Gold Smashes Through $3,000 as Recession Fears Mount

I just returned from the Cantor Global Technology Conference in New York, where I had the opportunity to speak with a prominent hedge fund manager. He revealed that his fund is leveraged 8:1, meaning even a small 3-5% decline in stocks, currencies or commodities can trigger automatic liquidations. This kind of extreme positioning is one reason why market swings can snowball so quickly.

What struck me most in our conversation was the broader sentiment in capital markets—loyalty and long-term relationships seem to be taking a backseat to short-term transactional thinking.

Nowhere is this more evident than in the ongoing tariff battle between the U.S. and Canada. The two countries have long been strong allies, fighting wars together and maintaining a mutually beneficial trade partnership. Yet the latest round of tariffs by the current administration treats Canada more like China, sending an unsettling message to global markets.

If economic alliances are seen as fleeting, investors may begin to reassess their confidence in long-term stability.

Indeed, investors are scrambling to make sense of the on-again, off-again nature of President Donald Trump’s tariffs, the Federal Reserve’s next moves and the broader geopolitical uncertainty gripping the world.

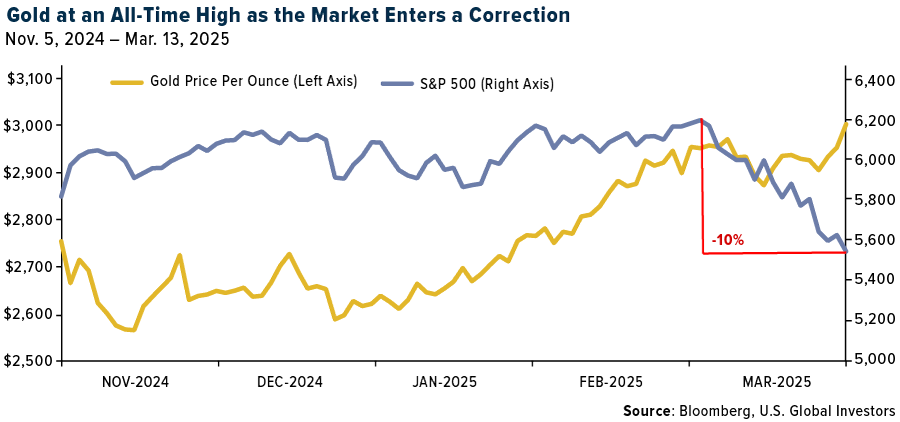

The S&P 500 has entered its first correction since October 2023, dropping 10% from its recent high. Meanwhile, gold prices have surged to record levels, topping $3,000 per ounce for the first time ever.

The headlines scream “Recession!” one day and “Strong labor market!” the next. With so much noise, how should investors respond?

Tariffs, Uncertainty and Mixed Economic Signals

Trade policy uncertainty is one of the biggest forces driving markets right now. One day, Trump imposes new tariffs on Canada, Mexico and China, sending markets lower. The next day, he scales them back.

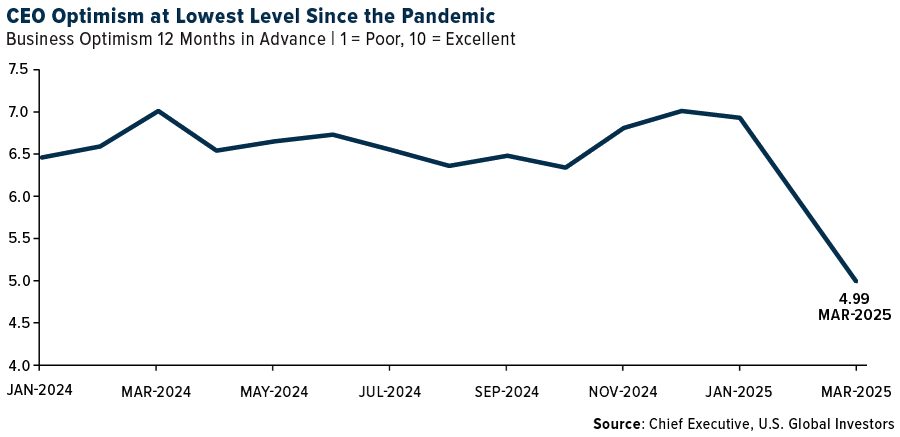

This kind of back-and-forth makes it difficult for businesses to plan, as a recent CEO survey suggests. Looking ahead 12 months in the future, CEOs’ business optimism fell to 4.99 this month, a 28% decline from January and the lowest recorded level since the spring of 2020, when the pandemic shut down the global economy.

It’s not just tariffs, though. Recent economic data has been all over the map. Consumer confidence sank this month to the lowest level since November 2022, according to University of Michigan data. Retail sales slowed in February, construction spending dipped and manufacturing activity declined. Yet the labor market remains strong, with historically low unemployment and rising wages.

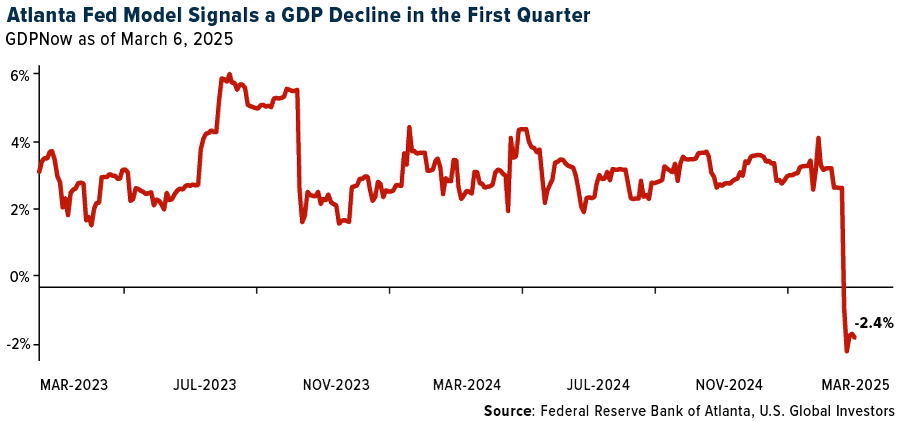

Some economists are convinced a recession is around the corner. The Atlanta Fed’s GDPNow model, for instance, forecasts that the U.S. economy will shrink by 2.4% in the first quarter.

Meanwhile, PIMCO sees a 35% chance of a U.S. recession in 2025, up from just 15% last December.

JPMorgan puts the odds at 40%, warning that Trump’s trade policies could damage America’s standing as a global investment destination.

On the other hand, some analysts argue that fears of a downturn are overblown. For instance, FactSet reports that fewer S&P 500 companies mentioned “recession” in their latest earnings calls than at any time since early 2018.

Confused yet?

The Smart Investor Cuts Through the Noise

When faced with mixed messages, it’s easy to get caught up in short-term market swings. But history teaches us that corrections are a normal part of investing. Markets don’t move in a straight line, and downturns often present buying opportunities for those who stay level-headed.

Take a look at hedge funds. Some of the recent market weakness may not even be about the economy but rather the actions of quant-driven hedge funds. According to JPMorgan strategist Nikolaus Panigirtzoglou, equity quant and telecommunications sector hedge funds aggressively cut their equity exposure in February, driving selling pressure in the market. That’s not a fundamental problem—it’s a technical one. Markets can swing in the short term for all kinds of reasons that have nothing to do with the real economy.

And let’s not forget the Fed. Inflation may still be a concern, but many investors expect the central bank to cut rates later this year. Historically, rate cuts are good for stocks and great for gold.

Why I Believe Gold Belongs in Your Portfolio

At times like this, I always return to one of my core investing principles: the 10% Golden Rule. I recommend investors keep 10% of their portfolio in gold—5% in physical gold (bars, coins, jewelry) and 5% in high-quality gold mining stocks or ETFs. I’ve found that this strategy has provided both stability and upside potential in volatile markets.

Gold’s been on a tear, hitting record highs. Why? Because it thrives in uncertainty. When investors don’t know what to believe—when markets correct, inflation worries persist and geopolitical risks escalate—gold has tended to shine. Central banks around the world are snapping up gold at an unprecedented pace, a clear sign that major institutions see it as a store of value amid economic turbulence.

Gold mining stocks, meanwhile, offer leverage to gold prices, as I told Fox Business’s Liz Claman this week. While the metal itself has climbed, many gold miners remain undervalued compared to historical trends. I believe this presents an attractive opportunity for investors looking to gain exposure to gold’s upside.

Stick to Your Long-Term Goals

If you’ve been in the markets long enough, you know that corrections come and go. The S&P 500 has experienced dozens of them over the years, and yet it continues to hit new highs over time. Panicking and making emotional investment decisions is one of the biggest mistakes an investor can make.

The same applies to gold. If you don’t already have an allocation, I believe now is a good time to start building one. Stay the course and consider using market dips to add to your position.

As investors, our job is not to predict the next move in the market—it’s to build a resilient portfolio that can weather any storm. That means cutting through the noise, focusing on long-term trends and making sure you have exposure to real assets like gold that have a history of providing a hedge against uncertainty.

Interested in learning more about our funds that invest in the precious metals space? Email “GOLD” to info@usfunds.com to request more information.

Happy investing!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 3.07%. The S&P 500 Stock Index fell 2.34%, while the Nasdaq Composite fell 2.43%. The Russell 2000 small capitalization index lost 1.78% this week.

- The Hang Seng Composite lost 21% this week; while Taiwan was down 2.69% and the KOSPI rose 0.11%.

- The 10-year Treasury bond yield rose 1 basis point to 4.317%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Southwest Airlines, up 8.6%. According to RBC, Boeing reported 44 aircraft deliveries in February, up 63% year-over-year. Across the 44 deliveries, Boeing reported 31 MAX deliveries, one 737NG, five 787s, five 767s, and two 777s.

- Ship ordering activity in the first two months of 2025 is only about one-third of that level six months ago, Stifel reports. So far in 2025, only $13.8 billion in ships have been ordered, which is the lowest two months of orders since the end of 2021 despite prices 23% higher now.

- Southwest Airlines announced several changes, including amending the Chase co-brand agreement, doubling the program cost to $1 billion by 2027. They’ve cut corporate overhead by 15%, optimized airport space and ground operations, and stopped fuel hedging. New changes include bag fees (with two free bags for Cardmembers), dynamic loyalty redemption rates, and a new basic economy fare. These moves will add $800M EBIT in 2025 and $1.7B EBIT in 2026, with ROIC exceeding WACC in 2025 and reaching 15% in 2026. The remaining 1.5B share buyback will be completed by Q2 2025.

Weaknesses

- The worst performing airline stock for the week was American Airlines, down 16.6%. February’s headline and core CPIs were encouraging – both up just 0.2% month-over-month – lighter than the expected 0.3% gain for both. Markets quickly realized it was mainly due to one component – airlines plunged 4.0% month-over-month.

- According to JPMorgan, industry experts anticipate that the reopening of the Suez Canal may be delayed at least until October 2025, rather than the previously expected first half of the year. Concurrently, U.S. trade dynamics remain uncertain, with tariffs and investigations into China’s maritime activities potentially exacerbating supply chain challenges.

- Delta Air Lines indicated that revenue is now expected to be up 3-4% year-over-year versus up 7-9% prior, and operating margins were revised to 4-5% from 6-8% prior, which is driving earnings per share (EPS) expectations to now be $0.30-0.50 from $0.70-1.00 prior.

Opportunities

- Ryanair announced that the EU ownership of the company’s ordinary share capital has now surpassed 50%. As a result, the restriction preventing non-EU investors from buying ordinary shares has been lifted, according to Goldman.

- In an interview, DHL Express CEO John Pearson says that if Trump’s executive order, known as the de minimis rule, were to come back, the company would hire about 200 people, not necessarily in U.S. gateways, but maybe in Malaysia. However, he notes that if Trump reinstates a version of the order but lowers the threshold, e-commerce companies that sell cheaper products would not be impacted.

- United Airlines triggered its proprietary D3030 trading analysis, shedding 30% of its value in fewer than 30 trading days, reports JP Morgan. Since the early ’90s there have been 29 such occurrences (ex-Covid), each of which was then followed by potential gains over the next 180 trading days. Afterward, there is a 71% probability of a minimum 50% potential return, with an average bounce of 103%. Not once have fundamentals justified this level of drop.

Threats

- According to UBS, 80% expect airlines to restock parts over the next 7-8 months while 25% anticipate that airlines will postpone maintenance within the next year, down from 31% in January 2024.

- MOL’s acquisition of the LBC tank terminals business looks mixed, explains Bank of America. While there are clear growth opportunities and synergies with MOL’s chemical tanker operations, the acquisition price appears expensive at 30x EV/EBIT. And while the deal will involve no equity issuance or use of treasury shares, they see the acquisition somewhat dampening the potential for large shareholder return surprises in the near term.

- Capacity cuts are occurring. Allegiant cut 190/180 basis points (bps) out of April/May schedules in the past week and Frontier trimmed May/June/July growth by 100/170/130 bps. U.S.-Canada transborder capacity continues to come down with Air Canada cutting 160/300bps out of the May/June schedules and WestJet cutting 420bps from April.

Luxury Goods and International Markets

Strengths

- German industrial production rose by 2.0% in January 2025, driven by a 6.4% increase in car output, suggesting a potential recovery despite concerns over U.S. trade tariffs.

- The monthly and annual CPI in the United States, one of the leading luxury markets worldwide, was reported to be lower than expected. Monthly inflation for February was reported at 0.2% versus expected 0.3%, and year-over-year was reported at 2.8% versus 2.9% expected. These numbers are a relief for the U.S. economy in the middle of a stressful economic environment that the country is facing with the trade wars and with tariffs that the government has initiated.

- Salvatore Ferragamo, a luxury retail footwear company, was the top-performing stock in the S&P Global Luxury Index this week, with an 8.78% increase over the past five days.

Weaknesses

- According to recent reports, Porsche SE, which is Volkswagen’s largest shareholder, expects to write down between 7 billion to 20 billion euros ($20.98 billion) on its investment in Volkswagen. Additionally, Porsche SE anticipates a charge between 1 billion and 3.4 billion euros related to its stake in Porsche AG, the sports car manufacturer.

- Selvatore Ferragamo reported a net loss of 68 million euros in 2024, a significant decline from a profit of 26 million euros the previous year. The slowdown was mostly attributed to weak demand in Asian markets.

- RH, a home furnishing product company, was the worst-performing stock in the S&P Global Luxury Index, falling by 14.36%. RH traces back to a long-term support zone dating back to 2022 ($216). The company is facing an investigation due to investor allegations that the company is not sharing its actual current financial situation.

Opportunities

- Sephora CEO Guillermo Motte has personally assumed control of its operations in China. This change seeks to gain the trust of consumers in the world’s second-largest economy. The leadership changes aim to revive sales and increase market share, helping to achieve the 2025 global revenue target of $17.5 trillion.

- According to Reuters, BMW, one of the leading carmakers worldwide, announced it intends to absorb the added cost of new tariffs on its imports from Mexico until May 1. The company is looking to “price protect” some Mexican-built models such as the 3 Series sedan and 2 Series coupe. About 10% of U.S. sales are imported from Mexico.

- Brunello Cucinelli, one of the leading Italian luxury fashion brands, reconfirms its outlook of 10% sales and profit expansion in 2025 and 10% growth in 2026. These come after positive first quarter results and a strong order book for autumn and winter this year. It is a good sign that people keep buying even though it is all about the trade war, inflation, etc. Additionally, next week, monthly retail sales in the U.S. are expected to be reported at positive 0.7% versus -0.9% in the previous month.

Threats

- Tesla shares sharply declined on Monday after UBS Group’s Joseph Spak downgraded projections for both the first quarter and the full year. Spak now expects Tesla to deliver just 367,000 cars this quarter, a 16% reduction from previous estimates. Additionally, car shipments from Tesla’s Shanghai plant dropped by 49% in February to 30,688 vehicles, while registrations in Germany plummeted by 70% during the first two months of the year.

- China’s CPI for February fell short of expectations, experiencing its sharpest decline in 13 months. Core inflation also dropped for the first time since 2021. This disappointing inflation data, coupled with weak import figures from last Friday, suggests a lack of consumer confidence and sluggish domestic demand.

- President Donald Trump threatened to impose a 200% tariff on wine, champagne, and other alcoholic beverages from the EU if the bloc’s 50% levy on American whiskey, a measure taken as a retaliation against Trump’s steel and aluminum tariff that went into effect on Wednesday. It would keep impacting internal prices that the local consumers would assume, and it could decelerate sales.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising 10.92%. Adentra, one of the largest lumber companies with operations in the U.S. and Canada, has reported as much as 8-10% headwind hit to its earnings from tariff implications. With the introduction of tariffs and what has seemed to be a tit-for-tat economic battle, lumber is on the chopping block.

- Carlyle Group Inc.’s Jeff Currie warned of a “security premium” that will be added to the cost of metals like copper, as tariffs mean countries will need to pay more to ensure domestic supplies. “Energy security is top of mind for everyone around the world right now,” Currie said during an interview with Alix Steel on Bloomberg Radio, minutes after President Donald Trump announced plans to increase steel and aluminum tariffs in retaliation against Ontario’s move to place a levy on electricity imported from the U.S.

- Tin prices jumped over 10% this week on the LME as mine production was halted at Alphamin Resources Corp. Bisie mine in the DRC, which provides about 6% of global supply, as Rwandan rebel fighters have taken over the region. Alphamin’s share price sank 38% on the day of the news but rallied 17% on Friday.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 6.57%. Bloomberg broke news that the U.S. Export-Import Bank’s board has approved a $4.7 billion loan for TotalEnergies SE’s Mozambique LNG project, marking a significant step toward reviving the facility that was halted four years ago due to militant attacks. More visibility toward bringing new supply online, coupled with warmer months in Europe and the U.S. next week pushing down demand, has released the upward pressure for natural gas prices.

- Uranium equities have been under pressure for the past several weeks from the broader market sell-off, spot market weakness, and uncertainty around Russia/Ukraine outcomes. Spot market activity has been challenged as buyers continue to wait on the sidelines given multiple macro uncertainties, while uncommitted supply has been made available, leading to prices drifting lower, according to RBC.

- Global diversified mining companies are looking to move away from key battery metals such as nickel as prices continue to languish since prices crashed at the end of 2023. Anglo American Plc is the latest company to limit its exposure to nickel. It was the largest nickel producer in Brazil until it sold its assets in the country in February, owning more than half of Brazil’s nickel production capacity, according to Bloomberg.

Opportunities

- First Quantum Minerals Ltd. and Franco-Nevada Corp look to further benefit from Panama’s President Jose Raul Mulino’s authorization to export the stockpiled copper concentrate from the Cobre Panama mine, since the mine was ordered to close in 2022. This is a promising first step in perhaps reopening the Cobre Panama Mine but there are still further challenges ahead that need to be resolved to derisk the investment.

- A proposed 25% tariff on U.S. imports of copper is rocking global markets, causing a massive price dislocation between New York and other commodity exchanges. Copper inventories on the Comex have surged while the cancellation of copper warrants in the London Metals Exchange soared, Michelle Leung, a Bloomberg Intelligence analyst, wrote.

- Major technology and energy companies, including Amazon, Meta, Occidental Petroleum, and Dow, have pledged support for tripling global nuclear capacity by 2050 to meet surging energy demands from data centers and factories. This unprecedented cross-industry commitment, announced at CERAWeek 2025 in Houston, aims to accelerate policy, finance, and regulatory changes that enable rapid expansion of nuclear power as a key solution for achieving energy security, resiliency, and continuous clean energy supply.

Threats

- Oil prices rose just 0.28% for the week by Friday afternoon, following seven weeks of consecutive price declines. A confluence of bearish factors has contributed to the worst crude-market sentiment in recent history. OPEC and its allies made a surprise announcement of plans to boost supplies with crude trading now just under $68 a barrel, according to Bloomberg. Billionaire wildcatter Harold Hamm says we need $80 per barrel to cover oil shale costs. Citigroup warned that prices below $65 a barrel would stifle the ability to drill.

- The Indonesian government is considering tax hikes on various minerals, including copper and nickel, to help cover budget shortfalls. In nickel, the proposed taxes would increase the current duty rate for nickel ore from a flat 10% to a range of 14-19% depending on the prevailing nickel price at the time. The proposed tax hikes also extend to copper, where duties are expected to rise from 4% to 7%-10% for copper concentrate and from 2% to 4%-7% for copper cathodes, according to Morgan Stanley.

- U.S. consumer sentiment dropped to more than a two-year low on the latest University of Michigan data issued at the end of the week. In addition, consumer inflation expectations rose to an annual rate of 3.9% over the next 5 to 10 years. Consumers cited uncertainty around government policy implications and in particular tariffs. Spending power is likely to slow.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Story, rising 31.28%.

- Binance received a $2 billion minority stake investment from Abu Dhabi’s MGX, the first institutional investment in the world’s largest cryptocurrency exchange. MGX’s investment is part of its broader push into funding AI infrastructure, including supporting U.S. President Donald Trump’s AI infrastructure plan, according to Bloomberg.

- World Liberty Financial, one of the Trump family’s crypto ventures, has discussed doing business with the world’s largest digital-asset exchange, Binance. In addition, representatives of the Trump family have held talks with Binance about taking a stake in its U.S. arm called Binance U.S., writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Hedera, down 17.37%.

- Crypto trading volumes dropped sharply in February as concerns that President Trump’s tariffs on Mexico, Canada and other countries would stifle international trade, reducing investor demand for adding to risky investments. Combined spot and derivatives trading volume on centralized exchanges fell 21% to $7.2 trillion, the lowest level since October, according to Bloomberg.

- Sam Bankman Fried appeared on Tucker Carlson’s podcast criticizing Joe Biden and SEC Chair Gary Gensler while expressing hope for what he’s heard from Donald Trump. Bankman-Fried said he was shocked by the first two years of Biden’s administration and described crypto regulation under Gensler as “something of a nightmare,” Bloomberg reports.

Opportunities

- Crypto payments network Mesh said it has raised $82 million in a funding round led by Paradigm that values the startup at $500 million. Founded in 2020, Mesh connects exchanges, wallets, and financial services platforms to enable crypto payments and conversions. Mesh has partnerships with companies such as Metamask, Shift4, and most recently Revolut, writes Bloomberg.

- Defiance’s leveraged Strategy (MSTR) exchange-traded funds (ETFs) saw a surge in activity on Monday as the bitcoin holding firm’s shares fell to their 200-day average, Bloomberg reports. A record 24.33 million shares in the Defiance daily target 2x long MSTR changed hands as the ETF price slipped 32%, the lowest since September.

- Russian central bank has proposed to allow buying and selling crypto assets to a limited number of investors. Only qualified individual investors, corporate qualified investors, and financial organizations will be eligible to conduct transactions with crypto, writes Bloomberg.

Threats

- The deluge of Bitcoin and crypto ETF inflows in 2024 may shift the so-called melting ice-cube risk to the speculative digital assets themselves, says Bloomberg. The chart below shows what might be the start of downward reversion in the Bloomberg Galaxy Crypto Index and upward in gold ETF holdings.

- An Argentine prosecutor asked a judge on Thursday to issue an Interpol “Red Notice” for Hayden Davis, who claims to be behind the launch of a memecoin backed by Bitcoin reserves. After Milei endorsed his memecoin, its value skyrocketed, reaching a market cap of more than $4.5 billion, according to Bloomberg.

- A San Francisco federal jury found Marcus Rowland Andrade guilty of one count of wire fraud and one count of money laundering for orchestrating a multimillion-dollar pump and dump. Andrade, founder of AML Bitcoin, could face decades in prison under the verdict, according to Bloomberg.

Defense and Cybersecurity

Strengths

- Rheinmetall expects sales to grow by 25-30% this year as European nations ramp up defense spending, potentially securing up to 25% of the nearly €1 trillion NATO defense budget by 2030. With record-breaking orders, rising ammunition production, and potential acquisitions, the company is positioning itself as a key player in Europe’s rearmament, significantly surpassing investor expectations.

- Leonardo announced it would reach €30 billion in revenue by 2029, driven by increased European defense spending and industry growth, as part of its 2025–2029 industrial plan.

- The best performing stock in the XAR ETF this week was Kratos Defense & Security, rising 11.51%, after its OpenEdge 2500 digitizer became one of the first to achieve DIFI compliance, enhancing satellite network interoperability and cloud integration.

Weaknesses

- NVIDIA Corporation is under investigation by multiple law firms for potential securities fraud, following reports that Chinese buyers circumvented U.S. export controls to purchase Nvidia’s AI chips.

- Employees at Evraz North America falsified inspection results for approximately 12,800 armor plates used in U.S. Army vehicles, an issue that surfaced two years after Oshkosh Corporation secured a $6.7 billion contract for military vehicles.

- The worst performing stock in the XAR ETF this week was Intuitive Machines, down 16.65%, after the company extended its selloff following an early end to its lunar mission due to a flawed landing, marking its second consecutive failure.

Opportunities

- Intel appointed experienced tech investor and former Cadence CEO Lip-Bu Tan as its new CEO to reverse its financial decline, restore its competitive edge, and rebuild investor confidence.

- At SXSW, Republican lawmakers like Sens. Rounds and Rep. Nunn discussed AI regulation, focusing on promoting innovation while establishing guardrails and addressing global competition, particularly from China. They are working on bipartisan legislation to boost federal spending on AI research and development and to review existing regulations before adding new ones.

- CoreWeave has secured a $11.9 billion, five-year contract with OpenAI to provide cloud services, along with OpenAI taking a $350 million stake in CoreWeave. This deal follows other significant agreements by OpenAI, including a $13 billion investment from Microsoft, as it continues to expand its AI capabilities with models like GPT-4.5.

Threats

- Russia may face difficulties in implementing a proposed 30-day ceasefire in Ukraine while insisting on a long-term settlement that addresses its strategic interests. Meanwhile, Russian troops have recaptured the key border town of Sudzha in the Kursk region, further pushing Ukrainian forces back and strengthening Putin’s position. As U.S. officials arrive in Moscow for negotiations, Putin is expected to prolong the talks to secure better terms for Russia.

- Juniper Networks faced a significant cyber threat as the Chinese group UNC3886 targeted their end-of-life MX routers, exploiting outdated hardware and software.

- Donald Trump criticized the CHIPS Act, calling it a “horrible” policy and suggesting its cancellation, which has caused concern among chip companies like AMD and Marvell.

Gold Market

This week gold futures closed at $2,999.51, up $85.40 per ounce, or 2.93%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 4.7%. The S&P/TSX Venture Index came in up 1.0%. The U.S. Trade-Weighted Dollar fell 0.16%.

Strengths

- The best-performing precious metal for the week was platinum, up 4.92%. Collective Mining shares jumped 8.2% after investors learned Agnico Eagle Mines agreed to subscribe to 4.74 million shares at C$11.00, nearly $2 above the prior closing price, and concurrently exercised 2.25 million warrants early at a price of C$5.01 per share. Agnico will now own 14.99% of Collective Mining, which has had exceptional copper and gold intercepts on its Guayabales Project in Caldas, Colombia.

- The World Gold Council notes that “Global physically backed gold ETFs saw significant inflows in February totaling $9.4 billion, the strongest since March 2022. North American flows flipped positive following two consecutive monthly outflows, recording one of its strongest months on record. Asian demand was also strong while European inflows narrowed.”

- Gold broke $3,000 this week and is currently flirting just under that all-time high mark! The yellow metal surpassed $3,000 an ounce for the first time, driven by central bank buying, economic fragility, and President Trump’s trade policies. The rally has been fueled by investors seeking a store of value in turbulent times, with central banks buying bullion to diversify away from the dollar and China’s economic worries contributing to the surge. And if you are getting wimpish on this gold rally (that the price can’t get any higher), take note that the peak inflation adjusted price in 1980, as shown in the chart below, was $3,800 per ounce.

Weaknesses

- The worst performing precious metal for the week was palladium, however still up 1.83%. Palladium was the best performing precious metal last week and still had a bit of room to run for upside this week. There are initiatives in the U.S. and China giving grants toward finding industrial or scientific uses for the precious metal, according to Bloomberg.

- According to Bank of America, precious metals refiner Heraeus notes that “Central bank purchases in January were down 60% year-on-year to 18.5 tons. Only 11 central banks bought gold in January – the lowest monthly count since January 2021.”

- Gold prices have surged to unprecedented levels, briefly reaching $3,000 an ounce for the first time this week, while silver prices have lagged, resulting in the gold-silver ratio reaching all-time highs. This divergence in precious metal performance is evident in recent ETF activity, where gold holdings have increased significantly while silver holdings have decreased on a year-to-date basis.

Opportunities

- Gold’s impressive run since late February 2024 has largely been driven by official sector purchases driven by the U.S. fiscal deficit, wars, and widespread economic uncertainty, reports Bank of America, with the recent record highs driven by uncertainty surrounding U.S. trade policies. The group forecasts gold to average $3,000 per ounce for 2025.

- Gold’s burgeoning safe-haven allure may see it surge to a record high of $3,500 an ounce during the third quarter, according to Macquarie Group analysts. Bullion could average $3,150 an ounce over that period, analysts led by Marcus Garvey said in a note. The precious metal — which was trading around $2,940 an ounce on Thursday — will get further support from concerns about a potentially growing U.S. deficit, they said.

- Bolivia’s new state gold trading firm plans to quadruple purchases this year as a way of boosting reserves of the high-flying metal for the nation’s struggling central bank. Known as Epcoro, the company has already bought a ton of gold this year from small-scale Bolivian producers, compared with a total of 2.4 tons last year, reports Bloomberg.

Threats

- Heraeus adds that “Poland, the dominant player in 2024, added 89 tons to its reserves. However, in January this year Poland ranked only fourth, buying just 3.1 tons – less than half its monthly average for 2024. Based on current reserves and gold prices, Poland would need to purchase less than 50 tons in 2025 to hit that target, explains Bank of America.

- Ramelius Resources’ updated mine plan for Mt Magnet has generally disappointed analysts, leading to downgrades in near-term production forecasts and increased capex expectations, while also sending shares sharply lower by 17.2%. The revised plan incorporates a mill expansion to 3Mtpa and a cutback of the Eridanus open pit, but lower than expected ore grades, particularly at Eridanus, have driven down production estimates for FY26 and FY27. This, coupled with higher costs and capital outlays, has resulted in reduced earnings forecasts and a negative impact on its net present value (NPV).

- Royal Gold issued guidance by individual metal—and when RBC converts these figures to gold-equivalent production using spot commodity prices, 2025 guidance is an implied 267-298K GEO, 5% below its 298,000 GEO forecast.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Boeing

Southwest Airlines

Delta Air Lines

Ryanair

United Airlines

Allegiant Travel

Frontier Group Holdings

Air Canada

Volkswagen

Tesla

Rheinmetall

Nvidia

Anglo American Plc

Franco Nevada Corp.

Collective Mining

Agnico Eagle

Ramelius Resources

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The CEO Confidence Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components.

The Michigan Consumer Sentiment Index (MCSI) is a monthly survey that gathers information on American consumer expectations regarding the overall economy.

The Federal Reserve Bank of Atlanta’s GDPNow is a forecasting model that provides a “nowcast” (a real-time estimate) of the official Gross Domestic Product (GDP) growth rate, which is released with a delay by the Bureau of Economic Analysis (BEA).