France’s Uncertain Future and Biden’s Leadership Crisis Shake Investor Confidence

As many of you are no doubt aware by now, France’s left-wing New Popular Front alliance thwarted Marine Le Pen’s National Rally party in a stunning upset, leaving the country without a clear majority in parliament. President Emmanuel Macron’s call for parties to form a governing alliance reflects the profound uncertainty gripping the country. In his open letter, Macron remarked that “no one won,” highlighting the political limbo France now faces.

The gridlock couldn’t have come at a worse time for France or its economy. The Olympics are set to begin in two short weeks, and high debt and sticky wage inflation continue to stunt growth. Markets are jittery, and the European Central Bank’s (ECB) task of maintaining stability across the eurozone has just become significantly more complicated.

France, the seventh largest country by GDP, casts a long shadow. It accounts for a significant 20% of the eurozone’s economy. Investors should be aware that this situation could lead to increased volatility in markets, not just within France, but across Europe. The FR40, which tracks the 40 largest French companies, is up only 2% year-to-date, compared to the EURO STOXX 50, up 11% over the same period.

Western Leadership Deficit

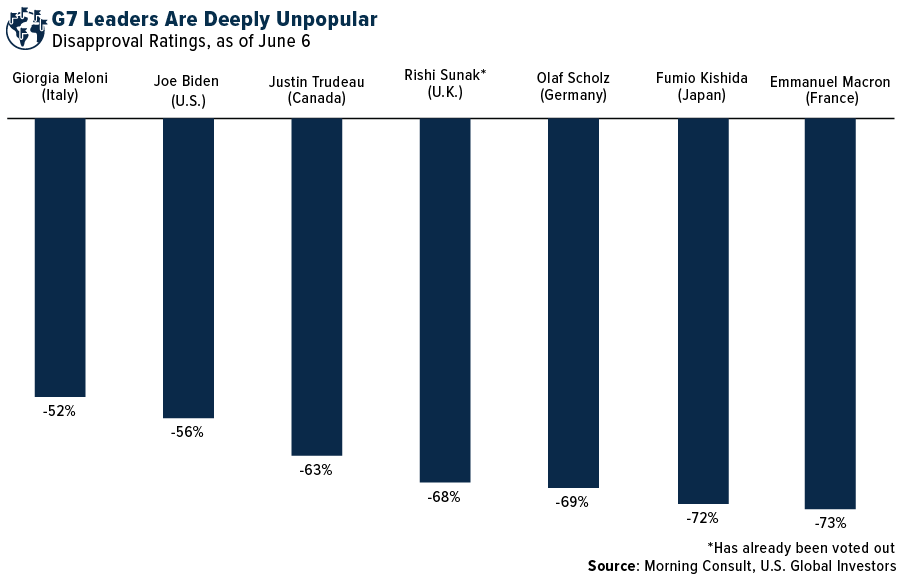

It’s not just France that’s dealing with leadership challenges. When G7 leaders met in Italy last month, their unpopularity was glaringly evident. Italian Prime Minister Giorgia Meloni is the most popular of the group, but even she has a 52% disapproval rating, according to Morning Consult. Contrast this with Indian Prime Minister Narendra Modi, who enjoys a remarkable 70% approval rating, and it’s clear that many Western economies are suffering from a leadership deficit.

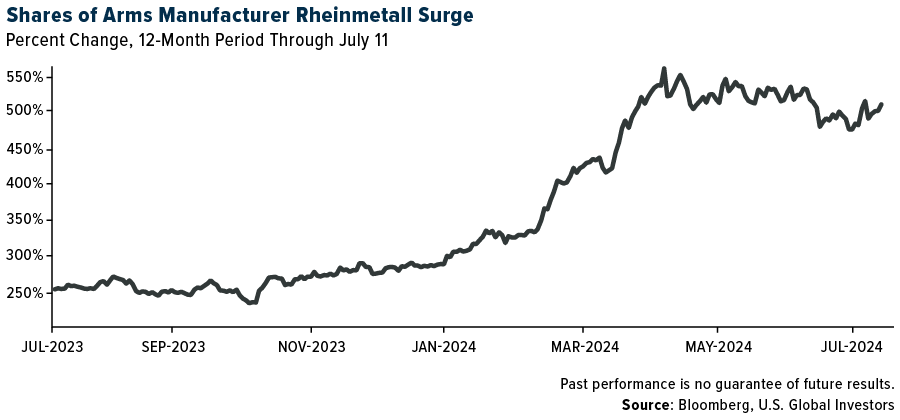

I don’t think it’s a stretch to say that the world is stuck in a state of permacrisis, an extended period of global instability. In this decade, there have been more armed conflicts involving state-based and non-state actors than at any time since the 1970s, according to the Uppsala University’s Conflict Data Program. This suggests to me a lack of strong leadership and commitment to peace, which has profound implications for global markets and investor sentiment.

Biden’s Election Outlook Post-Debate

Back home, President Joe Biden faces his own set of challenges, as you know. A recent Washington Post/ABC News/Ipsos poll found that a whopping 56% of Democratic voters want Biden to drop out of the 2024 race following his disastrous debate performance two weeks ago. Prominent figures like George Clooney have openly urged him to step aside, citing concerns about his cognitive fitness.

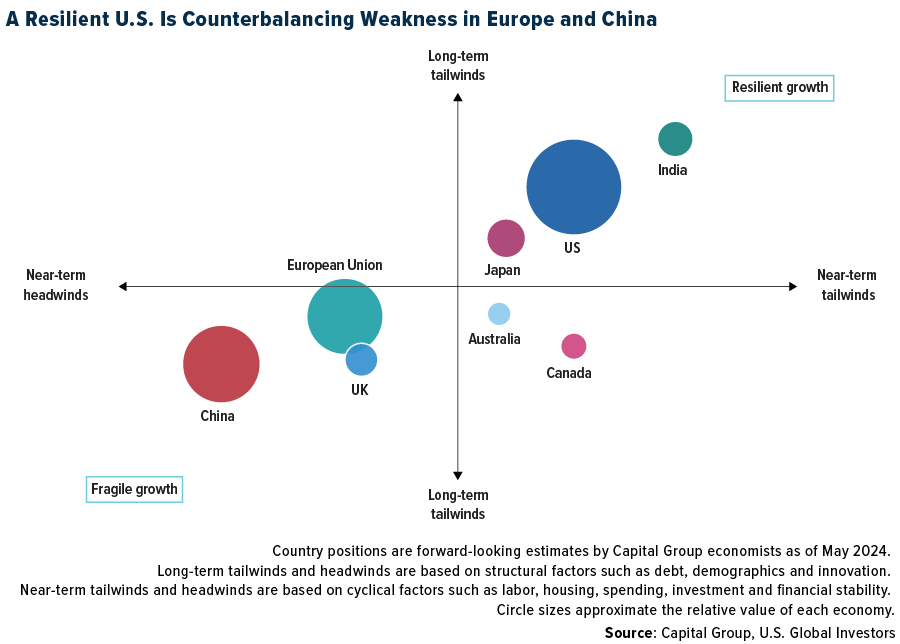

Despite these challenges, presidential election predictor Allan Lichtman—who, using his “Keys to the White House” system, has correctly predicted the outcome of all but one election since the early 80s—still sees a slight advantage for Biden, thanks in large part to the current strength of the U.S. economy. The International Monetary Fund (IMF) forecasts that the U.S. economy will grow at 2.7% this year, more than twice the rate of other major developed countries. And in its midyear report, Capital Group makes the case that the U.S. “is once again serving the critical role of global growth engine.”

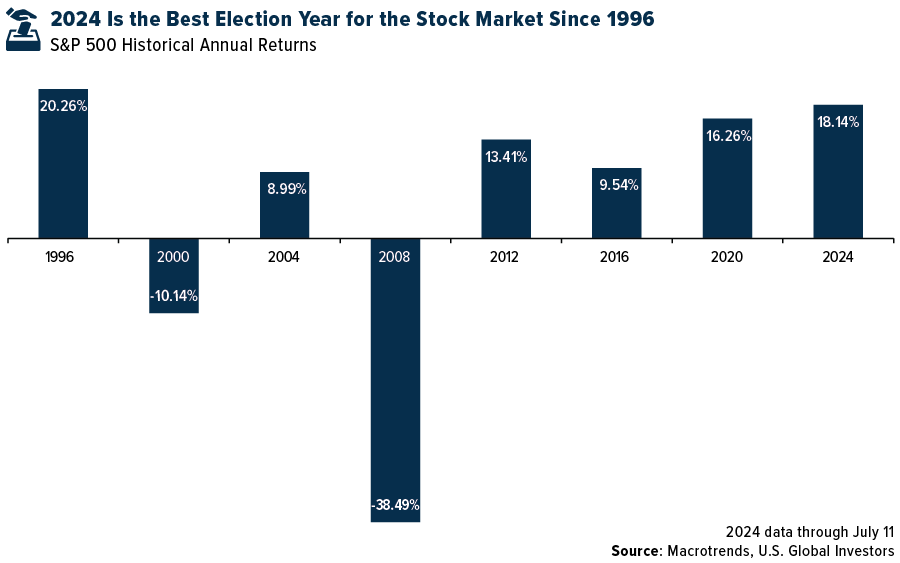

The U.S. stock market is also performing exceptionally well this year, which plays in Biden’s favor. The S&P 500 was up more than 18% year-to-date through July 11, making 2024 the best election year for stocks since 1996, when President Bill Clinton and Senator Bob Dole duked it out.

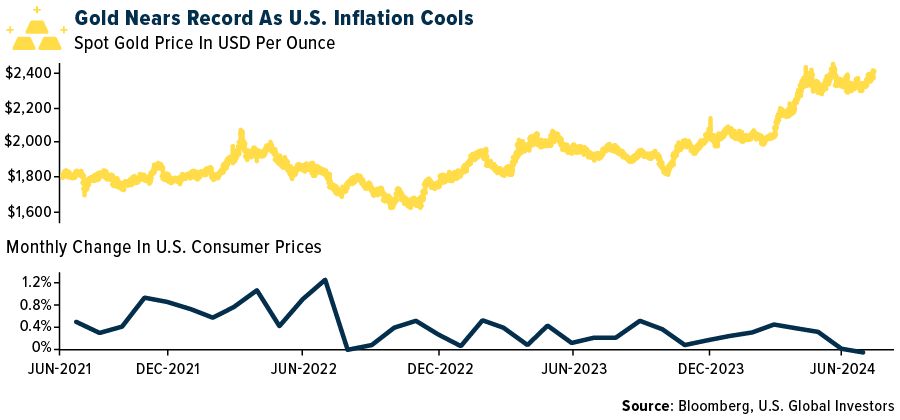

Gold Near All-Time High

In these uncertain times, I still believe that gold remains a beacon of stability. As I write this, the yellow metal is trading at $2,415 an ounce, about 1% away from its all-time high. A cooler CPI report and higher unemployment have opened the door to a potential rate cut in September; if the Federal Reserve acts, I expect gold to benefit. Diversifying with assets like gold can provide a hedge against the economic and political uncertainties we face today.

Stay informed, stay vigilant and invest wisely!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.59%. The S&P 500 Stock Index rose 0.87%, while the Nasdaq Composite climbed 0.25%. The Russell 2000 small capitalization index gained 6.00% this week.

- The Hang Seng Composite gained 5.85% this week; while Taiwan was up 1.53% and the KOSPI fell 0.18%.

- The 10-year Treasury bond yield fell 9 basis points to 4.19%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Bombadier, up 14.1%. According to Bank of America, total business jet utilization was 41% above 2019 levels, and utilization rose 2% year-over-year. Six to seven percent of the fleet for sale is still considerably lower than “normal.”

- According to Morgan Stanley, for air freight, demand in June was up 13% year-over-year, continuing the upward trend seen throughout the first half of 2024. In contrast, cargo supply grew at its slowest pace in 2024, edging up only 3% year on year.

- The July 4 holiday did not disappoint as Transportation Security Administration (TSA) passenger throughput achieved over 3 million passengers screened in one day, for the first time ever. TSA passengers were up nearly 8% y/y, on average, and up 9%+ vs. 2019 levels, according to Morgan Stanley.

Weaknesses

- The worst performing airline stock for the week was Frontier, down 6.2%. Delta reported 2Q24 adjusted earnings per share (EPS) of $2.36 vs. consensus of $2.38. Passenger revenue per available seat mile (PRASM) was down 2.6% versus consensus of down 1.3%. The company guided 3Q revenue, margin and EPS below estimates. The 3Q EPS guide is $1.70-2.00, below consensus due to lower revenue.

- According to Goldman Sachs, although the overall Shanghai Containerized Freight Index (SCFI) showed a growth of +0.5% week-over-week, the long-haul route to Europe, which has been most affected by disruptions in the Red Sea, recorded a decline of -0.5% w/w. This is the first decline seen since mid-April, marking the beginning of the second-wave rate hike following disruptions in the Red Sea due to strong demand.

- Boeing agreed to plead guilty in the 737 MAX criminal case associated with the two MAX crashes in 2018 and 2019, according to a court filing on Sunday. As part of the plea, Boeing must pay a second criminal fine of $244 million, spend $455 million over the next three years to improve its compliance and safety programs, and hire an independent monitor for the duration of the three years to overlook its improvements.

Opportunities

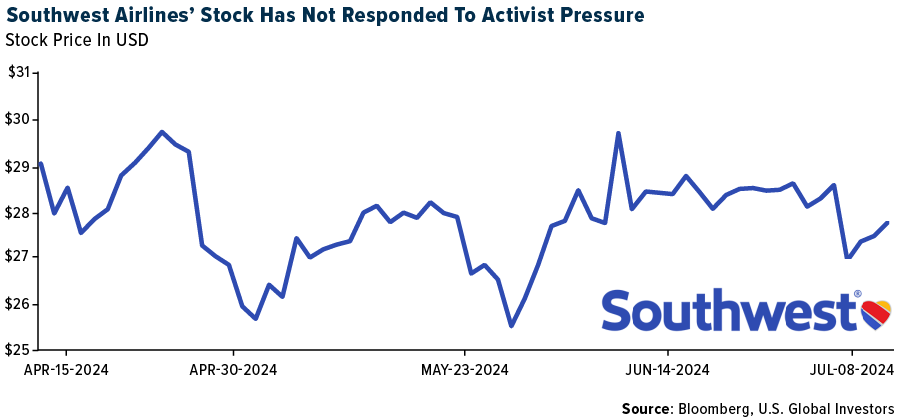

- According to a letter sent by Elliott Management to Southwest, the company’s performance is unacceptable and leadership change is required. According to the letter, Southwest’s actions included adopting an antiquated and shareholder-unfriendly “poison pill” to prevent Elliott from increasing its stake above 12.5%, and appointing a new director to the board today who appears to have been chosen in part due to his support for the company’s status-quo leadership.

- According to JPMorgan, the crude tanker demand-supply outlook remains favorable despite the OPEC+ extension of cuts. The decision by OPEC+ to extend output cuts until the end of 2024 has not impacted expectations for continued strength in crude tanker demand. Demand for 2024/25 is forecasted to grow by 1.8%/3.9% year-over-year (YoY). This growth is supported by longer sailing distances, particularly from long-haul Atlantic exports, notably from the U.S. (+8%), Brazil (+20%) and Guyana (+53%).

- Goldman Sachs is positive on Mexican airports for two reasons: i) They expect strong growth in passenger numbers in the coming years, which should lead to robust earnings growth momentum; and ii) Risk-free rates in Mexico remain significantly above the 10-year historical average, which enhances the airports’ potential once the interest rate easing cycle begins.

Threats

- The question RBC now asks is whether key suppliers such as GE, Pratt & Whitney, and Spirit AeroSystems can recover, and whether investor confidence in the lowered Boeing and Airbus 2024 delivery targets will improve, or if there will be another step down.

- The UK and the EU have begun enforcing a blacklist of ships, in addition to those already blacklisted by the U.S. last year, according to Stifel. Consequently, some of these blacklisted ships have been idle, potentially indicating a degree of success in restricting export activities. This could translate into lower tanker shipping revenue.

- Over 2,200 U.S. flights were canceled as Tropical Storm Beryl made landfall in Texas. Nearly 90% of flights at George Bush Intercontinental/Houston Airport (IAH) and 80% at William P. Hobby Airport (HOU) were canceled. According to Morgan Stanley, United is the largest carrier at IAH airport, and it has canceled over 16% of flights. Additionally, Southwest Airlines is the largest carrier at HOU airport, with Southwest canceling over 7% of flights.

Luxury Goods and International Markets

Strengths

- In June, Germany, Europe’s largest country, reported a decrease in inflation with the Consumer Price Index (CPI) easing to 2.5% from 2.8% in May. The U.S. also recorded a decline in inflation, as the price index fell to 3.0% in June, down from May’s 3.3% and below the expected 3.1%.

- China has reported stronger-than-expected exports, which rose by 8.6%, exceeding Bloomberg economists’ forecast of 8.0%. In contrast, imports declined by 2.3%, contrary to expectations of a 2.5% increase. This development has led to an improvement in China’s trade balance.

- EV maker Lucid Group was the top-performing S&P Global Luxury stock, rising 45.6% over the past five days. On Monday, the company reported production of 2,110 cars during the first quarter, above analyst expectations of 1,954. Later in the week, the CEO Peter Rawlison announced that production of the Gravity SUV would begin this year. Shares were up more than 20% in a single day of trading, on Friday.

Weaknesses

- Before the Summer Olympics in Paris, there has been a notable decline in demand for stays at high-end hotels, defined as those charging at least 800 euros ($865) per night for rooms. Bookings for the last week of June and much of July are reported to be down between 20% to 50% compared to the same period last year.

- The United States consumer sentiment index fell 3.2%, registering at 66.00 in preliminary reading for July. This figure is lower than June’s 68.2 and expected 68.5.

- Melco Resorts & Entertainment, a hotel and casino operator, was the worst-performing S&P Global Luxury stock, losing 6.5% in the past five days. Bank of America lowered the company’s price target to $8.5 from $10.4.

Opportunities

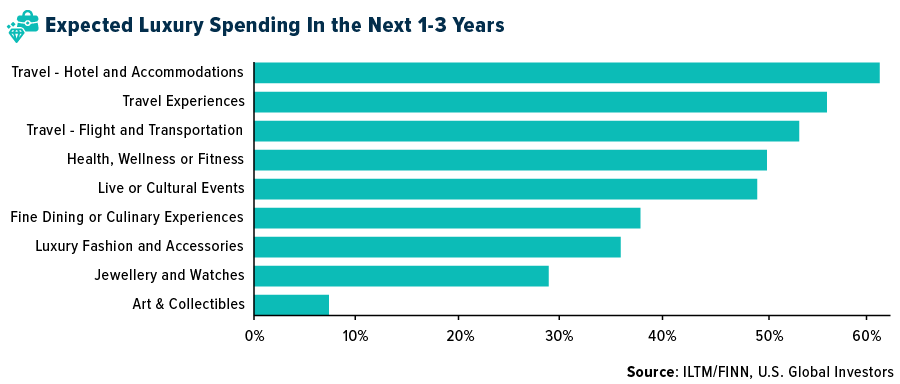

- According to a recent report by Finn Partners and ILTM Asia Pacific, more than 60% of affluent Chinese female travelers, who have a strong affinity for luxury goods and services, are planning to increase their spending on travel. Specifically, 60% intend to allocate more funds towards hotels and accommodations, 56% towards enriching travel experiences, and 53% towards flights. Additionally, the Global Business Travel Association (GBTA) has forecasted that global spending on business travel is poised to exceed pre-pandemic levels by 2024.

- According to a new report by the European Travel Commission, international tourists are expected to inject a record 800 billion euros into Europe’s economy this year. This marks a substantial 37% increase compared to pre-pandemic levels. Arrivals are also anticipated to rise by 6% compared to 2019 figures. Despite challenges such as high temperatures, elevated luxury hotel rates and crowded popular destinations, Europe remains a sought-after destination among affluent travelers.

- This week, major countries have reported declining inflation rates, potentially paving the way for central banks to consider more rate cuts. The European Central Bank (ECB) is expected to maintain its current rates next week, but there is speculation that it may reduce rates twice later in the year. Meanwhile, the Federal Reserve is anticipated to cut rates in September.

Threats

- Bank of America anticipates that Deckers Outdoor will announce a robust first-quarter performance, driven by improved quarterly sales. However, they project that this quarter marks the end of significant benefits for the UGG brand from previous price increases and reduced discounting. Looking ahead, analysts foresee a more challenging environment for Deckers for the remainder of the year. Following these insights, Deckers’ shares experienced a 5% decline on Wednesday.

- According to Bloomberg, in anticipation of the upcoming Summer Olympics set to open on July 26, law enforcement agencies are intensifying efforts against counterfeit luxury goods. Thousands of knockoffs, spanning from counterfeit Louis Vuitton handbags to fake Nike sneakers, have been confiscated. In 2023 alone, customs authorities seized a staggering 20.5 million counterfeit products, marking a significant 78% increase from the 11.5 million seized in 2022.

- Tesla delayed its planned robotaxi unveiling to October, allowing the team to work on the project more to build additional prototypes, according to people familiar with the decision. CEO Elon Musk set the initial August 8 for the event months ago. The company shares gained last week after the company reported better sales than expected, but this week UBS cut the rating on the company to a Sell on valuation risks.

Energy and Natural Resources

Strengths

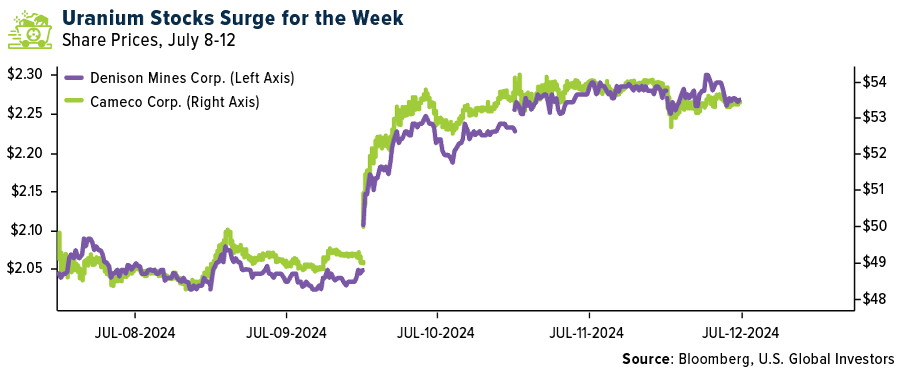

- The best performing commodity for the week was coffee, rising 8.65% on worries that supplies are getting stretched with key growing regions like Brazil, Vietnam and Indonesia having experienced production setbacks while some suppliers holding back on sales to further lift prices. Uranium stocks had a strong week on the news that Kazakhstan raised the mineral extraction tax on uranium to 9% in 2025. The current tax is 6% and the increase will raise the international price of uranium.

- Bank of America thinks that the latest data on U.S. utility uranium inventory and contracting indicate a potential U.S. restocking trend that would add support to their bullish view on uranium prices. Japanese demand points to material potential upside to demand from this historically important nuclear power nation.

- UBS estimates that European Union gas demand was down 5% year-over-year in the first half of 2024, coming 21% below the five-year average to 2021, with June demand also trending lower, down 11% y/y (25% below the five-year average).

Weaknesses

- The worst performing commodity for the week was wheat, dropping 6.65% along with soybean and corn on the assessment that U.S. crops are at their best shape in years according to the U.S. Department of Agriculture. Oil edged lower after touching a two-month high last week, tracked twin threats to crude production posed by a hurricane in the US and wildfires in Canada, according to Bloomberg.

- The spot Hot-Rolled Coil (HRC) market remained under pressure over the past two weeks with spot HRC prices declining roughly 4% to reach the lowest level since November 2022. Looking ahead, seasonally slower demand coupled with ample supplies offer little optimism for respite in the near term, according to BMO.

- BP Plc dropped in London trading after it warned of “significantly lower” refining margins and predicted a write down on the value of a plant in Germany of $1 billion to $2 billion. Lower profits from making fuels such as diesel and higher levels of maintenance will have an adverse impact on BP’s second-quarter earnings from oil products of $500 million to $700 million, the company said in a statement on Tuesday

Opportunities

- Devon Energy entered into an agreement to acquire Grayson Mill Energy’s Williston Basin assets for $5 billion. Financing consists of $3.25 billion cash and $1.75 billion of stock (37 million shares). Assets were acquired at less than 4.0x EBITDAX with a free cash flow (FCF) yield of 15% at $80/bbl., according to RBC. Devon expects to realize up to $50 million in synergies. In addition, Devon’s Board also expanded its share-repurchase authorization by 67% to $5 billion through mid-year 2026.

- Oil bulls are flexing their muscles, with money managers adding net-long holdings on Brent for a fourth week as supply faces weather risks and consumption picks up over the northern-hemisphere summer. Net-long positions climbed to just under 196,000 lots, rising for a fourth week in the longest run since April, according to Bloomberg.

- UBS argues that Indonesia’s nickel supply growth is overstated given: 1) falling nickel reserves at nearby smelters; 2) limited major exploration; 3) lower ore grade; and 4) an uncertain smelter IRR outlook. Recent evidence of nickel project closures globally and in high-cost regions could materially reduce the nickel surplus and limit price downside. BHP Group announced late in the week that they planned to shutter their Australian nickel business until at least early 2027, as reported by Bloomberg.

Threats

- According to JP Morgan, Hurricane Beryl’s potential impact on the refining system is difficult to predict, as refineries and offshore drilling rigs needed to be shut down. The Gulf Coast Houston region was hit hard by Beryl, and after a week, half a million residents are still without electricity, enduring temperatures that feel like 106 degrees. Weather threats are increasing, leading to escalating insurance costs that will likely slow economic growth in high-risk regions.

- Iron ore extended its decline from a one-month high on signs of abundant seaborne supply and persistent concerns about Chinese demand. Futures dropped to around $108 a ton in Singapore, according to Bloomberg.

- China’s struggling solar sector will continue to face tough times in the short term, according to major manufacturer Longi Green Energy Technology Co. The oversupplied market is keeping profits suppressed in the nation’s world-leading solar industry, which has seen production outpace demand in recent years, as reported by Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Notcoin, rising 48.12%.

- Donald Trump will speak at a Bitcoin conference later this month in an address that’s expected to highlight his growing embrace of the cryptocurrency industry. The presumptive Republican presidential nominee is scheduled to deliver his speech on July 27 on the main stage of the Bitcoin 2024 event in Nashville, Tennessee, according to Bloomberg.

- The U.S. spot Bitcoin exchange-traded funds (ETFs) recorded a total daily net inflow of $147.37 million on Wednesday, marking a fourth day of positive fund flows. Fidelity’s ETF led inflows with $57.79 million, followed by BlackRock’s ETF with $22.24 million, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was dogwifhat, down 18%.

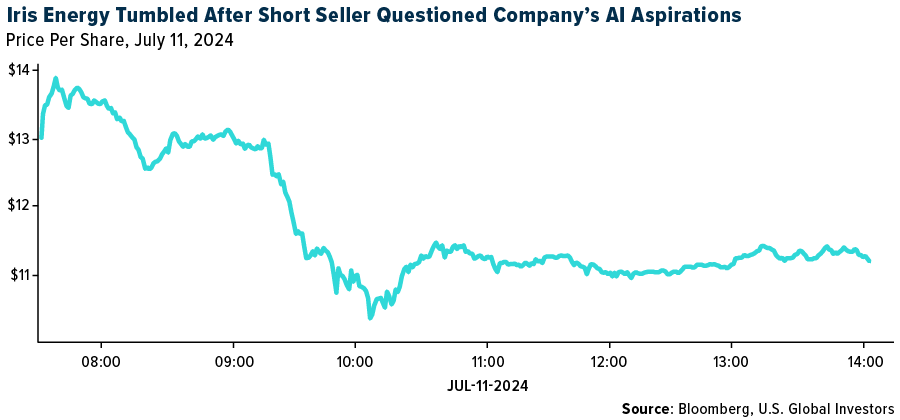

- Iris Energy’s shares fell the most since January after Culper Research questioned the Bitcoin mining company’s ability to serve the high-performance computers that make generative AI possible. Because of a steep decline in profitability of mining Bitcoin, some industry participants are looking to redirect their energy infrastructure for high performance computing writes Bloomberg.

- Suspect digital wallets have distributed close to $100 billion in illicit funds across the cryptocurrency market since 2019, flows that often touch popular stablecoins and centralized exchanges. Bad actors are making record use of stablecoins, which now account for most of the illicit transaction volume in crypto.

Opportunities

- MicroStrategy said it will conduct a 10-for-1 stock split to make the shares more accessible to investors and employees. The stock has surged around 1,000% since the enterprise software company started buying Bitcoin in 2020, outpacing Bitcoin itself, according to Bloomberg.

- The Securities and Exchange Commission (SEC) has opened a path for banks and brokerages to avoid reporting their customers’ crypto holdings on their balance sheets. But companies must offset risks those assets pose in order to bypass controversial crypto accounting guidance that has become a target of Congress.

- Germany still holds 29,286 BTC worth $2.2 billion, according to Arkahm Intelligence. The stash represents nearly 9% of BTC’s 24-hour trading volume.

Threats

- Anthony Scaramucci effectively barred clients from exiting SkyBridge Capital’s crypto-focused hedge fund even though returns have jumped. Investors who own about 70% of the fund’s shares asked for their money back in the latest redemption period that ended in March, writes Bloomberg.

- Lithuania fined crypto company Payeer a record $10.1 million for sanctions and money laundering violation involving Russian clients. Payeer allowed Russian customers “to carry out transactions in Russian rubles by transferring them from European Union-sanctioned Russian banks,” writes Bloomberg.

- American singer and rapper Amala Zandile Dlamini, known professionally as Doja Cat, warned that her X account appeared to have been hacked to promote a Solana-based token with the ticker DOJA. One tweet stated to “keep buying DOJA,” according to Bloomberg.

Defense and Cybersecurity

Strengths

- BAE Systems Land and Armaments secured a nearly $580 million contract for M109A7 and M992A3 howitzer vehicles, while its Technology Solutions and Services unit won an $88 million contract for the Naval Air Warfare Aircraft Division, with work expected to be completed by January 31, 2029.

- The Pentagon will resume deliveries of F-35 fighter jets next week, opting to retrofit them later with a crucial delayed upgrade to prevent weather damage and enable pilot training, instead of continuing to wait for the full TR-3 hardware and software update to complete testing.

- The best performing stock in the XAR ETF this week was , rising %

Weaknesses

- The cost of the Sentinel intercontinental ballistic missile program, designed to replace aging Minuteman III missiles and managed by Northrop Grumman, has surged to approximately $160 billion from $95.8 billion, potentially jeopardizing funding for other key Air Force modernization projects such as the Next Generation Air Dominance fighter jet, hypersonic weapons, the B-21 bomber and various space initiatives, prompting the Pentagon to consider extending the service life of the existing missiles and requiring a formal justification to Congress due to a significant increase in costs.

- Ukrainian President Volodymyr Zelenskiy condemned a Russian missile attack that partially destroyed a children’s hospital in Kyiv, part of a broader assault that killed at least 31 people. Ukraine’s Air Force reported that 30 out of 38 missiles were intercepted, but debris from the remaining missiles caused extensive damage, including at the Okhmatdyt children’s hospital, where children were undergoing dialysis; a war crimes investigation has been opened in response.

- The worst performing stock in the XAR ETF this week was , falling -%, after

Opportunities

- The Lithuanian Defense Ministry has signed agreements with Sweden’s Saab Dynamics AB for delivery between 2025-2027 to enhance their armed forces’ capabilities with a more mobile system, while also considering Polish Piorun and additional medium-range air defense systems, as stated by Defense Minister Laurynas Kasciunas.

- Rheinmetall will build an ammunition plant in Lithuania, fast-tracked by special government status, to produce 155 million bullets, create 150 jobs and enhance national security amid heightened defense needs in Europe.

- David Barnea, head of Israel’s Mossad, will meet Qatar’s Prime Minister Sheikh Mohammed bin Abdulrahman Al Thani to negotiate a cease-fire deal with Hamas following a new proposal that may lead to hostage releases and a temporary truce after months of conflict.

Threats

- The FC-31 Gyrfalcon, now officially designated as the “J-31B,” is poised to enter military service as China’s equivalent to the U.S. F-35 Lightning II, according to a manufacturer’s video posted by state media. This fifth-generation stealth fighter, developed by Shenyang Aircraft Corporation, features side weapon bays carrying two missiles and may serve in the PLA Air Force, enhancing China’s aerial combat capabilities alongside the J-20 and potentially the J-15 on carriers.

- The U.S. Air Force is hastily trying to retire its 32 least-upgraded Block 20 F-22 Raptor jets, which are costly to maintain and unsuitable for combat, but doing so would significantly reduce the number of available combat-ready F-22s, risking air superiority in potential conflicts, especially since the Next Generation Air Dominance fighter’s future is uncertain.

- Renewed fighting in northeastern Myanmar, involving the Ta’ang National Liberation Army and the Myanmar National Democratic Alliance Army, has ended a Chinese-brokered ceasefire, encircled the strategic city of Lashio and increased pressure on the military regime already facing attacks from multiple fronts.

Gold Market

Gold futures closed the week at $2,416.30, up $18.60 per ounce, or 0.78%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 5.73%. The S&P/TSX Venture Index came in up 1.36%. The U.S. Trade-Weighted Dollar fell 0.75%.

Strengths

- The best performing precious metal for the week was gold, up 0.78% after lagging the other precious metals last week. Uganda announced plans to start domestic gold purchases to build foreign exchange reserves. Purchases will be executed by the Bank of Uganda directly with artisanal miners. Both the central banks of Nigeria and Zimbabwe have enacted such programs. Gold jumped above $2,400 an ounce to close in on the record price set in May, after an unexpected drop in U.S. consumer prices bolstered hopes that the Federal Reserve will soon start cutting interest rates. Gold jumped as much as 1.8% after data from the Bureau of Labor Statistics showed a 0.1% monthly decline in consumer prices, marking the first negative reading in more than four years, according to Bloomberg.

- Osisko Gold Royalties reported preliminary revenue for the second quarter that beat the average analyst estimate. Preliminary revenue is C$64.8 million, compared to an estimate of C$59 million, according to Bloomberg.

- Wesdome Gold Mines reported record quarterly production of 44,035 ounces, well above BMO’s estimate of 35,000, as for the first time both company’s mines mined meaningful tons of high-grade mineralization. After several years of development, the Kiena mine is now able to process high-grade Deep A zone mineralization.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.60%, essentially giving up the prior week’s gain. According to Goldman, over the past 12 months, the Australian gold sector has returned to cash generation over absolute production growth. However, Australian gold equities have recently broadly underperformed the Australian gold price. They expect this is at least in part driven by continued cost escalation, where over the last 5 years all-in-sustaining costs (AISCs) are up 40% on average, reducing the pass through to margin expansion.

- Endeavour Silver reported preliminary silver production for the second quarter that missed the average analyst’s estimate. Preliminary silver production was 1.31 million ounces, which was below the estimate 1.38 million, according to Bloomberg.

- Sibanye-Stillwater experienced a cyber-attack that is affecting its IT systems globally. While the investigation into the incident is ongoing, there has been limited disruption to the Group’s operations globally, according to Bloomberg.

Opportunities

- Calibre Mining announced that it has received key environmental permits necessary for the development of open pit mines at the Volcan gold deposit in Nicaragua, located 5 kilometers south of the Libertad mill, according to Scotia.

- Central banks have been the most notable buyers of gold in recent years, particularly in the last three years. However, both retail and professional investors have been in liquidation mode regarding the SPDR Gold Shares ETF, a proxy for bullion, since 2020. That trend appears to have come to an end in the first half of March 2024, with 282.9 million shares outstanding. Since then, the shares outstanding have climbed to 292.2 million, with new shares being created as new money has finally started to flow back into gold.

- According to Stifel, G2 Goldfields represents the most exciting exploration-driven story they cover, with exploration success directly impacting share price performance. They highlight the discovery of 300,000 ounces of underground gold at 4.56 grams per ton already drilled at Ghanie, and they anticipate further drilling will yield similar results.

Threats

- According to Morgan Stanley, silver price-driven demand destruction may emerge. Silver jewelry demand already fell 13% in 2023, mainly driven by India. Solar demand could slow more significantly due to grid constraints, overcapacity, and poor margins. Additionally, high prices may encourage thrifting, with silver accounting for 11% of current solar module costs. Silver prices could also decline if rate cuts are implemented in response to economic weakness, which would weigh on industrial demand.

- Companies that buy metal sourced from central Africa could expose themselves to United Nations sanctions for supporting warfare in eastern Democratic Republic of Congo, according to a report by UN experts. Congo’s trade in gold, tin and tantalum—key minerals in portable electronics—is directly supporting armed groups involved in widespread human rights abuses and fueling one of the world’s deadliest conflicts, as reported by Bloomberg.

- Platinum jewelry demand is weakening. China’s demand for platinum jewelry is now less than half of what it was in 2013 and declined further last year amid competition from gold, according to BMO.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Deckers Outdoor Corp.

LVMH Moet Hennessy Louis Vuitton

BP PLC

The Boeing Co.

Southwest Airlines Co.

Airbus SE

United Airlines Holdings Inc.

Osisko Gold Royalties Ltd.

Wesdome Gold Mines Ltd.

Endeavor Mining PLC

Calibre Mining Corp.

G2 Goldfields Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

Bloomberg France 40 Price Return Index is a float market-cap weighted equity benchmark that covers the largest 40 issuers by float market capitalization.

The EURO STOXX 50 Index, Europe’s leading blue-chip index for the Eurozone, provides a blue-chip representation of super-sector leaders in the region. The index covers 50 stocks from 11 Eurozone countries.

A consumer sentiment index is a measure of how consumers are feeling about the next few months.