Gold, an “Attractive Insurance Policy”

After 20 years, the longest war in U.S. history is finally coming to a (clumsily handled) close. The war on Afghanistan's opium poppy production, on the other hand, looks set to escalate, at a potentially great expense to taxpayers.

After 20 years, the longest war in U.S. history is finally coming to a (clumsily handled) close. The war on Afghanistan’s opium poppy production, on the other hand, looks set to escalate, at a potentially great expense to taxpayers.

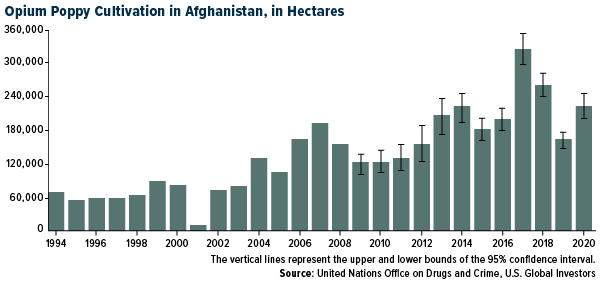

In case you don’t know, Afghanistan produces a lot of the stuff. The United Nations Office on Drugs and Crime (UNODC) estimates that the country is responsible for a whopping 85% of global poppy supply, much of which is used to make morphine, codeine and heroin.

The Taliban “officially” banned poppy cultivation in 2000—but soon realized it couldn’t do without the crop. Poppy is “an attractive insurance policy,” a recent inspector general report says. It’s “lightweight, easy to transport, lucrative and it can be stockpiled to await more favorable market or security conditions.”

Since 2002, the U.S. has spent some $9 billion fighting the Taliban’s narcotics trafficking. Nevertheless, cultivation has continued to ramp up. Last year, the area used to grow opium poppy in Afghanistan increased 37% from 2019—even after U.S. air strikes destroyed a quarter of Taliban-run poppy fields in 2018.

Now that the U.S. military is on its way out, do you think things will improve? I’m guessing no. Billions more will likely need to be spent to combat poppy cultivation and exporting, the Taliban’s number one source of financing.

Gold and Bitcoin Have No Counterparty Risk

This is yet another reminder that U.S. taxpayers and investors need their own “attractive insurance policy” against freewheeling government spending and currency debasement.

For my money, gold is such an asset, as it has no counterparty risk. The more money that’s printed to cover government spending, the more valuable I believe gold becomes.

The same is true of Bitcoin, which many perceive as “digital gold.” But as I told Michael Saylor during last week’s webcast, I don’t think Bitcoin should represent more than 2% to 5% of your portfolio right now. The crypto has incredible upside potential, but as it’s only been around since 2009, it lacks gold’s centuries-long track record as a store of value.

Risk is precisely the reason why Palantir Technologies decided to make an investment in gold. The data analytics firm, founded in part by billionaire Peter Thiel, announced last week that it had stockpiled as much as $50 million worth of gold bars in preparation for “a future with more black swan events.” What’s more, Palantir—named for the all-seeing crystal balls in Lord of the Rings—is also allowing customers to pay for its software in gold.

Palantir’s decision “is only the beginning of what will soon be many major corporations diversifying their U.S. dollar cash into gold,” the National Inflation Association (NIA) wrote in a note to subscribers.

Is Gold Being Manipulated?

That said, Bitcoin is trending up—today it jumped above $50,000 for the first time since May—while gold has continued to trade in a very narrow range since the last flash crash two weeks ago, which saw the yellow metal plunge below $1,700 an ounce.

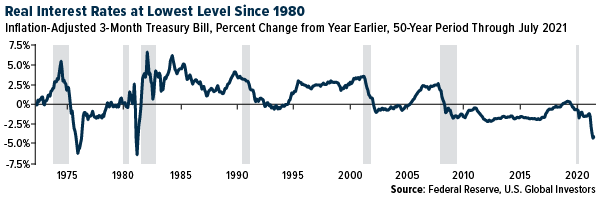

The stronger dollar bears a lot of responsibility for gold’s woes. But something doesn’t add up when inflation is running at 5.4% year-over-year and real rates remain deeply negative. By one measure, rates are lower now than they’ve been since 1980, the same year gold hit its all-time high when adjusted for inflation.

Are investors betting that inflation will be “transitory,” as Federal Reserve Chair Jerome Powell insists?

Or is gold being manipulated?

If you talk to Chris Powell (no relation to Jay), secretary and treasurer at the Gold Anti-Trust Action Committee (GATA), the answer to the latter question is an emphatic yes.

Back in 2019, Chris told me that gold is largely manipulated through the futures markets and the London over-the-counter (OTC) market. “The mechanisms are gold swaps and leases between central banks and bullion banks, and through the sale of futures contracts,” he said.

When I asked him where he thought gold would be were it not for the kind of institutional manipulation he’s observed, Chris wisely said that the “true value of gold is whatever our free market wants it to be.”

If gold is being suppressed, as Chris and others believe, with G7 countries and central bankers continuing their modern monetary theory (MMT) experiment, the spring effect has the potential to be even greater. We could see gold at $2,000 to $2,400 an ounce.

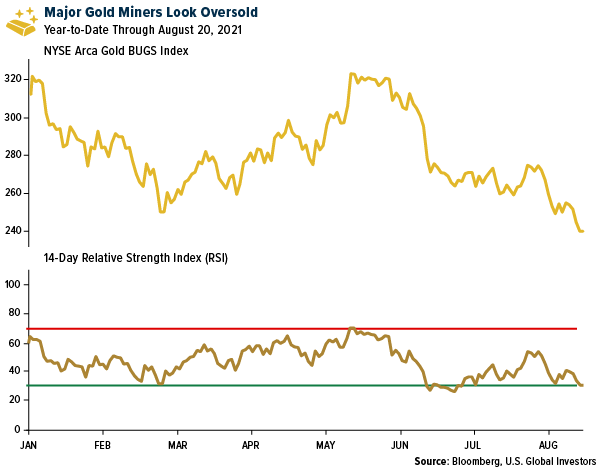

Gold Miners Could Be a Buy

No surprise, but gold miners are also down, as much as 20% for the year so far. Based on the 14-day relative strength index (RSI), the NYSE Arca Gold BUGS Index shows that producers are oversold right now, meaning they could be a buy in anticipation of higher metal prices.

If I were investing, I would focus on the royalty and streaming companies such as Franco-Nevada, Wheaton Precious Metals and Royal Gold. As I’ve explained several times before, these companies provide many of the benefits of the gold mining industry without a lot of the risks.

Recent earnings are evidence of that. Take Franco-Nevada. Despite lower gold prices, the Toronto-based company reported record sales of $347 million during the second quarter, an increase of 78% from the same quarter a year earlier. Adjusted net income came in at $182 million, almost double the income from a year ago.

This sets Franco up for a record year, says Paul Brink, president and CEO, adding that the company’s royalty business model “is particularly attractive during periods of industry cost inflation.”

Missed the webcast last week with Michael Saylor? Read my top 10 takeaways by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The relative strength index (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The NYSE Arca Gold Bugs Index is a rules-based, modified equal weighted equity benchmark designed to track the performance of companies involved in the mining of gold ore that do not hedge their production beyond 1.5 years. Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2021): Franco-Nevada Corp., Wheaton Precious Metals Corp., Royal Gold Inc.