Exploring Web3, Artificial Intelligence and the Digital Asset Revolution

Imagine a new digital environment where our data is portable and democratized, challenging the current monopolies. Web3 promises to be such an environment, using blockchain technology.

This week I was in beautiful Quebec City, Quebec, attending and speaking at THE Mining Investment Event of the North. Turnout was very strong this year, and it was great to catch up with and hear from the leaders of gold and precious metal mining companies.

My keynote focused on the state of junior mining, which, like the industry as a whole, has struggled to revisit its 2011 highs, despite the resilience of the gold price. I remain optimistic, however, a feeling I shared with many of the business leaders and attendees of the conference. There was a positive energy in the room, one that told me something big could be just on the horizon.

Bracing for Web3, the Next-Generation Internet

Switching gears, imagine a new digital environment where our data is portable and democratized, challenging the current monopolies. Web3 promises to be such an environment, and to understand this shift, it’s helpful for investors to consider the evolution of the internet.

The first phase, Web1, offered users unprecedented access to information and connectivity (think AOL, Yahoo! and Google). Then came Web2, which enhanced the experience by allowing personalized, user-generated content to be delivered through apps (think Facebook and Twitter).

As the next iteration, Web3 operates on a global, peer-to-peer infrastructure made possible by blockchain technology. Like Bitcoin, the Web3 network is decentralized, meaning it eliminates intermediaries; no single entity controls it.

At its core, Web3 aims to address data monopoly, privacy risks and algorithmic bias, promoting a more equitable and open internet. We’ll see a shift from platform-centric to individual-centric data and identity management, leading to new technologies and business models.

But to truly establish this network, users—both people and machines—need to actively participate. To do this, developers may use tokens (think Ether or Polkadot) to manage activity and record transactions on the blockchain. Other key components of this next-generation ecosystem could also include smart contracts and digital wallets.

Investment in Web3 Companies

Blockchain technology, with its “trustless” systems, has been seen as a remedy for growing mistrust in various traditional institutions. Yet recent failures by crypto-related firms, including FTX and Silvergate, have sparked investor uncertainty in digital assets, causing some uncertainty over the future of Web3.

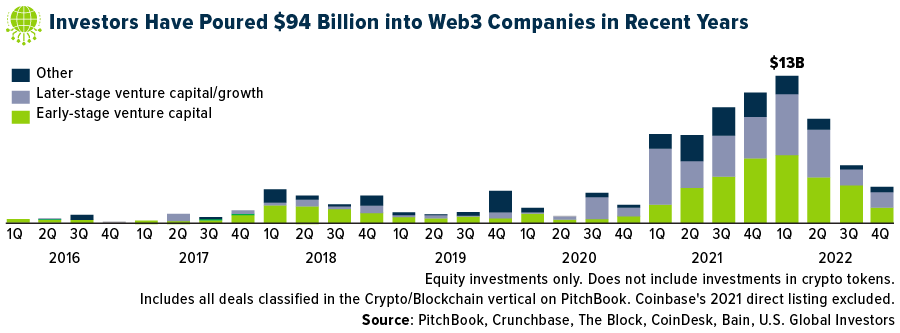

Look at the chart below, taken from a recent report by Deloitte. Early-stage investors poured around $94 billion into Web3 companies between 2016 and 2022, most of it in the last two years, with investment peaking at $13 billion in the first quarter of 2022. This corresponds to Bitcoin’s plunge in price after hitting its all-time high of nearly $69,000.

However, as Deloitte points out, there are parallels between the slump in digital asset prices and the dotcom crash of the early 2000s. Just as the internet became integral to life and work over time, the transformative potential of Web3 is likely to continue, attracting venture capital and private equity investors.

AI, the Rising Star of Corporate America and the Metaverse

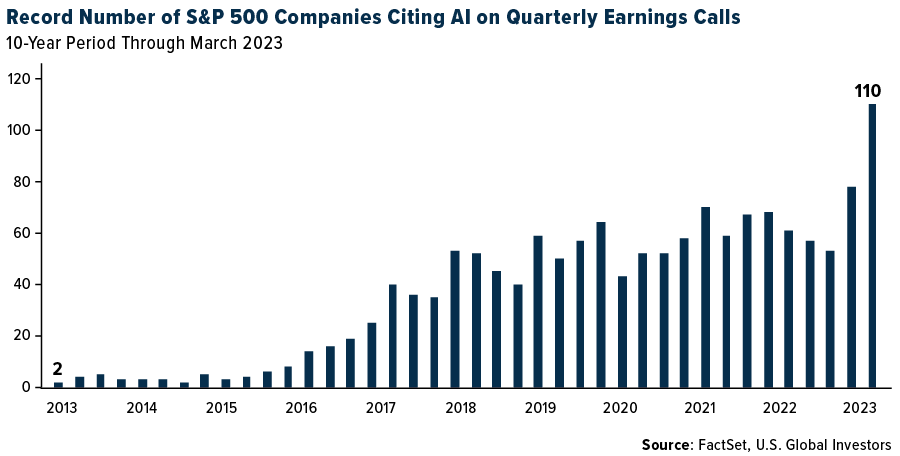

The buzz around artificial intelligence (AI) has also been growing, and it shows in corporate America. An analysis of earnings conference calls for the first quarter of 2023 reveals a significant uptick in the number of S&P 500 companies discussing AI. During this period, 110 companies mentioned AI, a notable increase from the five-year average of 57 and the 10-year average of 34, according to an analysis by FactSet.

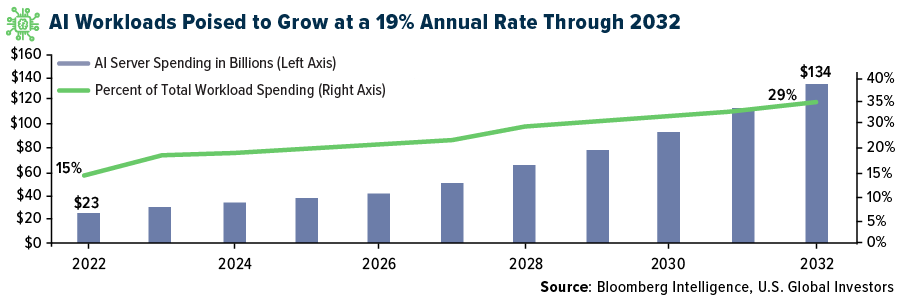

Along those same lines, the development of real-time, 3D virtual applications by companies like Meta, Roblox and Apple is expected to boost spending on AI servers, which are already projected to grow 19% annually through 2032. This is due to increasing demand for generative AI from popular applications such as ChatGPT and Midjourney.

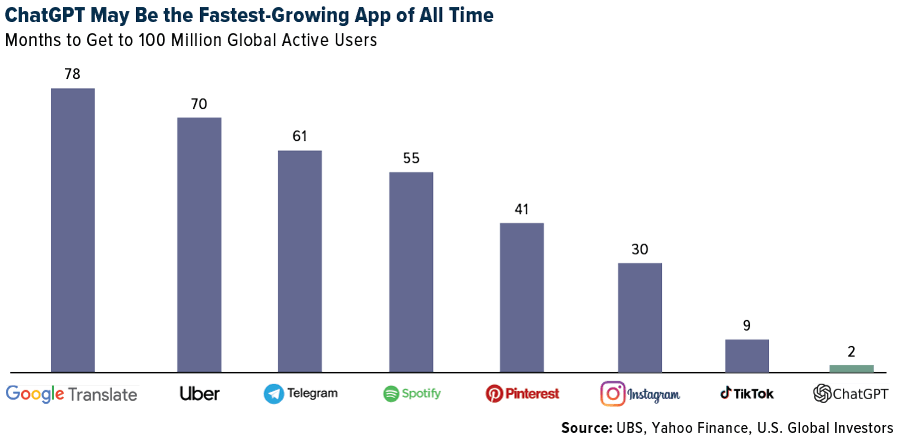

In case you’re wondering, “generative AI” refers to applications that can create unique content from simple prompts submitted by users. As I shared with you earlier this year, ChatGPT is the fastest-growing app in history, reaching 100 million users in as little as two months after launch.

To run efficiently, these metaverse applications will need advanced graphics and AI processors, increasing investments in high-performance AI chips from companies such as NVIDIA and AMD and in data center operators such as HIVE Blockchain Technologies. According to projections by Bloomberg Intelligence, AI server spending could account for nearly 30% of total workload expenditures by 2032, a significant increase from approximately 15% in 2022.

Generative AI Could Be a $4 Trillion to $7 Trillion Industry

But what can generative AI be used for in the “real world”? McKinsey & Co. found 63 such AI uses across 16 business functions, and if applied, they could create between $2.6 and $4.4 trillion in economic benefits on an annual basis. This would add 15% to 40% to the current $11 to $17.7 trillion potential value from non-generative AI and analytics.

Goldman Sachs’s projections are even more optimistic. According to the bank, advancements in generative AI could significantly impact the world economy, leading to a 7% rise in global GDP (equivalent to nearly $7 trillion) and a 1.5% increase in productivity growth over a decade.

As one such use case, Amazon Web Services (AWS) just this week announced the launch of the AWS Generative AI Innovation Center, a $100 million initiative aimed at helping customers develop and implement generative AI solutions. This move forms part of the company’s broader strategy to expand the accessibility of generative AI to customers and partners worldwide.

People Adopting New Technology at a Faster Pace

Some readers might understandably feel bewildered by all of this, but it’s worth remembering that technological cycles have emerged every 10-15 years. Web3, AI and digital assets are no exception.

Granted, widespread adoption of Web3, AI and assets such as Bitcoin won’t be easy. The primary roadblock is likely user experience. The process of setting up crypto wallets, for instance, can be complex and demanding, and standard web browsers may not even support Web3 without additional plug-ins.

To encourage mass adoption, Web3 needs to provide a user-friendly interface comparable to the shift from Web1 to the current, more interactive version of the internet. This transition could be led by major tech companies like Meta, which understand the potential benefits of simplifying Web3 for everyday users.

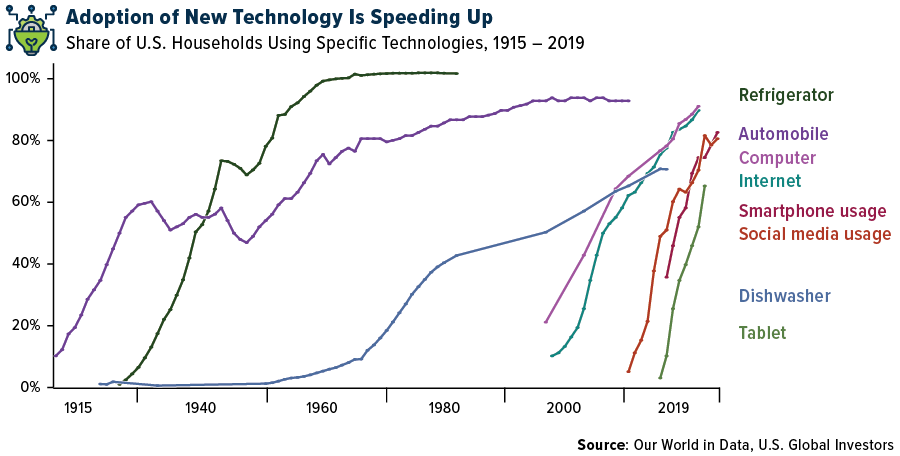

The good news is that people appear to be getting better at adopting new technologies. A 2013 study from MIT’s Technology Review confirms this trend. It took telephones half a century to become commonplace in American homes, for instance, whereas smartphones reached 40% penetration in just 10 years.

Similarly, I expect things to move fast when it comes to the digital transformation. A survey conducted last summer found that 75% of retailers planned to accept digital currencies as payment within the next two years. Blockchain technology, the backbone of Web3, is anticipated to usher in a new digital era, with a potential global user base of 1 billion by 2031, according to Andreessen Horowitz. (For comparison’s sake, the internet reached 1 billion users in 2005.)

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 1.67%. The S&P 500 Stock Index fell 1.37%, while the Nasdaq Composite fell 1.44%. The Russell 2000 small capitalization index lost 2.90% this week.

- The Hang Seng Composite lost 6.09% this week; while Taiwan was down 0.77% and the KOSPI fell 2.12%.

- The 10-year Treasury bond yield fell 3 basis points to 3.735%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Cathay Pacific up 8.9%. According to JPMorgan, U.S. airlines have taken off over the past month, with five of the bank’s nine covered U.S. airlines notching double-digit returns over the past 30 trading days. The looming recession narrative remains, but data checks continue to point to a healthy consumer that has shifted spend to “services” (travel/leisure) over “goods” (apparel).

- The Port of LA has not seen congestion over the last four to five months in vessel wait times or on dock takeaway (rail/truck), according to the port’s marketing manager. While labor had slight hiccups, delays did not last more than a day or two around those events. Truck dwell time is just under three-and-a-half days (versus historical average of three days) while rail dwell times are below four days on average (it targets three days).

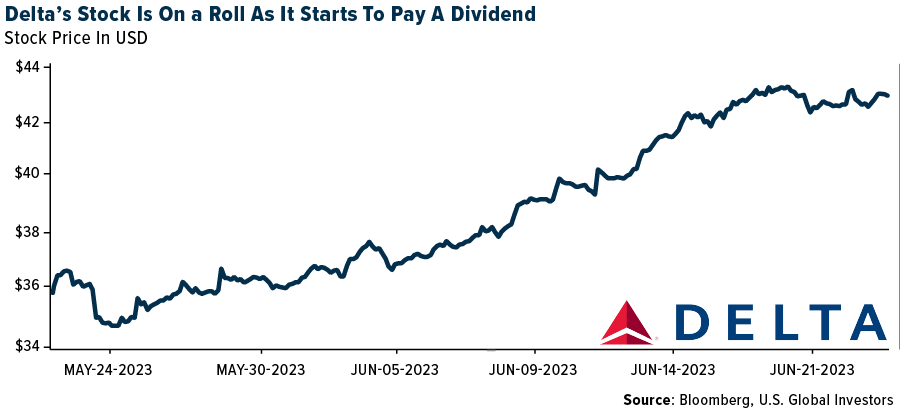

- Last week, Delta Air Lines’ Board of Directors declared a quarterly dividend of $0.10 per share. This announcement comes more than three years after Delta suspended the program in March 2020, and according to management, “reflects Delta’s progress on its three-year financial plan.” This marks a significant milestone for the company as well as the industry (Delta was the second airline to reinstate its dividend, with Southwest Airlines being the first).

Weaknesses

- The worst performing airline stock for the week was Wizz Air, down 10.6%. Web traffic declined 5% year-over-year for the week, compared to a 5% year-over-year decline in the trailing four-week period. Four percentage points of year-over-year web traffic decline is from Southwest Airlines, likely due to the 40% off sale occurring several days later this year.

- Global newbuild orders in May came in at 2.4 million tons, down 21% month-over-month, and 28% year-over-year, showing weak order flows, especially LNGCs, while bulk, LPG, and tankers grew from last year’s low base. Korean shipbuilders took 23% market share in May, mostly containerships (LNG-fueled), while Chinese shipbuilders took a 62% share, mostly tankers and bulk carriers.

- Delta reduced November capacity by 150 basis points (bps), with cuts coming from domestic flying. Delta also added 280bps of capacity on Latin American flying in November. JetBlue reduced September and October capacity by 370bps and 140bps, respectively. The reductions include fewer flights to London, in what is an effort to free up long-range A321 aircraft for new service to Paris and Amsterdam.

Opportunities

- RBC estimates that Airbus will account for 60% of industry 2023-2026 narrowbody deliveries. Moreover, the group estimates that the A320 family program margins will benefit from mix, and the analysis indicates that the A320 family will account for over 90% of 2025 Airbus commercial segment earnings, or €7.7B in 2025, up from €4.8B in 2022.

- The Port of LA sees 8% of its 30% year-to-date volume decline due to share loss to East Coast ports. It believes it can recapture 5% volumes (60% of lost share) following the tentative agreement between the International Longshoremen & Warehousing Union (ILWU) and the Pacific Maritime Authority (PMA) after a 13-month negotiation. This contrasts with East Coast Port of Savannah’s view of only 1%-2% of volume repatriation historically after West Coast labor deals given its better service.

- Air France-KLM said late Monday that it might buy back up to 5% of its share capital under a program that was authorized by shareholders earlier this month, amounting for up to 514 million euros ($561.5 million). The Franco-Dutch airline group said it might repurchase up to 128.5 million shares at a maximum price of EUR4 each. The buyback program is expected to run for 18 months from the company’s shareholder meeting held June 7, Air France-KLM said.

Threats

- According to Morgan Stanley, Singapore Air’s shares are up 43% year-to-date, with the current market cap and EV up 120% and 50%, respectively, above pre-pandemic levels. On its fiscal year 2024 EBITDA forecast of S$4.5 billion, the stock is at 6.5x EV/EBITDA, versus peers at 5.2x and its own historical average (pre-Covid) of 5x.

- The Air Line Pilots Association approved a tentative contract between FedEx and pilots. Following the announcement of a preliminary agreement two weeks ago, union leaders have approved a tentative contract and rank-and-file will begin a three-week period to vote on ratification. The new agreement includes a 30% pay raise, improved pension benefits, retroactive pension payments, and other quality-of-life improvements. The ALPA announced this was the “largest investment in a pilot contract, on a per-capita basis, and that it substantially raises the bar on pilot retirement.”

- Air France-KLM says the advantages rival Turkish Airlines has over its European counterparts are making competition tougher at a time when Russia’s invasion of Ukraine poses a challenge for carriers emerging from the pandemic. “We are not on an equal footing, and it is a challenge,” Air France-KLM CEO Ben Smith said at Paris Air Forum. “We are facing a competitor that has advantages that we don’t have, that has support from the Turkish government, with access to certain airports, certain flexibility, different cost levels, interest rates which are lower compared to those practiced in Europe.”

Luxury Goods and International Markets

Strengths

- Car sales in Europe are improving, with sales rising 18.2% in May, to 1.12 million vehicles. German carmaker Volkswagen Group accounted for 243,000 new registrations, representing a 19.5% rise over last May. Amsterdam-based Stellantis sold 170,300 cars (around 300 fewer than May 2022). Renault, the French car maker, had registrations jump 36% to 104,100. Germany’s BMW Group accounted for around 70,500 registrations, a 34% rise. Mercedes-Benz sold 6.6% more units than last May, with 47,600 registrations.

- Recently, the Eurozone (EU) fell into a technical recession due to the EU reporting gross domestic product (GDP) contraction in two consecutive quarters. However, at the beginning of this week, the EU surprised the market by releasing stronger-than-expected cited economic data. Construction output in April declined by 0.4% month-over-month, while a deeper correction of -2.4% was expected. The consumer confidence index remains in negative territory, but it is climbing higher after reaching last year’s low from September of 28.7. It was reported at -16.1 while -17.0 was expected.

- Soul Auction Company was the best performing S&P Global Luxury stock over the past five days, gaining 8.3%. Seoul Auction surged as much as 10% on Thursday, the most since January 26, after a media report said the South-Korean art gallery operator’s founder is in talks with Sotheby’s on a possible sale.

Weaknesses

- In the United States, initial jobless claims for the week to June 17 were unchanged at 264,000, missing consensus for 260,000, while the prior week was revised up to 264,000 from 260,000. The four-week moving average increased 8.5K to 25.750, the highest since November 2021, FactSet reported.

- The preliminary June PMIs in Europe were reported this week below market expectations. EU Manufacturing PMI dropped to 43.6 while a higher reading of 44.8 was expected. Service PMI was released at 52.4 versus 54.5 expected. The Composite PMI corrected to 50.3 in June, down from 52.8 in May. France’s Manufacturing PMI and Service PMI both dropped below the 50 level and remain in contractionary territory.

- Faraday Future Intelligence (an electric vehicle maker), is the worst performing S&P Global Luxury stock over the past five days, losing 49.29%. Shares dropped as Faraday Future Intelligence Electric postponed once more the delivery date of its FF91 car to the end of August from the original date at the end of June.

Opportunities

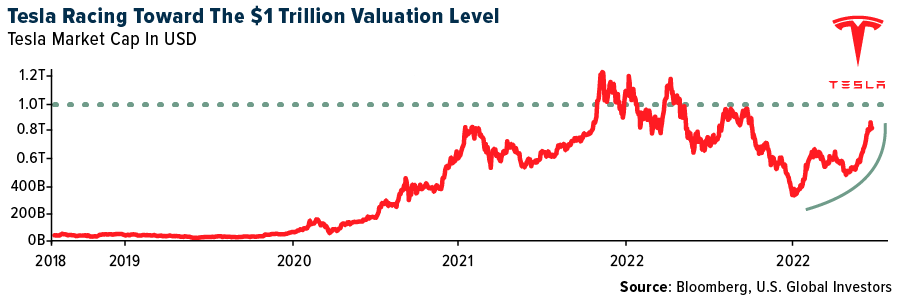

- Tesla’s shares have gained more than 100% year-to-date and the market capitalization of the company may once again hit the $ 1 trillion mark. Wall Steet remains undecided on the stock, with price targets ranging from $85 to $335, according to data collected by Bloomberg. On Friday, Tesla closed at $258 with a market capitalization of $818 billion.

- Dubai is a world-class luxury hub and is in a strong construction cycle where real estate is booming. In fact, Dubai’s Island of Palm of Jumeirah is getting its tallest building yet. The new housing complex there will add more than 1,700 homes. Once fully developed, the 71-story building complex will have 76 penthouses with a price tag of $5.7 million for the cheapest unit.

- Global travel numbers could return to pre-pandemic levels (1.47 billion in 2019) this year after tourists doubled in the first quarter and bookings continue to accelerate in the second quarter. Back in 2019, China had 170 million outbound travelers which dropped to just below 9 million by 2022, Bloomberg reported. China’s tourism will continue to rebound with the country reopening its borders in January. Chinese travelers returning to the market this year should benefit the luxury goods market and global travel retailers.

Threats

- The ongoing lawsuit filed by the Federal Trade Commission (FTC) against Amazon presents a notable threat to the company’s market position and financial performance. The lawsuit alleges that Amazon misled consumers and made it difficult for them to cancel their Prime memberships. If the allegations prove true, it could result in reputational damage, regulatory penalties, and potential changes to Amazon’s business practices, which may impact its revenue streams and overall competitiveness in the market.

- On Friday, the Eurozone and the United States reported weaker-than-expected preliminary PMI data for June. China will release its June Manufacturing PMI next week, and most likely it will remain in contractionary territory, below the 50 level, indicating an economic slowdown.

- Fed Chairman Powell said Friday that it will be appropriate to raise rates again this year, and perhaps twice, while the Fed is still committed to bringing inflation down to 2%. The odds of a July 25 basis point hike rose to 76%.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising 6.57%, perhaps responding to the stronger-than-expected housing starts data. According to UBS, the Platts spodumene price ticked up 13% to $3,500 per ton over the weekend. UBS forecasts that by September the chemical spodumene price should be $3,870 per ton.

- Integrated steel producer U.S. Steel has increased base pricing for all new flat-rolled spot orders by $50 per ton, the company said in a letter. The increase is effective immediately. This marks the first increase from a major U.S. steelmaker since March 13, when prices were set at a minimum of $1,200 per ton by Cleveland-Cliffs.

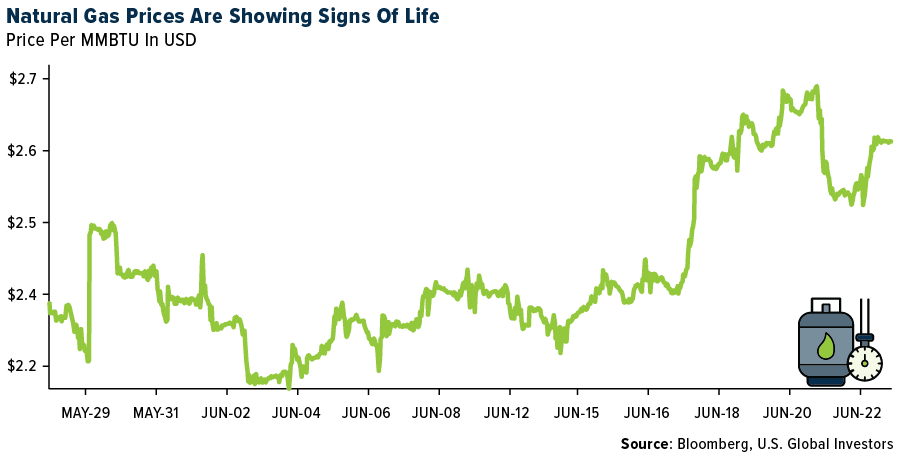

- U.S. natural gas is getting much more topical with investors as of late as lower U.S. supply and warmer weather in the U.S and Europe have breathed life into a previously “sleepy” natural gas market. Henry Hub prices gained 15% last week and are up 21% since the recent lows on June 1. Admittedly, prices are still down 55% for the year, but the market seems to have turned a corner.

Weaknesses

- The worst performing commodity for the week was coffee, dropping 8.80%, as Brazil’s harvest of arabica coffee beans is expected to improve by 6.1%. According to Baker Hughes, the U.S. rig count decreased to 687 this week. Unconventional gas rigs drove the small weekly decline, falling to 117 due to declines in the Marcellus to 33 and the Eagle Ford to 1, offsetting a small increase in the Utica to 11.

- Following strong production in April, global LNG production fell to 370 million tons in May 2023 reflecting lower prices. Output was 10% lower than the previous month and broadly flat on the prior comparable period. On average, export facilities operated at a utilization rate of 80% versus the long-run average of 83%. Softer global output was mainly attributed to plants in the Middle East, with lower exports from both Qatar LNG and Oman LNG, although production from plants in all regions was weaker than the previous month.

- Global crude steel production declined by 3.5% month-over-month day-adjusted and 5.1% year-over-year. The world’s largest producer, China, saw output decline by ~6% month-over-month, and 7.3% year-over-year, likely due to a combination of output curbs and weak margins. Nonetheless, more recent data points around China production were more mixed with the CISA production survey for early June pointing to a daily output of 2.23mt, up 6.5% versus late-May.

Opportunities

- Canadian wildfires and curtailments in Western Canada have led to an increased risk of supply. FastMarkets RISI reported that West Fraser is curtailing operations in the second half of June at almost all its BC sawmills. They estimate the potential impact to be 30-35mmbf. Lumber prices could continue to move higher in the coming weeks. The big unknown is the wildfire season in Canada. A challenging fire season could create short-term production disruption and put upward pressure on prices.

- An article on Bloomberg today states that “Barrick made overtures to First Quantum in the last few months as part of its search for ways to expand in copper.” Discussions amongst mining companies to search for value creating opportunities are common practice, but very few culminate in formal M&A offers. Nonetheless, with Rio Tinto in December buying Turquoise Hill, BHP buying Oz Minerals this spring, Glencore making an offer in February to acquire Teck, Hudbay acquiring Copper Mountain this month, and now commentary that Barrick has approached First Quantum, the hunt for copper is clearly underway.

- Iron ore is up 20% since the end of May and back to $115 per ton, as anticipation for China policy support announcements have moved into focus, specifically new measures that could touch the property sector (30% of China steel demand).

Threats

- According to Bank of America, labor politicians have previously called for the UK’s tax policy to align to Norway’s. That would add three points to take the total tax rate to 78% and leave it a permanent feature. Investment allowances in the UK would also cease under an alignment scenario. The bank sees direct comparisons with Norway’s successful industry as awkward given: 1) Norway’s long-standing fiscal stability across a variety of party-political regimes; 2) geological advantages; and 3) a more consolidated industry in Norway with operators of superior financial standing.

- Jefferies analysts, led by Christpher LaFemina, wrote this week that the China driven super cycles of the past in commodities are over. They expect demand to be driven by the U.S. and Europe. More specifically, the expansion driven by urbanization and industrialization is over. Their team points to growth being driven in China more so by the energy transition and decarbonization. There may well be significant demand from these sectors to address those goals.

- Canaccord believes the interpretation of Reasonable Prospects for Eventual Economic Extraction (RPEEE) is under review; specifically with respect to ‘Reasonable’ and ‘Eventual’. Focusing on ‘eventual economic extraction’, it is their understanding that the updated JORC code may require more rigor around commodity price assumptions to enable a deposit to be economically mined. There is potential for the requirement of resources to be reported within an optimized pit shell or stope using reasonable commodity price assumptions as well as geotechnical, mining width, and dilution considerations.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was PEPE, up 72.49%.

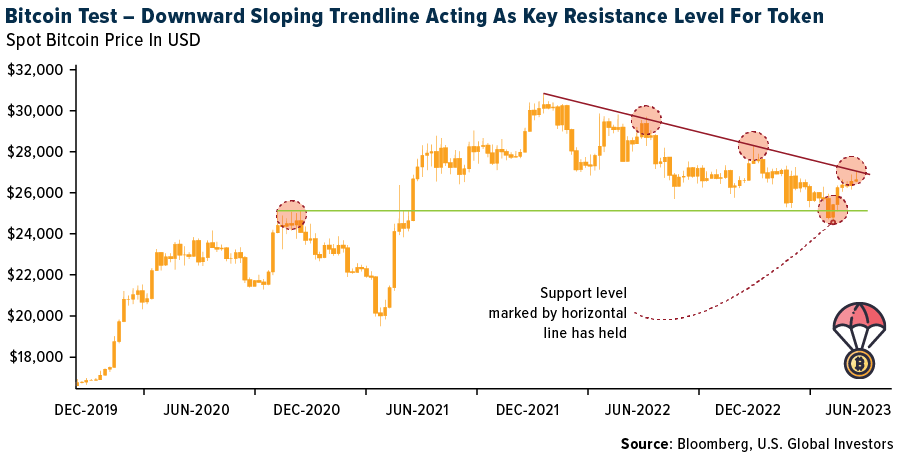

- Bitcoin’s boost from Blackrock’s ETF filing struggled to hold the $27,000 level on Tuesday. The company filed for a Bitcoin ETF on June 15, but so far, the SEC has resisted allowing spot funds, writes Bloomberg.

- Bitcoin climbed to the highest level since early May this week, writes Bloomberg, buoyed by crypto initiatives involving major players from the traditional financial sector.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was BitTorrent, down 10.39%.

- Bitcoin miners in Texas curbed operations, crimping power usage, as a heat wave drove electricity prices sky-high on Tuesday, reports Bloomberg, threatening to cripple the grid in the second largest U.S. state.

- The digital-asset firm BitGo Holdings has dropped plans to acquire the parent company of Prime Trust, reports Bloomberg, which served as the crypto custodian for the beleaguered Binance.US trading platform.

Opportunities

- Singapore’s central bank has proposed a common protocol to specify conditions for the usage of digital currencies as financial institutions trial the use of purpose-bound money in the city-state, writes Bloomberg.

- MakerDAO, one of the original decentralized-finance protocols that was set up to challenge the legacy banking system, purchased $700 million of short-term U.S. treasuries. This is its second purchase in eight months as part of a plan to diversify away from often volatile digital assets, writes Bloomberg.

- Sportswear maker Puma and pro basketball player LaMelo Ball, together with fashion line Gutter Cat Gang, are launching a collection of non-fungible token (NFT) sneakers called “GutterMelo MB.03,” writes Bloomberg.

Threats

- Terraform Labs co-founder Do Kwon, the entrepreneur who’s sought by the U.S. and South Korea on fraud charges, was sentenced to four months in prison by a Montenegrin court, writes Bloomberg, for attempting to travel with a forged passport.

- Binance has hired a former prosecutor at the Department of Justice to represent the firm in the SEC lawsuit, reports Bloomberg. M. Kendall Day will appear in the SEC case as counsel for Binance, the filing explains.

- Cryptocurrency platform Atomic Wallet’s weak cybersecurity failed to prevent North Korean hackers from stealing over $100 million in user funds, according to a proposed class action filed in Colorado federal court, writes Bloomberg.

Gold Market

This week gold futures closed the week at $1,929.70, down $41.50 per ounce, or 2.11%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 5.02%. The S&P/TSX Venture Index came in off 2.46%. The U.S. Trade-Weighted Dollar rose 0.62%.

Strengths

- The best performing precious metal for the week was gold, but still down 2.11%. Despite a “brutal week” for gold, it managed to find support by Friday, indicating a possible floor for the price. Swiss gold exports surged, particularly the shipments to India. This indicates strong demand for gold in India, one of the world’s largest consumers of the metal. The rise in exports to Turkey and Hong Kong further suggests increasing global demand for gold.

- Glencore’s recent investment in Stillwater provides funds for exploration and development of its nickel projects, particularly the Stillwater West project in Montana. The project is expected to become a large-scale source of battery and precious minerals that are critical in the U.S. and other markets. This investment signifies confidence in the potential growth of the critical minerals sector.

- Gold traders have a close eye on Tokyo these days. The likelihood of Japan intervening to arrest the yen’s slump seems to be ticking higher and should the authorities wade in, the precious metal would be a winner. The playbook was in action last October. When Japan loaded up on yen, gold spiked by 1.8%, although that initial gain failed to stick in the days that followed. Bullion’s rally got

underway in earnest from November, when USD/JPY accelerated on the downside helping to spread dollar weakness.

Weaknesses

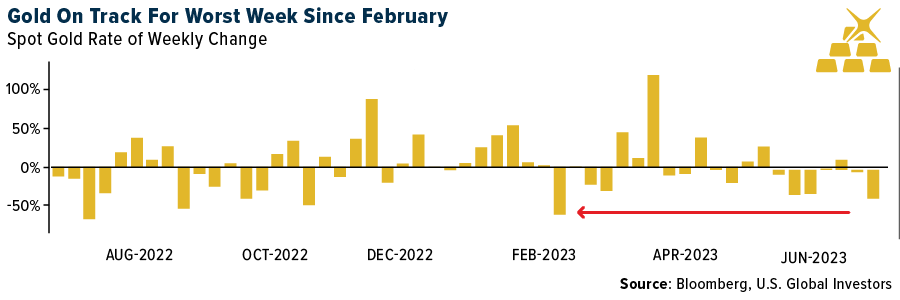

- The worst performing precious metal for the week was palladium, down 9.65%, and could extend its near 30% drop this year as the auto industry rapidly shifts to EVs. SP Angel analyst John Meyer noted that global EV sales are expected to reach 15 million vehicles this year, potentially displacing 1.5 million to 2.25 million ounces of demand. Gold headed for its biggest weekly loss since early February, reports Bloomberg, after major central banks signaled they’d need to stay hawkish for longer to bring down inflation.

- A surge in gold purchases by Chinese residents, driven by pent-up demand after three years of pandemic restrictions and optimism that the economy would quickly rebound, is starting to slow — yet another sign that the recovery is losing momentum. China vies with India as the world’s biggest consumer of gold bars, coins, and jewelry. The rapid expansion in retail sales of gold and silver jewelry looks to have topped out, rising 24% year-on-year in May to 26.6 billion yuan ($3.7 billion). That is slower than the 44% and 37% growth recorded in the previous two months.

- Anglo American Plc’s De Beers sold a provisional $450 million of rough stones in its fifth sale of 2023, compared with $479 million at the prior sale and $657 million a year earlier. “Following the JCK Show, and with ongoing global macroeconomic challenges continuing to impact end-client sentiment, the diamond industry remains cautious heading into summer,” said De Beers CEO Al Cook.

Opportunites

- According to Bank of America, looking at monthly gold price returns over the past 52 years, January stands out for its strong average return of 1.95%, with the price up 54% of the time. There are three other months with average monthly gold price returns in-excess of the 52-year average monthly return of +0.78%. These are December (+1.37%), September (+1.34%), and August (+1.18%), with the price up 56%, 54% and 58% of the time, respectively. The remaining months all have average returns below the 52-year average monthly return.

- Bank of America notes that holding gold for December and January improves the average return to 3.32% with the price up 60% of the time. Holding gold from December to February further improves the average return to 4.12% with the price up 58% of the time. Meanwhile, holding gold through the summer months (July to September) has worked, but has been less rewarding with an average return of 3.10% and the price up 60% of the time. Gold has historically appreciated in summer ahead of strong Indian demand in October/November.

- For a company with “gold” in its name, Barrick Gold Corp. has become noticeably fixated on copper. The world’s second-largest bullion producer recently approached First Quantum Minerals Ltd. to discuss a potential takeover, Bloomberg reported last week. And while the move was unsuccessful — Barrick’s informal overtures were rebuffed — its interest in buying a $17 billion copper miner provides the starkest evidence yet of a shifting focus at the company whose origins lie in Nevada’s gold veins.

Threats

- According to Scotia, SilverCrest reported that the updated technical report for its Las Chispas mine in Mexico is now expected to be released in July 2023 (previously expected by the end of the second quarter 2023). Scotia expects the updated study to incorporate industry-wide inflationary pressures and as such, it incorporates 40% higher capex and 30% higher AISC in the estimates along with added 8% dilution.

- BlackRock’s surprise filing for a U.S. spot Bitcoin ETF has triggered a flurry of similar applications from rival issuers. The filing by the world’s largest asset manager suggests that there may be key insights or changing dynamics in the regulatory environment that could lead to the approval of a physically backed Bitcoin ETF. If approved, such a product would offer investors a more accessible and regulated way to invest in Bitcoin, potentially diverting funds away from gold.

- A new gold venture between the Democratic Republic of Congo and an Abu Dhabi-based company must do more to ensure it does not launder metal linked to armed conflict, a United Nations group of experts said. Congo and the UAE’s Primera Group Ltd. launched Primera Gold DRC in January to combat smuggling, according to the government. The venture has not adhered to national and international standards that require companies to ensure their gold purchases haven’t supported violence, the UN experts said in a report published this week.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2023):

Delta Air Lines

Southwest Airlines

JetBlue Airways Corp

Airbus SE

Air France-KLM

Singapore Airlines Ltd.

FedEx Corp

Volkswagen Group

BMW

Mercedes-Benz

Tesla

Apple Inc.

Sibanye Stillwater

Newcrest Mining

First Quantum Minerals

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.