European Defense Stocks Go Parabolic as War Spending Surges

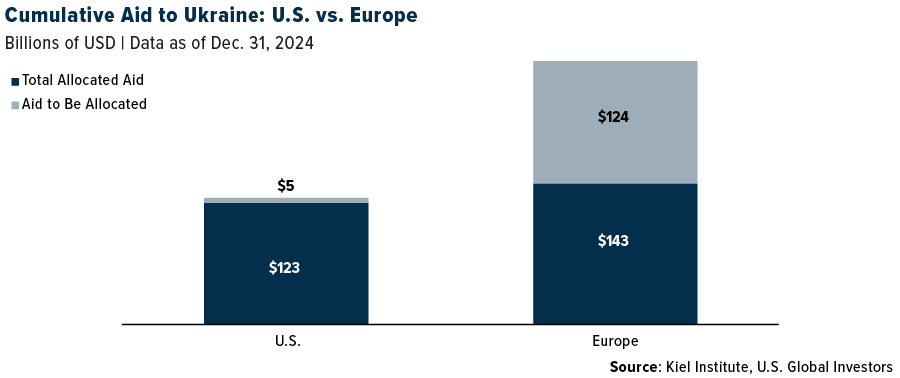

The U.S. has poured more than $120 billion into Ukraine since its war with Russia began three years ago, but with a new administration in Washington, that support is grinding to a halt.

The White House announced this week that further military aid will be paused until President Donald Trump can determine that Ukrainian President Volodymyr Zelenskyy is making a “good faith” effort toward peace negotiations with Russia.

This decision has left Ukraine in a precarious position. Without additional U.S. support, Western officials estimate that the Eastern European country has enough weaponry to sustain its current pace of fighting until mid-2025.

In response, European leaders are taking decisive action, launching an unprecedented military spending spree that is already reshaping global markets.

Germany Takes the Lead in Ramping Up Military Spending

Germany, Europe’s largest economy, is leading the charge, with Chancellor-in-waiting Friedrich Merz vowing that his government will do “whatever it takes” to support Ukraine. He’s even pledged to amend the German constitution to exempt defense spending from the country’s strict fiscal constraints.

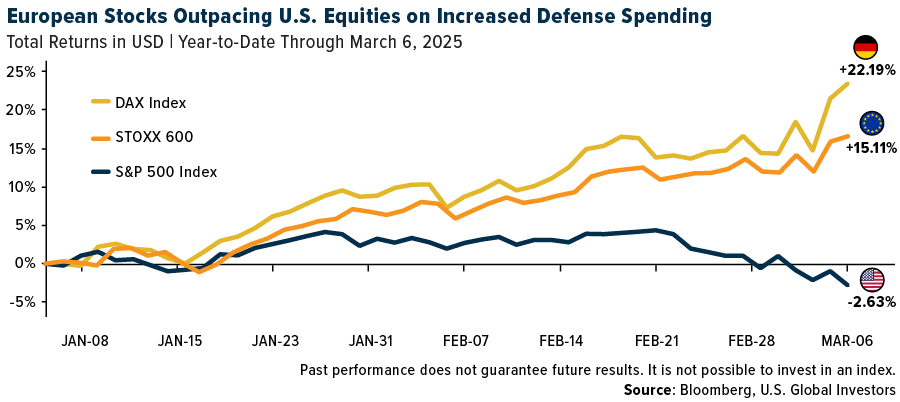

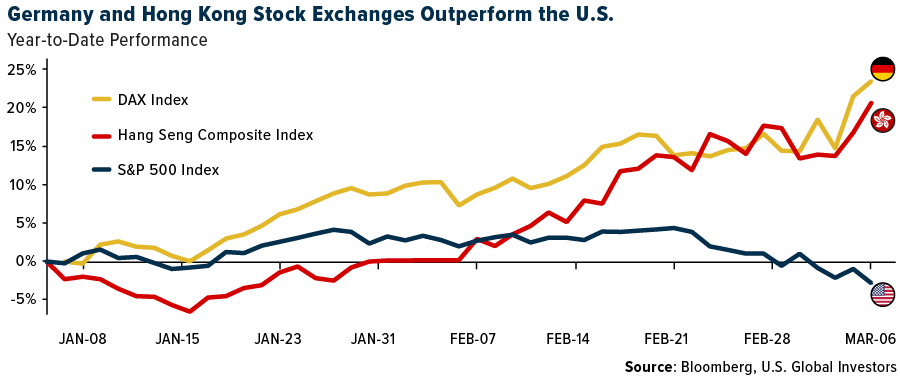

The markets have responded positively. German equities are rallying, with the DAX Index up more than 22% so far this year, compared to a loss of over 2% for the S&P 500.

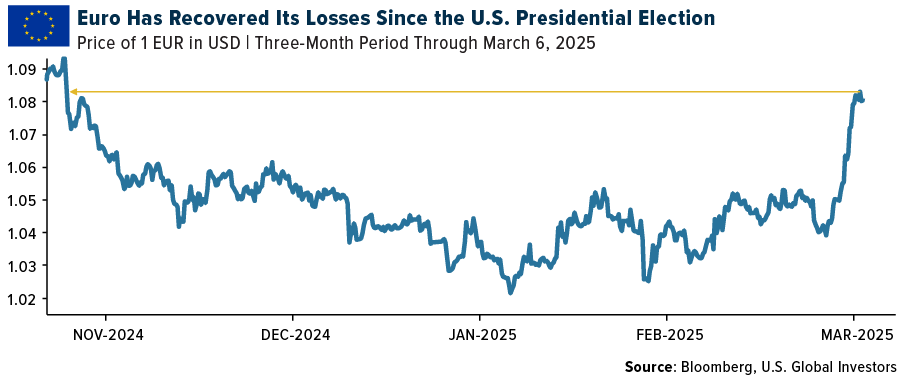

The euro has also rebounded from recent lows, erasing its losses since November’s U.S. presidential election.

EU Unveils $840 Billion Plan to Strengthen Defense

Other European nations are making similar moves. France’s President Emmanuel Macron delivered a stark warning in a televised address on Wednesday, declaring that Europe must be prepared to defend Ukraine without U.S. support. He made it clear that abandoning Ukraine now would only embolden Moscow, stating, “Who can believe that… Russia will stop at Ukraine? Russia has become, and will remain, a threat to France and Europe.”

The Czech government, meanwhile, has announced plans to raise its defense budget to 3% of GDP by 2030, up from its current 2%.

Brussels has responded with an unprecedented $840 billion plan to boost military readiness across the continent. This week, the European Commission laid out a framework to mobilize resources on a scale never seen before.

The bulk of this money will reportedly come from direct national spending, as European Union (EU) leaders have agreed to temporarily lift fiscal rules that limit government deficits. Additional funds will be made available in the form of loans to governments looking to modernize their defense industries.

An analysis by European research firms Bruegel and Kiel estimates that for Europe to establish a truly independent military deterrent against Russia, it will require at least 250 billion euros in annual defense spending. That means deploying tens of thousands of additional soldiers, acquiring thousands of new tanks and infantry fighting vehicles and ramping up production of long-range drones and other advanced military technologies.

European Arms Manufacturers See Record Gains

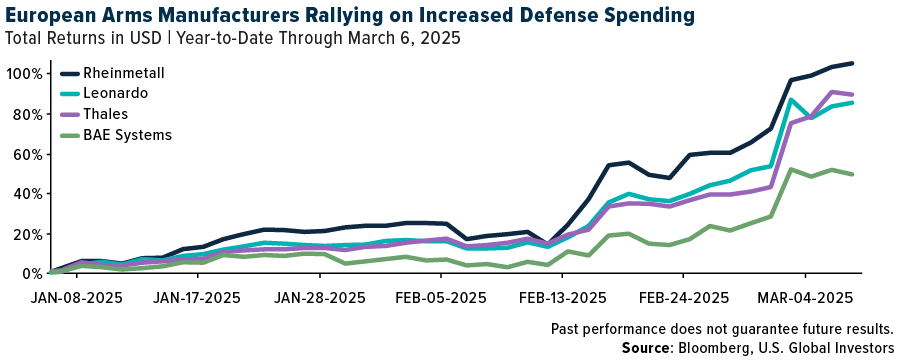

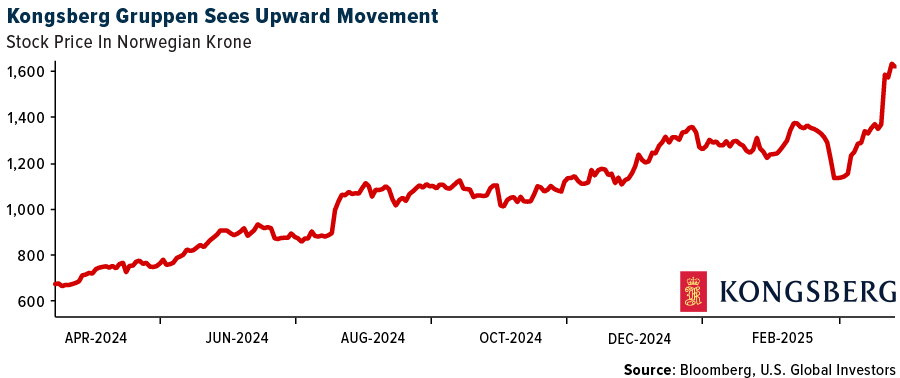

This wave of spending has fueled a blistering rally in European defense stocks as investors bet on long-term demand for military hardware.

Defense companies have been among the best-performing stocks in global markets this year. Italy’s Leonardo and France’s Thales have seen their shares jump 85%, while Britain’s BAE Systems has climbed close to 50%. Germany’s Rheinmetall, a leading supplier of armored vehicles and artillery systems, more than doubled in value as of Thursday but fell on Friday on news that Russian President Vladimir Putin may be ready to agree to a truce.

Russia’s Military Losses Mount

Europe’s military buildup comes at a time when Russia’s ability to stay in the fight is increasingly being questioned. While it still holds a strategic advantage in nuclear capabilities—Russia has an estimated 5,580 nuclear warheads, the most of any other country—its conventional forces have suffered immense losses.

Russia’s $2 trillion economy is dwarfed by the EU’s GDP, estimated at $20 trillion, and its population of roughly 145 million is significantly outnumbered by the EU’s 450 million. Hundreds of thousands of Russians have left the country since 2022, the largest exodus since the Bolshevik Revolution, further straining the country’s labor force.

On the battlefield, Russia is estimated to have lost over 875,000 soldiers, according to the U.K.’s Ministry of Defence. These losses, coupled with Western sanctions, have made Russia’s long-term military position more vulnerable than it might appear.

China Expands Defense Budget as Pacific Tensions Rise

The arms race is not confined to the West. China has announced a 7.2% increase in military spending this year as it continues its efforts to expand its influence in the Pacific.

Taiwan is under increasing pressure to boost its defense budget to deter a potential invasion from Beijing. Japan, too, has been urged to increase its military spending, though its leaders insist they will not allow foreign governments to dictate their defense budget.

Investors Are Taking Notice

With Washington shifting its focus inward, the post-World War II security order is changing, and Europe must now take greater responsibility for its own defense.

The consequences of this are already playing out in financial markets, as I’ve covered. For investors, I believe this is not just a short-term trend but a transformation of the global defense landscape. As history has shown, when nations prioritize military spending, the market follows.

How much is the world spending on defense? Find out here!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.37%. The S&P 500 Stock Index fell 3.28%, while the Nasdaq Composite fell 3.45%. The Russell 2000 small capitalization index lost 3.91% this week.

- The Hang Seng Composite gained 5.53% this week; while Taiwan was down 2.07% and the KOSPI rose 1.21%.

- The 10-year Treasury bond yield rose 9 basis points to 4.304%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Air France, up 37.0%. According to Raymond James, Frontier demand commentary was upbeat, citing healthy travel demand for spring into summer. As the network matures, Frontier has reiterated its double-digit pretax margin target by summer.

- UBS believes Gaza ceasefire bottlenecks suggest a low probability of a resumption of transit via the Red Sea over the next few months. The group assumes the redirection of vessels via the Cape of Good Hope reduces effective capacity by 7% of the total global fleet. UBS believes this represents the main reason rates are currently higher than pre-Covid levels.

- Air France reported fourth quarter EBIT of €396MM, a beat of 150% versus company consensus EBIT of €160MM, according to JP Morgan. This was driven by stronger passenger pricing, especially Transatlantic and cargo. The outlook for 2025 also appears very promising: 1) 2025 EBIT is expected to improve by at least €300MM, net of Schiphol and French aviation tax headwinds, 2) 2025 ex-fuel costs expected up low single digit percentages.

Weaknesses

- The worst performing airline stock for the week was Allegiant Travel, down 17.1%. According to Bank of America, Chinese domestic air travel spending declined by 21% year-over-year in February 2025 due to soft demand in post-New Year slack period. Domestic traffic declined by 3% year-over-year and yields were almost 20% down year-over-year as airlines prioritized improving seat loads.

- Crude tanker demand declined 2.2% year-over-year in February 2025, reports Bank of America, with both Chinese imports and U.S. exports weaker. Pricing forward curves suggest muted profits for the first half of 2025 before a seasonal slide to P&L losses in the third quarter.

- According to RBC, in February, CATSA (The Canadian Air Transport Security Authority) reported a total of 4.74MM passengers, or a daily average of 169,000 passengers, through Canada’s 17 largest airports, down 4.4% month-over-month and up 1.2% year-over-year.

Opportunities

- UBS notes that United Airlines has the most sophisticated pricing tools due to greater investments in this area under its management team. Delta Air Lines and American Airlines come second while Southwest has historically underinvested in this area. LCCs tend to have more basic revenue management tools.

- U.S. container imports in February 2025 stayed strong, up 12.4% year-over-year on pre-shipping, reports Bank of America. However, tariffs are arriving earlier than expected with more to possibly come in April, and they remain wary of the shock to world trade once tariffs are fully implemented.

- According to JP Morgan, American Airlines triggered its proprietary D3030 trading rule, shedding 30% of its value in fewer than 30 days, before recouping some of its losses by the close. This level of speed and severity has, in the past, overwhelmingly been followed by significant potential upside over the next 180 trading days.

Threats

- With continued headlines about Canadians canceling U.S. vacations due to tariff tensions, airlines continue to adjust schedules, explains Bank of America. WestJet cut 130/40 basis points (bps) out of the transborder market in April/May while Air Canada’s cuts were deeper at 290/330bps in May/June.

- Clarkson’s is indicating car carrier fees could be under pressure. First would be the normalization of traffic through the Suez Canal (currently only 1-3 auto carriers per week are going through the Canal, and if traffic were to normalize, this would mean a 6-7% increase in supply capacity, i.e. easing pressure). Second is that if tariffs were to be raised further, this would have a negative effect on demand, (though Japan’s Big 3 shippers are increasing exposure to medium-term contracts in its car carrier operations).

- According to Raymond James, Delta is tracking toward the lower half of the first quarter 2025 earnings per share (EPS) guide given a loss of domestic corporate momentum in February, likely reflecting a slowdown in government travel (<1% of traffic), challenging weather, and temporary booking headwinds from the Endeavor/PSA crashes. Conversely, demand over Spring Break appears to be strong along with a favorable industry capacity backdrop.

Luxury Goods and International Markets

Strengths

- Prada posted another set of strong financial results. Net revenue reached 4.7 billion euros, up 17% year-over-year. Miu Miu brand experienced exceptional growth in 2024, with sales growing 93% year-over-year. Prada is preparing to buy Italian luxury brand Versace for as much as 1.5 billion euros from Capri Holdings. It would allow Prada to create a larger Italian player to compete with global luxury groups such as LVMH and Kering.

- Car manufacturers outperformed this week. The White House announced a one-month exemption from new tariffs on auto imports from Canada and Mexico. This delay, until April 2, provides temporary relief to automakers concerned about potential increased costs.

- Chow Tai Fook Jewellery Group, a jewelry retialer , was the top-performing stock in the S&P Global Luxury Index, with a 20.45% increase over the past five days. Yuanta Securities recently upgraded Chow Tai Fook Jewellery Group to Hold from Sell, with a price target of HK$7.20. Analysts expect earnings to increase by 42% over the next few years.

Weaknesses

- Eurozone retail sales unexpectedly declined 0.3% in January, defying forecasts of a 0.1% rise and marking the fourth consecutive month without growth. Sales volumes now sit 0.6% below the September peak, reflecting a concerning downward trend despite significant improvements in purchasing power.

- The Eurozone’s Manufacturing PMI remains in contractionary territory, with the final February index reported at 47.6. A reading above 50 indicates expansion, while a reading below 50 signals contraction. The final Services PMI was revised down to 50.6 from 50.7.

- RealReal, the online marketplace for secondhand luxury goods, was the worst-performing stock in the S&P Global Luxury Index, dropping 20.7%. The decline followed the company’s report of quarterly results and full-year guidance that fell short of estimates.

Opportunity

- At the recent National People’s Congress (NPC) meeting, China emphasized its focus on boosting consumption and improving living standards. Premier Li Qiang’s Government Work Report for 2025 outlined key initiatives aimed at stimulating consumption and enhancing people’s well-being, which are expected to increase consumer confidence and drive higher spending.

- Germany plans a massive economic stimulus, potentially reaching €1T over the next decade, by increasing borrowing for defense and infrastructure. This initiative marks a shift from fiscal conservatism, aiming to revitalize Europe’s largest economy and address infrastructure gaps, though challenges like geopolitical risks and structural issues remain.

- Goldman Sachs raised its 12-month target for the MSCI China Index and the CSI 300 Index, citing optimism surrounding AI advancements and the potential for a $200 billion inflow. Additionally, the firm has upgraded its growth forecast for Germany and the Eurozone, driven by a boost in military spending. It now expects Germany’s GDP to grow by 0.2% in 2025, an increase of 20 basis points, while the Eurozone’s growth forecast for the current year has been revised up by 0.1% to 0.8%.

Threats

- Senate Republicans have introduced legislation to eliminate the $7,500 federal tax credit for electric vehicles (EVs). Led by Senator John Barrasso, the proposed “Eliminating Lavish Incentives to Electric (ELITE) Vehicles Act” seeks to repeal the $7,500 credit for new EVs, the $4,000 credit for used EVs, and federal incentives for EV charging stations. Removing these incentives could slow EV adoption in the U.S., impacting Tesla and other automakers heavily invested in electric vehicles.

- JPMorgan analyst Chiara Battistini stated that it is “too early to turn constructive on Europe’s luxury goods sector, as growth is expected to remain challenging.” While American spending is likely to slow, the situation in China may improve, but it will take time to restore the spending habits of Chinese consumers.

- Global stock markets have experienced increased volatility since the new Trump administration took office in January 2025. Investors are grappling with uncertainty stemming from policy changes, particularly the implementation of tariffs on major trading partners such as Canada, Mexico, and China. As the administration continues to implement its agenda, including potential changes to regulations and government appointments, this volatility may persist throughout 2025.

Energy and Natural Resources

Strengths

- The best-performing commodity for the week was natural gas, rising 14.11%. European natural gas prices surged as President Donald Trump threatened large-scale sanctions on Russia to push for a ceasefire in Ukraine, raising concerns about energy supply and potential shifts in gas flows to Europe. The situation is compounded by Ukraine’s gas shortages, forcing it to rely on European markets, while speculation grows over the possible return of Russian gas amid geopolitical tensions and fluctuating market dynamic, Bloomberg reports.

- Ivanhoe Mines Executive Co-Chairman Robert Friedland and President & Chief Executive Officer Marna Cloete announced an update on year-to-date production at the Kamoa-Kakula Copper Complex in the Democratic Republic of the Congo (DRC) and the ultra-high-grade Kipushi zinc mine, also in the DRC. Kamoa-Kakula delivered near-record copper production in January of 45,477 tons and 40,849 tons during the shorter month of February. Daily copper production averaged over each month totaled 1,467 tons per day in January and 1,459 tons per day in February.

- According to Morgan Stanley, China cobalt hydroxide prices jumped 8% week-over-week to $6.20 per pound in response to the four-month ban on cobalt exports from the DRC, aiming to stabilize prices. In addition, the DRC’s administration has requested an urgent meeting with President Trump, detailing an offer to give the U.S. exclusive access to their critical minerals and ability to build infrastructure projects in exchange for security aid against Rwandan rebels, Bloomberg reports.

Weaknesses

- The worst-performing commodity for the week was lithium carbonate, dropping 4.71%. The lithium market is facing increased pressure as Rio Tinto finalizes its $6.7 billion acquisition of Arcadium Lithium, aiming to significantly expand lithium carbonate equivalent (LCE) production to over 200,000 tonnes per year by 2028. Further compounding the issue, Chile’s Supreme Court has cleared the Codelco-SQM deal to proceed, paving the way for increased lithium production in Chile. While increased production is generally viewed as positive, the timing is cause for concern amid existing oversupply issues, which may further depress lithium prices, squeezing margins for all producers, including Rio Tinto Lithium and SQM, Bloomberg reports.

- Iron ore slumped below $100 a ton for the first time since mid-January as some steel mills curbed production to ensure blue skies during the government’s upcoming policy meetings in Beijing, where overcapacity in the industry is also likely to be a topic for discussion, according to Bloomberg.

- Oil held losses after logging its worst weekly decline this year after Commerce Secretary Howard Lutnick said the Trump administration could walk back some tariffs on Mexico and Canada, injecting more uncertainty into global markets. West Texas Intermediate (WTI) crude traded below $67 a barrel after falling 3% over the past three sessions, while Brent traded briefly below $70, according to Bloomberg.

Opportunities

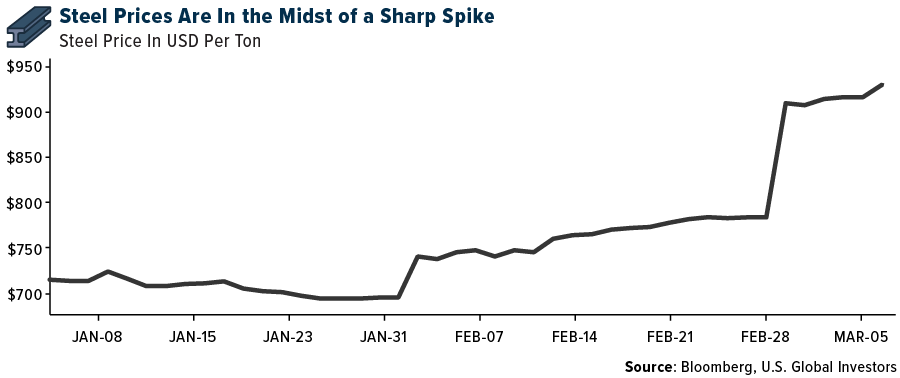

- According to CLSA, steel demand year-to-date is flat to incrementally negative versus 2024 seasonal demand profile. Steel production capacity cuts of 100 million tons are expected to be announced with implementation over 2025 and 2026.

- Lumber futures rose to the highest in more than two and a half years after Trump ordered an investigation into shipments of the commodity into the U.S. Trump on Saturday asked the Commerce Department to investigate the national security harm posed by lumber imports. Those shipments largely come from Canada, which is already facing the threat of 25% tariffs on its goods, according to Bloomberg.

- Global coal demand is experiencing a resurgence, driven by strong consumption in China, India and developing nations, alongside increased U.S. electricity needs for data centers. Despite declining investment in new production and a long-term shift toward renewables, limited supply and rising demand are expected to push coal prices higher in the near term, with Australian thermal coal contracts projected to reach $125 per ton by mid-2026.

Threats

- Shares of Sunnova Energy International plunged as much as 50% after the struggling solar company warned there’s substantial doubt it will remain in business. The Houston-based company said in a statement Monday that it does not have enough cash coming in to meet its obligations and is suspending guidance. “Substantial doubt exists regarding our ability to continue as a going concern for a period of at least one year,” Sunnova said in a statement Monday.

- According to Bloomberg, OPEC+ will proceed with plans to revive halted oil production after repeated delays amid pressure from Trump to lower oil prices. In a surprise move that sent crude tumbling, the group led by Saudi Arabia and Russia will go ahead with the increase of 138,000 barrels a day in April, according to a statement posted on the group’s website. It will be the first in a series of monthly hikes to revive production halted for more than two years, which will gradually restore a total of 2.2 million barrels a day by 2026.

- Ontario will slap a 25% export tax on the electricity it sends to 1.5 million homes in Minnesota, Michigan and New York in retaliation to Trump’s tariffs, said Doug Ford, Ontario’s leader. Ford added that he will direct the province’s energy producers to shut down the exports entirely if Trump moves ahead with even more tariffs on April 2, according to the Wall Street Journal. In addition, China’s demand for crude oil fell 5% in January and February, partially due to an overhang in supply where refining demand for has fallen due to the high penetration of electric vehicles (EVs) in China.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Cardano, rising 31.79%.

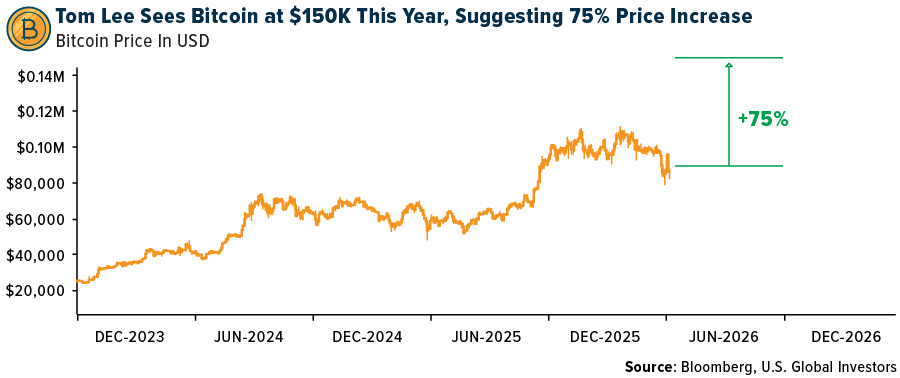

- Tom Lee, CIO of Fundstrat, recently spoke with CNBC, suggesting that the broader market may be nearing a bottom. Lee is predicting a market bottom this week and still sees Bitcoin closing the year at $150,000, Bloomberg reports, suggesting that Bitcoin will increase by 75% by the end of the year.

- Cryptocurrency industry elite are set to meet with U.S. President Donald Trump at the White House on Friday, writes Reuters, to discuss how the government will enact Trump’s vision of making the country the “crypto capital of the world.”

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Sonic, down 25.12%.

- One of the more dependable trading patterns in crypto appears to have become less reliable during the swift drawdown from the all-time highs reached amid the exuberance around the re-election of Donald Trump. In the past, smaller tokens referred to as altcoins tended to outperform Bitcoin toward the end of crypto rallies. That has changed this cycle with tokens like Solana and Dogecoin closely mirroring Bitcoin, according to Bloomberg.

- Singapore’s second Minister for Finance Chee Hong Tat said cryptocurrencies are highly speculative instruments that lack intrinsic value and do not fit the “long-term orientation” of the country’s investment entities. The minister was replying to a parliamentary question on whether there was utility in Singapore’s sovereign wealth funds holding cryptocurrency such as Bitcoin, writes Bloomberg.

Opportunities

- Flowdesk has secured $102 million in fresh funding to expand its digital asset trading and liquidity business, backed by HV capital and a debt facility from BlackRock-managed funds, Bloomberg reports. Flowdesk said it will use the proceeds of the round to scale its over-the-counter (OTC) derivatives business and launch a dedicated crypto credit desk while also doubling headcount at the trading firm.

- Nonfungible token creator Yuga Labs says the U.S. SEC has ended a years-long investigation into the company. Yuga Labs is the creator of the popular Bored Ape Yacht Club collection and operates the Crypto Punks franchise, explains Bloomberg.

- Chicago-based trading giant Jump is returning its U.S. cryptocurrency operations to full strength after scaling it back over the past couple of years due to regulatory scrutiny and uncertainty. Jump is looking to hire a clutch of crypto engineers and plans to start filing U.S. policy and governmental liaison roles in due course, according to Bloomberg.

Threats

- Investors withdrew $2.49 billion from crypto-focused exchange traded products during the past month, according to Bloomberg. That makes three consecutive weeks of outflows for ETFs that focus on the cryptocurrency industry.

- Trump’s strategic Bitcoin reserve plan, which relies solely on existing government-held Bitcoin and forfeited assets without new purchases, has surprisingly disappointed the crypto market, leading to a significant price drop. This development threatens Bitcoin’s bullish momentum by removing the anticipated government buying pressure and potentially signaling a lack of strong commitment to cryptocurrency adoption at the federal level.

- New research illustrates that Chris Larsen, co-founder of Ripple, suffered the theft of 283 million XRP, valued at $150 million at the time, due to compromised private keys stored in the LastPass password manager following its 2022 data breach. This incident underscores a critical threat to cryptocurrencies, as the lack of robust security measures for private key storage exposes even high-profile holders to significant financial losses and undermines trust in digital asset security.

Defense and Cybersecurity

Strengths

- Shares of European defense companies like BAE Systems, Kongsberg Grupp, Rheinmetall, Thales, and Leonardo surged significantly following the EU’s approval of a major rearmament plan. The growth is driven by expectations of substantial defense orders and strong government support, as confirmed by industry leaders.

- Taiwan Semiconductor announced plans to invest an additional $100 billion in U.S. chip manufacturing, including new plants in Arizona, bringing its total U.S. investment to $165 billion. Nvidia and Broadcom are testing Intel’s 18A manufacturing process, with AMD also evaluating it, potentially paving the way for significant manufacturing contracts for Intel.

- The best performing stock in the XAR ETF this week was Astronics Corp., rising 22.19%, after the company reported stronger-than-expected fourth-quarter sales and adjusted EBITDA, driven by a 12% increase in aerospace sales and improved margins, despite challenges in its Test Systems segment.

Weaknesses

- Nvidia announced a delay for the RTX 5070 graphics card from February to March, reportedly aligning with AMD’s RX 9070 series launch and to address potential hardware issues.

- Russian Foreign Minister Sergei Lavrov rejected any compromise allowing European troops to act as peacekeepers in Ukraine, accusing French President Emmanuel Macron of seeking to “fight Russia” and comparing him to Napoleon and Hitler.

- The worst performing stock in the XAR ETF this week was Intuitive Machines Inc., down 39.85%, after its Athena lunar lander ended its mission early by landing on its side 250 meters off target due to potential issues with navigation lasers, marking the company’s second consecutive setback.

Opportunities

- Lockheed Martin has unveiled the Common Multi-Mission Truck, an affordable cruise missile priced at around $150,000 with a range of over 500 miles, aimed at countering Chinese ambitions in the Pacific and supporting the U.S. strategy of “affordable mass.” The truck has potential production of up to 2,500 units annually pending Pentagon approval, Reuters reports.

- Hamas announced its readiness to proceed to the second phase of the Gaza ceasefire agreement while condemning Israel’s decision to halt humanitarian aid and imports to Gaza.

- Germany’s plan to boost spending on defense and infrastructure by over $500 billion has fueled a surge in its stock market, with the DAX Index rising 3.5%, while U.S. markets faltered due to Trump’s new tariffs. This move, which aligns with Trump’s desire for Europe to shoulder more of its own security burden, has led to a 16% gain for the DAX this year, outpacing the S&P 500’s losses.

Threats

- The CEO of Italy’s Leonardo stated that Donald Trump’s criticisms of Europe have created an unprecedented urgency for the region to increase defense spending.

- Core Scientific’s stock fell sharply after its AI partner, CoreWeave, faced setbacks with Microsoft due to delivery issues and missed deadlines, raising concerns about revenue stability.

- Trump issued a stark warning to Hamas, demanding the immediate release of all hostages held in Gaza or face total destruction.

Gold Market

This week gold futures closed at $2,929.40., up $80.90 per ounce, or 2.84%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 5.23%. The S&P/TSX Venture Index came in off 0.25%. The U.S. Trade-Weighted Dollar fell 3.59%.

Strengths

- The best-performing precious metal for the week was palladium, up 5.44%. Recent ETF buying of palladium reflects investor interest in the metal amid geopolitical uncertainties, with holdings rising by 2,384 troy ounces in the latest session, even as Russian supply risks remain a key factor in price volatility.

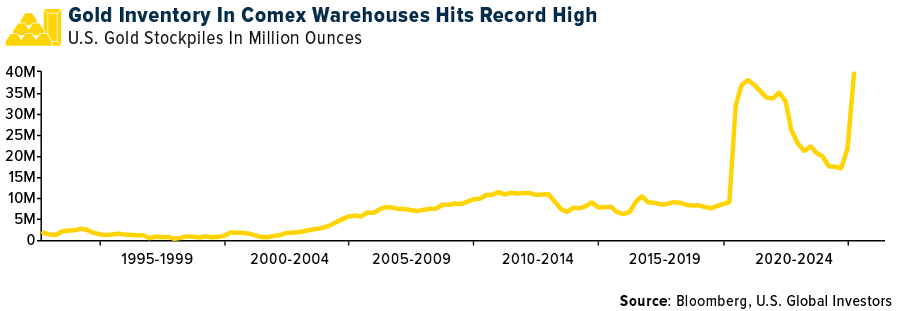

- Record-high U.S. gold stockpiles of 39.7 million ounces, worth approximately $115 billion, have been amassed in exchange warehouses due to a tariff-driven surge in U.S. gold prices. This unprecedented accumulation, driven by lucrative arbitrage opportunities, demonstrates gold’s enduring appeal as a safe-haven asset and its ability to attract significant capital flows during periods of economic uncertainty.

- Fresnillo reported strong FY24 results with group EBITDA +5% versus Bloomberg consensus. The total FY24 dividend of $0.74 per share is 200% ahead of consensus of $0.24 per share. This amounts to an 8% yield, according to JPMorgan.

Weaknesses

- The worst-performing precious metal for the week was gold; however, it was still up 2.84%. Gold was the best-performing precious metal last week and remains positive, but speculators this week bought up the other precious metals at a faster pace week-over-week, even outpacing the record inflows of gold into the U.S.

- According to CIBC, Fortuna Mining reported headline earnings of $0.04 per share, below consensus of $0.16 per share. Headline earnings had to be adjusted for several items, including a write-off of mineral properties, to arrive at adjusted earnings of $0.12 per share, but still below consensus. Q4 all-in sustaining costs (AISC) came in at $1,772 per gold equivalent ounces (GEOs), higher than their estimate of $1,701 per GEO.

- The retirement of Paul Voller, HSBC’s head of precious metals for the past 12 years, represents a significant loss of expertise and leadership in the bank’s precious metals business. This departure could potentially impact HSBC’s operations in the global gold market, where it plays a crucial role as one of only four clearing members whose vaults underpin billions of dollars in daily trades in the London gold market.

Opportunities

- The recent Bitcoin price drop, despite the announcement of a U.S. strategic reserve, highlights the volatile nature of cryptocurrencies and reinforces the appeal of gold as a stable store of value. Bitcoin fell from around $90,000 to as low as $84,000 following President Trump’s executive order, demonstrating that even positive developments can lead to unexpected market reactions in the crypto space, Bloomberg reports.

- Wheaton Precious Metals announced the winner of its inaugural Future of Mining Challenge. ReThink Milling Inc. has been awarded $1 million for its Conjugate Anvil Hammer Mill (CAHM) and MonoRoll technologies, which have the potential to revolutionize the milling process. This innovative grinding technology demonstrates immense potential to deliver greater efficiency with significantly lower energy use, leading to reduced greenhouse gas emissions and operating costs.

- The platinum market is set for its third consecutive deficit following a shortfall of almost a million ounces last year, according to an industry report. The gap in the supply of critical materials will amount to about 848,000 ounces in 2025, or 11% of total demand, according to a report by the World Platinum Investment Council, a trade association.

Threats

- According to RBC, Endeavor Mining reported an earnings per share (EPS) miss versus consensus, with higher free cash flow (FCF) generation on pre-released production, AISC and guidance. Previously released guidance for FY25 was essentially in line with consensus estimates, with the first full year of production from the Sabodala Biox expansion and Lafigue leading to +7% higher YoY production at the mid-point and lower expected total capital spending.

- According to RBC, Ghana’s Environmental Protection Authority reported that a tailings incident previously occurred at AngloGold’s Iduapriem mine. Tailings-related matters carry high sensitivity due to the potential for both environmental and safety-related risks. There are no direct injuries reported from the tailings incident, and they interpret the severity of the matter to be moderate, while an investigation into the matter is reportedly ongoing by Ghana’s EPA.

- Standard Chartered suggests the U.S. could sell a portion of its $760 billion gold reserves to fund the newly established Strategic Bitcoin Reserve, potentially undermining gold’s status as a premier reserve asset. This strategy, if implemented, could trigger a significant shift in reserve holdings, potentially leading to decreased demand for gold and increased interest in Bitcoin as a strategic asset, Bloomberg reports.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Frontier Group Holdings

Air France-KLM

United Airlines

American Airlines

Delta Air Lines

Southwest Airlines

Air Canada

Prada

Tesla

Kongsberg Grupp

Rheinmetall

Nvidia

Ivanhoe Mines Ltd.

Fortuna Mining Corp.

Wheaton Precious Metals Corp.

Endeavor Mining PLC

Anglogold Ashanti Plc

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The MSCI China Index captures large and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign.

The CSI 300 is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.