From the Magna Carta to Bitcoin: Tracing the Evolution of Human Rights

If we fail to remain vigilant and take these rights for granted.

Private property rights and freedom of speech are fundamental human rights, and yet—as many people in Canada, Europe and elsewhere are discovering—they are among the most fragile. If we fail to remain vigilant and take these rights for granted, we risk losing the privilege of owning our own property and expressing our own thoughts and opinions.

So said conference-goers who were kind enough to chat with me following my presentation last week at Bitcoin Amsterdam, Europe’s largest Bitcoin event.

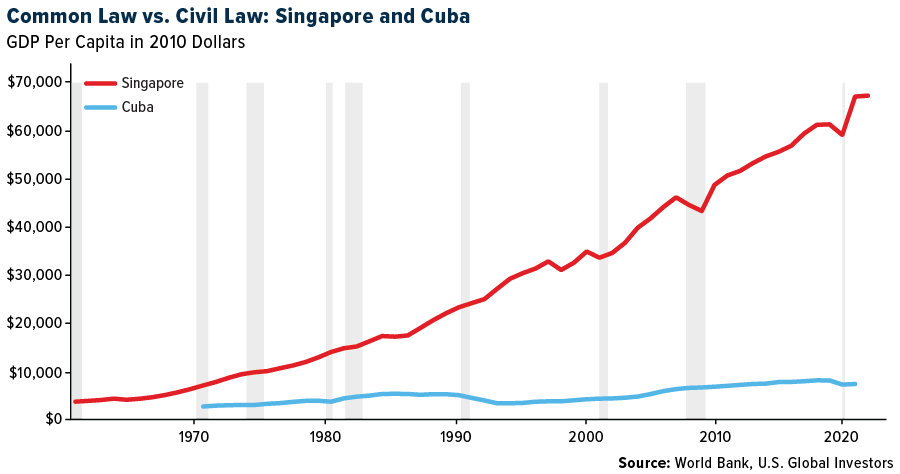

I spoke about the differences between common law and civil law, using two island-nations—Singapore and Cuba—as case studies for both legal systems. A former British colony, Singapore embraced common law and free markets and therefore saw its GDP per capita surge from around $3,600 at the start of Lee Kuan Yew’s decades-long rule to above U.S. levels today. Over the same period, Fidel Castro’s Cuba—held back by a centralized/communist economy, strict state controls and lack of economic diversification—has experienced next to no growth. (You can read my 2015 article on the subject here.)

From the Magna Carta to the Bitcoin Whitepaper

During my presentation, I traced the trajectory of common law from the signing of the Magna Carta in 1215 to the ratification of the U.S. Bill of Rights in 1791 and, eventually, the publication of the Bitcoin whitepaper in 2008.

Think about it: The Magna Carta was primarily designed to prevent kings from abusing their power and unjustly seizing their subjects’ private property. Similarly, Bitcoin was created to protect individual’s wealth in the digital age. Whereas the former laid the groundwork for the rule of law and the rights of individuals in the face of centralized power, the latter seeks to extend these principles into the realm of digital finance and beyond.

It should come as little surprise, then, that Bitcoin conferences typically attract human rights activists such as the Human Rights Foundation’s (HRF) Alex Gladstein, Togolese writer Farida Nabourema, North Korean defector Yeonmi Park and others.

Common Law and Civil Law Countries

Seeking Financial Freedom

Despite the guardrails, many people worry that their basic rights are under threat—and in some very notable cases, they are.

In the last couple of years, everyday Canadians have had their bank accounts frozen for legally protesting vaccine mandates. They’ve had stricter regulations and censorship of online content imposed on them, and, more recently, they’ve seen global news providers restrict access to Canadian users.

Here in the Netherlands, the world’s second-largest exporter of food, farmers gathered in March to protest the government’s draconian crackdown on nitrogen emissions, fearing it would result in the culling of thousands of heads of cattle. Irish farmers were forced to do the same in July.

Meanwhile, there are growing concerns that central bank digital currencies (CBDCs) will one day be used to monitor and control people’s spending habits. Christine Lagarde, head of the European Central Bank (ECB), admitted as much back in April, saying that CBDCs would give governments some measure of “control.”

These examples represent breaches of the proverbial social contract in mostly high-income countries. In many parts of the so-called Global South, the situation is even more dire, with flagrant human rights abuses, currency collapses and political instability driving people to flee their homes in search of safety and a better life. Why else are we seeing record numbers of Venezuelan asylum-seekers turn up at the U.S.-Mexico border and huge waves of North Africans wash up on the banks of Italy?

“Bitcoin fixes this” is a common refrain at conferences like the one in Amsterdam. The digital asset may not end up as the panacea that many of its biggest advocates claim it is, but its decentralized nature, resistance to censorship and ability to empower individuals in the face of increasing government controls can’t be ignored.

The 1970s Strikes Back

As more and more people become disillusioned with traditional systems, the appeal of decentralized alternatives like Bitcoin becomes evident. That’s especially true now that there are signs we may be entering an era of 1970s-style stagflation (high inflation coupled with high unemployment), triggered by stubborn consumer prices, spiking bond yields, rising oil costs, workers’ strikes, record debt levels, unexpected Chinese weakness, a nonfunctioning U.S. government and two international wars.

Indeed, the parallels are striking.

In October 1973, Egyptian and Syrian forces unexpectedly attacked Israel in a bid to recover territory they lost to the country just six years earlier. Launched on Yom Kippur, the holiest day of the Jewish year, the short yet bloody conflict had significant economic consequences, including the first of two major oil crises of the 1970s, a global recession and a decade of stagflation.

Almost exactly 50 years later, a similar engagement is playing out after Hamas militants, in a surprisingly well-organized assault, successfully breached Israel’s border with Gaza, capturing a number of Israeli settlements for the first time ever and taking soldiers and civilians hostage.

With Israeli Prime Minister Benjamin Netanyahu warning of a “long and difficult war,” can we expect the same global consequences as before?

Analysts at Deutsche Bank appear to believe so. The bank forecasts a mild recession in the U.S. in the first quarter of 2024 as geopolitical risks remain elevated and rates stay high for an extended period of time, among other factors.

In its World Economic Outlook, out last week, the International Monetary Fund (IMF) also predicts lower rates of economic growth and strongly urges governments to cut deficit spending. Doing so, the IMF says, will take some of the pressure off central banks in their mission to tame inflation.

Housing Least Affordable in Recent Memory

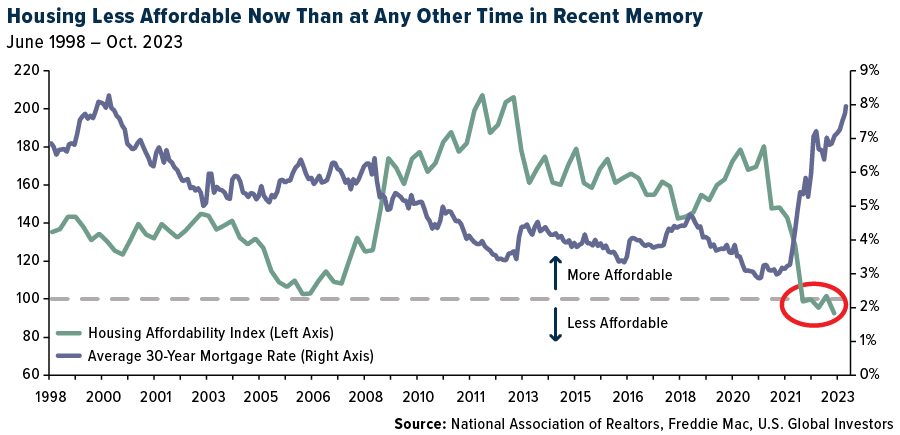

One of the most glaring signs that the economy isn’t working for everyone is the historic drop in housing affordability in the U.S. With 30-year mortgage rates now topping 8% in some cases, many Americans are priced out of owning their own home. According to real estate data provider ATTOM, single-family houses in a whopping 99% of U.S. counties are out of reach for the average American earning around $75,000.

Take a look at the chart below. Housing affordability has fallen even deeper below the magic 100 line for the first time in recent memory, according to the National Association of Realtors (NAR). (A value of 100 means that a family earning a median income makes just enough to afford a new home. A value under that means that new homes are no longer affordable.)

Factors such as the increase in home prices and mortgage rates have pushed the standard portion of wages required for primary homeownership costs to 35%, ATTOM says. This is significantly higher than conventional lending standards, which recommend a 28% debt-to-income ratio. Basic homeownership expenses now consume more than a third of average wages.

The lessons of history, whether from the Magna Carta or the events of the 1970s, remind us of the cyclical nature of societal and economic shifts. As I said earlier, Bitcoin may not be a magic solution to all our problems, but I believe it represents a tool to safeguard our freedoms and assets in an unpredictable landscape.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The National Association of Realtors (NAR) Housing Affordability Index measures whether or not a typical family could qualify for a mortgage loan on a typical home. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.