How M-PESA Is Leading a Financial Revolution Across Africa

I attended and spoke at the European Blockchain Convention this week in Barcelona, where the energy around digital assets, Bitcoin and Web3 was palpable. Among the 6,000 attendees, there was a sense that we’re on the brink of a new era in finance and digital infrastructure

One conversation that particularly struck me came from an unexpected source—my taxi driver, who hailed from East Africa. He was talking about M-PESA, a mobile payment system that’s revolutionized financial services across his home region. While Venmo and Zelle are household names here in the U.S., M-PESA has been quietly leading a financial revolution across Africa for over a decade.

M-PESA, which stands for “mobile money” in Swahili, launched in Kenya in 2007 by the mobile network operator Safaricom, targeting the unbanked. A survey just a year earlier found that under 20% of Kenyan adults had a bank account, whereas over half either owned or had access to a cellphone.

Today, M-PESA boasts more than 66 million users, including my taxi driver, and processes 33 billion transactions annually. And its success is no longer confined to Kenya. It’s expanded to countries such as the Democratic Republic of Congo, Egypt, Ghana and, most recently, Ethiopia, a country often referred to as the “last frontier” for digital banking.

Bitcoin Complements M-PESA

To me, what’s remarkable is how M-PESA was born out of necessity. In the early 2000s, people in sub-Saharan Africa would send cellphone airtime minutes as a form of currency. This simple, innovative idea evolved into a formal mobile payment system, operated by Safaricom in partnership with Vodafone, and became a model for not just payment apps that came after it but also financial inclusion.

Similarly, Bitcoin was born out of necessity in the wake of the 2008 financial crisis, offering a decentralized alternative to the traditional financial system. Both systems were created to address the gaps left by centralized institutions, but they operate in fundamentally different ways.

M-PESA operates within the framework of a centralized mobile network provider, making it subject to regulatory oversight. It also relies on traditional financial infrastructure.

Bitcoin, on the other hand, is decentralized by design, allowing peer-to-peer transactions without intermediaries. It provides a global, borderless payment network that complements services like M-PESA by offering greater financial autonomy, particularly in cross-border transactions.

Together, M-PESA and Bitcoin represent two sides of the same coin—innovative solutions born out of crises, each pushing the boundaries of what’s possible in financial inclusion and access.

The Growing Strain of Immigration

One year ago, I shared with you my thoughts on the immigration crisis, both here in the U.S. and Europe. At the time, there was speculation that international bad actors may be at least partially to blame for the record numbers of immigrants pouring across the Southern Border. You can read the article here. Below is an update to the story.

Immigration is once again making headlines (has it ever stopped?), and it’s not just the sheer numbers that have people talking. Concerns about mass migration—both legal and illegal—have dominated political and economic conversations in the U.S. and Europe.

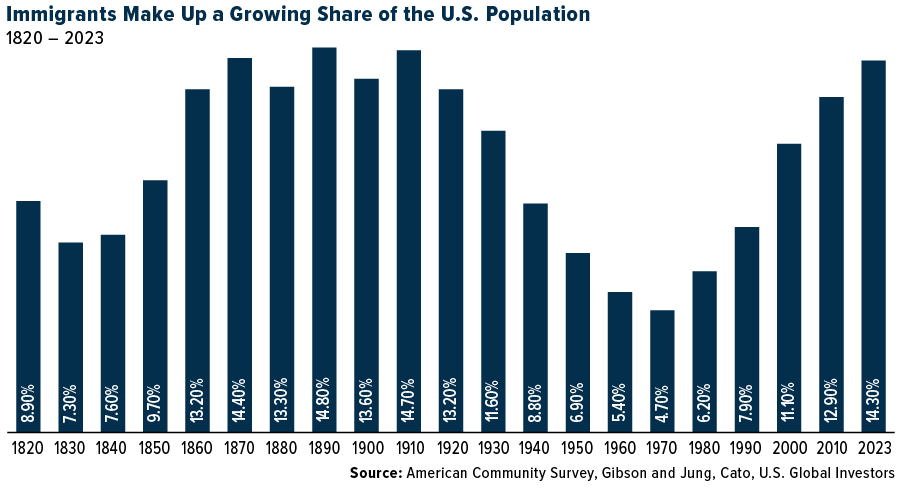

Although the number of migrants crossing into the U.S. has eased in the past 12 months, the underlying challenges remain. The Center for Immigration Studies estimates that the illegal immigrant population in the U.S. stands at 14 million strong, a significant increase from just a few years ago. And at 14.3% of the total population, the share of foreign-born residents is at its highest level since the early 1900s, when waves of immigrants came from Italy, Poland and elsewhere.

Today, the new arrivals are straining resources in ways that directly impact the American taxpayer and investor alike.

Springfield’s Skyrocketing Rents

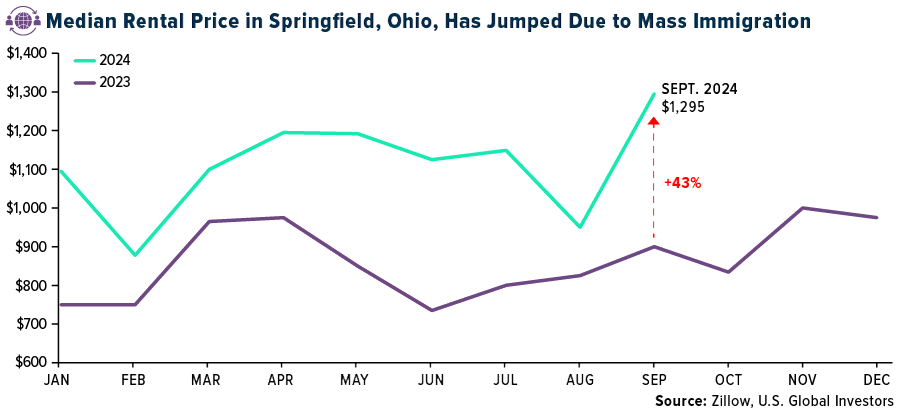

Let’s take Springfield, Ohio, as a microcosm of what’s happening across the country. You’ve probably heard that this town of 58,000 has seen a significant influx of Haitian asylum seekers, leading to skyrocketing housing costs and a sharp rise in the cost of living. The median rental price in Springfield jumped 43% in just one year, according to Zillow. Locals are feeling the pinch at the pump and the grocery store as inflation ripples through their economy.

It’s not just prices that are going up. Health care providers are stretched thin, as more translation services and additional staff are needed to accommodate the growing population. Earlier this month, Ohio Governor Mike DeWine announced $2.5 million in state support for Springfield, but the burden on local taxpayers is undeniable.

We’re seeing similar stories play out across the U.S. as towns and cities grapple with the surge of new arrivals. In New York City, Mayor Eric Adams, recently indicted on federal corruption charges, reported last summer that the city expected to spend $12 billion over the next three years on housing, food and health care for recently arrived immigrants. To cover these costs, the city plans to cut services across the board—sanitation, public education, even the police force. The fiscal strain is real, and it’s hitting Americans where it hurts most.

Immigration Is Testing Europe’s Social Welfare Spending

What’s happening in the U.S. is mirrored on a much larger scale across Europe. Over the past decade, 29 million immigrants—both legal and illegal—have poured into the region, overwhelming an already dysfunctional immigration system. Concerns about public safety and inadequate integration policies have led to widespread public unrest. Just look at the riots in the U.K., where immigration has emerged as a defining issue.

Investors should be paying close attention. Western Europe, traditionally known for its social safety nets and generous welfare systems, is struggling to accommodate this massive population influx. Europe’s current situation is a reminder that unchecked migration, without the proper systems in place, can lead to long-term fiscal challenges.

Legal Immigration as a Solution to Shrinking Fertility Rates

Having said all that, it’s important to recognize the value of legal immigration. With fertility rates having fallen well below the replacement level—or 2.1 children per woman—the U.S. and Europe face the prospect of near-zero population growth. Legal immigrants, then, play an essential role in maintaining productivity and supporting programs like Social Security.

The hard truth is that the U.S. and Europe face declining populations and a shrinking tax base. I believe the solution lies in smart, sustainable immigration policies—ones that emphasize legal pathways and prioritize integration.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.59%. The S&P 500 Stock Index rose 0.62%, while the Nasdaq Composite climbed 0.95%. The Russell 2000 small capitalization index fell 0.14% this week.

- The Hang Seng Composite gained 4.82% this week; while Taiwan was up 2.99% and the KOSPI rose 2.18%.

- The 10-year Treasury bond yield rose 1 basis point to 3.757%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Tongcheng, up 30.6%. According to Morgan Stanley, the Federal Aviation Administration (FAA) announced the largest number of air traffic control (ATC) hires in nearly a decade. On Monday, the FAA announced it exceeded its goal of hiring 1,800 air traffic controllers in 2024, hitting a “major milestone.”

- Despite the secular decline in coal, dry barge shipping is solid on a very healthy grain season. Containerized freight is benefiting from healthy international rates, despite somewhat tepid demand in markets like Hawaii. Ultimately, however, what is benefiting domestic shipping markets is the lack of supply with very few new ships built in years, Stifel reports.

- Japanese airlines are well positioned to benefit from growth in inbound demand to Japan, says Morgan Stanley. The group’s projections for Japan have inbound demand up 24% year-over-year to 36.6 million visitors in F3/25 and up 12% in F3/26 to 40 million. Morgan Stanley sees the industry posting record profits in F3/26, topping pre-Covid levels thanks to continued yield management and benefits from cheaper crude oil and a stronger yen.

Weaknesses

- The worst performing airline stock for the week was Make My Trip, down 12.5%. Boeing’s 737 production may have come to a complete halt following the IAM union strike. While the full impact on deliveries remains uncertain, the pace has slowed significantly recently, with only two 737s delivered in the last week, well below normal levels, and 20 so far this month, according to Bank of America.

- The Merchant Marine Act of 1920 requires that ships moving cargo closely from one U.S. port to another be: 1) built in the U.S., 2) at least 75% owned by U.S. citizens, 3) crewed by U.S. citizens, and 4) registered in the U.S. The requirement for U.S.-citizen crewing does mean operating expenses are higher than would be the case otherwise. But the most notable cost increase is that of building domestically, which can cause the price of the asset to be 3-5x more expensive than an identical ship built elsewhere in the world, Stifel explains.

- Following the rejection of the initial proposal, Boeing has now offered a 30% general wage increase, a $6,000 ratification bonus, reinstatement of the AMPP bonus plan, and a 100% match of the first 8% contributed to BA 401(k) plan, reports UBS.

Opportunities

- JetBlue is opening airport lounges at NY-JFK in late 2025 and Boston “soon after”. Airline lounges are expensive to build/run, albeit JetBlue’s planned 8,000/11,000 square foot lounges at JFK/BOS are modest, for example, versus Alaska’s in SEA (15,800) and Delta’s at JFK (39,000), according to Raymond James.

- The duration of an East Coast port strike will be key for determining the potential impacts, says Bank of America. A three-week strike would probably drive a surge in West Coast spot rates, add 5% to global congestion, and drive re-diversion of cargos away from the East Coast (40% of U.S. imports), although the impact would likely be limited to the Transpacific.

- Delta Air Lines plans to fly its largest-ever Trans-Atlantic schedule in Summer 2025. Last week Delta announced over 700 weekly flights to 33 European destinations, including expanding access to cities like Barcelona and Dublin and new non-stop routes, according to Morgan Stanley.

Threats

- Frontier further lowered November capacity by 100 basis points (bps) after a 910bps cut last week. Latin American flying saw a greater share of this week’s reductions at 330bps compared to domestic at 60bps, reports Bank of America. Fourth quarter 2024 capacity is now tracking toward 2.9% or higher.

- International Longshoremen’s Association represents some 85,000 workers across 36 Ports on the Eastern seaboard and Gulf Coast including five of the country’s 10 busiest ports. If there is a strike, it is hard to fathom if it will last long given the potential macro impacts. Indeed, a strike would be massively disruptive to the U.S. supply chain, with media reports pointing to cost estimates at $3.7 billion per day with just the Port of NY/NJ accounting for $640 million per day, according to TD.

- Southwest Airlines and United chose Adjusted EBITDA over pretax margin for management compensation, which then does not hold management accountable for capex/balance sheet decisions, says Raymond James, albeit Southwest addresses this with long-term ROIC incentives. United, however, does have a liquidity hurdle.

Luxury Goods and International Markets

Strengths

- Shares of Moncler jumped over 10% on Friday following LVMH’s announcement of an indirect investment in the brand. Moncler, known for its high-end puffy jackets that can price upwards of €7,000, has managed to navigate the slowdown in Chinese demand that has impacted many European companies. In its latest filings, the company reported an 11% increase in revenue for the first half of 2024, highlighting its resilience in a challenging market.

- The European Luxury Index significantly outperformed the broader European and U.S. indices. The STOXX Europe Luxury Index surged by 13%, while the broad Europe Index, measured by the STOXX Europe 600 Index, gained only 2.7%. In the United States, the S&P 1500 Index experienced a modest increase of just 0.65%.

- Cettire Ltd was the best-performing S&P Global Luxury stock this week, gaining 31.8%. The stock surged nearly 80% on Tuesday after the troubled retailer filed its annual report, announcing that its result audit had been completed.

Weaknesses

- In the United States, the September consumer confidence index was reported at 98.7, below consensus of 104.0 and August’s revised 105.6 (previously at 103.3). September’s decline was the largest since August of 2021.

- The preliminary September S&P Global U.S. Manufacturing PMI was reported at 47.0, falling short of the expected 48.6. Similarly, Europe saw weaker manufacturing data, with the HCOB Eurozone Manufacturing PMI coming in at 44.8, below the anticipated 45.7. Readings above 50 indicate expansion, while those below 50 signify contraction in activity.

- Star Entertainment Group was the worst-performing stock in the S&P Global Luxury index, plummeting 44.4%. The troubled casino operator resumed trading this week after a suspension since late August, losing nearly half of its market share. On Thursday, the company reported its full-year results, revealing a loss of $1.7 billion.

Opportunities

- Luxury companies are likely to benefit from the recent stimulus package announced by China. Brands that have been struggling due to a slowdown in Chinese consumer demand may see a rebound as the new measures could boost spending.

- UBS raised Tesla’s third-quarter delivery expectations to 470,000, up from the previous estimate of 421,000. This new projection suggests an 8% year-over-year increase and a 6% increase quarter-over-quarter. Tesla is expected to announce these delivery figures on October 2, followed by the highly anticipated robotaxi event on October 10.

- China is taking significant steps to strengthen its economy through increased stimulus measures. Reserve Requirement Ratio has been cut by 50 basis points, with further reductions anticipated. Additionally, the key policy rate (seven-day reverse repo rate) has been lowered by 20 basis points, and the rate on outstanding mortgages is set to decrease by 50 basis points. The announcement also includes support measures for the stock market.

Threats

- This week, luxury stocks experienced a rebound, driven by positive sentiment stemming from government stimulus in China. However, it may take time for consumers to begin spending on luxury goods and services, as many have been cautious with their spending. UBS has revised its growth expectations for the luxury sector for the second half of this year and into next year, projecting only 1% growth in the third quarter and 4% growth in 2025.

- According to business data and research company Bloomberg Intelligence, one in three European car-making factory companies like BMW, Mercedes, Stellantis, Renault and Volkswagen is underutilized. In some of their plants, less than half of the vehicles that could theoretically be produced are actually being made. Workers in Italy’s automotive sector will go on strike on October 18, in protest of declining output from Stellantis, the biggest carmaker in the country.

- The new reporting season kicks off next week, but many companies in the luxury sector are expected to report declining sales for the third quarter. While there’s hope that the anticipated stimulus in China will boost demand, any positive impacts are likely to be reflected in financial results next year.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was zinc, rising 7.82%. Teck Resources had to shut down one of its four electrolytic zinc plants in British Columbia due to a fire, which contributed to the price boost. The surge in iron ore and copper this week came on the back of China stimulus measures. China announced that the PBOC will reduce the banks’ required reserve ratio (RRR) by 50 basis points (bps) and indicated it could cut by a further 25-50bps by the end of the year. Besides reducing funding costs, there were some targeted measures aimed at supporting the housing market and boosting consumption, according to UBS.

- Copper saw its biggest weekly gain since May on the news out of China, with prices rising back above $10,000 a ton. Iron ore’s gains exceeded its April gains as policymakers in China unveiled a blitz of initiatives to support growth in the property sector, the largest consumer of steel, which should bode well for the materials sector.

- Bank of America notes pockets of tightness on the aluminum physical market, with nearby time spreads closely tilting into backwardation partially because more than half of LME inventories are earmarked for removal. The bank is comfortable with its constructive forecast and sees prices trading at $3,000 per ton next year.

Weaknesses

- The worst performing commodity for the week was crude oil, dropping 3.42%, as the market absorbs the return of Libyan supply, which was slashed when rival factions clashed. This came alongside rumblings from Saudi Arbia on Thursday, as picked up by the Financial Times, that it is committed to higher production following the unwind of the OPEC+ cuts in December.

- Speculative net positioning in total petroleum futures and options recently dropped to the lowest levels since at least 2011, suggesting investors are already more than positioned for a falling energy price environment, according to Bank of America.

- Russia’s crude shipments tumbled to the lowest since July last week, reports Bloomberg, sending the country’s gross income from the critical trade to the smallest in around eight months. The four-week average crude volume dropped to 3.1 million barrels a day, down by 115,000 barrels a day from the previous week.

Opportunities

- Natural gas producer EQT Corp. reports that new requests for data centers across the Appalachia region are likely to rely on natural gas to meet their electricity demand. Toby Rice, EQT’s chief executive officer, noted that AI-related electricity demand is expected to translate to between 6 billion to 13 billion cubic feet of gas a day in the short term. The current total U.S. consumption of natural gas is running at just over 100 billion cubic feet a day.

- Singapore LNG Corp.’s CEO Leong Wei Hung noted that the digital world “is a huge call on energy,” as the boom in data centers in its service area is driving demand growth for LNG. The Singapore government is targeting to increase the amount of power it allocates to data centers by as much as 35%. Both Amazon and Microsoft are pledging to invest billions of dollars in data centers, reports Bloomberg, to be built in Southeast Asia.

- Uranium and nuclear energy stocks jumped after Constellation Energy Corp. said it will invest $1.6 billion to revive a shuttered nuclear plant to provide Microsoft Corp. with noncarbon-emitting electricity, reports Bloomberg. This is a novel shift in risks. Users who demand cheap carbon free clean power are willing to put up capital to obtain more certainty over future supply needs.

Threats

- U.S. oil producers were scrambling to evacuate staff from Gulf of Mexico oil production platforms as the second major hurricane in two weeks was predicted to tear through offshore oil producing fields. The U.S. National Hurricane Center said a potential Tropical Cyclone in the Caribbean was expected to rapidly intensify over the Gulf’s warm waters and could become a major hurricane with winds of up to 115 miles per hour (185 kph), Morgan Stanley reports.

- China’s steel crisis is setting the stage for a wave of bankruptcies and speeding a much-needed consolidation of the industry, according to Bloomberg Intelligence. Almost three-quarters of the country’s steelmakers suffered losses in the first half and bankruptcy is likely for many of them, Michelle Leung, a senior analyst at BI, said in a note. Evidently, this carnage finally prompted China to change its policies this week.

- The world needs more mines to cope with rising demand for key energy-transition metals like copper, as mergers and acquisitions will not plug a looming supply gap, Rio Tinto Group Chairman Dominic Barton said. “As an industry, we’re not going to inorganic our way out of this challenge,” Barton said in a Bloomberg TV interview, referring to growth through deals. “It’s huge, and it’s in at least five different commodity areas.”

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Shiba Inu, rising 48.17%.

- Bitcoin jumped past $64,000 after the Federal Reserve kicked off an anticipated cycle of monetary easing, reports Bloomberg, with an aggressive 50 basis-point reduction in interest rates. The rally in Bitcoin has prompted a test of the 200-day moving average.

- Bitcoin had a significant run this week, for the first time in four weeks, before the expiration of options contracts on Friday, reports Bloomberg. Some analysts believe this could result in heightened volatility in the cryptocurrency market.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Monero, down 7.58%.

- Ether exchange-traded funds (ETFs) recorded their largest outflows since July with over $79 million exiting Monday in a sign of waning institutional demand for the world’s largest token. Those figures are the highest since July 29, writes Bloomberg.

- Dubai is adopting stricter rules around marketing crypto investments, reports Bloomberg. Dubai’s crypto regulator updated its marketing guidelines for virtual assets, with the new rules requiring firms to include a disclaimer clarifying the risks of such investments. As of October 1, companies looking to market virtual assets in the UAE will have to include a prominent disclaimer stating that virtual assets may lose their value in full or in part, the article explains.

Opportunities

- China’s over-the-counter cryptocurrency brokers are attracting unprecedented inflows, reflecting a hunger for alternative investments amid a weak equity and property market in a struggling economy. As reported by Bloomberg, inflows topped $20 billion in each of the three quarters through June.

- PayPal Holdings will now permit merchants to buy, hold and sell cryptocurrency from their business accounts, expanding on the payment firm’s already-available consumer offerings. PayPal has allowed consumers to buy, hold and sell digital crypto via their PayPal and Venmo accounts since 2020, writes Bloomberg.

- Bitcoin is on course for one of its biggest September gains as a global wave of interest-rate cuts by the U.S. Federal Reserve helps the largest digital asset to buck a seasonal jinx, Bloomberg reports. Bitcoin is up over 10% this month, contrasting with an average 5.9% decline in September.

Threats

- Caroline Ellison was sentenced to 24 months in prison by a federal judge for her role in the FTX collapse, Bloomberg reports, despite helping prosecutors in the conviction of Sam Bankman-Fried. Judge Kaplan praised her testimony and cooperation as remarkable but noted that this was one of the most serious financial fraud crimes ever committed and that her cooperation can’t be a “get out of jail free card.”

- Whoever was behind India’s biggest cryptocurrency hack is almost done laundering over $230 million worth of tokens. The hacker behind the WazirX hack was nearly finished laundering the stolen funds, using Tornado Cash to obscure the transactions, according to Bloomberg.

- The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned two virtual Russian crypto exchanges, PM2BTC and Cryptex, as well as their beneficiary Sergein Ivanov. The Treasury’s Financial Crimes Enforcement Network (FinCEN) also issued an order that identifies PM2BTC and Cryptex as being of “primary money laundering concern” in connection with Russian illicit finance, writes Bloomberg.

Defense and Cybersecurity

Strengths

- AeroVironment shares rose this week after a rare move by the U.S. Army. It lifted a stop work order issued for AeroVironment’s Switchblade-600 mission, signifying it is critical to the Army’s LASSO program, Bloomberg reports.

- This week, the Guernsey Press reported that the U.S. military tested its new hypersonic missile defense capabilities during a major Pacific exercise. This marks a significant improvement in defending against cutting-edge missile technology, reinforcing the United States’ strength in missile defense and its ability to protect against advanced threats in the evolving global security environment.

- The implementation of new cybersecurity regulations for U.S. water facilities marks a significant strength in addressing growing concerns about the vulnerability of critical infrastructure. Following incidents like the Kansas water plant attack, the White House is considering additional measures, reinforcing national efforts to enhance security and protect against future cyber threats, ensuring resilience in a sector vital to public safety, according to Bloomberg.

Weaknesses

- Israel’s rejection of a cease-fire with Hezbollah and its continued bombardment of targets in Lebanon complicates international efforts, led by the U.S. and Europe, to prevent an escalation into a broader regional conflict. The ongoing violence, which has resulted in significant casualties and displacement, raises concerns about further instability, while diplomatic efforts remain stalled amid Israel’s firm military stance.

- Meta’s recent €91 million fine by Ireland’s Data Protection Commission highlights a significant weakness in its cybersecurity measures. The social media giant “inadvertently” stored user passwords in plaintext without proper encryption, exposing sensitive data and underscoring the risks of inadequate data protection protocols.

- The Boeing strike has resulted in a $1 billion loss in U.S. GDP after just two weeks, with Washington State alone seeing a $700 million hit, mainly due to lost wages. The strike has also significantly impacted Boeing’s supply chain and household spending, reports Bloomberg, with ongoing negotiations aimed at resolving the dispute.

Opportunities

- Bloomberg reported that Finland’s proposal to host NATO’s new multi-corps land-component command unit in Mikkeli presents a strategic opportunity for both Finland and NATO. As a key location for managing NATO’s land operations and exercises in northern Europe, this strengthens Finland’s role within the alliance and bolsters its defense posture, especially against potential threats from Russia.

- Sweden has shown interest in purchasing three KC-390 cargo planes from Embraer, furthering defense discussions between the two countries. This potential deal represents a significant opportunity for Embraer to expand its presence in the European aerospace market, as reported by Reuters.

- Switzerland’s recent decision to join two major EU cybersecurity initiatives opens new doors for international collaboration and sharing of expertise in cyber defense. This partnership will enhance Switzerland’s ability to stay at the forefront of cyber technology and innovations, presenting an opportunity for companies involved in cybersecurity to expand their presence in collaborative international frameworks, reports the World Economic Forum.

Threats

- United Nations-led talks have resumed between Libya’s rival governments over the central bank crisis as an oil blockade, which has slashed the country’s crude output by more than half, near its second month. The standoff, sparked by the Tripoli-based government’s attempt to replace central bank governor Sadiq Al-Kabir, has intensified mediation efforts from countries like Turkey and Egypt to prevent Libya from sliding back into civil war.

- Russian President Vladimir Putin announced plans to revise Russia’s nuclear doctrine to treat aggression from non-nuclear states, supported by nuclear powers, as a joint attack on Russia. This decision follows warnings to the U.S. and Europe regarding Ukraine’s potential use of Western long-range weapons to strike deep inside Russia, further escalating tensions amid the ongoing conflict.

- The hacking of executives’ email accounts for illegal trades, as alleged in the case of Robert Westbrook, represents a significant cybersecurity threat, especially within the financial industry. With Westbrook reportedly making over $3 million from accessing confidential earnings data, this case highlights the dangers of insider trading facilitated by cybercrime, reports Bloomberg.

Gold Market

This week gold futures closed at $2,674.00, up $27.80 per ounce, or 1.05%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 0.57%. The S&P/TSX Venture Index came in off 0.30%. The U.S. Trade-Weighted Dollar fell 0.30%.

Strengths

- The best performing precious metal for the week was platinum, up 2.01%, breaking through the $1,000 per ounce mark which it hasn’t done since July. Touching on India, the World Gold Council stated: “Following an initial surge in consumer demand (for jewelry and bars and coins) due to the sharp import duty cut, demand is reported to have since normalized. However, market reports indicate that overall buying momentum remains healthy, with an uptick compared to the period before the import duty reduction.”

- Silver is living up to its promise as the Federal Reserve interest rate-cutting narrative gains greater traction. The cheaper precious metal is outperforming gold by a comfortable margin, flaunting a 33% year-to-date gain compared with the latter’s 28% rise. Right now, it is on pace to close out a fourth consecutive quarterly climb in what would be the longest winning run since 2011, according to Bloomberg.

- Gold hit another all-time high as traders parse the latest remarks from Federal Reserve officials (timing and speed of future interest rate cuts) and prepare for key U.S. economic data, Bloomberg reports. Bullion hit a record of $2,640.11 an ounce, beating the previous all-time high.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.90%, perhaps on news of weakening auto sales. The government of Mali announced its plan to start mining and processing lithium with help from the Russian Federation. Whether this deal proceeds to reality may be another story, but it represents further inroad of Russian influence into West Africa’s gold mining territory.

- According to Scotia, SSR Mining announced that the Seabee gold mine in Saskatchewan will restart operations in the second half of October following a suspension of operations that began on August 21 due to wildfires in the region. Following the suspension of operations, the company initially forecasted five days of mining and processing downtime, later increasing this estimate to 25 days of downtime; given the latest announcement, SSR Mining increased its allowance for mine downtime to 65 days in total.

- Following Petra Diamonds’ pre-released F2024 operating results, the company reported its F2024 financial results with EBITDA slightly below BMO’s estimate. Looking forward to F2025, free cash flow generation remains a key focus for Petra as the company looks to navigate the weakness in the diamond market.

Opportunities

- Nano One Materials gained 52% for the week as the U.S. Department of Defense awarded the company a $12.9 million grant. The project will support work underway at Nano One’s Candiac, Québec location, which is North America’s only lithium iron phosphate (LFP) production facility.

- U.S. consumer confidence unexpectedly fell in September by the most in three years on concerns about the labor market and the outlook for the broader economy. The Conference Board’s gauge of sentiment decreased 6.9 points to 98.7, the biggest drop since August 2021, data out Tuesday showed, according to Bloomberg.

- Gold is on course to complete a fourth quarterly rally, and there seems to be little on the horizon to stop its bull run. The precious metal has surged more than 40% in the past year, Bloomberg reports, with its fortunes burnished by traders factoring in deep interest-rate cuts from the Federal Reserve.

Threats

- African Rainbow’s healthy balance sheet reduces risk in a more severe and protracted downturn, in UBS’s view. However, in the absence of a recovery in commodity prices, the group believes the company needs to demonstrate improved operational performance, willingness to crystallize value in their Harmony stake, and commitment to returning excess cash to shareholders to fully unlock the valuation discount.

- B2Gold Corp has had a rebound in its share price with the resolution of its taxation and operating uncertainty in Mali. In addition, B2Gold cleared the air with regards to capex for the Goose Project. With that news, insiders COO William Lytle and Senior VP: Legal & Corporate Randall Chatwin at B2Gold, both sold a significant part of their shareholdings into the recent price strength.

- Bank of America notes gold prices are 15% above the 200-day moving average. Historically, returns are flat one to six months after trading at such extremes. Gold investors are also already discounting 150-200 basis points of interest rate cuts, and if Fed cuts are slower than expected, the pace of gold gains could also slow.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Boeing

JetBlue Airways Corp.

Delta Air Lines

Frontier Group Holdings

United Airlines

Southwest Airlines

Moncler

Tesla

BMW

Volkswagen

Nano One

B2Gold Corp

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The STOXX Europe Luxury 10 index aims to select 10 companies that are positively exposed to European luxury goods.