Hard Truths in Resource Investing, According to Bob Moriarty

The day you start thinking you are smarter than the market, you have made a giant mistake that will cost you dearly.

"The day you start thinking you are smarter than the market, you have made a giant mistake that will cost you dearly.”

"The day you start thinking you are smarter than the market, you have made a giant mistake that will cost you dearly.”

“All debts get paid… They are paid either by the borrower or by the lender.”

“The mob is always wrong. All you have to do is figure out what they think and then do the opposite.”

“Listening to liars gets very expensive.”

I could keep going, but these are just some of the kernels of wisdom and hard truths I came across while reading Robert Moriarty’s latest book, Basic Investing in Resource Stocks: The Idiot’s Guide. I’ve known Bob for many years, and if there’s one thing he’s proven about himself time and again is that he doesn’t mince words.

Nor should he. Bob’s accomplished far too much in his life to worry about tiptoeing around the truth. Many people reading this right now probably know Bob best from his highly popular resource websites 321Gold and 321Energy. 321Gold, I should point out, has done a lot over the years to bring U.S. Global Investors to people’s attention, and I’m grateful to Bob for that.

Besides extreme contrarian resource investing, Bob also has a place in the history books as an aviator. Not only was he the youngest naval combat pilot, at 20 years old, during the Vietnam War, but he still holds the time record for flying from Paris to New York and back again, in 1981. Three years after that, he famously flew his Beechcraft Bonanza V35 under the Eiffel Tower.

But back to the book.

Beware of False Prophets

Perhaps what I admire most about Basic Investing is how refreshingly open it is. Again, Bob doesn’t mince words, and he’s more than willing to share what he describes as his own past errors so that readers might learn from them. (To be perfectly honest, though, the longer anyone spends in the capital markets, the more likely it is that he or she will make a bad bet or 10. No one gets it right all of the time.)

Just as he does in his 2016 bestseller Nobody Knows Anything, he makes the case that you should be skeptical of anything the “experts” and “gurus” tell you. Otherwise, you could get seriously burned. In Bob’s experience, that’s amounted to placing too much trust in a junior resource company’s management team, some of whom go on to squander the money they raised.

“If you find a company with a story so compelling, so bulletproof that it simply cannot fail, rest assured that the village idiot is right around the corner looking for a job,” he colorfully writes. “When you believe [the company] would work even if someone spent 24 hours a day, seven days a week trying to screw it up, you will find that the village idiot ends up running the company and puts in a lot of overtime.”

No Alternative to Gold and Precious Metals

Despite the risk of having to deal with the occasional ineffective or destructive CEO, Bob says, “investing in resource shares may be the only logical investment for those looking to hedge other potentially more dangerous alternatives.”

Despite the risk of having to deal with the occasional ineffective or destructive CEO, Bob says, “investing in resource shares may be the only logical investment for those looking to hedge other potentially more dangerous alternatives.”

Government, corporate and household debt are all at record highs, and the “Yellow Vest” revolution in France threatens to spill over into the rest of the world. The coming financial meltdown could make 2007-2008 look like a dress rehearsal, and Bob sees gold “as a solution to our continuing financial chaos. It worked for much of history and nothing says it won’t work again.”

“If you don’t own some gold (or silver or platinum or palladium or rhodium) that you can lay your hands on, you may regret it. Precious metals are the most secure insurance policy that you can buy to protect your financial house, even as it begins to burn down.”

Trading Metals and Resource Stocks 101

Bob’s book is rich with practical advice on trading precious metals and resource stocks. Timing is key on both sides of the trade, and Bob uses a number of tools to help him make as large a profit as he can. Obviously you want to buy low and sell high, but sometimes that’s easier said than done. That’s where metal price ratios come in.

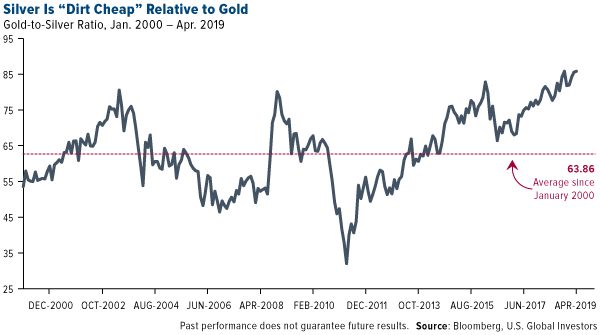

In the chart below is the gold-to-silver ratio. What it shows is the number of ounces of silver it takes to buy one ounce of gold. Since January 2000, the average has been about 64. But in the past few months, it’s spiked up to an incredible 85 or 86—meaning silver is “dirt cheap” relative to gold. Buying silver at this time, then, might make a lot of sense if you believe silver prices will soon go up or gold prices will go down.

“All commodities deviate from the mean at times, and always regress to the mean,” Bob writes. “Prices naturally go up and naturally go down, but they always go back to the mean eventually.”

Chapter 14 of Basic Investing includes a helpful list of other tools and websites Bob uses on a regular basis to track commodity prices and trends, and to time his trades.

Hard truths, practical guidance, invaluable insight. It’s all there in Bob’s book, which, I should add, is also a delightful, often humorous read. Order your copy today!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. Mean reversion is a theory used in finance that suggests that asset prices and historical returns eventually return back to the long-run mean or average level of the entire data set.