Elon Musk Goes to Fort Knox

This week has been both intense and inspiring as I attended the YPO Edge event in Barcelona, Spain. I had the privilege of experiencing numerous thought-provoking presentations, from the transformative impact of AI and disruptive technologies on businesses, to the vital role of health and wellbeing in fostering a learning-driven workforce. I’m excited to share a full recap of my experience and highlight my favorite speeches in next week’s Frank Talk blog.

As I reflect on these discussions, one thing that stands out is the growing importance of investing wisely in times of uncertainty—something especially relevant as we see gold prices hitting record highs.

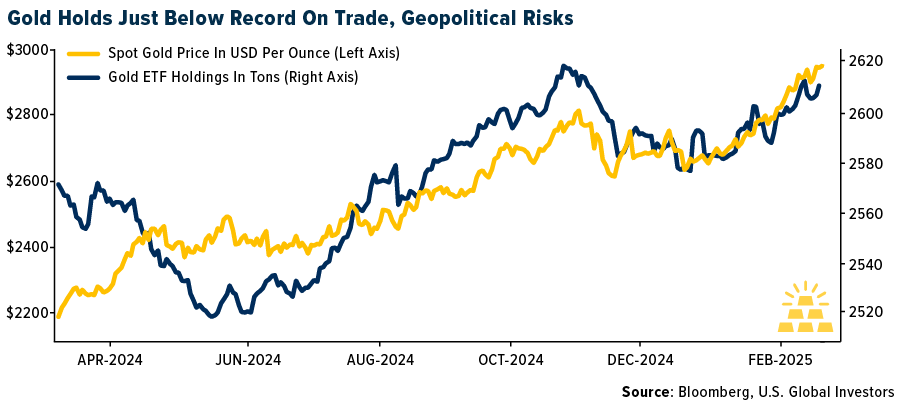

Gold prices surged to an all-time high of $2,940 per ounce on Thursday, pushing its market cap above $20 trillion for the first time ever, as trade tensions between the U.S. and Europe have stoked fears of a global economic slowdown. And while safe-haven demand is certainly a driver, there’s another potential catalyst that could send prices soaring even higher: the revaluation of America’s gold reserves.

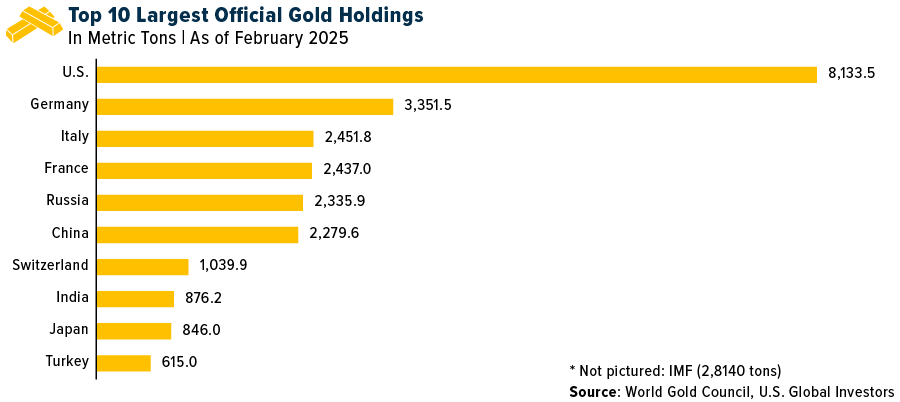

As many of you are aware, the U.S. holds the most gold of any country on earth by far, with reserves totaling 8,133 metric tons. But what’s less well-known is that the stockpile’s value has remained at just $42 per ounce since 1973, putting its total value at around $11 billion.

Let’s say we were to revalue those reserves at today’s price of around $2,900, which some people are in favor of. The total value, then, would jump to a staggering $760 billion, creating a windfall of $749 billion.

This could provide the government with options to sell a portion of its gold or enhance its balance sheet by reducing debt. It could even be used to fund a Sovereign Wealth Fund (SWF), which I wrote about earlier in the month.

Treasury Secretary Scott Bessent has tried to tamp down speculation that the U.S. will go through with this process, stating that it’s “not what [he] had in mind,” but I believe the fact that we’re having this discussion highlights gold’s importance as a financial asset and geopolitical tool.

Verifying the Gold at Fort Knox

Before any revaluation can occur, though, it’s probably best to verify that the gold reserves actually exist—a concern that’s lingered for decades.

The U.S. Bullion Depository at Fort Knox, which houses the bulk of the nation’s gold, has only opened its doors to non-authorized personnel three times in history: 1) in 1943 for President Franklin D. Roosevelt, 2) in 1974 for a small group of Congress members and 3) in 2017 for a delegation including Senator Mitch McConnell and then-Treasury Secretary Steven Mnuchin.

Elon Musk has announced plans to conduct an in-person audit of Fort Knox’s gold reserves on behalf of his cost-cutting operation, the Department of Government Efficiency, or DOGE. In a tweet on February 17, Musk wrote, “Who is confirming that gold wasn’t stolen from Fort Knox?… We want to know if it’s still there.”

Who is confirming that gold wasn’t stolen from Fort Knox?

— Elon Musk (@elonmusk) February 17, 2025

Maybe it’s there, maybe it’s not.

That gold is owned by the American public! We want to know if it’s still there. https://t.co/aEBXK1CfD6

I don’t doubt that the gold’s where it should be, but I fully support Musk and President Trump’s efforts to provide transparency. If the audit confirms the reserves—which I believe it will—it could boost confidence in the U.S. government’s finances. Conversely, if discrepancies are found, it could send shockwaves through global markets, adding further momentum to gold prices.

Central Bank Buying and Global Market Trends

Central banks have been on a gold buying spree, having snapped up over 1,000 tons of the metal for the third consecutive year in 2024, according to the World Gold Council (WGC). The National Bank of Poland (NBP) led the pack, adding 90 tons to its reserves, while the People’s Bank of China (PBoC) announced a fresh purchase of 5 tons to start 2025, bringing its total holdings to 2,285 tons.

Central banks are often considered the “smart money” in the gold market, and their sustained accumulation of gold reflects a broader strategy to diversify reserves and hedge against their very own policies. What’s more, this buying activity supports prices, creating a favorable backdrop for gold as an investment.

Peak Gold Ahead?

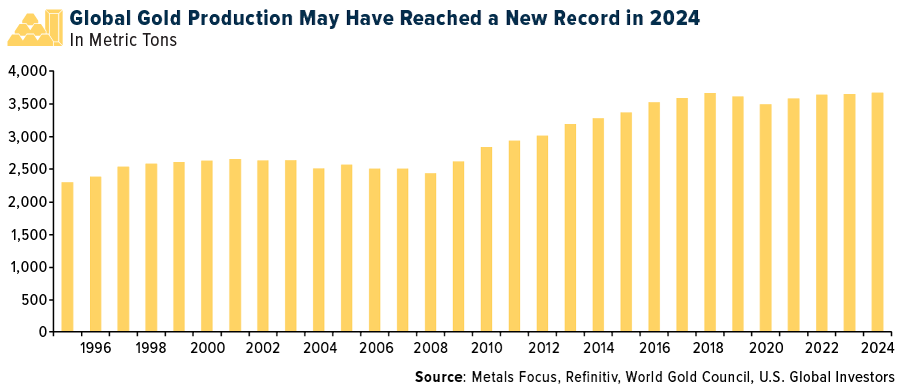

On the supply side, total gold production rose to a record 4,974 tons in 2024, driven by increased mine output and recycling. Initial estimates suggest mine production reached an all-time high of 3,661 tons, though final figures could revise this record. However, the long-term supply outlook is less rosy.

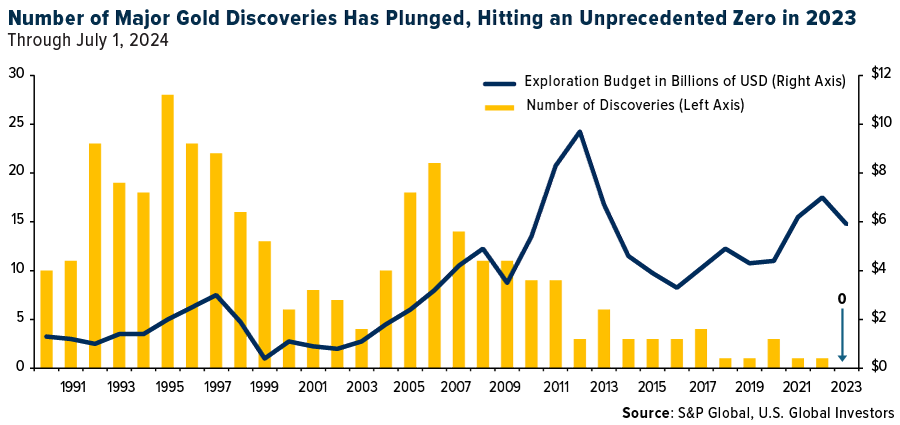

According to S&P Global’s Paul Manalo, the gold supply is expected to peak in 2026 before declining as a result of fewer new discoveries. Exploration budgets, which surged to $7 billion in 2022, have cooled off but remain higher than historical averages. This trend could support higher gold prices over the medium to long term, particularly if demand from central banks and investors remains robust.

Positioned for Growth

The high gold price environment has allowed gold mining companies to expand operations, prioritize sustainability initiatives and attract investor interest. Bank of America estimates that companies under its coverage could generate around $3 billion in free cash flow (FCF) in the fourth quarter of 2024, with even more expected this year.

However, rising costs present a challenge. The average All-In Sustaining Cost (AISC) for gold miners hit a record $1,456 per ounce in the third quarter of 2024, driven by higher labor costs and maintenance expenses.

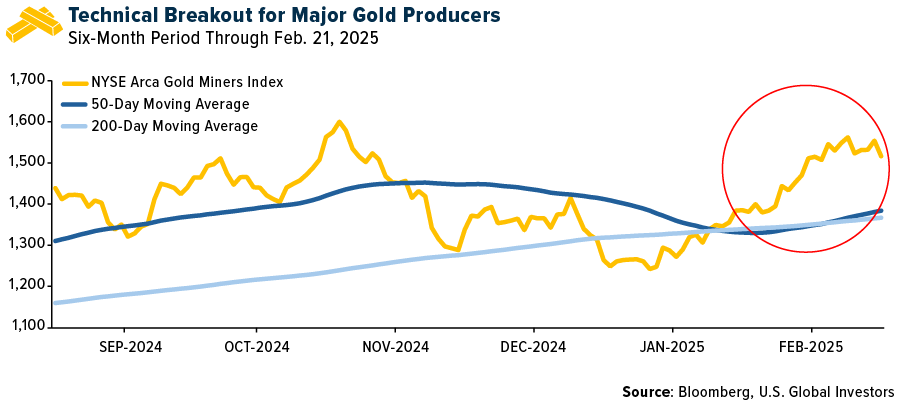

Despite these pressures, many miners remain highly undervalued, making them attractive to value investors. The NYSE Arca Gold Miners Index, which tracks major gold producers, recently made a technical breakout, with the 50-day moving average crossing above the 200-day moving average.

Strategic Takeaways

So, what does all this mean for your portfolio?

Gold remains a vital asset for diversification. I believe its role as a hedge against inflation, currency devaluation and geopolitical risks is as relevant today as ever for long-term investors.

For more tactical investors, the potential revaluation of U.S. gold reserves—or even the publicity surrounding Musk’s proposed audit—could act as a catalyst for price movements.

Meanwhile, the continued buying by central banks and supply constraints in the mining sector offer additional support for a bullish outlook on gold.

As always, I recommend a 10% weighting in gold, with 5% in physical gold (coins, bars, jewelry) and 5% in high-quality gold mining stocks, mutual funds and ETFs.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.51%. The S&P 500 Stock Index fell 1.66%, while the Nasdaq Composite fell 2.51%. The Russell 2000 small capitalization index lost 3.71% this week.

- The Hang Seng Composite gained 4.06% this week and the KOSPI rose 2.45%.

- The 10-year Treasury bond yield fell 5 basis points to 4.426%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Sabre Corp., up 26.90%. Billionaire Stanley Druckenmiller, known for his legendary 30% annual returns, made headlines this week by selling his remaining Microsoft shares to invest in major U.S. airlines, reports numerous financial outlets. United Airlines was Druckenmiller’s largest purchase in the fourth quarter of 2024, now making up 2.8% of his portfolio.

- American Airlines is now allowing passengers to share their AirTag location if their baggage is lost, joining other carriers adopting this technology. Travelers can generate a link via Apple’s Share Item feature on iOS 18.2 or later to help track misplaced luggage on flights with U.S. airport segments, reports Simple Flying.

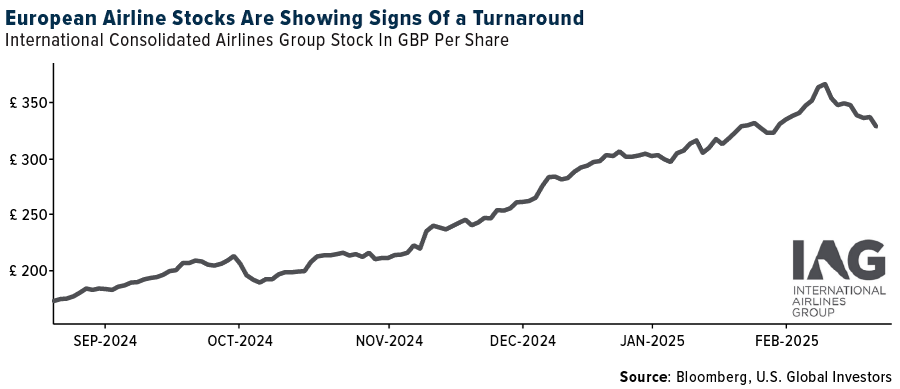

- European Airlines are up 20% over the past month, mostly on better sentiment on a potential Ukraine-Russia ceasefire agreement. JP Morgan sees direct implications for the sector through the re-opening of Russian airspace to overflights for European carriers and the re-opening of the Ukrainian aviation market. The group then sees indirect impacts from downward pressure on jet fuel, improved ATC, and tighter European capacity.

Weaknesses

- The worst performing airline stock for the week was Air China, down 6.52%. According to JP Morgan, Airport of Thailand’s elevated accounts receivable arises from extended payment terms (18 months) and a liquidity crunch for its concessionaires. It is considering cutting the 18% per annum late payment penalties and acknowledged the challenges faced by its concessionaires due to the slump in tourist arrivals since 2020.

- Air cargo demand growth slowed to 3% year-over-year in January 2025, while -10% year-over-year demand declines in February so far look largely driven by CNY calendar shifts. Bank of America sees building risks to demand from De Minimis policy changes with around 7.5% of global air cargo flows relating to Chinese eCommerce platforms.

- As a result of the recent storm and the Delta Air Lines incident at Toronto Pearson, there have been extensive delays, with Air Canada cancelling 1,290 flights over the past six days. The airport is seeing some significant operating disruptions as well (two of four runways apparently shut right now) that may continue for several days.

Opportunities

- According to Morgan Stanley, the European air travel market could benefit from the Ukraine conflict ending in four ways: 1) recovery of the Ukrainian market itself; 2) improved competitiveness on travel to Asia due to the reopening of Russian airspace; 3) a moderate fall in fuel prices; and 4) lower congestion in the intra-European market (fewer flight delays and cancellations).

- The shipping industry may have to brace itself for a much deeper rethink than it first thought considering the first weeks of the new Trump administration in Washington, a leading shipbroker has warned. “It goes beyond tariffs as people first thought,” said Hellenic Shipbrokers Association president John Cotzias. “We are going to see a totally different map as a result of Trump.” At this stage, however, it was too early to provide even educated guesstimates for exactly how the landscape would change, reports Morgan Stanley, either for better or for worse.

- Year-to-date TSA data has been trending up 2.5% year-over-year and up 8% versus 2019 levels. While not all that surprising given airline management teams recently reiterated that demand remains strong with domestic remaining steady, supply versus demand is at more of an equilibrium given the industry moderating capacity, explains Morgan Stanley.

Threats

- According to TD, WestJet is indicating a steep decline in sales for travel from Canada to the U.S. This echoes similar concerns from Air Canada.

- Morgan Stanley expects shipping spot rates to slide for the time being, with two key factors at play: 1) spot rates have a strong tendency to struggle after the Chinese New Year, being the low-demand season; and 2) the container shipping industry globally is transitioning from February toward a new alliance structure.

- According to Bank of America, Delta’s June growth has moved lower by about 200 basis points over the last few weeks. On Delta’s earnings call in January, President Glenn Hauenstein said that June, July and August would be the “low points for year-over-year growth,” so they expect further schedule reductions over time.

Luxury Goods and International Markets

Strengths

- Retail sentiment in early 2025 has been bolstered by robust consumer spending during the 2024 holiday season. In the United States, holiday sales reached $994.1 billion in November and December, marking a 4% increase from the previous year and surpassing the National Retail Federation’s expectations.

- Tesla is strengthening its global position by preparing to enter the Indian market. The company plans to ship a few thousand cars to a port near Mumbai next month and has already started hiring staff for showrooms and to manage orders and deliveries. The Indian government has reduced import duties on electric cars from 115% to 15%, allowing annual imports of up to 8,000 premium cars priced above $35,000.

- Star Entertainment, a casino operator, was the top-performing stock in the S&P Global Luxury Index, with a 12.7% increase over the past five days. The company’s shares continued to decline with increased volatility due to financial challaenges and regulatory issues.

Weaknesses

- Capri Holdings, the parent company of Versace and Michael Kors, was downgraded to junk by S&P Global Rankings. The company was placed on a negative watch list by S&P after the Tapestry deal was termianted last November.

- Mercedes’ operating revenue fell by 30% last year. The company has projected weaker-than-expected sales for 2025, with car sales expected to grow between 6-8% and van sales between 10-12%, compared to earlier estimates of 7.91% for cars and 12.8% for vans. Following the release of its fourth quarter results, the company’s shares declined.

- RealReal, the online marketplace for secondhand luxury goods, was the worst-performing stock in the S&P Global Luxury Index, dropping 18.7%. The decline followed the company’s report of quarterly results and full-year guidance that fell short of estimates.

Opportunities

- Hyatt Hotels Corporation is set to expand into 13 new markets across Europe, Africa, and the Middle East by 2028, aiming to address the demand for high-quality accommodations. This expansion includes the opening of the Hyatt Regency Nairobi Westlands, marking its brand debut in Kenya with a five-star property offering a blend of luxury and Kenyan culture.

- The average rate on a 30-year mortgage in the U.S. decreased for the fifth consecutive week, reaching its lowest level since late December. This decline has boosted homebuyer sentiment ahead of the busy summer home-buying season. As rates are expected to continue falling in the coming months, homes may become more affordable, offering a boost to homebuilders.

- U.S. Treasury Secretary Scott Bessent announced that he will hold an introductory call with his Chinese counterpart on Friday. He also reiterated his call for Beijing to shift its economic focus toward increasing domestic consumption. Earlier this week, China’s Prime Minister stated that the country plans to boost consumption as a means to enhance people’s lives and stimulate economic growth.

Threats

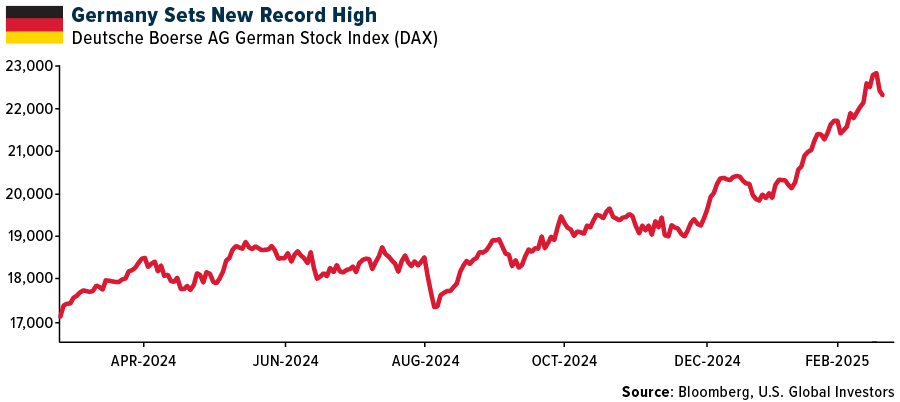

- Equities trading in Germany, Europe’s largest economy, recently reached record highs despite ongoing tariff talks and the lack of a ceasefire agreement between Ukraine and Russia. However, the market could face a correction depending on the outcome of the snap elections, set for February 23, following the collapse of the ruling coalition late last year. Major parties have recently lost ground to the Greens and Alternative for Germany (AfD).

- In the luxury sector, the fourth-quarter earnings season exceeded expectations following weak third-quarter results, but caution is still advised. Most of the positive performance came from strong American spending and some improvement among Chinese consumers. However, robust performance will likely be limited to a handful of companies, as others may struggle to return to long-term growth averages.

- Shares of Carnival, Royal Caribbean, and Norwegian Cruise Line dropped after incoming Commerce Secretary Howard Lutnick suggested that the Trump administration was considering closing tax loopholes in certain sectors, including the cruise industry. The new president has repeatedly threatened tax increases on specific sectors, such as luxury, which has created uncertainty and volatility in the equity markets.

Energy and Natural Resources

Strengths

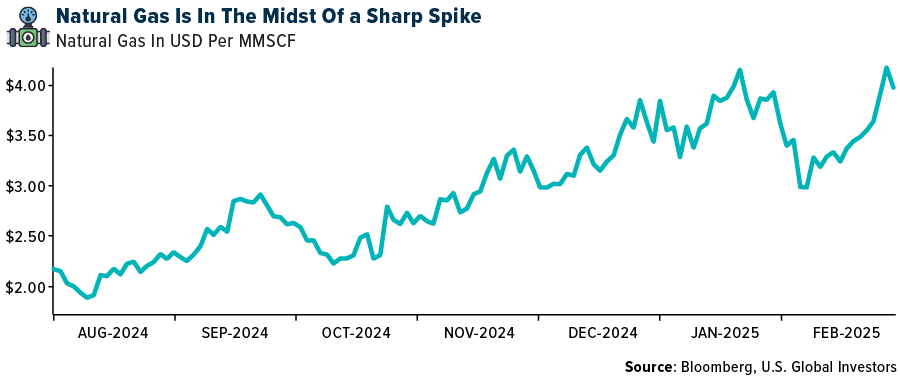

- The best performing commodity for the week was natural gas, rising 14.77%. Natural gas was the best-performing commodity for the week due to supply concerns in Colombia and rising demand amid a cold front in the U.S. Ecopetrol SA announced plans to develop two natural gas import facilities to offset Colombia’s declining reserves, reinforcing the country’s shift to a net importer status as more and more countries depend on importing natural gas, Bloomberg reports.

- Cameco’s strong earnings report is a positive signal for uranium as it reflects rising demand and higher realized prices, with uranium sales increasing from 9.8 million to 12.8 million pounds year-over-year at a higher average price of $58.45 per pound. The company’s revenue growth and better-than-expected production represent a bullish outlook for uranium, reinforcing market confidence in nuclear energy’s expanding role and supporting higher uranium prices.

- Diamondback Energy Inc. will expand its oil assets in the Permian Basin after agreeing to acquire some subsidiaries of Double Eagle IV Midco LLC. The transaction will be paid for with $3 billion in cash and 6.9 million shares of Diamondback common stock, according to a statement on Tuesday.

Weaknesses

- The worst performing commodity for the week was coffee, dropping to 4.46%. Coffee’s poor performance this week came from extreme volatility and profit-taking from speculative traders after the strongest rally since 1977. In addition to the profit taking there was low open interest, the lowest in over a decade, along with high margin requirements making it costly for exporters to stay in the market, which further accelerated the decline, Bloomberg highlighted.

- The rapid increase in aluminum prices, driven by supply concerns and upcoming U.S. tariffs raising rates from 10% to 25%, is negatively impacting key industries such as chip production and car manufacturing by increasing material costs and disrupting supply chains.

- Energy Transfer LP’s Sunoco Pipeline LP unit, the operator of a Pennsylvania pipeline that regulators say leaked jet fuel for more than 16 months, spilled more refined fuels than any other operator in 2024, according to data compiled by Bloomberg. The company is looking to buy out landowners in the affected region with tainted ground water.

Opportunities

- International Bismuth prices have exploded upward by 55% in the last two weeks to a 10-year high of $9.63 per pound, according to Fast Markets. This comes in response to Chinese export restrictions. China is the world’s leading bismuth producer, accounting for 80% of production and responsible for two thirds of U.S. imports, reports BMO.

- Iron ore swung higher after the head of BHP Group Ltd. — one of the biggest global suppliers — flagged tentative signs of a recovery in the crucial Chinese housing market. Other industrial metals were mixed. “We are starting to see some green shoots by way of increasing new starts and property price rises in some sectors,” Mike Henry, BHP’s Chief Executive Officer, said in an interview with Bloomberg TV.

- Gold and gold miners stand to benefit from gold’s scarcity and stability compared to the seemingly unlimited number of cryptocurrency projects, reinforcing its role as a safe-haven asset while Bitcoin faces increased competition and speculative volatility. With gold breaking out near $3,000 per ounce, its historical performance during economic downturns, along with ETF inflows and weakening industrial metals like copper, further support gold’s potential to outperform risk assets amid global economic uncertainty, Bloomberg reports.

Threats

- Stifel believes there could be a decline in LNG prices, but they still anticipate a significant growth in LNG development both in the U.S. and elsewhere around the world with slow recovery of momentum in Russia. The group expects an LNG price floor around $10/MMBtu rather than the current price of $15/MMBtu.

- Despite the fact that OPEC+ is expected to delay its production increase in April, citing cooling oil demand from China and increased supply for North America, a freeze on the war in Ukraine that is coupled with dropping sanctions on Russian energy exports could lead to drop in energy prices to a lower base with increased supplies.

- Anglo American Plc took another write-down on the company’s struggling De Beers diamond unit, and posted a slide in profit, as the miner moves ahead with a radical overhaul of its business, according to Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Story, rising 143%.

- Crypto security firm Blockaid has secured fresh funding as the platform gears up to tackle rising cyber crime risks in the digital asset space. The company raised $50 million in a series B round led by Ribbit Capital, Bloomberg reports.

- According to Bloomberg, Texas aims to become the top state to establish a strategic Bitcoin reserve, following President Trump’s suggestion of creating a federal reserve using the cryptocurrency.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Official Trump, down 30%.

- Nigerian authorities sued crypto exchange Binance for over $79 billion in economic losses and $2 billion in back taxes, explains Bloomberg. Nigeria’s tax authority, Federal Inland Revenue Service, also claimed Binance operated illegally within the country.

- Czech central bank Governor Ales Michl urges caution for those investing in crypto assets, saying the market is still in its infancy. Bitcoin should not be lumped together with other crypto assets according to Michi, writes Bloomberg.

Opportunities

- Cryptocurrency options exchange Deribit is still talking to Kraken for a potential acquisition contrary to reports that the U.S. exchange had walked away from a potential deal to buy Derbit. The firm could be valued at $4 billion -$5 billion or even more, according to Bloomberg.

- The estate of bankrupt crypto exchange FTX has begun distributing cash to creditors more than two years after the platform imploded. Customers should start to see the funds within one to three business days the estate said.

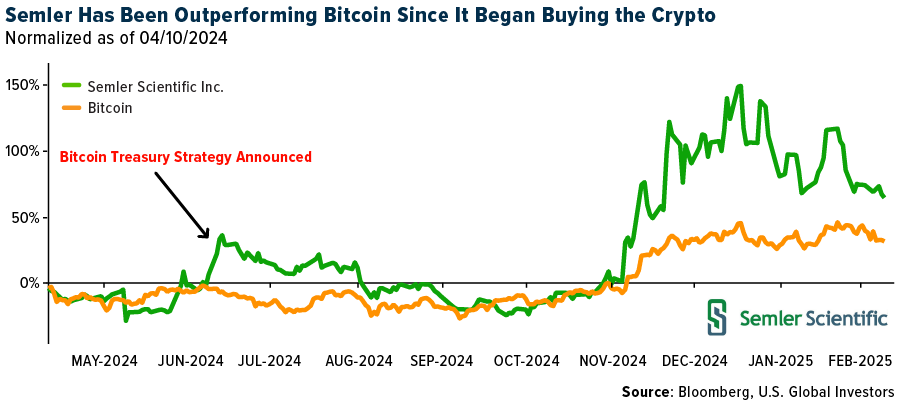

- The Bitcoin-buying strategy has gained momentum as the cryptocurrency’s price surged last year, prompting President Trump to suggest a U.S. Bitcoin reserve. Following MicroStrategy’s lead, Semler Scientific has purchased tens of millions of dollars in Bitcoin, with the stock doubling since the move, according to Bloomberg.

Threats

- An estimated 86% of crypto traders that took positions in a meme coin endorsed by Argentine President Javier Milei on Friday ended up losing money. The losses in the token called Libra totaled an estimated $251 million while the minority of traders who profited made a combined $180 million, writes Bloomberg.

- Crypto exchange Bybit said one of its wallets was hacked, resulting in what crypto analysts say is the theft of an estimated $1.5 billion worth of cryptocurrency. A hacker took control of one of Bybit’s offline Ethereum wallets the CEO said in a post on Friday.

- Coinbase CEO Brian Armstrong has cautioned against insider trading related to meme coins, stressing that such actions are illegal and could result in prison time. In a February 19 post on X, Armstrong raised concerns about insider trading in the meme coin market, according to Bloomberg.

Defense and Cybersecurity

Strengths

- Nvidia has significantly bolstered its position in the AI sector through strategic acquisitions and partnerships, including a $700 million acquisition of Run.ai and a major deal with Elon Musk’s xAI.

- Microsoft’s launch of the ‘Majorana 1’ quantum chip, hailed by Satya Nadella as a breakthrough in physics and fabrication, sparked a surge in quantum computing stocks. Skepticism remains about its commercial viability, especially because it is based on a newly discovered topological state of matter, distinct from solids, liquids, and gases, enabling more stable quantum information processing.

- The best performing stock in the XAR ETF this week was Astronics Corp, rising 9.13%, with rising volume, and witnessing mostly positive five-week positive price appreciation.

Weaknesses

- Palantir shares dropped following the Pentagon’s announcement of an 8% budget cut over the next five years, impacting the company’s performance and investor confidence as well.

- Defense tech services companies like Booz Allen Hamilton, CACI International, Leidos Holdings, Parsons, and General Dynamics face increased financial risk due to potential budget cuts under DOGE policies. The new policies could lead to contract terminations and a weaker pipeline for new government deals, impacting revenue and growth prospects.

- The worst performing stock in the XAR ETF this week was Axon Enterprise Inc., down 24.90%, after analyst downgrades citing a fall out with former partner Flock Safety, concerns over federal contract slowdowns, and uncertainty about fiscal year 2025 guidance.

Opportunities

- BWX Technologies announced $2.1 billion in contracts from the U.S. Naval Nuclear Propulsion Program for manufacturing reactor components for Columbia and Virginia class submarines and Ford class aircraft carriers. The work will span multiple U.S. locations over seven years.

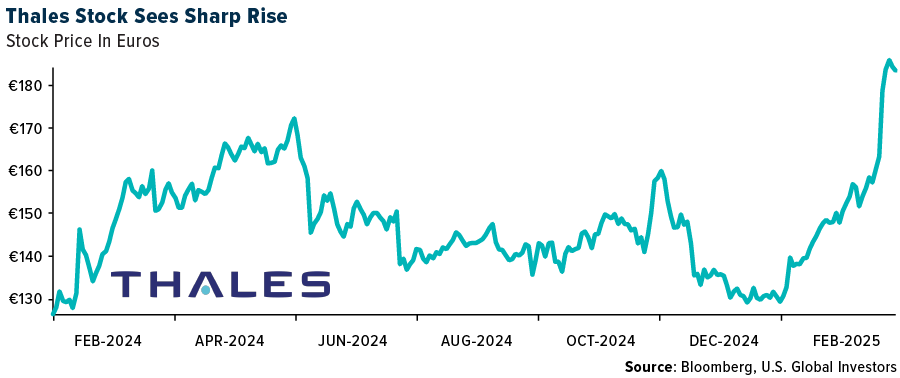

- Thales has partnered with Milrem Robotics and EM&E Group to integrate its 70mm rocket systems with a remote weapon station on an unmanned ground vehicle for the UAE, enhancing counter-drone capabilities. The system is set to debut at IDEX 2025.

- Lockheed Martin and the U.S. Army successfully tested the Precision Strike Missile, moving toward full-rate production with a $120 million contract. This is a significant advancement in replacing the MGM-140 ATACMS with extended strike capabilities.

Threats

- The Sudanese Armed Forces (SAF) announced major advances on multiple battlefronts, securing key areas in Khartoum and western Sudan while inflicting heavy losses on the paramilitary Rapid Support Forces (RSF).

- The U.S. will impose additional aluminum tariffs on March 12, affecting 123 products, including chipmaking and aircraft components, potentially impacting Japanese exporters.

- The Pentagon plans to cut its budget by 8% annually for the next five years—totaling $50 billion per year—while prioritizing 17 areas such as drones, submarines, border security, and military readiness, amid efforts led by the Department of Government Efficiency to reduce federal spending.

Gold Market

This week gold futures closed at $2,948.80, up $48.10 per ounce, or 1.66%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.84%. The S&P/TSX Venture Index came in off 0.87%. The U.S. Trade-Weighted Dollar fell just 0.07%.

Strengths

- The best performing precious metal for the week was gold, up 1.66%. Gold held near a new all-time high due to tariff threats and geopolitical tension. The metal’s price was little changed near $2,935 an ounce after hitting a fresh record high of $2,947.01. Goldman Sachs raised its year-end target for gold to $3,100 an ounce, citing central bank buying, and predicted it could reach $3,300 if economic policy uncertainty persists.

- Torex’s fourth quarter financial results were broadly better than BMO and consensus estimates, with earnings per share (EPS) of $0.81 beating BMO at $0.46. AISC of $1,112 per ounce and operating cashflow of $123 million represent modest beats compared to expectations. The first production from Media Luna was reiterated by end of March, and with free cash flow expected to turn substantially positive in mid-2025.

- According to Scotia, Wheaton Precious Metals reported GEO production of 633,000 ounces versus its estimate of 592,000 ounces driven by stronger performance from Salobo and Constancia (higher grades). Sales came in at 532,000 versus the expectation of 527,000. Wheaton guided 2024 GEO production of 550-620k; 2024 actual production exceeded the upper end of its guidance range.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.15%. According to JP Morgan, Anglo Platinum’s FY’24 EBITDA is 18% below its estimate, which corresponds to $1.1 billion PGM EBITDA at Anglo American for a 13% miss versus Bloomberg consensus $1.3 billion.

- Petra announced first-half 2025 financial results that indicated further reduction in costs, reports BMO, as the company continues to position itself for the diamond market weakness. However, Petra breached its loan covenants and has been granted a temporary waiver. Lenders are expected to re-engage with Petra following another round of planned restructuring. Richard Duffy has resigned as CEO – Vivek Gadodia and Juan Kemp have been appointed joint interim CEOs.

- According to Canaccord, Hecla’s fourth quarter production was weaker than anticipated, and financials generally missed estimates. 2025 guidance was also weak, with lower silver production, higher AISC, and total capex guidance that was 71% above its forecast.

Opportunities

- UBS is bullish on gold, as expectations for U.S. rate cuts are pushed out and is driven by continued: 1) official sector buying, 2) haven buying, 3) lack of positioning and 4) ongoing liquidity issues. Gold mining companies’ results to date have highlighted beats on returns, which UBS expects to continue to ramp up on the increased cash generation, before investment options run out and the inevitable M&A cycle ensues.

- Endeavour Silver’s high-grade silver and gold discoveries at its Bolañitos Mine in Mexico reinforce its ability to replace reserves, expand resources, and extend mine life, with recent drill results showing notable silver-equivalent grades up to 4,839 gpt AgEq.

- Gold and gold miners stand to benefit from gold’s scarcity and stability compared to the seemingly unlimited number of cryptocurrency projects, reinforcing its role as a safe-haven asset while Bitcoin faces increased competition and speculative volatility.

Threats

- Uganda deployed more forces to eastern Democratic Republic of Congo, highlighting the growing risk of a widening conflict in the unrest-prone, mineral-rich region. Troops have been sent to Bunia — a town close to Lake Albert, which straddles the border between the two nations — to “control the escalating ethnic tensions in the region,” according to Bloomberg.

- FVI shares still trade like a silver company, even though it has completed its transition into a West African producer with its key assets now in Burkina Faso and Cote d’Ivoire. Looking ahead, the company will only generate 3% of its revenue from silver in 2025, down from 50% just five years ago. In CIBC’s opinion, it is a matter of ‘when’ and not ‘if’ the market catches up to the fundamental changes at the company.

- The latest survey of U.S. consumers shows that long-term inflation expectations rose to the highest level in nearly 30 years, with a consensus annual rate of 3.5% over the next 10 years. Consumer sentiment also dropped below consensus expectations, and more than half the participants expect the unemployment rate to rise over the coming year, Bloomberg reports.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

American Airlines

United Airlines

Airports of Thailand PCL

Delta Air Lines

Air Canada

Tesla

Mercedes

Hyatt Hotels Corporation

Carnival

Royal Caribbean

Cameco

BHP Group Ltd.

Anglo American Plc

Nvidia

Palantir

Booz Allen

General Dynamics

Wheaton Precious Metals

Hecla Mining

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.