How 2024’s Record-Breaking Elections Are Shaping Market Trends

As we approach the halfway mark of 2024, I figured it’d be constructive to check in on the results of this year’s record-breaking elections. The numbers are particularly striking: Approximately 4.2 billion people are believed to be casting ballots this year, representing half of the world’s population and 68% of global equity market cap.

The implications for investors are profound, with several key elections likely to shape global markets and economies in the months and years to come. At U.S. Global Investors, we like to say that government policy is a precursor to change, and if that’s the case, we may be in for some serious change.

The EU’s Rightward Tilt

One of the most consequential political developments so far this year has been the rightward shift in the European Union. The recent elections for EU Parliament saw far-right parties making substantial gains across many of the bloc’s 27 member states.

This conservative groundswell has been driven by growing frustration over the migrant crisis, which I previously wrote about, and discontent with regulations on climate change and other issues that are perceived to disproportionately affect rural residents. The European economy has also been largely stagnant since the financial crisis, fueling dissatisfaction with the status quo.

These same issues motivated voters in the United Kingdom to approve Brexit eight years ago.

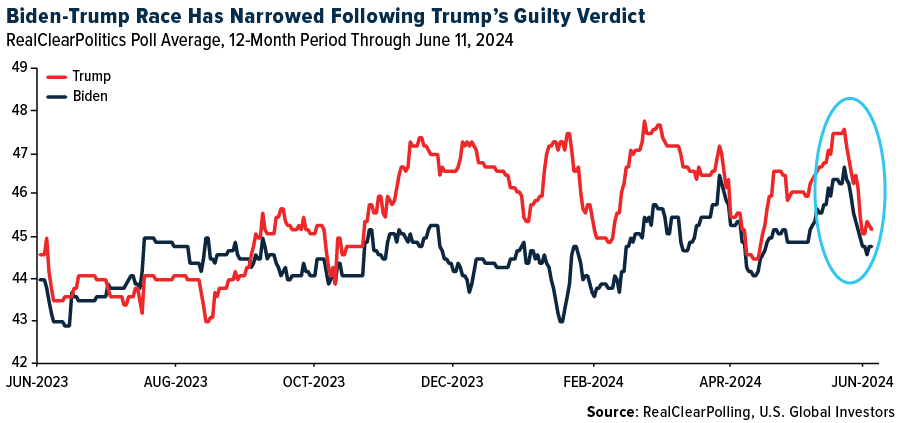

The surprising scale of the far-right’s victories is turning heads in the U.S., where President Donald Trump continues to poll higher than incumbent Joe Biden, though the race has narrowed considerably since Trump’s guilty verdict in his Manhattan hush money case.

Modi Scores a Third Term

In India, the world’s largest democracy, Prime Minister Narendra Modi secured a third consecutive term, but he returns with a diminished majority. The Bharatiya Janata Party (BJP) failed to win the required 272 seats to form a majority government on its own, resulting in a coalition government.

The market reacted negatively to the reduced majority, with a $371 billion selloff and foreign investors selling a record $1.4 billion worth of shares.

Despite this initial reaction, Modi’s historic reforms are expected to continue driving economic growth.

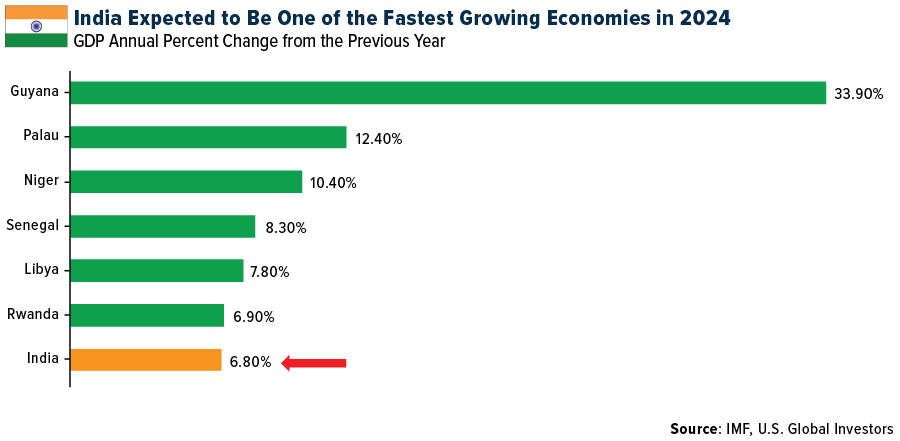

The International Monetary Fund (IMF) estimates that India will see its real gross domestic product (GDP) advance nearly 7% this year, ranking the country among the world’s fastest growers. The BJP is likely to push ahead with developing India’s manufacturing sector during Modi’s third term, though he will now have to contend with coalition allies, which could slow the process.

Mexico to Become Less Friendly to Business?

Mexico hosted its largest election ever last weekend, with over 20,000 local, state and federal offices on the ballot. Claudia Sheinbaum, the candidate from the National Regeneration Movement (Morena), claimed victory with a stunning 30% margin, the equivalent of 38 million votes, making her the first woman president of not just Mexico but any North American country.

A climate scientist and former mayor of Mexico City, Sheinbaum is set to continue many of the policies of the outgoing president, Andrés Manuel López Obrador (“AMLO”). Unlike Modi, Sheinbaum will enjoy a congressional supermajority, giving her a better chance of amending Mexico’s constitution, including potentially nationalizing the country’s power generation. This could lead to a less business-friendly environment, creating challenges for investors in the Mexican market.

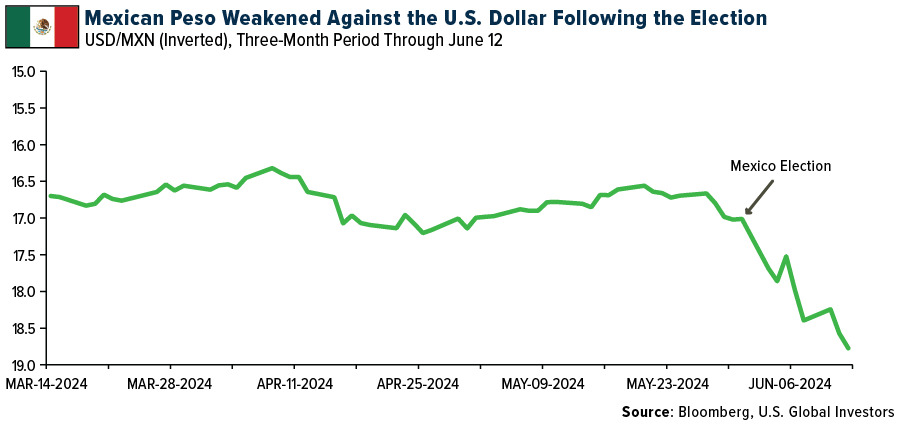

The Mexican peso has faced pressure since the election, with the USD/MXN exchange rate reaching levels unseen in over a year following Sheinbaum’s announcement that judiciary reform would be an early focus for the new congress in September.

Looking Ahead to November

Arguably, the most watched election of 2024 will be the upcoming U.S. presidential race. According to RealPoliticsPolling, which aggregates various national and statewide polls, Biden continues to trail Trump in favorability, despite the latter’s criminal guilty verdict. Most Americans cite the economy and inflation as the most important issues influencing their vote.

Yesterday, Trump unveiled his plan to eliminate income taxes by replacing them with an all-tariff policy. During his administration, the former president was a major proponent of tariffs, and he’s widely expected to leverage them again should he be reelected. However, to achieve what Trump is proposing would likely require an amendment to the Constitution, a hard sell in today’s hyper-partisan, divisive political climate.

At U.S. Global Investors, we continuously monitor these developments to provide you with insights and strategies. Understanding that government policy is a precursor to change will be key to making informed investment decisions the remainder of this year and beyond.

Here are the safest airlines in the world for 2024… watch the video!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 0.54%. The S&P 500 Stock Index rose 1.58%, while the Nasdaq Composite climbed 3.24%. The Russell 2000 small capitalization index lost 1.01% this week.

- The Hang Seng Composite gained 2.21% this week; while Taiwan was up 2.96% and the KOSPI rose 1.31%.

- The 10-year Treasury bond yield fell 21 basis points to 4.218%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Pegasus Airlines, up 10.4%. According to Raymond James, 67%/33% of trips were taken for leisure/business purposes and 33.9%/31.5% have an annual household income <$50K/>$100K, while blended trips made up 33.8%.

- According to Morgan Stanley, cumulative global new container ship supply is only 42% of the total the group forecasts for calendar year 2024, while scrapped volume is only 10% of the full-year forecast. Morgan Stanley believes the impact of supply shortages rooted in geopolitical risk in the Middle East is greater than assumed.

- According to Cowen, Delta Airlines did not update guidance, but reaffirmed previous comments that demand remains strong among premium consumers, which the group defines as those earning over $100,000 per year. Corporate travel appears to be a bright spot. It was slow to restart after the pandemic, but volumes are up more than double digits year-over-year.

Weaknesses

- The worst performing airline stock for the week was Aeroports de Paris, down 15.2%. Allegiant lowered capacity each month from August to November, reports Bank of America, notably reducing September and October capacity by 490 basis points (bps) and 460bps, respectively. Reductions are likely driven by Boeing delivery delays as they are still awaiting delivery of its first 737 MAX aircraft, constraining its ability to grow. Third quarter 2024 schedules currently reflect +3.7% capacity growth compared to the third quarter of 2023.

- According to Morgan Stanley, China container future prices have corrected sharply, likely in response to the news about U.S. Secretary of State Antony Blinken’s effort to push for a Gaza ceasefire.

- Boeing received just four aircraft orders for the 787 in May with a total backlog now at 6,200 aircraft. Boeing’s total backlog consists of 4,750 737 MAXs, 790 787s, 540 777s, and 100 767s. Year-to-date, the company has recorded 142 total orders, lower than the 223 total orders in the same timeframe in 2023, according to Goldman.

Opportunities

- The FAA has extended a limited waiver of slot usage at New York airports through October 25, 2025. The FAA projects that the New York ATC facility will not reach 70% of the targeted staffing level until year-end 2026, according to Raymond James.

- ISI believes it is likely that any incremental OPEC output/exports will add upside to the VLCC market spot rate outlook from the fourth quarter 2024 and beyond. Of course, other factors will play a material role in the path of VLCC spot rates going forward, but with the orderbook still at multi-decade lows, no end in sight to the disruptions and diversions that continue to add to tanker market ton miles, and global oil demand remaining resilient, every little bit of output is likely to add to the seasonal winter peak this year.

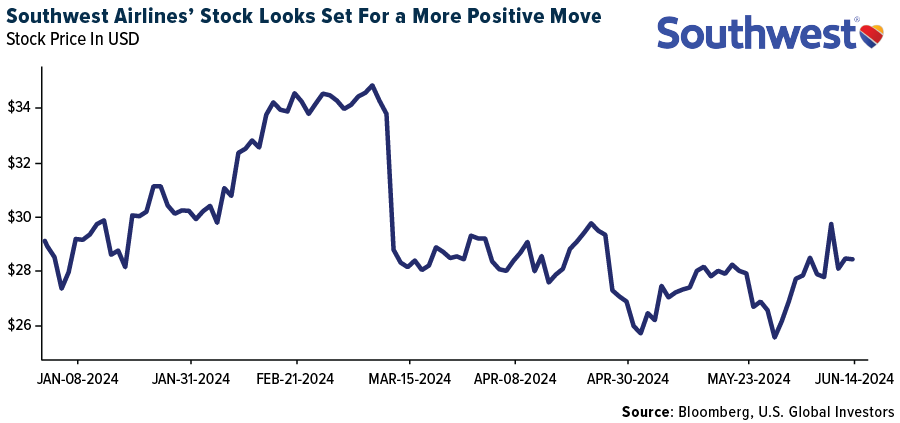

- Elliott Investment Management has reportedly built a stake of $2 billion in Southwest Airlines ($17.7B market cap) to push for changes aimed at reversing the airline’s underperformance. It is unclear if a management change is in the cards. Elliott is known for forcing changes that include management shake-ups and outright sales. There are some that believe sufficient change cannot occur without a change in leadership, reports Raymond James.

Threats

- In addition to board/management changes, ISI believes Elliott’s focus is on greater flexibility with revenue initiatives Southwest has been reluctant to pursue. These include assigned seating, segmentation, and, likely most controversial, bag fees. However, given how hard Southwest leans into “Bags Fly Free” in its marketing (viewed as a fundamental point of differentiation), this change is unlikely to occur any time soon.

- As reported by Morgan Stanley, if the Rea Sea disruptions disappear, the segment would quickly return to a downcycle, whereas if the disruption continues, the spot rally might continue into the summer, if not longer.

- JPMorgan has placed Lufthansa on Negative Catalyst Watch on potential for earnings downgrades and/or a further downwards revision in company guidance at some point over the coming months. They now forecast second-quarter group EBIT of €714m, 24% below consensus of €935m, and €370m lower year-over-year.

Luxury Goods and International Markets

Strengths

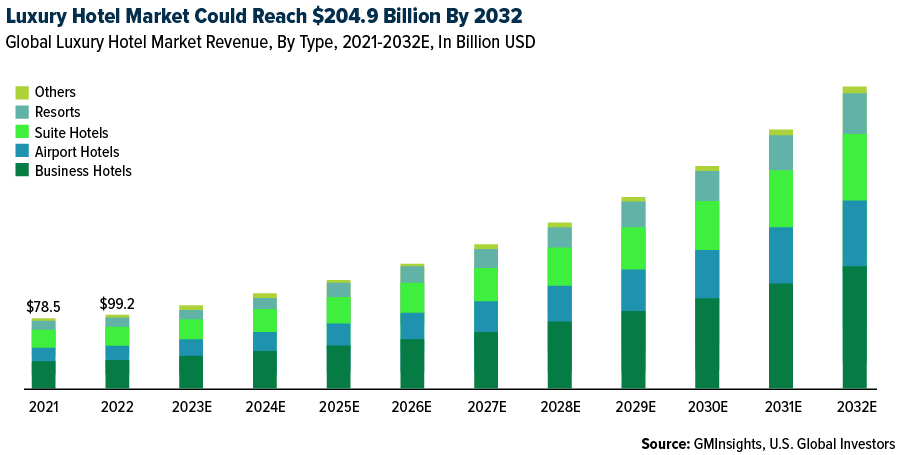

- In a research report published by Global Market Insights Inc., and reshared at the start of June, the group notes that the luxury hotel market valuation is predicted to cross $204.9 billion by the year 2032. The growing focus on personalized and exclusive experiences has led several luxury hotels to innovate their offerings, Yahoo! Finance shared from the report, ranging from personalized concierge services to unique amenities tailored to individual guest preferences. In addition, the rising influence of experiential travel and social media is also driving demand among millennials.

- Amazon, seeking to continue expanding and strengthening its presence in Latin America in alliance with the U.S. telecommunications firm Vrio, will launch in Argentina, Brazil, Chile, Uruguay, Peru, Ecuador, and Colombia, a satellite internet service. This will help these countries gain guaranteed internet access, especially in communities where the infrastructure has many challenges. Amazon will compete directly with Elon Musk’s Starlink, which already has a regional presence, reports Reuters.

- Hilton Worldwide Holding IN, an american holding company which provides hospitality services, was the best performing S&P Global Luxury stock, gaining 4.01% in the past five days.

Weaknesses

- As reported by Bloomberg, a Milan court put a unit of the French fashion house Christian Dior under judicial control citing alleged labor violations, an Italian official said. Manufactures Dior Srl, which produces in Italy luxury bags and accessories for LVMH’s Dior, didn’t “prevent and stem labor exploitation within its production cycle,” the Italian police said in a statement. Representatives for both Dior and LVMH were not available for comment.

- The Olympic games, which will take place in Paris between July 26 and August 11, were expected to increase the demand for luxury travel agencies in the United States. Still, according to Bloomberg, wealthier travelers prefer nearby destinations instead. Even though the Olympics attract many visitors, travel agencies say the bookings on those days are made by more modest travelers. At the same time, European luxury retailers such as LVMH and Cartier said they are banking on more business outside of France, as wealthy travelers are avoiding the crowded city during the event.

- Beneteau, a French manufacturer of leisure products who designs and sells sailboats and motorboats, was the worst performing S&P Global Luxury stock, losing 17.58% in the past five days. The group’s revenues for the first quarter of 2024 decreased by 39%, mainly because of the change in dealership inventory levels.

Opportunities

- Swatch Group AG is shaking up its executive management committee just months after the watch and jewelry maker faced investor calls for improved corporate governance, reports Bloomberg. According to a statement made Thursday, Chief Controlling Officer Peter Steiger – a 35-year veteran of the company – will retire. Two company executives have been elected to the executive management board. These changes come as Swatch shares hit a 52-week low on June 7, the article explains, amid a downturn in demand for pricey timepieces in mainland China and Hong Kong.

- According to a Reuters article, Audi, the German carmaker and a subsidiary of the Volkswagen Group, announced a $1.08 billion investment in electric vehicle (EV) projects in Mexico. This investment will create about 500 new jobs and is a strategy to expand its presence in the Latin American region.

- According to a study by London-based data firm Altrata, by 2033, 1.2 million people with at least $5 million (the world’s wealthiest) will transfer around $31 trillion to their heirs, primarily Gen X (those in their mid- to late-40s). Something different happens with Millenials and the younger Gen Z group, who receive sums from their grandparent’s legacies, not directly from their parents. The report says 46% of the wealth that will be transferred ($14.1 trillion) will be passed in North America, $7.4 trillion in Europe, and $6.1 trillion in Asia. These dynamics look to create new business opportunities and a new investor generation and will have to be reached by the different luxury brands in order to keep and increase their customer base.

Threats

- According to the Bureau of Labor Statistics latest consumer price index (CPI) reported on Wednesday, the cost of household furnishing and supplies decreased 2.5% last month compared with the same period last year. Appliances and furniture and bedding saw the most significant dips down 4.9% and 3.7%, respectively, according to the index.

- The electric vehicle (EV) trade war between China and the European Union could impact luxury cars. According to Bloomberg, if European politicians decide to slap a 100% tariff on chinese electric vehicles, as the U.S. did last month, China can quickly retaliate against the more than 300,000 luxury cars annually imported from the European Union. Now they have a tariff of 10%, but if the EU keeps that percentage, Chinese vehicles will have a significant advantage thanks to its high technology and 30% cost advantage. There is a high probability that the EU will anounce a tariff of 25% to 30%, which would make European EVs broadly competitive with lower-cost Chinese imports. At the same time, the China Chamber of Commerce to the EU is considering increasing the import tax from the EU by 15% to 25%. These measure could hit companies such as Porshe, which makes about one quarter of its revenue in China and produces its cars in Germany.

- Due to the growing number of unsold inventories, luxury brands in China offer unprecedented discounts on their products, reducing prices by around 50%, reports Bloomberg. Well-known luxury brands such as Balenciaga – part of Kering SA- is offering its iconic Hourglass handbag at 35% off its original price on the leading mainland e-commerce platform Alibaba’s Tmall. The price is lower than what is listed on Balenciaga’s official website and significant luxury platforms such as Farfetch as well. This trend can be seen other luxury brands such as Versace, LVMH and Burberry, all of whom have slashed prices by more than half on Tmall. Versace’s discounts jumped to over 50%. This pricing war could threaten to deteriorate luxury brands’ exclusive image.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was WTI crude oil, rising 4.00% after OPEC+ clarified its plan to return some oil supplies back online. Crude prices slumped to a four-month low last week on the announcement of restoring production. Oil traders piled back into the commodity. U.S. crude followed broader markets higher, reports Bloomberg.

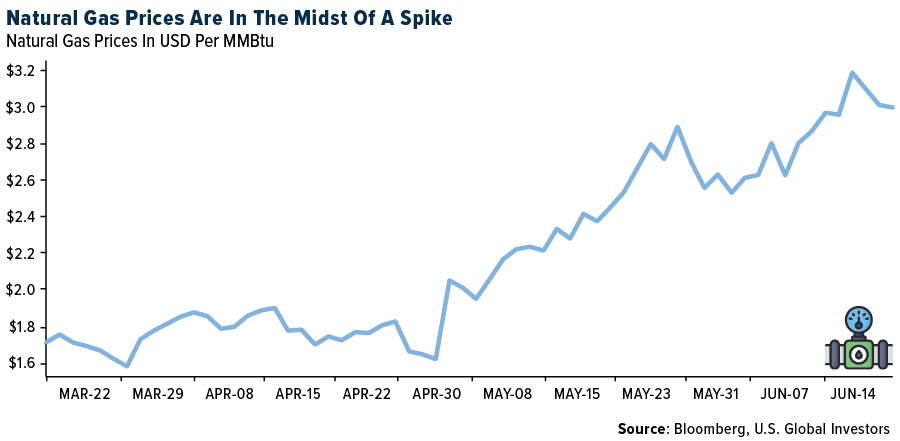

- U.S. gas production has rebounded in line with Goldman’s forecast as we move out of maintenance season and higher gas prices incentivize the reversal of previous shut ins. That said, a hotter-than-average June has helped support gas burns above their previous expectations, leading to a net tightening of estimated U.S. gas balances, and posing an upside risk to their balance-of-summer $2.65/MMBtu Henry Hub forecast.

- According to Morgan Stanley, after declining 15% through the first quarter, LNG prices have recovered so far in the second quarter and are now up 10% year-to-date on the back of stronger demand and unplanned outages. On the supply side, seasonal maintenance in Qatar and unplanned Australia and Malaysia downtime contributed to the lowest level of May LNG exports in three years.

Weaknesses

- The worst performing commodity for the week was lumber, dropping 4.05%, likely on prospects for interest rates to stay higher for longer based on Fed speak. Surging aluminum prices over the last three months resulted in aluminum stocks at London Metal Exchange warehouses surging with their largest daily inflow in early May, driven by deliveries into Malaysian warehouses by large metals trader including Trafigura. By the end of May, total aluminum inventories rose 128% on the month, Bloomberg explained.

- According to JPMorgan, refiners had another down week (-2.5%), in a tough week overall for energy (-3.4%) and are now down 18% quarter-to-date. Gasoline demand was down 3% year-over-year this week and has trended down 2.5% on average in April-May.

- Steel prices have had a quicker-than-expected drop in prices, says Morgan Stanley. The weakness in flat steel prices was most evident in Nucor’s weekly Consumer Spot Price (CSP), which saw a drop from $820 per ton to $760 per ton.

Opportunities

- Bank of America sees $75 per barrel oil as a floor under Brent. Firstly, physical demand for oil, including from China and the U.S. SPR, tends to rise when prices fall. Second, financial demand is likely to rise substantially if currently very low speculative positioning normalizes. Third, U.S. supply will remain price dependent, and OPEC can delay, pause, or reverse its plan to raise production if required to stabilize the market.

- Noble Corp., the world’s biggest offshore oil-rig contractor by market value, agreed to buy its smaller rival Diamond Offshore Drilling Inc. in a deal valued at $1.6 billion. Diamond stockholders will receive 0.2316 share of Noble plus $5.65 for each share they own; a 11.4% premium based on the June 7 closing price, according to a statement made Monday.

- Copper edged higher in London, bolstered by rising expectations that heavy losses over the past three weeks could tempt some buyers to make an opportunistic return to the market. Prices rose as much as 1.2% to $9,882 a ton, steadying after a steep decline on Friday as a strong U.S. jobs report cast further doubt on the timing and extent of Federal Reserve interest-rate cuts, according to Bloomberg.

Threats

- Nevada Copper Corp., a miner backed by Pala Investments and Mercuria Energy Group Ltd., has filed for bankruptcy protection, even as prices of the metal sit near the highest on record, according to Bloomberg. Triple Flag Precious Metals has a stream on the gold and silver byproducts and Elliott Investment Management, which owns two-thirds of Triple Flag, has offered a debt package to Nevada Copper to try to protect its investment.

- A liquefied natural gas export facility in Australia halted production on Monday, threatening to tighten global gas supply and boost prices from Asia to Europe. Chevron Corp.’s Wheatstone gas facility suspended activities to complete repairs of its offshore platform’s fuel system, according to a statement from the company.

- Cleveland-Cliffs shares slipped after JPMorgan downgraded its recommendation on the steel producer to neutral from overweight. The bank says that with forward pricing likely to be weaker than previously expected, and higher capital expenditure in the coming years, free cash flow and shareholder returns are less likely to be attractive in comparison to the prior view.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Monero, rising 5.16%.

- MicroStrategy will offer $500 million in convertible notes to acquire more Bitcoin, the third sale of the securities this year by the enterprise-software maker that has made buying the cryptocurrency part of its corporate strategy, writes Bloomberg. The largest publicly traded corporate holder of Bitcoin plans to issue unsecured senior notes due in 2032 according to a company statement.

- Bitfarms rose 14% to the highest point in almost 15 weeks. Trading volume was 2.7 million shares, quadruple the 20-day average, according to Bloomberg metrics.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Wormhole, down 36.70%.

- Bitcoin mining company Bitfarms is adopting a “poison pill” shareholder rights plan as a defense after an unsolicited takeover offer by larger rival Riot platforms. Riot made an unsolicited, $950 million offer in May to buy Bitfarms after the smaller Bitcoin miner rebuffed its takeover approach the prior month. Bitfarms said its board had determined that the proposal “significantly undervalues” the company, according to Bloomberg.

- Terraform Labs agreed to pay $4.47 billion to resolve a civil lawsuit filed by the U.S. SEC following the firm’s 2022 collapse, reports Bloomberg, which wiped out $40 billion in investor assets and shook the cryptocurrency world.

Opportunities

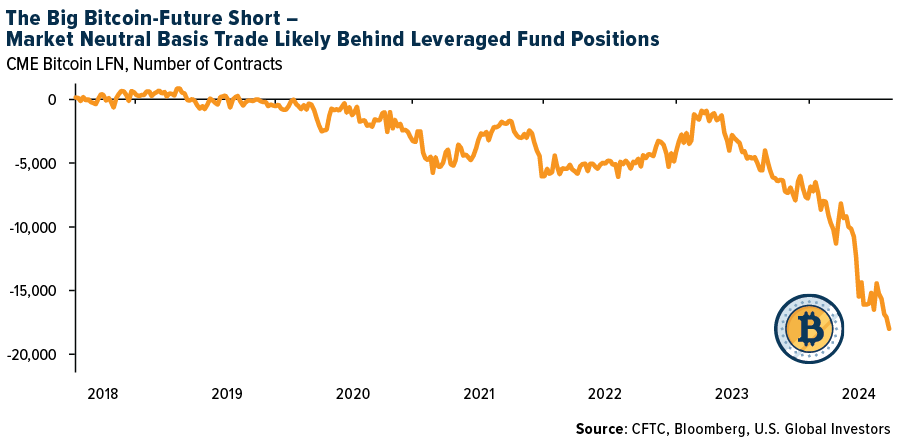

- Bitcoin futures are seeing a record high in net short interest among leveraged funds, yet don’t mistake that for an overwhelming sense of bearishness among hedge funds. It’s more likely due to an increasingly popular market-neutral strategy. What’s known as the basis trade, a strategy which seeks to profit between discrepancies in spot and futures markets, Bloomberg explains, likely accounts for much of the short interest of almost 18,000 CME Bitcoin futures contracts.

- U.S. President Joe Biden’s campaign is in discussions with cryptocurrency industry players about accepting crypto donations through Coinbase Commerce, which is a payment service that allows merchants to accept dozens of cryptocurrencies, writes Bloomberg.

- Venture capital firm Paradigm said it has raised $850 million for its third fund, reports Bloomberg, which will focus on early-stage crypto projects. Paradigm was previously an early investor and contributor for projects like crypto dex Uniswap and Optimism.

Threats

- The native token of Curve Finance, one of the cryptocurrency sector’s top decentralized exchanges, has tumbled to an all-time low. CRV slid as much as 38.2% on Thursday before paring some of the drop to trade at 26 cents, writes Bloomberg.

- Stablecoin issuer Paxos has cut its workforce by about 20%, says Bloomberg. The jobs cuts first reported by The Block come at a time when Paxos has more than $500 million on its balance sheet.

- Crypto exchange Gemini agreed to pay $50 million to resolve claims brought by New York’s AG accusing the company of defrauding investors. The settlement announced Friday will see Gemini return about $50 million of digital assets to investors who were locked out of their accounts when the program collapsed, writes Bloomberg.

Defense and Cybersecurity

Strengths

- General Dynamics Land Systems and Marshall Canada have been awarded a $1.88 billion U.S. contract to modernize the Canadian Armed Forces’ logistics vehicle fleet, reports Morningstar.

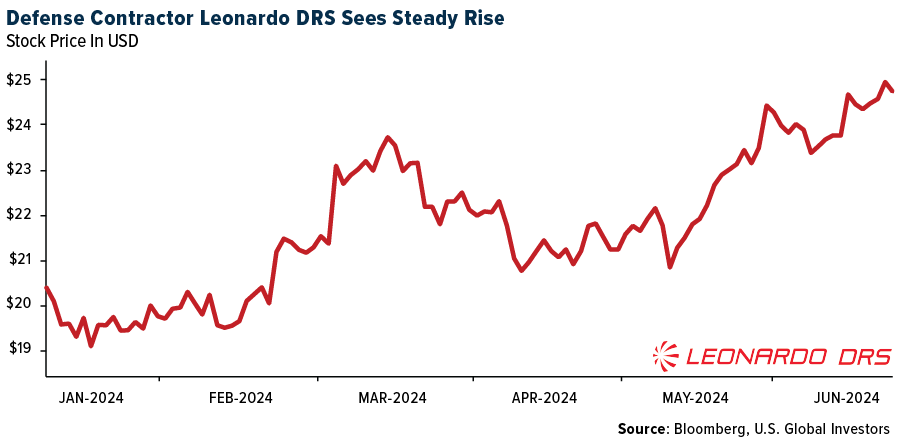

- Leonardo DRS, Inc. (NASDAQ: DRS) received a full-rate production contract from Northrop Grumman to supply its Quantum Cascade Laser (QCL) technology for Common Infrared Countermeasure (CIRCM) systems. This will enhance U.S. military aircraft protection against missile threats with advanced, lightweight, and powerful laser systems.

- The best performing stock in the XAR ETF this week was AeroVironment Inc., rising 6.40%, after partnering with the U.S. Defense Agency on Autonomous VTOL Aircraft in the end of May 2024, continuing its rising streak.

Weaknesses

- A major defense contractor, RTX Corporation, has been sued for allegedly discriminating against older workers in job ads by specifically targeting younger candidates. This violates federal and state age discrimination laws, with the company denying these claims and the AARP Foundation seeking class action status and policy changes.

- In response to the assassination of its commander Taleb Abdallah, Lebanon’s Hezbollah group launched coordinated rocket and drone attacks on multiple Israeli army bases on Thursday.

- The worst performing stock in the XAR ETF this week was Virgin Galactic, falling 19.02%, on a reverse stock split plan approved by the Board of Directors.

Opportunities

- Raytheon’s RTX has secured a $677 million contract to produce additional AN/SPY-6 radars for the U.S. Navy, part of a larger $3 billion contract over five years.

- AMD is helping companies prepare for the transformative potential of artificial intelligence (AI) in PCs by integrating dedicated AI processors into its CPUs and GPUs, enhancing performance and efficiency for emerging AI workloads. With AI’s ability to close the knowledge gap between user intent and capability, businesses investing in AI-oriented systems like AMD’s Ryzen AI processors will be better positioned to leverage its benefits, improving productivity and maintaining a competitive edge.

- G-7 leaders are calling on China to stop supporting Russia’s war in Ukraine by providing technologies and materials, amid ongoing trade tensions and efforts to enforce new sanctions, while also urging Beijing to promote peace and reduce dependencies on Chinese goods.

Threats

- A fleet of Russian warships reached Cuban waters on Wednesday, reports AP News, ahead of planned military exercises in the Caribbean that some see as a projection of strength as tensions grow over Western support for Ukraine.

- Taiwan has started mining the sea around the island, while China is meanwhile developing underwater drones shaped like rays with soft bodies.

- Boeing is inspecting undelivered 787 Dreamliners due to incorrectly installed fasteners, highlighting ongoing quality issues and increased scrutiny from the FAA. The FAA has multiple active investigations into the manufacturer following previous incidents, including a near-catastrophe with the 737 Max.

Gold Market

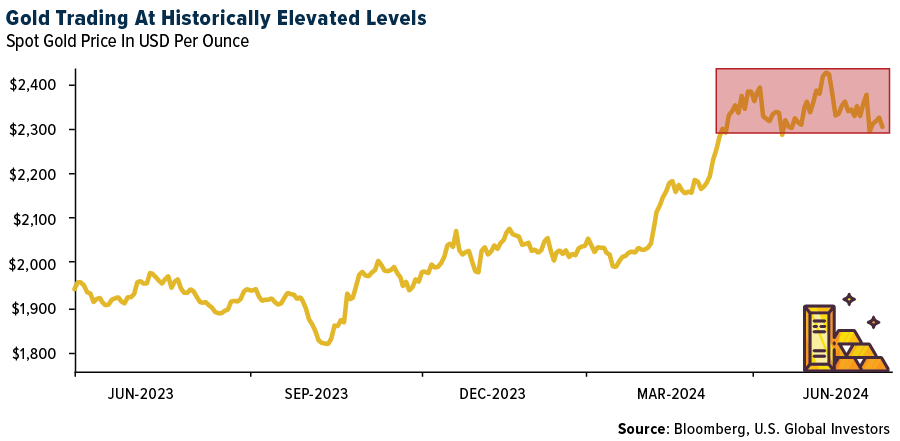

This week gold futures closed the week at $2,348.20, up $23.20 per ounce, or 1.00%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 2.22%. The S&P/TSX Venture Index came in off 2.41%. The U.S. Trade-Weighted Dollar rose 0.60%.

Strengths

- The best performing precious metal for the week was gold, up 1.00%. The World Gold Council (WGC) published its gold ETF flow data for May this week. Gold ETF holdings saw their first monthly inflow in 12 months, totaling $529 million or 8.2 tons.

- Vizsla Silver highlighted results from 12 new drill holes targeting the Copala resource area at its Panuco silver-gold project in Mexico. CS-24-354 returned 1,503 grams per ton of silver equivalent over 13 meters true width, including 6,229 grams per ton of silver equivalent over 1.40 meters and 3,813 grams per ton of silver equivalent over 1.31 meters, according to Bloomberg.

- Exchange-traded funds (ETFs) added 2,447 troy ounces of gold to their holdings in the last trading session, bringing this year’s net sales to 4.47 million ounces, according to data compiled by Bloomberg. This was the eighth straight day of growth, the longest winning streak since March 28, 2022.

Weaknesses

- The worst performing precious metal for the week was palladium, down 3.20%. According to RBC, Evolution Mining had previously maintained FY24 guidance, and a 26,000-ounce impact implies 218,000 ounces for Q4. This is 6% below RBC’s estimate. Accordingly, the company’s cash flow is tracking below their Q4 forecast.

- According to RBC, for Evolution, Cowal underground was not affected by the rainfall. Rainfall data from the Bureau of Meteorology and Elders Weather suggests that, while quarter-to-date rainfall has been higher than average at both sites, neither was substantially high versus peak months in the year. This creates some difficulty forecasting the quantum of impact at each site.

- A massive expansion in global solar manufacturing capacity is expected to suppress profits at least through the rest of this year even as demand for panels surges, according to Bloomberg. Prices for solar modules will remain near record lows in 2024 and some manufacturers will be forced to sell at a loss at times if they want to keep production lines running. Despite the current glut, more capacity to produce solar cells is still being added and this has helped keep silver demand firm.

Opportunities

- TriStar Gold announced this week they had received a favorable approval for their Preliminary License and the Environmental Impact Assessment for the Castelo de Sonhos gold project in Brazil. This was a major derisking event for TriStar, allowing the valuation to climb by over 50%. This puts TriStar to be able to engage in a more constructive manner with a mining company looking to take on a new project in a jurisdiction like mining friendly Brazil.

- Torex Gold Resources provided details on a multi-year exploration strategy for its highly prospective Morelos Property, designed to generate incremental additions to mineral resources in the near term, generate at least one new discovery in the mid-term, and extend the mine life at Morelos to deliver stable production and cash flow well beyond 2033, according to Bloomberg.

- Bloomberg reports that Asian retail gold buyers are still keen to acquire gold, even as prices hover at record highs. Participants at a precious metal conference in Singapore were enthusiastic about the future prospects for further gains in the price. With uncertainty regarding upcoming elections in more than 40 countries, the lack of traction in the Chinese economy, and less comfort in parking money in U.S. debt is giving gold an edge as a savings vehicle.

Threats

- Canaccord believes that SSR Mining will continue to assume an indefinite suspension at Çöpler. Çöpler is 80% owned by SSR Mining, 18.5% by Lidya Madencilik Sanayi ve Ticaret A.Ş. (Lidya), and a bank wholly owned by Çalık Holdings A.Ş. holds the remaining 1.5%.

- According to Canaccord, for SSR Mining remediation is estimated to cost $250-300 million at Copler, with an expected completion time frame of 24-36 months. SSR Mining remains fully financed for these efforts, in their view. The heap leach pad is expected to be permanently closed, and any future operations are contingent upon regulatory approvals.

- According to UBS, the ramp-up of Gold Fields’ Salares Norte project has been further impacted by adverse weather, affecting the volume and cost guidance for FY24. Although the overall 2024 group production guidance was only reduced by 5.5% and the all-in sustaining costs (AISC) increased by 4.5%, UBS believes that the additional delays in the Salares Norte ramp-up will likely diminish investor confidence in the project’s medium-term potential.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024):

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.