How AI Is Reshaping Aerospace & Defense Investment Opportunities

For a few months now, I’ve been referring to today’s heightened geopolitical climate as the “new red Cold War,” where artificial intelligence (AI)—not necessarily fighter jets and nuclear weapons—serves as the primary battleground between the U.S. and its adversaries, most notably Russia and China.

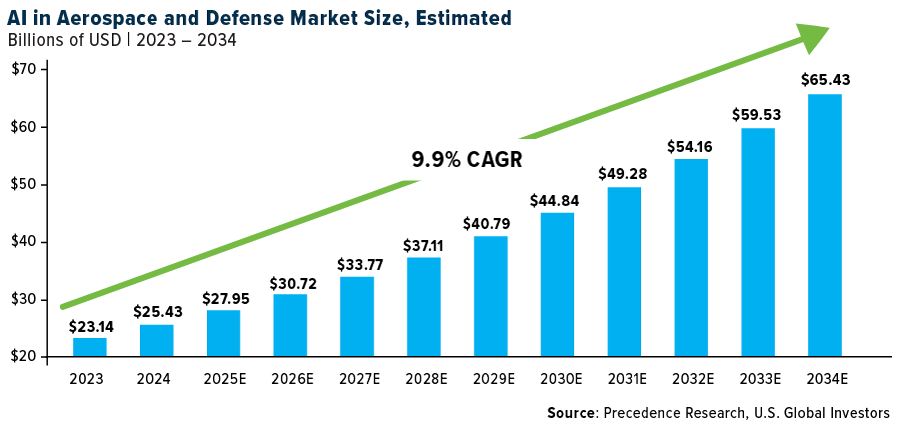

The numbers tell a compelling story. The global AI market in aerospace and defense is projected to surge from approximately $28 billion today to a staggering $65 billion by 2034. That’s a solid 9.91% compound annual growth rate (CAGR). North America alone represents $10.43 billion of this market, and it’s growing even faster at 10.02% annually.

Palantir’s Meteoric Rise

Here’s what’s really interesting: We’re seeing a dramatic reshuffling of the traditional defense sector hierarchy.

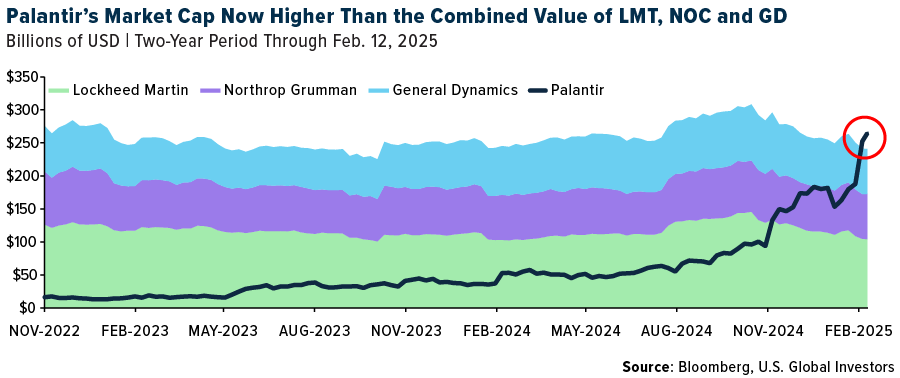

Take Palantir Technologies, for instance. The AI-focused company—founded in 2003 by Peter Thiel, among others, and named for a magical artifact from Lord of the Rings—has seen its stock soar approximately 55% so far this year, after returning a massive 340% in 2024.

Meanwhile, traditional defense giants like Lockheed Martin, Northrop Grumman and General Dynamics have been struggling, with their combined market value now lower than that of Palantir, whose chief technology officer, Shyam Sankar, recently called the competition between the U.S. and China an “AI arms race.”

And let’s not discount the influence of Elon Musk’s cost-cutting Department of Government Efficiency (DOGE) project. We could see a push to modernize military procurement, prioritizing software, drones and robots over traditional hardware. Musk’s initiative has already sent tremors through the defense sector, with traditional contractor stocks taking hits as new players like SpaceX, OpenAI and Anduril Industries gain ground.

Vice President Vance Pushes for AI in Paris

This shift isn’t happening in a vacuum, of course. The Trump administration, with Vice President JD Vance at the forefront, is actively pushing for AI development while taking a notably different approach from our European allies.

At the AI Action Summit in Paris this week, Vance made it clear that the U.S. won’t let excessive regulation stifle innovation in this critical sector. “We need our European friends in particular to look to this new frontier with optimism rather than trepidation,” Vance told the audience, which included world leaders, CEOs and scientists from over 100 countries.

This pro-growth stance has already benefited U.S. chipmakers like Intel, whose shares ended Tuesday’s session up more than 6% on news of increased support for domestic chip production. The company has its work cut out for it: Today, some 90% of the world’s most advanced chips are made by the Taiwan Semiconductor Manufacturing Company (TSMC).

Even Google, once hesitant about military contracts, has reversed its stance on AI weapons development. This shift signals a broader change in Silicon Valley’s relationship with defense contracts, opening up new investment opportunities in tech companies that previously stayed away from the sector.

Europe’s Defense Tech Boom Is Just Getting Started

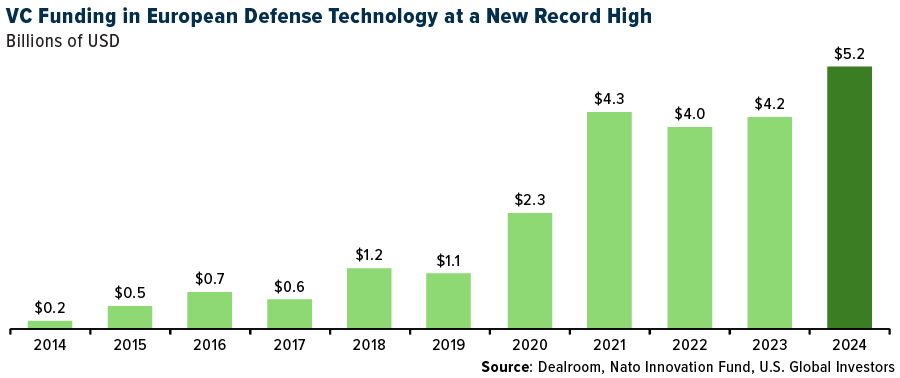

The transformation isn’t limited to the U.S. Facing its own security challenges with Russia, Europe is seeing unprecedented growth in defense tech investment. Venture capital (VC) funding in defense technology hit a record $5.2 billion in 2024, according to a new report by Dealroom data. This marks an incredible fivefold jump from six years ago, making defense one of the fastest growing VC sectors in Europe right now.

For investors, this creates what I see as a once-in-a-generation opportunity. Defense Secretary Pete Hegseth’s target of 3% of GDP for defense spending—roughly $1 trillion annually—suggests sustained government investment in the sector, despite Musk’s promise to cut costs. The key question isn’t whether there will be spending, but rather which companies will capture it.

Positioning for the Biggest Defense Tech Shift in Decades

So where should investors be looking? I see three key areas:

First, companies at the intersection of AI and defense, like Palantir, that are already proving their worth in military applications. These firms are positioning themselves as essential partners in modern warfare capabilities.

Second, domestic semiconductor manufacturers, like Intel, that are critical to both AI development and national security. The Trump administration’s focus on U.S. production could provide significant tailwinds for these companies.

And third, emerging defense tech companies that are disrupting traditional military procurement. While not all are publicly traded yet, keeping an eye on this space could reveal early opportunities as they come to market.

We’re witnessing the biggest transformation in defense technology since the advent of nuclear weapons. I believe that those who position themselves in this new “AI arms race” could see substantial returns as this multi-decade trend unfolds.

If you haven’t already, be sure to watch our latest video, “The New Red Cold War: China, Russia and the Battle for Global Power,” by clicking here!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 0.55%. The S&P 500 Stock Index rose 1.47%, while the Nasdaq Composite climbed 2.58%. The Russell 2000 small capitalization index gained 0.01% this week.

- The Hang Seng Composite gained 6.56% this week; while Taiwan was down 1.39% and the KOSPI rose 2.74%.

- The 10-year Treasury bond yield fell 1 basis point to 4.477%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was El Al, up 12.2%. According to UBS, Copa reported strong traffic for January 2025 with ASM up by 22% year-over-year and RPM increased by 24% year-over-year, leading to a load factor of 86.4%. Copa reported fourth-quarter 2024 adjusted EPS of $3.99, which was 5% ahead of consensus.

- Container volumes in December and early January remained stronger than expected in anticipation of large-scale tariff imposition in the U.S. and the earlier Chinese New Year. European container imports were up 12% year-over-year in December, a sequential acceleration that UBS believes is driven by front-loading volumes due to longer duration transit and potential inventory restocking.

- According to BMO, fourth quarter 2024 Air Canada EBITDA of $696 million was roughly 11% above expectations. Yields increased 3.0% year-over-year and PRASM was up 1.7% year-over-year, inflecting positive for the first time since the fourth quarter of 2023.

Weaknesses

- The worst performing airline stock for the week was Airports of Thailand, down 16.3%. Air Canada cut capacity from second quarter schedules with the deepest cuts coming on the transborder market. The changes are likely driven by softer demand, according to Bank of America.

- Freight rates have been sequentially declining since the start of the year, and UBS notes that ocean carriers’ quotes have been declining over recent weeks on Asia-Europe and Asia-U.S. Historically, rates see sequential declines post CNY to reflect the seasonal trough.

- UBS also notes that in Australia, market fares are currently tracking down 4% year-over-year while market capacity is down 4% year-over-year. For Australia international, market fares have slowed to 2% year-over-year growth on 8% industry capacity growth.

Opportunities

- Before the war, Ryanair was Ukraine’s second largest airline and has already announced a $3 billion post war Ukraine growth plan. Ryanair has stated it would return within eight weeks of the reopening of Ukraine airspace and plans to deliver in the first 12 months post war over 5m seats to and from Ukraine and over 10m seats over a five-year period, according to UBS.

- Freight futures for April to December have surged 20-50% over recent days according to Linerlytica, which we believe likely reflects recent news flow around the ceasefire negotiations under strain and growing expectations that Red Sea transit would not resume over the next quarters. In the absence of a resumption of sailing via the Red Sea, UBS sees a good chance for ocean rates in the peak season to pick up sequentially.

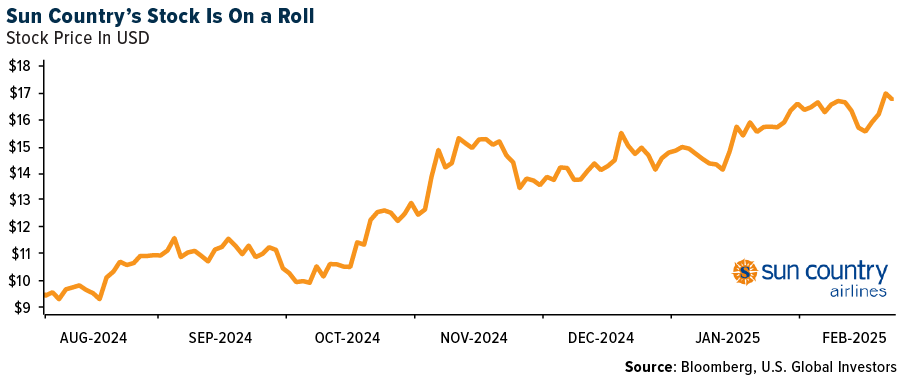

- Sun Country announced a secondary public offering of 6.3 million Apollo shares. In addition, Sun Country has authorized the purchase from the underwriters of $10 million shares of common stock. The airline plans to fund the share repurchase with existing cash on hand.

Threats

- RBC notes with the exhaustion of the Air Canada stock repurchase plan at an average price of $22.50, there is less ability for the company to support shares should tariff risks, turning travel sentiment to the U.S., and a weaker Canadian dollar negatively impact operations this year.

- An estimated 7.5% of global air cargo flows are from Chinese eCommerce platforms, and Bank of America’s analysis suggests that the removal of the De Minimis exemption could put up to 5% of global air cargo flows at risk.

- According to Morgan Stanley, due to soaring hotel ADR, sluggish JAL domestic growth is due to the increase in travel costs. Countermeasures include the following: 1) Using smaller aircraft to optimize supply and demand across the industry, which will lead to higher operating rates and allow cost pass-throughs. 2) Stimulate demand for domestic routes among the higher number of overseas visitors. In JAL’s case, the inbound ratio of domestic routes has increased from 3% to 4.5%.

Luxury Goods and International Markets

Strengths

- European stocks saw gains this week, and the euro strengthened. On February 12, U.S. President Donald Trump shared that he had a phone conversation with Russian President Vladimir Putin, where both leaders agreed to “start negotiations immediately” regarding the war in Ukraine. While official talks to end the conflict in Europe have yet to begin, these recent developments suggest they could be on the horizon.

- Hermès experienced a robust 18% increase in sales during the fourth quarter, exceeding the expected 11% growth. Leather goods were the standout category, with sales rising by 21.5%. Regionally, Japan led the growth with a 22.4% rise in sales, closely followed by the Americas at 22.3%, while Europe saw a more modest increase of 17%. On Friday, shares closed at a record high.

- Beneteau, a company specializing in the sale of sailboats and motorboats for both recreational and racing purposes, was the top-performing stock in the S&P Global Luxury sector, with a 21.5% increase over the past five days. The company reported financial results that exceeded analysts’ expectations.

Weaknesses

- Marriott reported stronger-than-expected results for the fourth quarter. However, on Tuesday, the company issued a more cautious outlook for the current quarter and the full year, with expectations for a decline in fee-based revenue and higher spending on technology.

- Kering, the luxury fashion group, reported a 12% decline in fourth-quarter revenues to €4.39 billion ($4.52 billion). This decrease was primarily driven by a significant 24% drop in sales at Gucci, Kering’s main brand, which accounts for almost half of the group’s total revenues.

- Hyatt Hotels was the worst-performing stock in the S&P Global Luxury Index, plummeting 13%. Shares declined after the company reported weaker-than-expected finacial results.

Opportunities

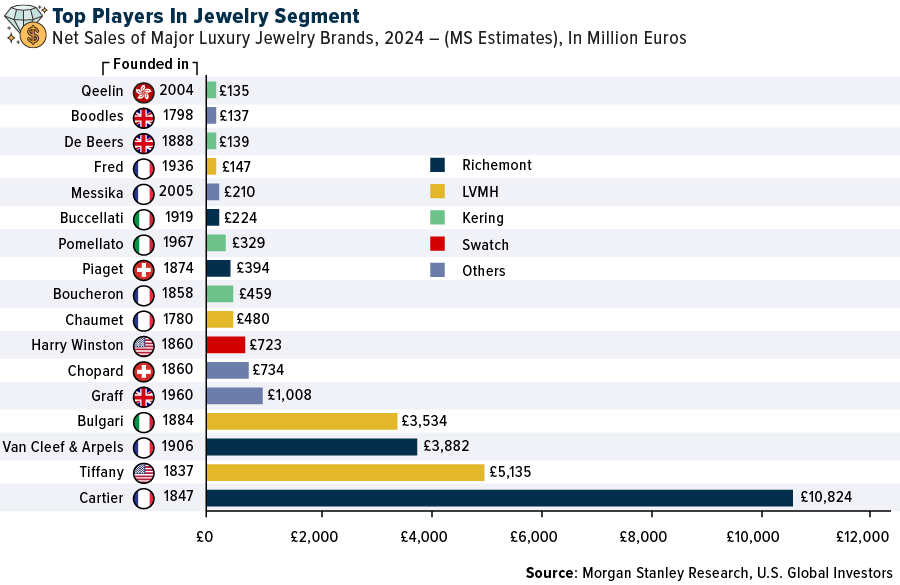

- According to Morgan Stanley’s Luxury Research team, sales of high-end jewelry are expected to remain strong this year, growing at a rate of 9.1%. In contrast, fine jewelry sales are projected to grow at a more modest 3.7%. Cartier, known for its Richemont brand, and Tiffany, now part of Louis Vuitton, are the leading players in the jewelry segment.

- The shift in Chinese consumer preferences from buying expensive luxury goods to valuing experiences offers a major growth opportunity for the luxury travel industry. Wealthy Chinese travelers are now prioritizing unique and meaningful experiences, fueling demand for high-end hotels, first-class flights, and indulgent wellness retreats.

- European car manufacturers saw gains on Thursday following a Reuters report that U.S. House Speaker Mike Johnson, a Republican, mentioned that he believed President Donald Trump is contemplating tariff exemptions, potentially benefiting automotive and pharmaceutical companies. As a result, shares of Volkswagen increased by 2.9%, Mercedes by 5.4%, and BMW by 6.1%.

Threats

- Chinese electric car maker BYD, on Monday, introduced a smart driving system called “The God’s Eye,” which will be available in most of its models, including those priced as low as $10,000. The system is comparable to Tesla’s AutoPilot and Full Self-Driving program. It will be included as standard on BYD models priced over 100,000 yuan ($13,689).

- Bloomberg reported that China’s property crisis is worsening. The country’s real estate sales have declined to levels last seen 14 years ago. JPMorgan is predicting that the real estate sector will be the biggest source of defaults in Asia this year, despite the Chinese government making some efforts to support the troubled developers.

- Zuzanna Pusz, head of the UBS Luxury Research team in London, remains cautious about the luxury sector’s revenue growth this year, despite strong year-to-date performance. She warns that only a handful of companies will be able to generate meaningful results, emphasizing that stock selection will be crucial in 2025. Companies with exposure to the jewelry sector and those catering to affluent shoppers are expected to succeed.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 12.57%. The combination of several factors drove natural gas prices upward this week. First, India’s LNG importers are actively negotiating to secure more long-term supply deals with U.S. companies, signaling a potential increase in Asian demand. Second, Germany is considering subsidies to refill gas storage, indicating a commitment to ensuring European energy security and potentially driving up near-term demand. Finally, Venture Global’s move to renegotiate higher prices for existing LNG contracts suggests tightening market conditions and strengthens the bullish outlook for natural gas.

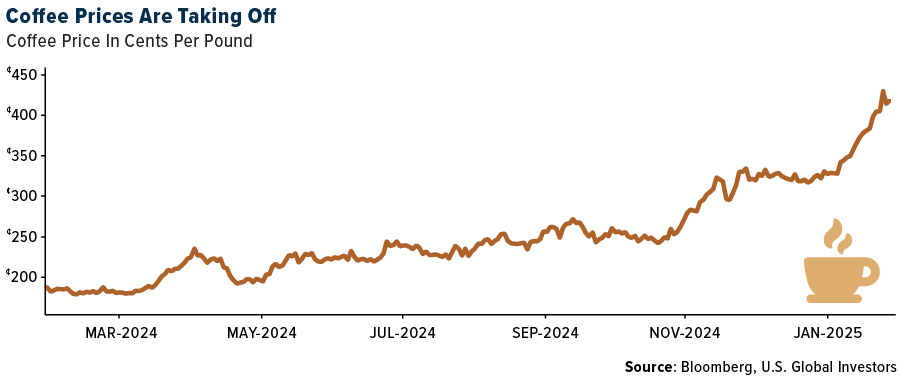

- Arabica coffee futures hit a fresh record high — remaining deep in overbought territory — on lingering worries over shortages. Prices have more than doubled over the past year amid tighter supplies from top grower Brazil and concerns its next Arabica harvest may also be impacted by bad weather, according to Bloomberg. In addition, on the demand side, Starbucks has announced plans to open as many as 500 stores across the Middle East over the next five years, according to Starbuck’s CEO, Brian Niccol.

- Bloomberg reports U.S. sanctions on Russia’s oil trade are significantly hindering operations, as roughly 60% of blacklisted tankers have stopped hauling, forcing Russia to overhaul its supply chains and absorb higher costs. This disruption is further amplified by Turkey’s largest refiner, Tupras, which is now limiting its Russian oil purchases to comply with the G7 price cap.

Weaknesses

- The worst performing commodity for the week was nickel, dropping 2.41%. Nickel prices continue to face downward pressure due to a combination of factors. China’s increasing overcapacity in refined nickel production is leading to a surge in exports, with projections nearing 70,000 tons this year, which is contributing to increased LME inventories and lower prices.

- Prime Minister Justin Trudeau stated that President Donald Trump views annexing Canada to access its natural resources as a “real thing.” Trudeau’s government vowed that Canadian sovereignty was non-negotiable amidst Trump’s threat of a 25% tariff on all Canadian imports. Although a 30-day reprieve was granted, these actions highlight a potential vulnerability for the U.S. in relying on natural resource imports and the economic risks associated with strained international relationships.

- Despite the current lithium oversupply, CleanTech Lithium is pursuing investment for Chilean production by 2027, while CATL and Jiangsu Lopal are restarting a lithium refinery in China after a five-month halt. This increased activity adds to the existing glut in the lithium market, making it more difficult for depressed prices to recover.

Opportunities

- Henry Hub natural gas prices will rise to an average of $3.4/MMBTU in 2025 from $2.4/MMBTU last year as the domestic market tightens on stronger demand from LNG export plants, BMI Research said in a note. With domestic energy markets looking as a good source of stable income, family offices, which manage the assets of ultra-rich families, are investing around $15 billion in U.S. shale plays as private equity has shifted to greener investments, reports Bloomberg.

- BP Plc shares surged the most since 2020 after one of the world’s most aggressive activist investors built a stake in the company, seeking to end years of under- performance by pushing for significant change. Elliott Investment Management, led by Paul Singer, has amassed a significant holding in the British energy giant, Bloomberg reported on Saturday. Over the years, the fund’s efforts have led to strategy shifts, CEO departures and even corporate breakups, the article continues.

- Elliott Investment Management disclosed a more than $2.5 billion stake in oil refiner Phillips 66 and plans to push the company to sell or spin off its pipeline business.

Threats

- President Trump’s imposition of a 25% tariff on steel and aluminum imports, including finished metal products from key trading partners like Canada and Mexico, is poised to significantly increase costs for U.S. consumers and industries. This tariff expansion, reviving measures from 2018, will impact sectors reliant on these metals, from automakers to construction, by raising prices and disrupting supply chains.

- The IEA notes that, “A wide range of export control measures on critical minerals have been announced in recent months. In December 2024, China restricted the export of gallium, germanium, and antimony – key minerals for semiconductor production – to the United States.” This was followed by additional export control announcements in February 2025 on a range of materials including tungsten, tellurium, bismuth, indium, and molybdenum – key minerals primarily used in defense and high-tech applications.

- The European Union vowed to respond to 25% tariffs President Donald Trump said the U.S. will impose on steel and aluminum imports, escalating a potential trade dispute with one of Washington’s closest allies. “I deeply regret the U.S. decision to impose tariffs on European steel and aluminum exports,” European Commission President Ursula von der Leyen said in a Tuesday statement.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was PancakeSwap, rising 77.88%.

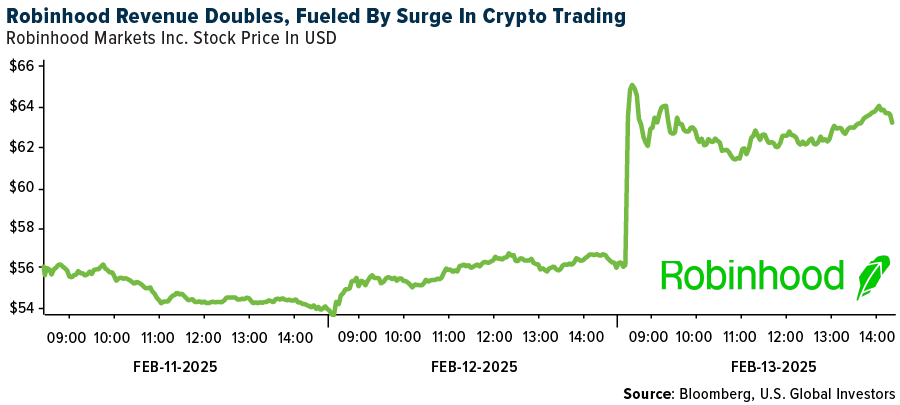

- Robinhood Markets’ shares jumped as much as 16%, reaching their highest intraday level since August 2021, reports Bloomberg. The rise took place after the retail brokerage reported fourth-quarter net revenue that topped expectations with cryptocurrency revenue soaring.

- Tokyo-listed mobile game studio Gumi intends to buy bitcoin worth 1 billion Japanese yen. Gumi plans to make the purchase in the period between February and May of this year, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Onyxcoin, down 20.21%.

- The Trump administration is preparing to release a Russian cybercriminal as part of a prisoner exchange that led to the release of an American schoolteacher from a Russian prison, Bloomberg reports.

- The SEC asked a court to pause its case against Binance, underscoring a new approach to the crypto industry under the Trump administration. As explained by Bloomberg, the SEC made the request in a joint motion filed late Monday with the crypto exchange.

Opportunities

- BitGo is considering an IPO with talks underway for a potential listing in the second half of this year. The company raised $100 million in 2023 at a $1.75 billion valuation with backers including Goldman Sachs and Valor Equity partners, Bloomberg reports. BitGo would join other crypto companies including Gemini and Bullish Global in planning to go public.

- South Korea is seeking to gradually allow companies to participate in the crypto market in a bid to increase demand for investment in blockchain business. The FSC plans in the first half of the year to allow real name accounts for some institutions including law enforcement agencies and non-profit corporations that need to dispose of digital assets, writes Bloomberg.

- Tether Holdings said it’s acquired a minority stake in Juventus Football Club SpA, as one of crypto’s most valuable companies continues to diversify its investment portfolio. The deal is part of Tether’s push to integrate digital assets into sports franchises, writes Bloomberg.

Threats

- Crypto miners in the U.S. are experiencing delays receiving deliveries of new equipment, threatening their competitiveness and profit margins as the Chinese juggernaut that supplies the bulk of their machinery comes under scrutiny amid a trade war. Bloomber explains that recent shipments of machines made by Beijing-based Bitmain Tech to U.S. clients have been delayed due to heightened Customs and Border Protection.

- The founder of a cryptocurrency called Anti-Money Laundering Bitcoin who’s charged with pilfering $5 million from investors shifted blame for the scheme on the notorious lobbyist Jack Abramoff at the first day of his federal criminal trial, Bloomberg reports.

- A 31-year-old man in Prague accidentally deposited 2,000 Solana tokens worth $63,700 into an old FTX account in October 2023, a year after FTX went bankrupt. He now needs a court order to withdraw the tokens which are now worth over $396,000 due to the increase in Solana’s price, writes Bloomberg.

Defense and Cybersecurity

Strengths

- U.S. President Donald Trump approved a $7.4 billion arms sale to Israel, including 3,000 Hellfire missiles from Lockheed Martin and $6.75 billion in bombs from Boeing and other contractors. Deliveries will begin next year, with the Hellfire missiles arriving in 2028.

- Rheinmetall announced a contract to supply C-390 flight simulators to the Royal Netherlands Air Force, with the order valued in the double-digit million Euro range and booked in early 2025.

- The best performing stock in the XAR ETF this week was Archer Aviation, rising 14.75%. Renaissance Technologies acquired a 1.1% stake in Archer Aviation Class A during the fourth quarter, holding 4.38 million shares valued at $43.8 million, as part of its broader investment in the industrials sector.

Weaknesses

- Nvidia experienced a historic market cap loss of nearly $600 billion following the launch of DeepSeek’s AI chatbot, which significantly impacted U.S. tech stocks.

- Boeing announced sizable job cuts in the Space Launch System program and reported a $11.8 billion loss in 2024 due to a machinists’ strike and safety issues.

- The worst performing stock in the XAR ETF this week was Kratos, down 16.33%. Rovida Advisors exited its seven-and-a-half-year investment in Kratos, selling 1.77 million shares in the fourth quarter, which previously accounted for 1.2% of the company’s outstanding stock.

Opportunities

- Safran SA and CyberArk Software Ltd. have provided strong positive earnings guidance for 2025, with Safran expecting 10% revenue growth and CyberArk projecting 31% year-over-year growth, both supported by record 2024 performances.

- CyberArk has acquired Zilla Security for up to $175 million to enhance its identity security platform with AI-driven automation tools.

- CrowdStrike announced the launch of Charlotte AI, an AI-driven system for threat detection and response, developed with CrowdStrike Falcon® Complete Next-Gen MDR, achieving over 98% accuracy and saving more than 40 hours of manual work weekly.

Threats

- Intel released its 2024 security report, criticizing AMD and Nvidia for having more security vulnerabilities compared to Intel’s products.

- A Russian drone strike on Chernobyl’s containment structure caused damage but no radiation leak, sparking international condemnation and escalating tensions between Ukraine and Russia.

- Rwanda-backed M23 rebels captured Kavumu airport in eastern Congo, tightening their control over the mineral-rich region as global leaders call for peace talks and a ceasefire.

Gold Market

This week gold futures closed at $2,895.30, up $7.70 per ounce. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 1.05%. The S&P/TSX Venture Index came in up .15%. The U.S. Trade-Weighted Dollar fell 1.16%.

Strengths

- The best performing precious metal for the week was palladium, up 1.23%. Gold ETFs experienced outflows, and platinum ETFs declined, indicating a potential shift away from these metals among ETF investors. The limited change in palladium holdings suggests a more resilient investor sentiment toward the metal, however, contributing to its outperformance relative to other precious metals this week, Bloomberg reports.

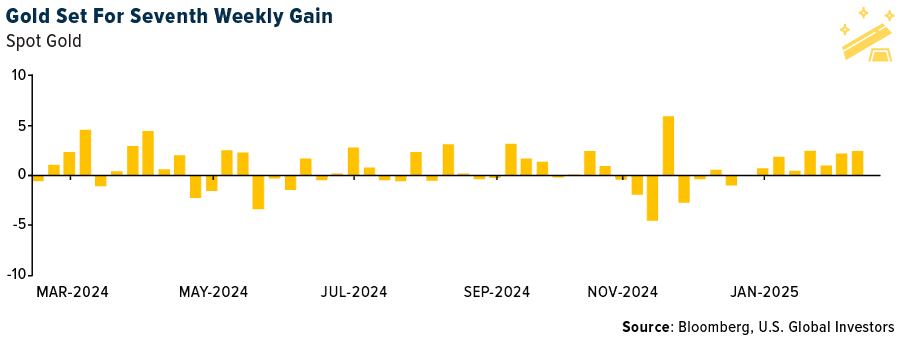

- Agnico Eagle Mines reported an outstanding 2024 performance, marked by record free cash flow of $2.14 billion and operational cash flow of $3.96 billion. This strong financial performance allowed the company to significantly reduce its net debt by $1.3 billion. The price of gold also moved higher this week, set for its seventh weekly gain, amid uncertainty around trade and the global economy following President Trump’s reciprocal tariffs.

- Evolution Mining reported first-half 2025 underlying EBITDA of $1,014 million, 11% above consensus of $912 million and underlying profit after tax of $385 million, 20% above consensus. Record $385 million group cash flows led the company to declare an interim dividend of 7 cents per share, according to Bank of America. Share price had increased by over 8% by the end of the week.

Weaknesses

- The worst performing precious metal for the week was platinum, down 0.90%. Platinum experienced the worst performance among precious metals this week as exchange-traded funds (ETFs) decreased their platinum holdings, indicating weakening investor sentiment. Further underscoring this weakness, Northam Platinum Ltd warned of a significant slump in first-half earnings due to depressed platinum group metal (PGM) prices.

- President Trump’s threatened tariffs on Europe have created a price disparity between New York and London gold markets, with gold worth substantially more in Manhattan than in London. The logistical challenges of transporting physical gold from London to New York, including recasting bars to meet Comex contract requirements and bottlenecks at the Bank of England’s vaults, are causing delays and increased costs. The price gap is creating difficulties for manufacturers and traders without easy access to physical gold, leading to a surge in gold borrowing rates and potential losses for those unable to quickly obtain gold to cover their positions. This comes as a weakness for gold traders, but a strength for those who bring it online, the gold miners.

- Barrick Gold again met with Mali this past week, but talks were ultimately suspended without reaching an agreement. Mali is holding 3 tons of gold seized from Barrick’s Loulo-Gounkoto mine, forcing Barrick to the negotiating table. However, management is highly reluctant to pay some kind of back tax assessment with the change in government.

Opportunities

- Tatiana Darie, of Bloomberg, noted that gold’s march toward $3,000 per ounce slowed on Friday despite soft spending data and a weaker dollar. However, haven demand amid trade uncertainty is a big driver of gold but central bank buying remains a potent force that will continue to buoy the precious metal, especially from China.

- Beyond just the macro issues,gold buying has been resilient and China’s Financial Supervision Administration has decided to launch a pilot program for insurance funds to invest in gold through a range of channels. Bank of America’s China insurance team estimates a total investment of China insurers of RMB32tn, or $4.4 trillion, so the potential inflows into gold could be RMB180-200bn, or $25-28 billion.

- Simon White, a reporter at Bloomberg, noted that silver’s underperformance relative to gold could shock markets as it plays catch up to gold. Gold has had several explosive rallies in the past but each time the rallies in silver were even more extreme. Investment banks are moving gold bullion from London to New York, and they are also grabbing silver too. This could lead to a shortage of physical metal in London and Europe.

Threats

- Gold’s scorching rally to near $3,000 per ounce threatens to leave buyers in China behind. Bullion’s ascent over the past year has counted Chinese demand among its key drivers. But record prices, a weak economy, and the extra costs imposed by a strong dollar, are making purchases too expensive for many consumers in the world’s biggest buyer, according to Bloomberg.

- BMO notes that New Gold’s updated three-year production guidance featured a 10% decrease for 2025, a 6% increase in 2026, compared to previous guidance, and new 2027 guidance (375-445k ounces). For 2025, production is anticipated to be H225 weighted due to a stripping campaign at Rainy River. New Gold’s share price declined by over 4% by the end of the week.

- As compared to November 2024 targets, Barrick’s revised guidance on average outlines 5% lower gold production, 2% lower copper production, 8% higher AISC, and 2% lower capex, according to RBC.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

General Dynamics Corp.

Taiwan Semiconductor Manufacturing Co. Ltd.

Alphabet Inc.

Copa Holdings

Ryanair Holdings

Sun Country Airlines

Hermes

Kering

Hyatt Hotels

Richemont

Louis Vuitton

Volkswagen

Mercedes

BP plc

Lockheed Martin

Rheinmetall

Boeing

Nvidia

Agnico Eagle

Evolution Mining

Barrick Gold

New Gold

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The compound annual growth rate (CAGR) is the annualized average rate of revenue growth between two given years, assuming growth takes place at an exponentially compounded rate.