government has said it will not help thousands of illegal miners inside a closed mine. The illegal miners are said to be running out of food, water and supplies after local police closed off entrances that were used to transport these necessities forcing them to come to surface and be apprehended.

- Fresnillo shares dropped after the gold and silver miner warned the Sabinas mine is experiencing “operational difficulties” that are affecting production. Analysts note this is likely to lead to a lower contribution from the Silverstream agreement, which entitles Fresnillo to a portion of the mine’s silver output from its owner Industrias Peñoles, according to Bloomberg.

- The rise of electric vehicles is poised to shake up demand for platinum group metals that are used in auto catalysts to reduce pollutants from car exhaust fumes. Palladium will be the hardest hit among the PGMs as catalytic converters are its main demand driver. Given its limited applications beyond transport, palladium is expected to start to see surplus volumes in the market beyond 2030, according to Bloomberg NEF analysis.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Spirit Airlines

Frontier Group Holdings

Boeing Co/The

Royal Caribbean Cruises

Christian Dior

Estee Lauder

PRADA SpA

Cie Financiere Richemont

LVMH Moet Hennessy Louis Vuitton

Amazon.com Inc.

General Dynamics

Harmony Gold

Resolute Mining

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.