Helium Is Soaring on Red-Hot Demand, Shrinking Supply

On Wednesday this week, some of you may have watched a man fly without a plane or hang glider. David Blaine, the illusionist and endurance artist, soared over the Arizona desert by holding onto 50 giant helium balloons. The stunt, called "Ascension," lasted about an hour, during which Blaine reached a maximum altitude of 24,900 feet, or about 4.7 miles, before parachuting back to earth.

U.S. Global Investors Presents Fiscal Year 2020 Results Webcast

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

On Wednesday this week, some of you may have watched a man fly without a plane or hang glider. David Blaine, the illusionist and endurance artist, soared over the Arizona desert by holding onto 50 giant helium balloons. The stunt, called “Ascension,” lasted about an hour, during which Blaine reached a maximum altitude of 24,900 feet, or about 4.7 miles, before parachuting back to earth.

What made his flight possible, of course, was helium, the lighter-than-air stuff that makes your voice sound like Mickey Mouse’s.

Many people may not be aware that the gas is used for much more than filling birthday balloons. It plays a critical role in a number of high-tech applications, from barcode readers to semiconductors to liquid-crystal display (LCD) panels. Magnetic resonance imaging (MRI) machines can’t work without it. Google, Netflix and Amazon have been buying massive quantities of it for their data centers.

So why am I talking about helium this week and not gold or oil or copper? Like those other raw materials, helium is an important but finite resource that must be extracted from the ground. In fact, it’s exclusively a byproduct of natural gas mining.

Also like gold, new large helium deposits are becoming fewer and farther between, even though we’ve only known about the element since 1868, a little over 150 years ago. We’ve only been mining it in earnest since 1915, when the U.S. Army built the first helium extraction plant at the Petrolia Oilfield in North Texas.

As a result, supply is getting tight. Helium is notoriously difficult and expensive to store, for the very good reason that it escapes every known container over time. Ever wondered why balloons lose their helium so fast? It’s because the gas’s atomic radius is so small, it can literally diffuse through any solid. Much of it floats up into the upper atmosphere and eventually gets torn away by the solar wind. Helium is the second-most abundant element in the universe, and yet the day is fast approaching when it may no longer exist on Earth.

Did you know the U.S. has a National Helium Reserve in Amarillo, Texas? Despite the plant having the capacity to hold over 1 billion cubic meters, its reserves are projected to be depleted within two years, according to Desert Mountain Energy, a North American explorer of the gas.

Desert Mountain Energy Announces New Helium Discovery

As I’ve said a number of times in the past, one of the most attractive investment cases of gold is that it’s an extremely rare commodity. Peak gold is here, even as demand for the yellow metal remains steady, and over time this will help support prices.

Investors seeking exposure to gold have other options than physical bullion. There’s individual gold mining stocks, futures, mutual funds and ETFs.

Investors interested in helium aren’t so lucky. There’s no helium futures market that I’m aware of. Explorers and producers are your best bet.

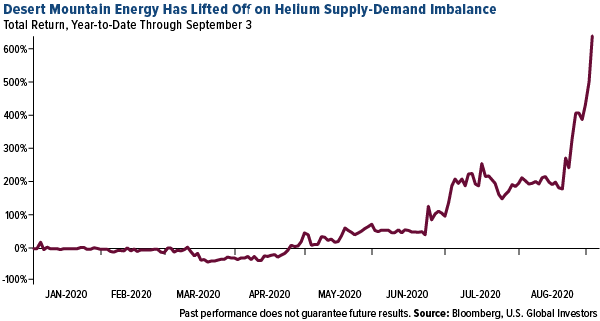

Among our favorites is Desert Mountain Energy. The company is headquartered in Vancouver and listed on the TSX Venture Exchange under the ticker DME.V, but it operates in the U.S. Southwest, particularly in Oklahoma and Arizona, the “Saudi Arabia of helium.”

Desert Mountain is up around 640 percent year-to-date on growing speculation of its prolific Holbrook Basin project in eastern Arizona, first leased in late 2017. This week, the company announced “significant” helium percentages at two of the project’s wells, which is highly encouraging.

The jump in share price fits in neatly with the “Lifecycle of a Mine” thesis, whereby mining stocks rise and fall depending on which phase of exploration or production aproject is in. In the past I’ve discussed this investor behavior as it applies to gold stocks, but clearly it applies to any commodity, including helium.

More importantly, though, this demonstrates the benefit investors get with active management. With decades’ worth of experience investing in natural resources, we have an expert understanding of the dynamics involved in the mining process. We were able to get into Desert Mountain soon before its remarkable runup.

For more on the Lifecycle of a Mine, explore our popular slideshow by clicking here.

Base Metals Supported by Recovering Manufacturing Activity

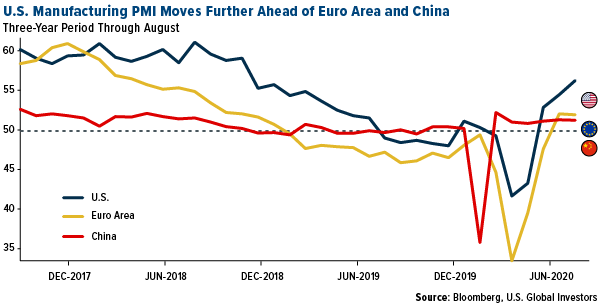

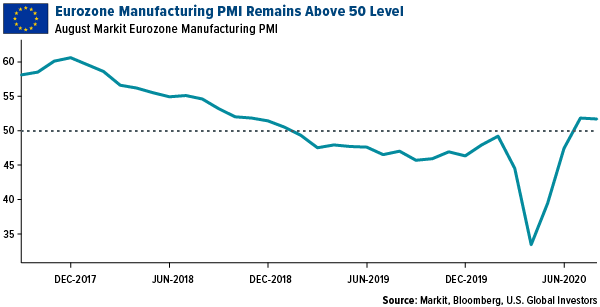

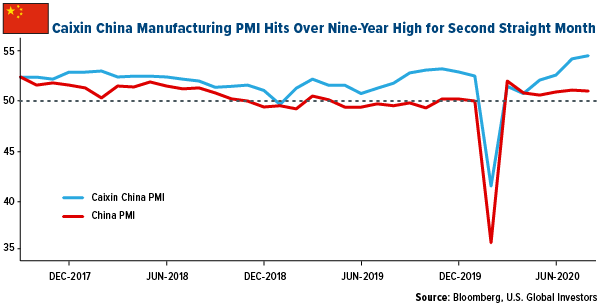

Helium isn’t the only commodity that’s surging on greater demand right now. Copper and iron ore are both up as manufacturing activity around the world continues to recover following the lockdowns. The manufacturing PMIs in the three largest economies—the U.S., China and euro area—all registered above the key 50.0 mark in August, indicating expansion. As I shared with you earlier this week, U.S. factories hit an incredible 56.0, the fastest pace since late 2018.

New orders in particular have increased, meaning demand for industrial metals has also improved. The price of copper has surged 41 percent since the March lows and closed at a two-year high of $6,697 per ton in London trading on Wednesday. Meanwhile, iron ore futures on China’s Dalian Commodity Exchange traded at nearly $126 on Thursday, up 70 percent from its April 2 low.

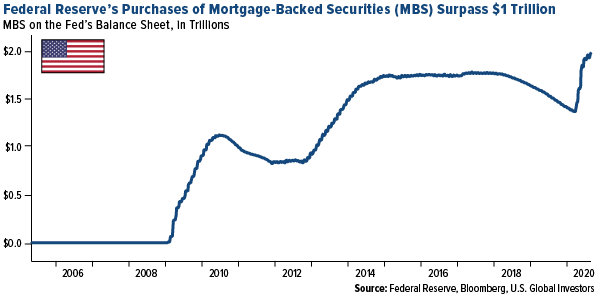

Gold Continues to Shine on Record Money-Printing

Gold may be off its record high of more than $2,070 per ounce, but the long-term investment case remains strong, not least of which because of peak gold production. Currency debasement is still a great fear as the Federal Reserve continues what is essentially the fourth round of quantitative easing (QE). According to Bloomberg, the Fed has now purchased more than $1 trillion of mortgage-backed securities (MBS) since March. Not only is that a record pace of money-printing, but it’s also inflated the Fed’s balance sheet. Believe it or not, the central bank now owns almost a third of all bonds backed by home loans in the U.S.

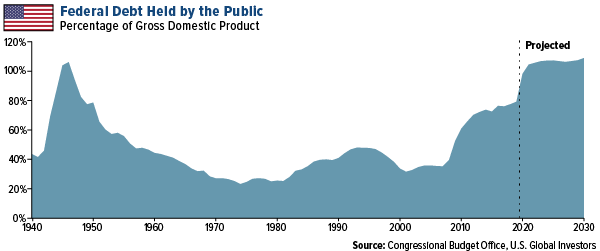

On the fiscal side, things are just as elevated. According to a report this week by the Congressional Budget Office (CBO), the amount of federal debt as a percent of gross domestic product (GDP) is on pace to hit, and exceed, the previous record set during World War II. As of today, total national debt stood at a mind-boggling $26.7 trillion, or more than $214,000 per U.S. taxpayer.

It’s starting to look as if appetite for another $1 trillion-or-more coronavirus relief package is waning among lawmakers and the president. Even so, the budget is near levels unseen in this country, with interest payments alone totaling more than $338 billion. This makes gold more attractive as a hedge against devaluation.

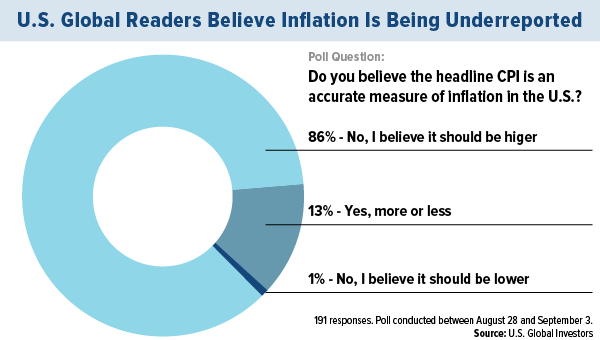

No Faith in Inflation

In last week’s commentary, I ran a poll asking if you believe the headline consumer price index (CPI) accurately measures inflation in the U.S. One hundred ninety-one people took the poll, and of those, a whopping 86 percent said they believe inflation is much higher than the monthly figure provided by the Bureau of Labor Statistics (BLS). Thirteen percent said they mostly agree with the CPI, while only 1 percent said they believe inflation is really lower than the headline figure.

I think these results are very telling. Few people, according to the poll, have faith in the current process to measure inflation, with a vast majority believing prices are rising at a faster rate than we’re being told.

Again I ask you, if you believe inflation is being unreported, why wouldn’t you have gold and gold mining stocks in your portfolio?

This week I spoke with Kitco’s David Lin about the effect of Fed policy on gold. To find out why I believe now is the “perfect” market for the yellow metal, watch the video below, and make sure to subscribe to our YouTube channel!

Gold Market

This week spot gold closed at $1,933.94, down $30.89 per ounce, or 1.57 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 2.42 percent. The S&P/TSX Venture Index came in off 1.56 percent. The U.S. Trade-Weighted Dollar rose 0.47 percent.

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| Aug-31 | Germany CPI YoY | 0.1% | 0.0% | -0.1% |

| Aug-31 | Caixin China Mfg | 52.5 | 53.1 | 52.8 |

| Sep-1 | Eurozone CPI Core YoY | 0.8% | 0.4% | 1.2% |

| Sep-1 | ISM Manufacturing | 54.5 | 56.0 | 54.2 |

| Sep-2 | ADP Employment Change | 1,000k | 428k | 212k |

| Sep-2 | Durable Goods Orders | 11.2% | 11.4% | 11.2% |

| Sep-3 | Initial Jobless Claims | 950k | 881k | 1,011k |

| Sep-4 | Change in Nonfarm Payrolls | 1,350k | 1,371k | 1,734k |

| Sep-10 | ECB Main Refinancing Rate | 0.000% | — | 0.000% |

| Sep-10 | PPI Final Dmeand YoY | -0.4% | — | -0.4% |

| Sep-10 | Initial Jobless Claims | 965k | — | 1,006k |

| Sep-11 | Germany CPI YoY | 0.0% | — | 0.0% |

| Sep-11 | CPI YoY | 1.2% | — | 1.0% |

Strengths

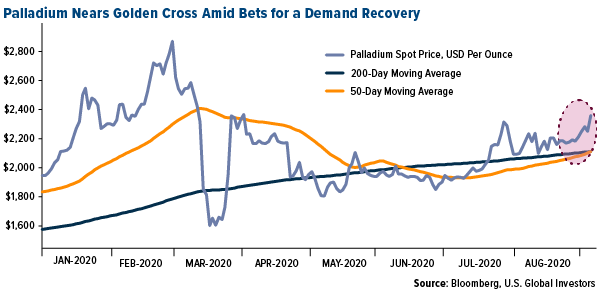

- The best performing precious metal for the week was palladium, up 3.90 percent. Impala Platinum Holdings expects supply shortfalls for palladium to continue this year, sending the metal higher. The miner reported a 10-fold surge in profits to $950 million for the year ended June 30. CEO Nico Muller said if the platinum-group metal rally holds, the company may raise its dividend ratio above 30 percent of free cash flow. Palladium prices are nearing a “Golden Cross” – when the 50-day moving average moves above the 200-day moving average. The rally is also driven by China’s automobile sector, which saw an 11 percent rise in car sales in August.

- Australian gold output is surging and proves production didn’t slow due to the pandemic. Production for the three months ended June 30 totaled 85 tons, up from 77 tons in the March quarter. Output for the 12 months ended June 30 totaled a record 328 tons.

- The Perth Mint said gold coin and minted bar sales totaled 67,462 ounces in August, up from 56,104 ounces in July and the highest since April. Gold imports to Turkey jumped to $4.08 billion. Preliminary data from the Trade Ministry shows Turkey’s trade gap widened 170 percent from a year earlier to $6.31 billion, led by the five-fold rise in gold imports. Currency depreciation of the lira is sending investors flocking to gold. India’s gold imports nearly doubled in August to 35.5 tons, up from 14.8 tons a year earlier. The world’s second largest consumer is preparing for the start of key festivals where gold is given in the form of jewelry for gifts.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.09 percent. Gold fell for a second day mid-week as the U.S. dollar rebounded. The equity rally continued amid hopes for a coronavirus vaccine. Gold and silver were down modestly on Friday ahead of the U.S. jobs numbers that were in-line with expectations.

- Due to sanctions and a collapsing oil industry, Venezuela is ramping up mining by moving into protected areas of the Amazon. Bloomberg notes the country already has a thriving illegal gold industry that harms waterways, forest and indigenous communities. According to a study by local non-profit Wataniba, the amount of land used for mining has more than tripled since March 2019.

- Global holdings in ETFs backed by gold had the smallest monthly gain this year in August, raising concern that investors are losing appetite. Bloomberg data shows around 1 million ounces of bullion were added to ETFs, behind the monthly average increase of 3.57 million ounces.

Opportunities

- An artificial intelligence start-up is working to solve the problem of declines in ore grades at mines. British tech company Intellisense.io has software that uses sensors built into the plant to form a model of the grinding process and flag problems before they happen – a valuable feature when a company’s mines produce ore with lower levels of gold. Bloomberg notes that the mining sector has been slower to adopt AI in comparison with other sectors.

- The Dynamic Precious Metals Fund, which beat 82 percent of its peers this year, says gold is a “nice, safe” bet heading into the November presidential election, reports Bloomberg. Portfolio manager Robert Cohen says he manages his gold exposure risk by investing in a range of equities including explorers, producers and developers, rather than “just picking a bunch of producers off by market cap.”

- Hecla Mining increased its quarterly dividend by 50 percent on the heels of higher silver prices. President and CEO Phillips S. Baker, Jr. said the dividend policy reflects “Hecla’s position as the United States’ largest silver producer with mines that have strong operating performance and high silver margins.”

Threats

- World Gold Council (WGC) data shows that central banks’ net purchases of gold fell below 9 tons in July, the lowest since 2018. After two years of strong buying, demand has eased in 2020. Bloomberg notes a slower pace of buying could curtail an important driver of gold’s rally.

- Bank of England policy maker Gertjan Vlieghe said that gold is a terrible predictor of inflation, reports Bloomberg. “If you look at previous episodes where the gold price is very elevated, you realize very quickly that gold is a terrible predictor of inflation.” The former Deutsche Bank bond strategist told lawmakers this week that the record-high price of bullion “tells you nothing.”

- Papua New Guinea is demanding a greater share of its resource wealth, stepping up a battle with companies including Exxon Mobile and Barrick Gold who have operations in the country, reports Bloomberg. Prime Minister Hames Marape told parliament this week of the efforts his administration is taking to increase the state’s share of benefits from the production and export of raw materials. Marape said the state should take a 60 percent to 65 percent share of revenue from future projects, up from 40 percent.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.26 percent. The S&P 500 Stock Index fell 1.65 percent, while the Nasdaq Composite fell 2.69 percent. The Russell 2000 small capitalization index lost 1.87 percent this week.

- The Hang Seng Composite lost 1.95 percent this week; while Taiwan was down 1.25 and the KOSPI rose 1.02 percent.

- The 10-year Treasury bond yield fell 3 basis points to 0.722 percent.

Domestic Equity Market

Strengths

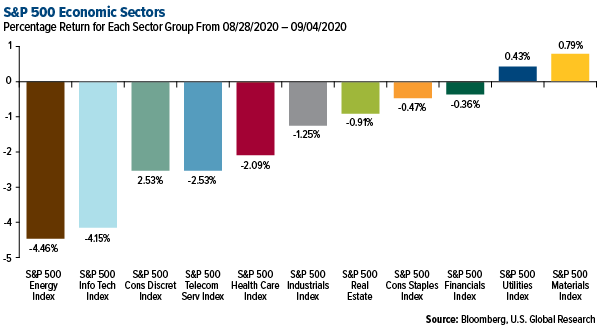

- The materials sector was the best performing sector of the week, increasing by 79 basis points compared to an overall decline of 2.31 percent for the S&P 500.

- PVH Corporation was the best performing S&P 500 stock for the week, increasing 10.8 percent.

- Zoom has had a meteoric rise in the past year — including a 355 percent revenue boost — as the pandemic has turned it into a household name. Zoom is now halfway through its fiscal year, and its first two quarterly reports revealed what analysts described as "historic" growth, as it soared past analyst expectations. The company reported revenue of $663.5 million in its second quarter, much higher than the $500.2 million analysts forecast, thanks to stunning growth during the coronavirus pandemic.

Weaknesses

- The energy sector was the worst performing sector for the week, decreasing by 4.46 percent compared to an overall drop of 2.31 percent for the S&P 500.

- Hollyfrontier Corporation was the worst performing S&P 500 stock for the week, falling 11.58 percent.

- The mega-cap tech shares that drove stocks to a record plunged Thursday as bearish investors reclaimed the upper hand on U.S. equity markets, at least for a day. The Nasdaq 100 sank 5.2 percent and posted its biggest rout since March. Apple, Tesla and Amazon.com, among the biggest contributors to the historic five-month rally, lost at least 4.6 percent. The index had gained in 11 of 13 sessions to notch records almost daily, defying strategists who warned that valuations had become too stretched.

Opportunities

- Warren Buffett’s Berkshire Hathaway has a $7 billion bet on five Japanese stocks. The company recently disclosed that it owns 5 percent of each of Japan’s five biggest trading companies or "sogo shosha": Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo. The positions, which Berkshire built over the past 12 months, were worth a combined $6.9 billion as of Wednesday’s close.

- Dating app Bumble is preparing for an IPO worth between $6 billion and $8 billion. Bumble, the location-based dating and networking app that allows women to make the first move, is prepared to go public as soon as early 2021, according to a Bloomberg report.

- Broadcom Inc., a chipmaker that has branched out into enterprise software, gave a bullish forecast helped by spending on data centers and a predicted rebound in shipments of smartphone components. Revenue in the three months ending November 1 will be $6.4 billion, plus or minus $150 million, the San Jose, California-based company said Thursday in a statement. That compares with an average analyst prediction of $6.19 billion, according to data compiled by Bloomberg.

Threats

- Campbell Soup shares fell as much as 5.8 percent on Thursday, the most since June 3, after the company said supply chain constraints will hinder the company’s “full upside” potential in the first half. Analysts expect continued headwinds in CPB’s soup offerings, given consumer concerns about the elevated sodium content and the canned format.

- Ciena Corp., a key supplier of fiber-optic equipment in large networks, delivered a wakeup call to investors Thursday, falling the most in 19 years after warning that major customers are trimming their tech spending. Shares of Ciena, whose equipment operates at the core of large internet operations like phone companies and data centers, fell as much as 30 percent to $42.25 in their biggest intraday drop since August 2001, when many technology stocks were crumbling. “Some large segments of enterprise businesses are suffering quite badly, especially areas like transport, hospitality, restaurants, etc.,” Chief Executive Officer Gary Smith said in an interview Thursday. “I think it reflects some caution on their part around spending and business initiatives.”

- Shares of hair salon operator and franchiser Regis fell as much as 20 percent after the company’s full-year fiscal 2020 earnings announcement. Regis’ revenue fell roughly 25 percent in fiscal 2020, with earnings plunging deeper into the red, going from a loss of $0.48 per share in fiscal 2019 to a loss of $4.79 in the recently ended year.

The Economy and Bond Market

Strengths

- American manufacturing expanded more than anticipated in August. The Institute for Supply Management’s purchasing managers’ index (PMI) jumped to 56 from 54.2. Economists surveyed by Bloomberg expected a reading of 54.8.

- U.S. investment-grade bonds are continuing their hot streak, adding a record $10.7 billion into retail funds in the week ended September 2. That tops the previous high of $9.91 billion set in early June, according to Refinitiv Lipper.

- The unemployment rate fell to 8.4 percent from 10.2 percent the prior week – significantly better than the expected drop to 9.8 percent.

Weaknesses

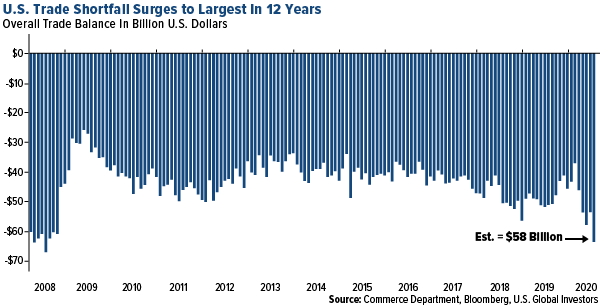

- The trade gap widened to the biggest in 12 years, with the overall deficit in goods and services increasing to $63.6 billion in July from a revised $53.5 billion in June, according to the Commerce Department. Trade volumes are higher than May’s pandemic lows but remain depressed following the initial uptick stemming from reopening measures.

- Texas’s sales-tax revenue totaled $2.82 billion in August, down 5.6 percent from a year earlier, according to Texas Comptroller Glenn Hegar. Motor vehicle sales and rental taxes were down 4 percent, fuel taxes down 12 percent, oil production and natural gas production taxes down 39 percent and 115 percent respectively, hotel-occupancy taxes down 49 percent and alcoholic beverage taxes down 39 percent.

- New applications for unemployment benefits fell sharply last week to a fresh pandemic low, but the entire decline stemmed from a major change in how the data is reported instead of more people finding jobs. The Bureau of Labor Statistics said last week it would alter its adjustment process to make the report more accurate. The level of seasonally adjusted new claims has run notably higher than the real or actual number of people applying for benefits each week.

Opportunities

- The Centers for Disease Control and Prevention (CDC) has asked states to prepare to distribute a potential coronavirus vaccine as soon as late October. CDC Director Robert Redfield also sent a letter asking governors to fast-track permits and licenses so that vaccine distribution sites can be up and running by November 1.

- House Speaker Nancy Pelosi and the Trump administration have informally agreed to keep a stopgap government-wide funding bill — needed to avert a shutdown at the end of this month — free of controversy or conflict. The accord is aimed at keeping any possibility of a government shutdown off the table despite ongoing battles over COVID-19 relief legislation, while sidestepping the potential for other shutdown drama in the run-up to the November election.

- As state and local debt rebounded from a record-setting selloff, banks increased their stakes by nearly $20 billion during the second quarter, according to Municipal Market Analytics, which cited data from the Federal Deposit Insurance Corp. It was the second-biggest quarterly jump since 2013 and marks a shift from the previous two years, when the 2017 tax-cut law spurred banks to reduce their investments in municipal bonds.

Threats

- Senate Majority Leader Mitch McConnell expressed doubts about whether Congress can get a deal on another pandemic relief package when lawmakers return to Washington after a month-long recess, despite the Trump administration’s push for a quick, targeted stimulus. “I don’t know if there will be another package in the next few weeks or not,” McConnell said at an event at a hospital in his home state of Kentucky.

- Chicago faces a 2021 budget deficit of $1.2 billion as the coronavirus pandemic decimates the city’s revenue with businesses shut down due to social distancing while recent unrest hurt reopening efforts. Next year’s projected gap comes on top of a 2020 deficit of nearly $800 million for its corporate fund, which accounts for many of the services the city provides, Chicago Mayor Lori Lightfoot said on Monday.

- Next Tuesday’s release of the NFIB Small Business Optimism index for August will be an important gauge of business sentiment. After recovering through June, the index hit a snag in July. A further drop in the index would be a concerning sign that a deteriorating trend is forming.

Energy and Natural Resources Market

Strengths

- The best performing commodity for the week was coffee, up 6.05 percent. Brazil, the world’s largest producer, is facing adversely dry conditions which may hamper development of the next crop. This year’s coffee inventories are mostly depleted. Years of low prices have forced farmers to move to more lucrative crops. Copper hit a two-year high, topping $6,800 a ton, after strong PMI data was released out of China, the world’s biggest consumer of the red metal. Volumes in LME warehouses fell to the lowest since 2005. Citigroup says a broadly balanced 2020 copper market and a deficit in 2021 would justify a price of $8,000 a ton over the next six to 12 months.

- Mitsubishi Power Americas announced three power plants in New York, Virginia and Ohio designed to replace natural gas with hydrogen produced from renewable sources. The facilities will collectively generate 3,284 megawatts of electricity. At first the plants will run on natural gas, then shift to burning on-site produced green hydrogen.

- BHP Group plans to buy back as much as $1.9 billion of its bonds as iron prices rise, reports Bloomberg. Iron ore rose above $100 a ton, giving BHP more cash reserves. The world’s biggest miner reported annual profit of $9 billion last month.

Weaknesses

- The worst performing commodity for the week was lumber, down 16.31 percent. Lumber has soared with the pandemic curtailing the supply chain when there is strong demand due to low interest rates. Rising lumber prices had recently added as much as $10,000 cost to build a typical home. Homebuilders in East Texas halted construction on new homes to wait out a price drop. Crude oil fell below $40 for the first time in a month on Thursday along with the sell-off in equities. Gas prices heading into Labor Day weekend are on average $2.22 per gallon – the lowest for this time of year in 16 years. Great news for the consumer, but bad news for the industry.

- Nickel led most base metals lower on Thursday, falling from its highest close in 10 months. The 14-day relative strength index (RSI) for nickel futures on the LME closed at 81 on Wednesday, indicating that recent gains may be excessive, according to Bloomberg News.

- Schlumberger, the world’s largest oilfield services company, is selling its U.S. fracking business to rival Liberty Oilfield Services in exchange for a 37 percent stake in the company. A massive decline in demand for its OneStim fracking unit contributed to a 40 percent drop in revenue for the second quarter compared to the first quarter.

Opportunities

- The Bar-Way Farm in Massachusetts teamed up with Vanguard Renewables to install a biodigester, which uses specialized bacteria to concert organic material into a biogas. In this case the organic material is cow poop from dairy cows. Once purified, the biomethane is chemically identical to the main ingredient in fossil-based natural gas that comes out of your stove or heats your water, writes Bloomberg’s Naureen Malik. An innovative way for the gas industry to survive, or a little gross?

- The nuclear industry is also adapting to survive. Companies globally are developing a new generation of reactors that are 90 percent smaller than massive facilities that have dominated the industry. These new plants are designed to be faster and easier to build and could make nuclear affordable and cleaner in developing nations that don’t need huge reactors, writes Bloomberg’s Will Wade.

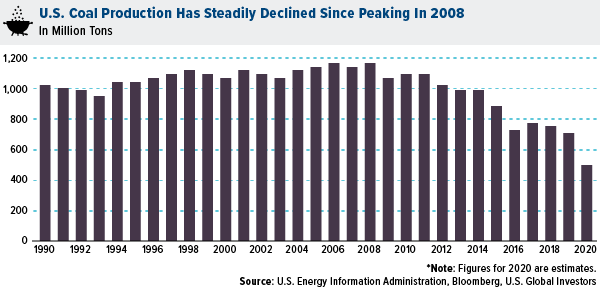

- American coal production is expected to be down 31 percent in 2020 from 2016 levels. A key promise of President Trump’s campaign was to revive the coal industry, but the opposite seems to have occurred. Since inauguration, 65 coal-fired power plants have been retired and 72 more plants have announced plans to do so, according to the Sierra Club and as reported by Bloomberg. As seen in the chart below, coal has steadily declined since peaking in 2008, but did increase marginally in 2017. This will be the first year that renewable energy exceeds the amount of power supplied by coal.

Threats

- Papua New Guinea is demanding a greater share of its resource wealth, stepping up a battle with companies including Exxon Mobile and Barrick Gold who have operations in the country, reports Bloomberg. Prime Minister Hames Marape told parliament this week of the efforts his administration is taking to increase the state’s share of benefits from the production and export of raw materials. Marape said the state should take a 60 percent to 65 percent share of revenue from future projects, up from 40 percent.

- Is gold appetite shrinking? World Gold Council (WGC) data shows that central banks’ net purchases of gold fell below 9 tons in July, the lowest since 2018. After two years of strong buying, demand has eased in 2020. Global holdings in ETFs backed by gold had the smallest monthly gain this year in August, raising concern that investors are losing appetite. Bloomberg data shows around 1 million ounces of bullion were added to ETFs, behind the monthly average increase of 3.57 million ounces.

- California is trying to avert more blackouts by asking residents to turn down their air conditioners ahead of the holiday weekend heat. Bloomberg reports electricity for deliver Friday in Southern California jumped by the most on record ahead of a heat wave that could further tax the power grid. During a heat wave a few weeks ago, the grid buckled, and natural gas and wind resources went offline.

Emerging Europe

Strengths

- Romania was the best performing country this week, gaining 1.6 percent. Economists predict that the country’s revenue will contract this year only 4.7 percent and GDP will fully recover to a pre-pandemic level next year. OMV Petrom, an oil and gas producer, was the best performing equity trading on the Bucharest Stock Exchange, gaining 6.8 percent over the past five days.

- The Romanian leu was the best relative performing currency this week, losing 84 basis points. All emerging European currencies depreciated as the dollar gained ground over the past five days. On a relative basis, the leu outperformed its peers.

- Materials was the best performing sector among eastern European markets this week.

Weaknesses

- Poland was the worst performing country this week, losing 3.2 percent. Poland banned flights to 44 destinations as the country is experiencing a spike in new coronavirus infections. The Polish government wants to focus on local and regional restrictions, avoiding full lockdown. Tauron Polska Energia SA, a utility company, was the worst performing equity trading on the Warsaw Stock Exchange, losing 20 percent over the past five days on concerns that the government may ask Polish utilities to help rescue unprofitable coal miners.

- The Hungarian forint was the worst performing currency in the region this week, losing 2.1 percent. Hungary reported a daily record of 459 coronavirus infections, with mostly new cases affecting younger people. The average age of those who have contracted the virus so far in the fall is 26, compared with 67 in the spring during the pandemic’s first wave.

- Information technology was the worst performing sector among eastern European markets this week.

Opportunities

- Eurozone manufacturing activity remained on a recovery path last month, a survey showed on Tuesday. The final IHS Markit Eurozone Manufacturing PMI was reported unchanged at 51.7 in August. It remains above the 50 level that separates growth from contraction.

- A majority of economists predict that the ECB will leave its policy rates unchanged next Thursday but increase the bond-buying program another EUR 350 billion and extend the program by six months. More stimulus from the bank may follow amid a faltering recovery and the rise in coronavirus infections.

- France reported details of its EUR100 billion stimulus plan to erase the economic impact of the coronavirus crisis over the next two years. It is worth approximately 4 percent of GDP, which French officials say is the largest of any big European countries measured against national output. The stimulus will focus on public investment, subsidies and tax cuts.

Threats

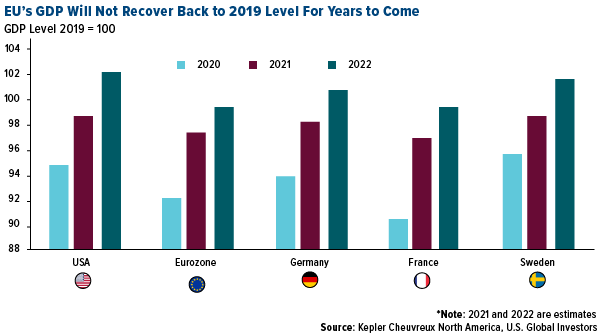

- According to Kepler Cheuvreux, the eurozone GDP will recover slowly with euro-block revenue not bouncing back to its 2019 level for years to come. The speed of recovery will much depend on the launch of vaccines, which forecasters expect within a year. Europe may experience a second wave of lockdowns after schools opened their doors to all students in September.

- The FT reported that the euro’s rise is worrying top policymakers at the ECB, who warn that if the currency keeps appreciating it will weigh on exports, drag down prices and intensify pressure for more monetary stimulus. Several members of the Governing Council told the FT the euro’s rise risks holding back the eurozone’s recovery.

- Germany said that tests show that Russian opposition leader Alexey Navalny was poisoned by novichok nerve agent, the same poison that was used in the March 2018 attempted murder of former Russian spy Sergei Skripal and his daughter in the United Kingdom. Russian currency sold off, as the threat of sanctions is coming back.

China Region

Strengths

- Vietnam was the best performing country this week, gaining 2.6 percent. The government announced that the nation’s economic growth will likely accelerate to 6.7 percent next year after an estimated expansion of 2 to 3 percent this year. Prime Minister Nguyen Xuan Phuc said that the economy remained stable so far, with monetary policy having done its part. Vietnam Electronic Equipment was the best performing equity among stocks trading in the VanEck Vietnam ETF (VNM), gaining 15.6 percent over the past five days.

- The Pakistani rupee was the best performing currency this week, gaining 2.7 percent. The currency strengthened, supported by remittances from about 9 million Pakistanis living abroad. Remittances from overseas Pakistanis reached $2,768 million in July 2020, the highest ever in one month in the history of Pakistan.

- Material stocks were the best performers among those trading on the Hong Kong Stock Exchange.

Weaknesses

- Hong Kong was the worst performing market this week, losing 2.9 percent. Hong Kong’s private sector economy contracted at a faster pace in August led by sharper declines in output and new orders amid increasingly stringent social distancing restrictions. Manufacturing PMI fell to 44 from 44.5 in July. A level below 50 indicates a decline in private sector business activities. Budweiser Brewing was the worst performing equity among stocks trading in the iShares MSCI Hong Kong ETF (EWH), losing 5.6 percent over the past five days.

- The Indonesian rupee was the worst performing currency this week, losing 3 basis points. The currency weakened in expectation that the Bank of Indonesia may cut rates in September due to a continued downtrend in inflation and a weakening dol lar.

- Telecommunication stocks were the worst performers among those trading on the Hong Kong Stock Exchange.

Opportunites

- China’s manufacturing sector grew in August at the fastest pace in nearly a decade. The Caixin manufacturing PMI came in at 53.1, up from 52.8 in July and above expectations for a decline to 52.7. IHS Markit said in its report that the sub-indices for output and total new orders hit their highest level since January 2011.

- Bloomberg reports China is planning a set of new government policies in the next five-year economic blueprint to develop its domestic semiconductor industry. These policies will directly counter Trump administration restrictions.

- Hong Kong’s stock market is embracing “new economy” sector companies such as Alibaba, Xiaomi and Meituan. Since launching a reform of the listing system in 2018, several large Chinese companies have returned to Hong Kong for relisting. The Hang Seng index series will be rebalanced on September 7.

Threats

- Bloomberg Economics estimates China’s potential growth rate could fall to 3.5 percent in 2030 if it decouples with the U.S. – down from the current forecast of 4.5 percent that assumes relations remain broadly unchanged. Decoupling – ending the flow of trade and technology – would have a much bigger impact on China than it would the U.S.

- Chinese consumer demand is uneven. Demand has recovered in the luxury category, such as handbags, cosmetics and cars, but has not extended into mass consumption in areas such as sporting goods, beer and restaurants.

- India’s Supreme Court ruled this week to restrain banks from declaring loans as non-performing assets, potentially delaying disclosure of bad debt in the economy that contract the most on record in the second quarter. Bloomberg reports that the central banks had earlier allowed banks to excuse cash-strapped borrowers from paying such installments and let lenders collect interest for the time the repayment was due.

Blockchain and Digital Currencies

Strengths

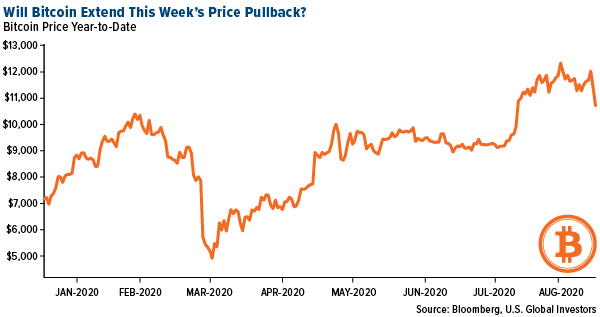

- Of the cryptocurrencies tracked by CoinMarketCap, the best performing for the week ended September 4 was yffi finance, up 1,524 percent. Bitcoin dropped slightly this week after reaching the $12,000 threshold – investors are watching closely for its next moves.

- Bitcoin miners saw a 23 percent increase in revenue in August, according to CoinDesk. The increase was driven by higher network fees from increased on-chain transaction volume as bitcoin avoided a daily close under $11,000 through the entire month.

- On Friday morning BitMEX announced plans to introduce futures markets for two cryptocurrencies, writes CoinDesk, the first new coins to appear on the exchange in over two years. The new futures markets are for chainlink (LINK) and tezos (XTZ), two cryptocurrencies with triple-digit, year-to-date returns.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week ended September 4 was TRXBEAR, down 86.86 percent.

- The Seoul Newspaper reported Wednesday that South Korean authorities have reportedly seized Bithumb, one of the country’s biggest cryptocurrency exchanges by trading volume. According to the article on CoinDesk, the police action was supposedly linked to a $25 million token sale hosted on Bithumb and a proposed acquisition by a Singapore platform, BTHMB, that never materialized.

- Bitcoin posted its largest one-day decline in about a month, writes Bloomberg, just a day after reaching $12,000. The popular digital currency fell as much as 6.9 percent on Wednesday before recouping some of the losses. “After another failed attempt of breaking free from the $12,000 level, bitcoin is starting to lose some momentum,” said Edward Moya, senior market analyst at Oanda.

Opportunities

- The Swiss canton of Zug is making it easier to imagine a world in which cryptocurrency users are resolutely in the mainstream, writes CoinTelegraph. The canton is known for its positive stance toward cryptocurrencies (earning itself the moniker of “Crypto Valley”) and will begin allowing citizens to pay taxes in bitcoin and Ethereum.

- In its September crypto outlook newsletter, Bloomberg’s analyst Mike McGlone says that the price of bitcoin could either be heading to the $500,000 mark, or it could fail. McGlone also says that bitcoin is set to become the “digital gold.” As reported by CoinTelegraph, the newsletter goes on to emphasize how bitcoin’s limited supply and increasing demand are key adoption indicators.

- The Ministry of Foreign Affairs of Denmark has released a report analyzing the use of blockchain in the fight against corruption, writes CoinTelegraph. The report details the use of IT technologies and services that include blockchain, e-governance, big data and crowdsourcing to fight administrative, or day-to-day, corruption as well as political corruption.

Threats

- Bad things might happen to you in Russia if you support bitcoin and don’t like Putin, writes CoinTelegraph. Apparently unknown assailants have attacked multiple pro-bitcoin politicians in recent weeks. As the article explains “more likely, they are being silenced because they are political activists who oppose the Russian government, and fears over having their donations seized have led to their acceptance of cryptocurrency as a side effect.”

- According to Andrew Bailey, Bank of England’s governor, crypto assets are just “unsuited to the world of payments.” In prepared remarks during a virtual conference hosted by the Brooks Institute, Bailey qualified bitcoin as an asset that has “no connection at all to money,” reports CoinTelegraph.

- “The tech cold war is here – and the U.S. isn’t winning,” wrote Ripple co-founder Chris Larsen in an opinion piece for The Hill. As the tech standoff heats up, writes CoinTelegraph, China launching a CBDC before the U.S. “absolutely does not guarantee global financial preeminence.”

Airline Sector

Strengths

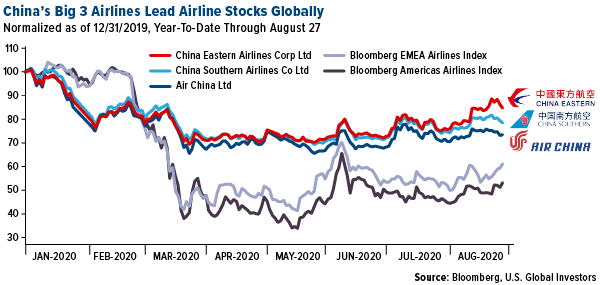

- China’s domestic air travel industry has made a speedy recovery from pandemic-hit demand. Ticket bookings for the last week of August hit 98 percent of last year’s levels, according to travel analytics company ForwardKeys. The firm also predicts that China’s travel demand will fully recover in September. The big three domestic airlines – Air China, China Eastern Airlines and China Southern Airlines – have outperformed airlines globally. China was also the first hit with the virus and the virus to ease restrictions.

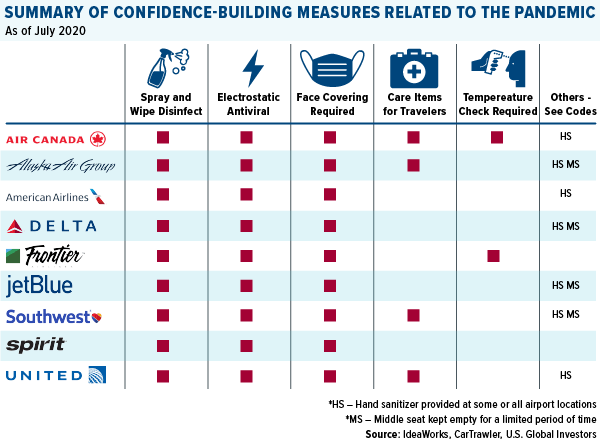

- The Trump administration gave emergency approval for American Airlines to deploy a surface coating that kills coronavirus for up to seven days. The EPA issued the emergency declaration for use in some planes and airport facilities, reports Bloomberg. This is a strong positive step forward for ensuring the safety of travelers. The administration is also looking at executive actions to help airlines avoid employee furloughs if Congress fails to provide financial assistance in a new round of stimulus. Several airlines have warned they will cut significant numbers of employees after restrictions on federal aid ends.

- Wizz Air, Europe’s third-biggest budget airline, said it will continue adding planes to its fleet. European budget carriers have emerged as the winners from weak travel demand for two key reasons: 1) they had significantly higher cash reserves compared to network carriers before the pandemic and 2) they rely on short-haul services that are expected to recover before long-haul travel. Wizz Air plans to expand its presence at London’s Gatwick airport from just one plane to 20 if it can secure takeoff and landing slots, reports Bloomberg.

Weaknesses

- Times are so tough for Qantas Airways that the carrier is selling its in-flight biscuit and tea bags to consumers at home. Bloomberg reports Qantas is selling its in-flight complimentary items online such as its signature biscuits, sleeper suits and smoked almonds. The packs, selling for $18 apiece, sold out within hours. Qantas announced 6,000 job cuts and plans to raise A$1.9 billion to weather the pandemic.

- Aviation industry job cuts continue globally. The latest example is Finnair Oyj, Finland’s national carrier, who plans to eliminate as much as 15 percent of its workforce. The carrier said in a statement that it will lay off practically all its personnel in Finland.

- Jet-engine maker Rolls-Royce reported its biggest-ever loss and shares fell as much as 10 percent August 27 on the news. The company plans to raise $2.6 billion in cash from disposals. Rolls-Royce said it lost 5.4 billion pounds in the first half of 2020 and said cash will flow out for at least another year. The company is one of many manufacturers suffering big losses from reduced aircraft demand.

Opportunities

- Boeing announced its first 737 MAX deal of 2020. Poland’s largest charter carrier Enter Air added an option to take two additional aircraft, which if exercised would bring its MAX fleet to 10, reports Bloomberg. This is a rare positive story for Boeing as the manufacturer copes with both coronavirus-induced demand collapse and mechanical issues with the 737 that has left it grounded for a year.

- Indonesia’s largest airport operator, PT Angkasa Pura II, is moving ahead with the construction of a new goods-handling facility in Jakarta, predicting that cargo will rise to 1 million tons a year within the next three years. The group is betting that cargo traffic at Jakarta’s Soekarno-Hatta airport will rise significantly from current levels around 600,000 tons annually.

- Virgin Atlantic Airways announced its first new routes since the beginning of the pandemic. The recently rescued carrier controlled by Richard Branson will begin serving Pakistan for the first time after bans on the country’s flag carrier created a void in the market, reports Bloomberg. The first commercial flight from Israel to the United Arab Emirates (UEA) took place, after crossing through Saudi Arabian airspace that is normally restricted to Israeli air traffic. The UAE is the third Arab country to recognize Israel and opens new routes for commercial flights.

Threats

- American Airlines said it will cut 19,000 workers when the federal payroll aid expires, capping a 30 percent workforce reduction since the pandemic began. United warned it may have to furlough 2,850 pilots if no extension to its federal aid is granted. Delta warned of 1,941 furloughed pilots. These are just a few examples of carriers warning of the consequences of a lack of more federal aid to stem decimated air travel demand losses.

- Singapore Airlines spent half of the $6.4 billion it raised through sale shares in just two months – a stark warning that airlines are still burning cash rapidly amid weakened travel demand. The company said in a statement that the proceeds have been used for operating expenses, maturing fuel-hedging trades and ticket refunds from canceled flights.

- Aviation Week Network said in a video conference that deliveries of commercial aircraft over the next decade will be 30 percent lower than previously forecast. The group sees around 16,000 jets delivered between 2021 and 2030 as the pandemic shattered air travel demand and a slow recovery is expected. This could be a long-term problem for aircraft and part manufacturers such as Boeing and Airbus.

Leaders and Laggards

| Index | Close | Weekly Change($) |

Weekly Change(%) |

|---|---|---|---|

| 10-Yr Treasury Bond | 0.72 | -0.03 | -4.12% |

| Oil Futures | 39.56 | -3.48 | -8.09% |

| Hang Seng Composite Index | 3,852.89 | -76.72 | -1.95% |

| S&P Basic Materials | 404.85 | +7.57 | +1.91% |

| Korean KOSPI Index | 2,368.25 | +23.80 | +1.02% |

| S&P Energy | 260.32 | -7.20 | -2.69% |

| Nasdaq | 11,313.14 | -312.21 | -2.69% |

| DJIA | 28,133.31 | -358.96 | -1.26% |

| Russell 2000 | 1,535.30 | -29.26 | -1.87% |

| S&P 500 | 3,426.96 | -57.59 | -1.65% |

| Gold Futures | 1,938.80 | +6.20 | +0.32% |

| XAU | 149.58 | +2.09 | +1.42% |

| S&P/TSX VENTURE COMP IDX | 733.69 | +1.73 | +0.24% |

| S&P/TSX Global Gold Index | 372.52 | +0.75 | +0.20% |

| Natural Gas Futures | 2.57 | -0.01 | -0.31% |

| Index | Close | Monthly Change($) |

Monthly Change(%) |

|---|---|---|---|

| Korean KOSPI Index | 2,368.25 | +56.39 | +2.44% |

| 10-Yr Treasury Bond | 0.72 | +0.17 | +31.51% |

| Gold Futures | 1,938.80 | -110.50 | -5.39% |

| S&P Basic Materials | 404.85 | +16.63 | +4.28% |

| S&P 500 | 3,426.96 | +99.19 | +2.98% |

| DJIA | 28,133.31 | +931.79 | +3.43% |

| Nasdaq | 11,313.14 | +314.74 | +2.86% |

| Oil Futures | 39.56 | -2.63 | -6.23% |

| Hang Seng Composite Index | 3,852.89 | +9.53 | +0.25% |

| S&P/TSX Global Gold Index | 372.52 | -34.42 | -8.46% |

| XAU | 149.58 | -11.56 | -7.17% |

| Russell 2000 | 1,535.30 | -10.93 | -0.71% |

| S&P Energy | 260.32 | -22.14 | -7.84% |

| S&P/TSX VENTURE COMP IDX | 733.69 | -13.39 | -1.79% |

| Natural Gas Futures | 2.57 | +0.38 | +17.34% |

| Index | Close | Quarterly Change($) |

Quarterly Change(%) |

|---|---|---|---|

| XAU | 149.58 | +33.13 | +28.45% |

| S&P/TSX Global Gold Index | 372.52 | +62.65 | +20.22% |

| Gold Futures | 1,938.80 | +192.40 | +11.02% |

| DJIA | 28,133.31 | +1,851.49 | +7.04% |

| S&P 500 | 3,426.96 | +314.61 | +10.11% |

| Nasdaq | 11,313.14 | +1,697.32 | +17.65% |

| Korean KOSPI Index | 2,368.25 | +217.07 | +10.09% |

| Natural Gas Futures | 2.57 | +0.75 | +41.11% |

| S&P Basic Materials | 404.85 | +38.97 | +10.65% |

| Russell 2000 | 1,535.30 | +83.24 | +5.73% |

| Oil Futures | 39.56 | +2.15 | +5.75% |

| Hang Seng Composite Index | 3,852.89 | +323.02 | +9.15% |

| S&P/TSX VENTURE COMP IDX | 733.69 | +171.28 | +30.45% |

| S&P Energy | 260.32 | -52.85 | -16.88% |

| 10-Yr Treasury Bond | 0.72 | -0.10 | -12.48% |

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2020):

BHP Group Ltd

Schlumberger Ltd

Barrick Gold Corp

Impala Platinum Holdings Ltd

China Southern Airlines Co Ltd

Air China Ltd

Air Canada

Alaska Air Group Inc

American Airlines Group Inc

Delta Air Lines Inc

JetBlue Airways Corp

Southwest Airlines Co

United Airlines Holdings Inc

Wizz Air Holdings Plc

Qantas Airways Ltd

Singapore Airlines Ltd

OMV Petrom

Desert Mountain Energy Corp

Amazon.com Inc

Alphabet Inc

Broadcom Inc

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges. The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The relative strength index (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset..