How Price Controls Could Harm the U.S. Economy Under a President Harris

This week, before she accepted the Democratic Party’s nomination for president, Vice President Kamala Harris threw her support behind President Joe Biden’s tax proposals for 2025, which include a steep 44.6% capital gains rate and an unprecedented 25% tax on unrealized gains.

While I’ve spoken before about the absurdity of taxing unrealized gains, today I want to discuss another alarming measure Harris supports: price controls.

For those unaware, price controls are a type of government regulation that sets limits on how much prices or wages can increase. These can take the form of price ceilings, such as rent controls, or price floors, like minimum wage laws.

On the surface, these measures might seem as though they’re intended to protect consumers from inflation, but in reality, they often do more harm than good—and there are thousands of years’ worth of examples. The economic principles that guide our markets are delicate, and when government intervention disrupts these natural forces, the consequences can be severe.

Price Controls Are a Recipe for Shortages and Stagnation

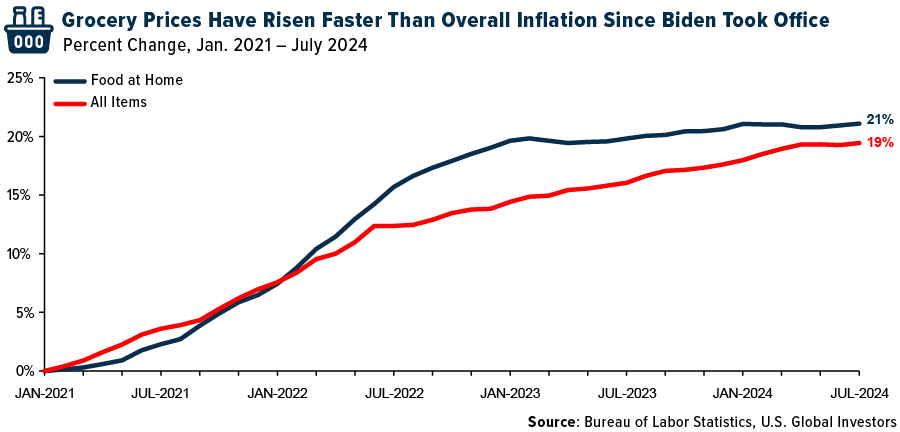

Consider the issue of inflation, which has been a persistent concern for many Americans. We’re all feeling the pinch at the grocery store, where food prices have risen 21% on average since Biden’s inauguration.

Harris’s proposed solution—price controls—sounds appealing, but it’s a Band-Aid on a bullet wound.

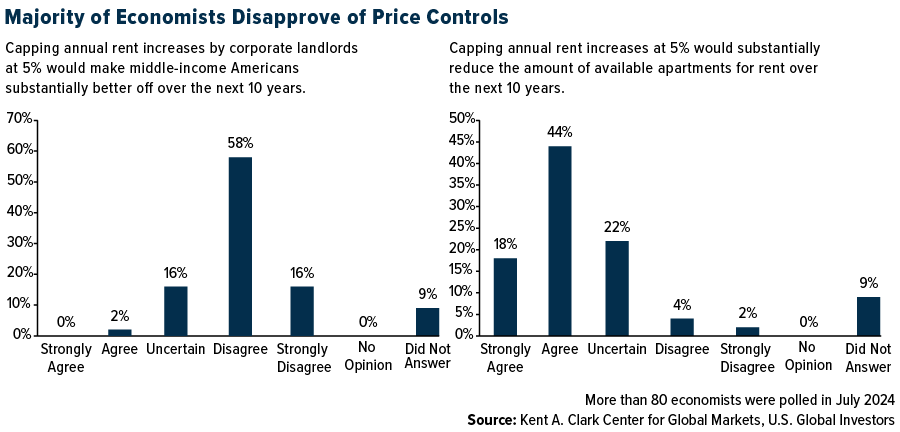

Most economists agree that price controls are not the answer. According to regular surveys conducted by the Chicago Booth School, a majority of economists do not believe that price controls could effectively limit U.S. inflation over the course of a year.

In a July survey, three quarters of economists either disagreed or strongly disagreed with the statement that capping rent hikes at 5% annually would help Americans over the long run. Similarly, an overwhelming 62% either agreed or strongly agreed that controlling price increases would lead to “substantial” supply shortages.

Nixon’s Price Freeze: A Cautionary Tale of Economic Mismanagement

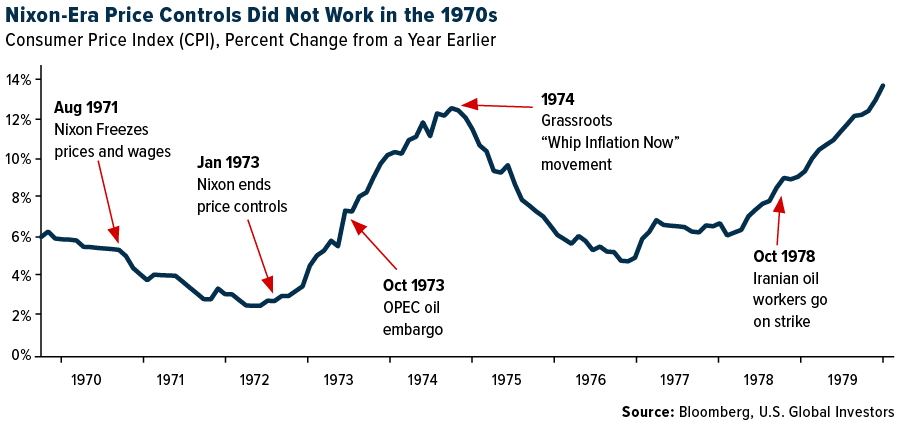

We don’t have to look very far back in U.S. history to see the dangers of price controls. In August 1971, President Richard Nixon imposed a 90-day freeze on all prices and wages in the United States.

At first, the move was popular, giving Nixon a boost in his re-election bid the following year.

But the initial success was short-lived. Nixon’s plan contributed to a decade of stagflation—a toxic mix of high inflation and slow growth that eroded living standards for millions of Americans.

It wasn’t until 1983, midway through Ronald Reagan’s first term as president, that the economy finally began to recover. In a radio address in October of that year, Reagan pointed to “solid evidence that America has turned the corner toward long-term economic expansion.”

The lesson is clear: Price controls are not a sustainable solution. They distort market signals, leading to inefficiencies and economic stagnation. Remember, prices serve as marketplace indicators. High prices might be frustrating for consumers, but they send an important message to producers: There’s profit to be made here, so invest more. For consumers, high prices signal scarcity, which encourages them to use resources more wisely.

Why Lowering Gas Prices Could Lead to Higher Costs and Shortages

Take gasoline as an example. If gas were to soar to $5 a gallon, people would probably cut back on non-essential driving. Meanwhile, the high price would encourage oil companies to ramp up production, which would eventually lead to lower prices.

But what if the government artificially capped gas at, say, $2 a gallon? It would send the wrong signals to both consumers and producers. Consumers would drive just as much as before, if not more, exacerbating the scarcity, while producers would have less incentive to increase supply. This could lead to even higher prices down the road or, worse, gas shortages.

Unrealized Gains Tax Could Trigger a Mass Capital Outflow from the U.S.

Harris’s support for a tax on unrealized gains would also have far-reaching consequences for the U.S. economy. As I’ve said before, taxing gains on assets you haven’t sold yet is not just absurd, it’s dangerous. It’s a policy that would drive capital out of the country at an unprecedented rate, leading to a loss of tax revenue and a weakening of our financial system.

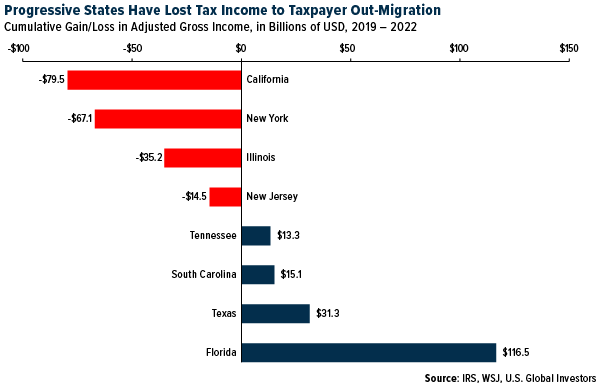

We’re already seeing a mass exodus of wealth from high-tax states like New York and California to more tax-friendly states like Florida and Texas.

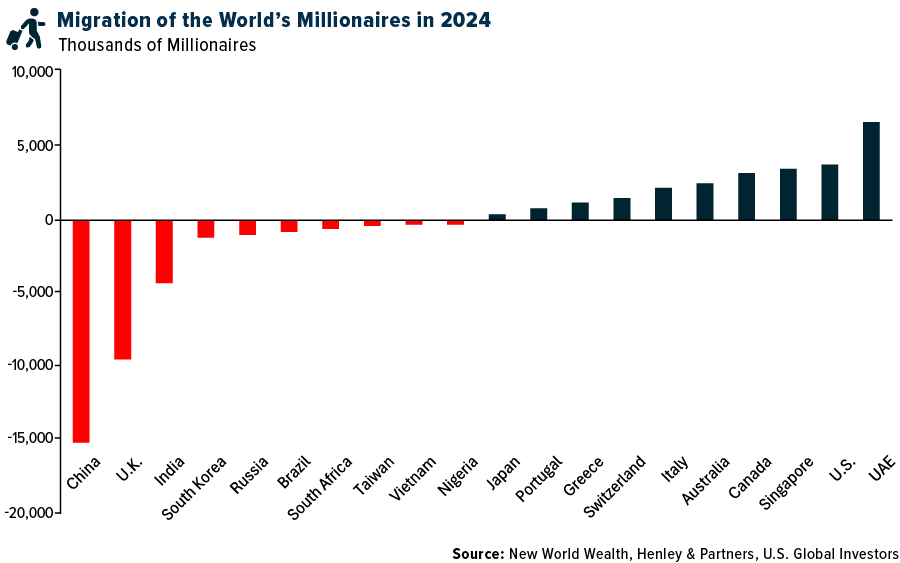

But this trend is not limited to the U.S. Globally, the movement of millionaires from countries with burdensome tax policies to more welcoming environments is accelerating. According to the Henley Private Wealth Migration Report, an estimated 128,000 millionaires are expected to relocate this year, surpassing the previous record set in 2023.

The United Arab Emirates (UAE) ranks first in attracting this wealth by offering a business-friendly environment and luxurious living conditions. Conversely, countries like China and the United Kingdom are facing significant outflows of high-net-worth individuals (HNWIs) due to slowing growth, geopolitical tensions and unfavorable tax regimes.

The implications of this “great millionaire migration” are profound. Wealthy individuals contribute significantly to the tax base, and their departure can cripple a nation’s finances.

Supporting Free Markets and Limited Government

The economic policies Harris supports—price controls and the taxation of unrealized gains—are misguided at best and catastrophic at worst. As history has shown us, these measures disrupt market forces, stifle economic growth and can lead to financial crises.

If we want to preserve America’s prosperity, we must resist these flawed policies and instead embrace the principles of free markets and limited government intervention. The stakes are too high to do otherwise.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.27%. The S&P 500 Stock Index rose 1.45%, while the Nasdaq Composite climbed 1.40%. The Russell 2000 small capitalization index gained 3.58% this week.

- The Hang Seng Composite gained 8.69% this week; while Taiwan was down 0.86% and the KOSPI rose 0.17%.

- The 10-year Treasury bond yield fell 8 basis points to 3.798%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Allegiant, up 14.5%. The closing of the Alaska Air/Hawaiian Air merger will not be objected to by the Department of Justice (DOJ). However, it remains subject to, among other customary conditions, receipt of U.S. Department of Transportation approval of an interim exemption application that Alaska and Hawaiian have previously jointly submitted.

- According to Goldman, the “Big Three” West Coast Ports (L.A., Long Beach, and Oakland) reported July 2024 traffic – with combined inbound loaded containers up 20% year-over-year, which is above the pre-pandemic five-year average of 1% year-over-year. Sequentially, the combined data was up 14% month-over-month, which is above the five-year average.

- As reported by TD, another major focus area will be refinancing Hawaiian’s loyalty program debt. Hawaiian’s debt exchange earlier this summer included a provision that allows refinancing at par for 180 days following the merger. Alaska management projected $235 million of run-rate synergies when the deal was first announced.

Weaknesses

- The worst performing airline stock for the week was Celebi Aviation, down 9.0%. According to RBC, it was announced that Boeing is grounding its 777X fleet after flight tests revealed failures of a key engine mounting structure. Unfilled orders for the 777X program currently stand at 481 aircraft. With its second-quarter earnings report, Boeing detailed that its inventory increased $800 million sequentially to $6.1 billion for the 777X program.

- Average worldwide air cargo volume slipped 1% in the first full week of August, reports Morgan Stanley, compared with the previous week, while rates continued to hold steady. With the latest decline, global tonnages have dropped since the start of July by 3%, while the average overall rate remained stable.

- Japan saw a strong start to the summer peak with positive 7.3% year-over-year growth in July domestic airline passengers, reports Bank of America. ANA continued to gain market share in July with 10.3% year-over-year domestic passenger growth helped by its more flexible pricing strategy.

Opportunities

- The Biden administration announced nearly $300 million in awards for sustainable aviation fuel (SAF) and other technologies, reports Morgan Stanley. As part of the Investing in America Agenda, the Federal Aviation Administration (FAA) announced $291 million for projects that will help achieve the goal of net-zero greenhouse gas emissions from aviation by 2050 by expanding SAF production and increasing availability.

- According to Stifel, EBITDA from the respective container shipping companies is likely to be 30%-300% higher than the third quarter depending on the operating leverage of the various companies. Rates are rolling over, having fallen each week since mid-July. They are still nearly triple where they were a year ago at this time, however, thanks to Red Sea disruptions and inventory pull forwards ahead of a likely longshoremen’s strike on the U.S. East and Gulf Coasts.

- Morgan Stanley reports that the number of U.S. citizen departures to international regions has continued to trend above both 2019 and 2023 levels, with U.S. departures coming in up 7% year-over-year and up 18% versus 2019 in the month of July. While the number of non-U.S. citizen international arrivals into the United States remains below 2019 levels, July 2024 arrivals reached all-time highs since the pandemic, coming in up 8% year-over-year and down 9% versus 2019 levels.

Threats

- Spirit lowered system capacity by 730/220 basis points (bps) in October/November, reports Bank of America. Both domestic and Latin American schedules saw capacity reductions in the periods, while domestic saw a modestly greater share of the cuts at 750/230bps compared to Latin America at 620/160bps. Fourth quarter 2024 schedules are currently tracking toward -7.0% year-over-year, below their -5.0% estimate.

- June was enormous, says Stifel, with 77 ships ordered, marking the second-highest month of ordering in history. This is followed by a slightly higher-than-average July, and now in August ordering is elevated, but there appears to be more on the way.

- According to Raymond James, Alaska flight attendants voted down their agreement. American Airlines flight attendants had a 33-36% pay increase over the five-year contract versus 32% at Alaska, and they believe Alaska’s flight attendant pay currently is 2% below American flight attendant pay.

Luxury Goods and International Markets

Strengths

- Preliminary August Eurozone Service PMI was reported at 53.3, above the expected reading of 51.7, and July’s 51.9 reading. The Euro-area service sector was boosted by activity in Paris during the Summer Olympics.

- Toll Brothers, a luxury homebuilder, reported stronger-than-expected earnings as lower mortgage rates sparked demand for luxury homes. Purchase contracts for the three months through July rose 11% from the same period a year ago.

- Lucid Group, a carmaker, was the best performing S&P Global Luxury stock, gaining 33.3%. Lucid is preparting to launch its highly anticpated Lucid Gravity SUV later this year, competing with Tesla’s Model 3 and Y.

Weaknesses

- Manufacturing activity slowed in both the Eurozone and the United States, signaling a broader slowdown. In the Eurozone, the Manufacturing PMI declined to 45.6 in August from 45.8 in July, falling short of the expected unchanged reading of 45.8. In the United States, the Manufacturing PMI was reported at 48.0, down from 49.6 in July and below the anticipated reading of 49.5.

- Dillard’s reported a significant earnings miss for the second quarter, with a notable decline in sales, particularly in men’s apparel, accessories, and shoes, amid a challenging consumer environment. Macy’s reported an earnings beat but the company guided for weaker sales in the full year.

- Prada was the worst-performing S&P Global Luxury stock, losing 6.9% in the past five days on little news.

Opportunities

- Hermès is set to open its first Tennessee store in Nashville’s Wedgewood-Houston neighborhood, highlighting the brand’s confidence in the U.S. market and potential for growth. The French brand’s first store in the state of Tennessee is expected to open in the fall of 2025. A majority of future Hermès store openings will be concentrated in the U.S. and China. Hermès opened a store in Princeton, N.J., last spring, and other recent U.S. openings have been in Aspen and Austin.

- Ferrari’s upcoming hypercar, the F250, successor to LaFerrari, has been spotted testing. It is expected to debut by the end of 2024 with a turbocharged V6 engine, potentially reaching 1,300 horsepower.

- The purchasing power of high-net-worth individuals in India is on the rise, driving luxury car brands to expand their presence across the country. Last year, British iconic luxury sports car manufacturer Aston Martin revealed plans to open a new dealership in South India, aiming to double its sales volume within a year or two. Lamborghini, another leading luxury car brand, is also targeting expansion in India. The luxury car segment reached its highest-ever volumes in the calendar year 2023, with 45,000 units sold, marking a 20% increase — nearly double the industry’s overall growth rate.

Threats

- Sephora, the luxury cosmetic retailer owned by LVMH, announced a 10% workforce reduction in China. The company entered the market in 2005 and expanded its brand to 300 stores but has struggled to achieve profitability, Bloomberg reported. Additionally, in recent years, the competitive landscape has shifted in favor of local Chinese brands. Domestic brands now hold about 50% of the market, offering products that are more affordable and better aligned with local preferences than Western beauty cosmetics.

- Estée Lauder forecasted annual sales significantly below estimates, as consumer weakness in China continues to drag on revenue growth. The company now expects revenue to be in a range of -1% to +2%, while analysts had anticipated a revenue increase of 5.6%. CEO Fabrizio Freda will retire at the end of June 2025, after a decade and a half with the company, during which he transformed the brand into a global cosmetic giant. However, the company has encountered difficulties in recent years, with its share price declining sharply.

- Burberry, a luxury apparel company listed on the London Stock Exchange, may leave the FTSE 100 Index after being part of the United Kingdom’s blue-chip index for the past 15 years. Burberry’s market capitalization of £2.5 billion ($3.3 billion) is below the required threshold to remain in the index, Bloomberg reported. Shares of Burberry have fallen 66% over the past year. FTSE Russell is expected to announce preliminary index changes on Tuesday.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, rising 9.41%. Kazatomprom, which provides over 40% of the world’s uranium, lowered its guidance for 2025 due to continued uncertainty in relation to its sulfuric acid supplies. Chinese copper exports dropped last month from an all-time high, as domestic buyers took advantage of the metal’s rapid retreat in price. Exports of unwrought copper and products fell 40% from June to 140,940 tons, according to customs data on Sunday.

- U.S. power developers boosted generation capacity in the first half of the year by the most in more than two decades to help meet growing electricity demand, driven by data centers and artificial intelligence (AI). Electricity generation rose by 20.2 gigawatts between January and June, the Energy Information Agency (EIA) said in a release Monday.

- The U.S. reported its first summer weekly withdrawal of natural gas stockpiles since 2016 and the first for this time of year in at least a decade. The supply drop is a tell-tale sign that gas, which has traditionally been thought of as a heating fuel, is becoming increasingly critical to keeping the lights on and air-conditioners blowing in hotter months. Natural gas futures climbed on Monday, according to Bloomberg.

Weaknesses

- Sentiment changed on Thursday with natural gas turning out to be the worst performing commodity for the week, dropping 4.29% on a weekly storage report that showed a greater increase in stockpiles than was expected. Morgan Stanley’s channel checks suggest current domestic zircon prices have decreased over the last three months, with demand weakness driving prices $70-$100 per ton lower. Zircon prices are expected to remain under pressure in the coming months, with downstream demand unlikely to rebound over the next three months.

- According to UBS, sentiment for iron ore remains cautious with spot prices falling to $94 per ton after Hu Wangming, chair of Baowu Steel, the world’s largest steelmaker, last week warned that the sector is in crisis, facing a “winter” that was “longer, colder and more difficult” than the previous market downturns of 2008 and 2015.

- Oil output from Mexico’s Petroleos Mexicanos has slumped to about half its peak from 20 years ago. It is a bad sign for the state-owned driller, whose conventional assets are running dry as it tries to dig itself out from under a nearly $100 billion debt burden, according to Bloomberg.

Opportunities

- Canada’s Electra Battery Materials has received a $20 million award from the U.S. government to build a cobalt plant close to North America’s automotive heartland. The funds will support construction of a cobalt sulfate facility in Ontario that will be North America’s only refinery for the material used in lithium-ion batteries for electric vehicles, Electra said Monday in a statement.

- Chatter increased on Monday regarding possible economic stimulus measures from China’s government. Expectations of big stimulus measures out of Beijing have produced a string of disappointments since early 2023. But Chinese economic data has turned so weak that this time will likely be different, according to Investor’s Business Daily.

- China approved 11 nuclear reactors across five sites on Monday, a record number of permits as the government leans even more heavily on atomic energy to support its push to cut emissions. The State Council greenlighted the new reactors in sites spread across Jiangsu, Shandong, Guangdong, Zhejiang and Guangxi, state-run China Energy News reported.

Threats

- Should President Donald Trump be reelected, rising tariffs and immigration curbs could bring U.S. inflation back, potentially limit the ability of the Federal Reserve to cut rates quickly and likely lead to a stronger than expected dollar environment. In turn, these moves could hurt emerging markets in the first half of 2025, dampen global consumption of commodities, curb oil demand growth by 500,000 barrels per day in 2025, and lead to a much flatter Brent crude oil curve, according to Bank of America.

- According to Scotia, the near-term copper market outlook has deteriorated. After incorporating their updated supply expectations for their combined coverage universe, they now forecast a weaker near-term outlook for the copper market due to lower global demand, particularly in China.

- Iron ore is poised to extend declines into the $80-per-ton range as China’s steelmakers reduce production, according to Citigroup, which pared price forecasts and said that market dynamics have shifted. “Further price weakness is required to bring the market back into balance,” Citigroup analysts including Shreyas Madabushi said in a report received on Tuesday. In a surprise move at the end of the week, China abruptly suspended its system for approving new steel plants.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Popcat, rising 63.18%.

- Binance Holdings is hiring 1,000 people this year with many earmarked for compliance roles, writes Bloomberg, as the crypto exchange’s annual spending to meet regulatory requirements, including U.S. oversight under a plea deal, tops $200 million. CEO Richard Teng, who is visiting the U.S. to talk to monitors and officials, outlined the employment goals.

- Coinbase Global Inc. announced the expansion of its crypto services into Canada, partnering with local banks to offer seamless integration with Canadian payment systems, aiming to capture a larger share of the growing North American crypto market, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Zcash down 4.16%.

- Bitcoin and the wider crypto market are nursing sharp losses for the month so far even as global stocks push back toward record highs after shaking off a growth scare over the U.S. economy. The largest digital asset has fallen about 9% in August, reports Bloomberg, lagging a gain of almost 1% in MSCI Inc.’s world share index as well as a jump in gold to all-time highs.

- Hong Kong’s push for a digital-asset hub faces growing pains amid uncertainty over whether 11 crypto exchanges will all achieve full licenses after earlier receiving initial approvals. The city’s Securities and Futures Commission found unsatisfactory practices at some of the “deemed-to-be-licensed” platforms during inspections, Bloomberg reports.

Opportunities

- Nigeria’s top finance regulator plans to license providers of virtual assets including cryptocurrencies to tap opportunities and protect investors as adoption rates surge in the nation, writes Bloomberg. The Abuja-based SEC is looking to issue its first licenses for digital service and tokenized assets this month.

- Bitcoin mining company Bitfarms agreed to acquire Stronghold Digital Mining for about $125 million in stock while it fends off a takeover attempt by Riot Platforms, according to an announcement this week. Stronghold shareholders will receive 2.52 Bitfarms shares for each share held.

- A signal from the Bitcoin derivative market points to the growing risk of a “short squeeze” that can stoke sharp rallies in the largest digital asset. The metric is the funding rate for Bitcoin perpetual futures, which helps to gauge how bullish or bearish speculators are, reports Bloomberg.

Threats

- Miami Heat basketball star Jimmy Butler and YouTube influencer Ben Armstrong agreed to pay a combined $340,000 to resolve claims that they helped dupe Binance Holdings customers into buying unregistered securities, according to an article published by Bloomberg.

- Blockchain security platform Scam Sniffer reported that a crypto trader lost $55.47 million in DAI stablecoin to a phishing attack, Bloomberg reports. According to the firm, the trader lost their assets after mistakenly transferring ownership of the collateralized debt position on DeFi Saver Proxy to a malicious wallet.

- The U.S. Department of Justice has intensified its investigation into Tether, the issuer of the world’s largest stablecoin, focusing on potential bank fraud, which could lead to heightened regulatory scrutiny across the entire stablecoin market, Bloomberg reports.

Defense and Cybersecurity

Strengths

- Oshkosh Defense was awarded a $1.54 billion contract by the U.S. Army to continue delivering and modernizing heavy tactical vehicles through 2031.

- The U.S. State Department approved a $3.5 billion sale of 36 Apache helicopters, engines, missiles and support equipment to South Korea. This continues a surge in American foreign military sales, with Boeing and Lockheed Martin as primary vendors, amid rising global defense spending and influenced by geopolitical tensions.

- The best performing stock in the XAR ETF this week was V2X Inc., rising 19.19% after it secured a $3.7 billion task order to enhance readiness and training capabilities for the U.S. Army globally. This solidifies its role in supporting mission-critical initiatives across all operational theaters.

Weaknesses

- Several NATO allies have failed to deliver promised air-defense systems and military equipment to Ukraine, causing delays that could weaken Ukraine’s defense against Russia as winter approaches. The news comes despite urgent pleas from President Zelenskiy for timely support.

- European defense stocks dropped following a report suggesting Germany would stop granting new aid requests to Ukraine, though the German government later refuted this claim, affirming continued support for Ukraine. Despite this, companies like Rheinmetall and Hensoldt saw significant losses, with a broader basket of defense shares also declining but still up considerably for the year.

- The worst performing stock in the XAR ETF this week was Mercury Systems Inc., falling 6.51%, after Mercury Systems insiders, including CFO David E. Farnsworth, collectively sold over $681,000 worth of shares, marking the largest insider sale for the company in the past year.

Opportunities

- Australia will invest up to A$850 million in partnership with Kongsberg Gruppen ASA to build a long-range missile manufacturing plant in Newcastle. This will strengthen its defense capabilities and strategic ties amid regional tensions.

- Shield AI successfully demonstrated its AI-powered ‘Hivemind’ piloting with two Kratos Firejets in coordinated autonomous maneuvers. This marks a significant step toward its goal of revolutionizing unmanned aerial systems with scalable AI capabilities.

- Hamas expressed its willingness to reach a cease-fire with Israel, rejecting U.S. accusations of delaying negotiations. Meanwhile Israel, backed by the U.S., insists that any cease-fire must allow the conflict to resume if necessary to dismantle Hamas’s military capabilities.

Threats

- The F-35 Lightning II program, the most advanced and expensive defense initiative in history with an estimated $2 trillion lifetime cost, has faced numerous challenges due to its complexity, high sustainment costs, and the need to serve multiple branches of the U.S. military with three distinct aircraft variants.

- Ukrainian President Zelenskiy urged the U.S. and Europe to lift restrictions on long-range weapons, arguing that Ukraine’s recent incursion into Russian territory in the Kursk region exposed the weakness of Kremlin threats and demonstrated the need for greater military capabilities.

- Borussia Dortmund fans are planning protests against the club’s sponsorship deal with arms manufacturer Rheinmetall, criticizing the decision as a betrayal of the club’s values.

Gold Market

This week gold futures closed at $2,545.80, up $8.00 per ounce, or 0.32%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.61%. The S&P/TSX Venture Index came in up 2.05%. The U.S. Trade-Weighted Dollar tumbled 1.73%.

Strengths

- The best performing precious metal for the week was silver, up 3.52%, on expectations of stronger demand, with India nearly doubling solar imports this year, cites Bloomberg. Gold climbed back above $2,500 per ounce after Federal Reserve Chair Jerome Powel signaled that time has come for interest-rate cuts. TD Securities Bart Melek, global head of commodity strategy, expects bullion to rise further to more than $2,700 in the coming quarters.

- For the first time ever, a bar of gold is worth a cool one million dollars. The milestone was reached when the precious metal’s spot price surpassed $2,500 per troy ounce, an all-time high. With gold bars typically weighing about 400 ounces, that would make each one worth more than $1 million, according to Bloomberg.

- According to BMO, Lucara Diamond reported that it has recovered a 2,492-carat diamond from its Karowe mine in Botswana. It is too early to comment on its value. Depending on the value of the diamond, the potential sale proceeds could provide much needed balance sheet flexibility and surplus cash flow for the company’s ongoing underground expansion project.

Weaknesses

- The worst performing precious metal for the week was palladium, but still up 0. 52%. SSR Mining’s Anagold Madencilik announced an employment reduction due to the long-term impact of February 2024 landslide at their Copler gold mine, according to Bloomberg. A spokesman tells Bloomberg that 187 out of 610 employees have been terminated.

- Gold Fields fell the most in 10 weeks after cutting its production guidance for a second time in three months. Operational challenges in Chili with severe weather at their open pit mine, high in the Andes Mountains above 4,000 meters (13,000 feet), has slowed operations and challenges at their South Deep Mine in South Africa were headwinds. The company noted their all-in-costs rose by almost 50% to $2,060 per ounces in the first half, as reported by Bloomberg.

- Regis Resources has announced that a declaration of protection under Section 10 of the Aboriginal and Torres Strait Islander Heritage Protection Act 1984 has been made over part of the McPhillamys Gold Project by the Federal Minister for Environment and Water. They advised that the declaration, which impacts a critical area of the Project being the proposed tailings storage facility (TSF) location, means the McPhillamys Gold Project is not viable, according to Canaccord.

Opportunities

- According to BMO, Reuters reported that the People’s Bank of China (PBOC) has issued new gold import quotas to several Chinese banks, according to BMO. The PBOC has held off on new import quotas for several months now, mainly due to low demand for the metal from the Chinese banking sector; however, this move could be a sign of stronger anticipated buying interest following the August quiet period.

- Allied Gold announced the signing of a power purchase agreement with the Ethiopian Electric Power, marking an important de-risking event. The agreement is expected to be in effect for 20 years with power rates (of 4c/kWhr) in-line with projected rates, supporting all-in sustaining costs (AISC) of <$950 per ounce, according to Stifel.

- RBC highlights the potential addition of G Mining Ventures, Abra Silver and FireFly Metals to the VanEck Vectors Junior Gold Mines ETF (GDXJ) this quarter. They also view the potential addition of Northern Star to the top of the GDXJ as it now falls within the junior investable universe.

Threats

- According to BMO, Endeavour Silver has resumed processing at Guanacevi after a mill failure reported last week. The mill is operating at 400 tons per day (tpd) with potential to increase to 500 tpd. Endeavour estimates the repair of the primary ball mill will take 16 weeks from last week’s shutdown, with an estimated cost of the replacement trunnion at $0.5M. Production guidance has been lowered by 1 million ounces of silver, and cost guidance suspended. This could be an opportunity to reenter the name with expectations reset.

- There has been a sharp decline in new gold deposit discoveries over the past few decades. Between 1990-1999, gold discoveries averaged 18 annually. This number fell in the 2000s to 12 discoveries annually, and then further declined to just four in the 2010s. Between 2020 and 2023, there have only been five major discoveries despite an increase in exploration spend, according to Bank of America.

- Chinese consumers continued to pull back on gold purchases last month, as record prices and a sustained economic slowdown curbed demand in the world’s biggest bullion- buying nation. Gold imports in July fell 24% to 44.6 tons, the lowest in more than two years, according to customs data released on Tuesday.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Alaska Air

Boeing

Spirit

American Airlines

Ferrari

Hermes

LVMH

Estee Lauder

Electra Battery Materials Corp.

Gold Fields Ltd.

Regis Resources Ltd.

FireFly Metals Ltd.

Endeavour Mining PLC

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the “Footsie”, is the United Kingdom’s best-known stock market index of the 100 most highly capitalised blue chips listed on the London Stock Exchange.