Global Markets React to the Japanese Yen Carry Trade Unwind

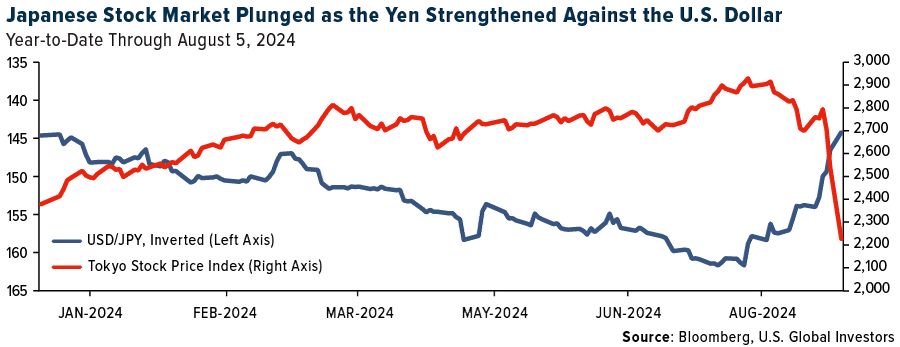

Last Monday, global equities and digital assets underwent a dramatic selloff as the unwinding of the Japanese yen carry trade rattled markets. The S&P Global Broad Market Index (BMI), which measures the performance of more than 14,000 stocks around the world, retreated 3.3%, its worst trading day in over two years. The Tokyo Stock Price Index, or TOPIX, fell 20% in its biggest three-day wipeout ever. Meanwhile, the Bloomberg Galaxy Crypto Index tumbled as much as 17.5%.

As an investor who’s weathered numerous market storms over the decades, I believe it’s important to understand the underlying causes of these movements and the lessons they hold for us.

Carry trades, for those less familiar, involve borrowing in a low-interest-rate currency—like the Japanese yen or Swiss franc—and investing the proceeds in higher-yielding assets elsewhere. This strategy has been immensely profitable, given the Bank of Japan’s (BOJ) longstanding zero-rate policy.

However, the recent rate hike by the BOJ has thrown a wrench into these trades, leading to a rapid appreciation of the yen against the U.S. dollar. As many of you are aware, a strong local currency can put pressure on that country’s stock market because exported goods become less competitive.

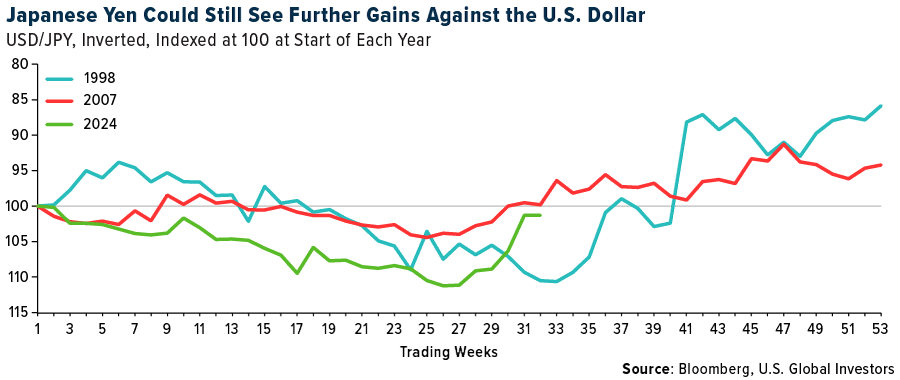

The Yen’s Rise Echoes Past Financial Crises

The yen’s appreciation mirrored past episodes, such as the 1998 Long-Term Capital Management (LTCM) hedge fund collapse and the 2007 subprime mortgage crisis, where the yen appreciated 20% from its low. As of early August, the yen had already appreciated over 10% against the U.S. dollar.

Following the selloff, the BOJ walked back its hawkish stance, with Deputy Governor Shinichi Uchida pledging to refrain from further rate hikes amid market instability. This should provide some relief in the near term, but the broader implications of the yen’s rebound and the carry trade unwind will likely continue to influence markets.

Given these developments, I urge caution. History suggests that the unwinding is not yet complete. In a report dated August 9, JPMorgan says it believes the unwind is about halfway done. What’s more, financial markets are pricing in multiple rate cuts by the Federal Reserve this year, which could further exacerbate the carry trade unwind. In such a scenario, it’s prudent to remain cautious about “buying the dip.”

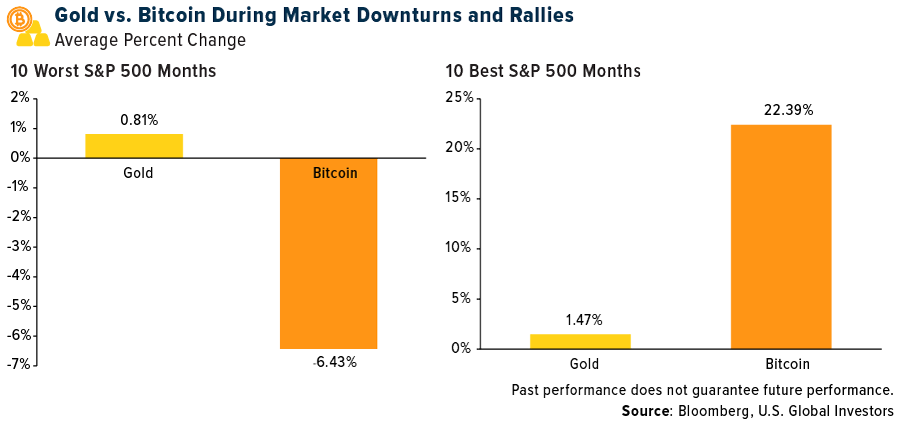

Bitcoin Volatility Challenges Digital Gold Narrative

As equities plummeted, Bitcoin’s behavior sparked significant interest. The world’s largest digital asset dropped as much as 17% last Monday—briefly falling below $50,000 for the first time since February—before recovering some of its losses, ending the day down 8%.

This contrasted with gold, which fell just over 1% on the day.

The selloff in Bitcoin highlights a crucial point: While it’s often touted as “digital gold,” there are some who believe the cryptocurrency has yet to prove itself as a stable store of value in times of market stress. “Despite both gold and Bitcoin being limited supply, zero-coupon instruments, [Bitcoin] does not exhibit gold’s ‘store of value’ properties,” Citi analyst David Glass said in a note this week.

Our own analysis adds some color to Citi’s conclusion and shows that Bitcoin has historically behaved more like a risk-on asset than a safe haven. Over the past decade, during the 10 worst months for the S&P 500, Bitcoin fell by an average of 6.4%, while gold remained slightly positive with an average return of 0.8%. During the best 10 best months, on the other hand, Bitcoin surged an eye-popping 22.4% on average, significantly outpacing gold’s 1.5%.

This suggests that Bitcoin may offer higher potential returns than gold during market rallies, but it comes with greater risk during downturns. This is why I always recommend a 10% weighting in gold and gold mining stocks for more conservative investors, while Bitcoin and other digital assets may be more attractive to investors with a longer time horizon or higher risk tolerance.

The S&P Global BMI (Broad Market Index), comprised of the S&P Developed BMI and S&P Emerging BMI, is a comprehensive, rules-based index measuring global stock market performance. The TOPIX, also known as the Tokyo Stock Price Index, is a capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. The Bloomberg Galaxy Crypto Index (BGCI) is a capped market capitalization-weighted index designed to measure the performance of the largest digital assets traded in USD. The S&P 500 Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.